Coherent's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bullish stance on Coherent COHR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with COHR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Coherent.

This isn’t normal.

The overall sentiment of these big-money traders is split between 66% bullish and 22%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $635,755, and 2 are calls, for a total amount of $66,961.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $67.0 to $95.0 for Coherent over the last 3 months.

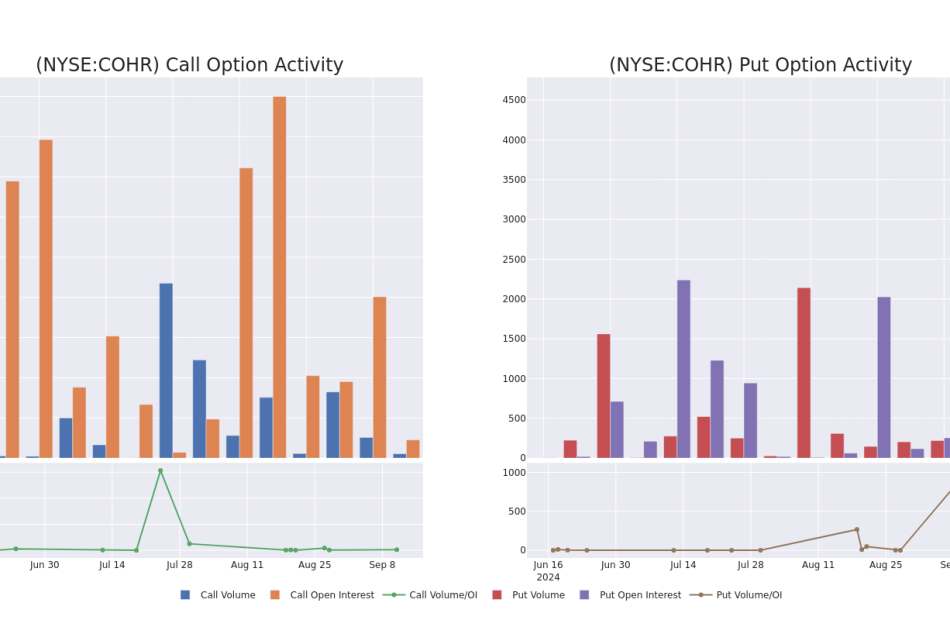

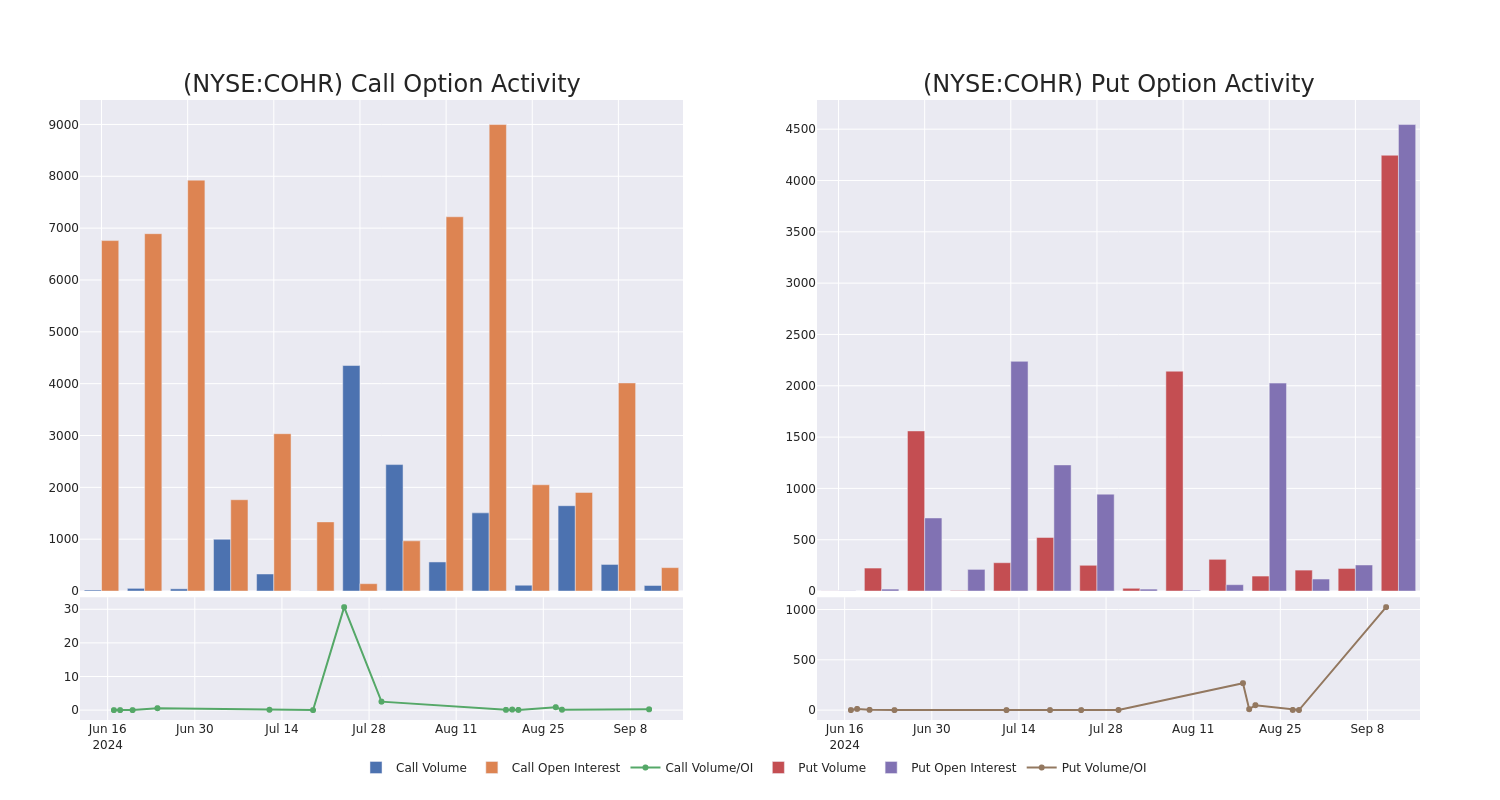

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Coherent stands at 832.83, with a total volume reaching 4,353.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Coherent, situated within the strike price corridor from $67.0 to $95.0, throughout the last 30 days.

Coherent Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COHR | PUT | TRADE | BULLISH | 10/18/24 | $7.1 | $6.9 | $6.9 | $80.00 | $207.0K | 459 | 300 |

| COHR | PUT | SWEEP | BULLISH | 09/27/24 | $0.8 | $0.2 | $0.5 | $67.00 | $100.2K | 2 | 2.0K |

| COHR | PUT | SWEEP | BULLISH | 02/21/25 | $24.1 | $23.9 | $23.9 | $95.00 | $95.6K | 2 | 41 |

| COHR | PUT | SWEEP | BULLISH | 10/04/24 | $2.25 | $2.1 | $2.1 | $72.00 | $73.5K | 300 | 400 |

| COHR | PUT | SWEEP | BEARISH | 10/18/24 | $4.4 | $4.1 | $4.4 | $75.00 | $66.0K | 2.2K | 150 |

About Coherent

Coherent Corp engaged in materials, networking, and lasers, is a vertically integrated manufacturing company that develops, manufactures, and markets engineered materials, optoelectronic components and devices, and lasers for use in the industrial, communications, electronics and instrumentation markets. The firm operates in three segments Networking, Materials, and Lasers Segment. It generates maximum revenue from Networking segment. The company geographically operates in North America. Europe, China, Japan and Rest of the world.

Having examined the options trading patterns of Coherent, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Coherent’s Current Market Status

- With a trading volume of 2,377,195, the price of COHR is up by 6.76%, reaching $75.65.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 54 days from now.

What Analysts Are Saying About Coherent

In the last month, 5 experts released ratings on this stock with an average target price of $75.4.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Coherent with a target price of $84.

- Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for Coherent, targeting a price of $86.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Coherent, maintaining a target price of $72.

- An analyst from Northland Capital Markets persists with their Market Perform rating on Coherent, maintaining a target price of $50.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Coherent with a target price of $85.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Coherent with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Streamline Health® Reports Fiscal Second Quarter 2024 Financial Results

- Net loss of ($2.8 million) during the second quarter of fiscal 2024 compared to a net loss of ($2.5 million) during the second quarter of fiscal 2023

- Adjusted EBITDA improved to a loss of ($0.3 million) for the second quarter of fiscal 2024 compared to a loss of ($0.9 million) for the second quarter of fiscal 2023

- Company reiterated $15.5 million implemented SaaS ARR adjusted EBITDA breakeven run rate expectation

- Company updated expectation for achievement of SaaS ARR adjusted EBITDA breakeven run rate to the second half of fiscal 2025

ATLANTA, Sept. 11, 2024 (GLOBE NEWSWIRE) — Streamline Health Solutions, Inc. (“Streamline” or the “Company”) STRM, a leading provider of solutions that enable healthcare providers to proactively address revenue leakage and improve financial performance, today announced financial results for the second quarter of fiscal 2024, which was the three month period ended July 31, 2024, and the six-month period ended July 31, 2024.

Fiscal Second Quarter and Six-Months Ended July 31, 2024 GAAP Financial Results

The following financial results have been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”).

Total revenue for the second quarter of fiscal 2024 was $4.5 million compared to $5.8 million during the second quarter of fiscal 2023. For the six months ended July 31, 2024, revenue totaled $8.8 million compared to $11.1 million during the same period in fiscal 2023. The change in total revenue was attributable to previously announced client non-renewals offset by successful implementation of new SaaS contracts.

SaaS revenue for the second quarter of fiscal 2024 totaled $3.1 million, 69% of total revenue, compared to SaaS revenue of $3.5 million, 61% of total revenue during the second quarter of fiscal 2023. For the six months ended July 31, 2024, SaaS revenue totaled $5.8 million, 66% of total revenue, compared to $6.7 million, 61% of total revenue, during the same period of fiscal 2023. As previously reported, the Company had a SaaS contract which did not renew at the end of its 2023 fiscal year. On a pro forma basis, excluding the revenue recognized from the SaaS contract that did not renew, SaaS revenue grew 19% during the second quarter of fiscal 2024 compared to the second quarter of fiscal 2023, and 21% during the six months ended July 31, 2024, compared to the same period in fiscal 2023.

Net loss for the second quarter of fiscal 2024 was ($2.8 million) compared to a net loss of ($2.5 million) during the second quarter of fiscal 2023. The increased net loss during the second quarter of fiscal 2024 reflected lower total revenues, higher interest expense and non-cash valuation adjustments offset by a $1.7 million reduction in operating expenses resulting from the Company’s strategic restructuring executed during fiscal 2023. Net loss for the six months ended July 31, 2024 was ($5.5 million) compared to ($5.4 million) in the same period of fiscal 2023. The slight increase in net loss resulted from lower revenues and higher interest and valuation adjustment expenses offset by cost savings achieved through the previously announced strategic restructuring.

Cash and cash equivalents as of July 31, 2024, were $3.5 million compared to $3.2 million as of January 31, 2024. The Company had no outstanding balance on its revolving credit facility as of July 31, 2024, compared to $1.5 million as of January 31, 2024.

Fiscal Second Quarter and Six Months Ended July 31, 2024 Non-GAAP Financial Results

Adjusted EBITDA for the second quarter of fiscal 2024 was ($0.3 million) compared to ($0.9 million) during the second quarter of fiscal 2023. Adjusted EBITDA for the six months ended July 31, 2024, was ($1.0 million) compared to ($2.2 million) during the same period in fiscal 2023. The significant improvement of adjusted EBITDA despite lower total revenue is the result of the Company’s focus on the growth of its SaaS revenue solutions as well as significant cost savings achieved through the previously announced strategic restructuring.

As of July 31, 2024, the Company’s total Booked SaaS Annual Contract Value (“ACV”) was $13.6 million compared to $15.0 million as of January 31, 2024. During the second quarter of fiscal 2024, the company won new contracts which totaled $0.8 million of ACV and received notifications of non-renewals for contracts with aggregate ACV of $2.8 million. Clients gave various reasons for their non-renewal, including full outsourcing of health system revenue cycles. $10.7 million of the Booked SaaS ACV was implemented as of July 31, 2024 compared to $11.1 million as of January 31, 2024.

Booked SaaS ACV represents the annualized value of all executed SaaS contracts, including contracts that have not been fully implemented as of the measurement date, assuming any contract that expires during the twelve months following the measurement date is renewed on its existing terms unless the Company has knowledge of the non-renewal.

The Company reiterated that it believes its adjusted EBITDA breakeven run rate is $15.5 million of implemented SaaS ARR, but due to the aforementioned client non-renewals, the Company has revised its expected timeline to achieve this run rate from the second half of fiscal 2024 to the second half of fiscal 2025. Due to the continued unpredictability of timing related to the closing of new contracts, the Company has not provided more specific guidance related to the timing of bookings.

Management Commentary

“During the first half of this year we have expanded the value we provide to the healthcare revenue cycle through our product enhancements for workforce automation and opportunity identification,” stated Ben Stilwill, President and Chief Executive Officer of the Company. “The Streamline team is focused on expanding our client footprint, maintaining a high caliber of client service, improving our solutions and progressing our financial goals and our mission to ensure our nation’s health systems are paid for all of the care they provide.”

Conference Call

The Company will conduct a conference call on Thursday, September 12, 2024, at 9:00 AM ET to review results and provide a corporate update. Interested parties can access the call by joining the live webcast: click here to register. You can also join by phone by dialing 877-407-8291.

A replay of the conference call will be available from Thursday, September 12, 2024 at 12:00 PM ET to Thursday, September 19, 2024 at 12:00 PM ET by dialing 877-660-6853 or 201-612-7415 with conference ID 13748721. An online replay of the presentation will also be available for six months following the presentation in the Investor Relations section of the Streamline website, www.streamlinehealth.net.

About Streamline

Streamline Health Solutions, Inc. STRM enables healthcare organizations to proactively address revenue leakage and improve financial performance. We deliver integrated solutions, technology-enabled services and analytics that drive compliant revenue leading to improved financial performance across the enterprise. For more information, visit www.streamlinehealth.net.

Non-GAAP Financial Measures

Streamline reports its financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). Streamline’s management also evaluates and makes operating decisions using various other measures. One such measure is adjusted EBITDA, which is a non-GAAP financial measure. Streamline’s management believes that this measure provides useful supplemental information regarding the performance of Streamline’s business operations.

Streamline defines “adjusted EBITDA” as net earnings (loss) plus interest expense, tax expense, depreciation and amortization expense of tangible and intangible assets, share-based compensation expense, significant non-recurring operating expenses, restructuring expenses, impairment of goodwill and long-lived assets and transactional related expenses including: gains and losses on debt and equity conversions, associate severances and related alignment expenses, associate inducements, and professional and advisory fees. A table reconciling this measure to “net loss,” to the extent relevant items were recognized in the periods covered, is included in this press release.

Booked SaaS ACV represents the annualized value of all executed SaaS contracts, including contracts that have not been fully implemented, as of the measurement date, assuming any contract that expires during the twelve months following the measurement date is renewed on its existing terms unless the Company has knowledge of the non-renewal. Booked SaaS ACV should be viewed independently of revenue and does not represent revenue calculated in accordance with GAAP on an annualized basis, as it is an operating metric that can be impacted by contract execution start and end dates and renewal rates. Booked SaaS ACV is not intended to be a replacement for, or forecast of, revenue. There is no GAAP measure comparable to Booked SaaS ACV.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements made by Streamline Health Solutions, Inc. that are not historical facts are forward-looking statements that are subject to certain risks, uncertainties and important factors that could cause actual results to differ materially from those reflected in the forward-looking statements included herein. Forward-looking statements contained in this press release include, without limitation, statements regarding the Company’s growth prospects, anticipated bookings, recognition of revenue from contracts included in Booked SaaS ACV, anticipated cost savings from previously announced strategic restructuring, expected improved implementation timelines and lower expenses for our clients, industry trends and market growth, adjusted EBITDA, success of future products and related expectations and assumptions. These risks and uncertainties include, but are not limited to, the timing of contract negotiations and execution of contracts and the related timing of the revenue recognition related thereto, the potential cancellation of existing contracts or clients not completing projects included in the backlog and Booked SaaS ACV, achievement of a breakeven SaaS ARR run rate, the impact of competitive solutions and pricing, solution demand and market acceptance, new solution development and enhancement of current solutions, key strategic alliances with vendors and channel partners that resell the Company’s solutions, the ability of the Company to generate cash from operations, the availability of additional debt and equity financing to fund the Company’s ongoing operations, the ability of the Company to control costs, the effects of cost-containment measures implemented by the Company, availability of solutions from third party vendors, the healthcare regulatory environment, potential changes in legislation, regulation and government funding affecting the healthcare industry, healthcare information systems budgets, availability of healthcare information systems trained personnel for implementation of new systems, as well as maintenance of legacy systems, fluctuations in operating results, effects of critical accounting policies and judgments, changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other similar entities, changes in economic, business and market conditions impacting the healthcare industry generally and the markets in which the Company operates and nationally, the Company’s ability to maintain compliance with the terms of its credit facilities, and other risks detailed from time to time in the Streamline Health Solutions, Inc. filings with the U. S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date hereof. The Company undertakes no obligation to publicly release the results of any revision to these forward-looking statements, which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law.

Company Contact

Jacob Goldberger

Vice President, Finance

303-887-9625

jacob.goldberger@streamlinehealth.net

| STREAMLINE HEALTH SOLUTIONS, INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (rounded to the nearest thousand dollars, except share and per share information) |

|||||||||||||||

| Three Months Ended July 31, | Six Months Ended July 31, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenues: | |||||||||||||||

| Software as a service | $ | 3,078,000 | $ | 3,531,000 | $ | 5,801,000 | $ | 6,706,000 | |||||||

| Maintenance and support | 883,000 | 1,100,000 | 1,773,000 | 2,257,000 | |||||||||||

| Professional fees and licenses | 515,000 | 1,139,000 | 1,233,000 | 2,139,000 | |||||||||||

| Total revenues | 4,476,000 | 5,770,000 | 8,807,000 | 11,102,000 | |||||||||||

| Operating expenses: | |||||||||||||||

| Cost of software as a service | 1,495,000 | 1,893,000 | 2,844,000 | 3,482,000 | |||||||||||

| Cost of maintenance and support | 43,000 | 32,000 | 84,000 | 121,000 | |||||||||||

| Cost of professional fees and licenses | 840,000 | 1,022,000 | 1,727,000 | 2,130,000 | |||||||||||

| Selling, general and administrative expense | 2,989,000 | 4,116,000 | 6,181,000 | 7,957,000 | |||||||||||

| Research and development | 1,324,000 | 1,305,000 | 2,435,000 | 3,006,000 | |||||||||||

| Total operating expenses | 6,691,000 | 8,368,000 | 13,271,000 | 16,696,000 | |||||||||||

| Operating loss | (2,215,000 | ) | (2,598,000 | ) | (4,464,000 | ) | (5,594,000 | ) | |||||||

| Other (expense) income: | |||||||||||||||

| Interest expense | (496,000 | ) | (267,000 | ) | (961,000 | ) | (515,000 | ) | |||||||

| Valuation adjustments | (91,000 | ) | 359,000 | (115,000 | ) | 723,000 | |||||||||

| Other | (1,000 | ) | (1,000 | ) | (2,000 | ) | 31,000 | ||||||||

| Loss before income taxes | (2,803,000 | ) | (2,507,000 | ) | (5,542,000 | ) | (5,355,000 | ) | |||||||

| Income tax expense | — | (8,000 | ) | — | (61,000 | ) | |||||||||

| Net loss | $ | (2,803,000 | ) | $ | (2,515,000 | ) | $ | (5,542,000 | ) | $ | (5,416,000 | ) | |||

| Basic and Diluted Earnings Per Share: | |||||||||||||||

| Net loss per common share – basic and diluted | $ | (0.05 | ) | $ | (0.04 | ) | $ | (0.09 | ) | $ | (0.10 | ) | |||

| Weighted average number of common shares – basic and diluted | 60,110,178 | 56,357,684 | 59,167,134 | 56,164,282 | |||||||||||

| STREAMLINE HEALTH SOLUTIONS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (rounded to the nearest thousand dollars, except share and per share information) |

|||||||

| July 31, 2024 |

January 31, 2024 |

||||||

| (Unaudited) |

|||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 3,536,000 | $ | 3,190,000 | |||

| Accounts receivable, net of allowance for credit losses of $59,000 and $86,000, respectively | 2,521,000 | 4,237,000 | |||||

| Contract receivables | 969,000 | 780,000 | |||||

| Prepaid and other current assets | 659,000 | 629,000 | |||||

| Total current assets | 7,685,000 | 8,836,000 | |||||

| Non-current assets: | |||||||

| Property and equipment, net of accumulated amortization of $316,000 and $291,000 respectively | 64,000 | 88,000 | |||||

| Capitalized software development costs, net of accumulated amortization of $8,848,000 and $7,960,000, respectively | 5,403,000 | 5,798,000 | |||||

| Intangible assets, net of accumulated amortization of $4,837,000 and $4,019,000, respectively | 11,253,000 | 12,071,000 | |||||

| Goodwill | 13,276,000 | 13,276,000 | |||||

| Other | 1,344,000 | 1,666,000 | |||||

| Total non-current assets | 31,340,000 | 32,899,000 | |||||

| Total assets | $ | 39,025,000 | $ | 41,735,000 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 1,413,000 | $ | 1,253,000 | |||

| Accrued expenses | 1,948,000 | 2,023,000 | |||||

| Current portion of term loan | 2,000,000 | 1,500,000 | |||||

| Deferred revenues | 6,591,000 | 7,112,000 | |||||

| Acquisition earnout liability | 577,000 | 1,794,000 | |||||

| Total current liabilities | 12,529,000 | 13,682,000 | |||||

| Non-current liabilities: | |||||||

| Term loan, net of current portion and deferred financing costs | 6,611,000 | 7,566,000 | |||||

| Line of credit | — | 1,500,000 | |||||

| Notes payable, net of deferred financing costs | 3,853,000 | — | |||||

| Deferred revenues, less current portion | 134,000 | 173,000 | |||||

| Total non-current liabilities | 10,598,000 | 9,239,000 | |||||

| Total liabilities | 23,127,000 | 22,921,000 | |||||

| Commitments and contingencies | |||||||

| Stockholders’ equity: | |||||||

| Common stock, $0.01 par value per share, 85,000,000 shares authorized; 63,307,832 and 58,945,498 shares issued and outstanding, respectively | 633,000 | 590,000 | |||||

| Additional paid in capital | 136,506,000 | 133,923,000 | |||||

| Accumulated deficit | (121,241,000 | ) | (115,699,000 | ) | |||

| Total stockholders’ equity | 15,898,000 | 18,814,000 | |||||

| Total liabilities and stockholders’ equity | $ | 39,025,000 | $ | 41,735,000 | |||

| STREAMLINE HEALTH SOLUTIONS, INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (rounded to the nearest thousand dollars) |

|||||||

| Six Months Ended July 31, | |||||||

| 2024 | 2023 | ||||||

| Net loss | $ | (5,542,000 | ) | $ | (5,416,000 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Depreciation and amortization | 2,290,000 | 2,134,000 | |||||

| Accrued interest expense – notes payable | 326,000 | — | |||||

| Valuation adjustments | 115,000 | (723,000 | ) | ||||

| Benefit for deferred income taxes | — | 43,000 | |||||

| Share-based compensation expense | 1,032,000 | 1,109,000 | |||||

| Provision for credit losses | (58,000 | ) | — | ||||

| Changes in assets and liabilities: | |||||||

| Accounts and contract receivables | 1,585,000 | 4,985,000 | |||||

| Other assets | (71,000 | ) | (146,000 | ) | |||

| Accounts payable | 78,000 | 31,000 | |||||

| Accrued expenses and other liabilities | (75,000 | ) | (1,361,000 | ) | |||

| Deferred revenue | (560,000 | ) | (1,592,000 | ) | |||

| Net cash used in operating activities | (880,000 | ) | (936,000 | ) | |||

| Cash flows from investing activities: | |||||||

| Purchases of property and equipment | — | (47,000 | ) | ||||

| Capitalization of software development costs | (426,000 | ) | (1,026,000 | ) | |||

| Net cash used in investing activities | (426,000 | ) | (1,073,000 | ) | |||

| Cash flows from financing activities: | |||||||

| Repayment of bank term loan | (500,000 | ) | (250,000 | ) | |||

| Repayment of line of credit | (1,500,000 | ) | — | ||||

| Proceeds from issuance of common stock | 100,000 | — | |||||

| Proceeds from notes payable | 4,400,000 | — | |||||

| Payments of acquisition earnout liabilities | (686,000 | ) | — | ||||

| Payments for deferred financing costs | (86,000 | ) | — | ||||

| Payments related to repurchase of common shares to satisfy employee tax withholding | (77,000 | ) | (252,000 | ) | |||

| Other | 1,000 | — | |||||

| Net cash provided (used in) by financing activities | 1,652,000 | (502,000 | ) | ||||

| Net increase (decrease) in cash and cash equivalents | 346,000 | (2,511,000 | ) | ||||

| Cash and cash equivalents at beginning of period | 3,190,000 | 6,598,000 | |||||

| Cash and cash equivalents at end of period | $ | 3,536,000 | $ | 4,087,000 | |||

| STREAMLINE HEALTH SOLUTIONS, INC. RECONCILIATION OF NET LOSS TO NON-GAAP ADJUSTED EBITDA (Unaudited, rounded to the nearest thousand dollars) |

||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| In thousands, except per share data | July 31, 2024 | July 31, 2023 | July 31, 2024 | July 31, 2023 | ||||||||||||

| Adjusted EBITDA Reconciliation | ||||||||||||||||

| Net Loss | $ | (2,803 | ) | $ | (2,515 | ) | $ | (5,542 | ) | $ | (5,416 | ) | ||||

| Interest expense | 496 | 267 | 961 | 515 | ||||||||||||

| Income tax expense | — | 8 | — | 61 | ||||||||||||

| Depreciation and amortization | 1,056 | 1,050 | 2,073 | 2,081 | ||||||||||||

| EBITDA | $ | (1,251 | ) | $ | (1,190 | ) | $ | (2,508 | ) | $ | (2,759 | ) | ||||

| Share-based compensation expense | 533 | 537 | 1,032 | 1,109 | ||||||||||||

| Non-cash valuation adjustments | 91 | (359 | ) | 115 | (723 | ) | ||||||||||

| Acquisition-related costs, severance, and transaction-related bonuses |

325 | 119 | 356 | 176 | ||||||||||||

| Other non-recurring charges | — | — | — | (33 | ) | |||||||||||

| Adjusted EBITDA | $ | (302 | ) | $ | (893 | ) | $ | (1,005 | ) | $ | (2,230 | ) | ||||

Source: Streamline Health Solutions, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Under-The-Radar Defensive AI Sector Quietly Outperforms All Others, Despite Receiving 'No Love' From Investors

The utilities sector has emerged as the top-performing sector within the S&P 500 so far in 2024.

As of Sept. 11, the Utilities Select Sector SPDR Fund XLU has surged 22% year-to-date, outpacing all other sectors and even surpassing the technology sector – tracked by the Technology Select Sector SPDR Fund XLK – by 9 percentage points.

This marks a significant turnaround for utilities, which trailed tech by 40 percentage points in 2023.

Chart: Utilities Sector Outperforms S&P 500, Tech Stocks In 2024

The Drivers Behind The Utility Sector Surge

The robust performance of utilities stocks in 2024 has caught many investors by surprise, especially given the broader market’s focus on growth sectors like technology in recent years.

“There is an undeniable defensive undertone here, as defensive stocks like utilities and consumer staples are leading the charge. The lack of momentum in the previously unstoppable ‘Magnificent 7’ tech stocks could be signaling a shift in market sentiment,” analyst Michael Gayed.

This move toward defensive assets is particularly significant amid rising concerns over macroeconomic volatility and an increasingly unpredictable interest rate environment.

Bank of America recently raised its outlook for the utilities sector to Overweight, citing a combination of income and quality characteristics, which have become increasingly attractive as volatility rises.

“Client flows have suggested no love for the sector, but single stocks have begun to see inflows in recent weeks and ETF flows have begun to trend positively since the spring,” analysts at Bank of America highlighted.

“It’s remarkable that the most defensive sector of the S&P 500 has officially become the year’s top performer, despite the widespread consensus that the economy is doing well,” Otavio Costa, a macro strategist at Crescat Capital, said in a post on social media X.

Utilities Meet Rising Demand For AI-Driven Data Centers

Indeed, a critical factor boosting the utilities sector is the rising demand for electricity tied to the growth of AI-linked data centers.

Carly Davenport, an analyst at Goldman Sachs, highlighted this trend in a note, saying, “Data center growth is starting to contribute meaningfully to power demand, and we’ve seen further positive revisions to the pipeline.”

Goldman Sachs estimates that data centers will be the largest driver of U.S. power demand growth, contributing around 90 basis points (bps) to the nation’s 2.4% power demand compound annual growth rate through 2030.

This increase in demand is expected to lead to incremental capital investments in transmission and generation capacity, potentially driving further upside for utilities stocks over the next several years.

Top-Performing Utility Stocks in 2024

Several utility companies have experienced outsized gains this year, driven by strong earnings, strategic investments, and sectoral tailwinds. Here’s a look at the top-performing utility stocks year-to-date through Sept. 11:

| Name | Price Chg. % (YTD) |

| Vistra Corp. VST | 107.95% |

| Constellation Energy Corporation CEG | 60.22% |

| NRG Energy, Inc. NRG | 54.88% |

| NextEra Energy, Inc. NEE | 37.39% |

| Public Service Enterprise Group Inc. PEG | 34.52% |

| American Electric Power Company, Inc. AEP | 26.86% |

| The Southern Company SO | 26.63% |

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Buy These 4 High-Yield Dividend Stocks Today and Sleep Soundly for a Decade

Everyone loves a stock that pays a huge dividend, but finding one you can trust is not always easy. After all, what good is a high dividend yield if the company cuts the payout?

Fortunately, there is hope. The energy industry can be a great place to look for big-time dividend stocks. Energy is the foundation of society; it’s everywhere, whether used for transportation, heating your home, or manufacturing the goods and services we buy.

