RBC Bearings President and CEO Trades Company's Stock

MICHAEL HARTNETT, President and CEO at RBC Bearings RBC, executed a substantial insider sell on September 11, according to an SEC filing.

What Happened: HARTNETT opted to sell 3,000 shares of RBC Bearings, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $852,690.

As of Thursday morning, RBC Bearings shares are down by 0.0%, currently priced at $283.93.

Discovering RBC Bearings: A Closer Look

RBC Bearings Inc is an international manufacturer and marketer of highly engineered precision bearings, components and essential systems for the industrial, defense and aerospace industries. The offering includes plain bearings, roller bearings, ball bearings, and engineered products. The end market is the United States of America. The company has two reportable segments: Aerospace Defense segment represents the end markets for the company’s highly engineered bearings and precision components used in commercial aerospace, defense aerospace, and sea and ground defense applications; and Industrial segment represents the end markets for the company’s engineered bearings and precision components used in various industrial applications. It derives maximum revenue from Industrial Segment.

Key Indicators: RBC Bearings’s Financial Health

Revenue Growth: RBC Bearings displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 4.96%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Insights into Profitability:

-

Gross Margin: With a high gross margin of 45.29%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): RBC Bearings’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.92.

Debt Management: With a below-average debt-to-equity ratio of 0.42, RBC Bearings adopts a prudent financial strategy, indicating a balanced approach to debt management.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 41.82 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 5.26 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 19.91 reflects market recognition of RBC Bearings’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Exploring Key Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of RBC Bearings’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

84K Reasons To Be Bullish On Daktronics Stock

A significant insider buy by John P. Friel, Director at Daktronics DAKT, was executed on September 11, and reported in the recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Friel purchased 7,160 shares of Daktronics. The total transaction amounted to $84,989.

As of Thursday morning, Daktronics shares are up by 0.9%, currently priced at $12.3.

About Daktronics

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Financial Milestones: Daktronics’s Journey

Revenue Challenges: Daktronics’s revenue growth over 3 months faced difficulties. As of 31 July, 2024, the company experienced a decline of approximately -2.77%. This indicates a decrease in top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 26.4%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Daktronics’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of -0.11.

Debt Management: Daktronics’s debt-to-equity ratio is below the industry average. With a ratio of 0.32, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 58.05 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.7, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 6.15, Daktronics presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Transaction Codes Worth Your Attention

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GURU Organic Energy Announces Third Quarter 2024 Financial Results

- Focused on Return to Profitability: 18.3% reduction in net loss to $6.8 million in the first nine months of 2024, down from $8.3 million in the same period of 2023; achieved 50.6% improvement over 2022, demonstrating strong commitment to reducing costs.

- Strong Financial Position: $37.7 million in cash, cash equivalents and short-term investments, coupled with unused credit facilities, providing ample resources to drive GURU’s path to profitability, and selectively investing in growth opportunities.

- Revenue Growth and Margin Improvement: Net revenue rose by 6.9% to $23.1 million for the first nine months of 2024, up from $21.6 million in 2023. Gross profit increased by 11.6% for the same period, resulting in year-to-date gross margin of 54.8% (55.4% in Q3), compared to 52.5% a year ago, underscoring continued focus on operational efficiency.

- Quebec Market Share Expansion: Increase in market share by more than one percentage point to 18.3% in units over the last nine months compared to the previous year, reinforcing strong presence in Quebec market (based on Nielsen Quebec and untracked channels).

- Upcoming US Launches: US launch of Zero Sugar line on Amazon, in select fitness clubs and retailers, featuring Wild Berry, Wild Strawberry Watermelon and Wild Ruby Red and representing a pivotal step in expanding GURU’s footprint in the rapidly growing US sugar-free energy drink market.

MONTRÉAL, Sept. 12, 2024 (GLOBE NEWSWIRE) — GURU Organic Energy Corp. GURU (“GURU” or the “Company“), Canada’s leading organic energy drink brand1, today announced its results for the third quarter ended July 31, 2024. All amounts are in Canadian dollars unless otherwise indicated.

| Financial Highlights (in thousands of dollars, except per share data) |

Three months ended July 31 |

Nine months ended July 31 |

||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| $ | $ | $ | $ | |||||

| Net revenue | 7,940 | 8,878 | 23,087 | 21,602 | ||||

| Gross profit | 4,402 | 4,545 | 12,648 | 11,331 | ||||

| Net loss | (2,230 | ) | (3,006 | ) | (6,760 | ) | (8,276 | ) |

| Basic and diluted loss per share | (0.07 | ) | (0.09 | ) | (0.22 | ) | (0.26 | ) |

| Adjusted EBITDA2 | (2,221 | ) | (3,010 | ) | (6,872 | ) | (8,062 | ) |

Operational Excellence and Strategic Growth

Robust Quebec Retail Performance: GURU’s 2024 product innovations, including Peach Mango Punch and Zero Wild Berry, continued to drive sales growth in Quebec, capturing a combined market share of 3.0% in the last four weeks ended July 13, 2024. Performance in Quebec wholesale club channel remained robust.

US Market Growth Momentum: Sales growth in the US natural food store channel (SPINS excluding Sprouts) remained strong at +7% over the last 52 weeks and +8% over the last 12 weeks, with Whole Foods showing significant acceleration in Q3 at +16% year-over-year. In August, sales at main retailers continued to rise sharply with Bristol Farms (+71%), Erewhon (+35%) and Independent Natural Food Retailers (+32%) leading the way against top brands.

Online Sales Surge: Double-digit online growth, with unit sales up by 37% on Amazon.ca and 45% on Amazon.com for the nine months ended July 31, 2024, compared to the previous year. Record Prime Day performance in July, outperforming last year’s Prime Day by 25% on Amazon.ca and 76% on Amazon.com.

Strategic Initiatives and Leadership

Board of Directors Strengthening: The Company has reinforced its board of directors with the addition of three new independent members—Jeff Church, Anne-Marie Laberge, and Tyler Ricks. These appointments bring extensive experience and diverse professional backgrounds to the board, enhancing the Company’s strategic oversight and governance.

Management Talent Acquisition: GURU has further bolstered its management team by appointing Shingly Lee as Vice President of Marketing. This strategic hire underscores the Company’s commitment to driving brand and market growth through innovative marketing strategies.

Share Buyback Program: Normal course issuer bid renewed, authorizing the purchase of up to 1,515,778 common shares through July 24, 2025, underscoring the Company’s confidence in its long-term growth strategy.

Special Promotions to Help Consumers Fight Inflation: Rising costs have been a constant battle for consumers in recent years, and to help our GURU customer save while enjoying their favorite natural energy drink, starting tomorrow and for a limited time, 4-packs of Fruit Punch and Peach Mango Punch will be available at discounted prices in most Quebec grocery stores. In addition, cases of 24 cans of GURU Original will be available in main Quebec wholesale club warehouses for $32.99.

Recognition as a Great Place to Work®: GURU is certified as a Great Place to Work®, reflecting commitment to fostering a positive and productive work environment.

Quote

“Despite a decline in net revenue in the third quarter, mainly due to reduced shipments and decreased convenience store traffic, we achieved retail scan growth in our key channels. Notably, we delivered double-digit growth in our retail and untracked channels in Quebec, on Amazon in both Canada and the US, and at Whole Foods, while making significant progress in reducing our net loss. In response to the challenges, we initiated a packaging and messaging revitalisation and strengthened our marketing team with a focus on digital strategies. These efforts are aimed at boosting consumer engagement and driving future sales growth,” said Carl Goyette, President and CEO of GURU.

“This fall will be very active for GURU, with the US launch of our GURU Zero Sugar line on Amazon and in select fitness clubs and retailers. This is a great opportunity for GURU to expand its GURU Zero brand in the US, a better-for-you energy drink that combines zero sugar, zero sucralose and zero aspartame in the zero-sugar beverage segment, which now represents 50% of the $20+ billion North American energy drink category. In Canada, we will conduct our first roadshow at a leading wholesale club, featuring our Punch line in prime locations across the country. If successful, this could lead to new opportunities in this major channel.”

“In the coming quarters, our primary focus will be on accelerating our return to profitability, and we are confident that we have ample resources to achieve this goal. We will continue to strategically deploy resources and capital to deliver tangible results and return on investment, all while remaining deeply committed to our consumers, driving innovation and fostering sustainable growth in key channels,” concluded Mr. Goyette.

Results of Operations

In Q3 2024, net revenue was $7.9 million, compared to $8.9 million in the same quarter of 2023. The decline was mainly due to GURU’s Canadian activities, slightly offset by US online growth. Sales in Canada decreased to $6.4 million from $7.5 million in Q3 2023 primarily due to lower shipments and the timing and execution of promotional activities in retail banners. US sales grew by 10.3% to $1.5 million from $1.4 million in Q3 2023, as a result of continued online sales growth. For the nine-month period, net revenue increased by 6.9% to $23.1 million, from $21.6 million for the same period in 2023, mainly driven by stronger performance in the US wholesale club channel and online sales.

Gross profit totalled $4.4 million in Q3 2024, compared to $4.5 million in Q3 2023. Gross margin, which is comprised of distribution, selling and merchandising fees, rose to 55.4% in Q3 2024, compared to 51.2% for the same period a year ago. The significant gross margin improvement was driven by pricing dynamics, as well as a reduction in input costs. For the nine-month period, gross profit totalled $12.6 million, compared to $11.3 million a year ago. Gross margin for the nine-month period was 54.8%, compared to 52.5% last year. The significant improvement resulted mainly from lower input costs.

Selling, general and administrative expenses (“SG&A”), which include operational, sales, marketing and administration costs, amounted to $7.0 million in Q3 2024, compared to $8.1 million for the same period a year ago. Selling and marketing expenses decreased to $4.0 million from $5.7 million in Q3 2023, a result of timing of selling expenses for in store promotional activities, and marketing efficiencies. General and administrative expenses increased to $3.0 million from $2.4 million in Q3 2023 primarily due to operational factors, along with costs associated with the appointment of new board members and the hiring of a new executive. For the nine-month period, SG&A amounted to $20.6 million, compared to $20.8 million a year ago, The decrease is primarily attributed to effective cost control measures stemming from the reduction in sales and marketing expenses in Q3 2024.

Net loss totalled $2.2 million or $(0.07) per share in Q3 2024, compared to a net loss of $3.0 million or $(0.09) per share for the same quarter a year ago. The improved net loss reflects the lower sales and marketing expenses incurred in Q3 2024. Net loss for the nine-month period totalled $6.8 million, or $(0.22) per share in 2024, compared to a net loss of $8.3 million or $(0.26) per share for the same period a year ago.

Adjusted EBITDA2 amounted to a loss of $2.2 million in Q3 2024, compared to a loss of $3.0 million for the same quarter in 2023. The decrease in Adjusted EBITDA loss this quarter was driven by lower sales and marketing expenses, while maintaining a relatively stable gross profit. Adjusted EBITDA for the first nine months of the year was a loss of $6.9 million in 2024, compared to a loss of $8.1 million in 2023. The improvement in Adjusted EBITDA loss for the period was driven by stronger net revenue and gross profit, coupled with lower expenses.

As at July 31, 2024, the Company had cash, cash equivalents and short-term investments of $27.7 million, and unused Canadian- and US-dollar denominated credit facilities totalling $10 million.

1 Nielsen, 52-week period ended July 13, 2024, All Channels, Canada vs. same period a year ago.

2 Please refer to the “Non-GAAP and Other Financial Measures” section at the end of this release.

Conference call

GURU will hold a conference call to discuss its third quarter results today, September 12, 2024, at 10:00 a.m. ET. Participants can access the call as follows:

About GURU Products

GURU energy drinks are made from a short list of plant-based active ingredients, including natural caffeine, with zero sucralose and zero aspartame. These carefully sourced ingredients are crafted into unique blends that push your body to go further and your mind to be sharper.

About GURU Organic Energy

GURU Organic Energy Corp. GURU is a dynamic, fast-growing beverage company that launched the world’s first natural, plant-based energy drink in 1999. The Company markets organic energy drinks in Canada and the United States through an estimated distribution network of about 25,000 points of sale, and through www.guruenergy.com and Amazon. GURU has built an inspiring brand with a clean list of organic ingredients, including natural caffeine, with zero sucralose and zero aspartame, which offer consumers Good Energy that never comes at the expense of their health. The Company is committed to achieving its mission of cleaning the energy drink industry in Canada and the United States. For more information, go to www.guruenergy.com or follow us @guruenergydrink on Instagram, @guruenergy on Facebook and @guruenergydrink on TikTok.

For further information, please contact:

Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking information includes, but is not limited to, information with respect to the Company’s objectives and the strategies to achieve these objectives, as well as information with respect to management’s beliefs, plans, expectations, anticipations, estimates and intentions. This forward-looking information is identified by the use of terms and phrases such as “may”, “would”, “should”, “could”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “believe” or “continue”, the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking information contains these terms and phrases. Forward-looking information is provided for the purposes of assisting the reader in understanding the Company and its business, operations, prospects and risks at a point in time in the context of historical and possible future developments and therefore the reader is cautioned that such statements may not be appropriate for other purposes. Forward-looking information is based upon a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond management’s control, which could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, the following risk factors, which are discussed in greater detail under the “RISK FACTORS” section of the annual information form for the year ended October 31, 2023: management of growth; reliance on key personnel; reliance on key customers; changes in consumer preferences; significant changes in government regulation; criticism of energy drink products and/or the energy drink market; economic downturn and continued uncertainty in the financial markets and other adverse changes in general economic or political conditions, as well as the COVID-19 pandemic, the war in Ukraine and geopolitical developments, global inflationary pressure or other major macroeconomic phenomena; global or regional catastrophic events; fluctuations in foreign currency exchange rates; inflation; revenues derived entirely from energy drinks; increased competition; relationships with co-packers and distributors and/or their ability to manufacture and/or distribute GURU’s products; seasonality; relationships with existing customers; changing retail landscape; increases in costs and/or shortages of raw materials and/or ingredients and/or fuel and/or costs of co-packing; failure to accurately estimate demand for its products; history of negative cash flow and no assurance of continued profitability or positive EBITDA; repurchase of common shares; intellectual property rights; maintenance of brand image or product quality; retention of the full-time services of senior management; climate change; litigation; information technology systems; fluctuation of quarterly operating results; risks associated with the PepsiCo distribution agreement; accounting treatment of the PepsiCo Warrants; conflicts of interest; consolidation of retailers, wholesalers and distributors and key players’ dominant position; compliance with data privacy and personal data protection laws; management of new product launches; review of regulations on advertising claims, as well as those other risks factors identified in other public materials, including those filed with Canadian securities regulatory authorities from time to time and which are available on SEDAR+ at www.sedarplus.ca. Additional risks and uncertainties not currently known to management or that management currently deems to be immaterial could also cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. Although the forward-looking information contained herein is based upon what management believes are reasonable assumptions as at the date they were made, investors are cautioned against placing undue reliance on these statements since actual results may vary from the forward-looking information. Certain assumptions were made in preparing the forward-looking information concerning availability of capital resources, business performance, market conditions, and customer demand. Consequently, all of the forward-looking information contained herein is qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that management anticipates will be realized or, even if substantially realized, that they will have the expected consequences or effects on the business, financial condition, or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained herein is provided as of the date hereof, and management does not undertake to update or amend such forward-looking information whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Non-GAAP and Other Financial Measures

This press release includes certain non-GAAP and other supplementary financial measures to help assess GURU’s financial performance. Those measures do not have any standardized meaning prescribed by International Financial Reporting Standards (“IFRS”). Management’s method of calculating these measures may differ from the methods used by other issuers and, accordingly, GURU’s definitions of these non-GAAP measures may not be comparable to similar measures presented by other issuers. Investors are cautioned that non-GAAP financial measures should not be construed as an alternative to IFRS measures.

Adjusted EBITDA

Adjusted EBITDA is defined as net income or loss before income taxes, net financial (income) expenses, depreciation and amortization, and stock-based compensation expense. This measure is a non-GAAP financial measure and is not an earnings or cash flow measure or a measure of financial condition recognized by IFRS. As such, it should not be construed as an alternative to “net income”, as determined in accordance with IFRS, as an alternative to “cash flows from operating activities” as a measure of liquidity and cash flows or as an indicator of the Company’s performance or financial condition.

The exclusion of net finance expense eliminates the impact on earnings derived from non-operational activities, and the exclusion of depreciation, amortization and share-based compensation eliminates the non-cash impact of these items. Management believes that Adjusted EBITDA is a useful measure of financial performance without the variation caused by the impacts of the excluded items described above because it provides an indication of the Company’s ability to seize growth opportunities in a cost-effective manner and finance its ongoing operations. Excluding these items does not imply that they are necessarily non-recurring. Management believes this measure, in addition to conventional measures prepared in accordance with IFRS, enable investors to evaluate the Company’s operating results, underlying performance and future prospects in a manner similar to management. Although Adjusted EBITDA is frequently used by securities analysts, lenders and others in their evaluation of companies, it has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under IFRS.

Reconciliation of Net Loss to Adjusted EBITDA

| Three months ended July 31 |

Nine months ended July 31 |

|||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| (In thousands of Canadian dollars) | $ | $ | $ | $ | ||||

| Net loss | (2,230 | ) | (3,006 | ) | (6,760 | ) | (8,276 | ) |

| Net financial income | (371 | ) | (512 | ) | (1,164 | ) | (1,259 | ) |

| Depreciation and amortization | 227 | 312 | 690 | 857 | ||||

| Income taxes | 17 | 13 | 21 | 32 | ||||

| Stock-based compensation expense | 136 | 183 | 341 | 584 | ||||

| Adjusted EBITDA | (2,221 | ) | (3,010 | ) | (6,872 | ) | (8,062 | ) |

Retail Consumer Scanned Sales

This indicator represents the total number of the Company’s products that were “scanned” for purchase by end consumers in retail points of sale in the respective period. Management believes this indicator provides meaningful information as it serves as an indicator of actual sales to end consumers and a potential indicator of growth or potential future sales.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

