'Put In' The CBDC: Russian Central Bank Targets July 2025 For Widespread Digital Ruble Use

The Bank of Russia announced on Thursday that by July 1, 2025, the country’s largest banks will be required to provide full digital ruble services to their clients, marking a significant step toward the widespread use of the national digital currency.

What Happened: This initiative will allow citizens and businesses to open and top up digital ruble accounts, make transfers, and integrate digital rubles into their payment infrastructure, offering an alternative to cash and non-cash transactions.

The Russian Central Bank’s plan aims to make digital rubles readily available to everyone.

As part of this push, banks with universal licenses will have until July 2026 to upgrade their systems, while other credit institutions will have until July 2027.

In addition, trade and service enterprises (TSEs) will be mandated to accept digital ruble payments based on their annual revenue, starting with businesses generating more than 30 million rubles by July 2025.

Smaller businesses will be phased in by 2027.

The proposals for these legislative changes have already been submitted to the Russian Ministry of Finance, as the Central Bank prepares for the mass adoption of the digital ruble.

“The rollout will make the digital ruble available on an equal basis with traditional cash and non-cash payments,” the regulator noted in the announcement.

Also Read: Crypto Bank Anchorage Digital Challenges Coinbase’s ETF Custody Dominance

Why It Matters: The digital ruble is a digital form of Russia’s national currency, designed to expand payment and transfer options while reducing costs for financial institutions.

The system, based on the National Payment Card System (NSPK), will utilize universal QR codes to streamline transactions. All digital ruble transactions for citizens will be free, providing a cost-effective alternative for both individuals and businesses.

Currently, a pilot program involving 12 banks and 9,000 participants is underway, and the program has been expanding.

By September 1, 2024, the number of participating trade and service enterprises grew to 1,200 from 22, further signaling the digital ruble’s potential impact on Russia’s financial landscape.

The introduction of the digital ruble is part of a broader global trend toward central bank digital currencies (CBDCs), as governments seek to modernize their financial systems.

What’s Next: Discussions on the future of digital currencies and their role in global finance will be explored at Benzinga’s Future of Digital Assets event on Nov. 19, where industry leaders will discuss the implications of CBDCs like the digital ruble and how they will shape the future of digital payments.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Laws Could Unleash $1.7B Demand For Cannabis Loans, This Real Estate Stock Is Set To Capitalize

Advanced Flower Capital Group AFCG, a NASDAQ-listed commercial mortgage REIT, has positioned itself as one of the leading lenders in the cannabis sector.

As one of two major externally managed REITs focusing on the U.S. cannabis industry, AFCG benefits from a capital supply-demand imbalance.

This imbalance allows the company to generate high yield-to-maturity (YTM) rates, with a reported YTM of 19% as of August 1, 2024, on a loan portfolio valued at $287 million.

Capitalizing On Supply-Demand Imbalance

In a Wednesday note, senior analyst Pablo Zuanic of Zuanic & Associates explains how AFCG secures favorable lending terms due to limited capital access for cannabis operators, driven by federal illegality. With 24 states legalizing adult use and 38 legalizing medical cannabis, AFCG has become a key lender, benefiting from the capital imbalance to maintain high YTM rates while keeping funding costs in the mid to high-single digits.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Streamlined Focus After CRE Spin-Off

In July 2024, AFCG spun off its commercial real estate (CRE) loan assets into a separate entity, Sunrise Realty Trust SUNS, marking a strategic move to focus solely on cannabis-related loans.

Zuanic explained that this spin-off was well-received by investors, contributing to a 20% increase in AFCG’s stock price since July 9. Following the spin-off, AFCG’s loan book stands at $240 million, with an additional $67 million in cash reserves and $88 million in debt. The company has access to over $100 million in capital, which it intends to deploy in further cannabis-related loans.

Growing Loan Book With Diverse Borrowers

AFCG’s loan book has shown significant growth, with four new deals totaling over $70 million secured between March and June 2024. Notable deals include loans to Sunburn Cannabis in Florida ($36.5 million), SocietyC in Michigan ($15 million), a Tier-2 licensee in Georgia ($11 million), and Gron Edibles ($7.5 million).

In addition, Zuanic noted the company’s loan portfolio is highly concentrated, with eight borrowers accounting for 96% of the principal. Despite this, AFCG has focused on expanding its reach by lending to operators in limited-license states, which tend to offer better financial stability due to restricted competition.

AFCG has encountered challenges with legacy loans, including two loans in non-accrual status totaling $62 million and a third loan in forbearance, valued at $79 million.

Favorable Industry Dynamics

The cannabis industry continues to present favorable growth prospects for AFCG. Legal cannabis sales in the U.S. are expected to reach $42 billion by 2027, with a compound annual growth rate (CAGR) of nearly 10%.

Zuanic also noted that several key states, including Florida, North Dakota, South Dakota and Pennsylvania are poised to expand their adult-use and medical cannabis programs, potentially increasing the demand for debt capital by $1.7 billion.

Strong Financial Position And Dividend Yield

According to Zuanic’s report, AFCG boasts a strong financial position, with a book value per share of $9.64 as of mid-2024.

The company’s stock is trading at a price-to-book ratio of 1.04x, in line with its peer Chicago Atlantic Real Estate Finance, Inc. REFI but below that of sector leader Innovative Industrial Properties IIPR, which trades at 1.82x. AFCG’s attractive dividend yield, currently near 13%, makes it an appealing choice for income-focused investors.

The company distributes 85% to 100% of its distributable earnings in dividends and is projected to increase its dividend payout to 36 cents per quarter by the end of 2024.

Zuanic’s Investment Outlook

AFCG offers a compelling investment case, driven by its high YTM rates, strong dividend yield and focused cannabis lending strategy. The company’s proactive approach to managing legacy loan issues, combined with its access to capital and expanding borrower base, positions it well for continued growth.

Moreover, the potential for favorable federal cannabis reforms and continued industry expansion could further enhance AFCG’s financial performance.

While the company’s loan book remains concentrated, its strategic focus on lending to well-capitalized operators in restricted-license states provides a measure of security for investors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Daktronics Director Trades $84K In Company Stock

A new SEC filing reveals that Howard I Atkins, Director at Daktronics DAKT, made a notable insider purchase on September 11,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Atkins purchased 7,160 shares of Daktronics. The total transaction amounted to $84,989.

At Thursday morning, Daktronics shares are down by 0.0%, trading at $12.19.

Get to Know Daktronics Better

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Daktronics: A Financial Overview

Decline in Revenue: Over the 3 months period, Daktronics faced challenges, resulting in a decline of approximately -2.77% in revenue growth as of 31 July, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Exploring Profitability:

-

Gross Margin: With a low gross margin of 26.4%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Daktronics’s EPS is below the industry average. The company faced challenges with a current EPS of -0.11. This suggests a potential decline in earnings.

Debt Management: With a below-average debt-to-equity ratio of 0.32, Daktronics adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 58.05 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.7 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 6.15 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Unlocking the Meaning of Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Footwear Company Caleres Faces Tough Q2 With Lowered FY24 Forecast As Back-To-School Sales Lag

Caleres, Inc. CAL shares are trading lower after the company reported worse-than-expected second-quarter results and lowered its annual outlook.

The company reported revenues of $683.32 million, missing the analyst consensus of $723.80 million. Famous Footwear sales rose 1.5% Y/Y, driven by a later-than-expected back-to-school season.

Meanwhile, Brand Portfolio sales fell 5.1%, impacted by operational reporting challenges from its SAP ERP implementation and weak seasonal demand in certain areas.

The company’s gross margin rate expanded 30 basis points year-over-year to 45.5%, with EBITDA totaling $57.2 million. Adjusted EPS of $0.85 missed the consensus of $1.22.

The company disclosed restructuring actions that are expected to result in $7.5 million in annualized SG&A savings, with $2 million in savings anticipated for fiscal 2024.

Outlook: The company lowered its guidance for FY24 net sales to decline by low single digits, compared to its previous guidance of flat to up 2%.

Caleres lowered its fiscal 2024 outlook for EPS to $3.94 – $4.09 versus prior guidance of $4.30 – $4.60 and guided adjusted EPS of $4.00 to $4.15 (consensus $4.42), which excludes $3 million in restructuring costs expected to occur in the third quarter.

For the third quarter, Caleres expects net sales to be flat to down 2% and adjusted EPS of $1.30 – $1.40 versus estimate of $1.50.

Jay Schmidt, president and chief executive officer, said, “While our brands and products continue to resonate with consumers and we remain confident in our long-term vision, our second quarter results in both segments fell short of our potential.”

“Our systems implementation led to lack of visibility that prevented us from delivering our expected results. We also experienced weak seasonal demand and back-to-school business came later than expected.”

“We are confident in our ability to get back on track and have addressed the issues from the ERP implementation that temporarily impacted visibility. We are also accelerating certain restructuring actions to improve the efficiency and effectiveness of our teams.”

As of August 3, 2024, inventories stood at $661.1 million, with cash and equivalents of $51.8 million. Borrowings under the asset-based revolving credit facility totaled $146.5 million at the end of the period.

In the near term, the company expects to continue focusing on reducing debt and still expects borrowings under its asset-based revolving credit facility to be less than $100 million by 2026.

Investors can gain exposure to the stock via SPDR S&P Retail ETF XRT and Cambria ETF Trust Cambria Micro and SmallCap Shareholder Yield ETF MYLD.

Price Action: CAL shares are down 18.7% at $30.28 at the last check Thursday.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Verusen Survey Reveals 71% of Manufacturing Procurement and Operations Leaders Believe MRO Should be a Strategic Initiative

ATLANTA, Sept. 12, 2024 (GLOBE NEWSWIRE) — Verusen, the industry leader driving AI-powered MRO (maintenance, repair, and operations) materials optimization, today announced the findings of its Future Strategies for MRO Optimization survey. The survey by Verusen, WBR Insights, and ProcureCon MRO focuses on the current state and future evolution of MRO materials and spare parts management, highlighting its strategic importance, existing challenges and opportunities.

Nearly three-quarters (71%) of the 250 procurement and operations leaders surveyed think MRO procurement/operations should be treated as a strategic initiative for continuous improvement and a potential innovation source. However, just over half (58%) of respondents note that MRO procurement/operations are treated as strategic organizational initiatives.

Balancing MRO working capital and risk has become increasingly important as large asset-intensive industries such as oil and gas, mining, energy and utilities, resources, and heavy manufacturing seek solutions to optimize their MRO inventories, spend, and risk with deeper intelligence. Roughly half of organizations need to take a risk-based approach, as the survey found that 46% of organizations do not include asset criticality (spare parts deemed the most critical to continuous operations) in their materials planning process.

“The survey highlights a critical need for organizations to align their MRO practices with broader business goals to drive strategic value,” said Chris Rand, Head of Research at WBR Insights. “By leveraging advanced technologies and improving data uniformity, companies can transform MRO from a cost center to a source of innovation and competitive advantage.”

“Rather than merely seeing the MRO function as a necessary project or cost, businesses now see it as a mission-critical deliverable, and companies are more apt to explore new methods and technologies, including AI, to enhance this capability and drive innovation,” said Scott Matthews, CEO of Verusen. “This is because improving MRO, while addressing asset criticality, delivers tangible results by removing risk and expense from procurement initiatives.”

The survey results underscore the fact that MRO is growing in mindshare among executives as one of the best methods to improve asset criticality and lower organizational risk. This understanding will help take MRO practices to a higher strategic level in the enterprise by 2030, with essential work yet to be accomplished, as an understanding of asset criticality applied to every material under an asset enables operations to make improved, risk-based decisions.

MRO Challenges And Opportunities

Survey respondents expressed specific challenges with product data inconsistencies and inaccuracies from different systems and sources. A lack of standardized data formats and incomplete information hampers efficient inventory management. The problem is further compounded by the complexity of integrating legacy systems with modern data management, leading to fragmented/siloed data. Centralizing inventory management and optimizing procurement without standardized product data is especially challenging.

Only 39% of survey respondents report full data uniformity across all materials, and many respondents do not regularly review asset criticality, which adds to the challenges.

Among the opportunities survey respondents noted, advanced technology is pivotal to future procurement and MRO improvements. Yet, most survey respondents cite the use of ERPs, supplier relationship management tools, and other systems that aren’t purpose-built for MRO as the primary systems they rely on to manage MRO procurement and inventory.

Additionally, respondents noted that they would expect AI-driven analytics of their inventory data to enhance operational effectiveness as part of their MRO practice. However, using technology alone is not enough to ensure success, as organizations must also prioritize continuous improvement in education and shaping the culture of their teams, for example, by investing in training employees in technology, processes, and best practices for working with partners.

For a copy of the complete survey findings, visit: https://verusen.com/collateral/future-strategies-for-mro-inventory-optimization/

Register for the Verusen, WBR Insights, and ProcureCon webinar: From Cost Center to Strategic Asset: Transforming MRO Procurement on September 17, 2024, at 1:00 p.m. ET here: https://wbresearch.zoom.us/webinar/register/WN_agShxuvIS0q2NrY0HbtOZQ#/registration.

Survey Background

The WBR Insights research team, sponsored by Verusen, spoke with 250 procurement and operations leaders for the Verusen Future Strategies for MRO Optimization report. All the respondents are at least partially responsible for indirect, spare parts, or maintenance (“MRO”) procurement or operations at their organizations. All the respondents represent organizations that manufacture their own products without outsourcing.

To learn more about Verusen and its approach to MRO Inventory Management, please visit https://verusen.com/

About Verusen

Verusen is a leading AI-powered MRO inventory optimization & collaboration SaaS provider focused on helping global, asset-intensive manufacturers streamline their supply and materials management strategy. Verusen uses advanced data science and artificial intelligence capabilities to harmonize disparate MRO data across multiple enterprise systems to provide complex supply chains with true visibility for supply and inventory planning and procurement intelligence. This helps organizations reduce risk, optimize working capital, and ensure production uptime to meet customer needs. The result is a foundation organizations can trust to fuel digital transformation and support supply chain maturity initiatives. Headquartered in Atlanta, Verusen has been named to the Inc. 5000 fastest-growing private companies list and one of Georgia’s Top 10 Innovative Technology Companies. Visit verusen.com for more information, or follow us on X/Twitter at @Verusen_AI and LinkedIn.

About ProCureCon MRO:

ProcureCon MRO is the premier event for procurement leaders and professionals specializing in Maintenance, Repair, and Operations (MRO) supplies and services. Bringing together experts from across industries, ProcureCon MRO provides a collaborative space to explore the latest trends, innovations, and strategies in managing MRO procurement. Through expert-led sessions, interactive discussions, and networking opportunities, attendees will gain actionable insights on optimizing supplier relationships, reducing costs, and driving operational efficiency. Whether you’re looking to streamline your MRO processes or stay ahead of the industry’s evolving demands, ProcureCon MRO is the must-attend event. For more information, please visit procureconmro.wbresearch.com.

About WBR Insights:

WBR Insights is the custom research division of Worldwide Business Research (WBR), the world leader in industry-driven thought-leadership conferences. Our mission is to help inform and educate key stakeholders with research-based whitepapers, webinars, digital summits, and other thought-leadership assets while achieving our clients’ strategic goals. For more information, please visit wbrinsights.com.

PR Contact:

Greg Cross

PenVine for Verusen

greg@penvine.com

+1 925 413 5327

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9354feb8-d27d-4efe-b65d-f198b11fea3e

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Three Warning Signals From The Economy Going Into 2025

With the U.S. presidential election weeks away, plenty of volatility catalysts could shift the market despite its solid performance year-to-date.

Cracks in the system have been appearing in recent months. We dive into three: a weakening labor market, Warren Buffett‘s cautious stance, and the potential presence of structural inflation.

Labor Revisions Flash Alert

After last month’s labor revision that saw 800,000 fewer jobs added, the August U.S. payroll report came lower than expected at 142,000.

Still, revisions from previous months paint an even worse picture.

July’s payroll figure was revised from 114,000 to 89,000, and June’s number nearly halved from 206,000 to 118,000. This data suggests that the labor market is weaker than expected. It raises questions about whether the August report has been overstated, too.

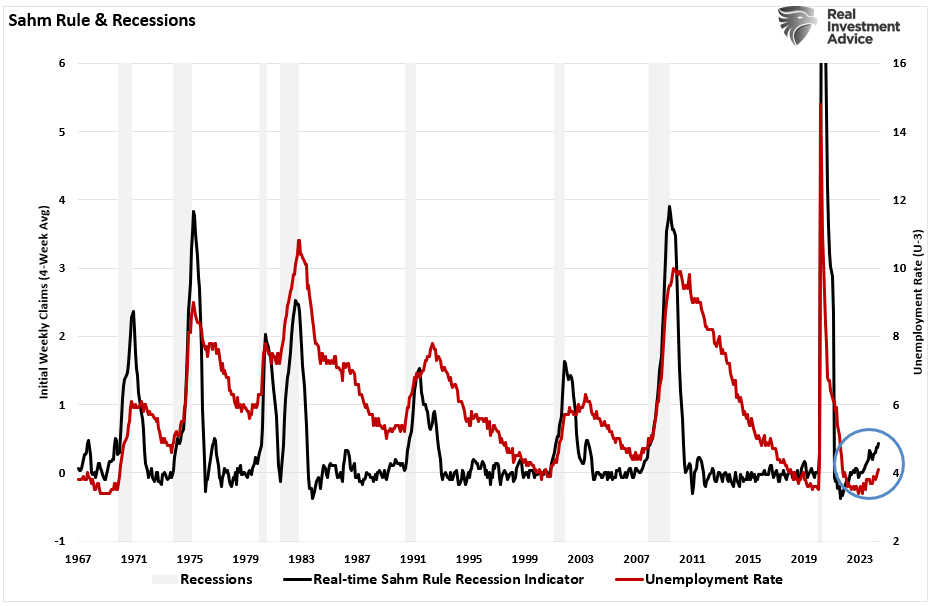

Furthermore, the Sahm rule, a recession confirmation tool, has been validated. After a 0.53 reading in July, the data ticked up to 0.57 in August, moving deeper into recession territory.

Sahm rule and recessions, Source: Real Investment Advice

Meanwhile, the yield curve has uninverted, with the two-year Treasury yield falling below the 10-year — a move that historically precedes recessions.

Buffett’s Cash Pile Sends A Message

Buffett has been slowly amassing almost $280 billion in cash, controlling over 3% of the T-bill market. In the second quarter, Berkshire Hathaway exited Paramount Global and Snowflake, reduced its position in Chevron, and nearly halved its huge position in Apple.

Furthermore, in Q3, Buffett started divesting from Bank of America, bringing the stake down to 11.1%. If this stake dips below 10%, the company could quietly exit the stake without disclosing the sale within the current regulatory framework of two business days.

Buffett’s cash pile is now closing in on BofA’s market cap of around $300 billion. Meanwhile, per the bank’s global research unit — the S&P 500 is determined to be expensive on 19 out of 20 metrics.

S&P 500 valuation metrics, Source: BofA Global Research

Thus, it is unsurprising that Buffett struggles to find new investment opportunities.

Inflation As A Part Of The New Economy

While the latest CPI data print showed a 2.5%, the inflation rate has been slow to decline since FED’s last rate hike in July 2023.

In fact, the July inflation rate was 2.89%, almost the same as 2.97% for July 2023. With modest seasonal oscillations, inflation has stabilized, and the market will need more than one data point to confirm a significant decline.

Stable inflation with a restrictive monetary policy means that this inflation could be structural — caused by persistent changes in supply and demand in the economy. In this case, lower supply caused by escalating deglobalization.

In 2023, US imports from China fell by 20% to $427 billion, and the trend might accelerate regardless of who sits in the White House in January. While Former President Trump initiated tariffs on Chinese goods, President Biden has increased tariffs on goods like steel, semiconductors, and EVs — bringing some up to 100%.

In the latest newsletter, EDC general partner Lyn Alden argued that the high debt-to-GDP ratio leaves the U.S. economy with two main choices. One is to keep interest very low despite periods of price inflation and debase all currency holders and bondholders.

The second one is to raise interest rates when needed meaningfully and contribute to a fiscal spiral of interest expense, hoping that the productivity growth from emerging technologies (such as AI) would be enough to offset the effect, contributing to the supply of goods and preventing the rapid rise in prices.

Now Read:

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

KOIL Energy to Present at Sidoti Virtual Investor Conference

HOUSTON, Sept. 12, 2024 (GLOBE NEWSWIRE) — KOIL Energy Solutions, Inc. KLNG, today announced Erik Wiik, President and CEO, will present and host one-on-one meetings with investors at the Sidoti September Virtual Investor Conference, taking place on September 18-19, 2024.

The presentation will begin at 10:45 AM ET on Wednesday, September 18, 2024 and can be accessed live here:

https://sidoti.zoom.us/webinar/register/WN_FNqu77kjRP2A_h57P9dRlQ

KOIL will also host virtual one-on-ones with investors on Wednesday and Thursday, September 18-19, 2024. To register for the presentation or one-on-ones, visit www.sidoti.com/events. Registration is free and you don’t need to be a Sidoti client.

About Sidoti Events, LLC (“Events”) and Sidoti & Company, LLC (“Sidoti”)

In 2023, Sidoti & Company, LLC , Sidoti & Company, LLC (www.sidoti.com) formed an affiliate company, Sidoti Events, LLC in order to focus exclusively on its rapidly growing conference business and to more directly serve the needs of presenters and attendees. The relationship allows Events to draw on the 25 years of experience Sidoti has as a premier provider of independent securities research focused specifically on small and microcap companies and the institutions that invest in their securities, with most of its coverage in the $200 million-$5 billion market cap range. Sidoti’s coverage universe comprises approximately 160 equities, of which 50 percent participate in the firm’s rapidly growing Company Sponsored Research (“CSR”) program. Events is a leading provider of corporate access through the eight investor conferences it hosts each year. By virtue of its direct ties to Sidoti, Events benefits from Sidoti’s small- and microcap-focused nationwide sales force, which has connections with approximately 2,500 institutional relationships in North America. This enables Events to provide multiple forums for meaningful interaction for small and microcap issuers and investors specifically interested in companies in the sector.

About KOIL

KOIL is a leading energy services company offering subsea equipment and support services to the world’s energy and offshore industries. Founded in 1997, the Houston-based company is comprised of world-class experts in engineering and manufacturing who provide innovative solutions to complex customer challenges with a fearless commitment to Energizing the Future. Koil Energy’s highly experienced team can support subsea engineering, manufacturing, installation, commissioning, and maintenance projects located anywhere in the world. Visit www.koilenergy.com to learn more.

Investor Relations Contact:

Trevor Ashurst

VP of Finance

ir@koilenergy.com

This press release was published by a CLEAR® Verified individual.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Guard Home Warranty Expands Nationally, Now Servicing 49 States

WARRENVILLE, Ill., Sept. 12, 2024 /PRNewswire/ — Guard Home Warranty, one of the fastest-growing home warranty companies in the United States, is excited to announce its recent national expansion. The company now operates in every state except California, offering its comprehensive home protection plans to millions of homeowners nationwide. This expansion is a significant milestone in the company’s growth and positions Guard Home Warranty as a leader in the home warranty industry.

“Our expansion into 49 states is a reflection of the trust homeowners have placed in us,” said Sergey Spisovskiy, CEO of Guard Home Warranty. “We are committed to providing homeowners with exceptional protection for their appliances and home systems, offering fast claims processing, and giving them the freedom to choose their own contractors. As we continue to grow, we remain focused on maintaining the high level of service and reliability that has defined our success.”

Founded in 2018, Guard Home Warranty has quickly risen to prominence by offering homeowners an unparalleled combination of value and flexibility. Key benefits that have contributed to the company’s rapid growth include:

- Choose your own contractor: Homeowners are not limited to a network but can select their own trusted professionals for repairs.

- Industry-leading claim turnaround time: Guard Home Warranty is known for processing claims faster than many competitors.

- $25,000 in aggregate coverage: This robust coverage provides financial protection for homeowners, reducing the stress of expensive repairs.

- No service claim fee unless approved: A significant cost-saving feature that sets Guard apart from other home warranty providers.

- Free listing policy: For homeowners selling their homes, this feature ensures coverage continues during the sales process.

Guard Home Warranty is also proud to hold an A rating from the Better Business Bureau (BBB), reflecting its dedication to customer satisfaction and trustworthiness.

Homeowners can choose from three main coverage plans:

- Appliance Package: Coverage for major household appliances like refrigerators, washers, and dryers.

- Systems Package: Protection for vital home systems including HVAC, plumbing, and electrical systems.

- VIP Package: A comprehensive plan that combines coverage for both appliances and home systems, offering maximum peace of mind.

Additionally, Guard Home Warranty offers optional coverage for items like pools, spas, and septic systems, allowing homeowners to customize their plans based on their specific needs.

As Guard Home Warranty continues its upward trajectory, Spisovskiy emphasized that the company’s core mission remains the same: “We strive to provide our customers with affordable and flexible solutions to protect their homes.”

For more information on Guard Home Warranty’s plans and services, visit www.guardhomewarranty.com or contact their customer support at 1-800-600-5129.

About Guard Home Warranty:

Guard Home Warranty provides home warranty services across 49 states, offering protection against costly repairs and replacements of home systems and appliances. Headquartered in Warrenville, IL, the company is accredited by the BBB with an A rating and is known for its industry-leading claims turnaround times and flexible coverage options.

Media Contact:

Sergey Spisovskiy

CEO, Guard Home Warranty

1-800-600-5129

383132@email4pr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/guard-home-warranty-expands-nationally-now-servicing-49-states-302246133.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/guard-home-warranty-expands-nationally-now-servicing-49-states-302246133.html

SOURCE Guard Home Warranty

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dollar Tree Unusual Options Activity For September 12

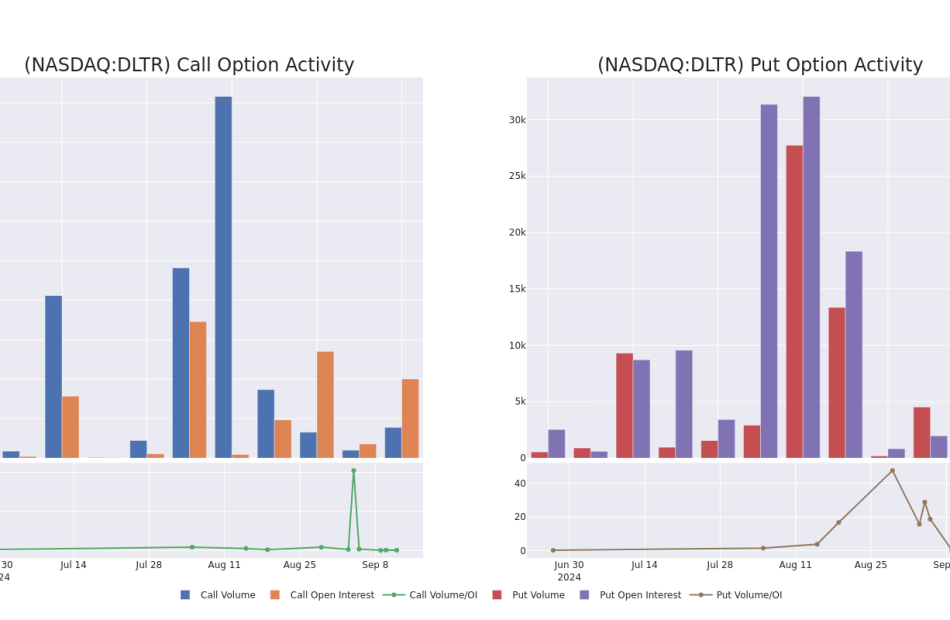

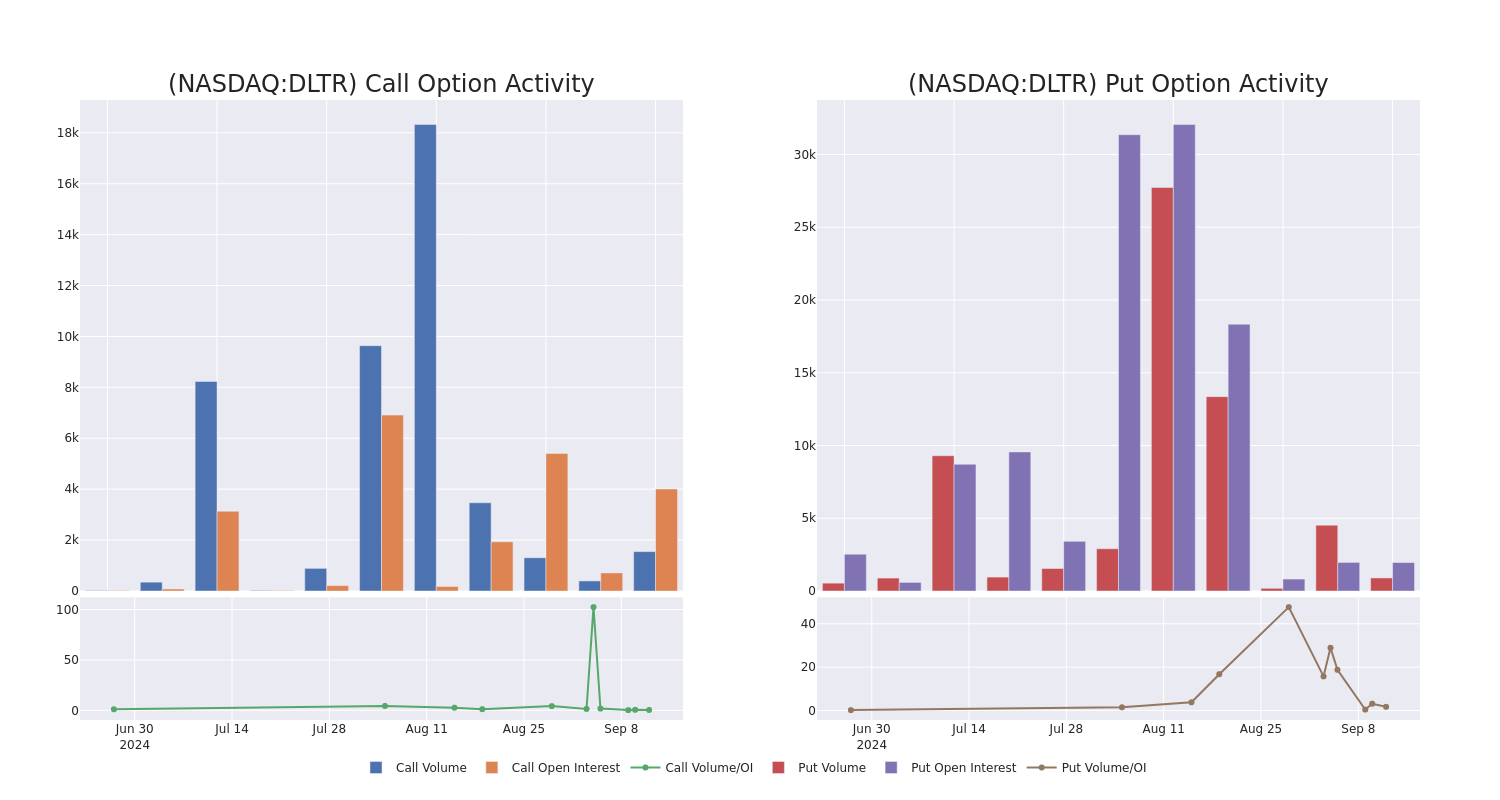

Financial giants have made a conspicuous bearish move on Dollar Tree. Our analysis of options history for Dollar Tree DLTR revealed 12 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $191,250, and 6 were calls, valued at $730,630.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $95.0 for Dollar Tree during the past quarter.

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Dollar Tree stands at 662.89, with a total volume reaching 2,449.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dollar Tree, situated within the strike price corridor from $65.0 to $95.0, throughout the last 30 days.

Dollar Tree Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DLTR | CALL | TRADE | BEARISH | 03/21/25 | $6.0 | $5.8 | $5.81 | $80.00 | $551.9K | 355 | 950 |

| DLTR | CALL | SWEEP | BULLISH | 10/18/24 | $6.65 | $6.6 | $6.65 | $65.00 | $46.5K | 1.0K | 262 |

| DLTR | PUT | SWEEP | BEARISH | 01/17/25 | $5.15 | $5.0 | $5.1 | $65.00 | $41.8K | 513 | 324 |

| DLTR | CALL | SWEEP | BULLISH | 02/21/25 | $4.9 | $4.75 | $4.8 | $80.00 | $40.8K | 186 | 38 |

| DLTR | CALL | TRADE | BULLISH | 09/20/24 | $4.0 | $3.1 | $4.0 | $65.00 | $40.0K | 2.0K | 200 |

About Dollar Tree

Dollar Tree operates discount stores across the United States and Canada, with over 8,600 shops under its namesake banner and nearly 7,800 under Family Dollar. About 47% of Dollar Tree’s sales in fiscal 2023 were composed of consumables (including food, health and beauty, and cleaning products), around 45% from variety items (including toys and homewares), and over 5% from seasonal items. The Dollar Tree banner sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. Conversely, Family Dollar primarily sells consumable merchandise (80% of the banner’s sales) at prices below $10. About two-thirds of Family Dollar’s stores are located in urban and suburban markets, with the remaining one-third located in rural areas.

Where Is Dollar Tree Standing Right Now?

- With a volume of 1,254,855, the price of DLTR is up 4.72% at $69.72.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 76 days.

What The Experts Say On Dollar Tree

In the last month, 5 experts released ratings on this stock with an average target price of $86.6.

- Consistent in their evaluation, an analyst from Telsey Advisory Group keeps a Outperform rating on Dollar Tree with a target price of $95.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Dollar Tree, which currently sits at a price target of $80.

- In a cautious move, an analyst from BMO Capital downgraded its rating to Market Perform, setting a price target of $68.

- An analyst from Wells Fargo has decided to maintain their Overweight rating on Dollar Tree, which currently sits at a price target of $100.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on Dollar Tree, which currently sits at a price target of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Dollar Tree options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

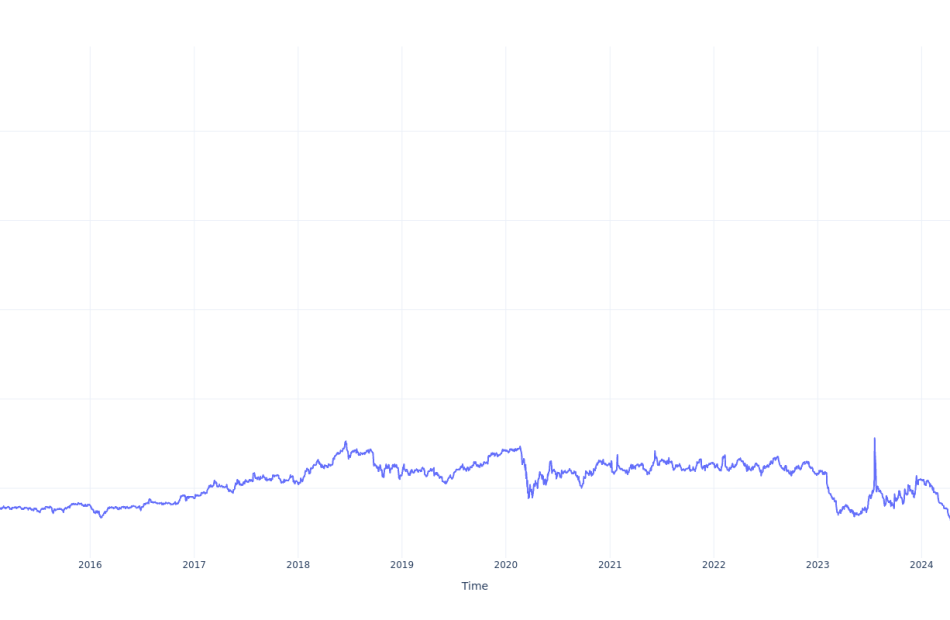

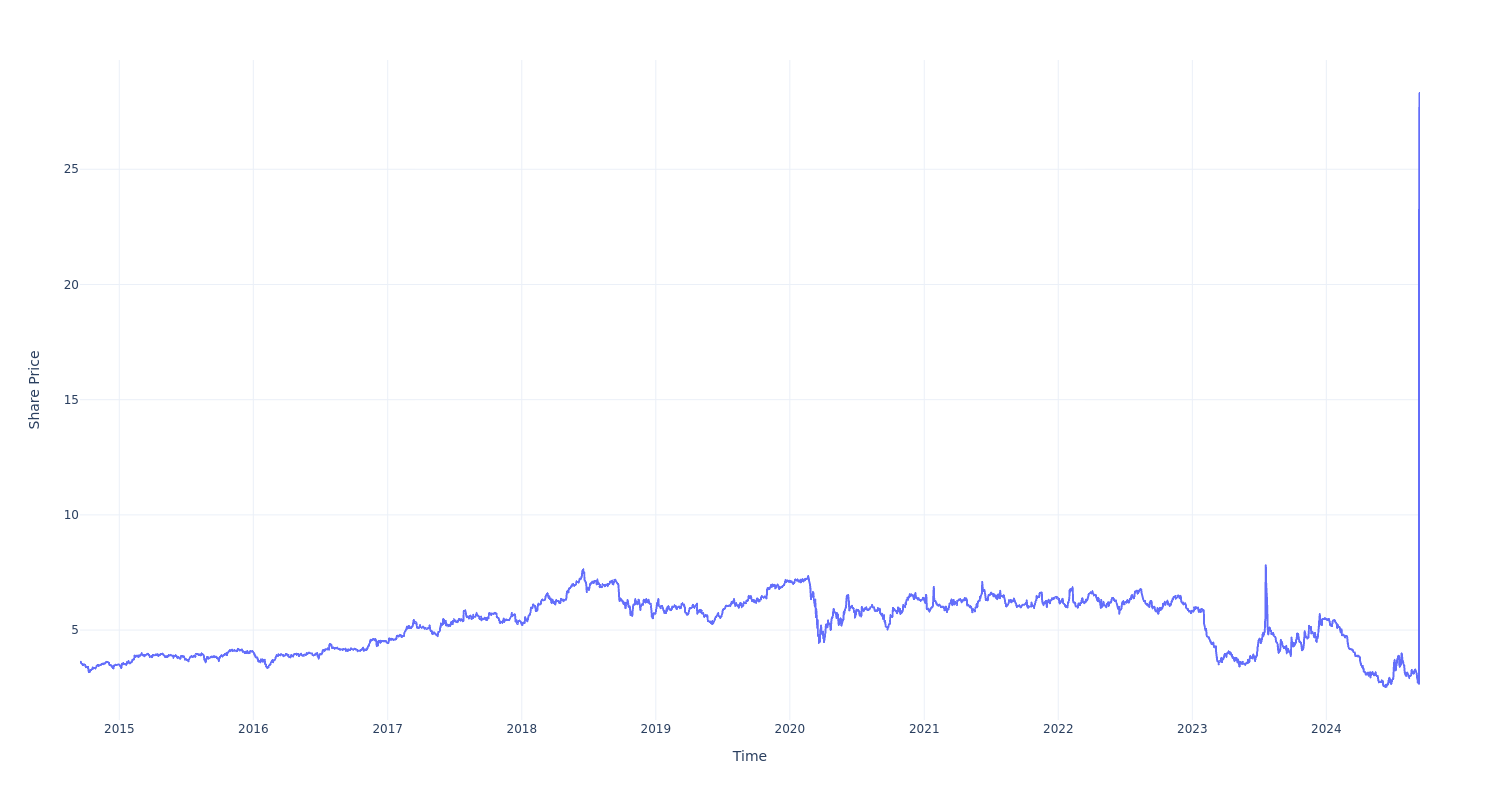

Here's How Much $1000 Invested In Sirius XM Holdings 10 Years Ago Would Be Worth Today

Sirius XM Holdings SIRI has outperformed the market over the past 10 years by 11.09% on an annualized basis producing an average annual return of 21.82%. Currently, Sirius XM Holdings has a market capitalization of $9.24 billion.

Buying $1000 In SIRI: If an investor had bought $1000 of SIRI stock 10 years ago, it would be worth $7,248.27 today based on a price of $28.28 for SIRI at the time of writing.

Sirius XM Holdings’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.