Insider Selling: ROBSON WALTON Unloads $442.77M Of Walmart Stock

ROBSON WALTON, 10% Owner at Walmart WMT, executed a substantial insider sell on September 10, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that WALTON sold 5,746,226 shares of Walmart. The total transaction amounted to $442,774,830.

At Wednesday morning, Walmart shares are down by 1.36%, trading at $77.73.

Get to Know Walmart Better

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart: Delving into Financials

Revenue Growth: Walmart’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 4.77%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Key Profitability Indicators:

-

Gross Margin: With a high gross margin of 25.11%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Walmart’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 0.56.

Debt Management: Walmart’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.73.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 41.05 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.96 is above industry norms, reflecting an elevated valuation for Walmart’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Walmart’s EV/EBITDA ratio, surpassing industry averages at 18.59, positions it with an above-average valuation in the market.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Important Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Walmart’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

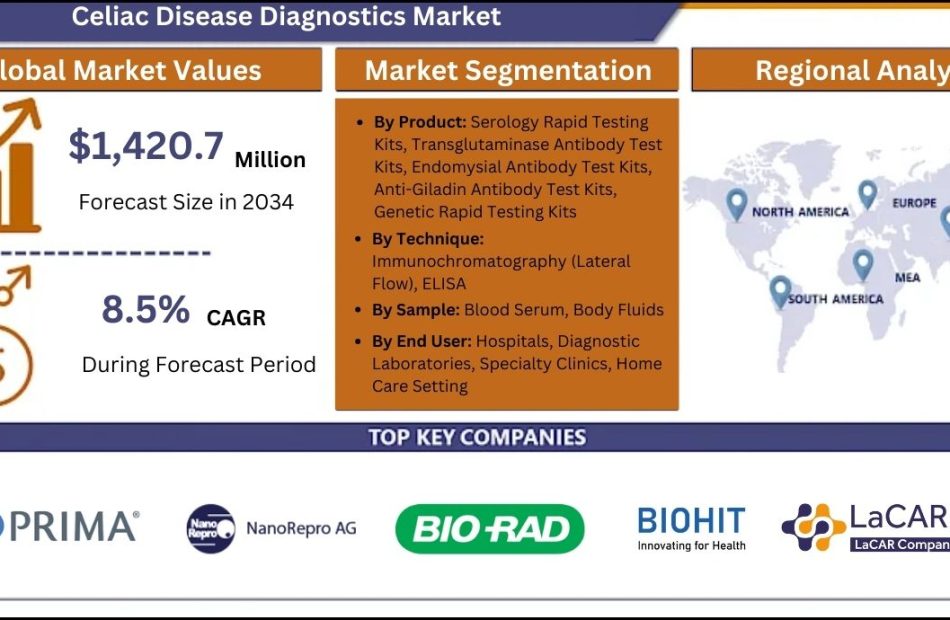

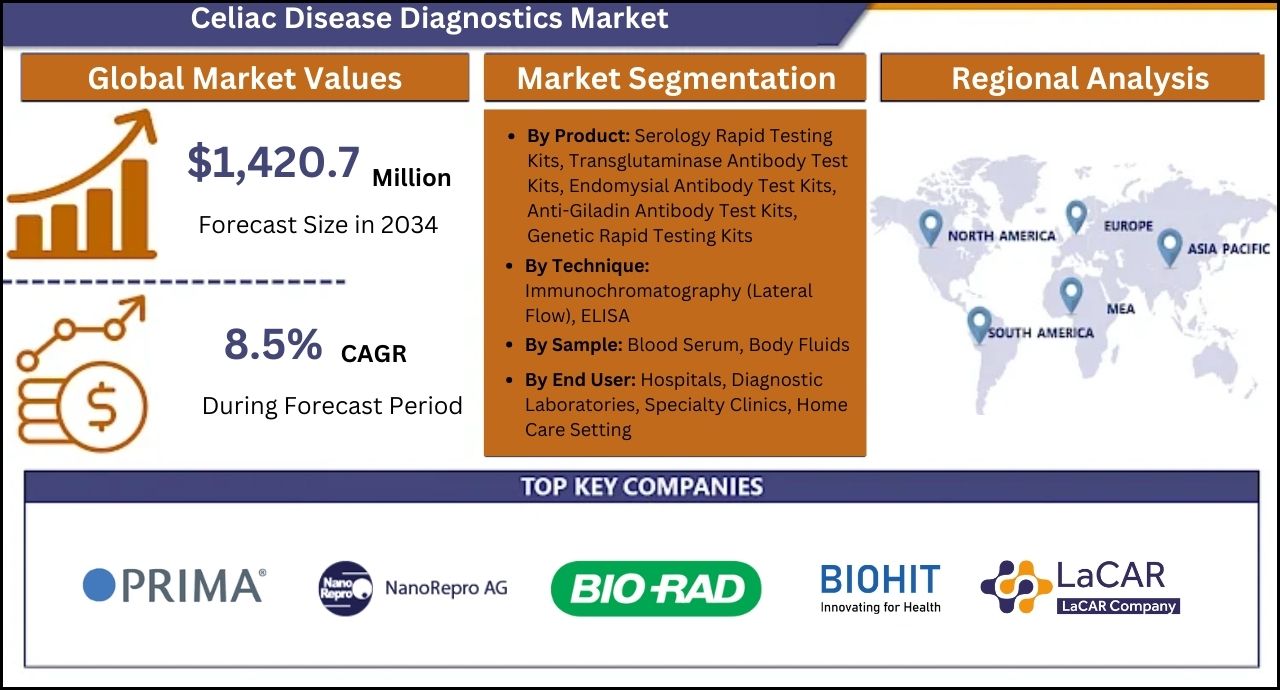

Celiac Disease Diagnostics Market to Reach US$ 1.42 Billion by 2034, Driven by 8.5% CAGR | Fact.MR Report

Rockville, MD, Sept. 11, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global celiac disease diagnostics market is estimated to reach a valuation of US$ 626.2 million in 2024 and is expected to grow at a CAGR of 8.5% during the forecast period of (2024 to 2034).

More accessible, efficient, and accurate testing results from advancements in diagnostic technology, which impacts the growth of the celiac disease diagnostic market. Newer serological diagnostics, like improved lateral flow assays and complex ELISA assays, offer higher sensitivity and specificity in detecting antibodies associated with celiac disease. Fewer false positives and negatives occur as a result. Modern serological techniques allow for the simultaneous detection of many antibodies, such as tTG-IgA, DGP-IgA, and DGP-IgG, providing a comprehensive diagnostic profile from a single sample.

Identifying HLA-DQ2 and HLA-DQ8 genotypes that are associated with higher predisposition to celiac disease has become fast and precise due to advancements in technology. This results in early detection and enhanced risk assessment capabilities providing means for optimized diagnosis. NGS serves to expand knowledge on genetic susceptibility and provides better diagnosis through its detailed genomic information that reveals infrequent mutations associated with coeliac disease. New point-of-care testing kits make it easier to examine patients and speed up decision-making in clinical or home settings by providing rapid results.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10338

Key Takeaways from Market Study:

- The global Celiac disease diagnostics market is projected to grow at 8.5% CAGR and reach US$ 1,420.7 million by 2034

- The market created an absolute $ opportunity of US$ 794.0 million growing at a CAGR of 8.5% between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 42.8% in 2034

- Serology rapid testing kits are estimated to grow at a CAGR of 9.0% creating an absolute $ opportunity of US$ 619.0 million between 2024 and 2034.

- North America and Western Europe are expected to create an absolute $ opportunity of US$ 455.0 million collectively.

“Increasing Usage of Home-Test Kits Boosts the Market Growth” says a Fact.MR analyst.

Regional Analysis:

The United States Celiac Disease Diagnostics Market is valued at an estimated US$ 234.3 million in 2024 and is expected to grow at a CAGR of 8.4% through 2034. With the efforts of organizations like the Celiac Disease Foundation and the National Celiac Association, along with various medical institutions, public awareness about celiac disease has grown significantly. Increased education and media coverage have led to a rise in testing and diagnosis rates, as more people seek medical advice when experiencing symptoms of gluten intolerance. This, combined with enhanced knowledge among healthcare providers, especially pediatricians, has fueled the market’s growth trajectory.

Leading Players Driving Innovation in Celiac Disease Diagnostics Market:

Thermo Fisher Scientific Inc.; PRIMA Lab SA; Glutenostics, Inc.; NanoRepro AG; Targeted Genomics; Bio-Rad Laboratories Inc.; Biohit Oyj; Labsystems Diagnostics Oy; RxHome Test; AESKU.GROUP GmbH; LaCAR MDx Technologies; Vitrosens Biotechnology; Inova Diagnostics; EmpowerDx (Eurofins Scientific); Everlywell, Inc.

Market Development:

The home test kits are increasingly popular as the method of diagnosing celiac disease, thus boosting the market. Many equipment makers offer kits for measuring gluten responses and thereby show the likelihood of getting the disease.

Blood or swab are generally used in testing and these tests can be sent to a laboratory so as to analyse results collected during a home test. All results obtained in labs are usually easy to comprehend, and which can be accessible in 5-7 working days.

Some examples of home-test kits include imaware Celiac Disease Screening Test, Targeted Genomics Gluten ID Test, LetsGetChecked Celiac Test, EmpowerDX Celiac Risk Gene Test and Genovate DNA Celiac Disease Test. There is increasing involvement of different manufacturers in more product releases of at-home test kits. For example, empowerDX launched a simple test for Celiac Disease Genetic Risk on May 5, 2022. Hence, it is anticipated that the rise in usage of home-test kits will promote market expansion during the prediction time.

Celiac Disease Diagnostics Industrial News:

- Inova Diagnostics acquired FDA (510k) clearance in September 2021 for their Aptiva System and IgA test for coeliac disease. Because of its fully automated digital system, clinical laboratories may now handle data at high throughput in the next generation.

- New nutritional and digestive health solutions, including at-home coeliac disease collecting tests, were announced by Everlywell, Inc. in June 2022.

- EmpowerDx and NIMA inked a collaboration agreement in September 2022 to jointly market EmpowrDx’s genetic test for coeliac disease identification.

- To develop ZED1227/TAK-227, a Phase 2b experimental therapeutic for coeliac disease, Takeda and Zedira and Dr. Falk Pharma agreed into a partnership and licensing agreement in October 2022.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10338

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global celiac disease diagnostics market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of the Product (Serology Rapid Testing Kits, Genetic Rapid Testing Kits), Technique (Immunochromatography and ELISA), Sample (Blood Serum and Body Fluids), and End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Home Care Setting) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa).

Check out More Related Studies Published by Fact.MR Research:

Blood Cancer Diagnostics Market: In FY 2021, the blood cancer diagnostics market reached a valuation of US$ 15.05 Billion, and is likely to register a Y-o-Y growth rate of 5.6% in 2022, closing at US$ 15.95 Billion.

Ovarian Cancer Diagnostics Market: This global ovarian cancer diagnostics market analysis by Fact.MR predicts the industry to expand at a robust CAGR of 7% from 2021 to 2031.

Breast Cancer Diagnostics Market: The global breast cancer diagnostics market is likely to acquire a market value of US$ 4 Bn in 2022 and is expected to register a CAGR of 7% by accumulating a market value of US$ 7.9 Bn in the forecast period 2022-2032.

Kidney Cancer Diagnostics Market: The global kidney cancer diagnostics market is projected to expand steadily at a CAGR 7% value, during the forecast period 2022-2032. In the year 2022, the market size is projected to expand and gain a global market valuation of US$ 800 Million

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Follow Us: LinkedIn | Twitter | Blog

Contact: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583 Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Children's Place Reports Second Quarter 2024 Results

Significant Improvement in Gross Profit Margin to 35%

Lowest Level of SG&A spending in more than 15 Years during Q2

Incurred a Non-Cash Impairment Charge of $28 Million for Gymboree Tradename

Adjusted Operating Income of $14.2 Million after Two Years of Losses during Q2

Positive Adjusted EBITDA, Improving $37.4 Million versus the Prior Year Loss

SECAUCUS, N.J., Sept. 11, 2024 (GLOBE NEWSWIRE) — The Children’s Place, Inc. PLCE, an omni-channel children’s specialty portfolio of brands, today announced financial results for the second quarter ended August 3, 2024.

Muhammad Umair, President and Interim Chief Executive Officer said, “During the second quarter we proactively made certain strategic and operational changes to improve the profitability of the business and provide a foundation for future growth and we were pleased with the results. While we anticipated that these efforts would provide pressure to topline sales, we drove significant improvements in gross profit margin versus the prior year’s second quarter and sequential improvement in margin for two quarters, which is particularly important moving from the first quarter to the second quarter. In addition, we were also able to significantly decrease Adjusted SG&A expenses as we reduced payroll costs and eliminated unprofitable marketing spend, all of which has combined to show more than a $39 million improvement in Adjusted operating income despite the lower top line sales. While these first steps to improve operating results have been promising, we still believe that we have significant work ahead of us in future quarters as we rationalize profitability.”

Second Quarter 2024 Results

Net sales decreased $25.9 million, or 7.5%, to $319.7 million in the three months ended August 3, 2024, compared to $345.6 million in the three months ended July 29, 2023. The decrease in net sales was primarily driven by an anticipated decrease in ecommerce revenue, as the Company proactively rationalized its unprofitable promotional strategies, inflated marketing spend and “free shipping” offers to significantly improve profitability, which was successful during the second quarter. These efforts not only improved the profitability of the Company’s ecommerce business, despite the lower revenue, but also benefited the brick-and-mortar channel, as the stores business experienced positive comparable store sales for the first time in ten quarters. The wholesale business also rebounded with double-digit growth after a decline in the first quarter.

Comparable retail sales decreased 7.2% for the quarter, largely driven by the planned decrease in ecommerce as this business decreased by a double-digit percentage as the Company proactively sacrificed unprofitable sales to improve profitability. Stores experienced a positive comparable store sales result for the first time since the post COVID-19 period of 2021, driven by stronger units per transaction and conversion metrics, and improving traffic trends.

Gross profit increased $24.0 million to $111.8 million in the three months ended August 3, 2024, compared to $87.8 million in the three months ended July 29, 2023. The gross margin rate increased by 960 basis points to 35.0% during the three months ended August 3, 2024, compared to 25.4% in the prior year period. The increase was caused by a combination of factors, including reductions in product input costs, including cotton and supply chain costs, which negatively impacted margins in the prior year. These improvements were combined with the success of the Company’s rationalization of profit-draining promotional strategies and shipping offers, which resulted in a significant improvement in the leverage of ecommerce freight costs due to the Company’s new shipping threshold for free shipping.

Selling, general, and administrative expenses were well controlled at $96.1 million in the three months ended August 3, 2024, compared to $112.0 million in the three months ended July 29, 2023. Adjusted selling, general & administrative expenses were $88.3 million in the three months ended August 3, 2024, compared to $101.7 million in the comparable period last year, and leveraged 180 basis points to 27.6% of net sales, primarily as a result of significant reductions in store payroll and home office payroll, and the elimination of inflated and unprofitable marketing costs. This represents the lowest level of Adjusted selling, general, and administrative expenses in over 15 years for the second quarter.

Operating loss was $(21.8) million in the three months ended August 3, 2024, compared to $(36.9) million in the three months ended July 29, 2023. Operating loss was impacted by incremental expenses of $36.0 million, which included an impairment charge of $28.0 million on the Gymboree tradename, primarily due to reductions in Gymboree sales forecasts and a reduction in the royalty rate used to value the tradename, and restructuring costs of $6.1 million due to recent changes in the senior leadership team. These charges have been classified as non-GAAP adjustments, leading to a shift back to profitability with an adjusted operating income of $14.2 million in the three months ended August 3, 2024, or an improvement of $39.2 million compared to an adjusted operating loss of $(25.0) million in the comparable period last year, and leveraged 1,170 basis points to 4.5% of net sales.

Net interest expense was $9.2 million in the three months ended August 3, 2024, compared to $7.6 million in the three months ended July 29, 2023. The increase in interest expense was primarily driven by higher average interest rates associated with the Company’s revolving credit facility due to the impact of refinancings and continued market-based rate increases, partially offset by continued benefits associated with certain non-interest bearing loans from the Company’s majority shareholder, Mithaq Capital SPC (“Mithaq”).

As previously announced, in the three months ended February 3, 2024, the Company established a valuation allowance against its net deferred tax assets and, as such, continues to adjust the allowance based upon the ongoing operating results. The provision for income taxes, which is reflected net of these adjustments, was $1.1 million in the three months ended August 3, 2024, compared to a benefit for income taxes of $(9.2) million during the three months ended July 29, 2023. The change in the provision (benefit) for income taxes was primarily driven by the establishment of the valuation allowance against the Company’s net deferred tax assets.

Net loss, which included certain non-cash impairment charges and non-operating restructuring charges, was $(32.1) million, or $(2.51) per diluted share, in the three months ended August 3, 2024, compared to $(35.4) million, or $(2.82) per diluted share, in the three months ended July 29, 2023. Adjusted net income shifted back to profitability after two years of losses during the second quarter, improving by $30.4 million versus the prior year to $3.9 million, or $0.30 per diluted share, compared to an adjusted net loss of $(26.5) million, or $(2.12) per diluted share, in the comparable period last year.

Fiscal Year-To-Date 2024 Results

Net sales decreased $79.7 million, or 11.9%, to $587.5 million in the six months ended August 3, 2024, compared to $667.2 million in the six months ended July 29, 2023. The decrease in net sales was primarily due to reductions in retail sales due to lower store count, and anticipated declines in ecommerce demand due to the rationalization of promotions, reductions in inflated and unprofitable marketing spend and the strategic decision to change “free shipping” offers, as the Company proactively sacrificed unprofitable sales in an effort to improve profitability. Comparable retail sales decreased 9.4% for the six months ended August 3, 2024.

Gross profit increased $20.3 million to $204.5 million in the six months ended August 3, 2024, compared to $184.2 million in the six months ended July 29, 2023. The gross margin rate increased by 720 basis points to 34.8% during the six months ended August 3, 2024 compared to 27.6% in the prior year period. The increase was primarily due to reductions in product input costs, including cotton and supply chain costs, which negatively impacted margins in the prior year. These improvements were combined with the success of the Company’s rationalization of profit-draining promotional strategies and shipping offers, which resulted in a significant improvement in the leverage of ecommerce freight costs due to the Company’s new shipping threshold for free shipping.

Selling, general, and administrative expenses were $205.2 million in the six months ended August 3, 2024, compared to $224.9 million in the six months ended July 29, 2023. Adjusted selling, general & administrative expenses were $177.0 million in the six months ended August 3, 2024, compared to $210.8 million in the comparable period last year, and leveraged 150 basis points to 30.1% of net sales, primarily as a result of significant reductions in store payroll and home office payroll, and the elimination of inflated and unprofitable marketing costs. This represents the lowest level of Adjusted selling, general and administrative expenses in over 15 years for the first two quarters of a fiscal year.

Operating loss was $(49.8) million in the six months ended August 3, 2024, compared to $(67.0) million in the six months ended July 29, 2023. Operating loss was impacted by incremental expenses of $58.9 million, which included an impairment charge of $28.0 million on the Gymboree tradename, primarily due to reductions in Gymboree sales forecasts and a reduction in the royalty rate used to value the tradename, restructuring costs of $6.4 million primarily due to recent changes in the senior leadership team, and several charges due to the Company’s recent change of control, due to the investment in the Company by Mithaq, and several new financing initiatives, which include $10.8 million of non-cash equity compensation charges and $3.8 million in other fees associated with the change of control, and $6.7 million of financing-related charges. These charges have been classified as non-GAAP adjustments leading to a shift back to profitability with an adjusted operating income of $9.2 million for year-to-date 2024, or an improvement of $58.7 million compared to an adjusted operating loss of $(49.5) million in the comparable period last year, and leveraged 900 basis points to 1.6% of net sales.

Net interest expense was $17.0 million in the six months ended August 3, 2024, compared to $13.5 million in the six months ended July 29, 2023. The increase in interest expense was primarily driven by higher average interest rates associated with the Company’s revolving credit facility due to the impact of refinancings and continued market-based rate increases, partially offset by continued benefits associated with certain non-interest bearing loans from Mithaq.

The provision for income taxes was $3.2 million in the six months ended August 3, 2024, compared to a benefit for income taxes of $(16.4) million during the six months ended July 29, 2023. The change in the provision (benefit) for income taxes was primarily driven by the establishment of a valuation allowance against the Company’s net deferred tax assets in the Company’s fiscal year for 2023.

Net loss, which included certain non-cash impairment charges and non-operating restructuring charges, was $(69.9) million, or $(5.50) per diluted share, in the six months ended August 3, 2024, compared to $(64.2) million, or $(5.16) per diluted share, in the six months ended July 29, 2023. Adjusted net loss, which was driven by losses in the first quarter and partially offset by profits in the second quarter, was $(11.0) million, or $(0.87) per diluted share, compared to $(51.2) million, or $(4.12) per diluted share, in the comparable period last year.

Store Update

The Company closed 3 stores in the three months ended August 3, 2024 and ended the quarter with 515 stores and square footage of 2.5 million.

Balance Sheet and Cash Flow

As of August 3, 2024, the Company had $9.6 million of cash and cash equivalents and $316.7 million outstanding on its revolving credit facility. Additionally, the Company used $194.7 million in operating cash flows in the six months ended August 3, 2024.

Inventories were $520.6 million as of August 3, 2024, compared to $537.0 million as of July 29, 2023.

Non-GAAP Reconciliation

The Company’s results are reported in this press release on a GAAP and as adjusted, non-GAAP basis. Adjusted net income (loss), adjusted net income (loss) per diluted share, adjusted gross profit, adjusted selling, general, and administrative expenses, adjusted operating income (loss) and adjusted EBITDA are non-GAAP measures, and are not intended to replace GAAP financial information, and may be different from non-GAAP measures reported by other companies. The Company believes the income and expense items excluded as non-GAAP adjustments are not reflective of the performance of its core business, and that providing this supplemental disclosure to investors will facilitate comparisons of the past and present performance of its core business.

Please refer to the “Reconciliation of Non-GAAP Financial Information to GAAP” later in this press release, which sets forth the non-GAAP operating adjustments for the 13-week periods and 26-week periods ended August 3, 2024, and July 29, 2023.

About The Children’s Place

The Children’s Place is an omni-channel children’s specialty portfolio of brands. Its global retail and wholesale network includes two digital storefronts, more than 500 stores in North America, wholesale marketplaces and distribution in 15 countries through five international franchise partners. The Children’s Place designs, contracts to manufacture, and sells fashionable, high-quality apparel, accessories and footwear predominantly at value prices, primarily under its proprietary brands: “The Children’s Place”, “Gymboree”, “Sugar & Jade”, and “PJ Place”. For more information, visit: www.childrensplace.com and www.gymboree.com, as well as the Company’s social media channels on Instagram, Facebook, X, formerly known as Twitter, YouTube and Pinterest.

Forward-Looking Statements

This press release contains or may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements relating to the Company’s strategic initiatives and results of operations, including adjusted net income (loss) per diluted share. Forward-looking statements typically are identified by use of terms such as “may,” “will,” “should,” “plan,” “project,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. These forward-looking statements are based upon the Company’s current expectations and assumptions and are subject to various risks and uncertainties that could cause actual results and performance to differ materially. Some of these risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including in the “Risk Factors” section of its annual report on Form 10-K for the fiscal year ended February 3, 2024. Included among the risks and uncertainties that could cause actual results and performance to differ materially are the risk that the Company will be unable to achieve operating results at levels sufficient to fund and/or finance the Company’s current level of operations and repayment of indebtedness, the risk that the Company will be unsuccessful in gauging fashion trends and changing consumer preferences, the risks resulting from the highly competitive nature of the Company’s business and its dependence on consumer spending patterns, which may be affected by changes in economic conditions (including inflation), the risk that changes in the Company’s plans and strategies with respect to pricing, capital allocation, capital structure, investor communications and/or operations may have a negative effect on the Company’s business, the risk that the Company’s strategic initiatives to increase sales and margin, improve operational efficiencies, enhance operating controls, decentralize operational authority and reshape the Company’s culture are delayed or do not result in anticipated improvements, the risk of delays, interruptions, disruptions and higher costs in the Company’s global supply chain, including resulting from disease outbreaks, foreign sources of supply in less developed countries, more politically unstable countries, or countries where vendors fail to comply with industry standards or ethical business practices, including the use of forced, indentured or child labor, the risk that the cost of raw materials or energy prices will increase beyond current expectations or that the Company is unable to offset cost increases through value engineering or price increases, various types of litigation, including class action litigations brought under securities, consumer protection, employment, and privacy and information security laws and regulations, the imposition of regulations affecting the importation of foreign-produced merchandise, including duties and tariffs, risks related to the existence of a controlling shareholder, and the uncertainty of weather patterns. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they were made. The Company undertakes no obligation to release publicly any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Contact: Investor Relations (201) 558-2400 ext. 14500

| THE CHILDREN’S PLACE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

| Second Quarter Ended | Year-to-Date Ended | ||||||||||||||

| August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||||||||||

| Net sales | $ | 319,655 | $ | 345,599 | $ | 587,533 | $ | 667,239 | |||||||

| Cost of sales | 207,861 | 257,840 | 382,998 | 483,019 | |||||||||||

| Gross profit | 111,794 | 87,759 | 204,535 | 184,220 | |||||||||||

| Selling, general and administrative expenses | 96,065 | 111,965 | 205,159 | 224,895 | |||||||||||

| Depreciation and amortization | 9,505 | 11,953 | 21,140 | 23,801 | |||||||||||

| Asset impairment charges | 28,000 | 782 | 28,000 | 2,532 | |||||||||||

| Operating loss | (21,776 | ) | (36,941 | ) | (49,764 | ) | (67,008 | ) | |||||||

| Interest expense, net | (9,231 | ) | (7,641 | ) | (16,952 | ) | (13,543 | ) | |||||||

| Loss before provision (benefit) for income taxes | (31,007 | ) | (44,582 | ) | (66,716 | ) | (80,551 | ) | |||||||

| Provision (benefit) for income taxes | 1,107 | (9,227 | ) | 3,193 | (16,363 | ) | |||||||||

| Net loss | $ | (32,114 | ) | $ | (35,355 | ) | $ | (69,909 | ) | $ | (64,188 | ) | |||

| Loss per common share | |||||||||||||||

| Basic | $ | (2.51 | ) | $ | (2.82 | ) | $ | (5.50 | ) | $ | (5.16 | ) | |||

| Diluted | $ | (2.51 | ) | $ | (2.82 | ) | $ | (5.50 | ) | $ | (5.16 | ) | |||

| Weighted average common shares outstanding | |||||||||||||||

| Basic | 12,772 | 12,522 | 12,707 | 12,448 | |||||||||||

| Diluted | 12,772 | 12,522 | 12,707 | 12,448 | |||||||||||

| THE CHILDREN’S PLACE, INC. RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION TO GAAP (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

| Second Quarter Ended | Year-to-Date Ended | ||||||||||||||

| August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||||||||||

| Net loss | $ | (32,114 | ) | $ | (35,355 | ) | $ | (69,909 | ) | $ | (64,188 | ) | |||

| Non-GAAP adjustments: | |||||||||||||||

| Asset impairment charges | 28,000 | 782 | 28,000 | 2,532 | |||||||||||

| Restructuring costs | 6,104 | 9,659 | 6,367 | 9,928 | |||||||||||

| Credit agreement/lender-required consulting | 1,102 | — | 1,852 | — | |||||||||||

| Professional and consulting fees | 422 | — | 422 | — | |||||||||||

| Accelerated depreciation | 256 | 907 | 1,813 | 907 | |||||||||||

| Fleet optimization | 123 | 81 | 708 | 1,168 | |||||||||||

| Change of control | — | — | 14,589 | — | |||||||||||

| Broken financing and restructuring fees | — | — | 6,661 | — | |||||||||||

| Canada distribution center closure | — | — | 781 | — | |||||||||||

| Reversal of legal settlement accrual | — | — | (2,279 | ) | — | ||||||||||

| Contract termination costs | — | 546 | — | 2,962 | |||||||||||

| Aggregate impact of non-GAAP adjustments | 36,007 | 11,975 | 58,914 | 17,497 | |||||||||||

| Income tax effect (1) | — | (3,113 | ) | — | (4,549 | ) | |||||||||

| Net impact of non-GAAP adjustments | 36,007 | 8,862 | 58,914 | 12,948 | |||||||||||

| Adjusted net income (loss) | $ | 3,893 | $ | (26,493 | ) | $ | (10,995 | ) | $ | (51,240 | ) | ||||

| GAAP net loss per common share | $ | (2.51 | ) | $ | (2.82 | ) | $ | (5.50 | ) | $ | (5.16 | ) | |||

| Adjusted net income (loss) per common share | $ | 0.30 | $ | (2.12 | ) | $ | (0.87 | ) | $ | (4.12 | ) | ||||

(1) The tax effects of the non-GAAP items are calculated based on the statutory rate of the jurisdiction in which the discrete item resides, adjusted for the impact of any valuation allowance.

| THE CHILDREN’S PLACE, INC. RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION TO GAAP (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

| Second Quarter Ended | Year-to-Date Ended | ||||||||||||||

| August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||||||||||

| Operating loss | $ | (21,776 | ) | $ | (36,941 | ) | $ | (49,764 | ) | $ | (67,008 | ) | |||

| Non-GAAP adjustments: | |||||||||||||||

| Asset impairment charges | 28,000 | 782 | 28,000 | 2,532 | |||||||||||

| Restructuring costs | 6,104 | 9,659 | 6,367 | 9,928 | |||||||||||

| Credit agreement/lender-required consulting | 1,102 | — | 1,852 | — | |||||||||||

| Professional and consulting fees | 422 | — | 422 | — | |||||||||||

| Accelerated depreciation | 256 | 907 | 1,813 | 907 | |||||||||||

| Fleet optimization | 123 | 81 | 708 | 1,168 | |||||||||||

| Change of control | — | — | 14,589 | — | |||||||||||

| Broken financing and restructuring fees | — | — | 6,661 | — | |||||||||||

| Canada distribution center closure | — | — | 781 | — | |||||||||||

| Reversal of legal settlement accrual | — | — | (2,279 | ) | — | ||||||||||

| Contract termination costs | — | 546 | — | 2,962 | |||||||||||

| Aggregate impact of non-GAAP adjustments | 36,007 | 11,975 | 58,914 | 17,497 | |||||||||||

| Adjusted operating income (loss) | $ | 14,231 | $ | (24,966 | ) | $ | 9,150 | $ | (49,511 | ) | |||||

| THE CHILDREN’S PLACE, INC. RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION TO GAAP (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

| Second Quarter Ended | Year-to-Date Ended | ||||||||||||||

| August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||||||||||

| Gross profit | $ | 111,794 | $ | 87,759 | $ | 204,535 | $ | 184,220 | |||||||

| Non-GAAP adjustments: | |||||||||||||||

| Change of control | — | — | 905 | — | |||||||||||

| Aggregate impact of non-GAAP adjustments | — | — | 905 | — | |||||||||||

| Adjusted gross profit | $ | 111,794 | $ | 87,759 | $ | 205,440 | $ | 184,220 | |||||||

| Second Quarter Ended | Year-to-Date Ended | ||||||||||||||

| August 3, 2024 |

July 29, 2023 |

August 3, 2024 |

July 29, 2023 |

||||||||||||

| Selling, general and administrative expenses | $ | 96,065 | $ | 111,965 | $ | 205,159 | $ | 224,895 | |||||||

| Non-GAAP adjustments: | |||||||||||||||

| Restructuring costs | (6,104 | ) | (9,659 | ) | (6,367 | ) | (9,928 | ) | |||||||

| Credit agreement/lender-required consulting | (1,102 | ) | — | (1,852 | ) | — | |||||||||

| Professional and consulting fees | (422 | ) | — | (422 | ) | — | |||||||||

| Fleet optimization | (123 | ) | (81 | ) | (708 | ) | (1,168 | ) | |||||||

| Change of control | — | — | (13,684 | ) | — | ||||||||||

| Broken financing deal | — | — | (6,661 | ) | — | ||||||||||

| Canada distribution center closure | — | — | (781 | ) | — | ||||||||||

| Reversal of legal settlement accrual | — | — | 2,279 | — | |||||||||||

| Contract termination costs | — | (546 | ) | (2,962 | ) | ||||||||||

| Aggregate impact of non-GAAP adjustments | (7,751 | ) | (10,286 | ) | (28,196 | ) | (14,058 | ) | |||||||

| Adjusted selling, general and administrative expenses | $ | 88,314 | $ | 101,679 | $ | 176,963 | $ | 210,837 | |||||||

| THE CHILDREN’S PLACE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands) (Unaudited) |

|||||||||||

| August 3, 2024 |

February 3, 2024* |

July 29, 2023 |

|||||||||

| Assets: | |||||||||||

| Cash and cash equivalents | $ | 9,573 | $ | 13,639 | $ | 18,846 | |||||

| Accounts receivable | 61,926 | 33,219 | 33,073 | ||||||||

| Inventories | 520,593 | 362,099 | 536,980 | ||||||||

| Prepaid expenses and other current assets | 35,251 | 43,169 | 65,108 | ||||||||

| Total current assets | 627,343 | 452,126 | 654,007 | ||||||||

| Property and equipment, net | 111,296 | 124,750 | 141,244 | ||||||||

| Right-of-use assets | 163,539 | 175,351 | 112,325 | ||||||||

| Tradenames, net | 13,000 | 41,123 | 70,491 | ||||||||

| Other assets, net | 6,236 | 6,958 | 45,018 | ||||||||

| Total assets | $ | 921,414 | $ | 800,308 | $ | 1,023,085 | |||||

| Liabilities and Stockholders’ (Deficit) Equity: | |||||||||||

| Revolving loan | $ | 316,655 | $ | 226,715 | $ | 347,546 | |||||

| Accounts payable | 215,793 | 225,549 | 262,369 | ||||||||

| Current portion of operating lease liabilities | 67,610 | 69,235 | 65,266 | ||||||||

| Accrued expenses and other current liabilities | 98,458 | 94,905 | 124,970 | ||||||||

| Total current liabilities | 698,516 | 616,404 | 800,151 | ||||||||

| Long-term debt | — | 49,818 | 49,785 | ||||||||

| Related party long-term debt | 165,354 | — | — | ||||||||

| Long-term portion of operating lease liabilities | 110,596 | 118,073 | 63,714 | ||||||||

| Other long-term liabilities | 15,820 | 25,032 | 23,505 | ||||||||

| Total liabilities | 990,286 | 809,327 | 937,155 | ||||||||

| Stockholders’ (deficit) equity | (68,872 | ) | (9,019 | ) | 85,930 | ||||||

| Total liabilities and stockholders’ (deficit) equity | $ | 921,414 | $ | 800,308 | $ | 1,023,085 | |||||

* Derived from the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024.

| THE CHILDREN’S PLACE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) |

|||||||

| Second Quarter Ended | |||||||

| August 3, 2024 |

July 29, 2023 |

||||||

| Net loss | $ | (69,909 | ) | $ | (64,188 | ) | |

| Non-cash adjustments | 100,757 | 63,570 | |||||

| Working capital | (225,535 | ) | (32,087 | ) | |||

| Net cash used in operating activities | (194,687 | ) | (32,705 | ) | |||

| Net cash used in investing activities | (12,478 | ) | (18,261 | ) | |||

| Net cash provided by financing activities | 203,652 | 52,969 | |||||

| Effect of exchange rate changes on cash and cash equivalents | (553 | ) | 154 | ||||

| Net (decrease) increase in cash and cash equivalents | (4,066 | ) | 2,157 | ||||

| Cash and cash equivalents, beginning of period | 13,639 | 16,689 | |||||

| Cash and cash equivalents, end of period | $ | 9,573 | $ | 18,846 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Verizon Just Increased Its Dividend for the 18th Year in a Row. Will Its $20 Billion Acquisition Put That Streak in Jeopardy?

Verizon (NYSE: VZ) is one of the top dividend stocks in the S&P 500. The telecom giant’s payout currently yields more than 6.5%. That puts it among the 10 highest yields in that broad market index, where the average is less than 1.5%.

Further, the company recently increased its payout for the 18th straight year. That’s the longest current streak in the U.S. telecom sector.

A big factor driving Verizon’s ability to continue increasing its dividend has been its improving free cash flow and leverage ratio. However, the company recently agreed to acquire Frontier Communications (NASDAQ: FYBR). While that deal will enhance its fiber network, the $20 billion all-cash acquisition will saddle it with a lot more debt. That increased leverage could impact the company’s ability to continue growing its dividend.

A notable step backward

In recent years, Verizon’s focus has been on reducing its debt. The company set a long-term goal of getting its leverage down to a range of 1.75 times to 2.0x. Its leverage ratio was 2.5x at the end of the second quarter, down from 2.7x at the end of 2022.

The company has been using all its excess free cash flow after capital spending and dividends on debt reduction. It planned to do that until leverage got to around 2.25x. Once it hit that level, the company anticipated launching a share repurchase program.

Verizon was on track to achieve the targeted leverage ratio to trigger share repurchases next year. It has been generating an increasing amount of post-dividend free cash flow, enabling it to accelerate its debt reduction. For example, it has produced $2.9 billion in excess free cash flow through the first half of 2024, up from $2.5 billion through the same period of last year. That debt paydown had the company on track to end next year with a 2.3x leverage ratio, according to Fitch.

However, the Frontier acquisition will throw a wrench in those plans. According to credit rating agency S&P Global, Verizon’s leverage ratio will rise to around 3.0x after closing the Frontier deal. This means Verizon won’t be able to start repurchasing shares anytime soon.

On a more positive note, both credit rating agencies expect the company to quickly de-lever its balance sheet following the Frontier deal. S&P Global believes it will achieve its targeted leverage ratio for share repurchases in 2027 (assuming everything goes according to plan). Likewise, Fitch sees the company getting back on track toward achieving its leverage target following the Frontier acquisition.

Silver linings

The Frontier deal will have a meaningful near-term impact on Verizon’s balance sheet. However, the company does have room to absorb the hit. S&P Global noted that while Verizon’s leverage level will rise to 3.0x after closing the transaction, that’s still comfortably below the 3.25x level, which would trigger a downgrade in its credit rating. S&P Global’s bond rating for Verizon is BBB+, which is a strong investment-grade level, while Fitch’s is even higher at A-.

Meanwhile, Verizon’s balance sheet is already stronger than that of rival AT&T (NYSE: T). The fellow telecom giant ended the second quarter with a roughly 2.9x leverage ratio. The company has also been aggressively repaying debt ($5.1 billion over the past year). That has AT&T on track to get its leverage ratio down to a range of 2.5 times in the first half of next year (which would put it around Verizon’s current level).

AT&T had previously cut its dividend by nearly 50% in 2022 to retain more cash to invest in its network and reduce debt following the spinoff of its media business.

Verizon is using its currently stronger balance sheet to acquire Frontier to better compete with AT&T in fiber. The deal will help grow its subscriber base from 7 million today to over 10 million homes by 2026, with the potential to reach 25 million homes. Further, the deal will be accretive to the company’s earnings, driven by at least $500 million in cost synergies over the first three years as Verizon integrates Frontier.

Finally, the company will still maintain a solid balance sheet (which will steadily improve). These factors should enable it to continue delivering its industry-leading dividend.

Elevating the risk profile a little bit

Verizon is making a big splash to bulk up its fiber business by acquiring Frontier in a $20 billion deal. That transaction will drive up its leverage ratio in the near term, delaying the company’s ability to start repurchasing its stock. That higher leverage level adds some risk to the dividend.

However, Verizon is in a strong position to handle the additional debt, which it expects to pay down in the coming years. Because of that, it still looks like a solid option for income-seeking investors, since it should be able to continue increasing its high-yielding dividend even as it deleverages.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Matt DiLallo has positions in Verizon Communications. The Motley Fool has positions in and recommends S&P Global. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Verizon Just Increased Its Dividend for the 18th Year in a Row. Will Its $20 Billion Acquisition Put That Streak in Jeopardy? was originally published by The Motley Fool

Rocket Lab USA Hires Rivian Veteran Frank Klein As New COO – What's Going On?

Rocket Lab USA, Inc. RKLB shares are trading higher on Wednesday.

Yesterday, the company announced that Frank Klein will be its new Chief Operations Officer, effective September 16th, 2024.

Rocket Lab Founder and CEO Peter Beck noted that Klein will help enhance the Electron launch and production schedule, implement Neutron, and bolster the company’s satellite and space systems divisions.

Klein, bringing over 30 years of global manufacturing and automotive industry leadership, joins Rocket Lab to drive the scaling of spacecraft, launch vehicles, and components. He will oversee efforts to address the company’s substantial backlog of over one billion dollars in customer orders.

Klein served Daimler AG (now Mercedes-Benz Group) for 27 years, leading various business divisions.

Most recently, Klein was COO at Rivian Automotive, where he played a key role in evolving the company from a low-volume startup into a high-volume premium electric vehicle manufacturer, overseeing more than 9,000 employees.

According to Benzinga Pro, RKLB stock has gained over 5% in the past year. Investors can gain exposure to the stock via Procure Space ETF UFO and SPDR S&P Kensho Final Frontiers ETF ROKT.

Price Action: RKLB shares are trading higher by 2.44% to $6.30 at last check Wednesday.

Now Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PodcastOne And 2 Other Stocks Under $3 Executives Are Buying

The Dow Jones index closed lower by around 0.2% on Tuesday. When insiders purchase or sell shares, it indicates their confidence or concern around the company’s prospects. Investors and traders interested in penny stocks can consider this a factor in their overall investment or trading decision.

Below is a look at a few recent notable insider transactions for penny stocks. For more, check out Benzinga’s insider transactions platform.

PodcastOne

- The Trade: PodcastOne, Inc. PODC Director D Jonathan Merriman bought a total of 10,000 shares at an average price of $1.60. To acquire these shares, it cost around $16,000.

- What’s Happening: On Sept. 9, PodcastOne named Steve Lehman Vice Chairman to Drive its mergers, acquisitions and strategy efforts.

- What PodcastOne Does: PodcastOne Inc is a podcast platform and publisher that makes its content available to audiences via all podcasting distribution platforms, including its website, its PodcastOne app, Apple Podcasts, Spotify, Amazon Music, and more.

P3 Health Partners

- The Trade: P3 Health Partners Inc. PIII 10% owner CPF III-A PT SPV, LLC acquired a total of 90,000 shares at an average price of $2.52. To acquire these shares, it cost around $227,142.

- What’s Happening: On Aug. 7, P3 Health Partners posted downbeat quarterly earnings.

- What P3 Health Partners Does: P3 Health Partners Inc is a patient-centered and physician-led population health management company.

Brightcove

- The Trade: Brightcove Inc. BCOV 10% owner Jonathan Brolin acquired a total of 16,830 shares at an average price of $2.04. The insider spent around $34,355 to buy those shares.

- What’s Happening: On Aug. 7, Brightcove posted upbeat quarterly results.

- What Brightcove Does: Brightcove Inc is a provider of cloud-based streaming technology and services.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toll Brothers Announces New Luxury Home Community Coming Soon to Parker, Colorado

DENVER, Sept. 10, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced its newest community, Toll Brothers at Cherry Creek Trail, is coming soon to Scott Avenue off of South Parker Road in Parker, Colorado. Construction of the Sales Center and model homes is currently underway and sales will begin in early 2025.

Toll Brothers at Cherry Creek Trail will include 102 home sites, offering an elevated selection of ranch-style home designs with unrivaled personalization options. Residents will enjoy a seamless blend of nature and the elegance of mid-century modern architectural style with four home designs ranging from 1,746 to 2,118+ square feet, each built with the outstanding quality, craftsmanship, and value for which Toll Brothers is known. Homes will be priced from the low $700,000s.

“With distinctive architectural features and ranch-style floor plans designed for today’s home buyers, the new homes at Toll Brothers at Cherry Creek Trail will offer residents the best in luxury living in one of Parker’s most desirable communities,” said Reggie Carveth, Division President of Toll Brothers in Colorado.

Home buyers will have access to exclusive amenities, including pickleball courts, walking trails, and direct access to the Cherry Creek Trail. Surrounded by shops, restaurants, golf courses, and more, the area offers an array of recreation and entertainment opportunities. Children will have the opportunity to attend school in the highly ranked Douglas County School District.

Major highways including Interstates 25 and 70, and Highways 83 and E-470 are easily accessible from Toll Brothers at Cherry Creek Trail, offering homeowners convenient access to Denver Tech Center, Inverness Tech Center, and Downtown Castle Rock.

Additional Toll Brothers new home communities in Colorado include Allison Ranch, Montaine, Regency at Montaine (55+), Toll Brothers at Crystal Valley, and Toll Brothers at Macanta. More communities coming soon include Heights at DTC, ParkVue on the Platte, and Toll Brothers at Ken-Caryl Ranch.

For more information on Toll Brothers new home communities in Colorado, call (877) 431-2870 or visit TollBrothers.com/Colorado.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4125906b-15c3-4b73-b94c-d2e68d71c77f

https://www.globenewswire.com/NewsRoom/AttachmentNg/a590886e-e788-4a83-a16f-2f2c39054fbf

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ALICE WALTON Takes Money Off The Table, Sells $442.77M In Walmart Stock

Revealing a significant insider sell on September 10, ALICE WALTON, 10% Owner at Walmart WMT, as per the latest SEC filing.

What Happened: WALTON’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday unveiled the sale of 5,746,226 shares of Walmart. The total transaction value is $442,774,830.

As of Wednesday morning, Walmart shares are down by 1.36%, currently priced at $77.73.

All You Need to Know About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart: Financial Performance Dissected

Positive Revenue Trend: Examining Walmart’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.77% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Evaluating Earnings Performance:

-

Gross Margin: Achieving a high gross margin of 25.11%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Walmart’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 0.56.

Debt Management: With a below-average debt-to-equity ratio of 0.73, Walmart adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Walmart’s current Price to Earnings (P/E) ratio of 41.05 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.96 is above industry norms, reflecting an elevated valuation for Walmart’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 18.59, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Exploring Key Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Walmart’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Designer Brands' Q2 Struggles: Earnings Miss, Comparable Sales Decline, And Outlook Cut

Designer Brands Inc. DBI shares are trading lower on Wednesday.

The company reported second-quarter adjusted earnings per share of 29 cents, missing the street view of 53 cents. Quarterly sales of $771.9 million missed the analyst consensus of $816.137 million.

Designer Brands reported a decrease in net sales of 2.6%. Total comparable sales also declined by 1.4%.

“We saw sustained pressure on challenged categories such as dress and seasonal in the second quarter, which we were able to partially mitigate through providing a greater selection of athletic and athleisure brands in our assortment,” stated Doug Howe, Chief Executive Officer.

Also Read: GameStop, Designer Brands And 3 Stocks To Watch Heading Into Wednesday

The company’s gross profit fell to $252.9 million, down from $273.4 million the previous year, and the gross margin decreased to 32.8%, compared to 34.5% in the prior year.

Cash and cash equivalents totaled $38.8 million at the end of the second quarter.

The company ended the second quarter with inventories of $642.8 million compared to $606.8 million at the end of the same period last year.

In the second quarter of 2024, the company closed one store in the U.S. and opened two stores in Canada, resulting in 499 stores in the U.S. and 177 stores in Canada as of August 3, 2024.

Outlook: Designer Brands has lowered its fiscal year 2024 outlook, now expecting adjusted EPS to be between $0.50 and $0.60, compared to the previous view of $0.70 to $0.80. This new forecast is below the estimate of $0.75.

The company projects net sales growth of flat to low-single digits (prior view: low-single digits).

Price Action: DBI shares are trading lower by 28.2% to $4.17 premarket at last check Wednesday.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

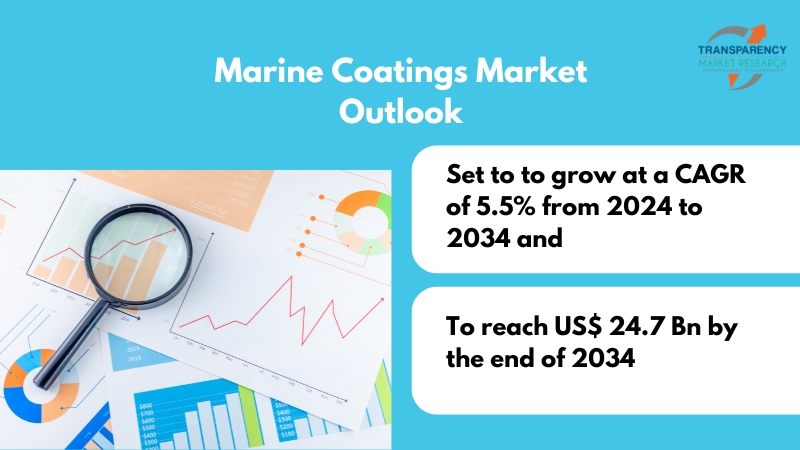

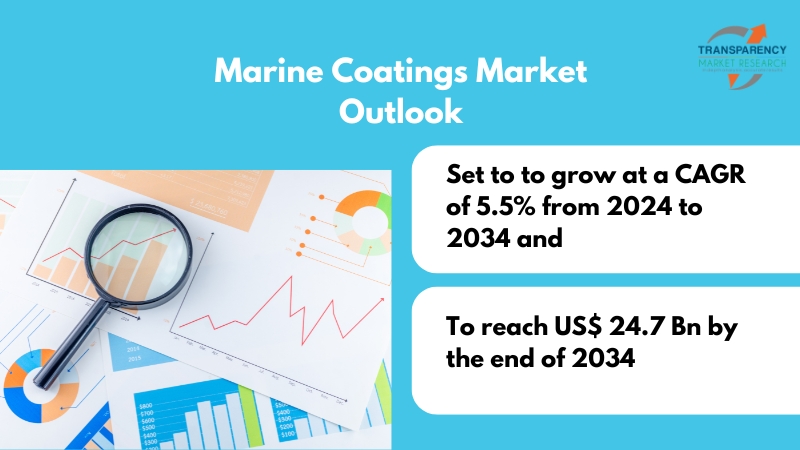

Marine Coatings Market Size & Share to Surpass USD 24.7 billion by 2034 | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 11, 2024 (GLOBE NEWSWIRE) — The global marine coatings market (해양 코팅 시장) is estimated to flourish at a CAGR of 5.5% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for marine coatings is estimated to reach US$ 24.7 billion by the end of 2034.

A significant driver is the increasing demand for coatings with enhanced antifouling properties to combat the spread of invasive species. As global shipping routes expand, there’s a growing concern about the introduction of non-native species into new ecosystems. To address this issue, there’s a rising need for marine coatings that effectively deter marine fouling organisms, minimizing their impact on marine ecosystems.

The rise of sustainable tourism and recreational boating activities is driving demand for eco-friendly marine coatings. Boat owners and operators are increasingly prioritizing environmentally responsible coatings that minimize harm to marine ecosystems while providing effective protection against corrosion and fouling.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/marine-coatings.html

The emergence of new substrates and materials in ship construction is influencing coating requirements. Advanced materials such as composites and aluminum alloys offer unique challenges for coating adhesion and durability, driving the need for specialized coatings tailored to these substrates.

The increasing prevalence of bio-based and renewable coatings is gaining traction in the marine industry. These coatings offer environmental benefits while maintaining high performance, aligning with the industry’s sustainability goals and regulatory requirements.

Key Findings of the Market Report

- Anti-fouling coatings lead the marine coatings market, providing essential protection against marine fouling organisms and maintaining vessel performance and fuel efficiency.

- Epoxy resin segment leads the marine coatings market due to its superior adhesion, durability, and resistance to water, chemicals, and abrasion.

- New shipbuilding segment leads the marine coatings market due to increased demand for coatings to protect newly constructed vessels.

Marine Coatings Market Growth Drivers & Trends

- Increasing global trade volumes drive demand for marine coatings to protect vessels from corrosion, fouling, and environmental degradation.

- Growing focus on eco-friendly coatings fuels innovation in sustainable and low-VOC formulations.

- Development of advanced coatings with enhanced durability, adhesion, and anti-corrosive properties boosts market growth.

- Growing investments in offshore oil and gas exploration, renewable energy, and maritime infrastructure drive demand for protective coatings.

- Adoption of hull coatings designed to reduce drag and improve fuel efficiency supports market growth amidst rising fuel costs and environmental concerns.

Global Marine Coatings Market: Regional Profile

- North America stands as a major market driven by the presence of prominent players like PPG Industries and Sherwin-Williams, catering to a robust marine industry encompassing shipping, offshore, and naval sectors. Stringent environmental regulations and a focus on sustainability propel demand for eco-friendly coatings in this region.

- Europe boasts a mature market characterized by strict regulatory standards and a strong emphasis on innovation. Key players such as AkzoNobel and Hempel A/S lead the region, offering a wide range of advanced coatings solutions for shipbuilding, maintenance, and repair. Growing investments in renewable energy and offshore wind farms further stimulate market growth in Europe.

- In the Asia Pacific, rapid industrialization, maritime trade expansion, and rising shipbuilding activities drive significant market demand. Local players like Nippon Paint Holdings Co., Ltd. and Kansai Paint Co., Ltd. dominate this region, capitalizing on their expertise and understanding of local market dynamics.

- Increasing investments in infrastructure development, particularly in emerging economies like China and India, fuel demand for marine coatings for port infrastructure, offshore platforms, and vessel maintenance.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/marine-coatings.html

Marine Coatings Market (Marché des revêtements marins): Competitive Landscape

In the competitive marine coatings market, global players such as AkzoNobel, PPG Industries, and Hempel A/S dominate, offering comprehensive portfolios of anti-corrosion, antifouling, and protective coatings. Regional contenders like Jotun and Chugoku Marine Paints also hold significant market share, leveraging localized expertise and distribution networks.

Technological advancements, environmental regulations, and shifting customer preferences drive competition, prompting companies to innovate sustainable, high-performance coatings. Strategic collaborations, mergers, and acquisitions further intensify rivalry, as players vie to expand market reach and enhance product offerings.

Amidst this dynamic landscape, differentiation through product quality, environmental compliance, and customer service remains key to sustaining competitive advantage. Some prominent players are as follows:

- Akzo Nobel N.V.

- Chugoku Marine Paints Ltd.

- Hempel A/S

- The Sherwin-Williams Company

- RPM International Inc.

- PPG Industries Inc.

- Nippon Paint Holdings Co. Ltd.

- Kansai Paint Co. Ltd.

- KCC Corporation

- Axalta Coating Systems Ltd.

- San Cera Coat Industries Pvt. Ltd

Product Portfolio

- RPM International Inc. offers a diverse range of specialty coatings, sealants, and building materials. With a commitment to innovation and sustainability, their products cater to various industries including construction, automotive, and industrial, ensuring durability, performance, and environmental responsibility.

- PPG Industries, Inc. is a global leader in coatings and specialty materials, providing innovative solutions for automotive, aerospace, and architectural applications. With a focus on performance, protection, and aesthetics, their products enhance surfaces, protect assets, and inspire creativity worldwide.

Marine Coatings Market: Key Segments

By Product

- Anti-fouling

- Anti-corrosion

- Foul Release

- Others

By Resin

By Marine

- Dry Docking

- New Shipbuilding

By Application

- Coastal

- Containers

- Deep Sea

- Leisure Boats

- Offshore Vessels

- Others

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

More Trending Reports by Transparency Market Research –

Alternate Marine Power Market (代替海洋電力市場) – The global alternate marine power Market is projected to advance at a CAGR of 11.2% from 2022 to 2031

Sustainable Marine Fuel Market (سوق الوقود البحري المستدام) – The global sustainable marine fuel market is projected to expand at a CAGR of 50.2% during the forecast period from 2022 to 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.