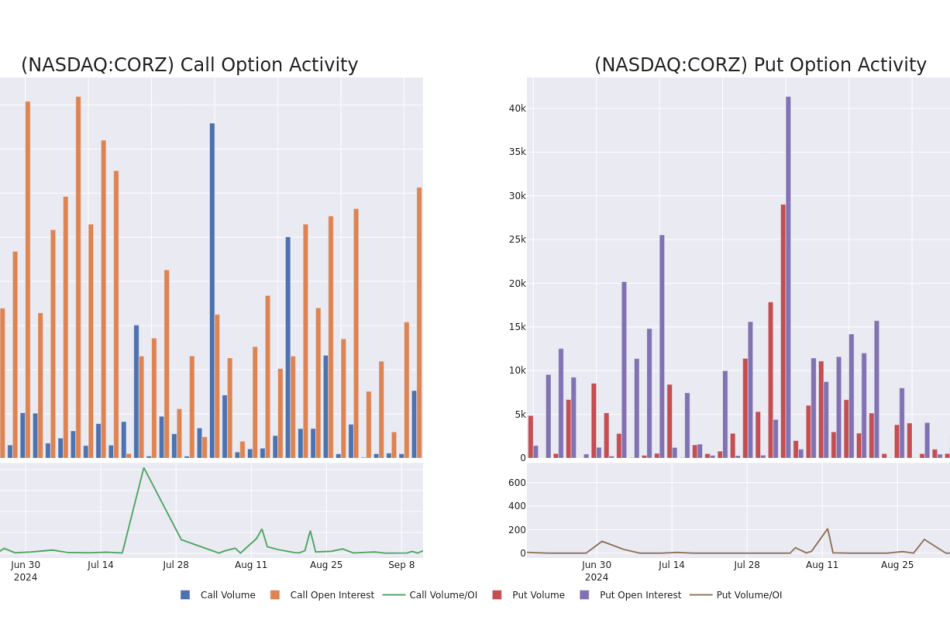

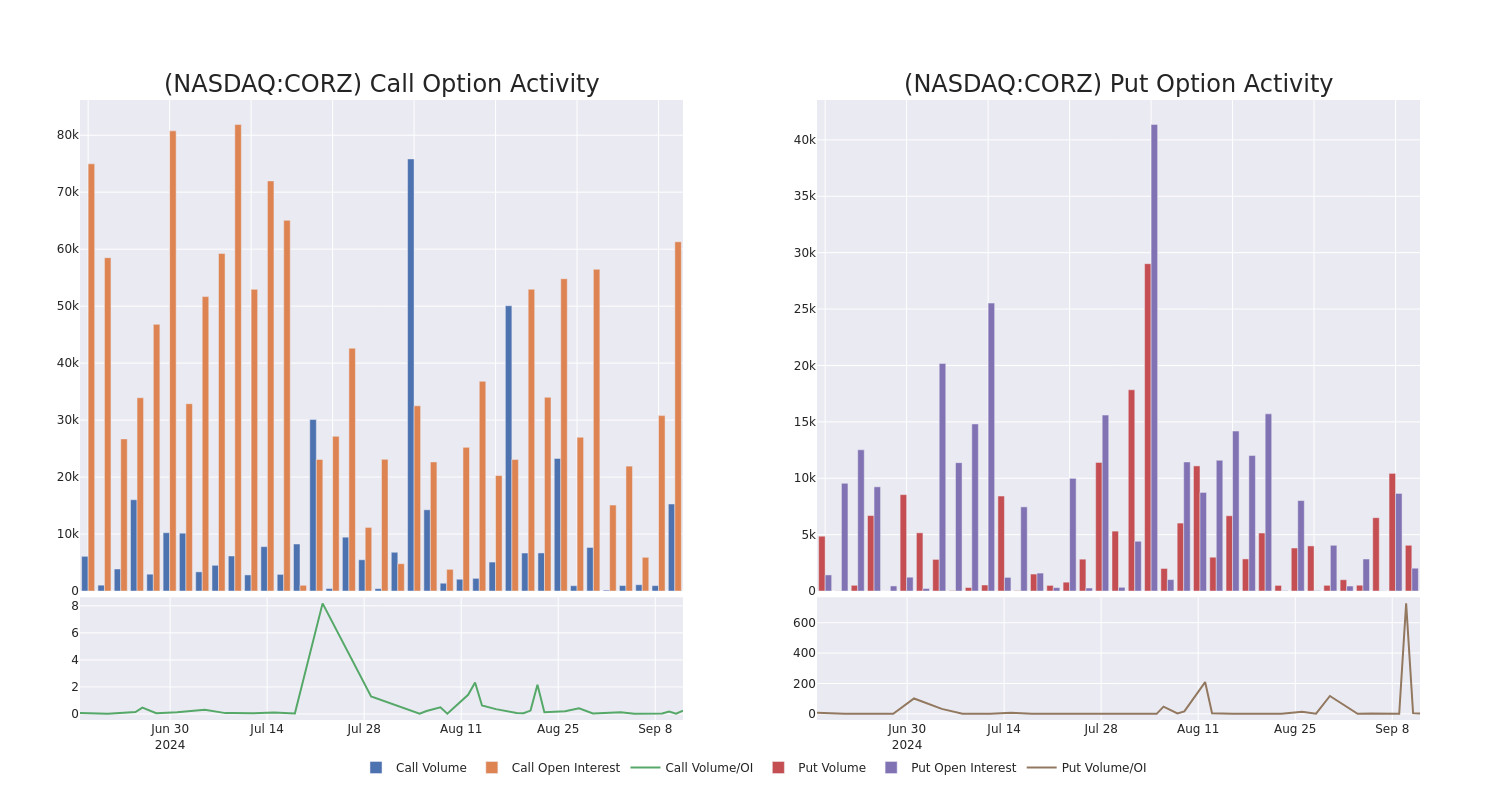

This Is What Whales Are Betting On Core Scientific

Investors with a lot of money to spend have taken a bearish stance on Core Scientific CORZ.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CORZ, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 13 options trades for Core Scientific.

This isn’t normal.

The overall sentiment of these big-money traders is split between 38% bullish and 61%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $120,400, and 12, calls, for a total amount of $1,014,743.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $10.5 for Core Scientific during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Core Scientific’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Core Scientific’s whale trades within a strike price range from $5.0 to $10.5 in the last 30 days.

Core Scientific Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CORZ | CALL | SWEEP | BEARISH | 01/17/25 | $5.5 | $5.3 | $5.4 | $5.00 | $135.0K | 16.9K | 1.5K |

| CORZ | CALL | SWEEP | BEARISH | 01/17/25 | $5.6 | $5.4 | $5.5 | $5.00 | $134.7K | 16.9K | 1.2K |

| CORZ | CALL | TRADE | BULLISH | 01/17/25 | $5.3 | $5.2 | $5.3 | $5.00 | $132.5K | 16.9K | 750 |

| CORZ | CALL | SWEEP | BULLISH | 01/17/25 | $5.3 | $5.1 | $5.3 | $5.00 | $132.5K | 16.9K | 500 |

| CORZ | CALL | SWEEP | BEARISH | 01/17/25 | $5.1 | $4.9 | $5.0 | $5.00 | $125.0K | 16.9K | 250 |

About Core Scientific

Core Scientific Inc is engaged in Blockchain and AI Infrastructure, Digital Asset Self-Mining, Premium Hosting, Blockchain Technology, and Artificial Intelligence related services. The business operates in two segments being; Equipment Sales and Hosting which consists of blockchain infrastructure, third-party hosting business and equipment sales to customers. Mining segment consists of digital asset mining for its account. The blockchain business generates revenue from the sale of consumption-based contracts and by providing hosting services. The digital asset mining segment earns revenue from operating a firm’s owned computer equipment as part of a pool of users that process transactions conducted on one or more blockchain networks. In exchange, it receives digital currency assets.

After a thorough review of the options trading surrounding Core Scientific, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Core Scientific

- Currently trading with a volume of 5,310,319, the CORZ’s price is up by 3.76%, now at $10.35.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 62 days.

What Analysts Are Saying About Core Scientific

3 market experts have recently issued ratings for this stock, with a consensus target price of $17.666666666666668.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $16.

- Reflecting concerns, an analyst from Bernstein lowers its rating to Outperform with a new price target of $17.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $20.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Core Scientific with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NACCE Sponsors Pilot to Boost Enrollment in Skilled Trades Program to Meet Workforce Demands

Cary, NC September 11, 2024 –(PR.com)– The National Association for Community College Entrepreneurship (NACCE) has announced a new pilot program through which 14 of its member community colleges will work with SkillPointe, a technology platform specially designed to help potential students identify training opportunities. The platform, which NACCE acquired in December 2023, provides users with detailed information about skilled trades training programs, including those at area community colleges.

Boosting Enrollment & Filling Workforce Gaps

“NACCE is increasing the number of SkillPointe subscribers by 40 percent through the new program, “The Pitch Winners Pilot,” which is underwritten by NACCE and the Ratcliffe Foundation,” said Rebecca Corbin, President and CEO of NACCE.

Through SkillPointe’s website, potential students can input their interests and demographic information and quickly find detailed information about training requirements for specific occupations, costs, income potential, and nearby training programs. Currently, 34 NACCE members are SkillPointe subscribers, using the platform to boost their enrollment. NACCE and the Ratcliffe Foundation are underwriting the SkillPointe annual subscription cost for the pilot colleges, and there is no cost to students using the platform.

Pilot Participants

Pilot colleges involved in the program are past winners of the NACCE-Ratcliffe Foundation “Pitch for the Skilled Trades” annual competition that awards cash prizes to winning community college pitch teams to fuel their entrepreneurial ventures. During the competition, teams present their proposals to a panel of judges at NACCE’s annual conference. The competition is co-sponsored by the Ratcliffe Foundation, which has awarded nearly one million dollars in awards since the competition began in 2019.

In return for their participation in the pilot program, colleges agree to work with project leaders to contribute and track data. A research component will quantify the student acquisition costs versus Google charges for clicks and other forms of traditional college marketing media such as direct mail, billboards, and ad placements. The pilot is co-chaired by NACCE Fellow Kevin Logan, adjunct professor at Anne Arundel Community College, and Darcie Tumey, NACCE director of Events and Programs.

“We are pleased to offer this exciting new program designed for community colleges seeking to expand their impact,” said Corbin. “Increasing completion rates and attracting a broader student base are top priorities among most community colleges, and SkillPointe helps schools achieve these goals while addressing the needs of local employers.”

Colleges participating in the pilot include:

· Carroll Community College – Westminster, MD

· Houston Community College – Houston, TX

· Ivy Tech Community College – Bloomington, IN

· Kauai Community College – Puhi, Hawaii

· Laramie County Community College – Laramie, WY

· Northwestern Michigan College – Traverse City, MI

· Pellissippi State Community College, Knoxville, TN

· Pima Community College – Tucson, AZ

· Rio Salado College – Tempe, AZ

· Santa Fe College – Gainesville, FL

· Tallahassee State College – Tallahassee, FL

· Tennessee College of Applied Technology – Knoxville, TN

· Vance-Granville Community College – Henderson, NC

· Wake Technical Community College – Cary, NC

About NACCE

NACCE is a 501(c)3 nonprofit association of faculty, administrators, presidents, and entrepreneurs focused on igniting entrepreneurship in classrooms, on campuses, and in communities. NACCE supports job creation and entrepreneurs in 46 states. NACCE represents nearly 400 colleges and approximately 3.3 million students and has its headquarters in Cary, North Carolina. Visit www.nacce.com for more information.

About SkillPointe

SkillPointe champions skills-based careers by offering a self-assessment tool, career exploration, access to training programs, scholarships, and thousands of listings for well-paying, in-demand jobs. Visitors to SkillPointe will find information about in-demand industries, including business, communications, construction, energy, healthcare, hospitality, information technology, manufacturing, public service, and transportation. Visit www.skillpointe.com for more information.

Contact Information:

National Association for Community College Entrepreneurship

Carol Savage

978-857-1473

Contact via Email

www.nacce.com

Read the full story here: https://www.pr.com/press-release/920165

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Transat A.T. Inc. Reports Results for the Third Quarter of Fiscal 2024

Implementation of a Comprehensive Optimization Plan to Accelerate Corporate Strategy Execution

Third-quarter highlights:

- Revenues of $736.2 million, down 1.4% from $746.3 million last year

- Adjusted EBITDA1 of $41.3 million, compared to $114.8 million last year

- Net loss of $39.9 million ($1.03 per share), versus net income of $57.3 million ($1.49 per share) last year

- Negative free cash flow1 of $168.7 million, compared to $52.1 million last year

- Customer deposits for future travel of $825.8 million, up 1% from July 31, 2023

- Named the World’s Best Leisure Airline for the sixth time at the 2024 Skytrax World Airline Awards

MONTREAL, Sept. 12, 2024 /CNW/ – Transat A.T. Inc., a leisure travel reference worldwide, operating as an air carrier under the Air Transat brand, announced today its results for the third quarter ended July 31, 2024.

“Transat’s third-quarter results reflect evolving market conditions and industry-wide pressure as recently indicated by other carriers. Demand for leisure travel remains healthy, as evidenced by higher traffic, but consumers are increasingly price conscious given the current economic uncertainty. Capacity increases throughout the industry also added to competitive pressure and negatively impacted yields,” said Annick Guérard, President and Chief Executive Officer of Transat.

“We have launched a comprehensive plan, referred to as our Elevation Program, which is designed to accelerate our corporate strategy execution and drive long-term profitable growth. The program, initiated this summer, aims for a complete review of operations and business practices. Its objective is to accelerate the implementation of enhanced tools and processes for our teams, in order to optimize overall execution and efficiency. The program will be spearheaded by the newly created Elevation Management Office, which will strengthen governance and accountability for the initiatives undertaken. Our target is to achieve a $100 million improvement in annual adjusted EBITDA1 over the next 18 months,” added Ms. Guérard.

“Profitability remains affected by costs related to capacity deployment and by the Pratt & Whitney GTF2 engine issue. We have agreed to a financial compensation from Pratt & Whitney relating to operational disruptions during the 2023-2024 period. Such financial compensation, which is mostly in the form of credits, will be applied to the purchase of additional spare engines, which we intend to monetize through a sale and leaseback transaction. Looking ahead, we are confident that the initiatives from our Elevation Program will gradually place us on the path to sustaining an improved financial performance. Nevertheless, it remains our top priority to complete a refinancing plan and strengthen our balance sheet. To that end, we are continuing our discussions with stakeholders and are reviewing a number of alternatives,” added Jean-François Pruneau, Chief Financial Officer of Transat.

|

_____________________________ |

|

2Geared turbofan (“GTF”). |

Third-quarter results

For the three-month period ended July 31, 2024, revenues reached $736.2 million, down 1.4% from $746.3 million in the corresponding period a year ago. The decrease in revenues is attributable to lower airline unit revenues (yield), which were down 9.7% compared with 2023, partially offset by a 2.8% increase in traffic expressed in revenue-passenger-miles (RPM). The intensified competition, industry wide overcapacity, inefficiencies resulting from the Pratt & Whitney GTF2 engine issue affecting revenue management and the economic uncertainty put downward pressure on airline unit revenues. Company-wide capacity was up 5.6% from last year.

Adjusted EBITDA1 stood at $41.3 million, compared with $114.8 million a year ago. In addition to lower yields, the variation is mainly due to higher operating expenses associated with capacity expansion, expenses caused by the Pratt & Whitney GTF2 engine issue, and by higher fuel expenses reflecting a 6% increase in fuel prices compared with the corresponding period in 2023.

Nine-month results

For the nine-month period ended July 31, 2024, revenues reached $2,494.9 million, up 9.2% from $2,283.9 million in the corresponding period a year ago. For the nine-month period, across the entire network, offered capacity increased by 12.9% compared with 2023. Overall, traffic was 10.0% higher than for the corresponding period in 2023. Revenue growth was impacted by the same factors provided for the three-month period, along with strike threats during the winter season.

For the nine-month period, adjusted EBITDA1 stood at $70.3 million, compared with $174.3 million a year ago. The decline is mainly attributable to the same factors provided for the three-month period.

Cash flow and financial position

Cash flow used in operating activities amounted to $91.1 million during the third quarter of 2024, compared with $7.5 million for the same period last year, due to lower liquidity generated by net change in non-cash working capital balances as well as other assets and liabilities and to a decrease in operating income this year. These factors were partially offset by an increase in the net change in the provision for return conditions. After accounting for investing activities and repayment of lease liabilities, negative free cash flow1 reached $168.7 million during the quarter, versus $52.1 million a year earlier.

As at July 31, 2024, cash and cash equivalents amounted to $361.9 million, compared to $570.6 million at the same date in 2023 and $435.6 million as at October 31, 2023. Cash and cash equivalents in trust or otherwise reserved mainly resulting from travel package bookings increased year-over-year reaching $274.7 million as at July 31, 2024, compared with $263.6 million at the same date in 2023.

During the nine-month period ended July 31, 2024, the Corporation early repaid its subordinated credit facility for its operations that was due to mature on April 29, 2025. The repayment totalled $46.0 million. The Corporation also reduced its LEEFF secured facility by repaying an amount of $11.0 million. Following these repayments, long-term debt and deferred government grant, net of cash, amounted to $430.0 million as at July 31, 2024, up from $380.1 million as at October 31, 2023.

Key indicators

To date, load factors for the fourth quarter are slightly higher compared to the same date in fiscal 2023, while airline unit revenues, expressed as yield, are 9.7% lower than they were at this time last year.

For fiscal 2024, the capacity increase now stands at 9.9%, a decrease of 1.1% since the second quarter.

Conference call

Third-quarter 2024 conference call: Thursday, September 12, 10:00 a.m. To join the conference call without operator assistance, you may register and enter your phone number here to receive an instant automated call back.

You can also dial direct to be entered into the call by an operator:

Montreal: 514 400-4446

North America (toll-free): 1 888 510-2154

Name of conference: Transat

The conference will also be accessible live via webcast: click here to register.

An audio replay will be available until September 19, 2024, by dialing 1 888 660-6345 (toll-free in North America), access code 15933 followed by the pound key (#). The webcast will remain available for 90 days following the call.

Fourth-quarter 2024 results will be announced on December 12, 2024.

(1) Non-IFRS financial measures

Transat prepares its financial statements in accordance with International Financial Reporting Standards [“IFRS”]. We will occasionally refer to non-IFRS financial measures in the news release. These non-IFRS financial measures do not have any meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. They are intended to provide additional information and should not be considered as a substitute for measures of performance prepared in accordance with IFRS. All dollar figures are in Canadian dollars unless otherwise indicated.

The following are non-IFRS financial measures used by management as indicators to evaluate ongoing and recurring operational performance.

Adjusted operating income (loss) or adjusted EBITDA: Operating income (loss) before depreciation, amortization and asset impairment expense, reversal of impairment of the investment in a joint venture, restructuring and transaction costs and other significant unusual items, and including premiums related to derivatives that matured during the period. The Corporation uses this measure to assess the operational performance of its activities before the aforementioned items to ensure better comparability of financial results.

Adjusted pre-tax income (loss) or adjusted EBT: Income (loss) before income tax expense before change in fair value of derivatives, revaluation of liability related to warrants, gain (loss) on long-term debt modification, gain (loss) on business disposals, gain on disposal of investment, gain (loss) on asset disposals, restructuring and transaction costs, write-off of assets, reversal of impairment of the investment in a joint venture, foreign exchange gain (loss) and other significant unusual items, and including premiums related to derivatives that matured during the period. The Corporation uses this measure to assess the financial performance of its activities before the aforementioned items to ensure better comparability of financial results.

Adjusted net income (loss): Net income (loss) before change in fair value of derivatives, revaluation of liability related to warrants, gain (loss) on long-term debt modification, gain (loss) on business disposals, gain on disposal of investment, gain (loss) on asset disposals, restructuring and transaction costs, write-off of assets, reversal of impairment of the investment in a joint venture, foreign exchange gain (loss), reduction in the carrying amount of deferred tax assets and other significant unusual items, and including premiums related to derivatives that matured during the period, net of related taxes. The Corporation uses this measure to assess the financial performance of its activities before the aforementioned items to ensure better comparability of financial results. Adjusted net income (loss) is also used in calculating the variable compensation of employees and senior executives.

Adjusted net earnings (loss) per share: Adjusted net income (loss) divided by the adjusted weighted average number of outstanding shares used in computing diluted earnings (loss) per share.

Free cash flow: Cash flows related to operating activities less cash flows related to investing activities and repayment of lease liabilities. The Corporation uses this measure to assess the cash that’s available to be distributed in a discretionary way such as repayment of long-term debt or deferred government grant or distribution of dividend to shareholders.

Total debt: Long-term debt plus lease liabilities, deferred government grant and liability related to warrants, net of deferred financing costs related to the unsecured debt – LEEFF. Management uses total debt to assess the Corporation’s debt level, future cash needs and financial leverage ratio. Management believes this measure is useful in assessing the Corporation’s capacity to meet its current and future financial obligations.

Total net debt:Total debt (described above) less cash and cash equivalents. Total net debt is used to assess the cash position relative to the Corporation’s debt level. Management believes this measure is useful in assessing the Corporation’s capacity to meet its current and future financial obligations.

Additional Information

The results were affected by non-operating items, as summarized in the following table:

Highlights and non-IFRS financial measures

|

Third quarter |

Nine-month period |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

(in thousands of Canadian dollars, except per share amounts) |

$ |

$ |

$ |

$ |

|

Operating income (loss) |

(9,837) |

64,375 |

(77,427) |

45,012 |

|

Depreciation and amortization |

55,412 |

53,752 |

160,324 |

137,623 |

|

Reversal of impairment of the investment in a joint venture |

— |

— |

(3,112) |

— |

|

Restructuring costs |

500 |

1,007 |

2,477 |

3,350 |

|

Premiums related to derivatives that matured during the period |

(4,749) |

(4,352) |

(11,925) |

(11,728) |

|

Adjusted operating income¹ or adjusted EBITDA |

41,326 |

114,782 |

70,337 |

174,257 |

|

Net income (loss) |

(39,893) |

57,303 |

(155,257) |

(28,487) |

|

Asset impairment |

— |

4,592 |

— |

4,592 |

|

Reversal of impairment of the investment in a joint venture |

— |

— |

(3,112) |

— |

|

Restructuring costs |

500 |

1,007 |

2,477 |

3,350 |

|

Change in fair value of derivatives |

7,142 |

(12,168) |

24,323 |

11,702 |

|

Revaluation of liability related to warrants |

(12,781) |

24,972 |

(7,270) |

31,877 |

|

Foreign exchange (gain) loss |

7,205 |

(29,052) |

(6,752) |

(36,014) |

|

Gain on disposal of an investment |

— |

— |

(5,784) |

— |

|

Gain on asset disposals |

(392) |

— |

(392) |

(2,511) |

|

Premiums related to derivatives that matured during the period |

(4,749) |

(4,352) |

(11,925) |

(11,728) |

|

Adjusted net income (loss)¹ |

(42,968) |

42,302 |

(163,692) |

(27,219) |

|

Adjusted net income (loss)¹ |

(42,968) |

42,302 |

(163,692) |

(27,219) |

|

Adjusted weighted average number of outstanding shares used in computing diluted earnings per share |

38,906 |

38,372 |

38,733 |

38,220 |

|

Adjusted net earnings (loss) per share¹ |

(1.10) |

1.10 |

(4.23) |

(0.71) |

|

Cash flows related to operating activities |

(91,137) |

(7,534) |

202,781 |

378,113 |

|

Cash flows related to investing activities |

(29,333) |

(4,136) |

(89,325) |

(21,896) |

|

Repayment of lease liabilities |

(48,250) |

(40,407) |

(133,298) |

(109,947) |

|

Free cash flow1 |

(168,720) |

(52,077) |

(19,842) |

246,270 |

|

As at |

As at |

|||

|

(in thousands of dollars) |

$ |

$ |

||

|

Long-term debt |

664,268 |

669,145 |

||

|

Deferred government grant |

127,600 |

146,634 |

||

|

Liability related to warrants |

13,546 |

20,816 |

||

|

Lease liabilities |

1,446,426 |

1,221,451 |

||

|

Total debt1 |

2,251,840 |

2,058,046 |

||

|

Total debt |

2,251,840 |

2,058,046 |

||

|

Cash and cash equivalents |

(361,891) |

(435,647) |

||

|

Total net debt1 |

1,889,949 |

1,622,399 |

About Transat

Founded in Montreal 36 years ago, Transat has achieved worldwide recognition as a provider of leisure travel particularly as an airline under the Air Transat brand. Voted World’s Best Leisure Airline by passengers at the 2024 Skytrax World Airline Awards, it flies to international destinations. By renewing its fleet with the most energy-efficient aircraft in their category, it is committed to a healthier environment, knowing that this is essential to its operations and the destinations it serves. TRZ www.transat.com

Caution regarding forward-looking statements

This news release contains certain forward-looking statements with respect to the Corporation, including those regarding its results, its financial position and its outlook for the future. These forward-looking statements are identified by the use of terms and phrases such as “anticipate” “believe” “could” “estimate” “expect” “intend” “may” “plan” “potential” “predict” “project” “will” “would”, the negative of these terms and similar terminology, including references to assumptions. All such statements are made pursuant to applicable Canadian securities legislation. Such statements may involve but are not limited to comments with respect to strategies, expectations, planned operations or future actions. Forward-looking statements, by their nature, involve risks and uncertainties that could cause actual results to differ materially from those contemplated by these forward-looking statements.

The forward-looking statements may differ materially from actual results for a number of reasons, including without limitation, economic conditions, changes in demand due to the seasonal nature of the business, extreme weather conditions, climatic or geological disasters, war, political instability, real or perceived terrorism, outbreaks of epidemics or disease, consumer preferences and consumer habits, consumers’ perceptions of the safety of destination services and aviation safety, demographic trends, disruptions to the air traffic control system, the cost of protective, safety and environmental measures, competition, maintain and grow its reputation and brand, the availability of funding in the future, the Corporation’s ability to repay its debt, the Corporation’s ability to adequately mitigate the Pratt & Whitney GTF engine issues, fluctuations in fuel prices and exchange rates and interest rates, the Corporation’s dependence on key suppliers, the availability and fluctuation of costs related to our aircraft, information technology and telecommunications, cybersecurity risks, changes in legislation, regulatory developments or procedures, pending litigation and third-party lawsuits, the ability to reduce operating costs, the Corporation’s ability to attract and retain skilled resources, labour relations, collective bargaining and labour disputes, pension issues, maintaining insurance coverage at favourable levels and conditions and at an acceptable cost, and other risks detailed in the Risks and Uncertainties section of the MD&A included in our 2023 Annual Report.

The reader is cautioned that the foregoing list of factors is not exhaustive of the factors that may affect any of the Corporation’s forward-looking statements. The reader is also cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements.

The forward-looking statements in this news release are based on a number of assumptions relating to economic and market conditions as well as the Corporation’s operations, financial position and transactions. Examples of such forward-looking statements include, but are not limited to, statements concerning:

- The outlook whereby the Corporation will be able to meet its obligations with cash on hand, cash flows from operations and drawdowns under existing credit facilities.

- The outlook whereby the Corporation is targeting an improvement in annual adjusted EBITDA1 of $100 million over the next 18 months as a result of the Elevation Program initiatives.

- The outlook whereby the initiatives from the Elevation Program will gradually place the Corporation on the path to sustaining an improved financial performance.

In making these statements, the Corporation assumes, among other things, that the standards and measures for the health and safety of personnel and travellers imposed by government and airport authorities will be consistent with those currently in effect, that workers will continue to be available to the Corporation, its suppliers and the companies providing passenger services at the airports, that credit facilities and other terms of credit extended by its business partners will continue to be made available as in the past, that management will continue to manage changes in cash flows to fund working capital requirements for the full fiscal year and that fuel prices, exchange rates, selling prices and hotel and other costs remain stable, the Corporation will be able to adequately mitigate the Pratt & Whitney GTF engine issues and that the initiatives identified to improve adjusted operating income (adjusted EBITDA) can be implemented as planned, and will result in cost reductions and revenue increases of the order anticipated over the next 18 months. If these assumptions prove incorrect, actual results and developments may differ materially from those contemplated by the forward-looking statements contained in this press release.

The Corporation considers that the assumptions on which these forward-looking statements are based are reasonable.

These statements reflect current expectations regarding future events and operating performance, speak only as of the date this news release is issued, and represent the Corporation’s expectations as of that date. For additional information with respect to these and other factors, see the MD&A for the quarter ended July 31, 2024 filed with the Canadian securities commissions and available on SEDAR at www.sedarplus.ca. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.

SOURCE Transat A.T. Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c4857.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c4857.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

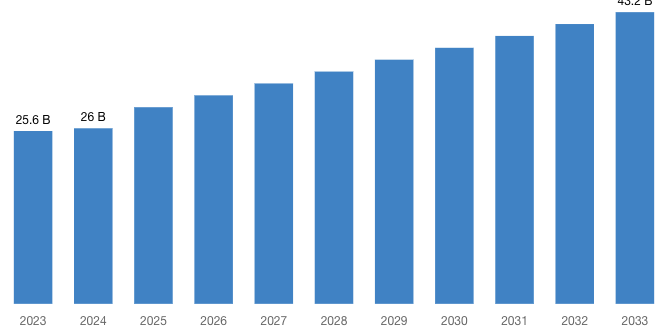

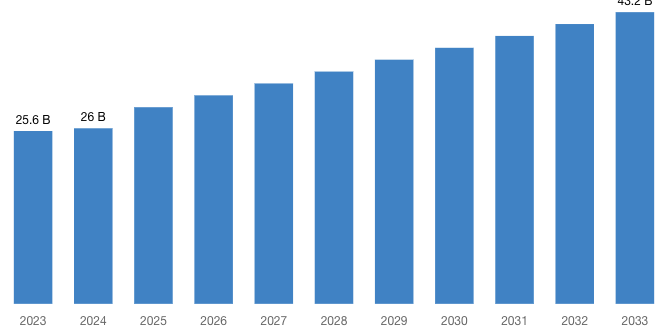

[Latest] Global Storage Tank Market Size/Share Worth USD 43.2 Billion by 2033 at a 5.1% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

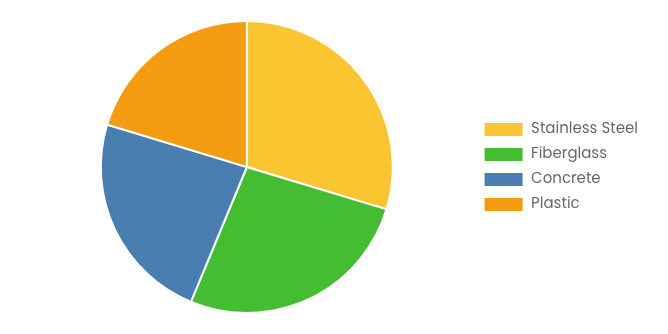

Austin, TX, USA, Sept. 11, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Storage Tank Market Size, Trends and Insights By Material (Stainless Steel, Fiberglass, Concrete, Plastic), By Application (Storage of Portable Water, Rain Water Harvesting, Water Storage for Firefighting, Others), By End-use (Oil & Gas Industry, Water and Waste water Treatment, Pharmaceutical Industry, Chemical Industry, Food and Beverage Industry, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Storage Tank Market size & share was valued at approximately USD 25.6 Billion in 2023 and is expected to reach USD 26 Billion in 2024 and is expected to reach a value of around USD 43.2 Billion by 2033, at a compound annual growth rate (CAGR) of about 5.1% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Storage Tank Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=51948

Storage Tank Market: Overview

An expansive container used to hold gas, oil, and other petrochemical goods is called a storage tank. It is utilized to store compressed gases, liquids, or media for the temporary or permanent storage of heat or cold.

The growth of the food and beverage, electricity, and oil and gas sectors is propelling the worldwide storage tank market. The need for more effective solutions as well as an increase in the development of tight oil and shale gas areas are the reasons behind the rise in demand for storage tanks in the oil and gas sector.

The other main drivers of market development are the increase in petrochemical project investments and the growing focus on energy efficiency. Moreover, throughout the projected period, the expansion of the global market is anticipated to be supported by the rise in demand for bulk storage facilities.

Storage tank industry participants can benefit greatly from technological developments in the storage tank production process. To keep ahead of the competition, storage tank manufacturers are devoting a significant amount of their profits to research and development.

Request a Customized Copy of the Storage Tank Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=51948

By material, the stainless steel segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. This growth is because stainless steel is perfect for storing corrosive materials and guarantees a longer operating lifespan due to its corrosion resistance, durability, and ease of maintenance.

By end-use, the oil & gas industry segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The oil and gas sector is the main end-user of storage tank insulation.

This dominance is explained by the rising demand for corrosion-resistant, long-lasting, and lightweight storage tanks brought on by the expanding requirement for oil and gas storage, particularly in coastal locations and the Middle East.

By application, water storage for the firefighting segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The water storage for the firefighting segment is dominant in part because of the increased awareness of fire safety and the necessity of efficient fire suppression systems.

North America’s booming oil and gas industry, is bolstered by massive exploration and production efforts. The use of sophisticated and compatible storage tank systems is required by the region’s strict environmental rules, which will accelerate market expansion.

Nova Plastic Industries is a prominent player in the plastic manufacturing sector, known for producing high-quality plastic products for a diverse range of industries. It produce durable plastic containers, bins, and pallets for industrial and commercial use.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 26 Billion |

| Projected Market Size in 2033 | USD 43.2 Billion |

| Market Size in 2023 | USD 25.6 Billion |

| CAGR Growth Rate | 5.1% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Material, Application, End-use and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Storage Tank report is available upon request; please contact us for more information.)

Request a Customized Copy of the Storage Tank Market Report @ https://www.custommarketinsights.com/report/storage-tank-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Storage Tank report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Storage Tank Market Report @ https://www.custommarketinsights.com/report/storage-tank-market/

Request a Customized Copy of the Storage Tank Market Report @ https://www.custommarketinsights.com/report/storage-tank-market/

CMI has comprehensively analyzed the Global Storage Tank Market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth by Amico Group of Companies to depict an in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Storage Tank industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Storage Tank market and what is its expected growth rate?

- What are the primary driving factors that push the Storage Tank market forward?

- What are the Storage Tank Industry’s top companies?

- What are the different categories that the Storage Tank Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Storage Tank market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Storage Tank Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/storage-tank-market/

Storage Tank Market: Regional Analysis

By Region, Storage Tank Market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. North America led the Storage Tank Market in 2023 with a market share of 39.9% and is expected to keep its dominance during the forecast period 2024-2033.

The area has a strong industrial base, especially in the United States and Canada, which contributes to a high need for storage tanks in a variety of industries. Storage solutions are in high demand because of North America’s booming oil and gas industry, which is bolstered by massive exploration and production efforts.

The use of sophisticated and compatible storage tank systems is required by the region’s strict environmental rules, which will accelerate market expansion.

Request a Customized Copy of the Storage Tank Market Report @ https://www.custommarketinsights.com/report/storage-tank-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Storage Tank Market Size, Trends and Insights By Material (Stainless Steel, Fiberglass, Concrete, Plastic), By Application (Storage of Portable Water, Rain Water Harvesting, Water Storage for Firefighting, Others), By End-use (Oil & Gas Industry, Water and Waste water Treatment, Pharmaceutical Industry, Chemical Industry, Food and Beverage Industry, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/storage-tank-market/

List of the prominent players in the Storage Tank Market:

- Nova Plastic Industries L.L.C

- CST Industries Inc.

- McDermott International Inc.

- Emiliana Serbatoi S.r.l.

- Containment Solutions Inc.

- Carbery Plastics Limited

- Sintex Industries Ltd

- Caldwell Tanks

- Balmoral Tanks Ltd

- DN Tanks

- Tank Connection

- PermianLide

- Superior Tank Co. Inc.

- Belco Manufacturing Company

- ZCL Composites Inc.

- Fox Tank Co.

- Tarsco

- Enduro

- Highland Tank

- Motherwell Bridge Industries Ltd.

- Others

Click Here to Access a Free Sample Report of the Global Storage Tank Market @ https://www.custommarketinsights.com/report/storage-tank-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Wood Pallets Market: Wood Pallets Market Size, Trends and Insights By Product (Block Wooden Pallet, Stringer Wooden Pallet, Engineered Molded Wood Pallet, Others), By End User (Logistics & Transportation, Food & Beverages, Chemicals, Pharmaceuticals, Manufacturing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Modular Storage System Market: Modular Storage System Market Size, Trends and Insights By Product (Racks, Cabinets, Bins, Shelves, Drawers, Others), By Material Type (Metal, Plastic, Wood, Others), By End User (Commercial, Residential, Industrial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Micro Motor Market: Micro Motor Market Size, Trends and Insights By Product Type (AC Motor, DC Motor), By Power Consumption (Below 9V, 10V-20V, 21V-50V, More than 50V), By End User (Electronics, Automotive, Healthcare, Industrial, Aerospace and Defence, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Laser Automation Market: Laser Automation Market Size, Trends and Insights By Type (Laser Cutting Machine, Laser Marking Machine, Laser Welding Machine, Precision Laser Processing System, Others), By End User (Automotive, Semiconductor & Electronics, Machine Industry, Aerospace & Defense, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Industrial Screen Printing Market: Industrial Screen Printing Market Size, Trends and Insights By Type (Screen Printing, Digital Printing, Flexography, Gravure, Others), By End User (Medical, Electronics, Textile, Packaging, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Positive Displacement Blowers Market: Positive Displacement Blowers Market Size, Trends and Insights By Type (Rotary Lobe Blowers, Rotary Screw Blowers, Roots Blowers, Others), By End User Industry (Wastewater Treatment, Chemical Processing, Food and Beverage, Pharmaceutical, Pneumatic Conveying, Cement and Construction, Power Generation, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

EPC Consulting Market: EPC Consulting Market Size, Trends and Insights By Service Type (Consulting, Maintenance, Design & Engineering, Procurement, Construction, Others), By End User Industry (Oil & Gas, Power, Infrastructure, Chemicals, Metals & Mining, Pharmaceuticals, Petrochemicals, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Chainsaw Market: Chainsaw Market Size, Trends and Insights By Type (Gas-powered, Electric-powered, Battery-powered, Other), By Application (Residential, Industrial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Tank Solution Market: Tank Solution Market Size, Trends and Insights By Material (Stainless Steel, Fiberglass, Concrete, Polyethylene), By End User (Oil and Gas, Water and Wastewater, Food and Beverage, Pharmaceuticals, Agriculture, Others), By Application (Storage of Portable Water, Rain Water Harvesting, Water Storage for Firefighting, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Storage Tank Market is segmented as follows:

By Material

- Stainless Steel

- Fiberglass

- Concrete

- Plastic

By Application

- Storage of Portable Water

- Rain Water Harvesting

- Water Storage for Firefighting

- Others

By End-use

- Oil & Gas Industry

- Water and Waste water Treatment

- Pharmaceutical Industry

- Chemical Industry

- Food and Beverage Industry

- Others

Click Here to Get a Free Sample Report of the Global Storage Tank Market @ https://www.custommarketinsights.com/report/storage-tank-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Storage Tank Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Storage Tank Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Storage Tank Market? What Was the Capacity, Production Value, Cost and PROFIT of the Storage Tank Market?