After some digging, I found a handful of high-yield energy stocks you can trust to keep delivering hefty dividends to your portfolio.

1. A diversified energy giant in Canada

Dividend yield: 6.6%

Enbridge (NYSE: ENB) is a North American energy company. Its pipelines transport oil and natural gas throughout the continent, including 20% of the natural gas America consumes. Additionally, it operates North America’s largest gas utility. These two businesses generate most of Enbridge’s profits, though the company also dabbles in renewable energy generation, which could be a long-term growth opportunity.

Enbridge enjoys very steady revenue from its core pipeline and utility businesses. Not only do people always need energy, but these two industries are also heavily regulated, which helps limit competition.

Slow and steady business performance is fertile ground for dividends; Enbridge has paid and raised its dividend for 28 consecutive years. So, investors get a high starting yield, and the payout grows, too. Enbridge expects to earn approximately 5.60 Canadian dollars per share in distributable cash profits in 2024 while paying out CA$3.66. That’s a healthy 65% dividend payout ratio, leaving some breathing room for future increases and a safety net if the business stumbles.

2. A long-standing oil major

Dividend yield: 4.6%

Chevron (NYSE: CVX) is an integrated oil and gas company with upstream and downstream operations. That means Chevron explores and drills for fossil fuels, refines them, and sells them to the market.

The company dates back to the 1800s as Pacific Coast Oil. Since the oil and gas industry dates back to the Industrial Revolution, it should be no surprise that such a historic company also has a storied dividend track record. Chevron has paid and raised its dividend for 37 consecutive years, proving it can pay its investors through the oil and gas industry’s ups and downs.

The dividend remains in excellent health today; the current payout ratio is 55% based on Chevron’s estimated 2024 earnings. The company’s strong balance sheet, rated AA-, is a safety net for tough times. Chevron’s footprint in the resource-rich Permian Basin sets the business up for long-term growth.

The company is also trying to acquire Hess for its coveted Guyana assets, though ExxonMobil has opposed the deal in court. Investors will need to wait and see how the Hess situation plays out, but Chevron should remain a dependable, high-yield dividend stock regardless of whether the Hess deal closes.

3. Dividends on the back of artificial intelligence

Dividend yield: 4.7%

Dominion Energy (NYSE: D) is a prominent gas and electric utility company in the United States, serving over 4.5 million customers in Virginia, North and South Carolina, Utah, Idaho, Wyoming, West Virginia, Ohio, Pennsylvania, and Georgia.

Dominion has had issues affording its dividend, unlike the other companies on this list. The company cut its dividend in late 2020 and hasn’t raised it since early 2022. So, how did it make this list?

Utility companies grow when customers need more energy. The Virginia market is high-tech and includes a massive and growing data center footprint. Dominion is poised to grow from the increased electricity demand.

Analysts believe Dominion will earn $2.77 per share this year, which isn’t good because its dividend is $2.67. That’s almost all its earnings going out the door. However, earnings estimates for next year are $3.39 per share, so the payout ratio should improve greatly over the next 12 to 18 months.

4. A healthier and improved pipeline stock

Dividend yield: 5.4%

Kinder Morgan (NYSE: KMI) is a pipeline company that transports oil and gas, CO2, and other resources through North America.

The company cut its dividend to protect its balance sheet in 2015 but has raised it for the past seven years and counting. A past cut may be a deal-breaker for some investors, but it might be worth having some faith in Kinder Morgan.

The company has decreased its leverage by 26% since 2016 and today has an investment-grade credit rating. Kinder Morgan is guiding for $2.26 in distributable cash flow this year versus a $1.15 dividend. That’s a payout ratio of just over 50%. The dividend should remain reliable as long as the company stays financially sound.

Kinder Morgan is more exposed to natural gas today than a decade ago, which positions the company for growth. Management believes natural gas demand in the U.S. will increase 19% by 2030, including significant growth in exports through Mexico (Kinder Morgan is based in Houston, Texas). Investors should see dependable dividends from Kinder Morgan for the foreseeable future.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron, Enbridge, and Kinder Morgan. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Buy These 4 High-Yield Dividend Stocks Today and Sleep Soundly for a Decade was originally published by The Motley Fool

Nvidia's $50 Billion Share Buyback Is the Ultimate Smoke-and-Mirrors Campaign

For the better part of two years, artificial intelligence (AI) has been the hottest thing since sliced bread on Wall Street. The prospect of AI-driven software and systems learning without human intervention gives this technology broad-reaching utility in almost every sector and industry.

Though we’ve seen no shortage of next-big-thing trends come and go on Wall Street since the advent of the internet three decades ago, none have offered as large of an addressable market as artificial intelligence. Based on a report issued by researchers at PwC, AI is forecast to add $15.7 trillion to the global economy in 2030.

While a number of stocks have soared on the heels of the AI revolution, no company has benefited more than semiconductor goliath Nvidia (NASDAQ: NVDA).

Nvidia is on the cutting edge of Wall Street’s hottest trend

In the blink of an eye, Nvidia’s AI-graphics processing units (GPUs) became the undisputed top choice by businesses looking run generative AI solutions and train large language models. Nvidia’s H100 chip has been backlogged due to excess demand, while its successor chip, Blackwell, is estimated to be sold out well into 2025. Blackwell is set to make its debut during the first quarter of next year.

The beauty of AI-GPU demand overwhelming supply is that it puts the ball completely in Nvidia’s court when it comes to pricing power. Nvidia’s GPU hardware has consistently been priced at a 100% to 300% premium to competing chips — and businesses are eagerly lining up to pay this higher price. Over the last six quarters, Nvidia’s adjusted gross margin has expanded by more than 10 percentage points, largely thanks to this otherworldly pricing power.

During the fiscal second quarter of 2025 (ended July 28), Nvidia delivered sales growth of 122% and reported just a hair over $30 billion in sales. For some context on just how quickly Nvidia has ramped its sales, it generated a little north of $6 billion in revenue for the fourth quarter of fiscal 2023.

But while it’s looked every bit like Wall Street’s textbook growth stock, Nvidia threw the ultimate smoke-and-mirrors curveball to investors with one aspect of its latest report.

Nvidia’s $50 billion share buyback is nothing more than a smoke-and-mirrors campaign

With professional and everyday investors looking for Nvidia to report blowout second-quarter sales growth and hype up its future hardware and software offerings — the company’s CUDA software toolkit has played a key role in keeping enterprise clients loyal to its AI-GPUs — Nvidia delivered the news that its board had approved a $50 billion share repurchasing program. This comes atop the $7.5 billion remaining from a previously announced buyback allotment.

The purpose of buyback programs is to signal to investors that a company’s board believes its stock is being undervalued by Wall Street and investors.

Furthermore, buying back stock has the ability to reduce a company’s outstanding share count, which can provide an upward lift to earnings per share (EPS). In other words, it can make a stock more attractive to fundamentally focused investors.

However, devoting up to $50 billion to a buyback program isn’t something you’d expect from a hypergrowth company that’s expected to spend a small fortune on researching and developing new products and services tied to the AI revolution.

One reason this is a complete smoke-and-mirrors move is because the company is dangling the prospect of repurchasing an additional $50 billion worth of its stock at a time when insiders are selling their shares at a historic pace. Since the midpoint of June, CEO Jensen Huang has disposed of around $600 million worth of his company’s stock. Net insider selling activity has topped $1.6 billion over the trailing-12-month period.

To add to the above, no insider has purchased a single share of their company’s stock on the open market since Chief Financial Officer Colette Kress bought 200 shares in (wait for it…) December 2020!

If this isn’t egregious enough, Nvidia is attempting to signal that its stock is undervalued at a time when its shares are historically pricey, relative to its trailing-12-month (TTM) price-to-sales (P/S) ratio.

Throughout history, you can count on one hand how many times we’ve witnessed market-leading companies approach a TTM P/S ratio of 40. The last time this occurred, both Amazon and Cisco Systems went on to lose around 90% of their respective value following the bursting of the dot-com bubble.

Dangling the carrot of buybacks at a time when Nvidia’s valuation is historically expensive is the ultimate smoke-and-mirrors campaign.

History would like a word, too

Looking beyond Nvidia’s head-scratching share repurchase announcement, investors should also note the warning history provides when it comes to next-big-thing innovations, technologies, and trends.

While there’s no question that big dollar figures tied to large addressable markets can lead to emotion-driven euphoria on Wall Street, history has repeatedly shown that every highly touted innovation, technology, and trend over the last 30 years has, eventually, navigated its way through an early stage bubble.

The catalyst for this bubble is investors who consistently overestimate the adoption and/or utility of next-big-thing trends. Although artificial intelligence has a promising future, the simple fact that most businesses lack a well-defined game plan to grow their sales and increase their profits is a glaring warning that investor expectations are outpacing reality.

History also tells us that every game-changing technology has needed time to mature. It took more than a half-decade for business-to-business commerce to find its footing following the proliferation of the internet in the mid-1990s. It’s going to take time for businesses to figure out what they have with AI and how to best utilize the technology to meet the needs of their customers.

Long story short, a $50 billion share repurchase program doesn’t hide the fact that Nvidia’s insiders are big-time sellers, the stock is historically pricey, and no highly touted innovation has escaped an early innings bubble for three decades.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cisco Systems, and Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s $50 Billion Share Buyback Is the Ultimate Smoke-and-Mirrors Campaign was originally published by The Motley Fool

Shaq Once Said The 'Earth Was Flat' And Then It Cost Him $20M: 'It Was Like 500K Hate Mail'

Earlier this month, NBA Hall of Famer, Shaquille O’Neal, also known as Shaq, revealed that he lost a $20 million deal due to his public comment that the Earth is flat.

What Happened: During an episode of Complex’s “GOAT Talk,” O’Neal spoke about how his involvement in the 2017 flat Earth debate led to the loss of a lucrative deal.

The former Los Angeles Lakers superstar discussed various topics with his son, Myles O’Neal when a cue card question brought up the incident.

The NBA legend remembered his contentious statement, “I said Earth was flat one time, and I lost a f**king big deal on that. Yeah, cause [of] the haters.”

He did not reveal the name of the company but stated that the decision-makers received 500,000 complaints, which prompted them to terminate the partnership.

“It was like 500,000 hate mail they said man we can’t big deal like $20 million I’m not going to elaborate on it,” he stated.

Why It Matters: O’Neal caused a media uproar in 2017 when he appeared to support the flat Earth theory on “The Big Podcast With Shaq.”

Later, while appearing on Jordan Harbinger’s podcast “The Art of Charm,” O’Neal took back his comments, saying he was only kidding.

“The Earth is flat,” he said, adding, “Would you like to hear my theory? The first part of the theory is, I’m joking, you idiots.”

His controversial statement coincided with a similar claim by Dallas Mavericks point guard, Kyrie Irving, who later apologized after facing backlash.

Meanwhile, O’Neal’s off-court activities have been making headlines. Earlier this month, he showcased his custom Tesla Cybertruck.

The vehicle, named the “Cyberbeast,” features a widebody kit and carbon fiber build, enhancing its lightweight design and bold appearance.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mortgage Rates Fall To Lowest Level Since February 2023

Mortgage rates declined to their lowest point in more than 18 months last week, encouraging homebuyers to refinance the amount they have left on their home loans.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.29 percent from 6.43 percent, marking the sixth straight week in declining rates, according to the Mortgage Bankers Association (MBA).

The average interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $766,550) decreased to 6.56% from 6.73%.

Read Also: Mortgage Applications Fall As Rates Climb Back Above 7%

The average rate for 15-year fixed-rate mortgages decreased to 5.71% from 5.98%.

The refinance share of mortgage activity increased to 46.7 percent of total applications from 46.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 5.4 percent of total applications.

“Mortgage rates declined for the sixth consecutive week, with the 30-year fixed rate decreasing to 6.29 percent, the lowest rate since February 2023,” said Joel Kan, MBA’s vice president and deputy chief economist.

“With rates almost a full percentage point lower than a year ago, refinance applications continue to run much higher than last year’s pace.”

Mortgage applications increased 1.4 percent from one week earlier, according to the MBA’s Weekly Applications Survey for the week ending Sept. 6, 2024.

