Trump Trades Are Dialed Back Even More After the US Debate

(Bloomberg) — Traders are further unwinding bets linked to Donald Trump winning the White House after he suffered what many pundits called a clear defeat in last night’s crucial debate with rival Kamala Harris.

Most Read from Bloomberg

Trump Media & Technology Group Corp. shares tumbled 14% and Bitcoin, an asset that’s been embraced by the former president, retreated slightly. A Bloomberg gauge of the dollar fell as much as 0.3% before recovering. A strong dollar has become somewhat associated with Trump given his plan to penalize countries moving away from the currency.

Meanwhile, green energy shares gained on speculation that Democrats would bring more funding for the transition to renewables, with the Invesco Solar ETF adding about 3%.

While the moves in a handful of assets deemed likely to benefit from a Trump win offer a signal that positioning is tilting in favor of Harris, strategists warned against reading too much into the price action. The race remains very close and some of the moves could be explained by shifts in the outlook for the US economy.

“Markets seem to have awarded Harris a victory,” wrote Francesco Pesole, a currency strategist at ING Bank. “In FX, a Trump win is associated with a stronger dollar, which is trading on the soft side across the board.”

The odds of the Democratic party candidate winning the election increased on the betting website PredictIt to 56%, compared with 53% before the debate. Wall Street has been adjusting its election bets for the past few weeks, tracking Vice President Harris’ rise in the polls.

One factor complicating any market interpretation of the debate was the report on US consumer prices also landing on Wednesday. With the Federal Reserve widely expected to cut interest rates next week, some strategists said the impact of monetary policy should outweigh any speculation on US politics.

What Bloomberg’s Strategists Say:

“The main markets takeaway from all the political analysis is that it would be financial folly to have conviction on who will win this election that’s still eight weeks away. Never mind worrying how you actually profit from knowing that answer, given the lack of clarity over what policy each candidate would be able to implement quickly, and the debate over how assets would subsequently react.”

— Mark Cudmore, MLIV Executive Editor in Singapore

Read more here.

Shares of Trump Media, which operates Truth Social and counts the presidential candidate as its top shareholder, have at times traded as a proxy for Trump’s election odds, rising sharply after an assassination attempt in July, when there was a sharp rise in betting-market odds of him winning a second term. Other times, it’s traded like a volatile meme stock, swinging wildly on little to no news or fundamental changes to its underlying business.

The company is also facing the expiration of a lockup period, which could take place as soon as Sept. 19 and enable insiders — including Trump himself — to start selling shares.

Trump Media Shares Slide After Debate as Lockup Expiry Looms

At Citigroup Inc., strategists pointed dollar weakness as an indication that Harris bested Trump in the debate, but added that the currency will stay strong heading into November given that tariffs remain a central plank of Trump’s economic platform.

“We still expect the election will remain close enough in the coming weeks that markets will maintain some premium for Trump policies,” wrote strategists including Daniel Tobon at Citigroup. “It remains to be seen if voters agree with betting and financial markets.”

Jefferies International’s Mohit Kumar echoed the caution around trades tied to a specific candidate and said the debate didn’t produce a clear winner. Even so, he said Harris did better than expected and her policies would likely focus less on tax cuts and fiscal expansion than Trump.

In the view of Saxo Bank, it’s still a challenge to price in a Harris trade, especially because the Democrats will likely face a split Congress.

“Harris’ rising prominence could have notable effects across various sectors,” wrote Charu Chanana, global market strategist at Saxo. “Many of the other ‘Trump Trades’ such as a weaker Chinese yuan or traction in defense stocks could take a backseat.”

(Updates market pricing throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Smart Money Is Betting Big In CRWD Options

Whales with a lot of money to spend have taken a noticeably bullish stance on CrowdStrike Holdings.

Looking at options history for CrowdStrike Holdings CRWD we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $131,775 and 8, calls, for a total amount of $382,975.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $210.0 to $350.0 for CrowdStrike Holdings over the last 3 months.

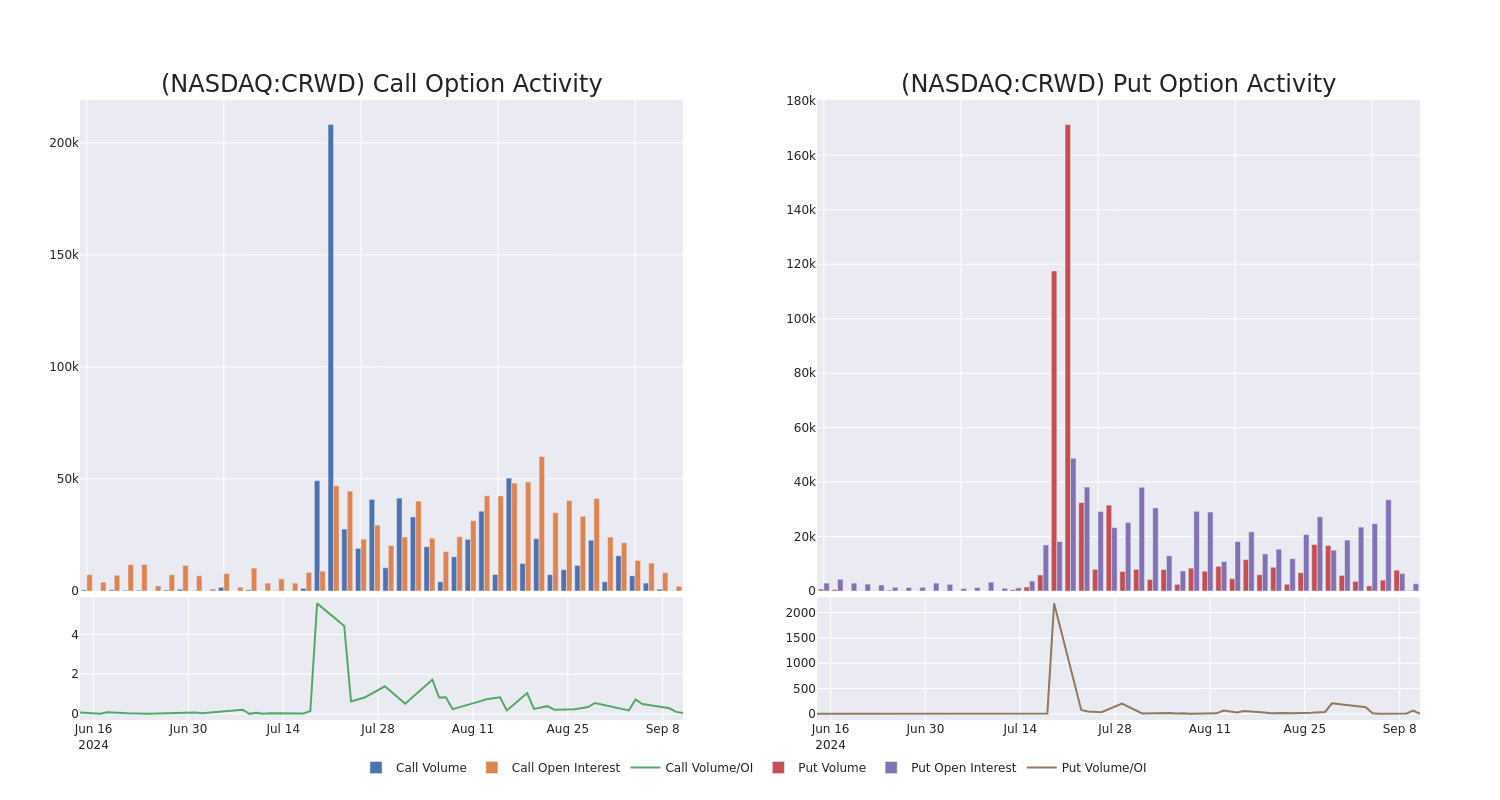

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for CrowdStrike Holdings’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings’s whale activity within a strike price range from $210.0 to $350.0 in the last 30 days.

CrowdStrike Holdings Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | TRADE | BEARISH | 08/15/25 | $41.15 | $40.5 | $40.5 | $260.00 | $125.5K | 19 | 31 |

| CRWD | PUT | TRADE | BULLISH | 12/20/24 | $21.5 | $21.0 | $21.0 | $240.00 | $52.5K | 1.1K | 55 |

| CRWD | CALL | TRADE | BEARISH | 12/18/26 | $75.35 | $73.55 | $73.55 | $250.00 | $51.4K | 213 | 0 |

| CRWD | CALL | SWEEP | NEUTRAL | 11/21/25 | $20.95 | $20.4 | $20.4 | $350.00 | $48.9K | 97 | 25 |

| CRWD | CALL | TRADE | BEARISH | 09/19/25 | $44.8 | $43.55 | $43.55 | $260.00 | $47.9K | 95 | 31 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike’s primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

CrowdStrike Holdings’s Current Market Status

- Currently trading with a volume of 534,973, the CRWD’s price is down by -1.71%, now at $243.5.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 76 days.

What Analysts Are Saying About CrowdStrike Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $318.0.

- An analyst from DA Davidson persists with their Buy rating on CrowdStrike Holdings, maintaining a target price of $310.

- An analyst from Morgan Stanley persists with their Overweight rating on CrowdStrike Holdings, maintaining a target price of $325.

- An analyst from Rosenblatt persists with their Buy rating on CrowdStrike Holdings, maintaining a target price of $330.

- An analyst from UBS has decided to maintain their Buy rating on CrowdStrike Holdings, which currently sits at a price target of $310.

- An analyst from Wedbush downgraded its action to Outperform with a price target of $315.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for CrowdStrike Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Symes Jeffrey Sells $168K Worth Of Cousins Props Shares

Symes Jeffrey, SVP at Cousins Props CUZ, executed a substantial insider sell on September 10, according to an SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday outlined that Jeffrey executed a sale of 5,997 shares of Cousins Props with a total value of $168,695.

At Wednesday morning, Cousins Props shares are down by 0.0%, trading at $28.73.

Get to Know Cousins Props Better

Cousins Properties Inc is a real estate investment trust principally involved in the ownership, management, and development of properties in the Southern United States. Cousins Properties’ real estate portfolio mainly comprises offices and mixed-use developments that encompass both apartment and retail space. Offices make up the vast majority of the portfolio in terms of total square footage. Cousins’ assets are mainly located in Texas and Georgia, with North Carolina also playing host to a smaller amount of rental space. The company derives nearly all of its revenue in the form of rental income from its properties, the majority of which comes from its office locations. A diverse set of tenants in the cities of Houston and Atlanta represent the company’s key markets.

Unraveling the Financial Story of Cousins Props

Positive Revenue Trend: Examining Cousins Props’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.24% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Key Profitability Indicators:

-

Gross Margin: The company shows a low gross margin of 66.84%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Cousins Props’s EPS reflects a decline, falling below the industry average with a current EPS of 0.05.

Debt Management: With a below-average debt-to-equity ratio of 0.59, Cousins Props adopts a prudent financial strategy, indicating a balanced approach to debt management.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 73.67 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 5.35 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 13.64 reflects market recognition of Cousins Props’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Exploring Key Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cousins Props’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: Joshua Horowitz Sells $65K Worth Of Limbach Holdings Shares

A substantial insider sell was reported on September 10, by Joshua Horowitz, Director at Limbach Holdings LMB, based on the recent SEC filing.

What Happened: After conducting a thorough analysis, Horowitz sold 1,000 shares of Limbach Holdings. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total transaction value is $65,030.

Limbach Holdings‘s shares are actively trading at $66.64, experiencing a down of 0.0% during Wednesday’s morning session.

Delving into Limbach Holdings’s Background

Limbach Holdings Inc is a commercial specialty contractor in the fields of heating, ventilation, air conditioning, plumbing, electrical, and building controls for the design and construction of new and renovated buildings, maintenance services, energy retrofits, and equipment upgrades. It operates in two segments namely General Contractor Relationships (GCR) and Owner Direct Relationships (ODR). The company generates maximum revenue from the ODR segment.

Limbach Holdings: Delving into Financials

Negative Revenue Trend: Examining Limbach Holdings’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -2.12% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 27.41%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Limbach Holdings’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.53.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.32.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 30.85 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 1.58 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 16.54, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Limbach Holdings’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vera Bradley Hurt By Stubborn Macro Headwinds In Q2, Stock Plummets

Vera Bradley, Inc. VRA shares are trading lower on Wednesday.

The company reported that the second quarter adjusted earnings per share was 13 cents, missing the street view of 21 cents. Quarterly revenues of $110.82 million missed the analyst consensus of $123.01 million.

“Our results for the period were also influenced by stubbornly persistent macro consumer headwinds that masked key successes across several areas of our business turnaround, as we registered top-line trends similar to the first quarter,” said Jackie Ardrey, Chief Executive Officer.

Vera Bradley Direct segment revenues totaled $72.2 million, a 15.7% decrease from $85.7 million in the prior year second quarter. Comparable sales declined 11.2% in the second quarter, with weakness in all direct channels.

Also Read: Designer Brands’ Q2 Struggles: Earnings Miss, Comparable Sales Decline, And Outlook Cut

Vera Bradley Indirect segment revenues totaled $21.8 million, a 25.3% increase over $17.4 million in the prior year second quarter. The increase was primarily related to an increase in sales to key accounts as well as an increase in liquidation sales.

Pura Vida segment revenues totaled $16.8 million, a 33% decrease from $25.1 million in the prior year, attributed to a decrease in both ecommerce and wholesale sales, partially offset by new store growth.

In the second quarter, consolidated gross profit was $56.4 million, or 50.9% of net revenues, down from $72.0 million, or 56.2% last year. The drop was due to more liquidation sales and increased promotions.

Cash and equivalents as of August 3 totaled $44.1 million.

Outlook: Vera Bradley forecasts fiscal year 2025 revenues of $410 million, below the $452.15 million estimate and the prior range of $460 million to $480 million, and projects consolidated diluted EPS of approximately $0.10, compared to the $0.35 estimate and the previous range of $0.54 to $0.62.

Price Action: VRA shares are trading lower by 10.2% to $4.47 premarket at last check Wednesday.

Photo via Wikimedia Commons

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: Is It Possible to Shrink My RMDs to $25k for Lower Social Security Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

I’m in my first year of required minimum distributions of $36,000, which is causing me to be taxed on my $33,000 in Social Security benefits. What is a good strategy to reduce my RMDs below $25,000 so my Social Security benefits do not become taxable? Would taking a lump sum from my pre-tax IRA and paying the taxes make sense to avoid the yearly taxable event with my Social Security benefits? Would gifting money to my children/grandchildren (thereby reducing the RMD base) have negative tax consequences for my children/grandchildren? Would it have a positive tax benefit for me?

– Laura

This is a great question Laura, and there are a few strategies that might help you reduce the long-term tax bill on your Social Security benefits. Let’s first explore how Social Security income is taxed and then get into the options available to you.

Do you need additional help managing your RMDs or tax liability in retirement? Consider speaking with a financial advisor today.

How Are Social Security Benefits Taxed?

Whether your Social Security income is taxed, and how much of it is taxed, depends on your tax filing status and your other income. The first step is determining your provisional or “combined income,” which is simply the sum of the following three variables:

If you’re single, you would be subject to the following tax thresholds:

-

If your combined income is less than $25,000, none of your Social Security benefits are taxed

-

If your combined income is between $25,000 and $34,000, up to 50% of your Social Security benefits are taxed

-

If your combined income is greater than $34,000, up to 85% of your Social Security benefits are taxed

If you are married and file jointly, the following limits apply:

-

If your combined income is less than $32,000, none of your Social Security benefits are taxed

-

If your combined income is between $32,000 and $44,000, up to 50% of your Social Security benefits are taxed

-

If your combined income is greater than $44,000, up to 85% of your Social Security benefit is taxed

Keep in mind that the 50% and 85% limits are not tax rates. They simply reflect the maximum portion of your Social Security benefits that could be subject to tax. The taxable amount is then added to your other income and the regular income tax rates and brackets are applied. (A financial advisor may be able to help you plan for Social Security, and this free matching tool can help you find an advisor.)

Strategies for Managing Taxes on Your Social Security Benefits

When it comes to your question about reducing your RMD so your benefits aren’t taxable, you’ll want to pay attention to your overall marginal income tax rate and the points at which a greater percentage of your Social Security benefit is taxed.

For example, if you can move yourself into a situation where only 50% of your Social Security is taxed instead of 85%, that could be advantageous. The same is true if you move from 50% to 0%. If you can’t move between those thresholds, there may not be much for you to do.

In your case, assuming that your RMDs are the only income you have aside from Social Security, there are two main strategies that I would consider.

1. Accelerate IRA Income

Let’s assume that you’re already at or near the point where 85% of your Social Security benefits are being taxed. In that case, taking more out of your IRA this year, as you suggested, could be a helpful strategy. You would increase your current tax bill, but you could potentially reduce future RMDs to the point where only up to 50% of your Social Security benefit is taxed in future years.

One way to do that would be to withdraw extra money and use it for whatever you’d like. Maybe there’s a home project that you’d like to tackle, or maybe, as you suggested, you’d like to give money to your children or grandchildren. You wouldn’t get a tax break for the gift, but they wouldn’t face any negative tax consequences either. Just keep the annual gift tax exclusion ($18,000 in 2024) in mind, as well as the lifetime exemption limit ($13.61 million in 2024).

Another option, and potentially the most tax-efficient route, is to convert some of that traditional IRA money to a Roth IRA. The conversion amount would still be taxable as income, but it would reduce future RMDs and get the money into a Roth, where it could grow tax-free and no longer be subject to RMDs.

Any of these strategies would require a close eye on your total taxable income and how it affects your marginal tax rate. If you can do this in a way that reduces the future taxability of your Social Security benefits without pushing you into higher tax brackets now, you could certainly save yourself some money over the long term. (But if you need additional guidance regarding this strategy, a financial advisor may be able to help.)

2. Make Qualified Charitable Distributions

Another option with the potential for a more immediate benefit is to make what’s called a qualified charitable distribution (QCD). This is when you contribute money to an eligible charity directly from an IRA. The charitable contributions both satisfy your RMD requirement and reduce your taxable income, which would reduce the amount of your Social Security benefit that gets taxed.

This is a good strategy to consider if you don’t need the money and there’s one or more charities that you want to support. However, while it will reduce your tax bill, it will still leave you with less money overall than simply paying the taxes you would otherwise owe. (And if you need help with tax planning and strategic giving, consider working with a financial advisor.)

Next Steps

Taxes are always worth considering as part of your financial planning, but they are only one part of the bigger picture. What matters most is that you have the money you need to support the life you want to live.

The strategies above could support those personal goals by reducing your long-term tax bill, making it easier to pay for the things you care about. It’s also possible to take them too far, reducing your tax bill at the cost of not having the money you need when you need it. Keep this all mind as you consider your options moving forward.

Social Security Planning Tips

-

A financial advisor can help you plan for Social Security and integrate your benefits into a retirement income plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Understanding how your claiming age affects your Social Security benefits is vital to making an informed decision about when to start collecting. Remember, waiting until age 70 will increase your benefits by up to 32% while claiming as early as 62 will result in as much as a 30% lifetime benefit reduction. However, the right decision for you may come down to simply how long you expect to live.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/Luke Chan, ©iStock.com/mphillips007

The post Ask an Advisor: How Do I Reduce My RMD to Just $25k So My Social Security Isn’t Taxed? appeared first on SmartReads by SmartAsset.

History Says the Nasdaq Will Soar: 2 Growth Stocks With 26% and 38% Upside to Buy Now, According to Wall Street

The Nasdaq Composite (NASDAQINDEX: ^IXIC) closed in correction territory on Aug. 2, meaning it had fallen at least 10% from its bull market high. Worrisome labor market data factored heavily into the drawdown. The U.S. added fewer jobs than analysts anticipated in July, and unemployment reached its highest level since 2021.

However, investors have good reason to be optimistic. The index tends to bounce back quickly. During the last 15 years, the Nasdaq has returned an average of 21.9% during the 12 months following its first close in correction territory. The implied upside is approximately 22% by August 2025 because the index has traded sideways since entering a correction last month.

Of course, past performance never guarantees future results. But Wall Street analysts forecast sizable gains for Amazon (NASDAQ: AMZN) and Zscaler (NASDAQ: ZS).

-

Amazon has a median 12-month price target of $220 per share, implying 26% upside from its current share price of $174.

-

Zscaler has a median 12-month price target of $220 per share, implying 38% upside from its current share price of $159.

Here’s what investors should about these Nasdaq stocks.

Amazon: Wall Street forecasts 26% upside

Amazon has a strong presence in e-commerce, digital advertising, and cloud computing, and the company is gaining share across all three markets. In e-commerce, Amazon will account for 40.4% of online retail sales in the U.S. this year, up 80 basis points from last year, according to eMarketer.

In digital advertising, Amazon will account for 13.9% of digital ad spending in the U.S. this year, up 140 basis points from last year, according to eMarketer. And in cloud computing, Amazon Web Services accounted for 32% of cloud infrastructure and platform services spending in the second quarter, up 100 basis points from the previous quarter, according to Synergy Research Group.

Amazon reported decent financial results in the second quarter, though the company narrowly missed top-line estimates. Revenue increased 10% to $148 billion, but Wall Street expected revenue to grow half a percentage point faster. However, GAAP earnings still increased 94% to $1.26 per dilute share, easily topping the 58% growth analysts anticipated.

Missing second-quarter revenue estimates alone may not have caused a problem, but management also forecasted slower growth in the third quarter. Specifically, the midpoint of guidance implies 9% revenue growth, which is slightly below the 11% growth analysts anticipated. The stock fell sharply on the news and it has yet to rebound.

But investors are missing the big picture. Amazon is gaining market share across its core businesses, and Wall Street expects the company to grow earnings at 23% annually over the next three years. That estimate makes the current valuation of 42 times earnings look reasonable. Those figures give a PEG ratio of 1.8, which is well below the three-year average of 2.9. In that context, investors should feel confident buying a small position in this growth stock today.

Zscaler: Wall Street analysts forecast 38% upside

Zscaler is a cybersecurity company that specializes in zero trust network access. Its security service edge (SSE) platform solves three major problems inherent to traditional perimeter-based solutions. First, it provides a better user experience because web traffic is inspected in the cloud rather than private data centers, which prevents bottleneck-based performance issues.

Second, it frees businesses from the burden of buying expensive on-premises security appliances. Third, it improves threat detection because Zscaler has more data than non-security companies. It uses that information to train artificial intelligence models, creating a network effect whereby every data point enhances its ability to detect and stop attacks.

CEO Jay Chaudhry recently highlighted that advantage. “We are training our AI security models with vast amounts of data generated by over 400 billion daily transactions on our platform to deliver superior threat detection. We are leveraging AI to automatically classify data and enforce policies for better data loss prevention.”

Zscaler reported better-than-expected financial results in the fourth quarter of fiscal 2024 (ended July 31). Revenue increased 30% to $593 million and non-GAAP net income jumped 38% to $0.88 per diluted share. CEO Jay Chaudhry said the company set a record for new and upsell business during the quarter, driven in part by emerging products for AI analytics and digital experience monitoring.

However, management provided disappointing guidance that caused the stock to fall over 17% following the report. Revenue growth is projected to decelerate to 20% in fiscal 2025. But that reflects temporary headwinds arising from higher-than-expected turnover in the sales organization last quarter. Hiring and training sales reps will take time, according to CFO Remo Canessa. But the company’s go-to-market capabilities should improve toward the second half of they year.

Meanwhile, the drawdown creates a buying opportunity for patient investors. Wall Street expects Zscaler’s revenue to grow at 21% annually over the next three years. That makes its current valuation of 10.9 times sales look reasonable. In fact, Zscaler shares haven’t been that cheap in 15 months.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon and Zscaler. The Motley Fool has positions in and recommends Amazon and Zscaler. The Motley Fool has a disclosure policy.

History Says the Nasdaq Will Soar: 2 Growth Stocks With 26% and 38% Upside to Buy Now, According to Wall Street was originally published by The Motley Fool

Stocks Well Off Lows as Nvidia Leads Tech Rally: Markets Wrap

(Bloomberg) — A rally in some of the world’s largest technology companies pushed stocks away from session lows in a volatile session that had traders digesting faster-than-anticipated inflation data.

Most Read from Bloomberg

The S&P 500 was little changed after a slide that topped 1.5% earlier Wednesday. Nvidia Corp. climbed 4% to lead gains in chipmakers. Financial, energy and industrial shares remained under pressure. Treasury yields edged up on bets the Federal Reserve will move gradually with rate cuts. Swap traders priced in a 25-basis-point Fed cut at next week’s gathering and see only a small chance for a half-point reduction.

Crypto, Prison Stocks Slide, Renewables Gain After US Debate

“While we’ve seen a slight pullback in stocks as of late with choppy earnings and economic data, we would expect more smooth sailing post this initial Fed rate cut and post-election, as uncertainty fades and investors start to price-in 2025 earnings,” said Skyler Weinand at Regan Capital.

The so-called core consumer price index — which excludes food and energy costs — increased 0.3% from July, the most in four months, and 3.2% from a year ago, Bureau of Labor Statistics figures showed Wednesday. The three-month annualized rate advanced 2.1%, picking up from 1.6% in July, according to Bloomberg calculations.

The S&P 500 hovered near 5,490. The Nasdaq 100 rose 0.6%. The Dow Jones Industrial Average slipped 0.5%. The Russell 2000 Index lost 0.3%. The KBW Bank Index slumped 1.3%.

Treasury 10-year yields advanced one basis point to 3.65%. The dollar fell. Oil climbed as Hurricane Francine ripped through key oil-producing zones in the US Gulf of Mexico, prompting traders to cover bearish bets.

“The firmer-than-expected core inflation print will make it harder for Jerome Powell to deliver a 50 basis-point cut in September,” said Krishna Guha at Evercore. “We continue to think a starter 50 basis-point cut is the right play and might even now win out. But the odds have moved against this, and risks to markets and the soft landing are higher as a result.”

Guha noted that if the Fed doesn’t cut rates by 50 basis points next week, it will possibly do that in November.

The inflation report has long been the most critical number in the market, but it has recently been overtaken by the concern for a cooling job market and recession worries, according to Jakob Westh Christensen at eToro.

“Going forward, the risks are clearly weighted toward slowing growth and a deteriorating labor market, and that’s why there are still four 25 bps cuts priced in with only three meetings left in the year,” said Chris Zaccarelli at Independent Advisor Alliance. “If the economy continues to slow – and not drop into an abrupt recession – the Fed will be able to cut at a measured, 25 basis-point per meeting pace.”

To David Russell at TradeStation, while the latest inflation numbers aren’t “runaway dovish,” they confirm the cooling process remains in effect. Attention could now shift from the Fed as a catalyst toward earnings and the election cycle, he noted.

“This isn’t the CPI report the market wanted to see,” said Seema Shah at Principal Asset Management. “The number is certainly not an obstacle to policy action next week, but the hawks on the committee will likely seize on today’s CPI report as evidence that the last mile of inflation needs to be handled with care and caution.”

Key events this week:

-

Japan PPI, Thursday

-

ECB rate decision, Thursday

-

US initial jobless claims, PPI, Thursday

-

Eurozone industrial production, Friday

-

Japan industrial production, Friday

-

U. Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 was little changed as of 1:07 p.m. New York time

-

The Nasdaq 100 rose 0.6%

-

The Dow Jones Industrial Average fell 0.5%

-

The MSCI World Index was little changed

-

The Russell 2000 Index fell 0.3%

-

KBW Bank Index fell 1.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro was little changed at $1.1019

-

The British pound fell 0.3% to $1.3042

-

The Japanese yen rose 0.3% to 142.01 per dollar

Cryptocurrencies

-

Bitcoin fell 0.1% to $57,510.5

-

Ether fell 0.9% to $2,356.19

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 3.65%

-

Germany’s 10-year yield declined two basis points to 2.11%

-

Britain’s 10-year yield declined six basis points to 3.76%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Dollar, Treasury Yields Rise As Small Caps Fall: August Inflation Crushes Odds Of 50-Point Fed Rate Cut

U.S. inflation in August hit its lowest annual rate since February 2021 at 2.5%, falling from 2.9% in July and below the expected 2.6%, yet the underlying story tells a more complicated tale.

Stripping out volatile food and energy prices, core inflation pressures remain stubborn at 3.2% as shelter costs surged at their fastest monthly pace since January 2024, fueling gains in the dollar and sending Treasury yields climbing.

Expectations for a hefty 50-basis-point rate cut at the Sept. 18 FOMC meeting plummeted to just 15%, down from 34% a day earlier, as per CME Group’s FedWatch tool.

Traders now increasingly anticipate a more measured 25-basis-point cut, as sticky core inflation—particularly in services—remains a key factor under close watch by the Fed.

Energy goods and services indices saw notable monthly drops, helping to ease overall price pressures. Gasoline prices fell 0.6% month-over-month in August after holding steady in July, while electricity declined 0.7% and utility bills for piped gas services dropped 1.9%.

Market Reactions

The mixed August inflation report and the corresponding drop in investor expectation for a larger rate cut by the Federal Reserve at the September meeting triggered the following reactions in major assets:

- The S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, opened Wednesday’s session 0.2% lower.

- Tech stocks, followed by the Invesco QQQ Trust, Series 1 QQQ were flat.

- Small caps, as tracked by the iShares Russell 2000 ETF IWM, sunk 1%.

- The Technology Select Sector SPDR Fund XLK was the top-performing S&P 500 sector, up 0.5%.

- The Real Estate Select Sector SPDR Fund XLRE was the main laggard, down 1.6%.

- The Invesco DB USD Index Bullish Fund ETF UUP rose 0.1%.

- The iShares 20+ Year Treasury Bond ETF TLT eased 0.1% as Treasury yields rose.

- Gold prices, monitored through the SPDR Gold Trust GLD, fell by 0.4%.

- Bitcoin BTC/USD fell 2%.

Read now:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Oracle Corp.

Analyst Profile

Joseph F. Bonner, CFA

Senior Analyst: Communication Services & Technology

Joe covers the Communication Services sector and selected software technology stocks for Argus. In 2010, he was named #5 Stock Picker for Telecom Services in the Wall Street Journal’s Best on the Street Analyst Survey. In 2008, Joe was named #1 Stock Picker for Media: U.S. by the Financial Times and was second in the Wall Street Journal’s Best on the Street Analyst Survey for Telecommunications: Fixed Line. For more than a decade, Joe worked with Technicolor Inc., where he focused on financial and legal issues. He received his Masters in Business Administration from Fordham University in New York, where he concentrated in Finance. He earned a BA in International Affairs from the George Washington University, and spent three years with the Peace Corps in Talgar, Kazakhstan, developing an English Language resource center and teaching students. Joe is a CFA charterholder.