Paragon 28 Stock Gains From the Latest Launch of Its Right-Angle Drill

Paragon 28, Inc. FNA recently introduced a novel Right-Angle Drill, designed to improve tibia preparation prior to the implantation of the APEX 3D tibia. The Right-Angle Drill will be an addition to the APEX 3D Total Ankle Replacement System.

This recent advancement to the APEX 3D Total Ankle Replacement System should contribute to the long-term success of ankle replacements and ultimately improve surgeon experience and patient outcomes.

Following the launch, shares of Paragon 28 rose 3.1% to $7.72 yesterday. With the company gaining a high level of synergies from its continuously expanding product portfolio within the total ankle replacement industry, we expect market sentiment to remain positive around this development.

About Paragon 28’s Right-Angle Drill

The introduction of the Right-Angle Drill is a critical step toward addressing tibia implant loosening, which is the primary cause of total ankle replacement failure. The drill uses a linear guide to precisely drill vertical holes into the tibia for ideal peg placement and a highly stable tibia implant interface. This drill provides surgeons with more precise preparation and promotes better implant integration, thereby improving long-term outcomes for foot and ankle patients.

More on the News

The total ankle replacement device’s performance is expected to improve with the launch of the Right-Angle Drill. The company has also made a few other instrumental enhancements, including the recently released Polishing Blocks, Square Tip Drill and next-generation Off-Set Impaction Handle.

Paragon 28 will showcase the APEX Right-Angle Drill at the American Orthopaedic Foot & Ankle Society Annual Meeting this week in Vancouver, British Columbia. The company will also showcase the recently launched R3FLEX Stabilization System, along with the SMART28 Case Management Portal. Throughout the meeting, FNA will showcase its other products, including the SMART Bun-Yo-Matic, the FJ2000 Power Console and Burr System, and the PRECISION MIS Bunion System.

Industry Prospects Favor Paragon 28

Per a Global Market Insights (GMI) report, the total ankle replacement market was valued at around $1 billion in 2023 and is expected to reach around $1.6 billion by 2032 at a CAGR of 5.3% during the period.

Key factors expected to spur the market growth include a growing patient preference for joint preservation and restoration, improved surgical outcomes, and ongoing investments in research and development.

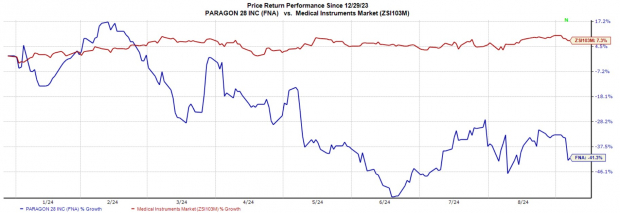

Image Source: Zacks Investment Research

Other Recent Developments by Paragon 28

Earlier this month, FNA launched the R3FLEX Stabilization System, designed to restore stability to the ankle syndesmosis after suffering an injury from an ankle fracture or high ankle sprain. The latest innovation is aimed at strengthening the company’s syndesmotic injury repair portfolio.

Last month, Paragon 28 launched the SMART28 Case Management Portal. This cutting-edge platform leverages AI to provide a seamless user experience to coordinate patient-specific surgical plans. It is the first major launch within Paragon 28’s SMART28 ecosystem, a portfolio of solutions and products.

Price Performance of Paragon 28

Year to date, shares of FNA have lost 37.9% against the industry’s 8.4% growth.

FNA’s Zacks Rank and Key Picks

Paragon 28 currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Intuitive Surgical, TransMedics Group and Quest Diagnostics. While Intuitive Surgical and TransMedics currently sport a Zacks Rank #1 (Strong Buy) each, Quest Diagnostics carries a Zacks Rank #2 (Buy).

Intuitive Surgical’s shares have surged 60.5% in the past year. Estimates for the company’s earnings have moved north 5.1% to $1.65 per share for 2024 in the past 30 days.

ISRG’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 8.97%. In the last reported quarter, it posted an earnings surprise of 16.34%.

Estimates for TransMedics’ 2024 EPS have moved up 125% to 27 cents in the past 30 days. Shares of the company have soared 135.2% in the past year compared with the industry’s 14.9% growth.

TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for Boston Scientific’s 2024 EPS have increased 1.7% to $2.40 in the past 30 days. In the past year, shares of BSX have risen 55.5% compared with the industry’s 17.9% growth.

In the last reported quarter, BSX delivered an earnings surprise of 6.90%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.18%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply