More Honesty in the Workplace Increases Productivity: New Survey

TORONTO, Sept. 11, 2024 (GLOBE NEWSWIRE) — Canadian companies should prioritize honest workplace communication if they want to improve productivity and attract and retain top talent, according to a newly released Express Employment Professionals-Harris Poll survey.

Almost all job seekers (93%) agree a work environment that allows employees and managers to be honest with one another is essential to a company’s success, with the vast majority (89%) adding honest workplace communication is critical for a productive workforce. Three-quarters of job seekers (75%) also say employees should feel comfortable discussing their personal issues with their manager if it is impacting their day-to-day work.

Companies can reap significant benefits from fostering more honest communication.

For instance, a large majority of job seekers (82%) say they would be more loyal to a company if they felt they could be honest with their manager. Indeed, job seekers report having seen firsthand when employees can speak honestly, morale (48%), productivity (44%) and loyalty to the company (43%) all increase.

On the other hand, when employees are not able to speak honestly at work job seekers report that employee morale falls (58%), productivity decreases (51%), employee burnout worsens (48%), workplace resentment jumps (47%) and employee turnover increases (44%).

Canadian hiring managers agree honest workplace communication plays a vital role in a company’s success. Two-thirds (66%) say it increases employee morale, while other benefits include making employees more loyal to the company (60%), improving productivity (56%), reducing conflicts and disagreements (51%) and decreasing employee turnover (47%).

More than half of hiring managers (58%) report the employees feeling comfortable being honest in the workplace is absolutely essential to their ability to be a good manager.

There’s Always Room for Improvement

Most companies (84%) feel they have created a workplace where employees can be honest, and more than three-quarters (76%) also believe their company has the right systems and tools in place to allow for constructive criticism to be received well.

As a result, nearly all employers (96%) feel their employees can speak honestly with anyone at the company regarding their concerns or issues — most commonly with their supervisor (66%) and their colleagues (57%).

Most job seekers (70%) agree their company encourages honest communication. The majority report it is easy to receive constructive feedback from a supervisor (76%), set professional boundaries so their work is not impacted by personal issues (73%) and be honest with a supervisor about issues they have with the company (63%).

However, less than half of job seekers (40%) report it is easy to discuss personal issues that are impacting their work with their manager.

Equipping Leaders with Relevant Training

Honest workplace communication requires managers to be properly trained on how to handle sometimes uncomfortable issues. Job seekers appreciate companies that offer resources to managers and employees to support honest communication.

However, more than half of hiring decision-makers (58%) report their company does not currently provide managers with resources or training on how to handle personal issues brought up by employees.

A strong majority of job seekers (90%) believe it is at least somewhat important (23% say it is absolutely essential) companies provide managers with resources and training on how to manage when an employee discusses personal issues. Most (88%) also believe it is at least somewhat important (21% say absolutely essential) that companies provide employees with resources and training on how to manage personal issues, so it doesn’t impact their work.

“The foundation of any good relationship is trust, which is no different in the workplace,” said Bill Stoller, Express Employment International CEO. “Similar to other leadership training, managers can significantly benefit from structured programs that emphasize healthy communication and the ability to handle challenging conversations.”

Survey Methodology

The Job Insights survey was conducted online within Canada by The Harris Poll on behalf of Express Employment Professionals between May 16 – June 3, 2024, among 504 Canadian hiring decision-makers between May 16 – June 3, 2024.

The Job Seeker Report was conducted online within Canada by The Harris Poll on behalf of Express Employment Professionals between May 28 – June 10, 2024, among 505 adults ages 18 and older.

For full survey methodologies, please contact Ana Curic at Ana@MapleLeafStrategies.com.

If you would like to arrange for an interview to discuss this topic, please contact Ana Curic at (613) 858-2622 or email Ana@MapleLeafStrategies.com.

About Bill Stoller

William H. “Bill” Stoller is chairman and chief executive officer of Express Employment International. Founded in Oklahoma City, Oklahoma, the international staffing franchisor supports the Express Employment Professionals franchise and related brands. The Express franchise brand is an industry-leading, international staffing company with franchise locations in the U.S., Canada, South Africa, Australia and New Zealand.

About Express Employment Professionals

At Express Employment Professionals, we’re in the business of people. From job seekers to client companies, Express helps people thrive and businesses grow. Our international network of franchises offers localized staffing solutions to the communities they serve across the U.S., Canada, South Africa, Australia and New Zealand, employing 492,000 people globally in 2023 and more than 11 million since its inception. For more information, visit ExpressPros.com/CA.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/59c8bfdd-2969-454e-bcdd-932fe513fd6b

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in NIO

Whales with a lot of money to spend have taken a noticeably bullish stance on NIO.

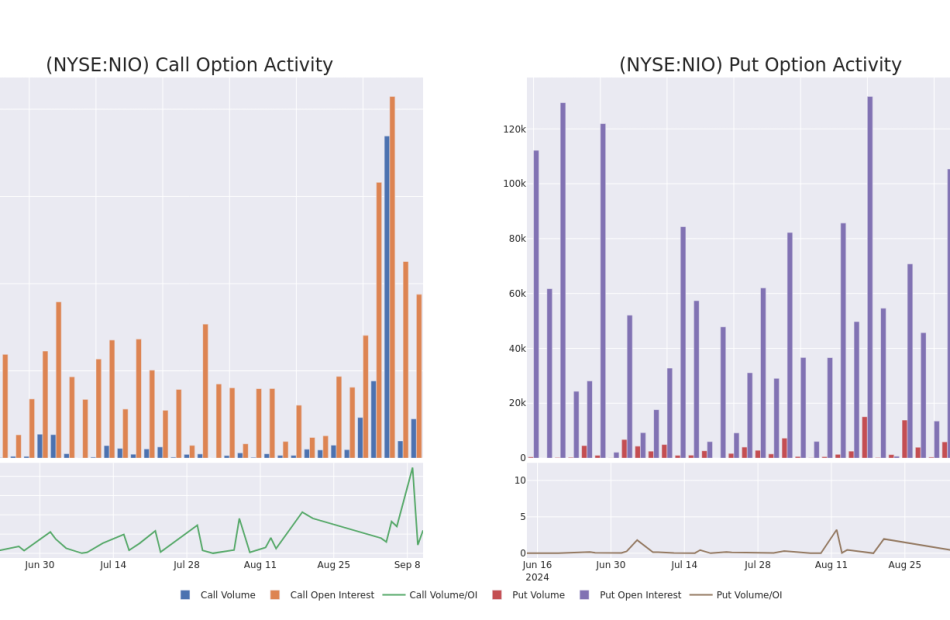

Looking at options history for NIO NIO we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $260,262 and 7, calls, for a total amount of $354,093.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $4.0 and $6.0 for NIO, spanning the last three months.

Insights into Volume & Open Interest

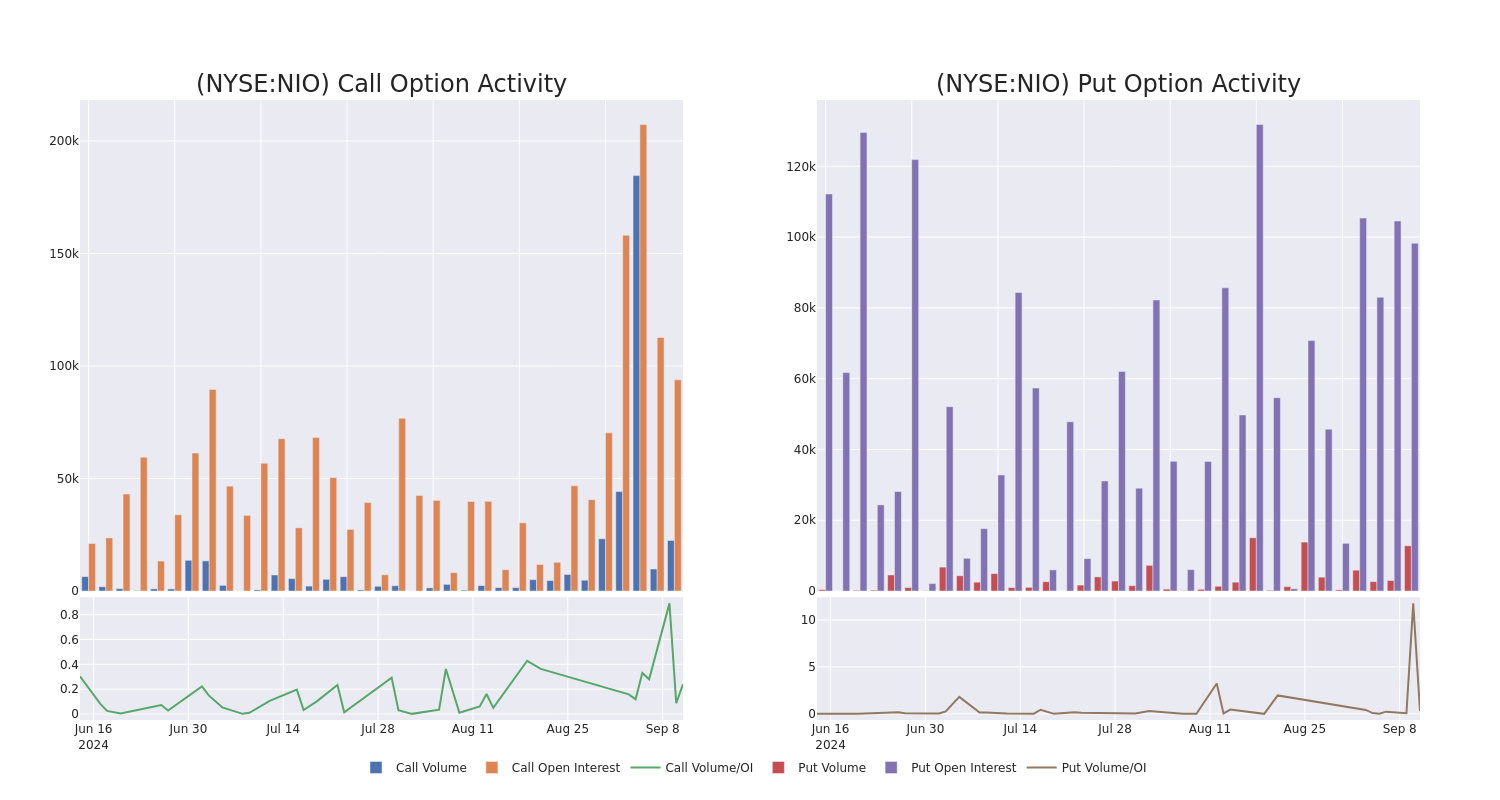

In terms of liquidity and interest, the mean open interest for NIO options trades today is 38417.8 with a total volume of 35,267.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for NIO’s big money trades within a strike price range of $4.0 to $6.0 over the last 30 days.

NIO Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | CALL | SWEEP | BULLISH | 11/15/24 | $0.52 | $0.49 | $0.52 | $6.00 | $104.0K | 38.8K | 560 |

| NIO | PUT | SWEEP | BEARISH | 01/17/25 | $0.61 | $0.58 | $0.61 | $5.00 | $84.3K | 57.6K | 1.4K |

| NIO | PUT | SWEEP | BEARISH | 12/20/24 | $0.55 | $0.53 | $0.55 | $5.00 | $82.6K | 40.6K | 4.9K |

| NIO | CALL | SWEEP | BULLISH | 11/15/24 | $0.54 | $0.51 | $0.54 | $6.00 | $79.2K | 38.8K | 4.5K |

| NIO | CALL | TRADE | BEARISH | 01/17/25 | $1.95 | $1.8 | $1.8 | $4.00 | $63.0K | 10.9K | 350 |

About NIO

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

Having examined the options trading patterns of NIO, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of NIO

- Currently trading with a volume of 5,423,130, the NIO’s price is up by 1.19%, now at $5.54.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 83 days.

What Analysts Are Saying About NIO

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $6.766666666666667.

- An analyst from B of A Securities persists with their Neutral rating on NIO, maintaining a target price of $5.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for NIO, targeting a price of $7.

- In a positive move, an analyst from JP Morgan has upgraded their rating to Overweight and adjusted the price target to $8.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for NIO with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Forget Palantir: 2 Tech Stocks to Buy Instead

Palantir‘s (NYSE: PLTR) stock has more than doubled over the past 12 months. The data mining and analytics company attracted a stampede of bulls as its revenue growth accelerated again, its margins expanded, and its profits soared. Its growing market cap and consistent profits also recently earned it a place in the S&P 500.

Palantir’s revenue rose 17% in 2023, and it anticipates 23%-24% growth this year as it gains new government contracts, expands its faster-growing U.S. commercial business, and rolls out more generative AI tools to crunch all of its data. It turned profitable in 2023, and analysts expect its earnings per share to more than double this year.

That’s a fantastic outlook, but Palantir’s stock is also priced for perfection at more than 70 times its forward adjusted earnings and 20 times next year’s sales. So instead of chasing Palantir at these levels, investors should look for other AI-oriented stocks that are also growing rapidly but trading at more reasonable valuations. I believe these two under-appreciated stocks fit the bill: Innodata (NASDAQ: INOD) and Datadog (NASDAQ: DDOG).

1. Innodata

Innodata provides business process, technology, and consulting services as well as software for creating, managing, and using digital information. It went public in 1993, and it only grew its revenue at an anemic compound annual growth rate (CAGR) of 6% from 1994 to 2019. By the end of 2019, its stock price had dropped to $1.14 — a 32% discount to its split-adjusted IPO price of $1.67 — and it was broadly dismissed as a slow-growth IT services and enterprise software company.

But today, Innodata’s stock trades at about $14. Its revenue accelerated and rose at a CAGR of 12% from 2019 to 2023. Analysts expect its revenue to grow at an even faster CAGR of 38% from 2023 to 2026. They also expect it to turn profitable in 2024 and nearly double its annual earnings per share (EPS) by 2026. Those are jaw-dropping growth rates for a stock that trades at 31 times forward earnings and 2 times next year’s sales.

That sudden growth spurt was entirely driven by Innodata’s launch of new generative AI services for five of the “Magnificent Seven” companies. It already secured master service agreements with three of those tech giants at the start of 2024, and it’s gradually tightening its relationships with two of those other companies. That steady expansion could turn this dusty old IT services company into a hyper-growth AI stock over the next few years.

2. Datadog

Datadog pulls diagnostic data from an organization’s infrastructure, applications, and logs in real-time and organizes all of that information on unified dashboards. That streamlined approach breaks down silos and makes it easier for IT professionals to spot potential problems. It’s also simplifying that process with generative AI tools and chatbots.

Datadog went public at $27 in 2019, and its stock skyrocketed to an all-time high of $196.56 during the apex of the meme and growth stock rally in November 2021. But today, it trades at about $107. It pulled back as its growth cooled in a more challenging market and rising interest rates squeezed its valuations, but it’s still a high-growth stock.

Datadog’s revenue grew at a CAGR of 67% from 2019 to 2022 as its total number of large customers (which generated over $100,000 in annual recurring revenue) — more than tripled. But in 2023, its revenue only rose 27% as its number of large customers increased 15% — but it turned profitable for the year as it reined in its spending.

The company’s slowing growth was disappointing, but analysts still expect its revenue to grow at a CAGR of 24% from 2023 to 2026 as its EPS increases at a CAGR of 77%. Those growth rates are comparable to Palantir’s, but Datadog trades at just 55 times its forward-adjusted earnings and 11 times next year’s sales. Therefore, this oft-overlooked growth stock might still attract more bulls and outperform Palantir in the near future.

Should you invest $1,000 in Datadog right now?

Before you buy stock in Datadog, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Datadog wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Datadog and Palantir Technologies. The Motley Fool has a disclosure policy.

Forget Palantir: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool

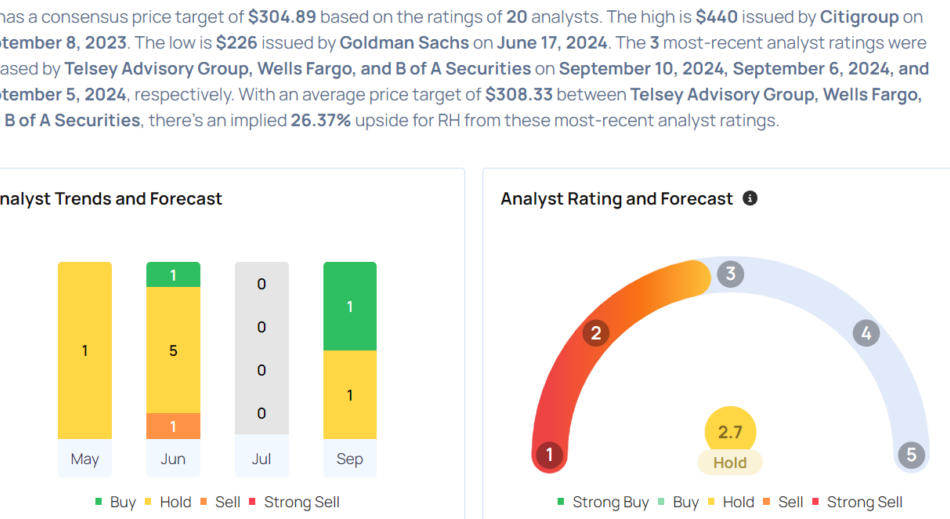

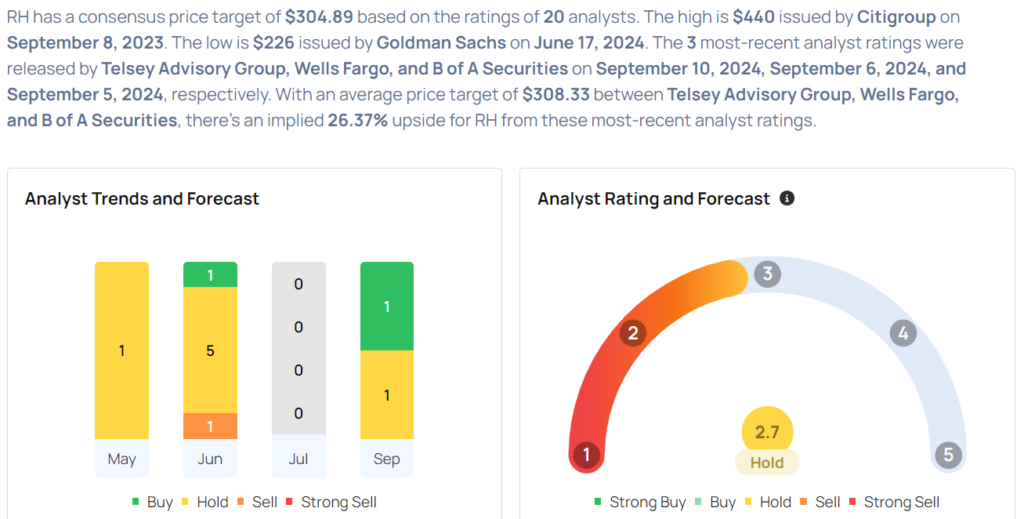

RH Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

RH RH will release earnings results for its second quarter, after the closing bell on Thursday, Sept. 12.

Analysts expect the Corte Madera, California-based company to report quarterly earnings at $1.56 per share, down from $3.93 per share in the year-ago period. RH is projected to post revenue of $824.52 million, according to data from Benzinga Pro.

On June 13, RH reported quarterly losses of 40 cents per share which missed the analyst consensus estimate of losses of 12 cents per share.

RH shares gained 1.1% to close at $244.09 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

Telsey Advisory Group analyst Joseph Feldman maintained a Market Perform rating with a price target of $290 on Sept. 10. This analyst has an accuracy rate of 69%.

Wells Fargo analyst Zachary Fadem maintained an Overweight rating and cut the price target from $350 to $325 on Sept. 6. This analyst has an accuracy rate of 87%.

Goldman Sachs analyst Kate McShane maintained a Sell rating and slashed the price target from $264 to $226 on June 17. This analyst has an accuracy rate of 66%.

Morgan Stanley analyst Simeon Gutman maintained an Equal-Weight rating and cut the price target from $320 to $300 on June 16. This analyst has an accuracy rate of 66%.

Wedbush analyst Seth Basham maintained a Neutral rating and slashed the price target from $320 to $250 on June 14. This analyst has an accuracy rate of 69%.

