August Producer Prices May Undermine Rate-Cut Hopes Even More Than Consumer Inflation — Here's Why

The August Consumer Price Index (CPI) report dealt a sharp blow to hopes of swift and aggressive monetary easing by the Federal Reserve.

Speculators who were eyeing steep interest rate cuts may need to temper their optimism as the Federal Open Market Committee (FOMC) meeting on Sept. 18 approaches.

While the headline CPI slowed to a 2.5% annual increase—its lowest reading since February 2021 and below consensus expectations of 2.6%—the story beneath the surface is less reassuring.

Core inflation, which strips out the more volatile food and energy components, advanced by 0.3% on a monthly basis, above the 0.2% predicted. Year-over-year, core CPI remained elevated at 3.2%, well above the Fed’s 2% target.

The stickiness of core inflation has decisively cooled any residual hopes of a more aggressive 50-basis-point rate cut.

Market-implied odds of such a cut have plummeted to just 15%, down sharply from 34% the previous day, as per CME FedWatch data.

The most likely scenario now points to a more measured 25-basis-point reduction in the federal funds rate at the upcoming meeting.

Scope For Outsized Fed Cuts Narrows Amid Sticky Inflation Readings

Ed Yardeni, president of Yardeni Research, highlighted in a post-CPI report note that investors remain overly optimistic, pricing in two more rate cuts before year-end, including one as large as 50 basis points.

“They might be similarly disappointed by stronger-than-expected economic indicators up ahead,” he warned.

Yardeni explained that this monetary easing cycle is going to be notably different from previous ones.

Historically, the Fed has slashed rates aggressively in response to financial crises that quickly spiraled into credit crunches and recessions.

This time, however, the central bank is acting preemptively to avert a downturn, which suggests that fewer rate cuts may be necessary to achieve its goals.

Focus Shifts To PPI Report For Fresh Inflation Insights

The next significant data release on the Fed’s radar is the Producer Price Index (PPI) for August, scheduled for Friday at 8:30 a.m. ET.

Here are economist expectations to the August PPI report:

- The PPI for final demand is expected to continue its downward trend, decelerating from 2.2% year-over-year in July to 1.8% in August. If realized, this would mark the second consecutive month of declining annual producer inflation.

- On a month-over-month basis, the PPI is expected to show a modest increase of 0.1%, matching July’s reading.

- The core PPI—which excludes volatile food, energy, and trade service prices—is anticipated to edge up slightly to 0.2% monthly, accelerating from an unchanged reading in July.

- The annual core PPI is projected to rise from 2.4% in July to 2.5% in August.

Bottom line, the market’s optimistic view that the Fed can cut rates aggressively could face further challenges if the August PPI report reveals stubborn price pressures among U.S. producers.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXCLUSIVE: Lazard Small-Cap Expert Predicts 30%-50% Russell 2000 Rally On The Back Of Lower Interest Rates (UPDATED)

Editor’s note: This story has been updated to clarify that an expectation of up to 200 basis points of interest rate cuts over the next year is the view of Sean Gallagher and not of Lazard itself.

Small-cap stocks may be poised for a powerful catch-up rally in the next six to 12 months, especially as interest rates begin to decline, according to Sean Gallagher, global head of Lazard‘s small-cap equity platform.

After years of sharp underperformance relative to large caps, Gallagher predicts that small caps, as tracked by the iShares Russell 2000 ETF IWM, are set to rally between 30% and 50% in the upcoming year, closing the gap with large-cap counterparts.

In an exclusive interview with Benzinga, Gallagher stressed the striking valuation gap between small and large caps, a key factor supporting his bullish outlook.

“Small caps have been lagging significantly for an extended period,” he said.

A Catalyst For Small Caps: Lower Interest Rates

Gallagher’s optimism centers on the Federal Reserve’s expected pivot towards rate cuts, a shift that could provide small caps with the tailwind they need to outperform.

“We feel very good that inflation is on a downward trajectory, and we expect the Federal Reserve to begin cutting rates soon. This should provide a much-needed catalyst for small caps to catch up with large caps,” he said.

Gallagher said he anticipates up to 200 basis points of rate cuts over the next year, which he said could significantly lift small-cap stocks, given their higher leverage and sensitivity to borrowing costs.

Chart: Russell 2000’s Sharp Underperformance vs. S&P 500, Nasdaq 100 Over The Past 5 Years

Valuation Gap Creates Opportunity

One of the primary reasons for Gallagher’s bullish stance is the sheer size of the valuation gap between small and large caps. “The median price-to-earnings (PE) ratio for small caps, excluding non-earners, stands at 9.5 times, which is incredibly attractive compared to large caps,” he said.

While the broader small-cap index might seem less compelling at first glance, Gallagher noted that the roughly 18% of small-cap companies that are non-earners skew the overall picture. “When you remove the non-earners from the index, small caps look exceptionally cheap,” he added.

The numbers are striking: Small caps have underperformed the S&P 500 by 10 percentage points this year, 30% over the past three years, and nearly 50% over the past five years.

Sector Focus: Financials, Health Care, and Consumer Durables

When it comes to Lazard’s small-cap strategy, Gallagher noted that the portfolio is heavily weighted toward sectors that will benefit the most from a lower interest rate environment.

“We are particularly bullish on financials, healthcare, and consumer durables,” he said.

Health care spending, especially in biotech, has been muted recently, but Gallagher said lower borrowing costs could reignite investment in this area.

He also sees significant potential in consumer durables, especially companies with debt-heavy balance sheets, which stand to benefit from reduced financing costs. “Many consumer durables companies have felt the impact of elevated rates, but we expect them to rebound strongly as borrowing costs decline,” he added.

A Republican Sweep Could Favor Small Caps

Gallagher also touched on the potential political implications for small-cap stocks, particularly with the upcoming 2024 U.S. presidential election.

Historically, small caps have fared better under Republican administrations, which tend to favor lower taxes and pro-market policies.

“While the election outcome remains uncertain, a Republican-led White House could be a tailwind for small caps, especially if it leads to tax cuts or reduced regulation,” Gallagher stated.

It’s worth noting that Goldman Sachs analysts predict stronger GDP and job growth if Democrats sweep the White House and Congress.

Recession Risk And Fed Missteps

Despite his overall bullishness, Gallagher acknowledged several risks that could derail the small-cap rally.

Chief among them is the potential for the Federal Reserve to fall behind the curve in addressing economic softening. “We’re seeing some signs of economic slowdown, particularly in consumer and industrial sectors, but it’s not flashing recession to me just yet,” he said.

Gallagher emphasized the importance of the Fed acting swiftly to cut rates, ensuring the economy doesn’t lose too much momentum before the rate cuts take effect. “We just need to get from here to there, and as long as the Fed acts in time, I believe we can avoid a significant contraction,” he added.

Now Read:

Don’t miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile.

Get exclusive access to CEO presentations, 1:1 meetings with investors, and valuable insights from top financial experts. Whether you’re a trader, entrepreneur, or investor, this event offers unparalleled opportunities to grow your portfolio and network with industry leaders.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Taylor Swift's Endorsement Of Kamala Harris Drives Over 330K Visitors To Vote.Gov

Pop music sensation Taylor Swift has been recognized for directing a massive influx of over 330,000 visitors to vote.gov, following her public endorsement of Vice President Kamala Harris.

What Happened: The General Services Administration reported that 337,826 visitors were referred to the voter information website via Swift’s custom link as of 2 p.m. EDT on Wednesday, reported The Hill.

This surge occurred less than 24 hours after Swift’s endorsement after the debate between Harris and former President Donald Trump.

Swift, a Grammy award-winning artist, announced her endorsement on Instagram, expressing her belief that the country should be “led by calm and not chaos.”

She also addressed fake images circulating online, allegedly showing her support for the Republican nominee, and concluded her post by urging her followers, particularly first-time voters, to do their research and register to vote.

Why It Matters: Swift’s endorsement comes on the heels of her album “The Tortured Poets Department” which experienced a 600% sales jump months after its release.

Former President Trump, however, dismissed Swift’s endorsement of his opponent, suggesting that she might “pay a price for it in the marketplace.”

In 2020, Swift backed the Joe Biden-Harris ticket, and during the 2018 midterms, she endorsed two Democratic candidates from Tennessee.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock jumps as CEO Jensen Huang looks to address key investor concerns

-

Nvidia stock surged 6% on Wednesday, helping fuel a tech-led rebound in the stock market.

-

CEO Jensen Huang discussed the return on investment of AI infrastructure at a Goldman Sachs conference.

-

Productivity gains and immediate cost savings are the core tenets of Nvidia’s ROI pitch to customers.

Nvidia stock jumped 6% on Wednesday, helping fuel a tech-led rebound in the broader market after the CPI report failed to excite the market about imminent interest rate cuts.

The gains in Nvidia stock came as CEO Jensen Huang addressed investors at a Goldman Sachs conference in San Francisco Wednesday morning.

Talking to Goldman Sachs CEO David Solomon, Huang answered key questions related to the ongoing buildout of AI infrastructure, including whether the return on investment was worth it for its customers.

“How would you assess customer ROI at this point in the cycle?” Solomon asked.

Huang noted that because efficiency gains in CPUs have nearly come to a halt, effectively ending Moore’s Law, the cost of data computations was poised to soar in a world that is creating exponentially more data.

But Nvidia’s GPU-based accelerators have meant massive power and efficiency gains in processing data computations, leading to immediate savings for its customers.

In other words, in a world where Nvidia’s AI-enabled GPUs didn’t exist, data centers would cost a lot more money due to the sluggish nature of CPUs.

“You reduce the computing time by about 20 times, and so you get a 10x savings,” Huang said of running Nvidia’s GPU accelerators relative to traditional CPUs.

He added: “That’s the instant ROI you get by acceleration.”

While Nvidia’s next-generation GPU racks for data centers cost millions of dollars, Huang said the cost pales in comparison to the materials costs for a setup built around CPUs.

“Nvidia server racks look expensive and it could be a couple of millions of dollars per rack, but it replaces thousands of nodes. The amazing thing is just the cables of connecting old general purpose computing systems costs more than replacing all of those and identifying into one rack,” Huang explained.

In the Gen AI world, where popular consumer-facing products like ChatGPT and Claude exist, Huang said the ROI for its customers is strong.

“The return on that is fantastic because the demand is so great that for every dollar they spend with us translates to $5 worth of rentals. And that’s happening all over the world and everything is all sold out,” Huang said.

Finally, Huang noted that investors need to take productivity gains that are unlocked via Nvidia’s GPU systems into account.

“The productivity gains are just incredible,” Huang said. “There’s not one software engineer in our company today who don’t use cogenerators.”

He added: “And so I think the days of every line of code being written by software engineers, those are completely over.”

Read the original article on Business Insider

Venture capital fund ends grant program supporting Black women after lawsuit

By Nate Raymond

(Reuters) – An Atlanta-based venture capital fund on Wednesday agreed to stop operating a program that awarded grants to small businesses run by Black women to settle a lawsuit by an anti-affirmative action group that claimed it discriminated based on race.

Fearless Fund agreed to settle the case after a federal appeals court in June agreed with the non-profit American Alliance for Equal Rights that the program likely violated a Civil War-era law barring racial discrimination in contracting.

The non-profit was founded by Edward Blum, who through a different group spearheaded the litigation that led the conservative-majority U.S. Supreme Court last year to bar the consideration of race as a factor in college admissions.

The lawsuit against Fearless Fund was filed in August 2023 and targeted the fund’s Fearless Strivers Grant Contest, which awarded Black women who own small businesses $20,000 in grants and other resources to grow their businesses.

According to the Fearless Fund, businesses owned by Black women in 2022 received less than 1% of the $288 billion that venture capital firms deployed.

The fund, headed by CEO and founding partner Arian Simone, has said its goal was to address that disparity. Fearless Fund counts JPMorgan Chase, Bank of America, and MasterCardas investors, and the fund has invested nearly $27 million into 40 startups led by women of color since 2019.

Lawyers for Blum’s group argued that by only considering Black women for grants, Fearless Fund had adopted a categorical racial bar against other applicants in violation of Section 1981 of the 1866 Civil Rights Act.

A trial court judge initially sided with Fearless Fund. But a 2-1 panel of the Atlanta-based 11th U.S. Circuit Court of Appeals in June held the program likely violated the law, warranting a preliminary injunction pending further litigation.

Blum in a statement on Wednesday said his group had “encouraged the Fearless Fund to open its grant contest to Hispanic, Asian, Native American and white women but Fearless has decided instead to end it entirely.”

Alphonso David, a lawyer for Fearless Fund, in a statement called the settlement agreement “very narrow,” as it does not restrict or relate to any other investment or charitable activity by Fearless Fund going forward.

“The Fearless Fund can now continue their work toward expanding economic opportunity,” he said.

(Reporting by Nate Raymond in Boston, Editing by Alexia Garamfalvi and Marguerita Choy)

Cava Group Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Cava Group.

Looking at options history for Cava Group CAVA we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $420,171 and 10, calls, for a total amount of $714,496.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $175.0 for Cava Group over the recent three months.

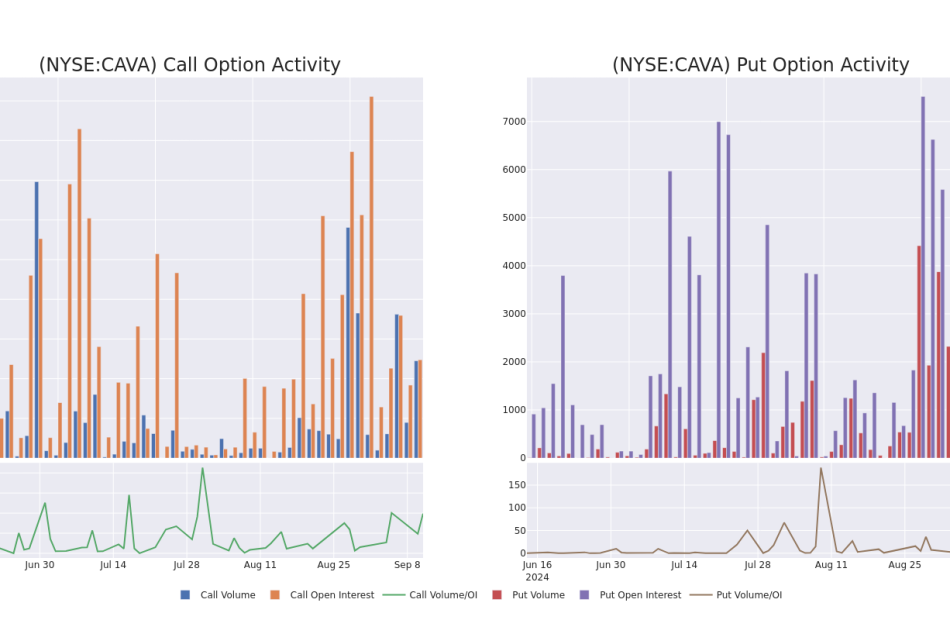

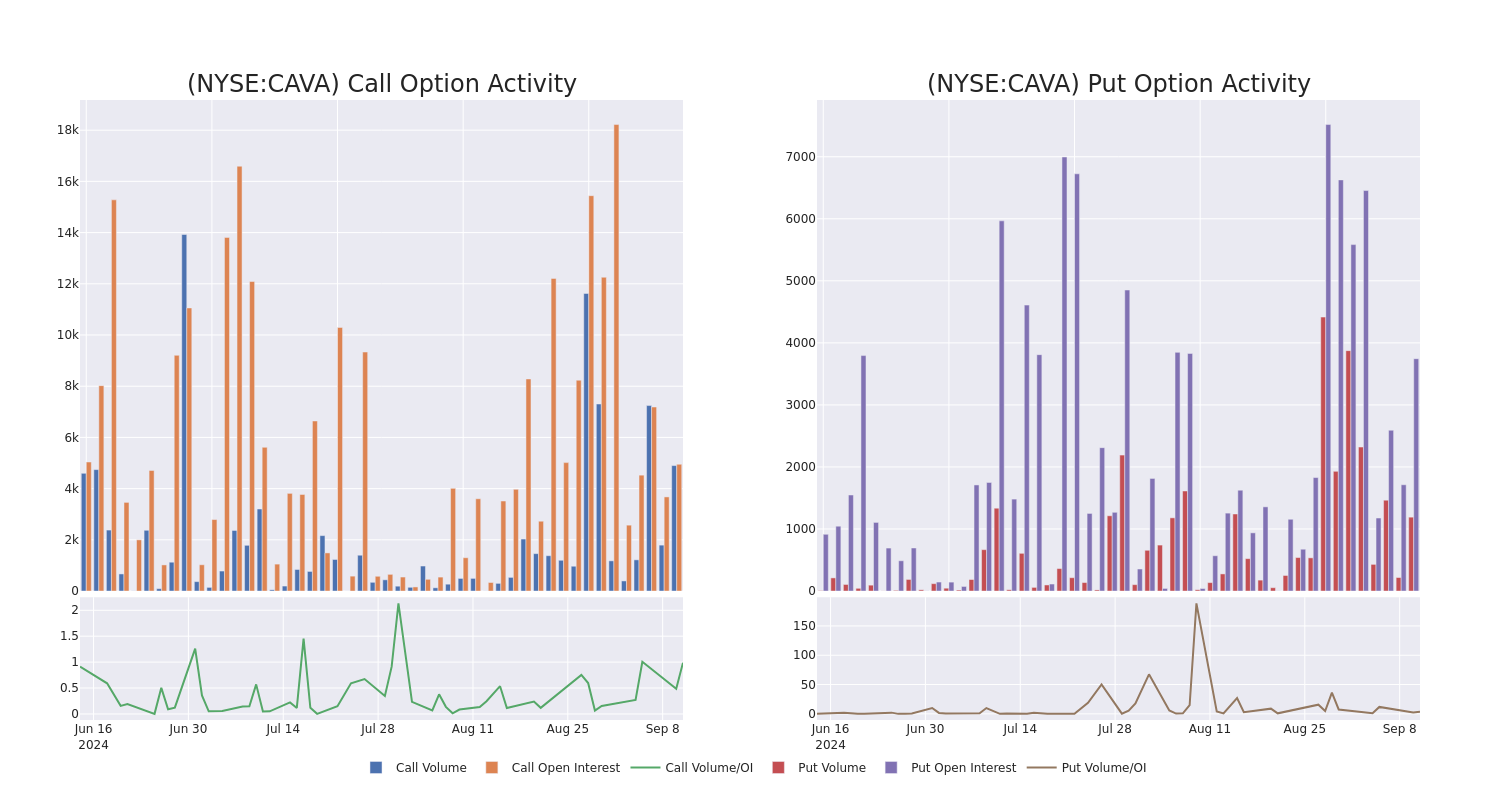

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cava Group’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cava Group’s substantial trades, within a strike price spectrum from $60.0 to $175.0 over the preceding 30 days.

Cava Group 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAVA | CALL | SWEEP | NEUTRAL | 01/16/26 | $38.2 | $37.6 | $38.2 | $110.00 | $286.0K | 33 | 75 |

| CAVA | CALL | TRADE | NEUTRAL | 01/16/26 | $17.6 | $17.0 | $17.3 | $175.00 | $95.1K | 112 | 55 |

| CAVA | PUT | SWEEP | BULLISH | 01/16/26 | $15.6 | $15.3 | $15.3 | $95.00 | $93.3K | 133 | 64 |

| CAVA | PUT | SWEEP | BEARISH | 01/17/25 | $9.8 | $9.6 | $9.8 | $110.00 | $83.2K | 234 | 86 |

| CAVA | PUT | SWEEP | BULLISH | 09/27/24 | $4.9 | $4.6 | $4.6 | $121.00 | $69.0K | 10 | 8 |

About Cava Group

Cava Group Inc owns and operates a chain of restaurants. It is the category-defining Mediterranean fast-casual restaurant brand, bringing together healthful food and bold, satisfying flavors at scale. The company’s dips, spreads, and dressings are centrally produced and sold in grocery stores. The company’s operations are conducted as two reportable segments: CAVA and Zoes Kitchen. The company generates the majority of its revenue from the CAVA segment.

In light of the recent options history for Cava Group, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Cava Group Standing Right Now?

- Currently trading with a volume of 1,412,511, the CAVA’s price is up by 0.84%, now at $120.73.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 55 days.

Expert Opinions on Cava Group

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $114.6.

- Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Cava Group, targeting a price of $95.

- Consistent in their evaluation, an analyst from Argus Research keeps a Buy rating on Cava Group with a target price of $128.

- An analyst from Citigroup persists with their Neutral rating on Cava Group, maintaining a target price of $115.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Cava Group, targeting a price of $120.

- Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Cava Group, targeting a price of $115.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cava Group with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq Surges Over 200 Points; US Crude Oil Stocks Increase

U.S. stocks traded mixed toward the end of trading, with the Nasdaq Composite gaining more than 200 points on Wednesday.

The Dow traded down 0.25% to 40,634.47 while the NASDAQ rose 1.43% to 17,269.59. The S&P 500 also rose, gaining, 0.40% to 5,517.65.

Check This Out: Wall Street’s Most Accurate Analysts Give Their Take On 3 Materials Stocks Delivering High-Dividend Yields

Leading and Lagging Sectors

Information technology shares rose by 1.4% on Wednesday.

In trading on Wednesday, consumer staples shares dipped by 1.3%.

Top Headline

The EIA said crude oil inventories in the U.S. increased by 0.833 million barrels during the week ended Sept. 6, compared to market estimates of a 1 million rise.

Equities Trading UP

- PureCycle Technologies, Inc. PCT shares shot up 38% to $6.45 after the company announced financing transaction and Ironton production update.

- Shares of BriaCell Therapeutics Corp. BCTX got a boost, surging 11% to $0.69 after the company announced overall survival data of its Phase 2 clinical study of Bria-IMT in combination with an immune check point inhibitor in late stage metastatic breast cancer.

- Liquidia Corporation LQDA shares were also up, gaining 13% to $10.05 after the company announced it raised $67.5 million from the common stock financing of 6,460,674 shares at $8.90 per share.

Equities Trading DOWN

- Telesis Bio, Inc. TBIO shares dropped 59% to $1.5688 after the company announced that it has notified the Nasdaq Stock Market of its decision to delist.

- Shares of Rentokil Initial plc RTO were down 21% to $24.98 after the company revised the guidance for the second half of FY24.

- Torrid Holdings Inc. CURV was down, falling 24% to $5.06 after the company announced the launch of secondary offering of common stock.

Commodities

In commodity news, oil traded up 3.2% to $67.87 while gold traded up 0.4% at $2,545.10.

Silver traded up 1.2% to $28.970 on Wednesday, while copper rose 1.1% to $4.1440.

Euro zone

European shares closed mixed today. The eurozone’s STOXX 600 rose 0.01%, Germany’s DAX gained 0.35% and France’s CAC 40 fell 0.14%. Spain’s IBEX 35 Index rose 0.67%, while London’s FTSE 100 fell 0.15%.

The UK’s trade deficit widened to £7.51 billion in July from £5.32 billion in the previous month, while industrial production fell 0.8% month-over-month in July. The UK’s economy stalled during the month of July compared to market estimates of a 0.2% increase.

Asia Pacific Markets

Asian markets closed lower on Wednesday, with Japan’s Nikkei 225 falling 1.49%, Hong Kong’s Hang Seng Index falling 0.73%, China’s Shanghai Composite Index dipping 0.82% and India’s BSE Sensex falling 0.49%.

The Reuters Tankan sentiment index for manufacturers in Japan declined to a reading of +4 in September compared to August’s reading of +10. China’s vehicle sales dipped by 5.0% year-over-year to 2.45 million units for the month of August.

Economics

- U.S. mortgage applications increased 1.4% in the week ending Sept. 6, compared to a 1.6% rise in the prior period.

- U.S. annual inflation rate eased for a fifth straight month to 2.5% in August from 2.9% in the previous month, and down from market estimates of 2.6%.

- The EIA said crude oil inventories in the U.S. increased by 0.833 million barrels during the week ended Sept. 6, compared to market estimates of a 1 million rise.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Glancy Prongay & Murray LLP Reminds Investors of Looming Deadline in the Class Action Lawsuit Against STMicroelectronics N.V. (STM)

LOS ANGELES, Sept. 11, 2024 (GLOBE NEWSWIRE) — Glancy Prongay & Murray LLP (“GPM”) reminds investors of the upcoming October 22, 2024 deadline to file a lead plaintiff motion in the class action filed on behalf of investors who purchased or otherwise acquired STMicroelectronics N.V. (“STM” or the “Company”) STM securities between January 25, 2024 to July 24, 2024, inclusive (the “Class Period”).

If you suffered a loss on your STM investments or would like to inquire about potentially pursuing claims to recover your loss under the federal securities laws, you can submit your contact information at www.glancylaw.com/cases/STMicroelectronics-NV/. You can also contact Charles H. Linehan, of GPM at 310-201-9150, Toll-Free at 888-773-9224, or via email at shareholders@glancylaw.com to learn more about your rights.

On July 25, 2024, STM released its second quarter 2024 financial results and reduced its revenue guidance for the full fiscal year 2024, stating that “customer orders for Industrial did not improve and Automotive demand declined.”

On this news, STM’s stock price fell $6.07, or 15.3%, to close at $33.47 per share on July 25, 2024, thereby injuring investors.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors that: (1) the Company did not truly have appropriate visibility to generate the guidance it put forth; (2) the Company failed to appropriately analyze the visibility it did have, or otherwise the Company was simply not truly equipped to handle the ongoing challenges in its end-market industries as they had projected; and (3) as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

Follow us for updates on LinkedIn, Twitter, or Facebook.

If you purchased or otherwise acquired STM securities during the Class Period, you may move the Court no later than October 22, 2024 to request appointment as lead plaintiff in this putative class action lawsuit. To be a member of the class action you need not take any action at this time; you may retain counsel of your choice or take no action and remain an absent member of the class action. If you wish to learn more about this class action, or if you have any questions concerning this announcement or your rights or interests with respect to the pending class action lawsuit, please contact Charles Linehan, Esquire, of GPM, 1925 Century Park East, Suite 2100, Los Angeles, California 90067 at 310-201-9150, Toll-Free at 888-773-9224, by email to shareholders@glancylaw.com, or visit our website at www.glancylaw.com. If you inquire by email please include your mailing address, telephone number and number of shares purchased.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Glancy Prongay & Murray LLP, Los Angeles

Charles Linehan, 310-201-9150 or 888-773-9224

shareholders@glancylaw.com

www.glancylaw.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fortune Media and Great Place To Work Name Evergreen Home Loans to 2024 Best Workplaces in Financial Services & Insurance List, Ranking 29th

BELLEVUE, Wash., Sept. 11, 2024 /PRNewswire/ — Great Place To Work® and Fortune have selected Evergreen Home Loans for the 2024 Fortune Best Workplaces in Financial Services & Insurance™ List. This is Evergreen’s 8th time being named to this prestigious list, this year coming in at number 29 in the medium category. Earning a spot means that Evergreen Home Loans is one of the best companies to work for in the country.

The Best Workplaces in Financial Services & Insurance list is based on analysis of survey responses from over 194,000 employees at Great Place To Work Certified™ companies in the financial services and insurance industry.

Haavard Sterri, CMO at Evergreen Home Loans shares, “We are incredibly honored to be recognized once again by Fortune and Great Place To Work. Our people are the heart of our success, and this recognition is a testament to the collaborative, supportive culture we’ve worked hard to build. At Evergreen, we are committed to fostering an environment where our team can thrive, grow, and feel valued every day. This award motivates us to continue putting our employees first, knowing that when they succeed, our clients and communities do too.”

The Best Workplaces in Financial Services & Insurance list is highly competitive. Great Place To Work, the global authority on workplace culture, determines its lists using its proprietary For All™ Methodology to evaluate and certify thousands of organizations in America’s largest ongoing annual workforce study, based on over 1.3 million survey responses and data from companies representing more than 8.2 million employees this year alone.

Survey responses reflect a comprehensive picture of the workplace experience. Honorees were selected based on their ability to offer positive outcomes for employees regardless of job role, race, gender, sexual orientation, work status, or other demographic identifier.

“Congratulations to the Best Workplaces in Financial Services & Insurance,” says Michael C. Bush, CEO of Great Place To Work. “These companies not only outperform the average for their industry but have created workplaces that outshine the average in every category, proving the importance of building trust with workers, no matter the industry.”

About Evergreen Home Loans

Founded in 1987, Evergreen Home Loans is a pioneer in the real estate finance industry, known for its unique selling proposition of providing unique home buying strategies and assisting clients and their community in making winning offers. Evergreen Home Loans continues it’s a lifelong belief that we can change the world, one relationship at a time.

For further information or media inquiries, please contact:

Selah Terwilliger

Senior Marketing Manager

sterwilliger@evergreenhomeloans.com

530-328-6539

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fortune-media-and-great-place-to-work-name-evergreen-home-loans-to-2024-best-workplaces-in-financial-services–insurance-list-ranking-29th-302245407.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fortune-media-and-great-place-to-work-name-evergreen-home-loans-to-2024-best-workplaces-in-financial-services–insurance-list-ranking-29th-302245407.html

SOURCE Evergreen Moneysource Mortgage Company dba Evergreen Home Loans

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Report Warns of $16,500 Annual Social Security Benefit Cut for Dual-Income Couples by 2033

A recent report has set off alarm bells for retirees: if Congress doesn’t act soon, dual-income couples could see their Social Security benefits slashed by up to $16,500 annually starting in 2033. Without significant changes, many retirees face a steep drop in their monthly checks, and it’s worth paying attention to now.

Don’t Miss:

Earlier this year, the Social Security Administration (SSA) wrote a letter to the Senate urging action on the projected depletion of the Federal Old Age and Survivors Insurance (OASI) Trust Fund. This OASI fund pays Social Security benefits to retired workers, their families, and the families of deceased workers.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

In the letter, the administration wrote, “The asset reserves … of the OASI Trust Fund are projected to fall below 20 percent by the beginning of calendar year 2033 based on our intermediate set of economic, demographic, and programmatic assumptions. Moreover, we project that the reserves of the OASI Trust Fund will be depleted soon after, during 2033, and only about 79 percent of benefits scheduled in current law will be payable at that time if no legislative action is taken.”

This program is paying out more than it brings in from payroll taxes, which is why it is running out. So, once the depletion date hits, the program will only be able to pay what it brings in, resulting in retirees facing a 21% cut in their benefits. And it’s not just couples who will be affected. Single-income individuals will also face an estimated cut of about $12,400 annually.

If legislative changes aren’t made soon, retirees and other beneficiaries across the board will feel the effects of this cut. The Committee for a Responsible Federal Budget (CRFB) has stated that low-income retirees will feel the blow particularly hard and could see their benefits cut by $10,000. While this is a smaller number than higher-income retirees, it represents a larger share of their income and could really hurt those who are already struggling.

See Also: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

So, what can be done?

Some experts suggest raising the Social Security tax rate, stating that raising it from its current 6.2% to 7.75% will at least cover 100% of benefits through 2034. Others have also said that a mix of tax increases and benefit reductions might be the solution.

There has been a lot of speculation and grand ideas this year about how to fix the problem – some have even suggested that seniors should work longer before taking their benefits to help slow the deficit. But there doesn’t seem to be a cohesive solution yet.

The political landscape only muddles things up further. While Vice President Kamala Harris and former President Donald Trump have promised to protect Social Security, neither has proposed a specific plan of action for this estimated funding depletion.

Less than a decade before the projected depletion date, it’s wise for those approaching retirement and in retirement to consider their options. Talk to a financial advisor to determine if the reduction in Social Security funds will significantly impact your finances, and come up with a game plan to secure your financial future no matter what comes next.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Report Warns of $16,500 Annual Social Security Benefit Cut for Dual-Income Couples by 2033 originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.