Forget Apple: Billionaires Are Buying Up This "Magnificent Seven" Stock Instead

With a market cap of over $3.3 trillion, Apple is the world’s largest public company.

Yet, it’s time for investors to forget it. Well, not literally — just figuratively.

That’s because, while billionaires like Warren Buffett have been selling shares of Apple, several other famous billionaires have been stocking up on a different stock: Amazon (NASDAQ: AMZN).

Here’s what’s happening and what it means for investors.

Billionaires are buying Amazon

Every three months, large investment managers, hedge funds, and company insiders are required to file 13F forms with the Securities and Exchange Commission (SEC). These forms disclose what stocks are held, thus providing the public with a glimpse behind the curtain to see which stocks prominent billionaires are buying and selling.

Last month, the most recent 13F filings were released, with data from the three months ending on June 30, 2024. And it revealed that several well-known billionaires are adding to their positions in Amazon.

For example, Bridgewater Associates, a hedge fund run by billionaire Ray Dalio, purchased more than 1.6 million shares of Amazon. That more than doubled the fund’s total holdings of Amazon to some 2.65 million shares, worth roughly $500 million.

What’s more, Citadel Advisors, the hedge fund run by billionaire Ken Griffin, increased its holdings of Amazon by around 1.1 million shares. It now controls about 7.7 million shares, valued at almost $1.5 billion.

Why billionaires are buying Amazon

All this buying begs the question: “Why are billionaires racing to buy up shares of Amazon?”

First off, let’s remember that 13F disclosures are not a perfect indication of how billionaires really think. For one thing, they’re a snapshot. Funds may have already reduced or sold out of stock positions before their 13Fs are even made public.

Second, funds are only forced to disclose their long positions, not their short positions. Therefore, it’s difficult to know a fund manager’s true intentions. Are they really bullish on a given stock, or is their big new position just a hedge? There’s no way to know for sure.

However, assuming that the Amazon positions are bullish bets, what are the reasons for being bullish on Amazon right now?

I can think of more than a few. But let’s focus on the company’s impressive growth.

Despite already generating well over $500 billion in annual sales, Amazon continues to increase its sales at a breakneck pace. In its most recent quarter (the three months ending on June 30, 2024), the company reported revenue growth of 10%.

At that pace, the company may add close to $50 billion to its sales total over the next 12 months. For context, that’s the same amount of annual sales generated by Nike, a titan within the sports apparel industry and an iconic American company for more than four decades. In other words, Amazon’s revenue is so big and growing so fast, that its growth alone is equivalent to adding a company like Nike — every year.

Is Amazon still a buy now?

Amazon remains a wonderful company. It has both the world’s largest e-commerce business and the largest cloud-services business (Amazon Web Services). Furthermore, it continues to innovate in new and exciting fields, like robotics and artificial intelligence (AI).

To sum up, it can be hard to really understand what billionaires are thinking (despite what their 13F filings reveal). Nevertheless, Amazon stock remains a buy now thanks to its excellent fundamentals and solid prospects for the future.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Nike. The Motley Fool has a disclosure policy.

Forget Apple: Billionaires Are Buying Up This “Magnificent Seven” Stock Instead was originally published by The Motley Fool

Daktronics Board Member Trades $84K In Company Stock

Lance D. Bultena, Board Member at Daktronics DAKT, reported an insider buy on September 11, according to a new SEC filing.

What Happened: Bultena made a significant move by purchasing 7,160 shares of Daktronics as reported in a Form 4 filing with the U.S. Securities and Exchange Commission. The transaction’s total worth stands at $84,989.

Daktronics shares are trading down 0.0% at $12.19 at the time of this writing on Thursday morning.

Get to Know Daktronics Better

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Daktronics’s Financial Performance

Revenue Growth: Daktronics’s revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -2.77%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 26.4%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Daktronics exhibits below-average bottom-line performance with a current EPS of -0.11.

Debt Management: With a below-average debt-to-equity ratio of 0.32, Daktronics adopts a prudent financial strategy, indicating a balanced approach to debt management.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Daktronics’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 58.05.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.7, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 6.15 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ADF GROUP INC. ANNOUNCES RESULTS FOR THE THREE-MONTH AND SIX-MONTH PERIODS ENDED JULY 31, 2024

HIGHLIGHTS

(All amounts are in Canadian dollars unless otherwise noted.)

- Revenue of $182.3 million recorded during the 6-month period ended July 31, 2024, up 13.6% compared with the same period a year earlier.

- Net income of $16.0 million and $31.3 million recorded for the 3-month and 6-month periods ended July 31, 2024, up 51.8 % and 96.5% respectively from the same periods a year ago.

- Cash flow from operating activities of $60.1 million for the 6-month period ended July 31, 2024.

- Order backlog (1) at $402.3 million as at July 31, 2024.

TERREBONNE, QB, Sept. 12, 2024 /CNW/ – ADF GROUP INC. (“ADF” or the “Corporation”) DRX, recorded revenues of $74.9 million during the second quarter ended July 31, 2024, compared with $80.2 million for the same period a year earlier. After the first six months of the fiscal year, revenues totalled $182.3 million, which is $21.8 million or 13.6% more than for the same period a year earlier.

Although revenues to date are $21.8 million higher than a year ago, those for the second quarter were impacted by one client’s delays in construction site preparation. The Corporation estimates that had it not been for these delays, revenues for the quarter and the 6-month period ended July 31, 2024, would have been approximately $35.0 million higher, revenues coming from additional steel erecting (installation) work. In fact, more than 300 truck loads of fabricated structural steel and steel components are waiting for delivery to the construction site. These revenues are naturally not lost but rather pushed forward in time. Given that installation schedules are difficult to compress over time, these missing revenues risk being pushed forward to the next fiscal year.

Gross margin, as a percentage of revenues (1) went from 22.2% for the 3-month period ended July 31, 2023, to 36.9% for the same period ended July 31, 2024. Gross margin, as a percentage of revenue (1) went from 19.5% during the first semester ended July 31, 2023, to 32.3% in the same period ended July 31, 2024.

The improvement in margins is in line with the increase observed in recent quarters and is largely attributable to a better absorption of fixed costs, in line with the increase in fabrication volume, the continued favorable impact of the investments in automation at ADF’s plant in Terrebonne, Quebec, and a favorable mix of projects. For the second consecutive quarter, the mix of products in fabrication was particularly favorable.

Adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) (2) for the 6-month period ended July 31, 2024, at $48.0 million, was $25.3 million higher than at the same date a year ago.

For the quarter ended July 31, 2024, ADF recorded net income of $16.0 million ($0.51 per basic and diluted share) compared with net income of $10.5 million ($0.32 per share, basic and diluted) a year earlier. At the close of the first semester on July 31, 2024, net income totalled $31.3 million ($0.98 per share, basic and diluted) compared with net income of $15.9 million ($0.49 per share, basic and diluted) for the same period a year ago.

The Corporation’s order backlog (1) stood at $402.3 million as at July 31, 2024. Projects currently in the order backlog will extend until the end of the fiscal year ending January 31, 2026.

As at July 31, 2024, the Corporation had working capital (1) of $90.1 million. The Corporation’s operating activities generated cash of $60.1 million during the first 6 months ended July 31, 2024. The Corporation remains in a good position to continue its current operations and carry out its development projects.

|

________________________________ |

|

|

(1) |

Gross margin, as a percentage of revenues, working capital, as well as the order backlog are additional financial measures. Refer to the “Non-GAAP Financial Measures and Other Financial Measures” section of this press release for the definition of these indicators. |

|

(2) |

Adjusted EBITDA is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Other Financial Measures” section of this press release for the definition of this indicator. |

Financial Highlights

|

3 months |

6 months |

|||

|

Periods ended July 31, |

2024 |

2023 |

2024 |

2023 |

|

(In thousands of dollars, and dollars per share) |

$ |

$ |

$ |

$ |

|

Revenues |

74,881 |

80,215 |

182,281 |

160,486 |

|

Adjusted EBITDA (1) |

24,914 |

12,644 |

48,013 |

22,675 |

|

Income before income tax expense |

22,226 |

10,949 |

43,484 |

18,874 |

|

Net income for the period |

16,000 |

10,542 |

31,265 |

15,913 |

|

— Per share (basic and diluted) |

0.51 |

0.32 |

0.98 |

0.49 |

|

(In thousands) |

Number |

Number |

Number |

Number |

|

Weighted average number of outstanding shares (basic and diluted) |

31,197 |

32,640 |

31,911 |

32,640 |

|

(1) |

Adjusted EBITDA is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Other Financial Measures” section of this press release for the definition of this indicator. |

Outlook

“We closed the periods ended July 31, 2024, with higher net income while increasing our liquidities, even with the decrease in revenues during the quarter closed on July 31, 2024, compared with last fiscal year. We are therefore maintaining the same objectives that have guided us for the past few quarters, namely the order backlog growth, cash generation and operational excellence, in order to continue to grow our Corporation in the coming quarters” said Mr. Jean Paschini, Chairman of the Board and Chief Executive Officer.

Dividend

On September 11, 2024, the Board of Directors of ADF Group approved the payment of a semi-annual dividend of $0.02 per Subordinate Voting Share and per Multiple Voting Share, payable on October 17, 2024, to Shareholders of Record as at September 27, 2024.

Conference call with Investors

An investor conference call will be held this morning, September 12, 2024, at 10 a.m. (EST) to discuss results for the second quarter and 6-month period ended July 31, 2024.

To join the conference call without operator assistance, you can register with your phone number on https://link.meetingpanel.com/?id=64653 to receive an instant automated call back. You can also join the conference call with operator assistance by dialing 1 (888) 510-2154 a few minutes prior to the conference call scheduled start time.

A replay of the conference call will be available from 1:00 p.m. September 12, 2024, until midnight, September 19, 2024, by dialing 1 (888) 660-6345; followed by the access code 64653 #.

The conference call (audio) will also be available at www.adfgroup.com. Members of the media are invited to join in listening mode.

About ADF Group Inc. | ADF Group Inc. is a North American leader in the design and engineering of connections, fabrication, including the application of industrial coatings, and installation of complex steel structures, heavy steel built-ups, as well as in miscellaneous and architectural metals for the non-residential infrastructure sector. ADF Group Inc. is one of the few players in the industry capable of handling highly technically complex mega projects on fast-track schedules in the commercial, institutional, industrial and public sectors. The Corporation operates two fabrication plants and two paint shops, in Canada and in the United States, and a Construction Division in the United States, which specializes in the installation of steel structures and other related products.

Forward-Looking Information | This press release contains forward-looking statements reflecting ADF’s objectives and expectations. These statements are identified by the use of verbs such as “expect” as well as by the use of future or conditional tenses. By their very nature these types of statements involve risks and uncertainty. Consequently, reality may differ from ADF’s expectations.

Non-GAAP Financial Measures and Other Financial Measures | Are measures derived primarily from the consolidated financial statements but are not a standardized financial measure under the financial reporting framework used to prepare the Corporation’s financial statements. Therefore, readers should be careful not to confuse or substitute them with performance measures prepared in accordance with GAAP. In addition, readers should avoid comparing these non-GAAP financial measures to similarly titled measures provided or used by other issuers. The definition of these indicators and their reconciliation with comparable International Financial Reporting Standards measure is as follows:

Adjusted EBITDA

Adjusted EBITDA shows the extent to which the Corporation generates profits from operations, without considering the following items:

- Net financial expenses;

- Income tax expense;

- Foreign exchange (gains) losses, and

- Depreciation and amortization of property, plant and equipment, intangible assets, and right-of-use assets.

Net income is reconciled with adjusted EBITDA in the table below:

|

3 months |

6 months |

|||

|

Periods Ended July 31, |

2024 |

2023 |

2024 |

2023 |

|

(In thousands of dollars) |

$ |

$ |

$ |

$ |

|

Net income |

16,000 |

10,542 |

31,265 |

15,913 |

|

Income taxes expense |

6,226 |

407 |

12,219 |

2,961 |

|

Net financial expenses |

268 |

628 |

666 |

1,467 |

|

Amortization |

1,528 |

1,434 |

3,017 |

2,878 |

|

Foreign exchange loss (gain) |

892 |

(367) |

846 |

(544) |

|

Adjusted EBITDA |

24,914 |

12,644 |

48,013 |

22,675 |

Gross Margin as a Percentage of Revenues

Gross margin as a percentage of revenue indicator is used by the Corporation to assess the level of profitability for a given period based on the project mix for that same period. This indicator is subject to fluctuations in project prices and also in the operational efficiency of the Corporation. The indicator of gross margin as a percentage of revenues results from dividing gross margin by revenues.

Order Backlog

The order backlog is a measure used by the Corporation to assess future revenue levels. The order backlog includes firm orders obtained by the Corporation, either through a firm contract or a formal notice to proceed confirmed by the client. The order backlog disclosed by the Corporation therefore includes the portion of confirmed contracts that have not been put into production.

Working Capital

The working capital indicator is used by the Corporation to assess whether current assets are sufficient to meet current liabilities. Working capital is equal to current assets, less current liabilities.

SOURCE ADF Group Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/12/c6590.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/12/c6590.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amphenol's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bearish on Amphenol APH, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in APH often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Amphenol. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $84,000, and 7 calls, totaling $565,780.

Predicted Price Range

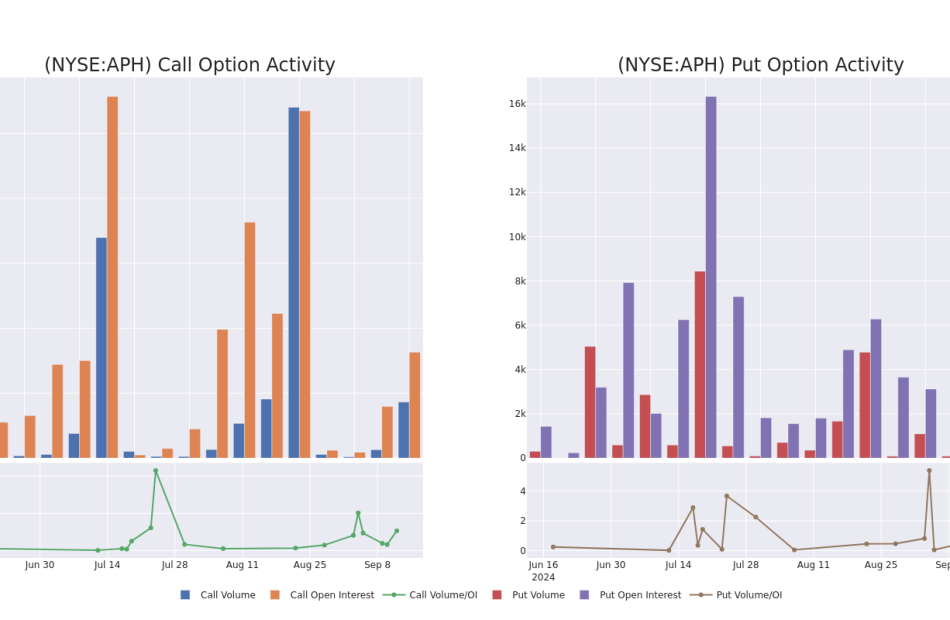

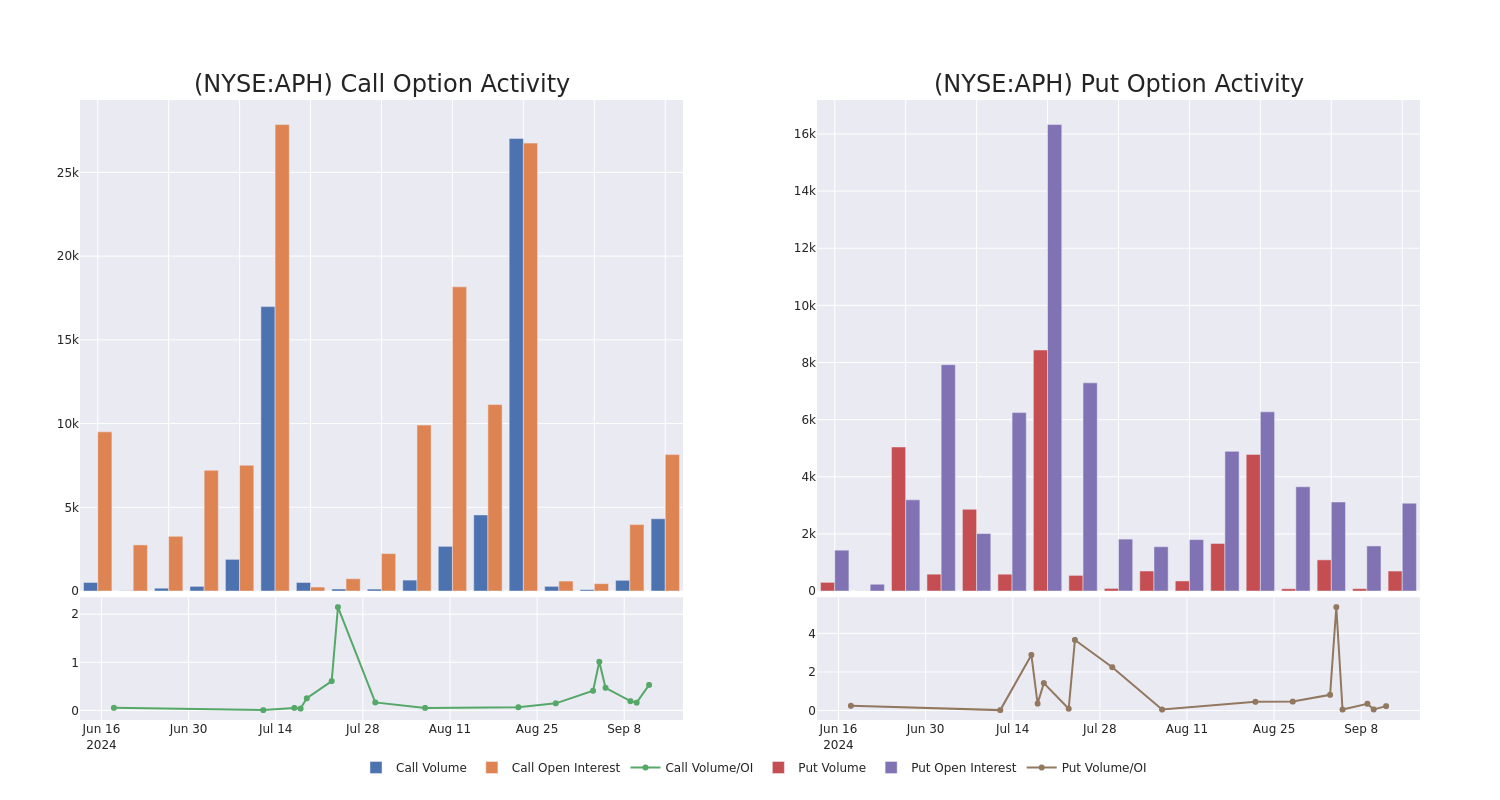

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $70.0 for Amphenol over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Amphenol’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amphenol’s whale activity within a strike price range from $55.0 to $70.0 in the last 30 days.

Amphenol Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APH | CALL | TRADE | BULLISH | 10/18/24 | $1.5 | $1.3 | $1.45 | $65.00 | $145.0K | 3.5K | 1.0K |

| APH | CALL | TRADE | NEUTRAL | 10/18/24 | $0.45 | $0.35 | $0.4 | $70.00 | $104.8K | 3.7K | 2.6K |

| APH | CALL | SWEEP | BULLISH | 04/17/25 | $11.2 | $10.5 | $11.2 | $55.00 | $88.4K | 54 | 80 |

| APH | PUT | TRADE | BEARISH | 10/18/24 | $1.2 | $1.05 | $1.2 | $60.00 | $84.0K | 3.0K | 700 |

| APH | CALL | TRADE | BEARISH | 01/17/25 | $6.8 | $6.7 | $6.7 | $60.00 | $67.0K | 205 | 102 |

About Amphenol

Amphenol is a global supplier of connectors, sensors, and interconnect systems. Amphenol holds the second-largest connector market share globally and sells into the end markets of automotive, broadband, commercial air, industrial, IT and data communications, military, mobile devices, and mobile networks. Amphenol is diversified geographically, with operations in 40 countries.

After a thorough review of the options trading surrounding Amphenol, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Amphenol

- Trading volume stands at 1,503,286, with APH’s price up by 1.78%, positioned at $63.16.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 41 days.

What Analysts Are Saying About Amphenol

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $71.0.

- Reflecting concerns, an analyst from B of A Securities lowers its rating to Neutral with a new price target of $71.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Amphenol, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aura Biosciences Touts Promising Data From Eye Cancer Candidate

Thursday, Aura Biosciences, Inc. AURA revealed Phase 2 end-of-study results evaluating bel-sar (AU-011) for the first-line treatment of early-stage choroidal melanoma (CM), a vision and ocular cancer.

The Phase 2 results demonstrated that bel-sar achieved an 80% tumor control rate (n=8/10) among Phase 3-eligible patients who received the therapeutic regimen, with complete cessation of growth following treatment among responders (post-treatment average growth rate of 0.011 mm/yr among responders compared to 0.351 mm/yr before study entry; p<0.0001).

Visual acuity preservation was achieved in 90% of these 10 patients. 80% of these 10 patients were at high risk for vision loss with tumors close to the fovea or optic disc.

The company adds that the current standard of care is radiotherapy, which leads to visual acuity of <20/200 (the cutoff for legal blindness) in the treated eye in up to 87% of patients.

The safety profile of bel-sar was highly favorable in all participants regardless of dose.

No treatment-related serious adverse events (SAEs) were reported. Ocular treatment-related AEs (TRAEs) were mild and resolved without sequelae.

Aura received a written agreement from the FDA under a Special Protocol Assessment (SPA) for the design and planned analysis of the global Phase 3 CoMpass trial. The agreement indicates that the FDA concurs with the study’s adequacy, if successful, to address the objectives necessary to support Aura’s planned biologics license application submission.

Price Action: Aura stock is up 6.39% at $9.65 at last check Thursday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Twin Cities Habitat for Humanity to Host 2024 Jimmy & Rosalynn Carter Work Project on St. Paul's Greater East Side

Weeklong National Event Includes Hosts Garth Brooks and Trisha Yearwood and 4,000 Volunteers Building Affordable Housing

ST. PAUL, Minn., Sept. 12, 2024 /PRNewswire/ — Twin Cities Habitat for Humanity will soon kick off the 2024 Jimmy & Rosalynn Carter Work Project, a weeklong homebuilding event. The project will run from Sunday, Sept. 29, through Friday, Oct. 4, 2024, and is the official launch of Twin Cities Habitat’s construction efforts on The Heights housing development on St. Paul’s Greater East Side. The Carter Work Project takes place over President Jimmy Carter’s 100th birthday (Oct. 1, 2024) and will be hosted by Garth Brooks and Trisha Yearwood, who will build alongside more than 4,000 volunteers from across Minnesota and the country.

“To have the Carter Work Project come to St. Paul’s Greater East Side and jumpstart The Heights development is a significant honor for Twin Cities Habitat for Humanity and all of our homeowners, partners, supporters and volunteers,” said Chris Coleman, president and CEO of Twin Cities Habitat for Humanity. “It’s a privilege to host the flagship event for Habitat for Humanity International along with hosts Garth Brooks and Trisha Yearwood, who continue to carry on President and the late Mrs. Carter’s legacy. We are proud to demonstrate our organization’s and Minnesota’s commitment to advancing racial equity through homeownership here in St. Paul with this historic development.”

The Heights is a 112-acre development in St. Paul’s Greater East Side neighborhood that will be the future location of 147 Habitat homes. It will be the largest project ever done by Twin Cities Habitat for Humanity. The Carter Work Project crew is set to help build the first 30 homes of the development during the event week. Applications are open now for The Heights and people making $50,000 to $100,000 (or more for larger household sizes) are eligible and encouraged to apply.

Twin Cities Habitat for Humanity will host a public celebration for the Carter Work Project and to honor President Jimmy Carter’s 100th Birthday at the Build Forward Bash on Tuesday, Oct. 1, at The Armory. The Build Forward Bash is a concert that is open to the public with performances by The Family Stone and St. Paul and the Minneapolis Funk All Stars. Property Brothers co-host, entrepreneur, and Habitat Humanitarian Jonathan Scott will emcee the Bash. Tickets to the Build Forward Bash are only $15 each and can be purchased at tchabitat.org/buildforwardbash.

Over its 40-year history, the Jimmy & Rosalynn Carter Work Project has inspired more than 106,000 volunteers across the U.S. and in 14 countries to build, renovate and repair 4,417 Habitat homes. Twin Cities Habitat was chosen as the host for the 2024 project, particularly because of its work to close the racial gap in homeownership and has been diligently working over the last year to prepare for the weeklong event.

“The Carter Work Project is an exciting chance to expand housing and homeownership opportunities in our city,” said Saint Paul Mayor Melvin Carter. “I’m grateful Habitat for Humanity chose The Heights this year, and can’t wait to work alongside hundreds of volunteers to literally build the future of our East Side together.”

Prospective homebuyers can learn more about becoming a homeowner at The Heights or other properties at home.tchabitat.org. To make a donation or learn other volunteer opportunities with Twin Cities Habitat for Humanity, visit tchabitat.org.

Media Assets: Broll, images and renderings from Twin Cities Habitat for Humanity can be found here. Broll and images from previous Carter Work Projects in Charlotte, North Carolina (2023) and Nashville, Tennessee (2019) can be found here (credit to Habitat for Humanity International).

About Twin Cities Habitat for Humanity

Twin Cities Habitat for Humanity brings people together to create, preserve, and promote affordable homeownership and advance racial equity in housing. Since 1985, more than 1,800 families have partnered with Twin Cities Habitat to unlock the transformational power of homeownership. Twin Cities Habitat is one of the highest-regarded Habitat for Humanity affiliates nationwide. www.tchabitat.org.

![]() View original content:https://www.prnewswire.com/news-releases/twin-cities-habitat-for-humanity-to-host-2024-jimmy–rosalynn-carter-work-project-on-st-pauls-greater-east-side-302244374.html

View original content:https://www.prnewswire.com/news-releases/twin-cities-habitat-for-humanity-to-host-2024-jimmy–rosalynn-carter-work-project-on-st-pauls-greater-east-side-302244374.html

SOURCE Twin Cities Habitat for Humanity

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Move: Charles F. Willis IV Invests $3.00M In Willis Lease Finance Stock

Charles F. Willis IV, Executive Chairman at Willis Lease Finance WLFC, reported an insider buy on September 11, according to a new SEC filing.

What Happened: IV’s recent purchase of 28,670 shares of Willis Lease Finance, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, reflects confidence in the company’s potential. The total transaction value is $3,000,028.

As of Thursday morning, Willis Lease Finance shares are down by 0.0%, currently priced at $108.75.

All You Need to Know About Willis Lease Finance

Willis Lease Finance Corp with its subsidiaries is a lessor and servicer of commercial aircraft and aircraft engines. The company has two reportable business segments namely Leasing and Related Operations which involves acquiring and leasing, pursuant to operating leases, commercial aircraft, aircraft engines and other aircraft equipment and the selective purchase and resale of commercial aircraft engines and other aircraft equipment and other related businesses and Spare Parts Sales segment involves the purchase and resale of after-market engine parts, whole engines, engine modules and portable aircraft components. The company generates the majority of its revenue from leasing and related operations.

Key Indicators: Willis Lease Finance’s Financial Health

Revenue Growth: Willis Lease Finance’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 38.65%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 77.98%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Willis Lease Finance’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 6.34.

Debt Management: Willis Lease Finance’s debt-to-equity ratio surpasses industry norms, standing at 3.95. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 8.44 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.46 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Willis Lease Finance’s EV/EBITDA ratio at 8.81 suggests potential undervaluation, falling below industry averages.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Navigating the World of Insider Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Willis Lease Finance’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chief Financial Officer Of Rexford Industrial Realty Sold $711K In Stock

Revealing a significant insider sell on September 11, Laura E Clark, Chief Financial Officer at Rexford Industrial Realty REXR, as per the latest SEC filing.

What Happened: Clark’s decision to sell 14,185 shares of Rexford Industrial Realty was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $711,342.

In the Thursday’s morning session, Rexford Industrial Realty‘s shares are currently trading at $50.19, experiencing a down of 0.0%.

Unveiling the Story Behind Rexford Industrial Realty

Rexford Industrial Realty Inc is a real estate investment trust engaged in the acquisition, ownership, and operation of industrial properties in Southern California. The company mainly focuses on leasing facilities in infill markets or relatively wealthy urban areas with a general scarcity of developable land. The vast majority of Rexford’s real estate portfolio, in terms of square footage, revenue generation, and total value, comprises light manufacturing and distribution warehouse buildings located in Los Angeles and San Diego. The company’s tenants are firms in the wholesale and retail, light manufacturing, industrial equipment, and food and beverage industries.

Financial Milestones: Rexford Industrial Realty’s Journey

Positive Revenue Trend: Examining Rexford Industrial Realty’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 21.36% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Key Profitability Indicators:

-

Gross Margin: The company sets a benchmark with a high gross margin of 78.15%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Rexford Industrial Realty exhibits below-average bottom-line performance with a current EPS of 0.37.

Debt Management: Rexford Industrial Realty’s debt-to-equity ratio is below the industry average at 0.43, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 41.48 is lower than the industry average, implying a discounted valuation for Rexford Industrial Realty’s stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 12.26 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 23.47, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Understanding Crucial Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Rexford Industrial Realty’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBL International Limited Announces 1H 2024 Interim Financial Results Highlighted by 44% Revenue Growth

CBL INTERNATIONAL LIMITED

(Incorporated in Cayman Islands with limited liabilities)

BANL

KUALA LUMPUR, Malaysia, Sept. 12, 2024 (GLOBE NEWSWIRE) — CBL International Limited BANL (the “Company” or “CBL”), the listing vehicle of Banle Group (“Banle” or “the Group”), a leading marine fuel logistic company in the Asia-Pacific region, today announced its unaudited financial results for the six months ended June 30, 2024.

Financial Highlights:

- Revenue: Consolidated revenue for 1H 2024 increased by 44.4% to approximately $277.23 million, compared to $191.96 million in the same period in 2023. This significant growth was driven by a 39.4% year-over-year increase in sales volume, attributed to the expansion of the Company’s global supply network and higher marine fuel demand due to geopolitical factors.

- Gross Profit: Gross profit for the period was approximately $2.72 million, a decrease of 32.2% compared to $4.01 million for 1H 2023. This decline was primarily driven by the reduction in premium sold to customers and led to lower gross profit per ton, which was partially offset by an increase in volume sold.

- Operating Expenses: Operating expenses rose by 64.0% to approximately $4.12 million, up from $2.51 million in 1H 2023. This increase was attributed to higher selling and distribution expenses related to our sales growth, strategic expansion in the Company’s supply network to new geographic areas, and the development of our biofuel operations.

- Net Income: The company reported a net loss of approximately $1.62 million, compared to a net income of $1.15 million in 1H 2023. The loss was driven by lower gross margin and higher operating costs.

- Cash Flow: Net cash provided by operating activities was approximately $2.30 million, a significant improvement from a cash outflow of $7.24 million in 1H 2023, reflecting better management of working capital.

- Cash position: As of June 30, 2024, Banle’s consolidated cash balance increased by approximately $2.29 million, or 30.9%, to $9.69 million, compared to $7.40 million as of December 31, 2023. This increase was primarily driven by improved working capital management. The Company also reported a significant increase in accounts receivable and accounts payable balances, reflecting the growth in its sales activities.

Operational Highlights:

- Global Network Expansion: As of June 30, 2024, Banle expanded its global service network from 36 ports at our IPO in March 2023 to over 60 ports across Asia, Europe and Africa. This strategic expansion has enabled the Company to secure new bunkering business opportunities, particularly in European markets where environmental regulations are increasingly stringent. The opening of the Company’s new office in Ireland in late 2023 has bolstered our market coverage and enhanced local sourcing capabilities. Notably, the Company completed inaugural bunkering services through a local physical supplier in Mauritius in May 2024, further strengthening our market presence.

- Biofuel Initiatives: Banle continued its commitment to sustainability by expanding its B24 biofuel operations, obtaining ISCC EU and ISCC Plus certifications in 2023. The Company successfully commenced biofuel bunkering services through local physical suppliers in Hong Kong, China, and Malaysia, positioning itself as a pioneer in sustainable fuel solutions. The B24 biofuel blend, which includes 24% UCOME (used cooking oil methyl ester), offers a 20% reduction in greenhouse gas emissions compared to conventional marine fuels, aligning with global decarbonization efforts.

- Response to Macroeconomic Environment: The global economy has shown signs of moderate growth in 2024, with emerging markets, particularly in Asia, driving this recovery. However, the shipping industry continues to face challenges such as fluctuating freight rates, port congestion, and disruptions in major trade routes due to the ongoing Red Sea Crisis. Banle has proactively adapted to these conditions, coordinating increased fuel supplies in Asian ports to meet heightened demand, ensuring that our customers’ needs are met despite logistical challenges.

Management Commentary:

“We are pleased with the robust growth in our revenue and sales volume during the first half of 2024, despite the challenging market conditions. Our strategic initiatives, including the expansion of our service network and our focus on sustainable fuel solutions, have positioned us well to navigate these challenges and capitalize on emerging opportunities,” said Teck Lim Chia, Chairman & CEO of Banle Group. “While the current market environment has pressured our margins, we remain confident in our long-term strategy and our ability to deliver value to our shareholders.”

Outlook:

Looking ahead, Banle remains focused on expanding its market presence, particularly in the biofuel sector, and continuing to enhance its global supply network. The Company is committed to driving operational efficiency and delivering sustainable growth in the face of ongoing macroeconomic challenges.

Webcast Details

CBL International Limited BANL cordially invites you to participate in a webcast to discuss its financial results for the six months ended June 30, 2024.

| Event: | 2024 Interim Results Webcast |

| Date and Time: | 10:00 am – 11:00 am HKT on 13 September 2024 (Friday) 10:00 pm – 11:00 pm EST on 12 September 2024 (Thursday) |

| Access: | The webinar can be accessed live through the website or the webcast link below. Webcast Link: https://webcast.roadshowchina.cn/SHMrSGhud1hrRTZTNmRkZ0dMb09Hdz09 |

About the Banle Group

CBL International Limited BANL is the listing vehicle of Banle Group, a reputable marine fuel logistic company based in the Asia Pacific region that was established in 2015. We are committed to providing customers with one-stop solution for vessel refueling, which is referred to as bunkering facilitator in the bunkering industry. We facilitate vessel refueling mainly through local physical suppliers in over 60 major ports covering Belgium, China, Hong Kong, India, Japan, Korea, Malaysia, Mauritius, Panama, the Philippines, Singapore, Taiwan, Thailand, Turkey and Vietnam, as of August 28, 2024. The Group actively promotes the use of sustainable fuels and is awarded with the ISCC EU and ISCC Plus certifications.

For more information about our company, please visit our website at: https://www.banle-intl.com.

Forward-Looking Statements

Certain statements in this announcement are not historical facts but are forward-looking statements. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan,” “should,” “would,” “plan,” “future,” “outlook,” “potential,” “project” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other performance metrics and projections of market opportunity. They involve known and unknown risks and uncertainties and are based on various assumptions, whether or not identified in this press release and on current expectations of BANL’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of BANL. Some important factors that could cause actual results to differ materially from those in any forward-looking statements could include changes in domestic and foreign business, markets, financial, political and legal conditions, geopolitical disruptions and other events that result in material changes in fuel prices. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

For more information, please contact:

CBL International Limited

Strategic Financial Relations Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Gilead Sciences

High-rolling investors have positioned themselves bullish on Gilead Sciences GILD, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GILD often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 19 options trades for Gilead Sciences. This is not a typical pattern.

The sentiment among these major traders is split, with 84% bullish and 15% bearish. Among all the options we identified, there was one put, amounting to $93,009, and 18 calls, totaling $1,310,925.

Expected Price Movements

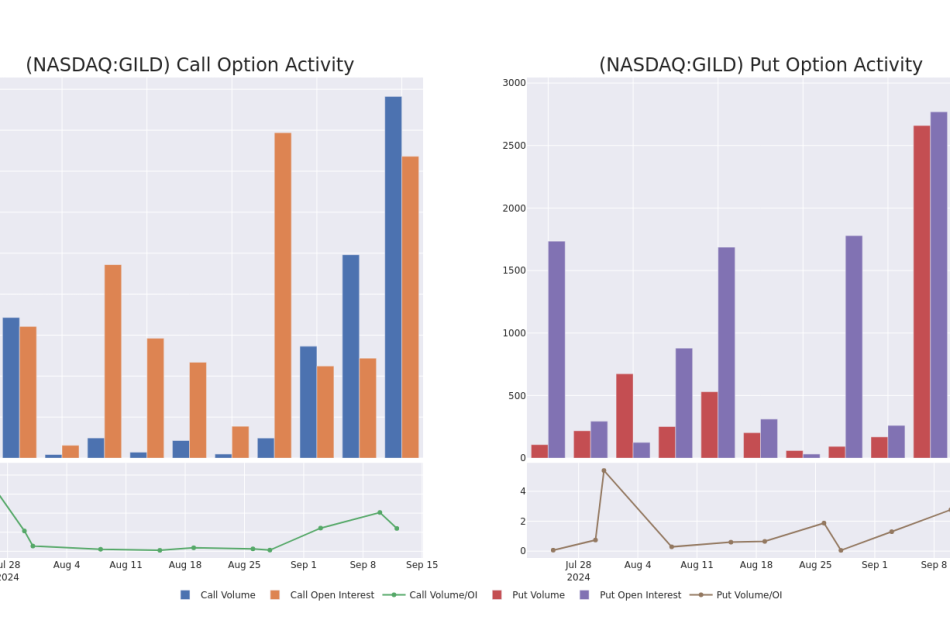

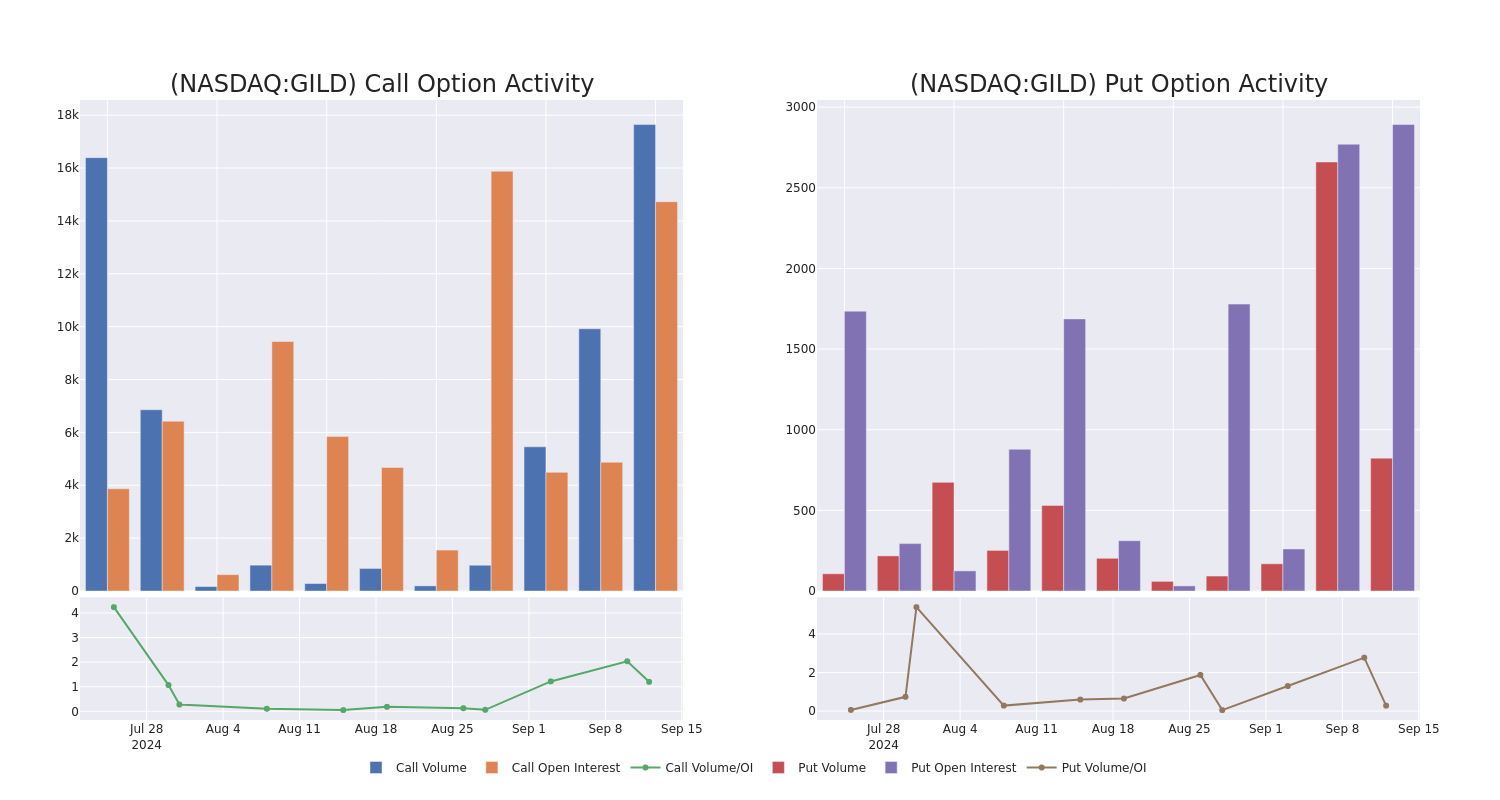

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $85.0 for Gilead Sciences during the past quarter.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Gilead Sciences stands at 2517.0, with a total volume reaching 18,469.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Gilead Sciences, situated within the strike price corridor from $75.0 to $85.0, throughout the last 30 days.

Gilead Sciences 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BEARISH | 01/16/26 | $13.25 | $12.95 | $13.0 | $75.00 | $635.7K | 1.2K | 490 |

| GILD | CALL | TRADE | BULLISH | 11/15/24 | $8.45 | $8.3 | $8.45 | $75.00 | $190.9K | 1.5K | 239 |

| GILD | PUT | SWEEP | BULLISH | 10/18/24 | $1.29 | $1.25 | $1.29 | $80.00 | $93.0K | 2.8K | 824 |

| GILD | CALL | SWEEP | BULLISH | 09/20/24 | $2.8 | $2.71 | $2.8 | $80.00 | $55.8K | 10.5K | 2.2K |

| GILD | CALL | SWEEP | BEARISH | 09/20/24 | $1.39 | $1.15 | $1.15 | $83.00 | $45.9K | 142 | 927 |

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. Gilead’s acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of newer combination regimens that remain standards of care. Gilead is also growing its presence in the oncology market via acquisitions, led by CAR-T cell therapy Yescarta/Tecartus (from Kite) and breast and bladder cancer therapy Trodelvy (from Immunomedics).

After a thorough review of the options trading surrounding Gilead Sciences, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Gilead Sciences

- With a trading volume of 4,190,255, the price of GILD is up by 2.2%, reaching $82.72.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 54 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Gilead Sciences, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.