Considering buying RH stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'I Know I'm Not Broke' – Shaquille O'Neal's Card Was Declined At Walmart After Attempting 'The Biggest Purchase In Walmart History'

Shaquille O’Neal is known for being one of the most dominant players in NBA history, but his life off the court is just as interesting. From smart investments to hilarious stories, Shaq never fails to entertain. Incredibly, one of his most memorable stories happened at Walmart (NYSE:WMT).

Don’t Miss:

It all started when Shaq moved from Miami to Phoenix. He arrived late at night, only to find his new apartment empty. Since Shaq isn’t the kind of guy who likes to wait, he decided to fix the situation right away. He went to Walmart at 2 or 3 in the morning to buy everything he needed for his place – sheets, towels, laptops, printers, T-shirts, underwear, you name it.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

By the time he filled his shopping cart, the total was $70,000. At Walmart. Shaq now jokes that it was the “biggest purchase in Walmart history.”

But when he went to pay, something surprising happened. Shaq’s credit card was declined. He tried again, but the card was declined a second time. He was confused, saying, “I know I’m not broke,” so he decided to leave and figure it out later.

Not long after, Shaq got a call from American Express security. They thought someone had stolen his card because they saw a suspicious $70,000 charge at Walmart. When Shaq explained that he made the purchase, they couldn’t believe it. The representative asked, “Why are you spending $70,000 at Walmart?”

Shaq’s response? “Because I’m Shaq.”

He always had a keen eye for smart investments, as seen with his decision to invest in the home security company Ring. When Shaq needed a security system for one of his three homes in Atlanta, a security company quoted him $80,000. Even though he’s worth millions, Shaq knew that price was too steep. While shopping at Best Buy, he spotted Ring cameras and bought a DIY solution.

Not only did he install the system himself, but he also realized how powerful it was when he could monitor his home while traveling in China. Impressed, Shaq tracked down the CEO at a tech conference and offered to invest in the company, which he later did. A few years later, Amazon bought Ring for $1 billion, and Shaq’s investment turned into a huge win, just like many of his other ventures.

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Interestingly, Shaq’s fortune, estimated to be around $500 million, isn’t something he will give to his kids. He’s made it clear they’ll have to work for it. And he doesn’t just want them to get one college degree – he expects them to earn two.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘I Know I’m Not Broke’ – Shaquille O’Neal’s Card Was Declined At Walmart After Attempting ‘The Biggest Purchase In Walmart History’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Starbucks CEO lays into overwhelming menus, inconsistent product and long, hectic waits

In his first week on the job, 50-year-old star CEO Brian Niccol pledged to restore Starbucks to its former glory when the ubiquitous coffee haunt served as a second living room for many of its patrons.

The turnaround wizard who revived the fortunes of Chipotle during his more than six-year stint at the fast-casual Tex-Mex chain said the 39,000-plus Starbucks stores around the world needed to return to their roots, offering tailor-made, high-quality coffee that consumers can enjoy on the premises.

“There’s a shared sense we have drifted from our core,” he wrote in an open companywide letter, summarizing numerous conversations he held with staff. “We’re refocusing on what has always set Starbucks apart—a welcoming coffeehouse where people gather, and where we serve the finest coffee, handcrafted by our skilled baristas.”

Niccol is hitting the ground running. Already on his second day at the company, he is addressing fundamental problems he sees in the business and giving a brief overview of its strategic direction.

By comparison, predecessor Laxman Narasimhan had nearly six months of on-the-job training before taking over in March 2023, and only presented his first strategic overview a month later.

As Starbucks’ fourth CEO in two years, Niccol takes over at a turbulent time for the chain.

Narasimhan cut the company’s financial targets three times in less than a year and presided over two straight quarters during which same-store sales fell.

To prop up sales, Starbucks introduced its hugely popular, autumn-themed pumpkin spice latte as early as August, a move that many viewed as a sign of desperation.

Brian Niccol’s plan to turn things around

Niccol said his initial attention will be devoted to fixing problems in its U.S. stores, a concern for founder Howard Schultz, since it makes up the bulk of its global profits.

In Starbucks’ home market, consumers are typically spoiled for choice and often have several convenient coffee chains along their daily commute where they can buy a cup of joe en route to work.

A brand that charges premium prices, therefore, needs to differentiate itself through its experience, and lately, Starbucks customers have been turning their backs on the chain in frustration.

More than 60% of its critical morning traffic comes from app users, but the company admitted recently that a material share are canceling their orders because of excessive wait times upon arriving at their local Starbucks.

Instead, Niccol wants consumers to associate the chain with emotions of joy and human connection, along with great coffee, and here he sees plenty of room for improvement.

“In some places—especially in the U.S.—we aren’t always delivering,” Niccol wrote. “It can feel transactional, menus can feel overwhelming, the product is inconsistent, the wait too long or the handoff too hectic.”

This focus on human connection is nothing new; it’s a brand claim harking back to Schultz’s vision, which Narasimhan also emphasized.

Starbucks’ slump

But Niccol’s predecessor industrialized the process further to shave seconds off wait times, diminishing the role baristas long held as the “heart of Starbucks” and turning the experience into more of a McCafé.

In a hunt for greater returns, Starbucks has also strayed from its coffee roots, focusing more and more on caffeinated soft drinks, where it can often earn higher margins.

Finally, the Seattle-based chain has to win back customers lost after it sued unionized employees who called for solidarity with Palestinians caught in the crossfire of Israel’s war with Hamas.

Starbucks sought to clarify that it objected to the misappropriation of its brand, but by that point, progressive consumers had started boycotting the chain.

With shares now no higher than they were five years ago, the board booted Narasimhan out of the company in August, with immediate effect, ending the tenure of its CEO after fewer than 18 months.

Niccol’s hire met with wild approval from investors, easily justifying the $85 million performance-based signing bonus in cash and equity Starbucks offered to lure him away from Chipotle.

Now, they will have to see if he’s more successful at reestablishing the emotional connection consumers once had with the brand than Narasimhan.

“We will get back to what made Starbucks, Starbucks,” Niccol pledged.

The company could not be reached immediately for further comment.

This story was originally featured on Fortune.com

iCAD to Participate in the iAccess Alpha Buyside Best Ideas Fall Conference 2024

NASHUA, N.H., Sept. 11, 2024 (GLOBE NEWSWIRE) — iCAD, Inc. ICAD (“iCAD” or the “Company”) a global leader on a mission to create a world where cancer can’t hide by providing clinically proven AI-powered breast health solutions, announced today that management is participating in the iAccess Alpha Buyside Best Ideas Fall Conference 2024 on September 24 and 25, 2024. CEO, Dana Brown and CFO, Eric Lonnqvist will deliver a company presentation at 11:00 am ET on September 24, and host one-on-one meetings the following day, September 25.

To learn more about the iAccess Alpha Buyside Best Ideas Fall Conference 2024, or to register and schedule a one-on-one meeting with iCAD, please visit the conference website at https://www.iaccessalpha.com/home.

The iCAD presentation will be webcast live and available for replay at https://www.webcaster4.com/Webcast/Page/3064/51217. The iCAD presentation will also be available on the company’s investor relations website under the Events & Earnings Calls tab.

About iAccess Alpha

iAccess Alpha hosts virtual investor conferences, where presenting companies are recommended by investors. The conference format spans two days, with company webcast presentations on day one, followed by one-on-one meetings with company management teams on day two.

About iCAD, Inc.

iCAD, Inc. ICAD is a global leader on a mission to create a world where cancer can’t hide by providing clinically proven AI-powered solutions that enable medical providers to accurately and reliably detect cancer earlier and improve patient outcomes. Headquartered in Nashua, N.H., iCAD’s industry-leading ProFound Breast Health Suite provides AI-powered mammography analysis for breast cancer detection, density assessment and risk evaluation. Used by thousands of providers serving millions of patients, ProFound is available in over 50 countries. In the last five years alone, iCAD estimates reading more than 40 million mammograms worldwide, with nearly 30% being tomosynthesis. For more information, including the latest in regulatory clearances, please visit www.icadmed.com.

Forward-Looking Statements

Certain statements contained in this News Release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about the expansion of access to the Company’s products, improvement of performance, acceleration of adoption, expected benefits of ProFound AI®, the benefits of the Company’s products, and future prospects for the Company’s technology platforms and products. Such forward-looking statements involve a number of known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited, to the Company’s ability to achieve business and strategic objectives, the willingness of patients to undergo mammography screening, whether mammography screening will be treated as an essential procedure, whether ProFound AI will improve reading efficiency, improve specificity and sensitivity, reduce false positives and otherwise prove to be more beneficial for patients and clinicians, the impact of supply and manufacturing constraints or difficulties on our ability to fulfill our orders, uncertainty of future sales levels, to defend itself in litigation matters, protection of patents and other proprietary rights, product market acceptance, possible technological obsolescence of products, increased competition, government regulation, changes in Medicare or other reimbursement policies, risks relating to our existing and future debt obligations, competitive factors, the effects of a decline in the economy or markets served by the Company; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. The words “believe,” “demonstrate,” “intend,” “expect,” “estimate,” “will,” “continue,” “anticipate,” “likely,” “seek,” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. The Company is under no obligation to provide any updates to any information contained in this release. For additional disclosure regarding these and other risks faced by iCAD, please see the disclosure contained in our public filings with the Securities and Exchange Commission, available on the Investors section of our website at http://www.icadmed.com and on the SEC’s website at http://www.sec.gov.

CONTACTS

Media inquiries:

pr@icadmed.com

Investor Inquiries:

John Nesbett/Rosalyn Christian

IMS Investor Relations

icad@imsinvestorrelations.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Warren Buffett Stocks That Are Screaming Buys Right Now

There are roughly four dozen stocks in the massive portfolio of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), and to be fair, there’s a solid investment case to be made for most of them. However, one of Berkshire’s bank stocks and one of its megacap tech holdings look especially attractive at their current prices. Which of these two stocks owned by the Warren Buffett-led conglomerate is the better fit for you?

A highly profitable bank with a bright future

Capital One Financial (NYSE: COF) is one of Berkshire’s smaller bank stock holdings, with a stake of 2.6% of the bank worth “only” $1.6 billion. But for long-term investors, Capital One looks like a tremendous value and has some interesting growth opportunities in the future.

Capital One is best known for its credit card business, and for good reason. Credit cards make up more than half of Capital One’s total-loan portfolio, and because of the high-interest nature of the credit card industry, this allows Capital One to produce a 6.7% net-interest margin, more than double what most other large U.S. banks typically report. There is plenty of cash in reserves to cover expected losses, and while Capital One’s net charge-off rate has increased significantly over the past year, it has stabilized over the past couple of quarters and is at a reasonable level.

There are two other big reasons why I’m bullish on Capital One. First, lower interest rates could be a major catalyst, as they would significantly reduce Capital One’s deposit costs. Capital One is one of the few branch-based banks that offers online-like interest rates on deposit accounts, so this could be a big tailwind.

There’s also the pending acquisition of Discover Financial Services (NYSE: DFS), which would not only dramatically increase the size of Capital One’s credit card business but would give Capital One its own payment network, creating all sorts of interesting long-term possibilities.

After a recent pullback, Capital One trades for about 12% below its recent high and for more than 10% below its book value. To be fair, there are some legitimate risks involved with such a credit card-heavy banking business. But the risk-reward dynamics look very attractive right now, especially if the bank can successfully complete the Discover merger.

Strong growth and an attractive price

Amazon.com (NASDAQ: AMZN) has pulled back by more than 10% from its recent highs despite strong growth momentum and improving profitability throughout its business.

In the second quarter of 2024, Amazon reported net-sales growth of 11% year over year. But due to CEO Andy Jassy’s focus on efficiency, operating income soared by a staggering 91%. Net income doubled year over year, and there was a big improvement in all three of Amazon’s business segments (U.S. sales, international sales, and Amazon Web Services, or AWS).

Don’t make the mistake of thinking that Amazon doesn’t still have tons of room to grow. The industry-leading AWS business should have a long-tailed growth opportunity, as the cloud-computing industry is expected to more than triple in size by 2032. In fact, with 19% year-over-year sales growth, it is the fastest-growing part of Amazon’s business, and it is also far more profitable than the e-commerce side.

International growth is another big potential growth area, as Amazon.com doesn’t have nearly the dominant presence it has in the U.S. in many of its key international markets.

Which Buffett stock is right for you?

Both stocks look attractive at their current valuations, and both have exciting long-term growth opportunities. Both certainly have their risk factors, and while I don’t think investors will go wrong with either, Capital One looks like a value investor’s dream right now, while Amazon is a growth stock with rapidly increasing bottom-line profitability.

Should you invest $1,000 in Capital One Financial right now?

Before you buy stock in Capital One Financial, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Capital One Financial wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. Matt Frankel has positions in Amazon and Berkshire Hathaway. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool recommends Discover Financial Services. The Motley Fool has a disclosure policy.

2 Warren Buffett Stocks That Are Screaming Buys Right Now was originally published by The Motley Fool

29.5% of Warren Buffett's $305.7 Billion Portfolio Is Invested in 2 Artificial Intelligence (AI) Stocks

Warren Buffett has been at the helm of the Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) investment company since 1965. During his 59 years of leadership, Berkshire Hathaway stock has delivered a compound annual return of 19.8%, which would have been enough to turn an investment of $1,000 back then into more than $42.5 million today.

Buffett’s investment strategy is simple. He looks for growing companies with robust profitability and strong management teams, and he especially likes those with shareholder-friendly programs like dividend payments and stock-buyback plans.

One thing Buffett doesn’t focus on is the latest stock market trend, so you won’t find him piling money into artificial intelligence (AI) stocks right now. However, two stocks Berkshire already holds are becoming significant players in the AI industry, and they account for about 29.5% of the total value of the conglomerate’s $305.7 billion portfolio of publicly traded stocks and securities.

1. Apple: 28.9% of Berkshire Hathaway’s portfolio

Apple (NASDAQ: AAPL) is the world’s largest company with a $3.3 trillion market capitalization, but it was worth a fraction of that when Buffett started buying the stock in 2016. Between then and 2023, Berkshire spent about $38 billion building its stake in Apple, and thanks to a staggering return, that position had a value of more than $170 billion earlier this year.

However, Berkshire has sold more than half of its stake in the iPhone maker during the past few months. Its remaining position is still worth $88.3 billion, so it’s still the largest holding in the conglomerate’s portfolio, and I think the recent sales reflect Buffett’s cautious view on the broader market as opposed to Apple itself. After all, the S&P 500 is trading at a price-to-earnings ratio (P/E) of 27.6 right now, which is significantly more expensive than its average of 18.1 going back to the 1950s.

Besides, Apple is preparing for one of the most important periods in its history. With more than 2.2 billion active devices globally — including iPhones, iPads, and Mac computers — Apple could become the world’s biggest distributor of AI to consumers.

The company unveiled Apple Intelligence earlier this year, which it developed in partnership with ChatGPT creator OpenAI. It’s embedded in the new iOS 18 operating system, and it will only be available on the latest iPhone 16 and the previous iPhone 15 Pro models because they are fitted with next-generation chips designed to process AI workloads.

Considering Apple Intelligence is going to transform many of the company’s existing software applications, it could drive a big upgrade cycle for the iPhone. Apps like Notes, Mail, and iMessage will feature new writing tools capable of instantly summarizing and generating text content on command. Plus, Apple’s existing Siri voice assistant is going to be enhanced by ChatGPT, which will bolster its knowledge base and its capabilities.

Although Apple’s revenue growth has been sluggish in recent quarters, the company still ticks nearly all of Buffett’s boxes. It’s highly profitable, it has an incredible management team led by Chief Executive Officer Tim Cook, and it’s returning truckloads of money to shareholders through dividends and buybacks — in fact, Apple recently launched a new $110 billion stock buyback program, which is the largest in corporate American history.

There is no guarantee Berkshire has finished selling Apple stock, but the rise of AI will likely drive a renewed phase of growth for the company, so that’s a good reason to remain bullish no matter what Buffett does next.

2. Amazon: 0.6% of Berkshire Hathaway’s portfolio

Berkshire bought a relatively small stake in Amazon (NASDAQ: AMZN) in 2019, which is currently worth $1.7 billion and represents just 0.6% of the conglomerate’s portfolio. However, Buffett has often expressed regret for not recognizing the opportunity much sooner, because Amazon has expanded beyond its roots as an e-commerce company and now has a dominant presence in streaming, digital advertising, and cloud computing.

Amazon Web Services (AWS) is the largest business-to-business cloud platform in the world, offering hundreds of solutions designed to help organizations operate in the digital era. But AWS also wants to be the go-to provider of AI solutions for businesses, which could be its largest financial opportunity ever.

AWS developed its own data center chips like Trainium, which can offer cost savings of up to 50% compared to competing hardware from suppliers like Nvidia. Plus, the cloud provider also built a family of large language models (LLMs) called Titan, which developers can use if they don’t want to create their own. They are accessible through Amazon Bedrock, along with a portfolio of third-party LLMs from leading AI start-ups like Anthropic. LLMs are at the foundation of every AI chat bot application.

Finally, AWS now offers its own AI assistant called Q. Amazon Q Business can be trained on an organization’s data so employees can instantly find answers to their queries, and it can also generate content to boost productivity. Amazon Q Developer, on the other hand, can debug and generate code to help accelerate the completion of software projects.

According to consulting firm PwC, AI could add a whopping $15.7 trillion to the global economy by 2030, and the combination of chips, LLMs, and software apps will help Amazon stake its claim to that enormous pie.

Amazon was consistently losing money when Berkshire bought the stock, and it doesn’t offer a dividend nor does it have a stock buyback program, so it doesn’t tick many of Buffett’s boxes (hence the small position). But it might be the most diverse AI stock investors can buy right now, and Berkshire will likely be pleased with its long-term return from here even if Buffett wishes it owned a bigger stake.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, and Nvidia. The Motley Fool has a disclosure policy.

29.5% of Warren Buffett’s $305.7 Billion Portfolio Is Invested in 2 Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

Harris Hit Trump With Claim Of 'Worst Unemployment Since The Great Depression' During Debate, Here Is What The Economists Said

In their first debate for the 2024 election, Vice President Kamala Harris criticized former President Donald Trump for severe unemployment during his tenure, as well as his economic policies and handling of the COVID-19 pandemic.

What Happened: “Donald Trump left us the worst unemployment since the Great Depression,” Harris stated. She also blamed Trump for the worst public health crisis in a century and the most severe attack on democracy since the Civil War.

The candidates discussed their plans to tackle the economy, a pressing issue for voters amid high inflation and gas prices. Trump proposed a tariff of at least 10% on imported goods, with some imports facing a 20% rate. He also suggested a 60% tariff on China.

Harris likened Trump’s tariff plan to a national sales tax on average Americans. Trump countered, saying Harris should have removed the tariffs if she disapproved, referencing the President Joe Biden administration’s decision to retain his previous tariffs on China.

The Vice President also took the opportunity to outline her own economic strategies. She acknowledged the pressing issue of housing costs and proposed offering $50,000 tax deductions for start-up small businesses, aiming to stimulate entrepreneurship and economic growth.

Why It Matters: To put these discussions in context, it’s worth examining the unemployment figures. According to the Bureau of Labor Statistics, unemployment during Trump’s presidency reached its peak in April 2020 at 14.8%, largely due to the impact of the COVID-19 pandemic.

However, it’s important to note that just a month before the pandemic took hold in the U.S., in February 2020, the unemployment rate stood at a much lower 3.5%. As of August, the unemployment rate was reported at 4.2%.

The debate sparked reactions from various public figures. Peter Schiff, a well-known gold advocate and Bitcoin BTC/USD critic, took to social media platform X to express his disappointment in the debate moderation. He criticized ABC for failing to address key economic issues such as the rising national debt, increasing debt servicing costs, entitlement spending, high inflation, and record-high consumer debt.

Gretchen Whitmer, the Governor of Michigan, weighed in on the discussion, claiming that under Trump’s previous administration, Michigan had lost 289,000 jobs. She warned against allowing Trump to “drag us backwards.”

Meanwhile, Betsey Stevenson, who served as a chief economist during the 44th U.S. President Barack Obama administration, pointed out that crime rates have decreased, a fact she suggested was “inconvenient for Trump.”

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.