Decoding Edwards Lifesciences's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on Edwards Lifesciences EW.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with EW, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 8 options trades for Edwards Lifesciences.

This isn’t normal.

The overall sentiment of these big-money traders is split between 100% bullish and 0%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $41,878, and 7, calls, for a total amount of $298,360.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $67.5 to $75.0 for Edwards Lifesciences over the recent three months.

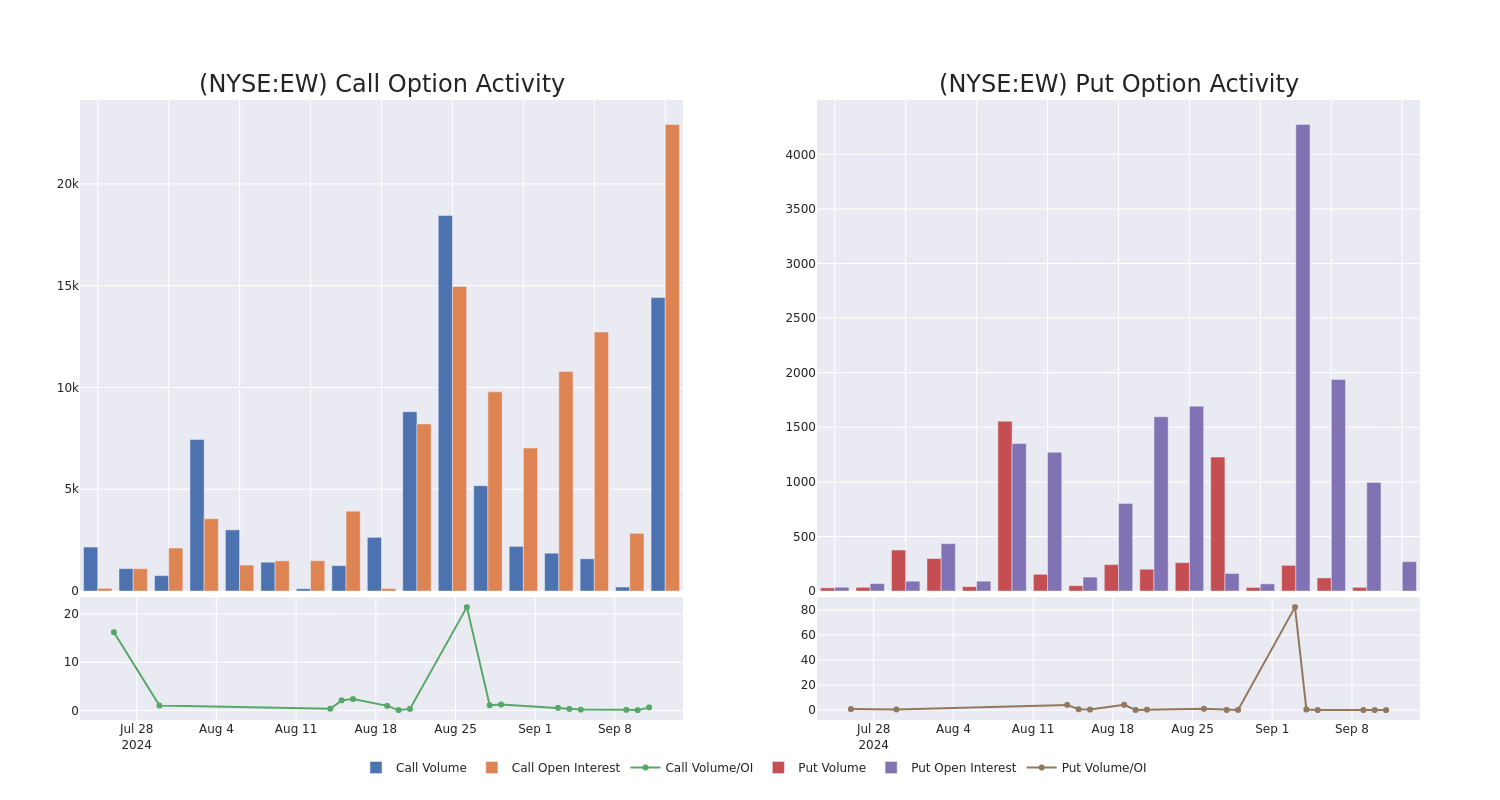

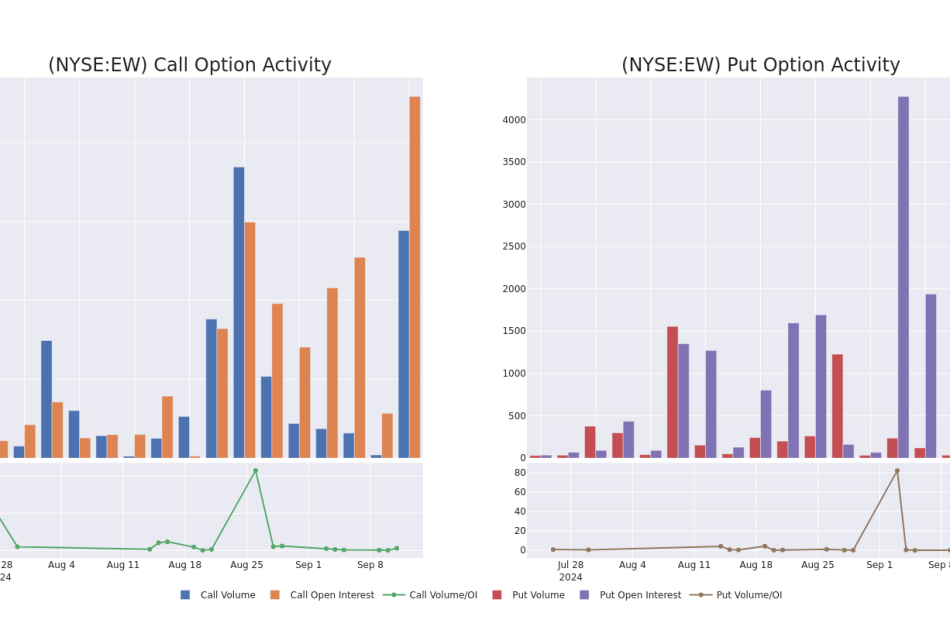

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Edwards Lifesciences options trades today is 5795.75 with a total volume of 14,415.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Edwards Lifesciences’s big money trades within a strike price range of $67.5 to $75.0 over the last 30 days.

Edwards Lifesciences Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | CALL | SWEEP | BULLISH | 10/18/24 | $1.9 | $1.7 | $1.75 | $70.00 | $94.3K | 2.3K | 539 |

| EW | CALL | SWEEP | BULLISH | 09/20/24 | $0.8 | $0.55 | $0.55 | $70.00 | $47.7K | 4.1K | 894 |

| EW | PUT | SWEEP | BULLISH | 11/15/24 | $4.8 | $4.6 | $4.6 | $67.50 | $41.8K | 269 | 1 |

| EW | CALL | SWEEP | BULLISH | 09/20/24 | $0.9 | $0.8 | $0.8 | $70.00 | $36.7K | 4.1K | 3.7K |

| EW | CALL | SWEEP | BULLISH | 09/20/24 | $0.6 | $0.25 | $0.25 | $75.00 | $32.4K | 16.5K | 1.5K |

About Edwards Lifesciences

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

Having examined the options trading patterns of Edwards Lifesciences, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Edwards Lifesciences Standing Right Now?

- Currently trading with a volume of 4,306,276, the EW’s price is up by 1.65%, now at $68.25.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

Expert Opinions on Edwards Lifesciences

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $78.33333333333333.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Edwards Lifesciences, targeting a price of $80.

- Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Edwards Lifesciences with a target price of $75.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Edwards Lifesciences, targeting a price of $80.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Edwards Lifesciences options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply