BV HoldCo Top Bitfury Executes Sell Order: Offloads $16.60M In Cipher Mining Stock

BV HoldCo Top Bitfury, 10% Owner at Cipher Mining CIFR, disclosed an insider sell on September 10, according to a recent SEC filing.

What Happened: Bitfury’s decision to sell 5,799,528 shares of Cipher Mining was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value of the sale is $16,596,269.

During Wednesday’s morning session, Cipher Mining shares down by 3.86%, currently priced at $2.99.

Unveiling the Story Behind Cipher Mining

Cipher Mining Inc ia an emerging technology company that operates in the Bitcoin mining ecosystem in the United States. The company is developing a cryptocurrency mining business, specializing in Bitcoin. The company is expanding and strengthening the Bitcoin network’s critical infrastructure in the United States.

Financial Milestones: Cipher Mining’s Journey

Revenue Growth: Cipher Mining displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 17.88%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Key Profitability Indicators:

-

Gross Margin: The company shows a low gross margin of 16.96%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): With an EPS below industry norms, Cipher Mining exhibits below-average bottom-line performance with a current EPS of -0.05.

Debt Management: Cipher Mining’s debt-to-equity ratio is below the industry average. With a ratio of 0.03, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: Cipher Mining’s P/E ratio of 63.42 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 5.61 is above industry norms, reflecting an elevated valuation for Cipher Mining’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 9.54, Cipher Mining’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Unlocking the Meaning of Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Cipher Mining’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vera Bradley Announces Second Quarter Fiscal Year 2025 Results

Consolidated net revenues totaled $110.8 million

Net income totaled $5.7 million, or $0.19 per diluted share; Non-GAAP net income totaled $3.9 million, or $0.13 per diluted share

Balance sheet remains strong, with cash and cash equivalents of $44.1 million, no debt, and year-over-year inventories down nearly 5%

Updates outlook for fiscal year ending February 1, 2025

FORT WAYNE, Ind., Sept. 11, 2024 (GLOBE NEWSWIRE) — Vera Bradley, Inc. VRA today announced its financial results for the second quarter and six months ended August 3, 2024.

In this release, Vera Bradley, Inc. or “the Company” refers to the entire enterprise and includes both the Vera Bradley and Pura Vida brands. Vera Bradley on a stand-alone basis refers to the Vera Bradley brand.

Second Quarter Comments

Jackie Ardrey, Chief Executive Officer commented, “Late in the second quarter, under Project Restoration, we successfully launched the first phase of our renewed vision for Vera Bradley, including elevated brand marketing, product, store design and website in our Brand stores and on VeraBradley.com. Our results for the period were also influenced by stubbornly persistent macro consumer headwinds that masked key successes across several areas of our business turnaround, as we registered top-line trends similar to the first quarter.

Project Restoration in our Brand stores, VeraBradley.com, and Indirect channels delivered a diversified mix of bold, thoughtfully designed pieces comprising elevated fabrics and materials, and a highly successful marketing campaign. We were successful in starting to attract a new customer who values both fashion and function at full price, and we saw strength across the board in solids, trend-right colors and prints, and our new leather franchise. This validates that our assortment direction and marketing have made huge leaps in the right direction, and we expect to see continued improvements in the future.”

Ardrey continued, “Vera Bradley belongs to every woman who chooses to be bold and expressive in all the ways that matter to them. During our launch, we heard passionate feedback from both new and existing customers on select product style adjustments they wanted to see from us. We embraced that feedback and are making adjustments that we will begin offering in the Holiday season and will continue through Spring of 2025. Importantly, we remain committed to Project Restoration’s key areas of focus including: restoring Vera Bradley’s brand relevancy; strategically marketing our distinctive and unique position as a feminine, fashionable brand that connects with consumers on a deep, emotional level; and building a balanced multi-channel structure that allows customers to shop when, where, and how they want to shop with us.

At Pura Vida, we also saw similar trends to the first quarter including elevated media costs that affected our ecommerce revenue, as well as a decline in wholesale revenue based on macro trends and a cautious outlook from our wholesale partners. We continue to manage this brand to balance revenue and profitability, and expect to see improved media effectiveness in the fourth quarter. We are excited about the upcoming opening of our new store at Disney Springs in the third quarter, which will be a strong addition to Pura Vida’s store fleet contributing revenue and customer acquisition for the brand.”

“We enter the second half of the fiscal year in a strong financial position with no debt and $44 million in cash allowing us to remain nimble while navigating a clearly dynamic consumer environment. We are prudently planning the second half through a more conservative lens, as we expect the trends we’ve seen in both brands to continue. With our brand restoration efforts well under way, we remain agile and flexible for the upcoming Fall and Holiday season, continuing to drive strong business discipline, and pursuing our vision to inspire people to be bold in their pursuits and brilliant in their self-expression,” concluded Ardrey.

Summary of Financial Performance for the Second Quarter

Consolidated net revenues totaled $110.8 million compared to $128.2 million in the prior year second quarter ended July 29, 2023.

For the current year second quarter, Vera Bradley, Inc.’s consolidated net income totaled $5.7 million, or $0.19 per diluted share. These results included pre-tax charges comprised of $0.6 million for the amortization of definite-lived intangible assets, $0.4 million of severance charges, $0.3 million of Project Restoration initiatives, and $0.2 million of consulting and professional fees primarily associated with strategic initiatives. These results also include a total tax impact of $3.3 million associated with the pre-tax items listed above, as well as a change in the annual estimated tax rate associated with the projection of the Company’s annual income in the current fiscal quarter, resulting in a $1.8 million net of tax impact. On a non-GAAP basis, Vera Bradley, Inc.’s consolidated second quarter net income totaled $3.9 million, or $0.13 per diluted share.

For the prior year second quarter, Vera Bradley, Inc.’s consolidated net income totaled $9.3 million, or $0.30 per diluted share. These results included pre-tax charges comprised $0.7 million for the amortization of definite-lived intangible assets, $0.3 million of consulting and professional fees primarily associated with strategic initiatives, and $0.1 million of severance charges. These results also include a total tax impact of $0.2 million associated with the pre-tax items listed above, resulting in a $0.9 million net of tax impact. On a non-GAAP basis, Vera Bradley, Inc.’s consolidated second quarter net income totaled $10.2 million, or $0.33 per diluted share.

Summary of Financial Performance for the Six Months

Consolidated net revenues totaled $191.4 million for the current year six months ended August 3, 2024, compared to $222.5 million in the prior year six month period ended July 29, 2023.

For the current year six months, Vera Bradley, Inc.’s consolidated net loss totaled ($2.4) million, or ($0.08) per diluted share. These results included pre-tax charges comprised of $1.3 million for the amortization of definite-lived intangible assets, $0.8 million of severance charges, $0.8 million of one-time vendor charges, $0.5 million of consulting and professional fees primarily associated with strategic initiatives, and $0.3 million of Project Restoration initiatives. These results also include a total tax impact of $3.9 million associated with the pre-tax items listed above, as well as a change in the annual estimated tax rate associated with the projection of the Company’s annual income in the current fiscal quarter, resulting in $0.2 million net of tax impact. On a non-GAAP basis, Vera Bradley, Inc.’s current year consolidated net loss for the six months totaled ($2.6) million, or ($0.09) per diluted share.

For the prior year six months, Vera Bradley, Inc.’s consolidated net income totaled $4.6 million, or $0.15 per diluted share. These results included pre-tax charges comprised of $2.0 million of severance charges, $1.5 million for the amortization of definite-lived intangible assets, and $0.5 million of consulting and professional fees primarily associated with strategic initiatives. These results also include a total tax impact of $1.0 million associated with the pre-tax items listed above, resulting in $3.0 million net of tax impact. On a non-GAAP basis, Vera Bradley, Inc.’s consolidated net income for the six months totaled $7.6 million, or $0.24 per diluted share.

Second Quarter Details

Current year second quarter Vera Bradley Direct segment revenues totaled $72.2 million, a 15.7% decrease from $85.7 million in the prior year second quarter. Comparable sales declined 11.2% in the second quarter, with weakness in all direct channels. The Company permanently closed 5 full-line stores and opened one outlet store over the last twelve months. Prior year second quarter Direct segment revenues included sales from the Vera Bradley Annual Outlet sale, which was held in the first quarter of the current fiscal year.

Vera Bradley Indirect segment revenues totaled $21.8 million, a 25.3% increase over $17.4 million in the prior year second quarter. The increase was primarily related to an increase in sales to key accounts as well as an increase in liquidation sales.

Pura Vida segment revenues totaled $16.8 million, a 33.0% decrease from $25.1 million in the prior year, attributed to a decrease in both ecommerce and wholesale sales, partially offset by new store growth. As anticipated, a focus on marketing efficiency and reduced marketing spend amidst a substantially higher cost environment decreased ecommerce performance. As a result, Pura Vida continues to focus on diversifying marketing allocation to other channels. Wholesale revenues were down, against a strong performance last year and as our partners were more discriminating in their purchases.

Second quarter consolidated gross profit totaled $56.4 million, or 50.9% of net revenues, compared to $72.0 million, or 56.2% of net revenues, in the prior year. The decrease in consolidated gross profit as a percentage of net revenues in the second quarter was attributable to an increase in liquidation sales in our Indirect segment coupled along with increased promotional activity in the current year quarter in the Direct segment.

Second quarter consolidated SG&A expense totaled $53.6 million, or 48.4% of net revenues, compared to $59.4 million, or 46.3% of net revenues, in the prior year. On a non-GAAP basis, consolidated SG&A expense totaled $52.2 million, or 47.1% of net revenues, compared to $58.3 million, or 45.5% of net revenues, in the prior year. The decrease in non-GAAP SG&A expense was due primarily to cost reduction initiatives along with reduced variable costs.

The Company’s second quarter consolidated operating income totaled $2.9 million, or 2.6% of net revenues, compared to $12.9 million, or 10.0% of net revenues, in the prior year second quarter. On a non-GAAP basis, the Company’s current year consolidated operating income totaled $4.3 million, or 3.9% of net revenues, compared to $14.0 million, or 10.9% of net revenues, in the prior year.

By segment:

- Vera Bradley Direct operating income was $13.4 million, or 18.6% of Direct net revenues, compared to $20.6 million, or 24.1% of Direct net revenues, in the prior year. On a non-GAAP basis, Direct operating income totaled $13.8 million, or 19.1% of Direct revenues.

- Vera Bradley Indirect operating income was $4.7 million, or 21.8% of Indirect net revenues, compared to $6.2 million, or 35.7% of Indirect net revenues, in the prior year. On a non-GAAP basis, Indirect operating income totaled $5.0 million, or 22.8% of Indirect net revenues.

- Pura Vida’s operating income was $0.1 million, or 0.5% of Pura Vida net revenues, compared to $4.0 million, or 15.9% of Pura Vida net revenues, in the prior year. On a non-GAAP basis, Pura Vida’s operating income was $0.7 million, or 4.1% of Pura Vida net revenues, compared to $4.8 million, or 19.2% of Pura Vida net revenues, in the prior year.

Details for the Six Months

Vera Bradley Direct segment revenues for the current year six-month period totaled $128.6 million, a 11.0% decrease from $144.6 million in the prior year. Comparable sales declined 10.5% for the six months.

Vera Bradley Indirect segment revenues for the six months totaled $33.3 million, a 1.7% increase from $32.7 million last year.

Pura Vida segment revenues totaled $29.5 million, a 34.8% decrease from $45.2 million in the prior year, attributed to a decrease in both ecommerce and wholesale sales, partially offset by new store growth.

Consolidated gross profit for the six months totaled $98.3 million, or 51.3% of net revenues, compared to $123.8 million, or 55.6% of net revenues, in the prior year. On a non-GAAP basis, gross profit totaled $99.1 million, or 51.8% of net revenues. The decrease in consolidated gross profit as a percentage of net revenues for the six months was driven by Indirect liquidation sales, an increase in promotional activity, and one-time vendor charges.

For the six months, consolidated SG&A expense totaled $107.4 million, or 56.1% of net revenues, compared to $117.9 million, or 53.0% of net revenues, in the prior year. On a non-GAAP basis, current year consolidated SG&A expense totaled $104.6 million, or 54.7% of net revenues, compared to $113.9 million, or 51.2% of net revenues, in the prior year. The decrease in non-GAAP SG&A expense was due primarily to cost reduction initiatives and a reduction in variable expenses.

For the six months, the Company’s consolidated operating loss totaled ($8.6) million, or (4.5%) of net revenues, compared to operating income of $6.5 million, 2.9% of net revenues, in the prior year six-month period. On a non-GAAP basis, the Company’s current year consolidated operating loss was ($4.9) million, or (2.6%) of net revenues, compared to an operating income of $10.5 million, or 4.7% of net revenues, in the prior year.

By segment:

- Vera Bradley Direct operating income was $17.4 million, or 13.5% million of Direct net revenues, compared to $28.0 million, or 19.3% of Direct net revenues, in the prior year. On a non-GAAP basis, current year Direct operating income was $18.6 million, or 14.5% of Direct net revenues, compared to $28.3 million, or 19.6% of Direct net revenues, in the prior year.

- Vera Bradley Indirect operating income was $8.6 million, or 25.7% of Indirect net revenues, compared to $10.9 million, or 33.3% of Indirect net revenues, in the prior year. On a non-GAAP basis, Indirect operating income totaled $8.8 million, or 26.4% of Indirect net revenues.

- Pura Vida’s operating loss was ($1.1) million, or (3.8%) of Pura Vida net revenues, compared to an operating income of $5.6 million, or 12.3% of Pura Vida net revenues, in the prior year. On a non-GAAP basis, Pura Vida operating income was $0.4 million, or 1.5% of Pura Vida revenues, compared to $7.1 million, or 15.7% of Pura Vida net revenues, in the prior year.

Balance Sheet

Cash and cash equivalents as of August 3, 2024 totaled $44.1 million compared to $48.5 million at the end of last year’s second quarter. The Company had no borrowings on its $75 million asset-based lending (“ABL”) facility at quarter end.

Total quarter-end inventory was $133.0 million, compared to $139.3 million at the end of the second quarter last year.

Net capital spending for the six months ended August 3, 2024 totaled $3.6 million compared to $1.7 million in the prior year.

During the second quarter, the Company repurchased approximately $9.5 million of its common stock (1,362,248 shares at an average price of $7.01), bringing the total repurchased for the six months to approximately $15.9 million (2,321,434 shares at an average price of $6.85). The Company has approximately $9.6 million remaining under its $50.0 million repurchase authorization that expires in December 2024.

Forward Outlook

Excluding net revenues, all guidance-related numbers are non-GAAP. The prior year income statement numbers used in the forward-looking discussion below are also non-GAAP as they exclude the previously disclosed charges for intangible asset impairment charges, amortization of definite-lived intangible assets, severance charges, and professional and consulting fees primarily associated with strategic initiatives. Current year guidance also excludes any similar charges as well as one-time vendor charges. Fiscal 2024 represented a 53-week year while Fiscal 2025 represents a 52-week year.

For Fiscal 2025, the Company’s expectations are as follows:

- Consolidated net revenues of approximately $410 million. Net revenues totaled $470.8 million in Fiscal 2024, including the estimated impact of a 53rd week of $6.0 million. Revenues for the back half of the year are expected to be down in the low-teen range with sequential improvement in Q4 over Q3 driven by six new outlet store openings along with the anniversary of Pura Vida’s digital marketing cost increase in Q3 last year.

- Consolidated gross profit percentage of approximately 53% compared to 54.5% in Fiscal 2024. The fiscal 2025 gross profit rate change is due to product margin improvements and lower supply chain costs, offset by increased shipping costs, increased promotional cadence in our direct segments, and increased liquidation sales.

- Consolidated SG&A expense of approximately $215 million compared to $234.7 million in Fiscal 2024. Year-over-year SG&A expense reductions are anticipated to come from decreased variable costs along with continued structural cost reductions.

- Consolidated operating income of approximately $3 million compared to $22.6 million in Fiscal 2024.

- Consolidated diluted EPS of approximately $0.10 based on diluted weighted-average shares outstanding of 29.8 million and an effective tax rate of approximately 34%. Diluted EPS totaled $0.55 last year, including the estimated impact of a 53rd week of $0.01.

- Net capital spending of approximately $13 million compared to $3.8 million in the prior year, reflecting investments associated with new and remodeled stores as well as technology and logistics enhancements.

- End of year cash balance of approximately $50 million.

Disclosure Regarding Non-GAAP Measures

Non-GAAP Numbers

The current year non-GAAP second quarter and six-month income statement numbers referenced below exclude the previously outlined intangible asset amortization, severance charges, one-time vendor charges, consulting and professional fees, Project Restoration initiative charges, the income tax effect related to these items, as well as a tax effect related to a change in the Company’s effective tax rate from a revision in the projection of the Company’s annual income in the current fiscal quarter. The prior year non-GAAP second quarter and six-month income statement numbers referenced below exclude the previously outlined severance charges, intangible asset amortization, consulting and professional fees, and the income tax effect related to these items.

The Company’s management does not, nor does it suggest that investors should, consider the supplemental non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). Further, the non-GAAP measures utilized by the Company may be unique to the Company, as they may be different from non-GAAP measures used by other companies.

The Company believes that the non-GAAP measures presented in this earnings release, including cash flow (usage); gross profit; selling, general, and administrative expenses; operating income (loss); net income (loss); and diluted net income (loss) per share, along with the associated percentages of net revenues, are helpful to investors because they allow for a more direct comparison of the Company’s year-over-year performance and are consistent with management’s evaluation of business performance. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures can be found in the Company’s supplemental schedules included in this earnings release.

Consistent with SEC regulations, the Company has not provided a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures in reliance on the “unreasonable efforts” exception set forth in the applicable regulations, because there is substantial uncertainty associated with predicting any future adjustments the Company may make to its GAAP financial measures in calculating non-GAAP financial measures.

Call Information

A conference call to discuss results for the second quarter is scheduled for today, Wednesday, September 11, 2024, at 9:30 a.m. Eastern Time. A broadcast of the call will be available via Vera Bradley’s Investor Relations section of its website, www.verabradley.com. Alternatively, interested parties may dial into the call at (877) 407-0779, and enter the access code 13742955. A replay will be available shortly after the conclusion of the call and remain available through September 25, 2024. To access the recording, listeners should dial (844) 512-2921, and enter the access code 13742955.

About Vera Bradley, Inc.

Vera Bradley, Inc. operates two unique lifestyle brands – Vera Bradley and Pura Vida. Vera Bradley and Pura Vida are complementary businesses, both with devoted, emotionally-connected, and multi-generational female customer bases; alignment as casual, comfortable, affordable, and fun brands; positioning as “gifting” and socially-connected brands; strong, entrepreneurial cultures; a keen focus on community, charity, and social consciousness; multi-channel distribution strategies; and talented leadership teams aligned and committed to the long-term success of their brands.

Vera Bradley, based in Fort Wayne, Indiana, is a leading designer of women’s handbags, luggage and other travel items, fashion and home accessories, and unique gifts. Founded in 1982 by friends Barbara Bradley Baekgaard and Patricia R. Miller, the brand is known for its innovative designs, iconic patterns, and brilliant colors that inspire and connect women unlike any other brand in the global marketplace.

Pura Vida, based in La Jolla, California, is a digitally native, highly-engaging lifestyle brand with a differentiated and expanding offering of bracelets, jewelry, and other lifestyle accessories.

The Company has three reportable segments: Vera Bradley Direct (“VB Direct”), Vera Bradley Indirect (“VB Indirect”), and Pura Vida. The VB Direct business consists of sales of Vera Bradley products through Vera Bradley Full-Line and Outlet stores in the United States; Vera Bradley’s websites, www.verabradley.com, outlet.verabradley.com, and international.verabradley.com; and the Vera Bradley annual outlet sale in Fort Wayne, Indiana. The VB Indirect business consists of sales of Vera Bradley products to approximately 1,450 specialty retail locations throughout the United States, as well as select department stores, national accounts, third party e-commerce sites, and third-party inventory liquidators, and royalties recognized through licensing agreements related to the Vera Bradley brand. The Pura Vida segment consists of sales of Pura Vida products through the Pura Vida websites, www.puravidabracelets.com and www.puravidabracelets.eu; through the distribution of its products to wholesale retailers and department stores; and through its Pura Vida retail stores.

Website Information

We routinely post important information for investors on our website www.verabradley.com in the “Investor Relations” section. We intend to use this webpage as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document.

Investors and other interested parties may also access the Company’s most recent Corporate Responsibility and Sustainability Report outlining its ESG (Environmental, Social, and Governance) initiatives at https://verabradley.com/pages/corporate-responsibility.

Vera Bradley Safe Harbor Statement

Certain statements in this release are “forward-looking statements” made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the Company’s current expectations or beliefs concerning future events and are subject to various risks and uncertainties that may cause actual results to differ materially from those that we expected, including: possible adverse changes in general economic conditions and their impact on consumer confidence and spending; possible inability to predict and respond in a timely manner to changes in consumer demand; possible loss of key management or design associates or inability to attract and retain the talent required for our business; possible inability to maintain and enhance our brands; possible inability to successfully implement the Company’s long-term strategic plan; possible inability to successfully open new stores, close targeted stores, and/or operate current stores as planned; incremental tariffs or adverse changes in the cost of raw materials and labor used to manufacture our products; possible adverse effects resulting from a significant disruption in our distribution facilities; or business disruption caused by pandemics or other macro factors. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended February 3, 2024. We undertake no obligation to publicly update or revise any forward-looking statement. Financial schedules are attached to this release.

CONTACTS:

Investors:

Tom Filandro, Partner

ICR, Inc

VeraBradleyIR@icrinc.com

Media:

mediacontact@verabradley.com

877-708-VERA (8372)

| Vera Bradley, Inc. | ||||||||||||

| Condensed Consolidated Balance Sheets | ||||||||||||

| (in thousands) | ||||||||||||

| (unaudited) | ||||||||||||

| August 3, 2024 |

February 3, 2024 |

July 29, 2023 |

||||||||||

| Assets | ||||||||||||

| Current assets: | ||||||||||||

| Cash and cash equivalents | $ | 44,147 | $ | 77,303 | $ | 48,522 | ||||||

| Accounts receivable, net | 25,126 | 17,112 | 23,944 | |||||||||

| Inventories | 133,047 | 118,278 | 139,301 | |||||||||

| Income taxes receivable | 6,433 | 461 | 2,180 | |||||||||

| Prepaid expenses and other current assets | 14,702 | 12,803 | 14,625 | |||||||||

| Total current assets | 223,455 | 225,957 | 228,572 | |||||||||

| Operating right-of-use assets | 63,319 | 66,488 | 69,932 | |||||||||

| Property, plant, and equipment, net | 55,984 | 54,256 | 56,127 | |||||||||

| Intangible assets, net | 6,237 | 7,573 | 14,460 | |||||||||

| Deferred income taxes | 20,279 | 20,355 | 20,014 | |||||||||

| Other assets | 9,940 | 6,157 | 2,395 | |||||||||

| Total assets | $ | 379,214 | $ | 380,786 | $ | 391,500 | ||||||

| Liabilities and Shareholders’ Equity | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable | $ | 37,949 | $ | 14,155 | $ | 21,605 | ||||||

| Accrued employment costs | 6,615 | 12,944 | 12,965 | |||||||||

| Short-term operating lease liabilities | 17,661 | 18,452 | 19,587 | |||||||||

| Other accrued liabilities | 15,935 | 12,070 | 13,496 | |||||||||

| Income taxes payable | 170 | 640 | 528 | |||||||||

| Total current liabilities | 78,330 | 58,261 | 68,181 | |||||||||

| Long-term operating lease liabilities | 58,306 | 62,552 | 66,718 | |||||||||

| Other long-term liabilities | 44 | 44 | 82 | |||||||||

| Total liabilities | 136,680 | 120,857 | 134,981 | |||||||||

| Shareholders’ equity: | ||||||||||||

| Additional paid-in-capital | 113,503 | 112,590 | 111,663 | |||||||||

| Retained earnings | 280,052 | 282,467 | 279,204 | |||||||||

| Accumulated other comprehensive loss | (72 | ) | (72 | ) | (69 | ) | ||||||

| Treasury stock | (150,949 | ) | (135,056 | ) | (134,279 | ) | ||||||

| Total shareholders’ equity | 242,534 | 259,929 | 256,519 | |||||||||

| Total liabilities and shareholders’ equity | $ | 379,214 | $ | 380,786 | $ | 391,500 | ||||||

| Vera Bradley, Inc. | ||||||||||||||||

| Condensed Consolidated Statements of Operations | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Thirteen Weeks Ended | Twenty-Six Weeks Ended | |||||||||||||||

| August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

|||||||||||||

| Net revenues | $ | 110,822 | $ | 128,172 | $ | 191,425 | $ | 222,534 | ||||||||

| Cost of sales | 54,461 | 56,156 | 93,154 | 98,769 | ||||||||||||

| Gross profit | 56,361 | 72,016 | 98,271 | 123,765 | ||||||||||||

| Selling, general, and administrative expenses | 53,627 | 59,405 | 107,408 | 117,911 | ||||||||||||

| Other income, net | 138 | 260 | 580 | 631 | ||||||||||||

| Operating income (loss) | 2,872 | 12,871 | (8,557 | ) | 6,485 | |||||||||||

| Interest income (expense), net | 343 | (12 | ) | 946 | (44 | ) | ||||||||||

| Income (loss) before income taxes | 3,215 | 12,859 | (7,611 | ) | 6,441 | |||||||||||

| Income tax (benefit) expense | (2,491 | ) | 3,605 | (5,196 | ) | 1,866 | ||||||||||

| Net income (loss) | $ | 5,706 | $ | 9,254 | $ | (2,415 | ) | $ | 4,575 | |||||||

| Basic weighted-average shares outstanding | 29,290 | 30,901 | 29,972 | 30,847 | ||||||||||||

| Diluted weighted-average shares outstanding | 29,817 | 31,139 | 29,972 | 31,208 | ||||||||||||

| Basic net income (loss) per share | $ | 0.19 | $ | 0.30 | $ | (0.08 | ) | $ | 0.15 | |||||||

| Diluted net income (loss) per share | $ | 0.19 | $ | 0.30 | $ | (0.08 | ) | $ | 0.15 | |||||||

| Vera Bradley, Inc. | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (in thousands) | |||||||||||

| (unaudited) | |||||||||||

| Twenty-Six Weeks Ended | |||||||||||

| August 3, 2024 |

July 29, 2023 |

||||||||||

| Cash flows from operating activities | |||||||||||

| Net (loss) income | $ | (2,415 | ) | $ | 4,575 | ||||||

| Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities: | |||||||||||

| Depreciation of property, plant, and equipment | 3,845 | 4,070 | |||||||||

| Amortization of operating right-of-use assets | 9,334 | 10,501 | |||||||||

| Amortization of intangible assets | 1,336 | 1,458 | |||||||||

| Provision for doubtful accounts | 31 | 17 | |||||||||

| Stock-based compensation | 1,376 | 1,601 | |||||||||

| Deferred income taxes | 76 | 2,102 | |||||||||

| Other non-cash loss, net | 15 | 40 | |||||||||

| Changes in assets and liabilities: | |||||||||||

| Accounts receivable | (8,045 | ) | (1,856 | ) | |||||||

| Inventories | (14,769 | ) | 2,974 | ||||||||

| Prepaid expenses and other assets | (5,682 | ) | 1,107 | ||||||||

| Accounts payable | 22,691 | 1,403 | |||||||||

| Income taxes | (6,442 | ) | (899 | ) | |||||||

| Operating lease liabilities, net | (11,202 | ) | (10,552 | ) | |||||||

| Accrued and other liabilities | (3,300 | ) | (566 | ) | |||||||

| Net cash (used in) provided by operating activities | (13,151 | ) | 15,975 | ||||||||

| Cash flows from investing activities | |||||||||||

| Purchases of property, plant, and equipment | (3,649 | ) | (1,727 | ) | |||||||

| Cash paid for business acquisition | – | (10,000 | ) | ||||||||

| Net cash used in investing activities | (3,649 | ) | (11,727 | ) | |||||||

| Cash flows from financing activities | |||||||||||

| Tax withholdings for equity compensation | (463 | ) | (942 | ) | |||||||

| Repurchase of common stock | (15,893 | ) | (1,415 | ) | |||||||

| Net cash used in financing activities | (16,356 | ) | (2,357 | ) | |||||||

| Effect of exchange rate changes on cash and cash equivalents | – | 36 | |||||||||

| Net (decrease) increase in cash and cash equivalents | $ | (33,156 | ) | $ | 1,927 | ||||||

| Cash and cash equivalents, beginning of period | 77,303 | 46,595 | |||||||||

| Cash and cash equivalents, end of period | $ | 44,147 | $ | 48,522 | |||||||

| Vera Bradley, Inc. | |||||||||||||||||

| Second Quarter Fiscal 2025 | |||||||||||||||||

| GAAP to Non-GAAP Reconciliation Thirteen Weeks Ended August 3, 2024 | |||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||

| (unaudited) | |||||||||||||||||

| Thirteen Weeks Ended | |||||||||||||||||

| Net income | $ | 5,706 | |||||||||||||||

| Amortization of definite-lived intangible assets(1) | 607 | ||||||||||||||||

| Severance(2) | 353 | ||||||||||||||||

| Project Restoration(1) | 330 | ||||||||||||||||

| Consulting and professional fees(1) | 178 | ||||||||||||||||

| Income tax adjustments(3) | (3,282 | ) | |||||||||||||||

| Net income – Non-GAAP | 3,892 | ||||||||||||||||

| Diluted net income per share – Non-GAAP | 0.13 | ||||||||||||||||

| 1Recorded in selling, general, and administrative expenses | |||||||||||||||||

| 2$295 recorded in selling, general, and administrative expenses and $58 recorded in cost of goods sold | |||||||||||||||||

| 3Related to the tax impact of the items mentioned above, along with the effect of the change in the Company’s effective tax rate from a revision in the projection of the Company’s annual income in the current fiscal quarter | |||||||||||||||||

| Thirteen Weeks Ended | |||||||||||||||||

| VB Direct | VB Indirect | Pura Vida | Unallocated Corporate Expenses |

Total | |||||||||||||

| Operating income | $ | 13,433 | $ | 4,743 | $ | 89 | $ | (15,393 | ) | $ | 2,872 | ||||||

| Amortization of definite-lived intangible assets | – | – | 607 | – | 607 | ||||||||||||

| Severance | – | 209 | – | 144 | 353 | ||||||||||||

| Project Restoration | 330 | – | – | – | 330 | ||||||||||||

| Consulting and professional fees | – | – | – | 178 | 178 | ||||||||||||

| Operating income – Non-GAAP | $ | 13,763 | $ | 4,952 | $ | 696 | $ | (15,071 | ) | $ | 4,340 | ||||||

| Vera Bradley, Inc. | ||||||||||||||||

| Second Quarter Fiscal 2024 | ||||||||||||||||

| GAAP to Non-GAAP Reconciliation Thirteen Weeks Ended July 29, 2023 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Thirteen Weeks Ended | ||||||||||||||||

| Net income | $ | 9,254 | ||||||||||||||

| Amortization of definite-lived intangible assets(1) | 729 | |||||||||||||||

| Consulting and professional fees(1) | 293 | |||||||||||||||

| Severance(1) | 79 | |||||||||||||||

| Income tax adjustments(2) | (157 | ) | ||||||||||||||

| Net income – Non-GAAP | 10,198 | |||||||||||||||

| Diluted net income per share – Non-GAAP | 0.33 | |||||||||||||||

| 1Recorded in selling, general, and administrative expenses | ||||||||||||||||

| 2Related to the tax impact of the items mentioned above | ||||||||||||||||

| Thirteen Weeks Ended | ||||||||||||||||

| VB Direct | VB Indirect | Pura Vida | Unallocated Corporate Expenses |

Total | ||||||||||||

| Operating income | $ | 20,621 | $ | 6,204 | $ | 4,000 | $ | (17,954 | ) | $ | 12,871 | |||||

| Amortization of definite-lived intangible assets | – | – | 729 | – | 729 | |||||||||||

| Consulting and professional fees | – | – | – | 293 | 293 | |||||||||||

| Severance | – | – | 79 | – | 79 | |||||||||||

| Operating income – Non-GAAP | $ | 20,621 | $ | 6,204 | $ | 4,808 | $ | (17,661 | ) | $ | 13,972 | |||||

| Vera Bradley, Inc. | ||||||||||||||||||

| Second Quarter Fiscal 2025 | ||||||||||||||||||

| GAAP to Non-GAAP Reconciliation Twenty-Six Weeks Ended August 3, 2024 | ||||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||

| (unaudited) | ||||||||||||||||||

| Twenty-Six Weeks Ended | ||||||||||||||||||

| Net loss | $ | (2,415 | ) | |||||||||||||||

| Amortization of definite-lived intangible assets(1) | 1,336 | |||||||||||||||||

| Severance(2) | 789 | |||||||||||||||||

| One-time vendor charges(3) | 747 | |||||||||||||||||

| Consulting and professional fees(1) | 438 | |||||||||||||||||

| Project Restoration(1) | 330 | |||||||||||||||||

| Income tax adjustments(4) | (3,874 | ) | ||||||||||||||||

| Net loss – Non-GAAP | (2,649 | ) | ||||||||||||||||

| Diluted net loss per share – Non-GAAP | (0.09 | ) | ||||||||||||||||

| 1Recorded in selling, general, and administrative expenses | ||||||||||||||||||

| 2$678 recorded in selling, general, and administrative expenses and $111 recorded in cost of goods sold | ||||||||||||||||||

| 3Recorded in cost of goods sold | ||||||||||||||||||

| 4Related to the tax impact of the items mentioned above, along with the effect of the change in the Company’s effective tax rate from a revision in the projection of the Company’s annual income in the current fiscal quarter | ||||||||||||||||||

| Twenty-Six Weeks Ended | ||||||||||||||||||

| VB Direct | VB Indirect | Pura Vida | Unallocated Corporate Expenses |

Total | ||||||||||||||

| Operating income (loss) | $ | 17,426 | $ | 8,569 | $ | (1,112 | ) | $ | (33,440 | ) | $ | (8,557 | ) | |||||

| Amortization of definite-lived intangible assets | – | – | 1,336 | – | 1,336 | |||||||||||||

| Severance | 135 | 217 | – | 437 | 789 | |||||||||||||

| One-time vendor charges | 747 | – | – | – | 747 | |||||||||||||

| Consulting and professional fees | – | – | 222 | 216 | 438 | |||||||||||||

| Project Restoration | 330 | – | – | – | 330 | |||||||||||||

| Operating income (loss) – Non-GAAP | $ | 18,638 | $ | 8,786 | $ | 446 | $ | (32,787 | ) | $ | (4,917 | ) | ||||||

| Vera Bradley, Inc. | ||||||||||||||||

| Second Quarter Fiscal 2024 | ||||||||||||||||

| GAAP to Non-GAAP Reconciliation Twenty-Six Weeks Ended July 29, 2023 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Twenty-Six Weeks Ended | ||||||||||||||||

| Net income | $ | 4,575 | ||||||||||||||

| Severance(1) | 2,068 | |||||||||||||||

| Amortization of definite-lived intangible assets(1) | 1,458 | |||||||||||||||

| Consulting and professional fees(1) | 475 | |||||||||||||||

| Income tax adjustments(2) | (1,013 | ) | ||||||||||||||

| Net income – Non-GAAP | 7,563 | |||||||||||||||

| Diluted net income per share – Non-GAAP | 0.24 | |||||||||||||||

| 1Recorded in selling, general, and administrative expenses | ||||||||||||||||

| 2Related to the tax impact of the items mentioned above | ||||||||||||||||

| Twenty-Six Weeks Ended | ||||||||||||||||

| VB Direct | VB Indirect | Pura Vida | Unallocated Corporate Expenses |

Total | ||||||||||||

| Operating income | $ | 27,961 | $ | 10,910 | $ | 5,562 | $ | (37,948 | ) | $ | 6,485 | |||||

| Severance | 342 | – | 79 | 1,647 | 2,068 | |||||||||||

| Amortization of definite-lived intangible assets | – | – | 1,458 | – | 1,458 | |||||||||||

| Consulting and professional fees | – | – | – | 475 | 475 | |||||||||||

| Operating income – Non-GAAP | $ | 28,303 | $ | 10,910 | $ | 7,099 | $ | (35,826 | ) | $ | 10,486 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On American Express

Deep-pocketed investors have adopted a bearish approach towards American Express AXP, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AXP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for American Express. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 11% leaning bullish and 55% bearish. Among these notable options, 7 are puts, totaling $261,890, and 2 are calls, amounting to $60,356.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $250.0 for American Express over the recent three months.

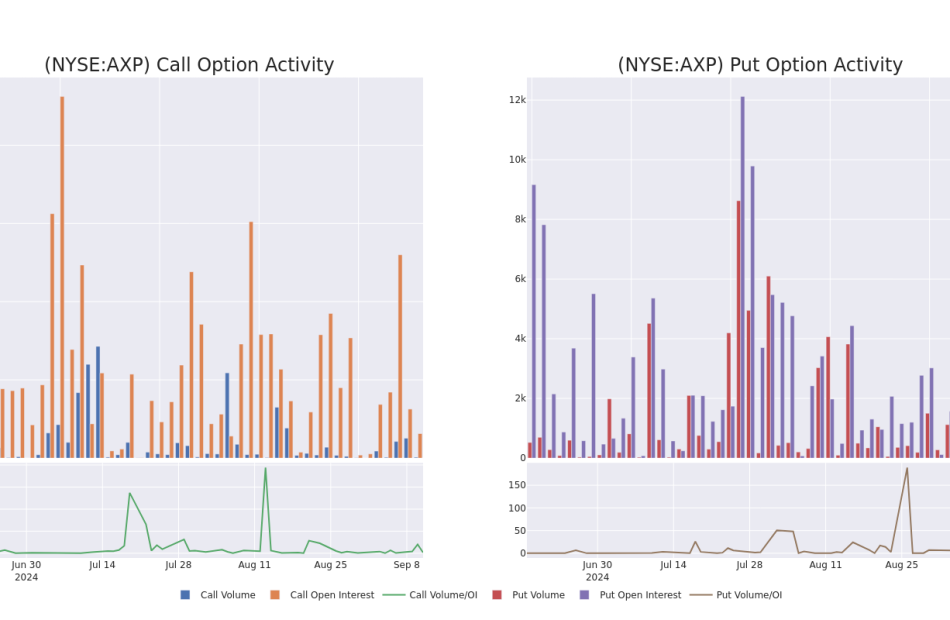

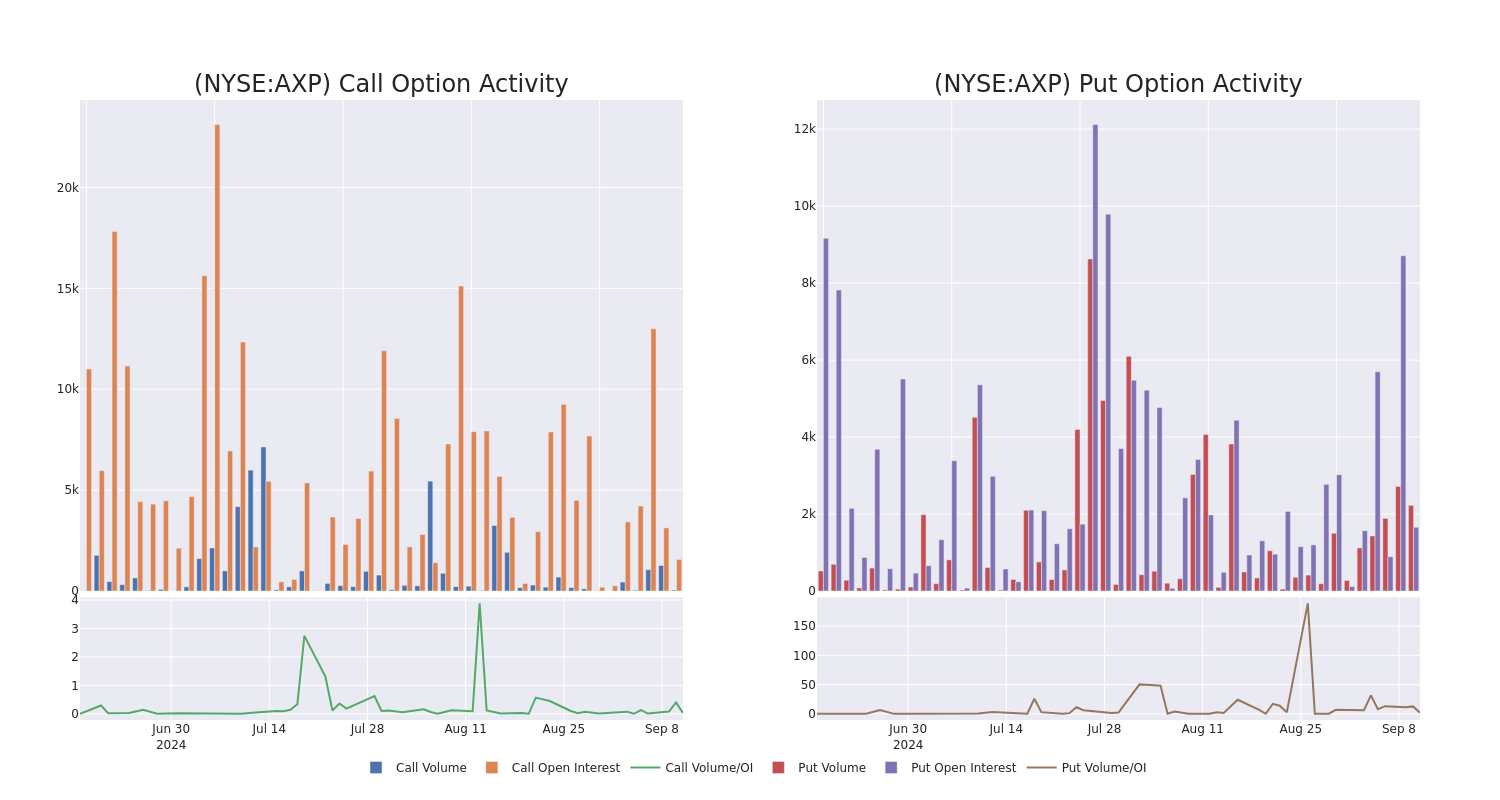

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for American Express options trades today is 805.0 with a total volume of 2,274.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for American Express’s big money trades within a strike price range of $155.0 to $250.0 over the last 30 days.

American Express Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | PUT | SWEEP | BEARISH | 09/13/24 | $4.8 | $4.0 | $4.8 | $247.50 | $54.7K | 1.1K | 232 |

| AXP | PUT | TRADE | NEUTRAL | 09/13/24 | $5.05 | $4.1 | $4.55 | $247.50 | $49.1K | 1.1K | 525 |

| AXP | PUT | TRADE | NEUTRAL | 09/13/24 | $5.25 | $4.2 | $4.7 | $247.50 | $39.0K | 1.1K | 744 |

| AXP | PUT | SWEEP | BEARISH | 09/13/24 | $2.87 | $2.56 | $2.87 | $245.00 | $35.6K | 512 | 138 |

| AXP | CALL | SWEEP | BEARISH | 10/18/24 | $7.55 | $7.25 | $7.25 | $250.00 | $33.3K | 1.5K | 46 |

About American Express

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company’s commercial business offers expense management tools, consulting services, and business loans.

Following our analysis of the options activities associated with American Express, we pivot to a closer look at the company’s own performance.

Where Is American Express Standing Right Now?

- Currently trading with a volume of 52,040, the AXP’s price is down by -0.37%, now at $244.51.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 37 days.

What Analysts Are Saying About American Express

In the last month, 1 experts released ratings on this stock with an average target price of $263.0.

- In a cautious move, an analyst from B of A Securities downgraded its rating to Neutral, setting a price target of $263.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for American Express, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Technologies Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Palantir Technologies PLTR.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with PLTR, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 10 options trades for Palantir Technologies.

This isn’t normal.

The overall sentiment of these big-money traders is split between 60% bullish and 40%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $34,890, and 9, calls, for a total amount of $726,870.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $36.0 for Palantir Technologies over the last 3 months.

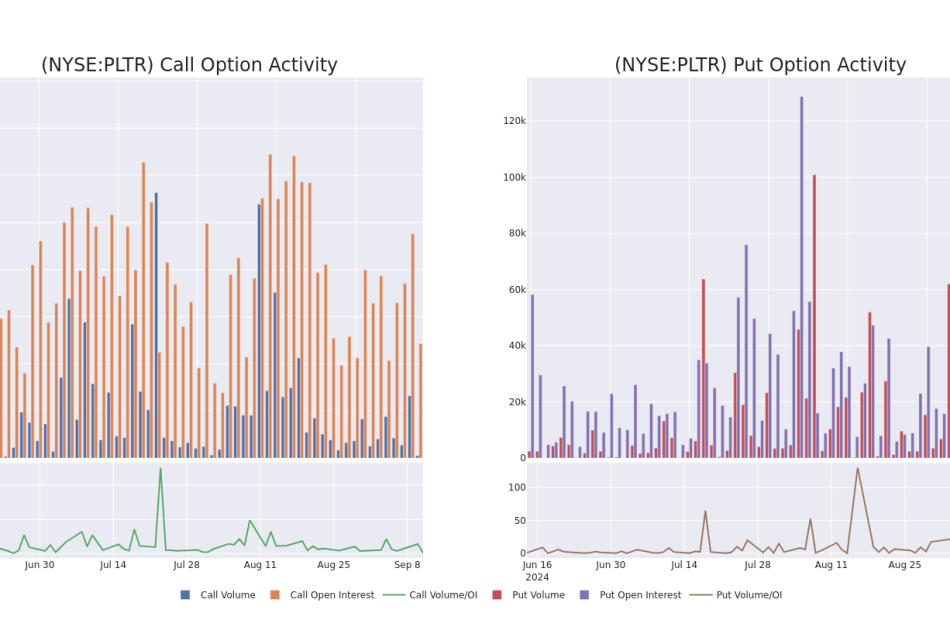

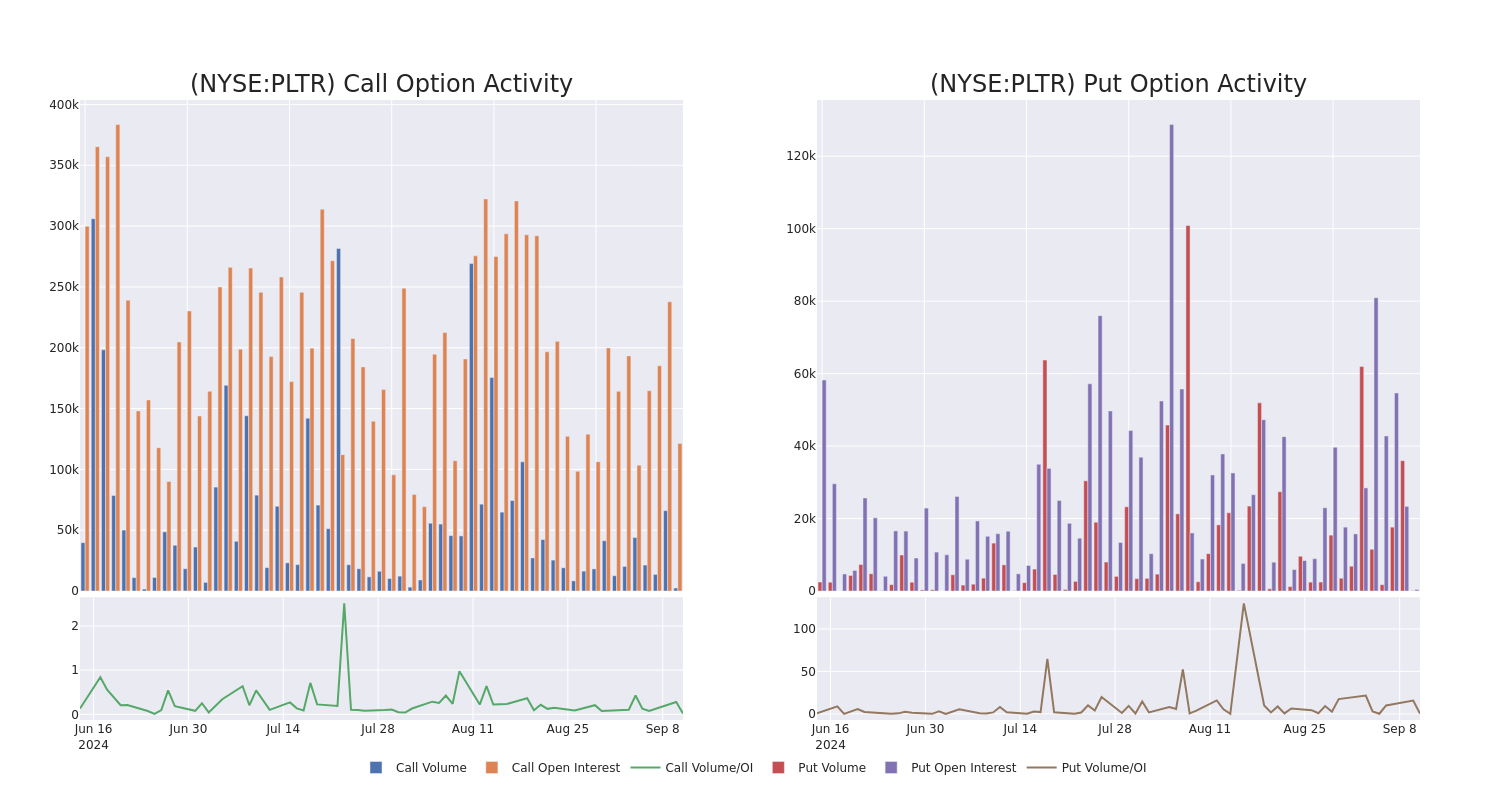

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Palantir Technologies’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palantir Technologies’s whale activity within a strike price range from $20.0 to $36.0 in the last 30 days.

Palantir Technologies Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | CALL | SWEEP | BEARISH | 09/20/24 | $0.7 | $0.75 | $0.75 | $35.00 | $190.3K | 35.6K | 0 |

| PLTR | CALL | SWEEP | BULLISH | 03/21/25 | $13.75 | $13.7 | $13.75 | $22.00 | $137.5K | 895 | 0 |

| PLTR | CALL | SWEEP | BEARISH | 01/17/25 | $4.05 | $4.0 | $4.0 | $35.00 | $75.6K | 22.1K | 222 |

| PLTR | CALL | SWEEP | BULLISH | 09/13/24 | $1.24 | $1.23 | $1.24 | $33.00 | $71.6K | 10.6K | 391 |

| PLTR | CALL | TRADE | BEARISH | 11/15/24 | $3.1 | $3.0 | $3.0 | $35.00 | $60.0K | 8.8K | 611 |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients’ organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Following our analysis of the options activities associated with Palantir Technologies, we pivot to a closer look at the company’s own performance.

Palantir Technologies’s Current Market Status

- Trading volume stands at 10,997,211, with PLTR’s price down by -2.25%, positioned at $33.98.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 50 days.

Expert Opinions on Palantir Technologies

3 market experts have recently issued ratings for this stock, with a consensus target price of $41.0.

- In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $38.

- An analyst from B of A Securities persists with their Buy rating on Palantir Technologies, maintaining a target price of $50.

- In a cautious move, an analyst from Northland Capital Markets downgraded its rating to Market Perform, setting a price target of $35.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palantir Technologies options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Historic Inflation Data Hits Lowest Level Since February 2021 — But One Segment Remains Stubbornly High (UPDATED)

Editor’s note: This story has been updated with additional details.

The U.S. annual inflation rate in August fell to its lowest point since February 2021, signaling a further easing of pressure on the cost of goods and services for U.S. consumers.

The Consumer Price Index (CPI) saw a cooler-than-anticipated annual headline print in August, cementing convictions for interest rate cuts by the Federal Reserve.

August CPI Inflation Report: Key Highlights

- Headline CPI inflation fell from 2.9% in July to 2.5% in August 2024 on a year-over-year basis, falling short of the consensus forecast of 2.6% tracked by TradingEconomics.

- On a monthly basis, inflation increased by 0.2% in August, matching both the previous month’s reading and expectations.

- The energy index declined by 0.8% in the month, following a stagnation in the previous month.

- The shelter index soared by 0.5% in August, contributing the most to the overall increase in the all-items index.

- Core inflation, which excludes volatile energy and food items, held steady at 3.2% year-over-year in August, matching forecasts.

- On a monthly basis, core inflation rose by 0.3%, accelerating from the previous 0.2% and surpassing estimates of 0.2%.

- In August, several items saw increases, including shelter, airline fares, motor vehicle insurance, education and apparel.

- The items for used cars and trucks, household furnishings and operations, medical care, communication and recreation were among those that recorded a decline over the month.

| Consumer Price Index | August 2024 | July 2024 | Expected |

|---|---|---|---|

| Headline (y/y) | 2.5% | 2.9% | 2.6% |

| Headline (m/m) | 0.2% | 0.2% | 0.2% |

| Core (y/y) | 3.2% | 3.2% | 3.2% |

| Core (m/m) | 0.3% | 0.2% | 0.2% |

Market Reactions

Investors focused on the unexpected rise in core monthly inflation than the drop in the annual headline figure, sending Treasury yields and the U.S. dollar higher after the report.

The U.S. dollar, as tracked by the Invesco DB USD Index Bullish Fund ETF UUP, climbed 0.3% minutes after the release, while yields on the 10-year Treasury note surged by 8 basis points.

Rate-sensitive assets like gold and the Japanese yen fell, and futures on major U.S. equity indices saw minor declines.

The SPDR S&P 500 ETF Trust SPY was down 0.3% in Wednesday’s premarket trading. Tech stocks, as tracked by the Invesco QQQ Trust, Series 1 QQQ traded 0.1% lower.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Linarc Taps Visionary Leader Vikshut Mundkur to Drive Operations Forward as New Head of Operations

Los Angeles, CA, Sept. 11, 2024 (GLOBE NEWSWIRE) — Linarc, Inc., the fastest growing collaborative project management platform in the construction industry, today announced that Vikshut Mundkur has been appointed as Head of Operations. In this role, Mundkur will be responsible for customer success and business operations, in addition to overseeing presale activities in the Indian, Middle Eastern and APAC regions.

“Linarc could not be more pleased to be bringing Vikshut aboard,” said Shanthi Rajan, CEO, Linarc. “Over the course of a career spanning close to two decades, Vikshut has demonstrated vision, tenacity, and an unerring sense of where modern B2B SaaS technology is headed, particularly in the construction space. Linarc’s all-in-one construction management software is already overhauling the way construction gets done globally, and I can think of few people as qualified as Vikshut to help keep that momentum going in the years and decades ahead.”

Mundkur’s breadth of expertise, ranging from IT to computer vision, drones, to renewable energy, can be attributed to a career spent at the cutting-edge of B2B technology. Before joining Linarc, Mundkur served as co-founder and CEO of the construction management platform CONSTRA. Through his leadership initiatives—including the successful launch of a B2B visual intelligence platform—CONSTRA’s technology was adopted across more than 200 million square feet of construction in India and the UAE before Mundkur sold the company to Bandhoo Solutions. In his time at CONSTRA, Mundkur nurtured a highly motivated team of 60, developing a customer-centric approach geared towards operational excellence.

Prior to founding CONSTRA, Mundkur oversaw the renewable energy consumption strategy and implementation at Infosys and managed institutional sales and product innovation at SELCO, a renewable energy social enterprise. Throughout his career, Mundkur has devoted himself to driving new technology, innovating at the highest level, generating consistent revenue growth, and ensuring customer satisfaction at all costs.

“Having founded and sold a company in the construction management space, I know a thing or two about streamlining construction—and I can say with confidence that Linarc is pushing the boundaries in ways we haven’t yet seen before,” said Mundkur. “Emerging technologies, including AI, are radically overhauling the construction industry, and Linarc is at the forefront of these changes, facilitating more efficient collaboration and more successful outcomes. It’s a mission I believe in strongly, and I look forward to transmitting that enthusiasm to our customers.”

# # #

About Linarc:

Linarc is a modern, easy-to-use, all-in-one cloud-based construction management software for teams. Collaborate and manage multiple projects from anywhere. Gain complete visibility into your operations, keep your team accountable, and make informed decisions based on data you can trust. Learn more: https://linarc.com/

Joanne Hogue Smart Connections PR for Linarc +1 (410) 658-8246 joanne@smartconnectionspr.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shaquille O'Neal Key Speaker at Keyspire's First Public Investor Summit

Canada’s number one real estate investing conference just got 10x bigger; three days of more expert advice, celebrity guest speakers and unparalleled networking than ever before

TORONTO, Sept. 10, 2024 /CNW/ – Keyspire celebrates milestone 40th Investor Summit by opening attendance to the public for the first time ever, increasing the learning and networking opportunities by tenfold and featuring world-renowned celebrity speakers, exclusive expert training and a diverse agenda tailored for both new and seasoned Real Estate Investors, this event is poised to attract a wide array of participants looking to grow their personal wealth through property investments. Since its inauguration in 2013, the Keyspire conference has facilitated more than $100,000,000 worth of investments.

The list of more than 30 speakers includes retired NBA superstar turned savvy property investor, Shaquille O’Neal; stars of Amazon Prime’s Toronto-based real estate show Luxe Listings, Peter and Paige Torkan; host of numerous HGTV shows including Income Property, and co-founder of Keyspire, Scott McGillivray; Interior Designer and key member of the team for Scott’s Vacation House Rules, Debora Salmoni; plus, even more HGTV stars, trainers, industry experts, financial advisors, service providers and investors.

“At Keyspire, our mission has always been about more than just real estate—it’s about empowering people to take control of their financial future,” says Scott McGillivray, Co-founder at Keyspire. “This year’s summit is a testament to how far we’ve come, as we open our doors to the public for the first time, bringing together an incredible lineup of speakers and opportunities. We’re dedicated to teaching others the strategies that can grow wealth and create lasting legacies.”

Years of planning have culminated in this unparalleled experience, spanning three days and offering attendees, exhibitors and sponsors a journey unlike anything they’ve encountered before. Over three experience-filled days in Toronto, the Summit’s largest audience yet will learn about a variety of topics including multi-family investing, vacation rentals, infinite banking, tax minimization, legacy planning, pre-construction, developing properties and more.

“Keyspire is not just changing lives,” adds Keyspire Co-founder, Michael Sarrachini. “We’ve transformed the landscape of North American real estate investing. Our Summit provides a central place to learn about investing in properties, build your all-star professional team, expand your peer network, and get started right away. It’s all happening here.”

“We are so excited to have Shaquille O’Neal join us this year. He’s going to be talking about how to own your future in real estate and how he’s taken his success off the court,” adds Michael.

Too many people remain uncertain about how to start a real estate investing journey or how to advance beyond a plateau. At the 40th Investor Summit, attendees won’t just learn what’s next—they’ll leave equipped with the tools and training to turn their plans into reality.

Luxe Listing alum, Peter Torkan notes, “It’s an honour to be speaking at the Keyspire Real Estate Summit this September. For us, success in real estate is more than just closing deals—it’s about passion, persistence and creating lasting impact. Together, let’s redefine success and inspire others to dream bigger.”

Real estate is one of the most powerful tools for building generational wealth. Whether just starting out or growing a portfolio, the knowledge and connections gained at the Summit can change the course of a person’s financial future.

About Keyspire Investor’s Summit

At Keyspire, we live by the mantra, Knowledge Empowers You. We are on a mission to not only educate people about real estate investing but give them real power over their financial health. Our quest to put people in control of their future by removing the mystery of real estate investing is what led us to create our Investor’s Summit. Through 39 summits we’ve hosted over 20,000 attendees and enabled more than $100,000,000 in investment deals.

About Keyspire

Established in 2010 by Michael Sarracini and Scott McGillivary, Keyspire has helped more than 250,000 people power their passive income with real estate investing to create a bigger future. Today, the Keyspire organization touches the lives of tens of thousands of people across North America, adding millions of dollars to the personal wealth of North Americans annually.

To register for the 40th Investor’s Summit, please visit keyspireinvestorsummit.com. For more information about Keyspire, please visit keyspire.com.

Join us on Facebook , LinkedIn, Instagram and YouTube.

SOURCE Keyspire

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/10/c5031.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/10/c5031.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Business Unit President At Simulations Plus Exercises Options Worth $53K

In a new SEC filing on September 10, it was revealed that Fiedler-Kelly, Business Unit President at Simulations Plus SLP, executed a significant exercise of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that Fiedler-Kelly, Business Unit President at Simulations Plus, a company in the Health Care sector, just exercised stock options worth 2,250 shares of SLP stock with an exercise price of $9.71.

Simulations Plus shares are trading, exhibiting down of 0.0% and priced at $33.36 during Wednesday’s morning. This values Fiedler-Kelly’s 2,250 shares at $53,212.

All You Need to Know About Simulations Plus

Simulations Plus Inc is engaged in the software industry. It develops and produces software for use in pharmaceutical research and education, and provides consulting and contract research services to the pharmaceutical industry. The company’s operating segments include Software and services. It generates maximum revenue from the software segment.

Unraveling the Financial Story of Simulations Plus

Revenue Growth: Simulations Plus displayed positive results in 3 months. As of 31 May, 2024, the company achieved a solid revenue growth rate of approximately 14.23%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Holistic Profitability Examination:

-

Gross Margin: With a low gross margin of 71.49%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Simulations Plus’s EPS reflects a decline, falling below the industry average with a current EPS of 0.16.

Debt Management: Simulations Plus’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Simulations Plus’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 69.5.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 10.12 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 37.98 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Cracking Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Simulations Plus’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Manchester United Q4 Earnings: Topline Decline, Broadcasting Takes Major Hit & More

Manchester United PLC MANU reported a fiscal fourth-quarter 2024 sales decline of 15.0% year-on-year to 142.2 million British pounds or $179.43 million, missing the analyst consensus estimate of $189.09 million.

Broadcasting revenue plummeted 40.5%, Commercial revenue rose 5.6%, and Matchday revenue declined 7.9%.

The operating loss for the quarter was (32.4) million pounds compared to (0.3) million pounds last year.

Adjusted EBITDA was 19.3 million pounds versus 43.2 million pounds last year.

The adjusted loss per share for the period expanded to (15.79) pence versus (6.18) last year. Adjusted EPS loss of $(0.20) missed the analyst consensus loss estimate of $(0.17).

As of June 30, 2024, the company held 73.55 million pounds in cash and equivalents. The quarter’s net cash inflow from operating activities was 125.86 million pounds.

As of June 30, 2024, the company’s USD non-current borrowings were $650 million, unchanged from last year.

Outlook: Manchester United expects fiscal 2025 revenue of 650 million pounds-670 million pounds versus analyst consensus of 658.67 million pounds.

It expects fiscal 2025 adjusted EBITDA of 145 million pounds-160 million pounds.

Beginning in the third quarter of fiscal 2024, the club commenced a business transformation plan, which included installing a new executive leadership teamsides, streamlining the organizational structure, and implementing a significant cost rationalization program.

The stock is down over 17.3% in the last 12 months as reports indicated the team being sold in its entirety. In December 2023, Jim Ratcliffe bought 25% of the team.

Price Action: MANU stock is down 3.59% at $15.81 premarket at the last check Wednesday.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's the Average Age Americans Claim Social Security and the Monthly Benefit They Receive

The age you decide to start Social Security will have a tremendous impact on the trajectory of your retirement. As such, it’s not a decision to be taken lightly.

Often times, it helps to follow the wisdom of the crowd, so to speak, when weighing a tough decision. Aggregating the decisions of everyone else and taking the average can often inform you to the best choice going forward.

So, it’s worth considering the average Social Security claiming age and the monthly benefit they receive. They may shed some light on the biggest factors for you to take into account in your own claiming decision, and whether you should follow the crowd or forge your own path in retirement.

Here’s the average age Americans claim Social Security

The age of eligibility for Social Security hasn’t changed since the program’s inception. You can claim retirement benefits at any age starting at 62. But more and more Americans are waiting longer to claim their benefits.

In 2008, the average retiree claimed benefits at 63.6 years old for both men and women. Ten years later, the average claiming age increased about a year to 64.7 years old for men and 64.6 years old for women. That age continues to climb.

The explanation for the rise in claiming age is simple. The program has changed.

In 1983, Congress enacted a law that began the process of raising the full retirement age, or FRA. That’s the age at which you become eligible for your full Social Security benefit. The FRA increased from 65 to 66 around the turn of the millennium. It’s currently undergoing the transition from 66 to 67.

Raising the full retirement age incentivizes people to wait longer to claim benefits because the penalties for claiming earlier are harsher. Someone with a full retirement age of 67 will receive just 70% of their full benefit if they claim at 62. Comparatively, someone who had a full retirement age of 65 would receive 80%. In other words, there’s much more to gain by delaying benefits these days.

As such, we saw the average retirement benefit claiming age rise to 65 years old for men and 64.9 years old for women in 2022 (the most recent data available from the Social Security Administration).

Here’s the average amount retirees receive when they apply for benefits

The average new retirement benefit award in 2022 was $1,938.75. Those retirees have benefited from two substantial cost-of-living adjustments (COLAs) in 2023 and 2024, and they now receive an average benefit of $2,174.86.

That’s just for people who newly claimed retirement benefits in 2022. The average retirement benefit in July was less, $1,871.09, or $1,919.40 when you don’t include people claiming spousal or child benefits.

It’s reasonable to expect anyone claiming earlier than average to have a lower-than-average benefit, but you may be surprised to learn that even those waiting until 65 received a lower-than-average benefit. The average 65-year-old applying for Social Security in 2022 received just $1,874.56 per month. That’s 3.3% below the average.

That discrepancy points to a few factors. First, people who claim earlier typically had lower earnings during their career than those who delay benefits. That’s reflected in their primary insurance amounts, which are based primarily on average earnings during your career. Someone with lower earning likely couldn’t save as much for retirement, increasing the need for supplemental income.

Second, the benefit of delaying accelerates over time. For those with a full retirement age of 67, their benefit increases by 5/12 of a percent of their full retirement benefit for each month they delay from 62 through 64. The next three years their benefit increases by 5/9 of a percent per month. And for the three years following their full retirement age, they can receive a 2/3 of a percent increase in their benefit for each month they delay. The accelerating curve shifts the average benefit higher than the average claiming age.

Should you follow the wisdom of the crowd?

Age 65 is often considered the standard retirement age. It’s the original age you became eligible for full retirement benefits. It’s also the age you become eligible for Medicare, which makes it easier to leave your job and the employer-subsidized health insurance that comes with it.

But sticking to age 65 for when to claim retirement benefits could be a big mistake for many retirees.

If you’ve consistently saved and invested for retirement on your own and built up enough in your accounts to retire comfortably, it will probably work out in your favor to delay your benefits until at lest full retirement age. More often than not, you’ll maximize your lifetime Social Security income by delaying until age 70.

Your lifetime Social Security income is a function of your lifespan, and life expectancy data from the CDC indicates most people that live until age 62 will live long enough to receive more in benefits over their life by waiting until 70. So, unless you have a good reason to expect your lifespan will be shorter than the average retiree’s, you should delay as long as possible.

A 2019 study from United Income backs up the CDC data. It found the majority of retirees would maximize their wealth in retirement by waiting until age 70 to claim benefits. The next best age, 67, would only maximize the wealth for about 10% of retirees in the study. Just 8% were better off claiming before they reached 65.

Following the wisdom of the crowd for a decision like Social Security won’t work out for most Americans. That’s because the decision is based on multiple factors, not just optimizing the lifetime income from Social Security. Consider your personal circumstances and whether you can afford to optimize or if you’ll be better off taking a smaller benefit earlier.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Here’s the Average Age Americans Claim Social Security and the Monthly Benefit They Receive was originally published by The Motley Fool