“Purchase applications increased over the week and are edging closer to last year’s levels,” Kan said.

“Despite the drop in rates, affordability challenges and other factors such as limited inventory might still be hindering purchase decisions.”

Price Action: Lenders trended downward into Wednesday’s late-morning trading.

- Invesco Mortgage Capital Inc. IVR slipped 1.14% to $8.67

- Rocket Companies Inc RKT declined 1.78% to $18.52

- Lendingtree (TREE) fell 1.74% to $50.74

Exchange-traded funds that hold these stocks saw gains and losses on Wednesday.

- Kingsbarn Dividend Opportunity ETF DVDN went up 0.14%

- Global X SuperDividend REIT ETF SRET declined 1.31%

- VanEck Mortgage REIT Income ETF MORT fell 1.45%

Read Now:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fortune and Great Place to Work Name CATIC to 2024 Best Workplaces in Real Estate List, Ranking No. 13

ROCKY HILL, Conn., Sept. 10, 2024 /PRNewswire/ — Great Place To Work® and Fortune have selected CATIC for the 2024 Fortune Best Workplaces in Real Estate™ List. This is CATIC’s second time being named to this prestigious list, this year coming in at 13th place. Earning a spot means that CATIC is one of the best companies to work for in the country.

This is CATIC’s second time being named to this prestigious list, this year coming in at 13th place.

The Best Workplaces in Real Estate award is based on analysis of survey responses from over 29,000 employees at Great Place To Work Certified™ companies in the real estate industry.

“We are grateful for our hard working and dedicated employees who have made us a part of this prestigious list,” said James M. Czapiga, Esq., President and CEO of the CATIC Family of Companies. “Our people make working at CATIC a truly special experience every day. We have built a strong culture of collaboration, inclusiveness, and innovation. We celebrate and thank our employees for all they do to earn this incredible honor.” Damon Carter, Senior Vice President and Chief Administrative Officer, added, “We are excited and thankful to be recognized again this year. Our amazing employees continue to be the key differentiating factor that makes CATIC a great place to work. They remain steadfast in their commitment to upholding our core values in various ways and clearly understand the importance of doing their part to establish an engaging and inclusive workplace culture every day.”

CATIC was previously ranked #21 on Fortune’s Best Workplaces in Real Estate List. In 2023, CATIC was also named to the Hartford Courant Top Workplaces List for the sixth year in a row and the company successfully renewed its Great Place to Work Certification. Earlier this year, the company was also named to the USA Today Top Workplaces List and received recognition as a Monster Remote Work Top Workplaces Winner.

About CATIC

CATIC, along with its sister company, CATIC Title Insurance Company, is currently the ninth largest title insurance underwriter in the United States and is the premier underwriter exclusively for independent agents. CATIC offers standard ALTA policies and expanded protection policies for both residential and commercial properties. The company is licensed in 44 states and is currently doing business in 25 states. CATIC is currently partnered with over 2,400 independent agents nationwide and is committed to preserving the independent agent’s critical role in the real estate eco-system. The company has been in business for over 50 years and is an underwriting member of the American Land Title Association (ALTA) and numerous other local land title associations. For its stability and dependability in the market, CATIC has earned an A’ rating from Demotech and an A- rating from Kroll Bond Ratings. For more information about the company, or to become a CATIC agent, please visit us at www.CATIC.com, or follow us on LinkedIn, Facebook, and Instagram.

About the Fortune Best Workplaces in Real Estate List

Great Place To Work selected the 2024 Fortune Best Workplaces in Real Estate by analyzing confidential survey responses from more than 1.3 million employees, representing the experiences of over 8.2 million employees in the U.S. in 2023 and 2024. Of those, more than 29,000 responses came from employees at Great Place To Work Certified companies in the real estate industry, and these rankings are based on that feedback. Company rankings are derived from 60 employee experience questions within the Great Place To Work Trust Index™ Survey. To eligible for this list, companies must have at least 10 employees. Read the full methodology.

To get on this list next year, start here.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fortune-and-great-place-to-work-name-catic-to-2024-best-workplaces-in-real-estate-list-ranking-no-13-302244200.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fortune-and-great-place-to-work-name-catic-to-2024-best-workplaces-in-real-estate-list-ranking-no-13-302244200.html

SOURCE CATIC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Nvidia Stock

NVIDIA Corporation NVDA shares closed higher during Tuesday’s session.

Nvidia shares extended gains on Tuesday after adding 3.5% on Monday. Shares of the AI darling fell around 14% last week.

U.S. antitrust authorities have reportedly initiated an early-stage investigation into NVIDIA over its potential dominance in the artificial intelligence chip market. The Justice Department’s antitrust division has contacted Nvidia to inquire about its contracts and partnerships, The Wall Street Journal reported on Sunday, citing people familiar with the matter.

With the recent buzz around Nvidia, some investors may be eyeing potential gains from the company’s dividends too. As of now, Nvidia offers an annual dividend yield of 0.04%, which is a quarterly dividend amount of 1 cent per share (4 cents a year).

So, how can investors exploit its dividend yield to pocket a regular $500 monthly?

To earn $500 per month or $6,000 annually from dividends alone, you would need an investment of approximately $16,215,000 or around 150,000 shares. For a more modest $100 per month or $1,200 per year, you would need $3,243,000 or around 30,000 shares.

To calculate: Divide the desired annual income ($6,000 or $1,200) by the dividend ($0.04 in this case). So, $6,000 / $0.04 = 150,000 ($500 per month), and $1,200 / $0.04 = 30,000 shares ($100 per month).

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

How that works: The dividend yield is computed by dividing the annual dividend payment by the stock’s current price.

For example, if a stock pays an annual dividend of $2 and is currently priced at $50, the dividend yield would be 4% ($2/$50). However, if the stock price increases to $60, the dividend yield drops to 3.33% ($2/$60). Conversely, if the stock price falls to $40, the dividend yield rises to 5% ($2/$40).

Similarly, changes in the dividend payment can impact the yield. If a company increases its dividend, the yield will also increase, provided the stock price stays the same. Conversely, if the dividend payment decreases, so will the yield.

NVDA Price Action: Shares of Nvidia rose 1.5% to close at $108.10 on Tuesday.

Read More:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.