Franklin's August AUM Balance Improves on Favorable Markets

Franklin Resources, Inc. BEN reported its preliminary assets under management of $1.68 trillion as of Aug. 31, 2024. This reflected an increase of 1.1% from the prior month’s level.

The improvement in AUM balance was due to the impact of positive markets, partially offset by long-term net outflows. Outflows included $7.7 billion of long-term net outflows at Western Asset Management. As previously revealed, the Macro Opportunities strategy, included in Alternative AUM, is closing and had $1.1 billion of AUM as of Aug. 31, 2024, and $0.9 billion of net outflows in the month.

Break Down of BEN’s AUM Based on Asset Class

BEN recorded equity assets of $603.7 billion, which rose 2.5% from the previous month. Further, fixed income AUM of $574.5 billion at the end of August 2024 increased marginally from the prior month. Likewise, Multi-asset AUM was $172.9 billion, growing modestly from July 2024.

On the other hand, Alternative AUM decreased 1.5% to $251.2 billion from the prior month’s level. Alternative AUM in the reported month includes a $2 billion reduction related to the reclassification of assets under administration.

The cash management balance was $64.35 billion, up 4.6% from the previous month.

Our Viewpoint on BEN

Franklin’s efforts to diversify business through buyouts, solid AUM balance and a strong distribution platform will aid its top line. However, elevated expenses and volatility in investment management fees, which bring in the majority of its revenues, are near-term concerns.

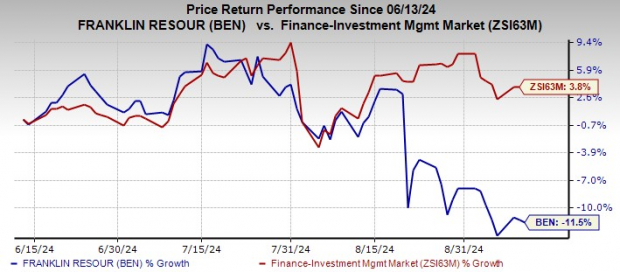

Over the past three months, shares of BEN have plunged 11.5% against the industry’s 3.8% rise.

Image Source: Zacks Investment Research

Currently, BEN carries a Zacks Rank #3 (Hold).

Performance of Other Asset Managers

Cohen & Steers, Inc. CNS reported a preliminary AUM of $88.1 billion as of Aug. 31, 2024. This reflected a rise of 4.1% from the prior month’s level.

The increase in CNS’ AUM balance was driven by the market appreciation of $3.7 billion and net inflows of $8 billion, partially offset by distributions of $152 million.

Invesco IVZ reported a preliminary month-end AUM of $1.75 trillion in August 2024. This represented a 1.1% increase from the previous month.

IVZ reported net long-term inflows of $2.4 billion in August. Non-management fee-earning net inflows were $0.9 billion, while money market net outflows totaled $6.4 billion. Further, Invesco’s AUM was favorably impacted by solid market returns, which boosted its AUM by $16 billion. Further, FX increased the AUM balance by $7.3 billion.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply