Here's Why You Should Buy Kronos Worldwide Stock Right Now

Kronos Worldwide, Inc. KRO is expected to benefit from higher demand for titanium dioxide (TiO2) and easing pricing pressure this year. Cost-reduction initiatives are also expected to support margins.

We are positive about KRO’s prospects and believe that the time is right for you to add the stock to your portfolio as it looks promising and is poised to carry the momentum ahead.

Let’s take a look into the factors that make this Zacks Rank #2 (Buy) stock a compelling choice for investors right now.

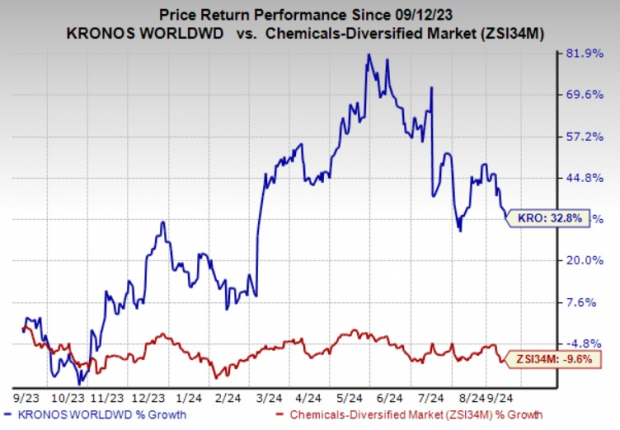

Kronos Worldwide’s Stock Outperforms Industry

KRO has outperformed the industry it belongs to over the past year. The company’s shares have rallied 32.8% compared with a 9.6% decline of the industry.

Image Source: Zacks Investment Research

Solid Earnings Growth Prospects for KRO

The Zacks Consensus Estimate for earnings for 2024 for Kronos Worldwide is currently pegged at 88 cents, reflecting an expected year-over-year growth of 304.7%. Earnings are also expected to register a 288.9% growth in third-quarter 2024.

KRO’s Earnings Estimates Northbound

Earnings estimates for KRO have been going up over the past 60 days. The Zacks Consensus Estimate for 2024 has increased by 3.5%. The consensus estimate for the third quarter has also been revised 9.7% upward over the same time frame. The favorable estimate revisions instill investor confidence in the stock.

Higher TiO2 Demand, Cost Actions Aid Kronos Worldwide

Kronos is well-positioned to gain from higher demand for TiO2 in major markets. Per the company, TiO2 consumption has increased at a compound annual growth rate of around 2% since 2000. Western Europe and North America account for roughly 14% and 15% of global TiO2 consumption, respectively. These regions are expected to continue to be the biggest consumers of TiO2. Markets for TiO2 are growing in South America, Eastern Europe, the Asia Pacific region and China.

The company expects sales volumes in 2024 to exceed 2023 levels factoring in the recently experienced improved demand and expectations that demand will continue to improve this year.

Kronos Worldwide is also taking actions to reduce costs and align production and inventories to expected demand levels, which are expected to support its margins. It has increased its production rates in sync with current and expected near-term demand improvement. It expects its production rates for the balance of 2024 to be higher than the level witnessed in 2023.

The company’s internal cost initiatives are also expected to continue to support margins in 2024. Reduced energy costs along with its cost-cutting initiatives and the realization of selling price increases are likely to result in improved margins on a year-over-year basis this year. The company has undertaken TiO2 selling price hikes, which need to be sustained to attain margins in line with historical levels. KRO expects to report higher operating results on a year-over-year basis for full-year 2024 based on the expected improved demand, higher selling prices and reduced production costs.

Stocks to Consider

Other top-ranked stocks in the Basic Materials space are, Hawkins, Inc. HWKN, IAMGOLD Corporation IAG and Eldorado Gold Corporation EGO, each sporting a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14, indicating a rise of 15.3% from year-ago levels. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days. The stock has rallied around 103% in the past year.

The consensus estimate for IAMGOLD’s current-year earnings has increased by 46.4% in the past 60 days. IAG beat the consensus estimate in each of the last four quarters with the average surprise being 200%. Its shares have shot up 111% in the past year.

The Zacks Consensus Estimate for Eldorado Gold’s current year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.3%. The company’s shares have rallied roughly 69% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply