Nvidia Soared Today Thanks to AI News — Is It Time to Buy the Stock?

Nvidia (NASDAQ: NVDA) stock posted big gains in Wednesday’s trading. The artificial intelligence (AI) leader’s share price closed out the daily session up 8%, according to data from S&P Global Market Intelligence.

Nvidia stock gained ground in conjunction with a report from Semafor that the U.S. was considering lifting restrictions on the sale of advanced semiconductors to Saudi Arabia. If so, it would open up a new market for the AI company.

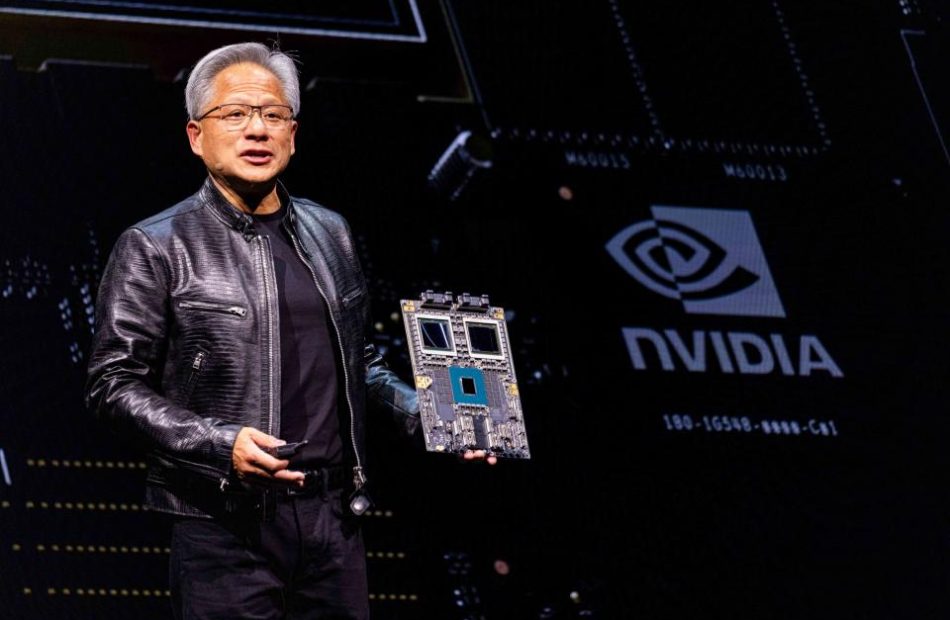

Nvidia’s valuation also got a significant boost thanks to comments made in a presentation by CEO Jensen Huang. Speaking at the Communacopia and Technology Conference hosted by Goldman Sachs, Huang stated that his company was continuing to see incredible levels of demand.

He also issued encouraging guidance for Blackwell, the company’s next-generation processors. Huang said that Blackwell’s manufacturing has already ramped up, the chips are set to begin shipping to customers in significant numbers in Q4, and demand among customers is very high.

The Nvidia CEO also said that his company was approaching its designs with fabrication versatility in mind. The company currently relies on Taiwan Semiconductor Manufacturing to manufacture its chip designs, but it says it’s taking steps to ensure it can move to other fabs if necessary.

Is Nvidia stock a buy right now?

On the heels of some recent volatility for the stock, Jensen Huang gave Nvidia investors a lot of reassuring news today. The report about Nvidia’s chips potentially being greenlit for sale in Saudi Arabia also highlights untapped growth opportunities among government customers.

Nvidia has been serving up stellar sales and earnings growth that has powered incredible share price gains, but that’s also raised questions among investors about how long the momentum can be sustained. Today’s favorable news developments helped allay concerns and power big gains for the stock, and I think Nvidia still offers attractive upside at current prices.

The company continues to have a clear lead in the advanced graphics processing unit (GPU) space, and the long-term demand outlook for its GPUs and emerging technology and service offerings remains very favorable. Recent volatility for the stock highlights that expectations are very high, but the company looks poised to deliver another big leap forward in processing with its Blackwell chips — and it could be laying the foundations for long-term dominance in the AI space.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Soared Today Thanks to AI News — Is It Time to Buy the Stock? was originally published by The Motley Fool

Nvidia CEO Says Chipmaker Is Seeing ‘Incredible’ Demand, Sending Stock Higher Wednesday

Annabelle Chih / Bloomberg / Getty Images

Nvidia CEO Jensen Huang at COMPUTEX 2024, an industry trade show, in Taipei, Taiwan, on June 2, 2024

Key Takeaways

-

Nvidia shares surged Wednesday after CEO Jensen Huang said the chipmaker is seeing “incredible” demand.

-

“Everything is sold out,” Huang said, as customers clamor for Nvidia’s products to support artificial intelligence.

-

The CEO also touted the return on Nvidia products for customers, saying every dollar a cloud company might spend on Nvidia infrastructure translates to $5 in rentals for the company.

Nvidia Corporation (NVDA) shares surged 8% Wednesday after CEO Jensen Huang said the chipmaker is seeing “incredible” demand.

Huang said at Goldman Sachs’ Communacopia + Technology Conference that “everything is sold out,” as customers clamor for Nvidia infrastructure to support artificial intelligence (AI).

“Our company works with every AI company in the world today,” Huang said, according to a transcript provided by AlphaSense. “Everybody’s counting on us.”

Nvidia’s chips are used by several major cloud providers, including Microsoft (MSFT) and Amazon (AMZN). Both companies have told investors they expect to boost spending on AI infrastructure.

Huang touted the return on Nvidia’s products for customers as well, saying every dollar a cloud company might spend on Nvidia infrastructure translates to $5 in rentals for the company.

Nvidia GPS on Display at Oracle CloudWorld

Nvidia GPUs were also on display at Oracle’s (ORCL) CloudWorld conference Wednesday. The company unveiled an Oracle Cloud Infrastructure (OCI) Supercluster supported by Nvidia’s Blackwell platform equipped with more than 100,000 GPUs to train and deploy AI models. The OCI Superclusters are expected to be available in the first half of 2025.

Oracle and Nvidia partnered at the conference to showcase how Nvidia’s platform can accelerate AI and data processing for enterprise customers.

Shares of Nvidia closed 8% higher at $116.91 Wednesday, partially reversing recent losses following a sales forecast that came up short of lofty expectations.

Read the original article on Investopedia.

HABITAT FOR HUMANITY OF OMAHA TEAMS WITH BUILD YOUR FORTRESS TO BUILD HOMES USING BREAKTHROUGH CONSTRUCTION PROCESS

Partnership aims to provide new HyPerformance Homes & Structures to support local communities using Structural Insulated Panels (SIPs)

IDAHO FALLS, Idaho, Sept. 11, 2024 /PRNewswire/ — Build Your Fortress, one of the industry leaders in Structural Insulated Panels (SIPs), has announced a partnership with Habitat for Humanity of Omaha to build HyPerformance Homes & Structures for communities in need using smart SIPs technology, allowing for homes to be built with greater energy efficiency, durability and structural integrity in a far shorter time frame than conventional construction.

“We are elated to announce the formation of our partnership with Habitat for Humanity of Omaha, part of a world-class organization with an extraordinary track record in helping people build homes, communities and hope throughout the world,” said Build Your Fortress CEO Michelle Fox.

“We are proud that Habitat for Humanity of Omaha has recognized our innovative approach to home construction as well as our commitment to community, and we are so pleased to have the opportunity to work together. Habitat for Humanity of Omaha is dedicated to helping neighbors achieve prosperity and independence through homeownership, and those values are closely aligned with ours at Build Your Fortress, making this partnership a perfect fit.”

The partnership will launch in several communities in Nebraska while Build Your Fortress develops plans to expand the program to additional states.

SIPs construction technology allows for finished framing with cutouts for plumbing and electrical within three days of launch, a far shorter and more efficient time frame compared with conventional construction methods, according to Build Your Fortress principal Dr. Travis Fox. Additionally, the robust structure of SIPs provides enhanced protection in regions susceptible to extreme weather such as high winds, compared to conventional methods.

“Traditional hammer-and-nail 2×4 construction can be time-consuming and subject to outside forces such as the availability of labor and, in some areas of the country, freezing winter conditions,” said

Dr. Fox. “SIPs solves those problems while offering a wide array of advantages including excellent insulation, much faster construction and better temperature control, making it a smart investment and an ideal approach for our partnership with Habitat for Humanity of Omaha.”

For more information about Build Your Fortress, visit buildyourfortress.com.

About Build Your Fortress

Build Your Fortress is one of the industry leaders in Structural Insulated Panels (SIPs), prefabricated building materials that consist of an insulating foam core sandwiched between two structural facings. Unlike stick framing, which involves constructing the frame piece by piece on-site, SIPs come as large, ready-made panels, providing quicker and more efficient building. SIPs offer a wide array of benefits, including excellent insulation, energy efficiency, reduced labor costs, and faster construction.

About Habitat For Humanity of Omaha

Habitat for Humanity of Omaha partners with the community to help build or improve a place that people can call home. Habitat homeowners help build their own homes alongside volunteers and pay an affordable mortgage. With the support of the community, Habitat homeowners achieve the strength, stability and independence they need to build a better life for themselves and for their families.

Contact: Jeff Haney

jeff@fierrocommunications.com

Office: (702) 385-7300

Cell: (702) 538-6117

![]() View original content:https://www.prnewswire.com/news-releases/habitat-for-humanity-of-omaha-teams-with-build-your-fortress-to-build-homes-using-breakthrough-construction-process-302245191.html

View original content:https://www.prnewswire.com/news-releases/habitat-for-humanity-of-omaha-teams-with-build-your-fortress-to-build-homes-using-breakthrough-construction-process-302245191.html

SOURCE Build Your Fortress

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump closing in on being able to sell his shares of Truth Social's parent company. But will he?

Shares of Trump Media & Technology fell more than 10% Wednesday following last night’s debate between Donald Trump and Vice President Kamala Harris.

The former president can start selling shares of Truth Social’s parent company next week starting on Sept. 19 when a lockup provision ends, if he chooses to do so. That’s because the lockup provision prevented company insiders from selling newly issued shares for six months.

Trump owns nearly 115 million shares of the company, according to a recent filing with the Securities and Exchange Commission. Based on Tuesday’s closing price of $18.04, Trump’s shares are worth approximately $2 billion.

The question remains if Trump will decide to sell any of his shares. Even though he’d be certain to receive a sizeable payout, the stock is now worth considerably less than it was valued at several months ago. When Truth Social & Technology Group Corp. made its debut on the Nasdaq in March, it hit a high of $79.38.

The stock closed Wednesday down $1.95 at $16.68 but above the day’s low of $15.30. The decline also came after Taylor Swift endorsed Harris for president shortly after the debate ended.

Trump Media runs the social media platform Truth Social, which Trump created after he was banned from Twitter and Facebook following the Jan. 6, 2021, Capitol riot. Based in Sarasota, Florida, the company has been losing money and struggling to raise revenue. It lost nearly $58.2 million last year while generating only $4.1 million in revenue, according to regulatory filings.

Shares of Trump Media have been considered a meme stock by some market experts, which is a nickname given to stocks that get caught up in buzz online and shoot way beyond what traditional analysis says they’re worth. The stock has fluctuated for the past several months, with trading largely driven by individual investors who are typically considered less sophisticated than day traders.

SigmaTron International, Inc. Regains Compliance with Nasdaq Listing Rule 5250(c)(1)

ELK GROVE VILLAGE, Ill., Sept. 11, 2024 (GLOBE NEWSWIRE) — SigmaTron International, Inc. SGMA, an electronic manufacturing services company (the “Company”), announced today that on September 10, 2024, it received notice from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) indicating the Company has regained compliance with Nasdaq Listing Rule 5250(c)(1) by filing with the Securities and Exchange Commission (“SEC”) its Form 10-K for the annual period ended April 30, 2024, on September 3, 2024 (as amended on September 6, 2024, the “Form 10-K”).

As previously disclosed, on August 16, 2024, the Company received notice from Nasdaq indicating that, as a result of the Company’s delay in filing its Form 10-K, the Company was no longer in compliance with the timely filing requirements under Nasdaq Listing Rule 5250(c)(1). As a result of filing the Form 10-K, the Company has regained compliance with Nasdaq Listing Rule 5250(c)(1).

About SigmaTron International, Inc.

Headquartered in Elk Grove Village, Illinois, SigmaTron International, Inc. operates in one reportable segment as an independent provider of electronic manufacturing services (“EMS”). The EMS segment includes printed circuit board assemblies, electro-mechanical subassemblies and completely assembled (box-build) electronic products. The Company and its wholly-owned subsidiaries operate manufacturing facilities in Elk Grove Village, Illinois; Acuna, Chihuahua, and Tijuana Mexico; Union City, California; Suzhou, China; and Biên Hòa City, Vietnam. In addition, the Company maintains an International Procurement Office and Compliance and Sustainability Center in Taipei, Taiwan. The Company also provides design services in Elk Grove Village, Illinois, U.S.

For Further Information Contact:

SigmaTron International, Inc.

James J. Reiman

1-800-700-9095

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

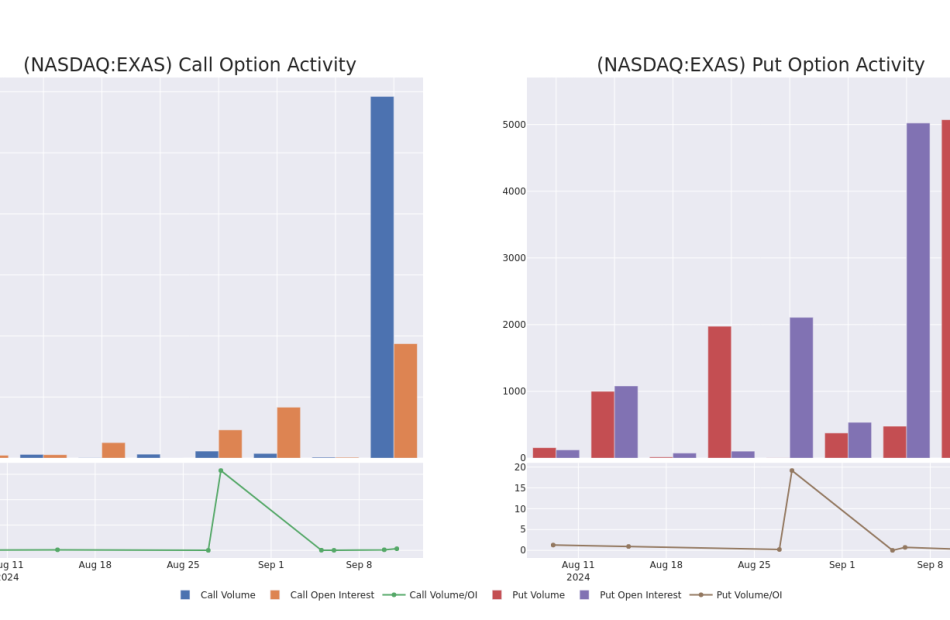

Market Whales and Their Recent Bets on EXAS Options

Deep-pocketed investors have adopted a bullish approach towards Exact Sciences EXAS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in EXAS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 28 extraordinary options activities for Exact Sciences. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 57% leaning bullish and 32% bearish. Among these notable options, 4 are puts, totaling $278,937, and 24 are calls, amounting to $1,400,044.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $75.0 for Exact Sciences over the recent three months.

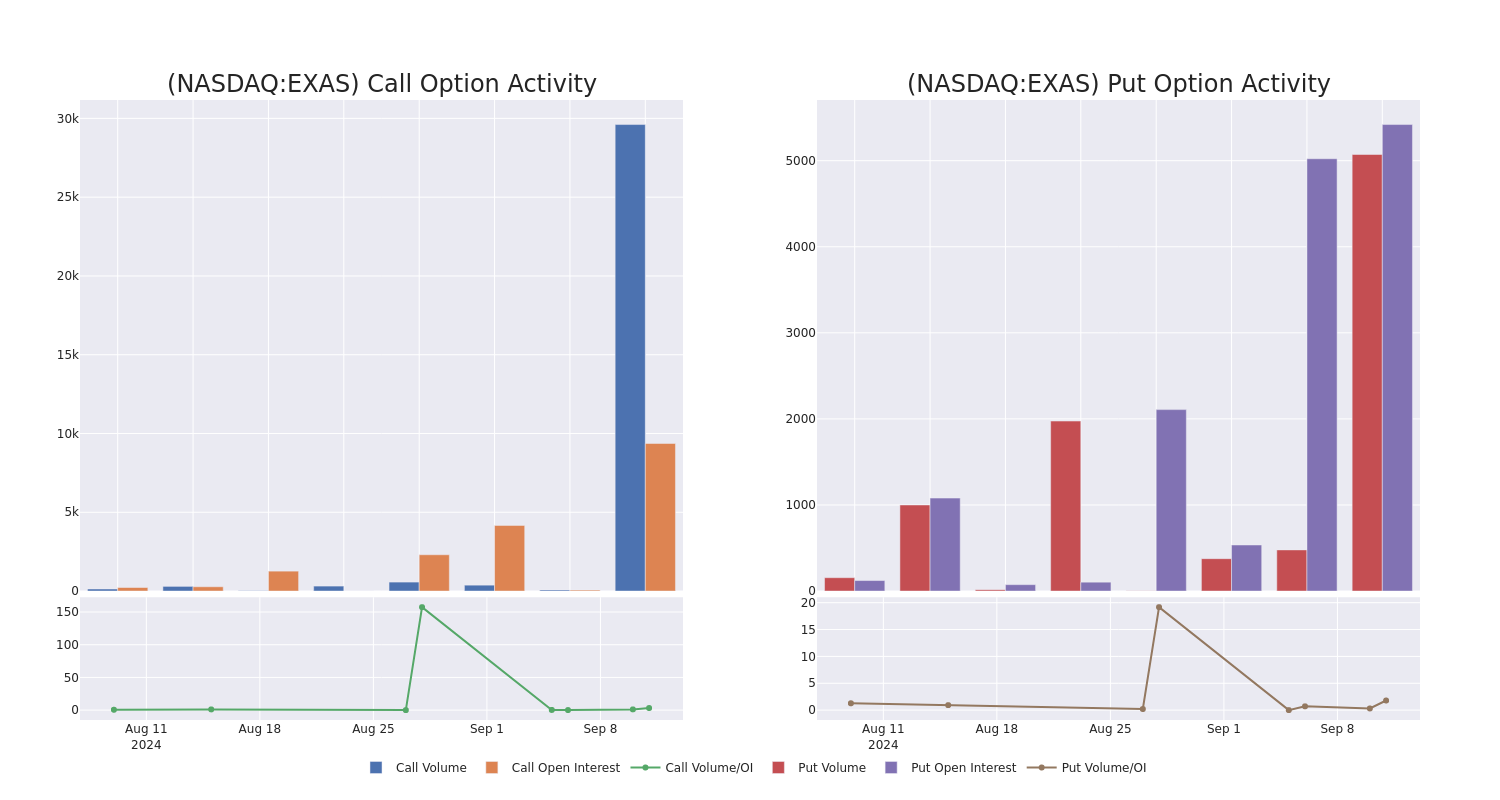

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Exact Sciences stands at 1642.89, with a total volume reaching 34,681.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Exact Sciences, situated within the strike price corridor from $55.0 to $75.0, throughout the last 30 days.

Exact Sciences Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXAS | CALL | SWEEP | BEARISH | 09/20/24 | $6.0 | $5.1 | $5.3 | $60.00 | $179.1K | 5.0K | 2.8K |

| EXAS | CALL | SWEEP | BULLISH | 09/20/24 | $3.9 | $3.0 | $3.9 | $62.50 | $117.0K | 1.5K | 650 |

| EXAS | PUT | TRADE | BULLISH | 09/20/24 | $2.0 | $0.5 | $0.7 | $55.00 | $104.9K | 4.3K | 3.1K |

| EXAS | CALL | SWEEP | BULLISH | 09/20/24 | $6.3 | $4.6 | $6.3 | $60.00 | $99.7K | 5.0K | 2.4K |

| EXAS | CALL | SWEEP | BULLISH | 09/20/24 | $2.8 | $1.4 | $2.8 | $60.00 | $93.2K | 5.0K | 1.4K |

About Exact Sciences

Exact Sciences Corporation, headquartered in Madison, Wisconsin, provides cancer screening and diagnostic test products in the United States and internationally. Exact’s Cologuard screening test, a noninvasive stool-based DNA test, is a pre-cancer screening test for colorectal cancer. The company also competes in the precision oncology market with Oncotype DX, a suite of tissue-based genomic tests for estimating recurrence risk and likelihood of benefit from chemotherapy for breast and colon cancer, and OncoExTra, a liquid-based comprehensive genomic profiling test. It is developing liquid biopsy tests for molecular residual disease, colorectal cancer screening, and multicancer screening, too.

Having examined the options trading patterns of Exact Sciences, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Exact Sciences Standing Right Now?

- With a trading volume of 5,015,141, the price of EXAS is up by 11.94%, reaching $65.35.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 49 days from now.

What The Experts Say On Exact Sciences

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $75.0.

- An analyst from Wells Fargo has revised its rating downward to Overweight, adjusting the price target to $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Exact Sciences with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global Theme Park Market Poised for Remarkable Growth: Projected to Reach USD 119 Billion by 2034 at a CAGR of 5.2% | FMI

NEWARK, Del, Sept. 11, 2024 (GLOBE NEWSWIRE) — The global theme park market is set to witness significant growth, with revenues projected to soar from USD 71.4 billion in 2024 to an impressive USD 119.0 billion by 2034, achieving a compound annual growth rate (CAGR) of 5.2% over the next decade.

As tourism continues to evolve, the theme park industry is emerging as a focal point in the conversations about fun, experience, and leisure. Whether it’s the adrenaline-pumping rides, serene nature-inspired environments, up-close animal encounters, or thrilling water adventures, theme parks offer a blend of excitement and escapism that resonates with people across all age groups. In today’s fast-paced world, these attractions provide a perfect balance between fun and relaxation, catering to diverse preferences.

The rise of theme parks highlights a dynamic shift toward a customer-centric model that prioritizes experiences over material authenticity. Unlike traditional tourism, where the focus was often on historical landmarks or physical objects, modern theme parks emphasize immersive, interactive experiences that foster connection and joy.

With this evolving trend, theme parks are set to redefine the future of leisure and entertainment, offering an antidote to the stresses of modern life. The market’s promising growth trajectory underscores its importance as a key driver in the global tourism and recreation industry.

As the theme park market gears up for a remarkable decade of expansion, industry leaders are expected to innovate continuously, delivering enhanced experiences that will captivate the hearts of millions worldwide.

Market CAGR Value of Theme Park by Country:

| Countries | CAGR from 2024 to 2034 |

| Japan | 7.00% |

| South Korea | 6.80% |

| United Kingdom | 6.30% |

| China | 6.00% |

| United States | 5.50% |

Surge in Market Demand: Explore Comprehensive Trends and Analysis in Our Full Report!

“Theme parks have become much more than just destinations; they represent a dynamic fusion of thrill, relaxation, and discovery,” says Nandini Roy Choudhury, Client Partner at Future Market Insights. “In an era where consumers seek meaningful and engaging experiences, theme parks have successfully carved out a niche that delivers both joy and escapism, ensuring their enduring appeal.”

Prominent Drivers of the Theme Park Market:

The theme park market is driven by several prominent factors that fuel its growth and development. Key drivers include:

- Rising Disposable Income and Consumer Spending: As global incomes rise, especially in emerging markets, more people have the financial means to visit theme parks, contributing to increased attendance and higher spending within parks.

- Tourism Growth: Theme parks are often major tourist attractions. The growth of international and domestic tourism directly supports the expansion of the theme park market.

- Increased Demand for Family Entertainment: With a focus on multi-generational family activities, theme parks provide an ideal destination for family entertainment, leading to higher visitor numbers and diversified offerings.

- Technological Innovations: The use of immersive technologies such as virtual reality (VR), augmented reality (AR), and advanced ride systems enhances the visitor experience, driving repeat visits and customer satisfaction.

- Strategic Collaborations and Licensing Agreements: Partnerships between theme parks and entertainment companies (e.g., Disney, Universal) for exclusive rights to popular franchises (movies, TV shows, video games) attract fans and expand the audience base.

- Urbanization and Infrastructure Development: Expanding urban areas and improved transport networks make theme parks more accessible, leading to higher foot traffic.

- Diversification of Offerings: Parks are offering year-round attractions, themed accommodations, shopping experiences, and dining options to enhance guest satisfaction and extend the time spent at the park.

Challenges Faced by the Theme Park Market:

The theme park market faces several challenges, which impact both operational and financial aspects. Here are some of the key challenges:

- High Operating Costs: Maintenance, staffing, and energy consumption contribute to significant expenses. Keeping attractions safe and functional requires constant investment.

- Seasonality and Weather Dependency: Theme parks typically see fluctuating attendance based on seasons and weather. Bad weather can drastically reduce visitor numbers, affecting revenue.

- Rising Competition: The rise of virtual entertainment options, such as VR and online gaming, presents new competition, particularly for younger audiences.

- Economic Downturns: During economic recessions, theme park attendance drops as families cut down on non-essential leisure activities.

- Safety and Security Concerns: Managing large crowds while ensuring safety is a logistical challenge, particularly after incidents like accidents or health crises (e.g., COVID-19).

- Sustainability Pressures: There is growing pressure to adopt sustainable practices, from reducing water and energy consumption to minimizing waste.

- Technological Advancements: Keeping up with technological trends, such as virtual queues and digital enhancements, requires continual investment.

Key Companies in the Market:

- Cedar Fair Entertainment Company

- Comcast Corporation

- Fantawild

- Hershey Entertainment and Resorts Company

Regional Analysis Theme Park Market:

The theme park market shows varied growth trends across different regions:

- North America: Dominates the global theme park market due to well-established parks like Disney and Universal Studios, with strong visitor numbers and high per capita spending.

- Europe: Home to major parks like Disneyland Paris, the market is stable but faces growth challenges due to economic factors and seasonal tourism.

- Asia-Pacific: Fastest-growing region, led by China and Japan. Rising disposable incomes, urbanization, and investments in new parks are driving expansion.

- Middle East & Africa: Emerging market with growing interest, driven by tourism initiatives, especially in the UAE with attractions like Dubai Parks and Resorts.

- Latin America: Moderate growth with potential in countries like Brazil and Mexico, but hindered by economic instability.

Market Segmentation:

By Type:

- Theme Parks

- Water Parks

- Adventure Parks

- Zoo Parks

By Ride:

- Mechanical Rides

- Water Rides

- Others

By Age-Group:

- Up to 18 years

- 19 to 35 years

- 36 to 50 years

- 51 to 65 years

- Above 65 years

By Revenue Source:

- Tickets

- Food & Beverage

- Merchandise

- Hotel & Resorts

- Others

By Region:

- North America

- Latin America

- Asia Pacific

- Middle East and Africa (MEA)

- Europe

Authored by:

Nandini Roy Choudhury (Client Partner for Food & Beverages at Future Market Insights, Inc.) has 7+ years of management consulting experience. She advises industry leaders and explores off-the-eye opportunities and challenges. She puts processes and operating models in place to support their business objectives.

She has exceptional analytical skills and often brings thought leadership to the table.

Nandini has vast functional expertise in key niches, including but not limited to food ingredients, nutrition & health solutions, animal nutrition, and marine nutrients. She is also well-versed in the pharmaceuticals, biotechnology, retail, and chemical sectors, where she advises market participants to develop methodologies and strategies that deliver results.

Her core expertise lies in corporate growth strategy, sales and marketing effectiveness, acquisitions and post-merger integration and cost reduction. Nandini has an MBA in Finance from MIT School of Business. She also holds a Bachelor’s Degree in Electrical Engineering from Nagpur University, India.

Nandini has authored several publications, and quoted in journals including Beverage Industry, Bloomberg, and Wine Industry Advisor.

Explore FMI’s related ongoing Coverage on Travel and Tourism Market Insights Domain:

The global tourism market size is expected to develop at a CAGR of 5% over the next ten years. By the end of this forecast year in 2032, analysts anticipate the tourism market size would be worth USD 17.1 Trillion.

The spanish sports tourism market share is estimated to reach USD 18,135.6 million in 2024. As per the analysis, sales are forecast to increase at a robust 13.5% CAGR during the forecast period from 2024 to 2034 and it is projected to reach USD 64,341.3 million by the end of 2034.

The South Africa faith-based tourism market demand is estimated to reach ~USD 86.5 million in the year 2024. The market is forecast to reach a valuation of ~USD 193.8 million by the year 2034 with a CAGR of ~8.4% from the years 2024 to 2034.

The Germany culinary tourism market growth is estimated to reach ~USD 6,062.3 million in the year 2024. It is forecast to reach a valuation of ~USD 19,511.9 million by the year 2034 with a CAGR of 12.4% from the years 2024 to 2034.

The India sustainable tourism market forecast is estimated to reach ~USD 37.1 million in the year 2024 and is further forecasted to reach a valuation of ~USD 216.7 million in the year 2034 with a market CAGR of 19.3% between the years 2024 and 2034.

The Japan sports tourism market outlook registered a market value of USD 9,577.8 million in 2023 and is expected to grow at a steady CAGR of 8.5% during the forecast period from 2024 to 2034. The target market is anticipated to be valued at USD 23,561.0 million by 2034.

As per newly released data, the Japan faith-based tourism market overview is estimated at ~USD 548.3 million in 2024. The market is projected to grow at a significant CAGR of ~10.3% during the forecast period from 2024 to 2034 and reach a market valuation of ~USD 1,461.4 million by 2034 end.

The global tech savvy hotel chains market opportunity is estimated at ~USD 70,898.5 million in the year 2024 and is anticipated to reach an industry valuation of ~USD 294,394.8 million in the year 2034 with a market CAGR of 15.3% between the years 2024 and 2034.

The global ecotourism market development has been estimated at USD 2,51,188.1 million in the year 2024 and is expected to reach an industry valuation of USD 9,79,128.7 million in the year 2034 with a market CAGR of 14.6% between the years 2024 and 2034.

The yoga and meditation market trends is expected to progress strongly, with an estimated CAGR of 13.5% over the forecast period. As of 2024, it is valued at USD 6,942.8 million and is anticipated to go beyond USD 24,631.6 million by 2034, reflecting a 3.5X increase in its value.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Future Market Insights Inc. Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, USA T: +1-347-918-3531 For Sales Enquiries: sales@futuremarketinsights.com Website: https://www.futuremarketinsights.com LinkedIn| Twitter| Blogs | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IRG Names Long-Time Senior Executive Greg Hipp as Chief Operating Officer

IRG Realty Advisors’ President steps into an expanded role

LOS ANGELES, Sept. 11, 2024 /PRNewswire/ — Industrial Realty Group, LLC (IRG), a national leader in industrial redevelopment and adaptive reuse, announced today the promotion of Greg Hipp, formerly the President of IRG Realty Advisors (IRGRA), to Chief Operating Officer (COO) of IRG. In his new role, Hipp will oversee the company’s operations at a national level, leading both IRG and IRGRA through the next phase of growth.

“Greg has been an incredible asset to IRG and a key contributor to the success of our real estate portfolio,” said Stuart Lichter, President of IRG. “As we continue to expand, both in the scale of our projects and our workforce, we are confident that Greg will provide the same level of dedication and strategic insight that he has applied to shape the trajectory of our company over the past two decades.”

In this expanded role, Hipp will spearhead national operations across the IRG group of companies, providing leadership in strategic planning and execution for both IRG and their service company, IRGRA.

“Since joining the company in 2005, I’ve had the privilege of contributing to IRG’s exponential growth and evolution,” said Hipp. “I am honored to have been part of IRG’s long-standing history and excited to help steer the company toward an even brighter future.”

During Hipp’s tenure, IRG has grown its portfolio to over 100 million square feet of space and expanded its workforce to over 300 associates across the country.

About IRG

IRG is a nationwide real estate development and investment firm specializing in the acquisition, development, and management of commercial and industrial real estate throughout the United States. IRG, through its affiliated partnerships and limited liability companies, operates a portfolio containing over 150 properties in 31 states with over 100 million square feet of rentable space. IRG is nationally recognized as a leading force behind the adaptive reuse of commercial and industrial real estate, solving some of America’s most difficult real estate challenges.

Learn more at www.industrialrealtygroup.com.

For more information, contact:

Lauren Crumrine | Vice President Marketing | IRG

614-562-9252

lcrumrine@industrialrealtygroup.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/irg-names-long-time-senior-executive-greg-hipp-as-chief-operating-officer-302245228.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/irg-names-long-time-senior-executive-greg-hipp-as-chief-operating-officer-302245228.html

SOURCE Industrial Realty Group, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MIND TECHNOLOGY, INC. REPORTS FISCAL 2025 SECOND QUARTER RESULTS

THE WOODLANDS, Texas, Sept. 11, 2024 /PRNewswire/ — MIND Technology, Inc. MIND (“MIND” or the “Company”) today announced financial results for its fiscal 2025 second quarter ended July 31, 2024.

Revenues from continuing operations for the second quarter of fiscal 2025 were approximately $10.0 million compared to approximately $7.6 million in the second quarter of fiscal 2024. The Company reported operating income from continuing operations of approximately $1.4 million for the second quarter of fiscal 2025 compared to an operating loss of $767,000 for the second quarter of fiscal 2024. Net income for the second quarter of fiscal 2025 amounted to $798,000 compared to a loss of approximately $1.5 million in the second quarter of fiscal 2024. Second quarter of fiscal 2025 net loss attributable to common shareholders (after declared and undeclared preferred stock dividends) was $149,000, or a loss of $0.11 per share compared to a loss of approximately $2.4 million, or a loss of $1.74 per share in the second quarter last year. Adjusted EBITDA from continuing operations for the second quarter of fiscal 2025 was approximately $1.8 million compared to a loss of $120,000 in the second quarter of fiscal 2024.

Adjusted EBITDA from continuing operations, which is a non-GAAP measure, is defined and reconciled to reported net income (loss) from continuing operations and cash used in operating activities in the accompanying financial tables. These are the most directly comparable financial measures calculated and presented in accordance with United States generally accepted accounting principles, or GAAP.

The backlog of Marine Technology Products related to our Seamap segment as of July 31, 2024 was approximately $26.2 million compared to approximately $17.0 million at July 31, 2023.

Rob Capps, MIND’s President and Chief Executive Officer, stated, “We delivered positive results for our fiscal second quarter that were in line with our expectations and achieved further operational efficiencies that drove margin improvement. In addition to streamlining our operations and narrowing our strategic focus with the sale of Klein, we have been able to implement various cost containment initiatives that have meaningfully enhanced our financial results over the last twelve months. Our backlog remains strong, and is over 50% above the year ago amount. Furthermore, our pipeline of pending orders and prospects is also strong, with over $6 million of orders having been added since quarter end or that we expect shortly. This activity and ongoing discussions regarding other pending orders demonstrate the significant customer demand we are seeing across our differentiated product lines.

“Given our enhanced cost structure, current visibility, and robust customer engagement, we fully expect to achieve year-over-year revenue growth, positive Adjusted EBITDA and greater full year profitability in fiscal 2025.

“As announced last week, we have completed the conversion of our preferred stock to common stock. This is an important step for MIND. It simplifies our capital structure and, in my opinion, sets the stage for creating meaningful stockholder value,” concluded Capps.

CONFERENCE CALL

Management has scheduled a conference call for Thursday, September 12, 2024 at 9:00 a.m. Eastern Time (8:00 a.m. Central Time) to discuss the Company’s fiscal 2025 second quarter results. To access the call, please dial (412) 902-0030 and ask for the MIND Technology call at least 10 minutes prior to the start time. Investors may also listen to the conference call live on the MIND Technology website, http://mind-technology.com, by logging onto the site and clicking “Investor Relations”. A telephonic replay of the conference call will be available through September 19, 2024 and may be accessed by calling (201) 612-7415 and using passcode 13748560#. A webcast archive will also be available at http://mind-technology.com shortly after the call and will be accessible for approximately 90 days. For more information, please contact Dennard Lascar Investor Relations by email at MIND@dennardlascar.com.

ABOUT MIND TECHNOLOGY

MIND Technology, Inc. provides technology to the oceanographic, hydrographic, defense, seismic and security industries. Headquartered in The Woodlands, Texas, MIND has a global presence with key operating locations in the United States, Singapore, Malaysia, and the United Kingdom. Its Seamap unit designs, manufactures, and sells specialized, high performance, marine exploration and survey equipment.

Forward-looking Statements

Certain statements and information in this press release concerning results for the quarter ended July 31, 2024 may constitute “forward-looking statements“ within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts of our existing operations and do not include the potential impact of any future acquisitions or dispositions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and uncertainties include, without limitation, reductions in our customers‘ capital budgets, our own capital budget, limitations on the availability of capital or higher costs of capital and volatility in commodity prices for oil and natural gas.

For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, unless required by law, whether as a result of new information, future events or otherwise. All forward-looking statements included in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to herein.

Non-GAAP Financial Measures

Certain statements and information in this press release contain non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company‘s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Company management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. Company management also believes that these non-GAAP financial measures enhance the ability of investors to analyze the Company’s business trends and to understand the Company’s performance. In addition, the Company may utilize non-GAAP financial measures as guides in its forecasting, budgeting, and long-term planning processes and to measure operating performance for some management compensation purposes. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Reconciliation of Backlog, which is a non-GAAP financial measure, is not included in this press release due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate the most directly comparable GAAP financial measures.

-Tables to Follow-

|

MIND TECHNOLOGY, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except per share data) (unaudited) |

||||||||

|

July 31, 2024 |

January 31, 2024 |

|||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ |

1,904 |

$ |

5,289 |

||||

|

Accounts receivable, net of allowance for credit losses of $332 at each of July 31, 2024 |

9,586 |

6,566 |

||||||

|

Inventories, net |

19,069 |

13,371 |

||||||

|

Prepaid expenses and other current assets |

2,075 |

3,113 |

||||||

|

Total current assets |

32,634 |

28,339 |

||||||

|

Property and equipment, net |

782 |

818 |

||||||

|

Operating lease right-of-use assets |

1,732 |

1,324 |

||||||

|

Intangible assets, net |

2,566 |

2,888 |

||||||

|

Deferred tax asset |

122 |

122 |

||||||

|

Total assets |

$ |

37,836 |

$ |

33,491 |

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ |

4,387 |

$ |

1,623 |

||||

|

Deferred revenue |

428 |

203 |

||||||

|

Customer deposits |

2,726 |

3,446 |

||||||

|

Accrued expenses and other current liabilities |

1,905 |

2,140 |

||||||

|

Income taxes payable |

2,171 |

2,114 |

||||||

|

Operating lease liabilities – current |

747 |

751 |

||||||

|

Total current liabilities |

12,364 |

10,277 |

||||||

|

Operating lease liabilities – non-current |

985 |

573 |

||||||

|

Total liabilities |

13,349 |

10,850 |

||||||

|

Stockholders’ equity: |

||||||||

|

Preferred stock, $1.00 par value; 2,000 shares authorized; 1,683 shares issued and |

37,779 |

37,779 |

||||||

|

Common stock, $0.01 par value; 40,000 shares authorized; 1,406 shares issued and |

14 |

14 |

||||||

|

Additional paid-in capital |

113,215 |

113,121 |

||||||

|

Accumulated deficit |

(126,555) |

(128,307) |

||||||

|

Accumulated other comprehensive gain |

34 |

34 |

||||||

|

Total stockholders’ equity |

24,487 |

22,641 |

||||||

|

Total liabilities and stockholders’ equity |

$ |

37,836 |

$ |

33,491 |

||||

|

MIND TECHNOLOGY, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) (unaudited) |

||||||||||||||||

|

For the Three Months |

For the Six Months |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Revenues: |

||||||||||||||||

|

Sales of marine technology products |

$ |

10,036 |

$ |

7,561 |

19,714 |

18,158 |

||||||||||

|

Cost of sales: |

||||||||||||||||

|

Sales of marine technology products |

5,258 |

4,620 |

10,718 |

10,681 |

||||||||||||

|

Gross profit |

4,778 |

2,941 |

8,996 |

7,477 |

||||||||||||

|

Operating expenses: |

||||||||||||||||

|

Selling, general and administrative |

2,784 |

2,913 |

5,543 |

6,219 |

||||||||||||

|

Research and development |

328 |

493 |

790 |

971 |

||||||||||||

|

Depreciation and amortization |

236 |

302 |

503 |

635 |

||||||||||||

|

Total operating expenses |

3,348 |

3,708 |

6,836 |

7,825 |

||||||||||||

|

Operating income (loss) |

1,430 |

(767) |

2,160 |

(348) |

||||||||||||

|

Other income (expense): |

||||||||||||||||

|

Interest expense |

— |

(163) |

— |

(367) |

||||||||||||

|

Other, net |

40 |

238 |

509 |

310 |

||||||||||||

|

Total other income (expense) |

40 |

75 |

509 |

(57) |

||||||||||||

|

Income (loss) from continuing operations before income taxes |

1,470 |

(692) |

2,669 |

(405) |

||||||||||||

|

Provision for income taxes |

(672) |

(66) |

(917) |

(477) |

||||||||||||

|

Net income (loss) from continuing operations |

798 |

(758) |

1,752 |

(882) |

||||||||||||

|

Loss from discontinued operations, net of income taxes |

— |

(736) |

— |

(852) |

||||||||||||

|

Net income (loss) |

$ |

798 |

$ |

(1,494) |

$ |

1,752 |

$ |

(1,734) |

||||||||

|

Preferred stock dividends – declared |

— |

— |

— |

— |

||||||||||||

|

Preferred stock dividends – undeclared |

(947) |

(947) |

(1,894) |

(1,894) |

||||||||||||

|

Net loss attributable to common stockholders |

$ |

(149) |

$ |

(2,441) |

$ |

(142) |

$ |

(3,628) |

||||||||

|

Net loss per common share – Basic and Diluted |

||||||||||||||||

|

Continuing operations |

$ |

(0.11) |

$ |

(1.21) |

$ |

(0.10) |

$ |

(1.97) |

||||||||

|

Discontinued operations |

$ |

— |

$ |

(0.52) |

$ |

— |

$ |

(0.61) |

||||||||

|

Net loss |

$ |

(0.11) |

$ |

(1.74) |

$ |

(0.10) |

$ |

(2.58) |

||||||||

|

Shares used in computing net income (loss) per common share: |

||||||||||||||||

|

Basic and diluted |

1,406 |

1,406 |

1,406 |

1,406 |

||||||||||||

|

MIND TECHNOLOGY, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited) |

||||||||

|

For the Six Months Ended July 31, |

||||||||

|

2024 |

2023 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Net income (loss) |

$ |

1,752 |

$ |

(1,734) |

||||

|

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

||||||||

|

Depreciation and amortization |

503 |

940 |

||||||

|

Stock-based compensation |

95 |

158 |

||||||

|

Provision for inventory obsolescence |

45 |

— |

||||||

|

Gross profit from sale of other equipment |

(457) |

(336) |

||||||

|

Changes in: |

||||||||

|

Accounts receivable |

(3,032) |

(3,238) |

||||||

|

Unbilled revenue |

75 |

31 |

||||||

|

Inventories |

(5,742) |

(333) |

||||||

|

Prepaid expenses and other current and long-term assets |

1,042 |

1,329 |

||||||

|

Income taxes receivable and payable |

54 |

63 |

||||||

|

Accounts payable, accrued expenses and other current liabilities |

2,465 |

(1,556) |

||||||

|

Deferred revenue and customer deposits |

(495) |

1,199 |

||||||

|

Net cash used in operating activities |

(3,695) |

(3,477) |

||||||

|

Cash flows from investing activities: |

||||||||

|

Purchases of property and equipment |

(146) |

(102) |

||||||

|

Sale of other equipment |

457 |

336 |

||||||

|

Net cash provided by investing activities |

311 |

234 |

||||||

|

Cash flows from financing activities: |

||||||||

|

Payment on short-term loan |

— |

2,947 |

||||||

|

Net cash provided by financing activities |

— |

2,947 |

||||||

|

Effect of changes in foreign exchange rates on cash and cash equivalents |

(1) |

12 |

||||||

|

Net change in cash and cash equivalents |

(3,385) |

(284) |

||||||

|

Cash and cash equivalents, beginning of period |

5,289 |

778 |

||||||

|

Cash and cash equivalents, end of period |

$ |

1,904 |

$ |

494 |

||||

|

MIND TECHNOLOGY, INC. Reconciliation of Net Income (Loss) and Net Cash Used in Operating Activities to EBITDA and Adjusted EBITDA from Continuing Operations (in thousands) (unaudited) |

||||||||||||||||

|

For the Three Months |

For the Six Months |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Reconciliation of Net income (loss) to EBITDA and Adjusted EBITDA from continuing operations |

(in thousands) |

|||||||||||||||

|

Net income (loss) |

$ |

798 |

$ |

(1,494) |

$ |

1,752 |

$ |

(1,734) |

||||||||

|

Interest expense, net |

— |

163 |

— |

367 |

||||||||||||

|

Depreciation and amortization |

236 |

459 |

503 |

940 |

||||||||||||

|

Provision for income taxes |

672 |

66 |

917 |

477 |

||||||||||||

|

EBITDA (1) |

1,706 |

(806) |

3,172 |

50 |

||||||||||||

|

Stock-based compensation |

46 |

108 |

95 |

158 |

||||||||||||

|

Loss from discontinued operations net of depreciation and amortization |

— |

578 |

— |

546 |

||||||||||||

|

Adjusted EBITDA from continuing operations (1) |

$ |

1,752 |

$ |

(120) |

$ |

3,267 |

$ |

754 |

||||||||

|

Reconciliation of Net Cash Provided by (Used in) Operating Activities to EBITDA |

||||||||||||||||

|

Net cash provided by (used in) operating activities |

$ |

1,058 |

$ |

(490) |

$ |

(3,695) |

$ |

(3,477) |

||||||||

|

Stock-based compensation |

(46) |

(108) |

(95) |

(158) |

||||||||||||

|

Provision for inventory obsolescence |

(22) |

— |

(45) |

— |

||||||||||||

|

Changes in accounts receivable (current and long-term) |

111 |

(244) |

2,957 |

3,207 |

||||||||||||

|

Interest paid, net |

— |

203 |

— |

407 |

||||||||||||

|

Taxes paid, net of refunds |

508 |

236 |

938 |

425 |

||||||||||||

|

Gross profit from sale of other equipment |

— |

198 |

457 |

336 |

||||||||||||

|

Changes in inventory |

2,930 |

1,312 |

5,742 |

333 |

||||||||||||

|

Changes in accounts payable, accrued expenses and other current liabilities and deferred revenue |

(1,813) |

(1,825) |

(1,970) |

357 |

||||||||||||

|

Changes in prepaid expenses and other current and long-term assets |

(942) |

(21) |

(1,042) |

(1,329) |

||||||||||||

|

Other |

(78) |

(67) |

(75) |

(51) |

||||||||||||

|

EBITDA (1) |

$ |

1,706 |

$ |

(806) |

$ |

3,172 |

$ |

50 |

||||||||

|

1. |

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA is defined as net income before (a) interest income and interest expense, (b) provision for (or benefit from) income taxes and (c) depreciation and amortization. Adjusted EBITDA excludes non-cash foreign exchange gains and losses, stock-based compensation, impairment of intangible assets and other non-cash tax related items. We consider EBITDA and Adjusted EBITDA to be important indicators for the performance of our business, but not measures of performance or liquidity calculated in accordance with GAAP. We have included these non-GAAP financial measures because management utilizes this information for assessing our performance and liquidity, and as indicators of our ability to make capital expenditures, service debt and finance working capital requirements and we believe that EBITDA and Adjusted EBITDA are measurements that are commonly used by analysts and some investors in evaluating the performance and liquidity of companies such as us. In particular, we believe that it is useful to our analysts and investors to understand this relationship because it excludes transactions not related to our core cash operating activities. We believe that excluding these transactions allows investors to meaningfully trend and analyze the performance of our core cash operations. EBITDA and Adjusted EBITDA are not measures of financial performance or liquidity under GAAP and should not be considered in isolation or as alternatives to cash flow from operating activities or as alternatives to net income as indicators of operating performance or any other measures of performance derived in accordance with GAAP. In evaluating our performance as measured by EBITDA, management recognizes and considers the limitations of this measurement. EBITDA and Adjusted EBITDA do not reflect our obligations for the payment of income taxes, interest expense or other obligations such as capital expenditures. Accordingly, EBITDA and Adjusted EBITDA are only two of the measurements that management utilizes. Other companies in our industry may calculate EBITDA or Adjusted EBITDA differently than we do and EBITDA and Adjusted EBITDA may not be comparable with similarly titled measures reported by other companies. |

|

Contacts: |

Rob Capps, President & CEO |

|

MIND Technology, Inc. |

|

|

281-353-4475 |

|

|

Ken Dennard / Zach Vaughan |

|

|

Dennard Lascar Investor Relations |

|

|

713-529-6600 |

|

|

MIND@dennardlascar.com |

![]() View original content:https://www.prnewswire.com/news-releases/mind-technology-inc-reports-fiscal-2025-second-quarter-results-302245348.html

View original content:https://www.prnewswire.com/news-releases/mind-technology-inc-reports-fiscal-2025-second-quarter-results-302245348.html

SOURCE MIND Technology, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.