Petco, AppLovin, Dave & Buster's And Other Big Stocks Moving Higher On Wednesday

U.S. stocks were lower, with the Dow Jones index falling over 1% on Wednesday.

Shares of Petco Health and Wellness Company, Inc. WOOF rose sharply during Wednesday’s session following quarterly results.

Petco reported quarterly losses of nine cents per share, which missed the analyst consensus estimate of losses of two cents per share. Quarterly sales of $1.52 billion met the analyst consensus estimate and represented a 1.99% increase over the same period last year.

Petco Health and Wellness shares surged 8.4% to $3.3299 on Wednesday.

Here are some other big stocks recording gains in today’s session.

- PureCycle Technologies, Inc. PCT shares jumped 20% to $5.63 after the company announced financing transaction and Ironton production update.

- Sigma Lithium Corporation SGML gained 17.4% to $11.05 amid a rise in the price of lithium. Chinese company Contemporary Amperex Technology halted production at its lepidolite mine in Yichun, Jiangxi.

- Lithium Americas (Argentina) Corp. LAAC rose 15.7% to $2.49 amid a rise in the price of lithium. Chinese company Contemporary Amperex Technology halted production at its lepidolite mine in Yichun, Jiangxi.

- Hyliion Holdings Corp. HYLN gained 13.3% to $2.0046. Hyliion Holdings recently announced it has been awarded a $15 million + contract by the Office of Naval Research to develop its KARNO generator for Navy ships and stationary power applications.

- Oscar Health, Inc. OSCR jumped 13.2% to $19.72.

- Arcadium Lithium plc ALTM gained 11.7% to $2.5250.

- Albemarle Corporation ALB gained 10.2% to $86.67 amid a rise in the price of lithium. Chinese company Contemporary Amperex Technology halted production at its lepidolite mine in Yichun, Jiangxi.

- Liquidia Corporation LQDA gained 10.1% to $9.81 after the company announced raise of $67.5 million from new common stock financings and $32.5 million advance from HealthCare Royalty under current financing agreement.

- SolarEdge Technologies, Inc. SEDG rose 8.8% to $19.41.

- Array Technologies, Inc. ARRY gained 7.8% to $6.14.

- Dave & Buster’s Entertainment, Inc. PLAY rose 7.5% to $32.09 after the company reported better-than-expected second-quarter EPS results.

- Verona Pharma plc VRNA gained 6.6% to $29.86. HC Wainwright & Co. analyst Raghuram Selvaraju reiterated Verona Pharma with a Buy and maintained a $36 price target.

- First Solar, Inc. FSLR gained 6.2% to $221.14.

- AppLovin Corporation APP gained 6.2% to $91.53. B of A Securities analyst Omar Dessouky maintained AppLovin with a Buy and raised the price target from $100 to $120.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TEN, Ltd. Reports Profits for the Second Quarter and First Half 2024 and Declares Second Semi-Annual Dividend of $0.90 Per Common Share Bringing Total Distributions for 2024 Operations to $1.50 Per Share

50% increased dividend from amount paid for 2023 operations

Dynamic growth and renewal – 21 vessels contracted/acquired within 2024

Minimum contracted revenues of $2.0 billion

TST inaugurates first private naval academy in Greece

Tanker market fundamentals remain solid

ATHENS, Greece, Sept. 11, 2024 (GLOBE NEWSWIRE) — TEN, Ltd (TEN) TEN (the “Company”) today reported results (unaudited) for the six months and the second quarter ended June 30, 2024.

FIRST HALF 2024 SUMMARY RESULTS

In the first half of 2024, TEN’s fleet generated $416 million in gross revenues and $179 million in operating profits which included capital gains of $49 million.

The resulting net income for the first half of 2024 reached $130.4 million or $3.96 per share.

The average Time Charter Equivalent (TCE) per ship per day for the 2024 first half was a solid $33,830.

Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) for the first half of 2024 reached $214 million.

Depreciation and amortization combined were at $77 million, an increase of $6.6 million from last year’s first half.

Vessel operating expenses experienced a modest increase to $98 million, reflecting the higher number of vessels and larger vessel sizes in the fleet.

Interest and finance costs for the 2024 first six months were at $55.2 million, as a result of new loans for the acquisition of five modern vessels during that period as well as the delivery of four modern dual-fuel LNG powered new-buildings during the fourth quarter of 2023 and the first quarter of 2024.

Total operating expenses per ship per day, despite persisting inflationary pressures, remained almost identical to 2023 first half levels at $9,367.

At the end of June 2024, TEN’s cash position reached $476 million, almost $100 million higher from year-end 2023.

Q2 2024 SUMMARY RESULTS

With three vessels undergoing scheduled dry dockings and special surveys, fleet utilization dropped to 92% and gross revenues reached $214 million.

Operating income, which included $32 million of capital gains in the second quarter of 2024 were at $103 million resulted in a net income of $76.4 million for the same period.

Average TCE per ship per day in the 2024 second quarter, which was impacted by vessel repositionings, reached $34,235 leading to an adjusted EBITDA of $113 million for the same period.

Fleet operating expenses were modestly higher from the 2023 second quarter levels, reaching $49.7 million in the 2024 second quarter again reflecting the larger sizes of vessels in the fleet. Despite that, and largely due to efficient vessel management, operating expenses per ship per day for the second quarter of 2024 dropped to $9,347 from $9,492 in the 2023 equivalent period.

Depreciation and amortization during the second quarter of 2024 was in line with the increased number of vessels in the fleet at $39.5 million.

Interest and finance costs for the second quarter of 2024 reached $30.0 million reflecting the aforementioned loans and continued elevated global interest rates.

SUBSEQUENT EVENTS

TEN, during the summer of 2024, triggered the repurchase of two sister vessels, the 2006-built suezmaxes Alaska and Archangel, by exercising, in-the-money, purchase options. With the termination of this leasing arrangement, TEN generated approximately $5.0 million in forward hire savings. These two vessels continue to operate in the fleet, unencumbered, and are currently on charter to significant oil concerns at attractive rates.

NAVAL ACADEMY

On 7th September 2024, TST, our technical managers, inaugurated a non-profit private naval academy on the seafaring island of Chios. This will result to more than 100 students graduating on an annual basis with an exceptionally high standard, technologically advanced and environmentally friendly workforce for TEN’s ever-growing, modern, innovative fleet going forward. We expect this to provide us with a competitive advantage in running safe and efficient vessels for our clients.

CORPORATE AFFAIRS – DIVIDEND

TEN is pleased to announce that it will distribute to common shareholders a second semi-annual dividend of $0.90 per share following the $0.60 per share paid in July, bringing the total dividend for 2024 operations to $1.50, representing a 50% increase over the amount distributed for 2023 operations. Dividend date to be announced.

Since the Company’s NYSE listing in 2002, TEN has consistently demonstrated its commitment to enhancing shareholder value, having distributed well over $820 million in common and preferred share dividends.

CORPORATE STRATEGY

The underlying market fundamentals continue to be favorable as the newbuilding orderbook is well in check, spurred by ongoing debates on alternative fuels, and global oil demand on the increase. The various geopolitical events around the globe continue unabated with freight rates and asset prices on solid ground. The recent incidents in the Red Sea have also added an additional layer of complexity to the geopolitical landscape, causing most vessels, particularly product tankers, enroute to Europe, to divert their trip via the Cape of Good Hope. Such diversions have caused an inevitable increase in ton-mile demand and further reduction in vessel supply, assisting charter rates to remain elevated.

On top of this, the recent announcement from OPEC+ to unwind approximately 2.2 million bpd of voluntary production cuts is expected to provide an added boost to seaborne trade and, ultimately, tanker demand.

In this environment, TEN has embarked on a dynamic growth and renewal program and has acquired/contracted 21 fuel efficient environmentally friendlier vessels to adhere to the increasing transportation needs of its blue-chip clientele.

With a solid balance sheet, $2.0 billion in minimum contracted revenues and a fleet generating healthy cash flows, TEN continues to expand in the sectors it operates. The increasing appetite for longer-term contracts from new and particularly existing clients is being effectively met by the Company’s current vessels in the water and those under construction.

“We are pleased to report another profitable quarter which despite being impacted by various repositioning voyages and three drydockings, allowed TEN to reward its shareholders with a dividend payment 50% higher than the one paid for 2023 operations,” Mr. George Saroglou, President & COO of TEN, commented. “With a fleet continuing to reap the rewards of the solid tanker market and receiving encouraging signs from our clients for attractive long-term business, we remain confident that we will continue to generate healthy cash flows and reward shareholders in order to elevate TEN in the forefront of their investment consideration,” Mr. Saroglou concluded.

TEN’s CURRENT NEWBUILDING PROGRAM

| # | Name | Type | Expected Delivery | Status | Employment |

| 1 | Athens 04 | DP2 Shuttle Tanker | Q2 2025 | Under Construction | Yes |

| 2 | Paris 24 | DP2 Shuttle Tanker | Q2 2025 | Under Construction | Yes |

| 3 | Anfield | DP2 Shuttle Tanker | Q3 2026 | Under Construction | Yes |

| 4 | TBN | Suezmax – Scrubber Fitted | Q2 2025 | Under Construction | Yes |

| 5 | TBN | Suezmax – Scrubber Fitted | Q4 2025 | Under Construction | Under Discussion |

| 6 | TBN | MR – Scrubber Fitted | Q1 2026 | Under Construction | Under Discussion |

| 7 | TBN | MR – Scrubber Fitted | Q1 2026 | Under Construction | Under Discussion |

| 8 | TBN | Panamax LR1 | Q3 2027 | Under Construction | Under Discussion |

| 9 | TBN | Panamax LR1 | Q3 2028 | Under Construction | Under Discussion |

| 10 | TBN | Panamax LR1 | Q1 2028 | Under Construction | Under Discussion |

| 11 | TBN | Panamax LR1 | Q3 2028 | Under Construction | Under Discussion |

| 12 | TBN | Panamax LR1 | Q3 2028 | Under Construction | Under Discussion |

ABOUT TSAKOS ENERGY NAVIGATION

TEN, founded in 1993 and celebrating this year 31-years as a public company, is one of the first and most established public shipping companies in the world. TEN’s diversified energy fleet currently consists of 74 vessels, including three DP2 shuttle tankers, two scrubber-fitted suezmax vessels, two scrubber-fitted MR product tankers and five scrubber-fitted LR1 tankers under construction, consisting of a mix of crude tankers, product tankers and LNG carries, totaling 8.9 million dwt.

ABOUT FORWARD-LOOKING STATEMENTS

Except for the historical information contained herein, the matters discussed in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those predicted by such forward-looking statements. TEN undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Conference Call Details:

As announced previously, today, Wednesday, September 11, 2024 at 10:00 a.m. Eastern Time, TEN will host a conference call to review the results as well as management’s outlook for the business. The call, which will be hosted by TEN’s senior management, may contain information beyond what is included in the earnings press release. Participants should dial into the call 10 minutes before the scheduled time using the following numbers: 877-405-1226 (US Toll-Free Dial In) or +1 201-689-7823 (US and Standard International Dial In). Please quote “Tsakos” to the operator and/or conference ID 13748715. Click here for additional participant International Toll-Free access numbers.

Alternatively, participants can register for the call using the call me option for a faster connection to join the conference call. You can enter your phone number and let the system call you right away. Click here for the call me option.

Simultaneous Slides and Audio Webcast:

There will also be a live, and then archived, webcast of the conference call and accompanying slides, available through the Company’s website. To listen to the archived audio file, visit our website www.tenn.gr and click on Webcasts & Presentations under our Investor Relations page. Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

For further information, please contact:

Company

Tsakos Energy Navigation Ltd.

George Saroglou

President & COO

+30210 94 07 710

gsaroglou@tenn.gr

Investor Relations / Media

Capital Link, Inc.

Nicolas Bornozis

Markella Kara

+212 661 7566

ten@capitallink.com

| TSAKOS ENERGY NAVIGATION LIMITED AND SUBSIDIARIES | |||||||||||

| Selected Consolidated Financial and Other Data | |||||||||||

| (In Thousands of U.S. Dollars, except share, per share and fleet data) | |||||||||||

| Three months ended | Six months ended | ||||||||||

| June 30 (unaudited) | June 30 (unaudited) | ||||||||||

| STATEMENT OF OPERATIONS DATA | 2024 | 2023 | 2024 | 2023 | |||||||

| Voyage revenues | $ | 214,055 | $ | 221,454 | $ | 415,644 | $ | 482,667 | |||

| Voyage expenses | 41,403 | 38,892 | 83,423 | 84,789 | |||||||

| Charter hire expense | 5,095 | 5,731 | 11,108 | 12,522 | |||||||

| Vessel operating expenses | 49,704 | 46,669 | 98,328 | 94,943 | |||||||

| Depreciation and amortization | 39,494 | 35,264 | 77,020 | 70,403 | |||||||

| General and administrative expenses | 7,904 | 12,336 | 15,230 | 19,493 | |||||||

| Gain on sale of vessels | (32,495) | – | (48,662) | (81,198) | |||||||

| Total expenses | 111,105 | 138,892 | 236,447 | 200,952 | |||||||

| Operating income | 102,950 | 82,562 | 179,197 | 281,715 | |||||||

| Interest and finance costs, net | (30,053) | (24,334) | (55,198) | (48,848) | |||||||

| Interest income | 4,687 | 4,125 | 7,935 | 6,888 | |||||||

| Other, net | 4 | (241) | 75 | (180) | |||||||

| Total other expenses, net | (25,362) | (20,450) | (47,188) | (42,140) | |||||||

| Net income | 77,588 | 62,112 | 132,009 | 239,575 | |||||||

| Less: Net income attributable to the noncontrolling interest | (1,202) | (1,471) | (1,587) | (2,379) | |||||||

| Net income attributable to Tsakos Energy Navigation Limited | $ | 76,386 | $ | 60,641 | $ | 130,422 | $ | 237,196 | |||

| Effect of preferred dividends | (6,750) | (8,673) | (13,500) | (17,346) | |||||||

| Deemed dividend on Series D preferred shares | – | (3,256) | – | (3,256) | |||||||

| Net income attributable to common stockholders of Tsakos Energy Navigation Limited | $ | 69,636 | $ | 48,712 | $ | 116,922 | $ | 216,594 | |||

| Earnings per share, basic and diluted | $ | 2.36 | $ | 1.65 | $ | 3.96 | $ | 7.34 | |||

| Weighted average number of common shares, basic and diluted | 29,505,603 | 29,505,603 | 29,505,603 | 29,505,603 | |||||||

| BALANCE SHEET DATA | June 30 | December 31 | |||||||||

| 2024 | 2023 | ||||||||||

| Cash | 476,426 | 376,694 | |||||||||

| Other assets | 240,513 | 236,800 | |||||||||

| Vessels, net | 2,930,160 | 2,600,021 | |||||||||

| Advances for vessels under construction | 124,686 | 150,575 | |||||||||

| Total assets | $ | 3,771,785 | $ | 3,364,090 | |||||||

| Debt and other financial liabilities, net of deferred finance costs | 1,781,379 | 1,562,657 | |||||||||

| Other liabilities | 238,946 | 148,786 | |||||||||

| Stockholders’ equity | 1,751,460 | 1,652,647 | |||||||||

| Total liabilities and stockholders’ equity | $ | 3,771,785 | $ | 3,364,090 | |||||||

| Three months ended | Six months ended | ||||||||||

| OTHER FINANCIAL DATA | June 30 | June 30 | |||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| Net cash provided by operating activities | $ | 84,651 | $ | 143,496 | $ | 160,222 | $ | 258,502 | |||

| Net cash (used in) provided by investing activities | $ | (104,991) | $ | (49,298) | $ | (302,007) | $ | 37,025 | |||

| Net cash provided by (used in) financing activities | $ | 112,772 | $ | (35,786) | $ | 201,517 | $ | (70,872) | |||

| TCE per ship per day | $ | 34,235 | $ | 38,353 | $ | 33,830 | $ | 40,182 | |||

| Operating expenses per ship per day | $ | 9,347 | $ | 9,492 | $ | 9,367 | $ | 9,349 | |||

| Vessel overhead costs per ship per day | $ | 1,392 | $ | 2,337 | $ | 1,358 | $ | 1,793 | |||

| 10,739 | 11,829 | 10,725 | 11,142 | ||||||||

| FLEET DATA | |||||||||||

| Average number of vessels during period | 62.4 | 58.0 | 61.6 | 60.1 | |||||||

| Number of vessels at end of period | 62.0 | 58.0 | 62.0 | 58.0 | |||||||

| Average age of fleet at end of period | Years | 9.7 | 10.5 | 9.7 | 10.5 | ||||||

| Dwt at end of period (in thousands) | 7,612 | 7,178 | 7,612 | 7,178 | |||||||

| Time charter employment – fixed rate | Days | 2,855 | 2,308 | 5,485 | 4,585 | ||||||

| Time charter and pool employment – variable rate | Days | 1,361 | 1,554 | 2,753 | 3,355 | ||||||

| Period employment coa at market rates | Days | 0 | 86 | 0 | 147 | ||||||

| Spot voyage employment at market rates | Days | 1,033 | 1,024 | 2,068 | 2,276 | ||||||

| Total operating days | 5,249 | 4,972 | 10,306 | 10,363 | |||||||

| Total available days | 5,678 | 5,278 | 11,217 | 10,872 | |||||||

| Utilization | 92.4% | 94.2% | 91.9% | 95.3% | |||||||

Non-GAAP Measures |

|||||||||||

| Reconciliation of Net income to Adjusted EBITDA | |||||||||||

| Three months ended | Six months ended | ||||||||||

| June 30 | June 30 | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| Net income attributable to Tsakos Energy Navigation Limited | $ | 76,386 | $ | 60,641 | $ | 130,422 | $ | 237,196 | |||

| Depreciation and amortization | 39,494 | 35,264 | 77,020 | 70,403 | |||||||

| Interest Expense | 30,053 | 24,334 | 55,198 | 48,848 | |||||||

| Gain on sale of vessels | (32,495) | – | (48,662) | (81,198) | |||||||

| Adjusted EBITDA | $ | 113,438 | $ | 120,239 | $ | 213,978 | $ | 275,249 | |||

| The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, management believes that certain non-GAAP measures used within the financial community may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods as well as comparisons between the performance of Shipping Companies. Management also uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating the Company’s performance. We are using the following Non-GAAP measures: | |||||||||||

| (i) TCE which represents voyage revenue less voyage expenses is divided by the number of operating days less 99 days lost for the second quarter and 270 days for the first half of 2024 and 117 days for the prior year quarter of 2023 and 281 days for first half of 2023, respectively, as a result of calculating revenue on a loading to discharge basis. | |||||||||||

| (ii) Vessel overhead costs are General & Administrative expenses, which also include Management fees, Stock compensation expense and Management incentive award. | |||||||||||

| (iii) Operating expenses per ship per day which exclude Management fees, General & Administrative expenses, Stock compensation expense and Management incentive award. | |||||||||||

| (iv) Adjusted EBITDA. See above for reconciliation to net income. | |||||||||||

| (v) Cash includes Restricted cash and Time deposits under and over 90 days. |

|||||||||||

| Non-GAAP financial measures should be viewed in addition to and not as an alternative for, the Company’s reported results prepared in accordance with GAAP. | |||||||||||

| The Company does not incur corporation tax. | |||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chief Financial Officer Of Integral Ad Science Makes $87K Sale

Disclosed on September 10, TANIA SECOR, Chief Financial Officer at Integral Ad Science IAS, executed a substantial insider sell as per the latest SEC filing.

What Happened: SECOR opted to sell 7,889 shares of Integral Ad Science, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The transaction’s total worth stands at $87,410.

In the Wednesday’s morning session, Integral Ad Science‘s shares are currently trading at $10.76, experiencing a down of 0.55%.

About Integral Ad Science

Integral Ad Science Holding Corp is a digital advertising verification company. The cloud-based technology platform of the company delivers independent measurement and verification of digital advertising across all devices, channels, and formats, including desktop, mobile, connected TV, social, display, and video. Geographically, the company derives a majority of its revenue from the Americas region.

Key Indicators: Integral Ad Science’s Financial Health

Revenue Growth: Integral Ad Science’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 13.51%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Communication Services sector.

Holistic Profitability Examination:

-

Gross Margin: The company maintains a high gross margin of 79.0%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Integral Ad Science’s EPS reflects a decline, falling below the industry average with a current EPS of 0.05.

Debt Management: Integral Ad Science’s debt-to-equity ratio is below the industry average. With a ratio of 0.13, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 1082.0 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The P/S ratio of 3.55 is lower than the industry average, implying a discounted valuation for Integral Ad Science’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 18.01, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Cracking Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Integral Ad Science’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Designer Brands Inc. Reports Second Quarter 2024 Financial Results

Reported third consecutive quarter of sequential comparable sales improvement

Impressive performance in growing athleisure category, which outpaced the market by over 4 percentage points

COLUMBUS, Ohio, Sept. 11, 2024 /PRNewswire/ — Designer Brands Inc. DBI (the “Company,” “we,” “us,” “our,” and “Designer Brands”), one of the world’s largest designers, producers, and retailers of footwear and accessories, today announced financial results for the second quarter ended August 3, 2024.

“This quarter, we further built on our track record of steady improvement as we continued to refine and refresh our strategic initiatives intended to accelerate our ongoing business transformation,” stated Doug Howe, Chief Executive Officer. “We saw sustained pressure on challenged categories such as dress and seasonal in the second quarter, which we were able to partially mitigate through providing a greater selection of athletic and athleisure brands in our assortment. During the second quarter, we drove athleisure category sales growth of 8% in the U.S. Retail segment over the same period last year, outpacing overall athleisure market growth by over 4 percentage points, and total U.S. Retail sales outpaced the footwear market by 1 percentage point according to Circana. Our strategy successfully supported a solid start to the back-to-school season, particularly in our kids’ category, which helped us to exit the second quarter in a stronger position than we started.”

Howe continued, “We continue to believe that our investments across our retail and brand businesses will help us to accelerate growth moving forward as we sharpen our focus and optimize our assortment, our marketing, and our omnichannel customer experience. With shoppers becoming increasingly mindful of their discretionary spending, and trends rapidly evolving, we want to ensure that we remain top of mind as the destination for all their footwear needs.”

Second Quarter Operating Results (Unless otherwise stated, all comparisons are to the second quarter of 2023)

- Net sales decreased 2.6% to $771.9 million.

- Total comparable sales decreased by 1.4%.

- Gross profit decreased to $252.9 million versus $273.4 million last year, and gross margin was 32.8% compared to 34.5% last year.

- Reported net income attributable to Designer Brands Inc. was $13.8 million, or diluted earnings per share (“EPS”) of $0.24, including net after-tax charges of $0.05 per diluted share from adjusted items, primarily related to restructuring, integration, and acquisition costs.

- Adjusted net income was $17.1 million, or adjusted diluted EPS of $0.29.

Liquidity

- Cash and cash equivalents totaled $38.8 million at the end of the second quarter of 2024, compared to $46.2 million at the end of the same period last year, with $155.1 million available for borrowings under our senior secured asset-based revolving credit facility. Debt totaled $465.7 million at the end of the second quarter of 2024 compared to $331.0 million at the end of the same period last year.

- The Company ended the second quarter with inventories of $642.8 million compared to $606.8 million at the end of the same period last year.

Return to Shareholders

- During the second quarter of 2024, the Company repurchased 2.7 million Class A common shares at an aggregate cost of $18.0 million. As of August 3, 2024, $69.7 million of Class A common shares remained available for repurchase under the Board-approved share repurchase program.

Store Openings and Closings

During the second quarter of 2024, the Company closed one store in the United States (“U.S.”) and opened two stores in Canada, resulting in a total of 499 stores in the U.S. and 177 stores in Canada as of August 3, 2024.

Updated 2024 Financial Outlook

The Company has updated the following guidance for the full year 2024:

|

Metric |

Previous Guidance |

Current Guidance |

||

|

Designer Brands Net Sales Growth |

Low-single digits |

Flat to low-single digits |

||

|

Adjusted Diluted EPS |

$0.70 – $0.80 |

$0.50 – $0.60 |

Forward-looking adjusted diluted EPS for 2024 excludes potential charges or gains that may be recorded during the fiscal year, including among other things: (1) restructuring and integration costs, including severance charges; (2) acquisition-related costs; (3) impairment charges; (4) foreign currency transaction losses (gains); (5) the net tax impact of such items; (6) the change in the valuation allowance on deferred tax assets; and (7) net income attributable to redeemable noncontrolling interest. A reconciliation of forward-looking non-GAAP earnings guidance to the comparable GAAP measure is not provided, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K, because the impact and timing of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the Company believes that such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items are uncertain and could have a substantial impact on GAAP measures of our financial performance.

Webcast and Conference Call

The Company is hosting a conference call today at 8:30 am Eastern Time. Investors and analysts interested in participating in the call are invited to dial 1-888-317-6003, or the international dial-in, 1-412-317-6061, and reference conference ID number 9337169 approximately ten minutes prior to the start of the conference call. The conference call will also be broadcast live over the internet and can be accessed through the following link, as well as through the Company’s investor website at investors.designerbrands.com:

https://app.webinar.net/wjDQNwDnZxP

For those unable to listen to the live webcast, an archived version will be available on the Company’s investor website until September 18, 2024. A replay of the teleconference will be available by dialing the following numbers:

U.S.: 1-877-344-7529

Canada: 1-855-669-9658

International: 1-412-317-0088

Passcode: 4546270

Important information may be disseminated initially or exclusively via the Company’s investor website; investors should consult the website to access this information.

About Designer Brands

Designer Brands is one of the world’s largest designers, producers, and retailers of the most recognizable footwear brands and accessories, transforming and defining the footwear industry through a mission of inspiring self-expression. With a diversified, world-class portfolio of coveted brands, including Crown Vintage, Hush Puppies, Jessica Simpson, Keds, Kelly & Katie, Lucky Brand, Mix No. 6, Topo Athletic, Vince Camuto and others, Designer Brands designs and produces on-trend footwear and accessories for all of life’s occasions, delivered to the consumer through a robust direct-to-consumer omni-channel infrastructure and powerful national wholesale distribution. Powered by a billion-dollar digital commerce business across multiple domains and 676 DSW Designer Shoe Warehouse, The Shoe Co., and Rubino stores in North America, Designer Brands delivers current, in-line footwear and accessories from the largest national brands in the industry and holds leading market share positions in key product categories across Women’s, Men’s, and Kids’. Designer Brands also distributes its brands internationally through select wholesale and distributor relationships, while also leveraging design and sourcing expertise to build private label product for national retailers. Designer Brands is committed to being a difference maker in the world, taking steps forward to advance diversity, equity, and inclusion in the footwear industry and supporting a global community and the health of the planet by donating more than ten million pairs of shoes to the global non-profit Soles4Souls since 2018. To learn more, visit www.designerbrands.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Certain statements in this press release may constitute forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “could,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “would,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of those words or other comparable words. These statements are based on the Company’s current views and expectations and involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. These factors include, but are not limited to: uncertain general economic and financial conditions, including concerns of a potential recession in the U.S., fluctuating interest rates, inflationary pressures, and the related impacts to consumer discretionary spending, as well as our ability to plan for and respond to the impact of these conditions; our ability to anticipate and respond to rapidly changing consumer preferences, seasonality, customer expectations, and fashion trends; the impact on our consumer traffic and demand, our business operations, and the operations of our suppliers, as we experience unseasonable weather, climate change evolves, and the frequency and severity of weather events increase; our ability to execute on our business strategies, including integrating and growing our Brand Portfolio segment, enhancing in-store and digital shopping experiences, and meeting consumer demands; whether we will be able to successfully and efficiently integrate our recent acquisitions in a manner that does not impede growth; our ability to maintain strong relationships with our vendors, manufacturers, licensors, and retailer customers; risks related to losses or disruptions associated with our distribution systems, including our distribution centers and stores, whether as a result of reliance on third-party providers or otherwise; risks related to cyber security threats and privacy or data security breaches or the potential loss or disruption of our information technology (“IT”) systems, or those of our vendors; risks related to the implementation of new or updated IT systems; our ability to protect our reputation and to maintain the brands we license; our reliance on our loyalty programs and marketing to drive traffic, sales, and customer loyalty; our ability to successfully integrate new hires or changes in leadership and retain our existing management team, and to continue to attract qualified new personnel; risks related to restrictions imposed by our senior secured asset-based revolving credit facility, as amended (“ABL Revolver”), and our senior secured term loan credit agreement, as amended (“Term Loan”), that could limit our ability to fund our operations; our competitiveness with respect to style, price, brand availability, shopping platforms, and customer service; risks related to our international operations and our reliance on foreign sources for merchandise; our ability to comply with privacy laws and regulations, as well as other legal obligations; risks associated with climate change and other corporate responsibility issues; and uncertainties related to future legislation, regulatory reform, policy changes, or interpretive guidance on existing legislation. Risks and other factors that could cause our actual results to differ materially from our forward-looking statements are described in the Company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024 (“2023 Form 10-K”) or our other reports made or filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the time when made. Except as may be required by applicable law, the Company undertakes no obligation to update or revise the forward-looking statements included in this press release to reflect any future events or circumstances.

|

DESIGNER BRANDS INC. SEGMENT RESULTS (unaudited)

|

|||||||||||

|

Net Sales |

|||||||||||

|

Three months ended |

|||||||||||

|

(dollars in thousands) |

August 3, 2024 |

July 29, 2023 |

Change |

||||||||

|

Amount |

% of Segment |

Amount |

% of Segment |

Amount |

% |

||||||

|

Segment net sales: |

|||||||||||

|

U.S. Retail |

$ 641,694 |

79.0 % |

$ 658,542 |

81.0 % |

$ (16,848) |

(2.6) % |

|||||

|

Canada Retail |

74,797 |

9.2 % |

70,266 |

8.6 % |

4,531 |

6.4 % |

|||||

|

Brand Portfolio |

95,993 |

11.8 % |

84,217 |

10.4 % |

11,776 |

14.0 % |

|||||

|

Total segment net sales |

812,484 |

100.0 % |

813,025 |

100.0 % |

(541) |

(0.1) % |

|||||

|

Elimination of intersegment net sales |

(40,584) |

(20,808) |

(19,776) |

95.0 % |

|||||||

|

Consolidated net sales |

$ 771,900 |

$ 792,217 |

$ (20,317) |

(2.6) % |

|||||||

|

Six months ended |

|||||||||||

|

(dollars in thousands) |

August 3, 2024 |

July 29, 2023 |

Change |

||||||||

|

Amount |

% of Segment |

Amount |

% of Segment |

Amount |

% |

||||||

|

Segment net sales: |

|||||||||||

|

U.S. Retail |

$ 1,263,061 |

79.3 % |

$ 1,271,428 |

80.8 % |

$ (8,367) |

(0.7) % |

|||||

|

Canada Retail |

130,309 |

8.2 % |

124,221 |

7.9 % |

6,088 |

4.9 % |

|||||

|

Brand Portfolio |

200,123 |

12.5 % |

177,200 |

11.3 % |

22,923 |

12.9 % |

|||||

|

Total segment net sales |

1,593,493 |

100.0 % |

1,572,849 |

100.0 % |

20,644 |

1.3 % |

|||||

|

Elimination of intersegment net sales |

(74,997) |

(38,550) |

(36,447) |

94.5 % |

|||||||

|

Consolidated net sales |

$ 1,518,496 |

$ 1,534,299 |

$ (15,803) |

(1.0) % |

|||||||

|

Net Sales by Brand Categories |

|||||||||

|

(in thousands) |

U.S. Retail |

Canada Retail(2) |

Brand Portfolio |

Eliminations |

Consolidated |

||||

|

Three months ended August 3, 2024 |

|||||||||

|

Owned Brands:(1) |

|||||||||

|

Direct-to-consumer |

$ 98,040 |

$ 10,550 |

$ 13,889 |

$ — |

$ 122,479 |

||||

|

External customer wholesale, commission income, and other |

— |

— |

41,520 |

— |

41,520 |

||||

|

Intersegment wholesale |

— |

— |

40,584 |

(40,584) |

— |

||||

|

Total Owned Brands |

98,040 |

10,550 |

95,993 |

(40,584) |

163,999 |

||||

|

National brands |

543,654 |

64,247 |

— |

— |

607,901 |

||||

|

Total net sales |

$ 641,694 |

$ 74,797 |

$ 95,993 |

$ (40,584) |

$ 771,900 |

||||

|

Three months ended July 29, 2023 |

|||||||||

|

Owned Brands:(1) |

|||||||||

|

Direct-to-consumer |

$ 115,749 |

$ 10,048 |

$ 15,776 |

$ — |

$ 141,573 |

||||

|

External customer wholesale, commission income, and other |

— |

— |

47,633 |

— |

47,633 |

||||

|

Intersegment wholesale and commission income |

— |

— |

20,808 |

(20,808) |

— |

||||

|

Total Owned Brands |

115,749 |

10,048 |

84,217 |

(20,808) |

189,206 |

||||

|

National brands |

542,793 |

60,218 |

— |

— |

603,011 |

||||

|

Total net sales |

$ 658,542 |

$ 70,266 |

$ 84,217 |

$ (20,808) |

$ 792,217 |

||||

|

Six months ended August 3, 2024 |

|||||||||

|

Owned Brands:(1) |

|||||||||

|

Direct-to-consumer |

$ 203,054 |

$ 18,910 |

$ 27,819 |

$ — |

$ 249,783 |

||||

|

External customer wholesale, commission income, and other |

— |

— |

97,307 |

— |

97,307 |

||||

|

Intersegment wholesale |

— |

— |

74,997 |

(74,997) |

— |

||||

|

Total Owned Brands |

203,054 |

18,910 |

200,123 |

(74,997) |

347,090 |

||||

|

National brands |

1,060,007 |

111,399 |

— |

— |

1,171,406 |

||||

|

Total net sales |

$ 1,263,061 |

$ 130,309 |

$ 200,123 |

$ (74,997) |

$ 1,518,496 |

||||

|

Six months ended July 29, 2023 |

|||||||||

|

Owned Brands:(1) |

|||||||||

|

Direct-to-consumer |

$ 238,958 |

$ 17,920 |

$ 26,400 |

$ — |

$ 283,278 |

||||

|

External customer wholesale, commission income, and other |

— |

— |

112,250 |

— |

112,250 |

||||

|

Intersegment wholesale and commission income |

— |

— |

38,550 |

(38,550) |

— |

||||

|

Total Owned Brands |

238,958 |

17,920 |

177,200 |

(38,550) |

395,528 |

||||

|

National brands |

1,032,470 |

106,301 |

— |

— |

1,138,771 |

||||

|

Total net sales |

$ 1,271,428 |

$ 124,221 |

$ 177,200 |

$ (38,550) |

$ 1,534,299 |

||||

|

(1) |

“Owned Brands” refers to those brands that we have rights to sell through ownership or license arrangements. |

|

(2) |

Beginning with the 2023 Form 10-K, we are providing a breakout of Canada Retail segment net sales by brand categories and we have recast the three months and the six months ended July 29, 2023 on a consistent basis. |

|

Comparable Sales |

|||||||

|

Three months ended |

Six months ended |

||||||

|

August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||

|

Change in comparable sales: |

|||||||

|

U.S. Retail segment |

(1.1) % |

(9.2) % |

(1.7) % |

(10.4) % |

|||

|

Canada Retail segment |

(3.1) % |

(7.3) % |

(3.9) % |

(3.0) % |

|||

|

Brand Portfolio segment – direct-to-consumer channel |

(7.0) % |

0.5 % |

(4.8) % |

5.3 % |

|||

|

Total |

(1.4) % |

(8.9) % |

(1.9) % |

(9.6) % |

|||

|

Store Count |

|||||||

|

(square footage in thousands) |

August 3, 2024 |

July 29, 2023 |

|||||

|

Number of |

Square |

Number of |

Square |

||||

|

U.S. Retail segment – DSW stores |

499 |

9,879 |

498 |

9,978 |

|||

|

Canada Retail segment: |

|||||||

|

The Shoe Co. stores |

123 |

631 |

113 |

594 |

|||

|

DSW stores |

26 |

511 |

25 |

496 |

|||

|

Rubino Stores |

28 |

149 |

— |

— |

|||

|

177 |

1,291 |

138 |

1,090 |

||||

|

Total number of stores |

676 |

11,170 |

636 |

11,068 |

|||

|

Gross Profit |

|||||||||||||

|

Three months ended |

|||||||||||||

|

(dollars in thousands) |

August 3, 2024 |

July 29, 2023 |

Change |

||||||||||

|

Amount |

% of Segment |

Amount |

% of Segment |

Amount |

% |

Basis Points |

|||||||

|

Segment gross profit: |

|||||||||||||

|

U.S. Retail |

$ 206,061 |

32.1 % |

$ 225,768 |

34.3 % |

$ (19,707) |

(8.7) % |

(220) |

||||||

|

Canada Retail |

25,307 |

33.8 % |

23,811 |

33.9 % |

1,496 |

6.3 % |

(10) |

||||||

|

Brand Portfolio |

26,635 |

27.7 % |

24,298 |

28.9 % |

2,337 |

9.6 % |

(120) |

||||||

|

Total segment gross profit |

258,003 |

31.8 % |

273,877 |

33.7 % |

(15,874) |

(5.8) % |

(190) |

||||||

|

Net elimination of intersegment gross profit |

(5,089) |

(490) |

(4,599) |

||||||||||

|

Consolidated gross profit |

$ 252,914 |

32.8 % |

$ 273,387 |

34.5 % |

$ (20,473) |

(7.5) % |

(170) |

||||||

|

Six months ended |

|||||||||||||

|

(dollars in thousands) |

August 3, 2024 |

July 29, 2023 |

Change |

||||||||||

|

Amount |

% of Segment |

Amount |

% of Segment |

Amount |

% |

Basis Points |

|||||||

|

Segment gross profit: |

|||||||||||||

|

U.S. Retail |

$ 404,516 |

32.0 % |

$ 422,582 |

33.2 % |

$ (18,066) |

(4.3) % |

(120) |

||||||

|

Canada Retail |

42,692 |

32.8 % |

40,985 |

33.0 % |

1,707 |

4.2 % |

(20) |

||||||

|

Brand Portfolio |

60,112 |

30.0 % |

46,383 |

26.2 % |

13,729 |

29.6 % |

380 |

||||||

|

Total segment gross profit |

507,320 |

31.8 % |

509,950 |

32.4 % |

(2,630) |

(0.5) % |

(60) |

||||||

|

Net recognition (elimination) of intersegment gross profit |

(9,337) |

1,176 |

(10,513) |

||||||||||

|

Consolidated gross profit |

$ 497,983 |

32.8 % |

$ 511,126 |

33.3 % |

$ (13,143) |

(2.6) % |

(50) |

||||||

|

Intersegment Eliminations |

|||

|

Three months ended |

|||

|

(in thousands) |

August 3, 2024 |

July 29, 2023 |

|

|

Intersegment recognition and elimination activity: |

|||

|

Elimination of net sales recognized by Brand Portfolio segment |

$ (40,584) |

$ (20,808) |

|

|

Cost of sales: |

|||

|

Elimination of cost of sales recognized by Brand Portfolio segment |

28,174 |

15,066 |

|

|

Recognition of intersegment gross profit for inventory previously purchased that |

7,321 |

5,252 |

|

|

$ (5,089) |

$ (490) |

||

|

Six months ended |

|||

|

(in thousands) |

August 3, 2024 |

July 29, 2023 |

|

|

Intersegment recognition and elimination activity: |

|||

|

Elimination of net sales recognized by Brand Portfolio segment |

$ (74,997) |

$ (38,550) |

|

|

Cost of sales: |

|||

|

Elimination of cost of sales recognized by Brand Portfolio segment |

52,267 |

28,277 |

|

|

Recognition of intersegment gross profit for inventory previously purchased that |

13,393 |

11,449 |

|

|

$ (9,337) |

$ 1,176 |

||

|

DESIGNER BRANDS INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited and in thousands, except per share amounts) |

|||||||

|

Three months ended |

Six months ended |

||||||

|

August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||

|

Net sales |

$ 771,900 |

$ 792,217 |

$ 1,518,496 |

$ 1,534,299 |

|||

|

Cost of sales |

(518,986) |

(518,830) |

(1,020,513) |

(1,023,173) |

|||

|

Gross profit |

252,914 |

273,387 |

497,983 |

511,126 |

|||

|

Operating expenses |

(226,896) |

(214,530) |

(465,447) |

(434,649) |

|||

|

Income from equity investments |

2,571 |

2,138 |

5,435 |

4,469 |

|||

|

Impairment charges |

— |

(308) |

— |

(649) |

|||

|

Operating profit |

28,589 |

60,687 |

37,971 |

80,297 |

|||

|

Interest expense, net |

(11,035) |

(6,932) |

(22,596) |

(13,529) |

|||

|

Non-operating income (expenses), net |

(109) |

579 |

(252) |

245 |

|||

|

Income before income taxes |

17,445 |

54,334 |

15,123 |

67,013 |

|||

|

Income tax provision |

(3,363) |

(17,079) |

(156) |

(18,385) |

|||

|

Net income |

14,082 |

37,255 |

14,967 |

48,628 |

|||

|

Net income attributable to redeemable noncontrolling interest |

(258) |

(51) |

(360) |

(9) |

|||

|

Net income attributable to Designer Brands Inc. |

$ 13,824 |

$ 37,204 |

$ 14,607 |

$ 48,619 |

|||

|

Diluted earnings per share attributable to Designer Brands Inc. |

$ 0.24 |

$ 0.56 |

$ 0.25 |

$ 0.73 |

|||

|

Weighted average diluted shares |

58,576 |

66,997 |

58,978 |

66,863 |

|||

|

DESIGNER BRANDS INC. CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited and in thousands) |

|||||

|

August 3, 2024 |

February 3, 2024 |

July 29, 2023 |

|||

|

ASSETS |

|||||

|

Current assets: |

|||||

|

Cash and cash equivalents |

$ 38,834 |

$ 49,173 |

$ 46,187 |

||

|

Receivables, net |

49,671 |

83,590 |

97,364 |

||

|

Inventories |

642,783 |

571,331 |

606,841 |

||

|

Prepaid expenses and other current assets |

66,760 |

73,338 |

50,308 |

||

|

Total current assets |

798,048 |

777,432 |

800,700 |

||

|

Property and equipment, net |

216,313 |

219,939 |

226,634 |

||

|

Operating lease assets |

723,818 |

721,335 |

751,637 |

||

|

Goodwill |

130,611 |

123,759 |

135,259 |

||

|

Intangible assets, net |

86,334 |

82,827 |

72,640 |

||

|

Deferred tax assets |

39,997 |

39,067 |

48,100 |

||

|

Equity investments |

61,020 |

62,857 |

62,938 |

||

|

Other assets |

50,993 |

49,016 |

49,430 |

||

|

Total assets |

$ 2,107,134 |

$ 2,076,232 |

$ 2,147,338 |

||

|

LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND SHAREHOLDERS’ EQUITY |

|||||

|

Current liabilities: |

|||||

|

Accounts payable |

$ 294,739 |

$ 289,368 |

$ 294,724 |

||

|

Accrued expenses |

161,155 |

159,622 |

172,130 |

||

|

Current maturities of long-term debt |

6,750 |

6,750 |

2,500 |

||

|

Current operating lease liabilities |

156,394 |

166,531 |

181,484 |

||

|

Total current liabilities |

619,038 |

622,271 |

650,838 |

||

|

Long-term debt |

458,974 |

420,344 |

328,506 |

||

|

Non-current operating lease liabilities |

653,416 |

646,161 |

682,248 |

||

|

Other non-current liabilities |

16,642 |

24,948 |

22,784 |

||

|

Total liabilities |

1,748,070 |

1,713,724 |

1,684,376 |

||

|

Redeemable noncontrolling interest |

3,519 |

3,288 |

3,144 |

||

|

Total shareholders’ equity |

355,545 |

359,220 |

459,818 |

||

|

Total liabilities, redeemable noncontrolling interest, and shareholders’ equity |

$ 2,107,134 |

$ 2,076,232 |

$ 2,147,338 |

||

|

DESIGNER BRANDS INC. NON-GAAP RECONCILIATION (unaudited and in thousands, except per share amounts) |

|||||||

|

Three months ended |

Six months ended |

||||||

|

August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||

|

Operating expenses |

$ (226,896) |

$ (214,530) |

$ (465,447) |

$ (434,649) |

|||

|

Non-GAAP adjustments: |

|||||||

|

CEO transition costs |

— |

744 |

— |

2,954 |

|||

|

Restructuring and integration costs |

2,349 |

818 |

7,178 |

2,938 |

|||

|

Acquisition-related costs |

1,586 |

90 |

2,072 |

1,597 |

|||

|

Total non-GAAP adjustments |

3,935 |

1,652 |

9,250 |

7,489 |

|||

|

Adjusted operating expenses |

$ (222,961) |

$ (212,878) |

$ (456,197) |

$ (427,160) |

|||

|

Operating profit |

$ 28,589 |

$ 60,687 |

$ 37,971 |

$ 80,297 |

|||

|

Non-GAAP adjustments: |

|||||||

|

CEO transition costs |

— |

744 |

— |

2,954 |

|||

|

Restructuring and integration costs |

2,349 |

818 |

7,178 |

2,938 |

|||

|

Acquisition-related costs |

1,586 |

90 |

2,072 |

1,597 |

|||

|

Impairment charges |

— |

308 |

— |

649 |

|||

|

Total non-GAAP adjustments |

3,935 |

1,960 |

9,250 |

8,138 |

|||

|

Adjusted operating profit |

$ 32,524 |

$ 62,647 |

$ 47,221 |

$ 88,435 |

|||

|

Net income attributable to Designer Brands Inc. |

$ 13,824 |

$ 37,204 |

$ 14,607 |

$ 48,619 |

|||

|

Non-GAAP adjustments: |

|||||||

|

CEO transition costs |

— |

744 |

— |

2,954 |

|||

|

Restructuring and integration costs |

2,349 |

818 |

7,178 |

2,938 |

|||

|

Acquisition-related costs |

1,586 |

90 |

2,072 |

1,597 |

|||

|

Impairment charges |

— |

308 |

— |

649 |

|||

|

Foreign currency transaction losses (gains) |

109 |

(579) |

252 |

(245) |

|||

|

Total non-GAAP adjustments before tax effect |

4,044 |

1,381 |

9,502 |

7,893 |

|||

|

Tax effect on above non-GAAP adjustments |

(1,149) |

(377) |

(2,547) |

(2,032) |

|||

|

Discrete and permanent tax on non-deductible CEO transition costs |

— |

1,750 |

— |

1,897 |

|||

|

Valuation allowance change on deferred tax assets |

94 |

(607) |

(42) |

(2,724) |

|||

|

Total non-GAAP adjustments, after tax |

2,989 |

2,147 |

6,913 |

5,034 |

|||

|

Net income attributable to redeemable noncontrolling interest |

258 |

51 |

360 |

9 |

|||

|

Adjusted net income |

$ 17,071 |

$ 39,402 |

$ 21,880 |

$ 53,662 |

|||

|

Diluted earnings per share |

$ 0.24 |

$ 0.56 |

$ 0.25 |

$ 0.73 |

|||

|

Adjusted diluted earnings per share |

$ 0.29 |

$ 0.59 |

$ 0.37 |

$ 0.80 |

|||

Non-GAAP Measures

To supplement amounts presented in our consolidated financial statements determined in accordance with accounting principles generally accepted in the U.S. (“GAAP”), the Company uses certain non-GAAP financial measures, including adjusted operating expenses, adjusted operating profit, adjusted net income, and adjusted diluted earnings per share as shown in the table above. These measures adjust for the effects of: (1) CEO transition costs; (2) restructuring and integration costs, including severance charges; (3) acquisition-related costs; (4) impairment charges; (5) foreign currency transaction losses (gains); (6) the net tax impact of such items, including discrete and permanent tax on non-deductible CEO transition costs; (7) the change in the valuation allowance on deferred tax assets; and (8) net income attributable to redeemable noncontrolling interest. The unaudited adjusted results should not be construed as an alternative to the reported results determined in accordance with GAAP. These financial measures are not based on any standardized methodology and are not necessarily comparable to similar measures presented by other companies. The Company believes that these non-GAAP financial measures provide useful information to both management and investors to increase comparability to prior periods by adjusting for certain items that may not be indicative of core operating measures and to better identify trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company compared to prior periods, when reviewed in conjunction with the Company’s GAAP statements. These amounts are not determined in accordance with GAAP and therefore should not be used exclusively in evaluating the Company’s business and operations.

Comparable Sales Performance Metric

We consider the percent change in comparable sales from the same previous year period, a primary metric commonly used throughout the retail industry, to be an important measurement for management and investors of the performance of our direct-to-consumer businesses. We include in our comparable sales metric sales from stores in operation for at least 14 months at the beginning of the applicable year. Stores are added to the comparable base at the beginning of the year and are dropped for comparative purposes in the quarter in which they are closed. Comparable sales include the e-commerce sales of the U.S. Retail and Canada Retail segments. For calculating comparable sales in 2024, periods in 2023 are shifted by one week to compare similar calendar weeks. Comparable sales for the Canada Retail segment exclude the impact of foreign currency translation and are calculated by translating current period results at the foreign currency exchange rate used in the comparable period of the prior year. Comparable sales include the e-commerce net sales of the Brand Portfolio segment from the direct-to-consumer e-commerce sites for Vince Camuto, Keds, and Topo. Net sales from the direct-to-consumer e-commerce sites for Hush Puppies will be added to the comparable base for the Brand Portfolio segment beginning with the third quarter of 2024. Stores added as a result of the Rubino acquisition that will have been in operation for at least 14 months at the beginning of 2025, along with its e-commerce sales, will be added to the comparable base for the Canada Retail segment beginning with the second quarter of 2025. The calculation of comparable sales varies across the retail industry and, as a result, the calculations of other retail companies may not be consistent with our calculation.

CONTACT: Stacy Turnof, DesignerBrandsIR@edelman.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/designer-brands-inc-reports-second-quarter-2024-financial-results-302244341.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/designer-brands-inc-reports-second-quarter-2024-financial-results-302244341.html

SOURCE Designer Brands Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Is Betting Big In Micron Technology Options

Investors with a lot of money to spend have taken a bullish stance on Micron Technology MU.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MU, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 13 options trades for Micron Technology.

This isn’t normal.

The overall sentiment of these big-money traders is split between 53% bullish and 38%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $38,400, and 12, calls, for a total amount of $667,904.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $150.0 for Micron Technology over the last 3 months.

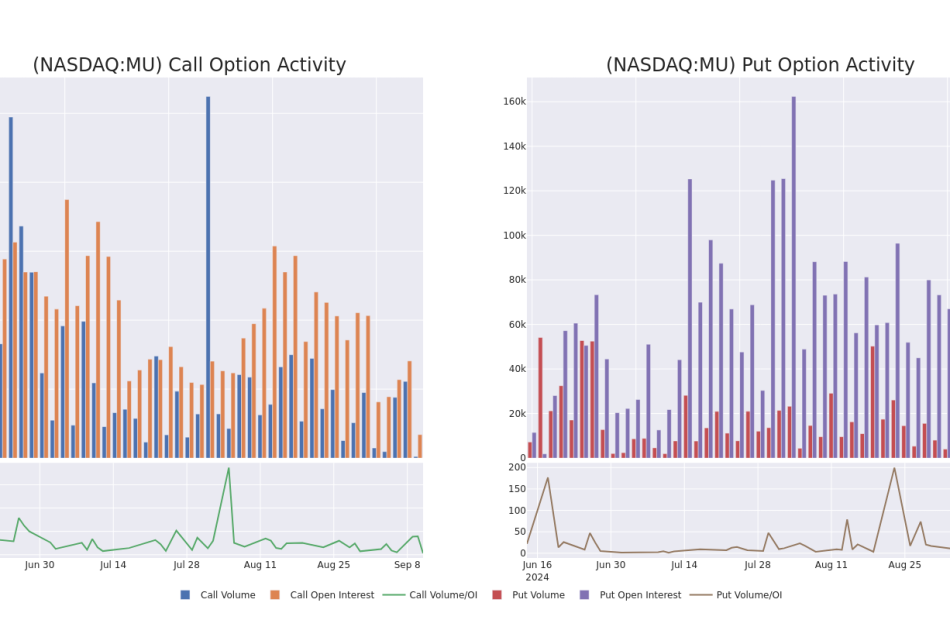

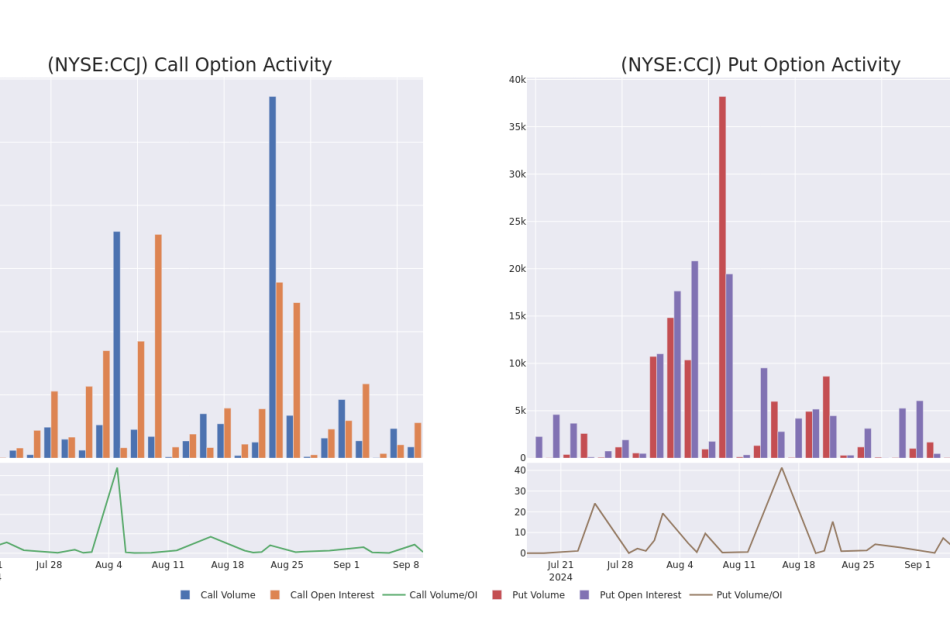

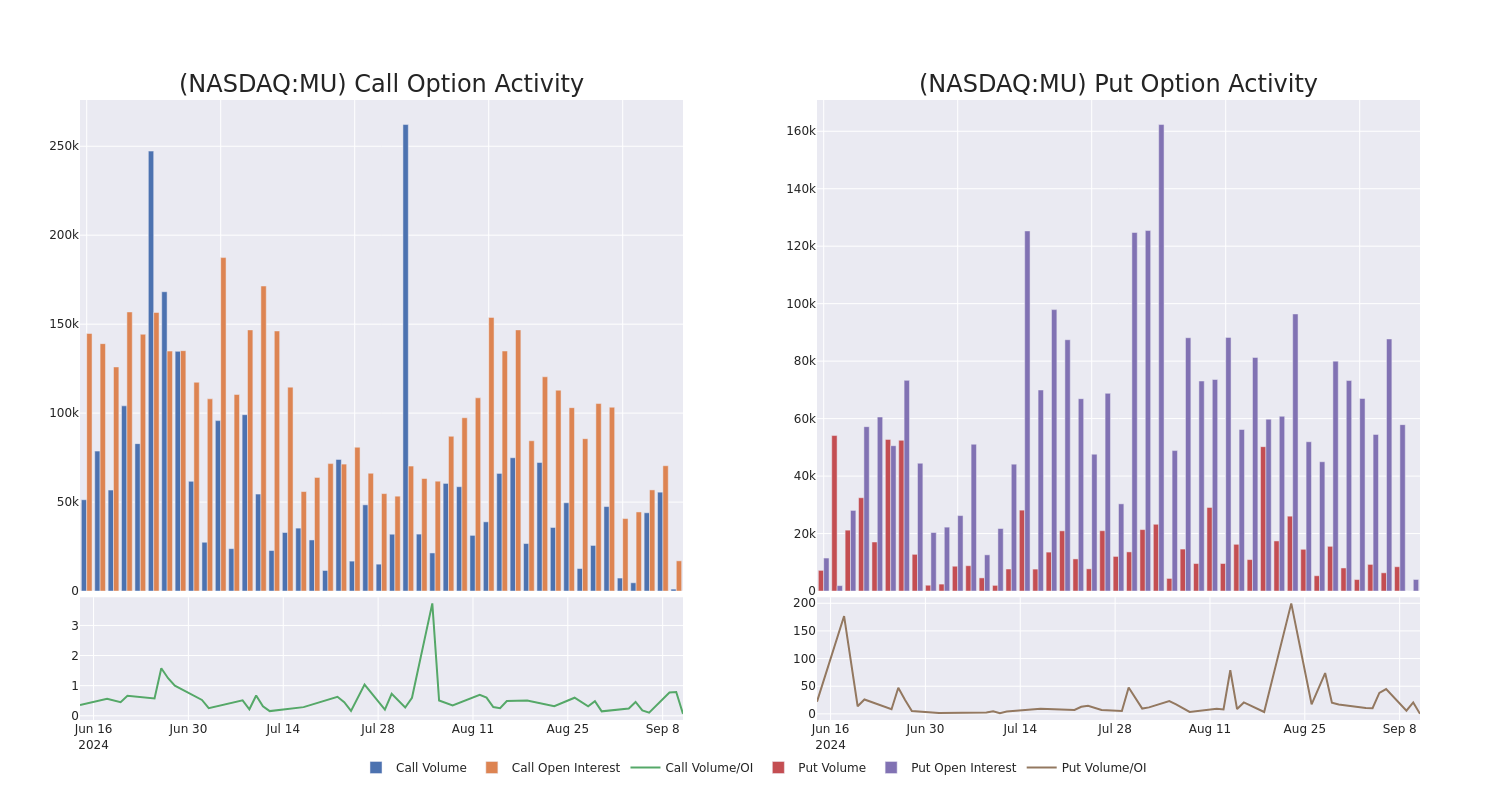

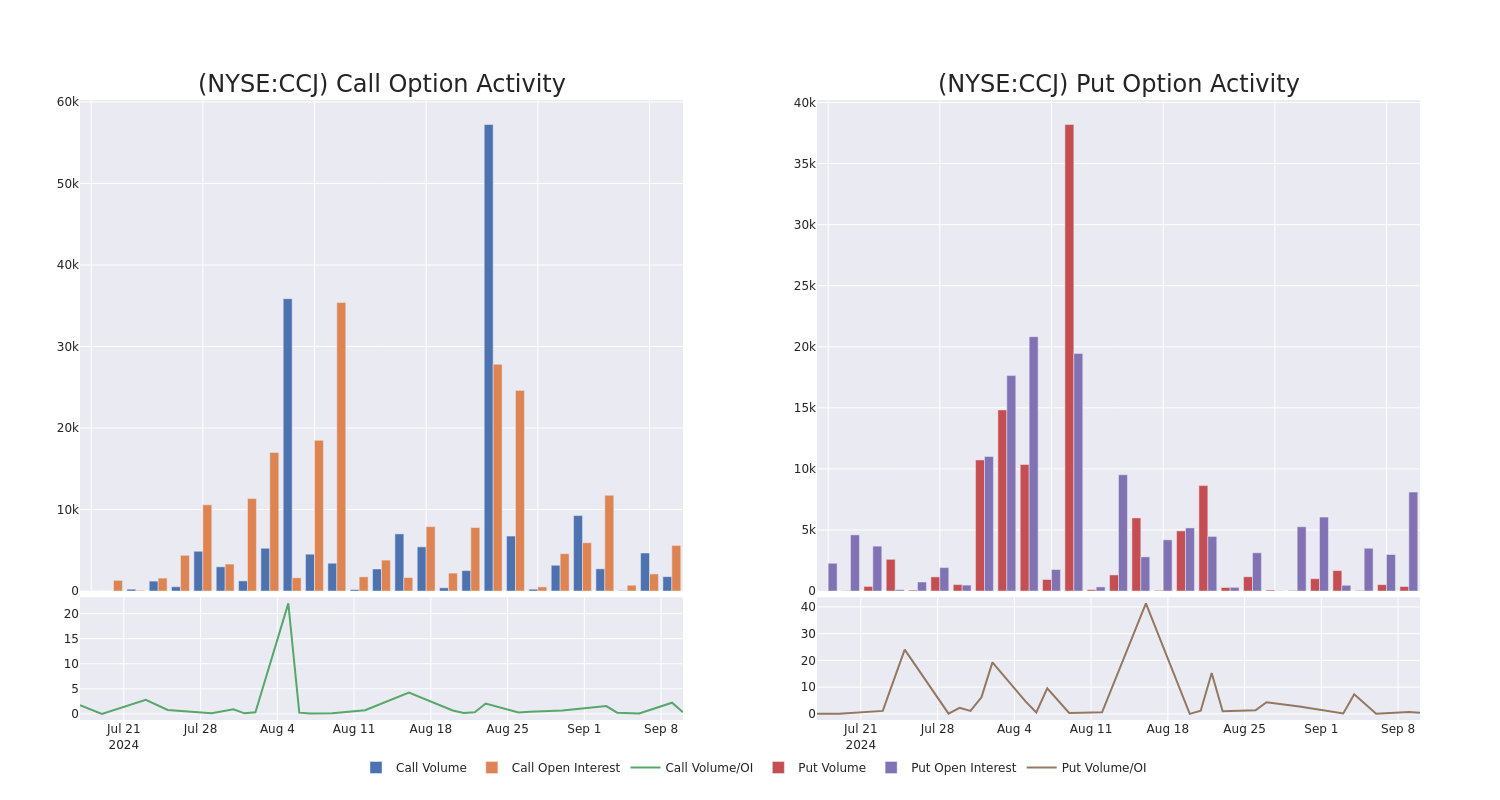

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Micron Technology’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Micron Technology’s whale trades within a strike price range from $50.0 to $150.0 in the last 30 days.

Micron Technology Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BULLISH | 10/18/24 | $10.4 | $10.35 | $10.39 | $82.50 | $103.9K | 378 | 100 |

| MU | CALL | TRADE | BULLISH | 09/19/25 | $4.35 | $4.0 | $4.21 | $150.00 | $100.1K | 329 | 238 |

| MU | CALL | TRADE | BULLISH | 01/16/26 | $43.7 | $43.6 | $43.7 | $50.00 | $87.4K | 246 | 20 |

| MU | CALL | SWEEP | BULLISH | 11/15/24 | $13.65 | $13.55 | $13.65 | $80.00 | $61.4K | 827 | 90 |

| MU | CALL | SWEEP | NEUTRAL | 11/15/24 | $13.75 | $13.05 | $13.6 | $80.00 | $59.4K | 827 | 45 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Where Is Micron Technology Standing Right Now?

- Currently trading with a volume of 2,341,019, the MU’s price is up by 1.5%, now at $88.15.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 14 days.

Expert Opinions on Micron Technology

In the last month, 2 experts released ratings on this stock with an average target price of $157.5.

- An analyst from Needham has decided to maintain their Buy rating on Micron Technology, which currently sits at a price target of $140.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Micron Technology with a target price of $175.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Micron Technology, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ocean Power Market to hit $3.98 billion, Globally, by 2031 at 19.5% CAGR, says Coherent Market Insights

Burlingame, Sept. 11, 2024 (GLOBE NEWSWIRE) — The global Ocean Power Market Size to Grow from USD 1.14 Billion in 2024 to USD 3.98 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Growing push for renewable sources as oceans represent a vast, untapped reservoir of clean energy. As environmental regulations tighten around the world and public sentiment sours against fossil fuels, the demand for non-polluting renewable energy from the oceans is expected to increase substantially in the coming years.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7168

Market Dynamics:

The ocean power market is expected to witness significant growth over the forecast period. Power generated from ocean power has minimal environmental impact and provides a long-term sustainable energy solution. In addition, ocean power technologies such as tidal, wave, and salinity gradients are renewable sources of energy that have potential for base load power generation. Ocean power technologies offer a reliable source of energy as ocean resources are continually replenished and are predictable over many time scales.

Ocean Power Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $1.14 billion |

| Estimated Value by 2031 | $3.98 billion |

| Growth Rate | Poised to grow at a CAGR of 19.5% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type, By Application |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing awareness about climate change • Advancements in ocean power technologies |

| Restraints & Challenges | • High initial installation costs • Location dependence |

Market Trends:

Tidal stream power technology generates energy from the kinetic energy of moving water in tidal currents, and has lower visual and physical impact compared to offshore wind turbines. Technological advancements have improved the efficiency and commercial viability of tidal stream power technology. For instance, in November 2021, a tidal turbine developer Sustainable Marine Energy announced plans to develop a 10MW tidal energy project in Ireland in partnership with the University of Limerick.

Investments in wave energy technologies have been increasing over the past few years. Wave energy technologies harness the energy from surface waves and convert it into electricity. Government agencies and private organizations across regions such as Europe, North America, and Asia Pacific are investing in research, demonstration projects, and commercialization of wave energy technologies to reduce dependence on fossil fuels.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7168

Market Opportunities:

Tidal barrages make use of dams and sluice gates to capture the energy of rising and falling tides. They work as hydropower plants by utilizing the potential energy of tides. Tidal barrages can generate bulk power on a predictable and reliable schedule. The Rance Tidal Power Station in Brittany, France, which opened in 1966, is still one of the largest tidal power plants in operation. However, tidal barrages require major civil construction works and alter the natural tidal movements in coastal regions. They can also negatively impact the ecosystem in surrounding areas. Nevertheless, tidal barrages remain a promising tidal energy technology if environmental factors are addressed properly.

Tidal stream technology uses underwater turbines similar to wind turbines mounted on the seabed to capture energy from tidal currents. They extract kinetic energy from free-flowing water and have lower visual impacts than tidal barrages. Tidal stream turbines are easy to install and have modular designs making them suitable for phased roll-outs. However, deploying and maintaining turbines in marine environments poses technical challenges. Corrosion, biofouling, and turbulence from tides and waves can affect operations. Advancements in material sciences and development of new materials are helping address these issues. With predictable tides producing strong tidal streams, tidal stream technology has significant potential for power generation.

Key Market Takeaways

The global ocean power market size was valued at USD 1144.2 Mn in 2024 and is anticipated to witness a CAGR of 19.5% during the forecast period 2024-2031. Rising concerns about climate change and focus on developing renewable sources of energy are supporting market growth.

By type, the tidal barrage segment currently dominates due to bulk power generation capability. However, the tidal stream segment is expected to grow at a higher rate due to its modularity and ease of installation.

On the basis of application, power generation remains the key application segment fueled by the rising need for renewable power sources. Within this, the tidal stream power generation sub-segment is projected to be the major revenue contributor during the forecast period.

Regionally, North America holds the major share of the overall ocean power market, driven by supportive policies and presence of key industry players in the US and Canada. Europe holds the second position due to thriving tidal stream projects in the UK.

Some of the prominent players operating in the global ocean power market include Aqua-Magnetics, Atargis Energy Corporation, Able Technologies, Atlantis Resources Ltd., and Minesto, among others. Strategic collaborations and new product launches are among the key strategies adopted by market players to gain competitive advantage.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7168

Recent Developments

In January 2022, Ocean Power Technologies announced a partnership with Eco Wave Power to collaborate on its key projects. Furthermore, solutions will produce by combining each company’s offshore & onshore technologies with the OPT’s off-shore engineering & robot skills.

In August 2021, Mocean Energy tested its Blue X wave energy product at the European Marine Energy Centre (EMEC). This machine has started trials at its site to understand its applicability.

Detailed Segmentation-

By Type:

- Tidal Barrages

- Tidal Stream

- Wave Energy

- Others

By Application:

- Power Generation

- Desalination

- Water Pumping

- Others

By Region:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Energy Domain:

Global offshore wind energy market size is expected to reach US$ 70.38 Bn by 2031, from US$ 33.98 Bn in 2024, exhibiting a compound annual growth rate (CAGR) of 12.9% during the forecast period (2024-2031)

The Global Power Grid System Market is estimated to be valued at USD 11.67 Bn in 2024 and is expected to reach USD 24.78 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 11.4% from 2024 to 2031.

The global renewable natural gas market is estimated to be valued at USD 14.03 Bn in 2024 and is expected to reach USD 24.23 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2024 to 2031.

Global energy storage as a service market is estimated to be valued at USD 1.81 Bn in 2024 and is expected to reach USD 3.71 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 10.8% from 2024 to 2031.

The hybrid power system market is estimated to be valued at USD 704.2 Mn in 2024 and is expected to reach USD 1,072.9 Mn by 2031, exhibiting a compound annual growth rate (CAGR) of 6.2% from 2024 to 2031.

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Peter Schiff Raises Specter Of Early August-Like Collapse In Risky Assets As Dollar Falls To Worst Level In 9 Months Against Yen

The slew of weak data has increased the odds of a deeper cut by the Federal Reserve at the September meeting, weighing down on the dollar. Against the backdrop, economist Peter Schiff flagged the eerie possibility of the return of the yen-carry unwinding.

What Happened: The U.S. dollar fell below the 142 handle against the yen for the first time in 2024, observed Schiff in a post on X, formerly Twitter. The next support level for the pair is around 128, a 20% drop from the June high, he said.

“This will result in significant pressure to unwind the yen carry trade, which is bearish for long-term Treasuries and risk assets,” he added.

See Also: Best Value Stocks