Market Whales and Their Recent Bets on EXAS Options

Deep-pocketed investors have adopted a bullish approach towards Exact Sciences EXAS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in EXAS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 28 extraordinary options activities for Exact Sciences. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 57% leaning bullish and 32% bearish. Among these notable options, 4 are puts, totaling $278,937, and 24 are calls, amounting to $1,400,044.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $75.0 for Exact Sciences over the recent three months.

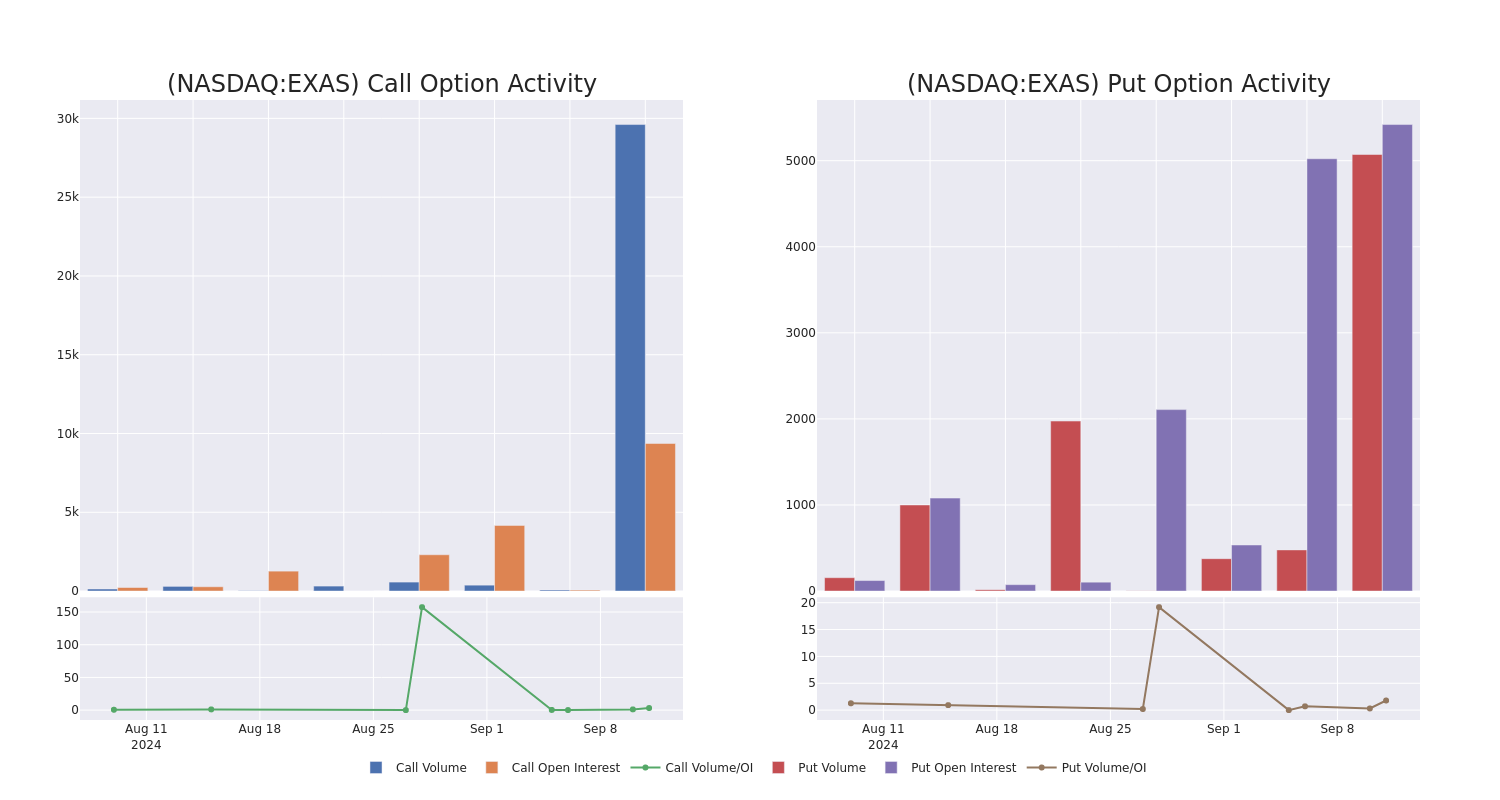

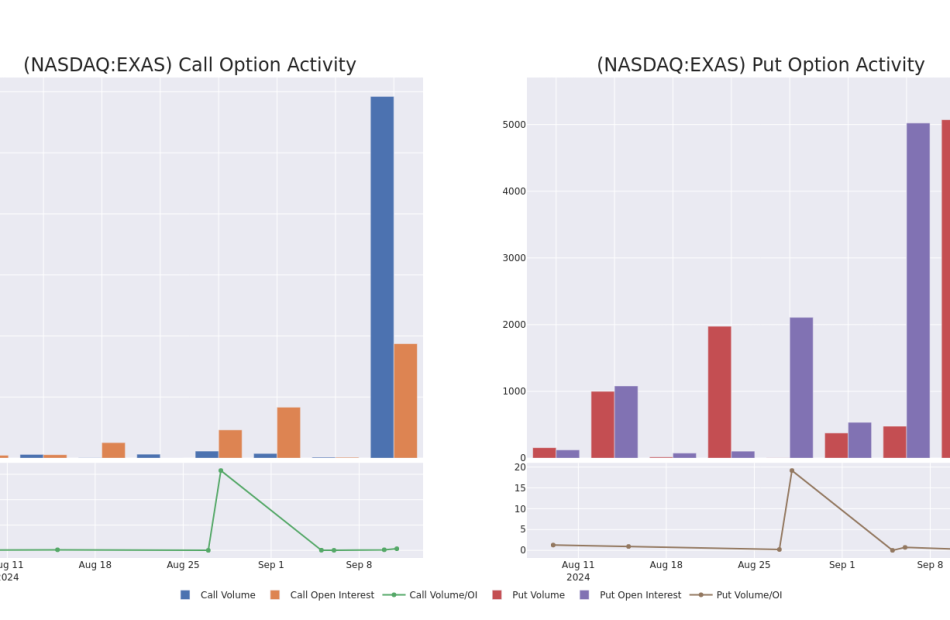

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Exact Sciences stands at 1642.89, with a total volume reaching 34,681.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Exact Sciences, situated within the strike price corridor from $55.0 to $75.0, throughout the last 30 days.

Exact Sciences Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXAS | CALL | SWEEP | BEARISH | 09/20/24 | $6.0 | $5.1 | $5.3 | $60.00 | $179.1K | 5.0K | 2.8K |

| EXAS | CALL | SWEEP | BULLISH | 09/20/24 | $3.9 | $3.0 | $3.9 | $62.50 | $117.0K | 1.5K | 650 |

| EXAS | PUT | TRADE | BULLISH | 09/20/24 | $2.0 | $0.5 | $0.7 | $55.00 | $104.9K | 4.3K | 3.1K |

| EXAS | CALL | SWEEP | BULLISH | 09/20/24 | $6.3 | $4.6 | $6.3 | $60.00 | $99.7K | 5.0K | 2.4K |

| EXAS | CALL | SWEEP | BULLISH | 09/20/24 | $2.8 | $1.4 | $2.8 | $60.00 | $93.2K | 5.0K | 1.4K |

About Exact Sciences

Exact Sciences Corporation, headquartered in Madison, Wisconsin, provides cancer screening and diagnostic test products in the United States and internationally. Exact’s Cologuard screening test, a noninvasive stool-based DNA test, is a pre-cancer screening test for colorectal cancer. The company also competes in the precision oncology market with Oncotype DX, a suite of tissue-based genomic tests for estimating recurrence risk and likelihood of benefit from chemotherapy for breast and colon cancer, and OncoExTra, a liquid-based comprehensive genomic profiling test. It is developing liquid biopsy tests for molecular residual disease, colorectal cancer screening, and multicancer screening, too.

Having examined the options trading patterns of Exact Sciences, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Exact Sciences Standing Right Now?

- With a trading volume of 5,015,141, the price of EXAS is up by 11.94%, reaching $65.35.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 49 days from now.

What The Experts Say On Exact Sciences

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $75.0.

- An analyst from Wells Fargo has revised its rating downward to Overweight, adjusting the price target to $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Exact Sciences with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply