Cava Group Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Cava Group.

Looking at options history for Cava Group CAVA we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $420,171 and 10, calls, for a total amount of $714,496.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $175.0 for Cava Group over the recent three months.

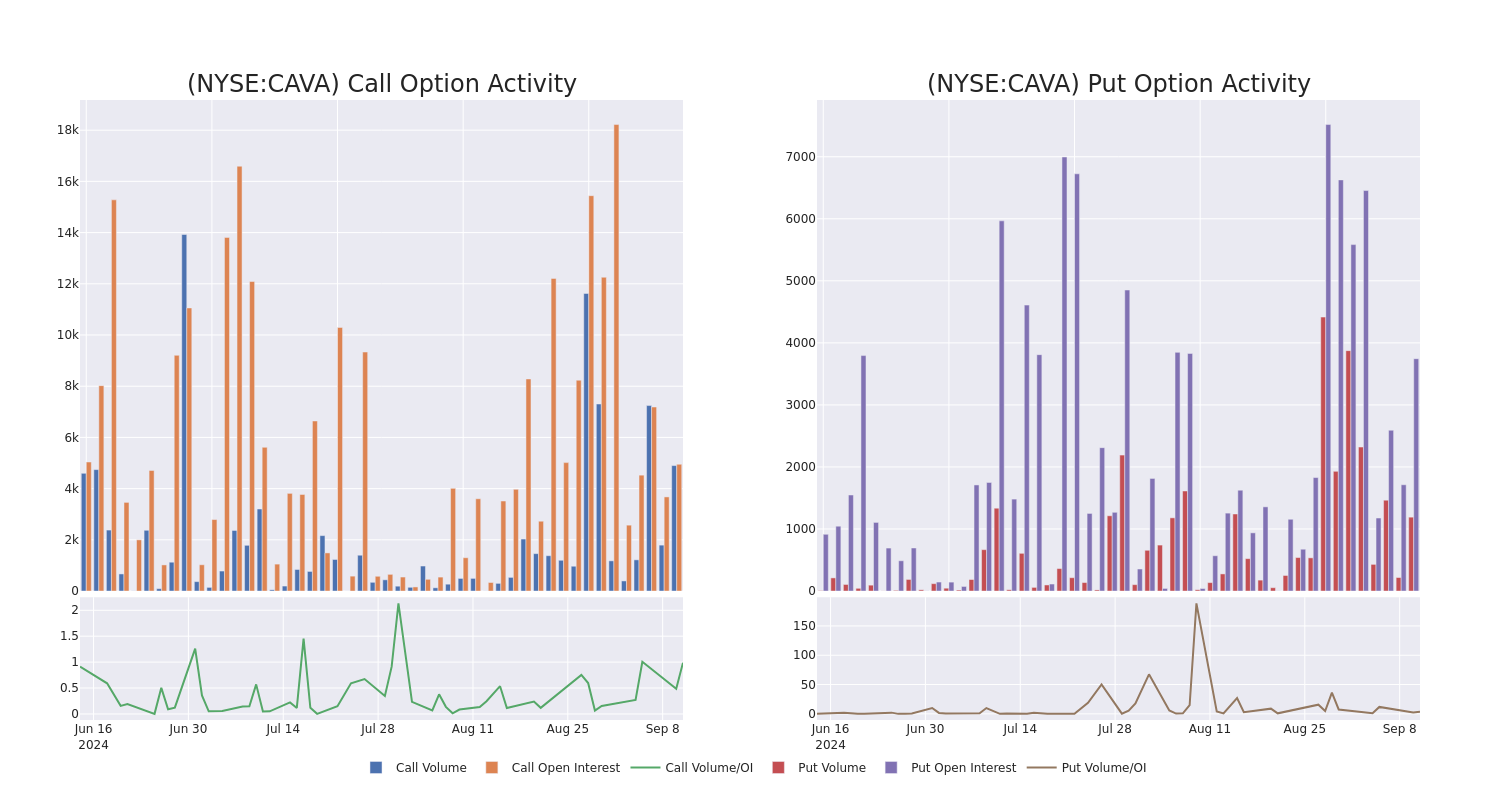

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cava Group’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cava Group’s substantial trades, within a strike price spectrum from $60.0 to $175.0 over the preceding 30 days.

Cava Group 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAVA | CALL | SWEEP | NEUTRAL | 01/16/26 | $38.2 | $37.6 | $38.2 | $110.00 | $286.0K | 33 | 75 |

| CAVA | CALL | TRADE | NEUTRAL | 01/16/26 | $17.6 | $17.0 | $17.3 | $175.00 | $95.1K | 112 | 55 |

| CAVA | PUT | SWEEP | BULLISH | 01/16/26 | $15.6 | $15.3 | $15.3 | $95.00 | $93.3K | 133 | 64 |

| CAVA | PUT | SWEEP | BEARISH | 01/17/25 | $9.8 | $9.6 | $9.8 | $110.00 | $83.2K | 234 | 86 |

| CAVA | PUT | SWEEP | BULLISH | 09/27/24 | $4.9 | $4.6 | $4.6 | $121.00 | $69.0K | 10 | 8 |

About Cava Group

Cava Group Inc owns and operates a chain of restaurants. It is the category-defining Mediterranean fast-casual restaurant brand, bringing together healthful food and bold, satisfying flavors at scale. The company’s dips, spreads, and dressings are centrally produced and sold in grocery stores. The company’s operations are conducted as two reportable segments: CAVA and Zoes Kitchen. The company generates the majority of its revenue from the CAVA segment.

In light of the recent options history for Cava Group, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Cava Group Standing Right Now?

- Currently trading with a volume of 1,412,511, the CAVA’s price is up by 0.84%, now at $120.73.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 55 days.

Expert Opinions on Cava Group

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $114.6.

- Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Cava Group, targeting a price of $95.

- Consistent in their evaluation, an analyst from Argus Research keeps a Buy rating on Cava Group with a target price of $128.

- An analyst from Citigroup persists with their Neutral rating on Cava Group, maintaining a target price of $115.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Cava Group, targeting a price of $120.

- Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Cava Group, targeting a price of $115.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cava Group with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply