Dollar Tree Unusual Options Activity For September 12

Financial giants have made a conspicuous bearish move on Dollar Tree. Our analysis of options history for Dollar Tree DLTR revealed 12 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $191,250, and 6 were calls, valued at $730,630.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $95.0 for Dollar Tree during the past quarter.

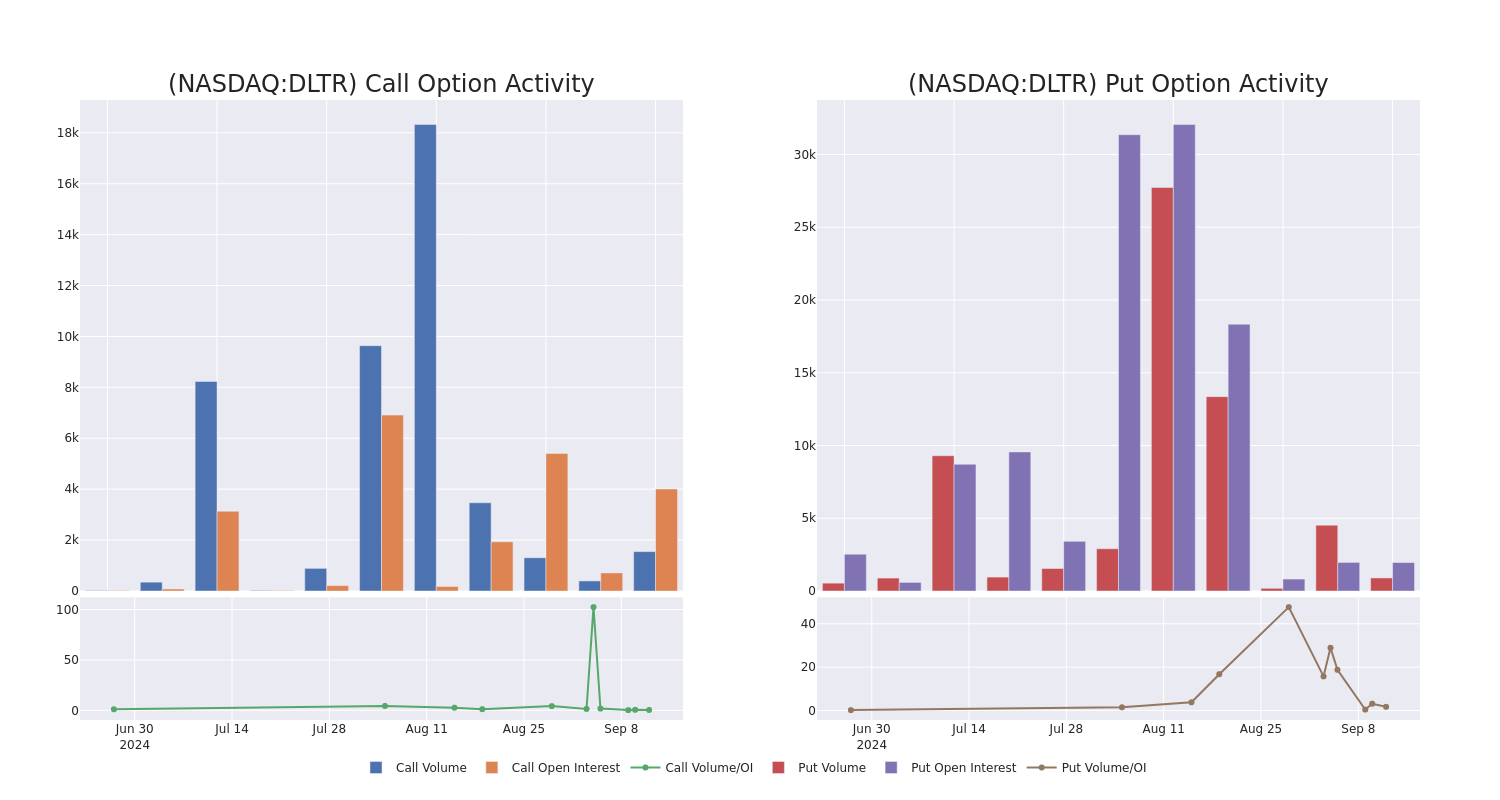

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Dollar Tree stands at 662.89, with a total volume reaching 2,449.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dollar Tree, situated within the strike price corridor from $65.0 to $95.0, throughout the last 30 days.

Dollar Tree Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DLTR | CALL | TRADE | BEARISH | 03/21/25 | $6.0 | $5.8 | $5.81 | $80.00 | $551.9K | 355 | 950 |

| DLTR | CALL | SWEEP | BULLISH | 10/18/24 | $6.65 | $6.6 | $6.65 | $65.00 | $46.5K | 1.0K | 262 |

| DLTR | PUT | SWEEP | BEARISH | 01/17/25 | $5.15 | $5.0 | $5.1 | $65.00 | $41.8K | 513 | 324 |

| DLTR | CALL | SWEEP | BULLISH | 02/21/25 | $4.9 | $4.75 | $4.8 | $80.00 | $40.8K | 186 | 38 |

| DLTR | CALL | TRADE | BULLISH | 09/20/24 | $4.0 | $3.1 | $4.0 | $65.00 | $40.0K | 2.0K | 200 |

About Dollar Tree

Dollar Tree operates discount stores across the United States and Canada, with over 8,600 shops under its namesake banner and nearly 7,800 under Family Dollar. About 47% of Dollar Tree’s sales in fiscal 2023 were composed of consumables (including food, health and beauty, and cleaning products), around 45% from variety items (including toys and homewares), and over 5% from seasonal items. The Dollar Tree banner sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. Conversely, Family Dollar primarily sells consumable merchandise (80% of the banner’s sales) at prices below $10. About two-thirds of Family Dollar’s stores are located in urban and suburban markets, with the remaining one-third located in rural areas.

Where Is Dollar Tree Standing Right Now?

- With a volume of 1,254,855, the price of DLTR is up 4.72% at $69.72.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 76 days.

What The Experts Say On Dollar Tree

In the last month, 5 experts released ratings on this stock with an average target price of $86.6.

- Consistent in their evaluation, an analyst from Telsey Advisory Group keeps a Outperform rating on Dollar Tree with a target price of $95.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Dollar Tree, which currently sits at a price target of $80.

- In a cautious move, an analyst from BMO Capital downgraded its rating to Market Perform, setting a price target of $68.

- An analyst from Wells Fargo has decided to maintain their Overweight rating on Dollar Tree, which currently sits at a price target of $100.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on Dollar Tree, which currently sits at a price target of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Dollar Tree options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply