Seller Of $79M Mansion To Jeff Bezos Says He Was Deceived, Files Lawsuit Over Lost Millions Against Real Estate Firm That Brokered The Deal

In a recent development, Amazon founder, Jeff Bezos, has found himself indirectly involved in a $6 million lawsuit following his purchase of a mansion in Miami.

Leo Kryss, co-founder of Brazilian toy company Tectoy, has filed a lawsuit against real estate brokerage Douglas Elliman over a $79 million mansion sale to Bezos, The Wall Street Journal reported on Tuesday.

Kryss had listed his seven-bedroom mansion on Indian Creek Island, Miami, for $85 million in May 2023. The property, which includes a home theater, wine cellar, library, and pool, is adjacent to a $68 million three-bedroom house that Bezos bought in June 2023.

When Kryss received an offer for the property, he suspected that his new neighbor, Bezos, was the buyer. However, Jay Parker, the Florida CEO of Douglas Elliman, assured Kryss that Bezos was not the buyer and that the offer would not exceed $79 million.

After selling his mansion for $6 million less than its list price, Kryss discovered that the buyer was indeed connected to Bezos. Kryss is now suing Douglas Elliman, which earned over $3 million in commission from the sale, claiming that knowledge of Bezos’ intention to buy adjacent properties would have significantly influenced his decision-making.

Douglas Elliman’s Parker stated in an email to Kryss that he was also unaware of Bezos’ identity as the buyer. The Journal reported that the property was believed to be purchased by the family of Benny Klepach, the mayor of Indian Creek Village.

Check This Out:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Venterra Realty Named To Fortune® Media and Great Place to Work® 2024 Best Medium Workplaces List

HOUSTON, Sept. 11, 2024 /PRNewswire/ — Venterra Realty has been recognized by Fortune® magazine & the Great Place To Work® Institute as one of the 2024 Fortune® Best Medium Workplaces. This is the 7th time Venterra has been named on the list.

To determine the Best Medium Workplaces list, Great Place To Work analyzed the survey responses of over 213,000 employees from Great Place To Work Certified™ companies with between 100 and 999 U.S. employees.

“Being recognized among the top 100 companies is a significant achievement for Venterra, and we are proud that this marks the 7th time we have been mentioned on this list. This acknowledgment reflects our teams’ commitment to our core values and our relentless pursuit of excellence in everything we do.,” said Venterra CEO, John Foresi. “Our culture of collaboration, innovation, and inclusivity is what truly sets us apart and makes Venterra a great place to work. We look forward to continuing to foster a workplace that inspires growth, creativity, and success for our colleagues,” said Andrew Stewart, Venterra Chairman.

The Best Medium Workplaces list is highly competitive. Great Place To Work, the global authority on workplace culture, determines its lists using its proprietary For All™ methodology to evaluate and certify thousands of organizations in America’s largest ongoing annual workforce study, based on over 1.3 million survey responses and data from companies representing more than 8.2 million employees this year alone.

Survey responses reflect a comprehensive picture of the workplace experience. Honorees were selected based on their ability to offer positive outcomes for employees regardless of job role, race, gender, sexual orientation, work status, or other demographic identifier.

“Some of the strongest work cultures we measure every year come from companies with relatively small headcounts,” says Michael C. Bush, CEO of Great Place To Work. “Companies that make this highly competitive list offer the care and support found at companies 10 times their size.”

Venterra’s unique culture has been honored by the Great Place To Work® Institute with various awards in the past. Other recent recognitions from the organization include 2024 PEOPLE® Companies that Care, Best Workplaces in Real Estate, Best Workplaces in Texas™, and Best Workplaces in Canada. View all Venterra’s previous awards from the Great Place To Work® Institute and learn more about their latest survey results from their U.S. company profile and Canadian company profile.

About Venterra:

Founded in 2001, Venterra Realty develops, owns and manages approximately 90 communities and about 26,000 apartment units across 21 major US cities. Venterra provides housing to over 50,000 people and 15,000 pets. The organization has completed $9.7 Billion in real estate transactions and currently manages a portfolio of multi-family real estate assets valued at approximately $5.5 Billion. Venterra is committed to improving the lives of its residents by delivering industry-leading customer experience. Find out more about Venterra Realty and its award-winning company culture at Venterra.com.

About the Fortune® Best Medium Workplaces List

Great Place To Work selected the Fortune® Best Medium Workplaces List by surveying companies employing 8.2 million people in the U.S., with 1.3 million confidential responses received. Of those, more than 213,000 responses were received from employees at companies eligible for the Best Medium Workplaces list and this ranking is based on that feedback. Company scores are derived from 60 employee experience questions within the Great Place To Work Trust Index™ Survey. Read the full methodology.

To get on this list next year, start here.

About Great Place To Work

As the global authority on workplace culture, Great Place To Work brings 30 years of groundbreaking research and data to help every place become a great place to work for all. Its proprietary platform and For All™ Model help companies evaluate the experience of every employee, with exemplary workplaces becoming Great Place To Work Certified or receiving recognition on a coveted Best Workplaces™ List.

Follow Great Place To Work on LinkedIn, X, and Instagram or visit greatplacetowork.com and sign up for the newsletter to learn more.

About Fortune®

Fortune® upholds a legacy of award-winning writing and trusted reporting for executives who want to make business better. Independently owned, with a global perspective and digital agility, Fortune® tells the stories of a new generation of innovators, builders, and risk takers. Online and in print, Fortune® measures corporate performance through rigorous benchmarks, and holds companies accountable. Fortune® creates communities by convening true thought leaders and iconoclasts — those who shape industry, commerce, and society — through powerful and prestigious lists, events, and conferences, such as the iconic Fortune® 500, the CEO Initiative and Most Powerful Women. For more information, visit fortune.com.

From Fortune®, ©2024 Fortune® Media IP Limited. All rights reserved. Used under license. Fortune® is a registered trademark and Fortune® World’s Most Admired Companies™ is a trademark of Fortune® Media IP Limited and are used under license. Fortune® and Fortune® Media IP Limited are not affiliated with, and do not endorse the products or services of, Venterra Realty. Logo adapted with permission.

CONTACT:

Allie Lewnes

venterramedia@venterraliving.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/venterra-realty-named-to-fortune-media-and-great-place-to-work-2024-best-medium-workplaces-list-302245238.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/venterra-realty-named-to-fortune-media-and-great-place-to-work-2024-best-medium-workplaces-list-302245238.html

SOURCE Venterra Realty

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Movers For September 11, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Transcontinental Inc. Announces Results for the Third Quarter of Fiscal 2024

Highlights

- Revenues of $700.0 million for the quarter ended July 28, 2024; operating earnings of $69.2 million; and net earnings attributable to shareholders of the Corporation of $43.6 million ($0.50 per share).

- Adjusted operating earnings before depreciation and amortization(1) of $121.0 million for the quarter ended July 28, 2024; adjusted operating earnings(1) of $84.2 million; and adjusted net earnings attributable to shareholders of the Corporation(1) of $51.4 million ($0.60 per share).

- Growth in adjusted operating earnings before depreciation and amortization(1) of 12.1%, with an increase of 20.6% in the Packaging Sector and of 12.4% in the Retail Services and Printing Sector.

- Sale of a building for an amount of $7.1 million.

- Repurchase of 1.2 million shares during the quarter ended July 28, 2024, for a total consideration of $17.7 million.

- Appointment of Serge Boulanger to the Board of Directors of the Corporation.

(1) Please refer to the section entitled “Non-IFRS Financial Measures” in this press release for a definition of these measures.

MONTRÉAL, Sept. 11, 2024 (GLOBE NEWSWIRE) — Transcontinental Inc. TCL announces its results for the third quarter of fiscal 2024, which ended July 28, 2024.

“I am satisfied with the increase in our results in both the Packaging Sector and the Retail Services and Printing Sector,” said Thomas Morin, President and Chief Executive Officer of TC Transcontinental. “This fourth consecutive quarter of improvement in our profitability is the results of our cost reduction initiatives, including the optimization of our manufacturing network, as well as our efforts to market higher value-added products.

“In our Packaging Sector, despite the ongoing pressure on our medical market activities, we experienced a modest increase in volume. Our cost reduction initiatives, combined with volume growth, contributed to a solid increase of 20.6% in adjusted operating earnings before depreciation and amortization.

“In our Retail Services and Printing Sector, we posted a 12.4% increase in adjusted operating earnings before depreciation and amortization. As in the previous quarter, the actions taken to improve our cost structure, a more favourable product mix, including the roll-out of raddarTM, as well as growth in our in-store marketing activities, have shown results.”

“The implementation of our two-year program aimed at improving our profitability and our financial position is proceeding in accordance with the objectives announced in December 2023,” added Donald LeCavalier, Executive Vice President and Chief Financial Officer of TC Transcontinental. We remain on track to generate annual recurring savings of approximately $30 million by the end of fiscal 2024. Our ability to generate significant cash flows enables us to reduce our net indebtedness and improve our balance sheet while allocating capital to our share repurchase program.”

Financial Highlights

| (in millions of dollars, except per share amounts) | Q3-2024 | Q3-2023 | Variation in % |

|

| Revenues | $700.0 | $706.7 | (0.9 | ) % |

| Operating earnings before depreciation and amortization | 121.5 | 95.3 | 27.5 | |

| Adjusted operating earnings before depreciation and amortization (1) | 121.0 | 107.9 | 12.1 | |

| Operating earnings | 69.2 | 39.2 | 76.5 | |

| Adjusted operating earnings (1) | 84.2 | 70.2 | 19.9 | |

| Net earnings attributable to shareholders of the Corporation | 43.6 | 20.9 | 108.6 | |

| Net earnings attributable to shareholders of the Corporation per share | 0.50 | 0.24 | 108.3 | |

| Adjusted net earnings attributable to shareholders of the Corporation (1) | 51.4 | 44.0 | 16.8 | |

| Adjusted net earnings attributable to shareholders of the Corporation per share (1) | 0.60 | 0.51 | 17.6 | |

| (1) Please refer to the section entitled “Reconciliation of Non-IFRS Financial Measures” in this Press release for adjusted data presented above. | ||||

Results for the Third Quarter of Fiscal 2024

Revenues decreased by $6.7 million, or 0.9%, from $706.7 million in the third quarter of 2023 to $700.0 million in the corresponding period of 2024. This decrease is mainly due to lower volume in the Retail Services and Printing Sector, partially mitigated by the favourable effect of exchange rate fluctuations as well as higher volume in the Packaging Sector.

Operating earnings before depreciation and amortization increased by $26.2 million, or 27.5%, from $95.3 million in the third quarter of 2023 to $121.5 million in the third quarter of 2024. This increase in mainly attributable to our cost reduction initiatives, the decrease in restructuring and other costs, a more favourable product mix in the Retail Services and Printing Sector, the favourable effect of exchange rate fluctuations and higher volume in the Packaging Sector, partially offset by lower volume in the Retail Services and Printing Sector.

Adjusted operating earnings before depreciation and amortization increased by $13.1 million, or 12.1%, from $107.9 million in the third quarter of 2023 to $121.0 million in the third quarter of 2024. This increase is mainly attributable to our cost reduction initiatives, a more favourable product mix in the Retail Services and Printing Sector, the favourable effect of exchange rate fluctuations and higher volume in the Packaging Sector, partially offset by lower volume in the Retail Services and Printing Sector.

Net earnings attributable to shareholders of the Corporation increased by $22.7 million, or 108.6%, from $20.9 million in the third quarter of 2023 to $43.6 million in the third quarter of 2024. This increase is mainly due to the previously explained increase in operating earnings before depreciation and amortization, the decrease in depreciation and amortization, and lower financial expenses, partially offset by higher income taxes. On a per share basis, net earnings attributable to shareholders of the Corporation went from $0.24 to $0.50, respectively.

Adjusted net earnings attributable to shareholders of the Corporation increased by $7.4 million, or 16.8%, from $44.0 million in the third quarter of 2023 to $51.4 million in the third quarter of 2024. This increase is mainly attributable to the previously explained increase in adjusted operating earnings before depreciation and amortization, the decrease in depreciation and amortization, and lower financial expenses, partially offset by higher income taxes. On a per share basis, adjusted net earnings attributable to shareholders of the Corporation went from $0.51 to $0.60, respectively.

Results for the First Nine Months of Fiscal 2024

Revenues decreased by $97.3 million, or 4.5%, from $2,160.9 million in the first nine months of fiscal 2023 to $2,063.6 million in the corresponding period of 2024. This decrease is mainly due to lower volume in the two main operating sectors.

Operating earnings before depreciation and amortization increased by $16.5 million, or 6.0%, from $276.4 million in the first nine months of fiscal 2023 to $292.9 million in the corresponding period of 2024. This increase is mainly attributable to our cost reduction initiatives and a more favourable product mix, partially offset by lower volume and asset impairment charges.

Adjusted operating earnings before depreciation and amortization increased by $26.2 million, or 8.7%, from $301.0 million in the first nine months of fiscal 2023 to $327.2 million in the corresponding period of 2024. This increase is mainly attributable to our cost reduction initiatives and a more favourable product mix, partially offset by lower volume.

Net earnings attributable to shareholders of the Corporation increased by $29.3 million, or 66.4%, from $44.1 million in the first nine months of fiscal 2023 to $73.4 million in the corresponding period of 2024. This increase is mainly attributable to the previously explained increase in operating earnings before depreciation and amortization, the decrease in depreciation and amortization, and lower financial expenses, partially offset by higher income taxes. On a per share basis, net earnings attributable to shareholders of the Corporation went from $0.51 to $0.85, respectively.

Adjusted net earnings attributable to shareholders of the Corporation increased by $29.9 million, or 28.7%, from $104.2 million in the first nine months of fiscal 2023 to $134.1 million in the corresponding period of 2024. This increase is mostly attributable to the previously explained increase in adjusted operating earnings before depreciation and amortization, the decrease in depreciation and amortization, and lower financial expenses, partially offset by higher income taxes. On a per share basis, adjusted net earnings attributable to shareholders of the Corporation went from $1.20 to $1.55, respectively.

For more detailed financial information, please see the Management’s Discussion and Analysis for the third quarter ended July 28, 2024, as well as the financial statements in the “Investors” section of our website at www.tc.tc.

New Director

The Corporation announces the appointment of Serge Boulanger, CPA and corporate director, to its Board of Directors. Mr. Boulanger has worked for more than 25 years in the retail industry in the fields of food and pharmacies, where he held leadership positions in procurement, food manufacturing and private brand development. He also led all the activities of several major banners and, earlier in his career, the marketing of major brands. In 2023, he was awarded the Lifetime Achievement Award by the Retail Council of Canada.

“I am delighted to welcome Serge Boulanger to our Board of Directors,” said Isabelle Marcoux, Executive Chair of the Board of TC Transcontinental. “His vast experience and extensive professional background will be valuable assets for our two main sectors in pursuing their activities and developing products and services for retailers.”

Outlook

In the Packaging Sector, our investments, including those related to sustainable packaging solutions, position us well for the future and should be a key driver of our growth. The economic environment however had a negative impact on demand during the fiscal year. In terms of profitability, we expect an increase in adjusted operating earnings before depreciation and amortization for fiscal 2024 compared to fiscal 2023.

In the Retail Services and Printing Sector, we are encouraged by the roll-out of raddarTM and growth opportunities in our in-store marketing activities. The decrease in volume in our traditional activities should be offset by our cost reduction initiatives, the favourable impact of the roll-out of raddarTM and the growth in our in-store marketing activities. We therefore expect adjusted operating earnings before depreciation and amortization for fiscal 2024 to be stable compared to fiscal 2023.

Given the solid financial performance since the beginning of the fiscal year and the benefits of our profitability and financial position improvement program, we expect an increase in consolidated adjusted operating earnings before depreciation and amortization for fiscal 2024 compared to fiscal 2023.

For the fourth quarter of fiscal 2024, we expect adjusted operating earnings before depreciation and amortization for our two main operating sectors to remain relatively stable compared to the fourth quarter of fiscal 2023. However, as a result of an anticipated increase in the incentive compensation expense, including stock-based compensation, and the solid performance of the Media Sector in the fourth quarter of fiscal 2023, we expect a decrease in consolidated operating earnings before depreciation and amortization for the fourth quarter of fiscal 2024.

Lastly, we expect to continue generating significant cash flows from operating activities, which will enable us to reduce our net indebtedness while continuing to make strategic investments and return capital to our shareholders.

Non-IFRS Financial Measures

In this document, unless otherwise indicated, all financial data are prepared in accordance with International Financial Reporting Accounting Standards (“IFRS”) and the term “dollar”, as well as the symbol “$” designate Canadian dollars.

In addition, in this press release, we also use certain non-IFRS financial measures for which a complete definition is presented below and for which a reconciliation to financial information in accordance with IFRS is presented in the section entitled “Reconciliation of Non-IFRS Financial Measures” and in Note 3, “Segmented Information”, to the condensed interim consolidated financial statements for the third quarter ended July 28, 2024.

| Terms Used | Definitions |

| Adjusted operating earnings before depreciation and amortization | Operating earnings before depreciation and amortization as well as restructuring and other costs (revenues) and impairment of assets. |

| Adjusted operating earnings | Operating earnings before restructuring and other costs (revenues), amortization of intangible assets arising from business combinations and impairment of assets. |

| Adjusted income taxes | Income taxes before income taxes on restructuring and other costs (revenues), impairment of assets and amortization of intangible assets arising from business combinations as well as the recognition of previous years tax assets of an acquired company. |

| Adjusted net earnings attributable to shareholders of the Corporation | Net earnings attributable to shareholders of the Corporation before restructuring and other costs (revenues), amortization of intangible assets arising from business combinations and impairment of assets, net of related income taxes as well as the recognition of previous years tax assets of an acquired company. |

| Net indebtedness | Total of long-term debt, of current portion of long-term debt, of lease liabilities and of current portion of lease liabilities, less cash. |

| Net indebtedness ratio | Net indebtedness divided by the last 12 months’ adjusted operating earnings before depreciation and amortization. |

Reconciliation of Non-IFRS Financial Measures

The financial information has been prepared in accordance with IFRS. However, financial measures used, namely adjusted operating earnings before depreciation and amortization, adjusted operating earnings, adjusted income taxes, adjusted net earnings attributable to shareholders of the Corporation, adjusted net earnings attributable to shareholders of the Corporation per share, net indebtedness and net indebtedness ratio, for which a reconciliation is presented in the following table, do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many of our readers analyze the financial performance of the Corporation’s activities based on these non-IFRS financial measures as such measures may allow for easier comparisons between periods. These measures should be considered as a complement to financial performance measures in accordance with IFRS. They do not substitute and are not superior to them.

The Corporation also believes that these measures are useful indicators of the performance of its operations and its ability to meet its financial obligations. Furthermore, management also uses some of these non-IFRS financial measures to assess the performance of its activities and managers.

| Reconciliation of operating earnings – Third quarter and cumulative | |||||

| Three months ended | Nine months ended | ||||

| (in millions of dollars) | July 28, 2024 |

July 30, 2023 | July 28, 2024 | July 30, 2023 | |

| Operating earnings | $69.2 | $39.2 | $130.2 | $98.0 | |

| Restructuring and other costs (revenues) | (0.5 | ) | 12.6 | 26.8 | 24.6 |

| Amortization of intangible assets arising from business combinations (1) | 15.5 | 18.4 | 51.0 | 55.6 | |

| Impairment of assets | — | — | 7.5 | — | |

| Adjusted operating earnings | $84.2 | $70.2 | $215.5 | $178.2 | |

| Depreciation and amortization (2) | 36.8 | 37.7 | 111.7 | 122.8 | |

| Adjusted operating earnings before depreciation and amortization | $121.0 | $107.9 | $327.2 | $301.0 | |

| (1) Amortization of intangible assets arising from business combinations includes our customer relationships, non-compete agreements, rights of first refusal and educational book titles. (2) Depreciation and amortization excludes the amortization of intangible assets arising from business combinations. |

|||||

| Reconciliation of operating earnings – Third quarter and cumulative for the Packaging Sector | ||||

| Three months ended | Nine months ended | |||

| (in millions of dollars) | July 28, 2024 | July 30, 2023 | July 28, 2024 | July 30, 2023 |

| Operating earnings | $29.4 | $17.7 | $84.1 | $48.4 |

| Restructuring and other costs | 2.4 | 1.5 | 9.7 | 7.4 |

| Amortization of intangible assets arising from business combinations (1) | 14.3 | 15.9 | 46.5 | 48.0 |

| Impairment of assets | — | — | 0.6 | — |

| Adjusted operating earnings | $46.1 | $35.1 | $140.9 | $103.8 |

| Depreciation and amortization (2) | 18.8 | 18.7 | 55.6 | 64.0 |

| Adjusted operating earnings before depreciation and amortization | $64.9 | $53.8 | $196.5 | $167.8 |

| (1) Amortization of intangible assets arising from business combinations includes our customer relationships. (2) Depreciation and amortization excludes the amortization of intangible assets arising from business combinations. |

||||

| Reconciliation of operating earnings – Third quarter and cumulative for the Retail Services and Printing Sector | ||||

| Three months ended | Nine months ended | |||

| (in millions of dollars) | July 28, 2024 | July 30, 2023 | July 28, 2024 | July 30, 2023 |

| Operating earnings | $36.8 | $27.3 | $71.1 | $82.8 |

| Restructuring and other costs | 1.7 | 2.7 | 19.6 | 7.2 |

| Amortization of intangible assets arising from business combinations (1) | 0.7 | 1.9 | 3.0 | 6.0 |

| Impairment of assets | — | — | 6.9 | — |

| Adjusted operating earnings | $39.2 | $31.9 | $100.6 | $96.0 |

| Depreciation and amortization (2) | 11.6 | 13.3 | 36.8 | 39.8 |

| Adjusted operating earnings before depreciation and amortization | $50.8 | $45.2 | $137.4 | $135.8 |

| (1) Amortization of intangible assets arising from business combinations includes our customer relationships. (2) Depreciation and amortization excludes the amortization of intangible assets arising from business combinations. |

||||

| Reconciliation of operating earnings – Third quarter and cumulative for the Other Sector | ||||||||

| Three months ended | Nine months ended | |||||||

| (in millions of dollars) | July 28, 2024 |

July 30, 2023 | July 28, 2024 |

July 30, 2023 | ||||

| Operating earnings | $3.0 | ($5.8 | ) | ($25.0 | ) | ($33.2 | ) | |

| Restructuring and other costs (revenues) | (4.6 | ) | 8.4 | (2.5 | ) | 10.0 | ||

| Amortization of intangible assets arising from business combinations (1) | 0.5 | 0.6 | 1.5 | 1.6 | ||||

| Adjusted operating earnings | ($1.1 | ) | $3.2 | ($26.0 | ) | ($21.6 | ) | |

| Depreciation and amortization (2) | 6.4 | 5.7 | 19.3 | 19.0 | ||||

| Adjusted operating earnings before depreciation and amortization | $5.3 | $8.9 | ($6.7 | ) | ($2.6 | ) | ||

| (1) Amortization of intangible assets arising from business combinations includes non-compete agreements, rights of first refusal and educational book titles. (2) Depreciation and amortization excludes the amortization of intangible assets arising from business combinations. |

||||||||

| Reconciliation of net earnings attributable to shareholders of the Corporation – Third quarter and cumulative | ||||||||

| Three months ended | Nine months ended | |||||||

| (in millions of dollars, except per share amounts) | July 28, 2024 |

July 30, 2023 | July 28, 2024 |

July 30, 2023 | ||||

| Net earnings attributable to shareholders of the Corporation | $43.6 | $20.9 | $73.4 | $44.1 | ||||

| Restructuring and other costs (revenues) | (0.5 | ) | 12.6 | 26.8 | 24.6 | |||

| Tax on restructuring and other costs | — | (3.3 | ) | (6.8 | ) | (6.3 | ) | |

| Amortization of intangible assets arising from business combinations (1) | 15.5 | 18.4 | 51.0 | 55.6 | ||||

| Tax on amortization of intangible assets arising from business combinations | (3.8 | ) | (4.6 | ) | (12.5 | ) | (13.8 | ) |

| Impairment of assets | — | — | 7.5 | — | ||||

| Tax on impairment of assets | — | — | (1.9 | ) | — | |||

| Recognition of previous years tax assets of an acquired company | (3.4 | ) | — | (3.4 | ) | — | ||

| Adjusted net earnings attributable to shareholders of the Corporation | $51.4 | $44.0 | $134.1 | $104.2 | ||||

| Net earnings attributable to shareholders of the Corporation per share | $0.50 | $0.24 | $0.85 | $0.51 | ||||

| Adjusted net earnings attributable to shareholders of the Corporation per share | $0.60 | $0.51 | $1.55 | $1.20 | ||||

| Weighted average number of shares outstanding | 86.4 | 86.6 | 86.5 | 86.6 | ||||

| (1) Amortization of intangible assets arising from business combinations includes our customer relationships, non-compete agreements, rights of first refusal and educational book titles. | ||||||||

| Reconciliation of net indebtedness | ||||

| (in millions of dollars, except ratios) | As at July 28, 2024 |

As at October 29, 2023 | ||

| Long-term debt | $667.1 | $937.8 | ||

| Current portion of long-term debt | 199.8 | 2.1 | ||

| Lease liabilities | 93.5 | 94.6 | ||

| Current portion of lease liabilities | 22.8 | 23.5 | ||

| Cash | (79.9 | ) | (137.0 | ) |

| Net indebtedness | $903.3 | $921.0 | ||

| Adjusted operating earnings before depreciation and amortization (last 12 months) | $472.7 | $446.5 | ||

| Net indebtedness ratio | 1.91 |

x | 2.06 | x |

Dividend

The Corporation’s Board of Directors declared a quarterly dividend of $0.225 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on October 21, 2024, to shareholders of record at the close of business on October 3, 2024.

Normal Course Issuer Bid

On June 12, 2024, the Corporation has been authorized to repurchase, for cancellation on the open market, or subject to the approval of any securities authority by private agreements, between June 17, 2024 and June 16, 2025, or at an earlier date if the Corporation concludes or cancels the offer, up to 3,662,967 of its Class A Subordinate Voting Shares and up to 668,241 of its Class B Shares. The repurchases are made in the normal course of business at market prices through the Toronto Stock Exchange.

During the third quarter ended July 28, 2024, the Corporation repurchased and cancelled 1,159,758 Class A Subordinate Voting Shares at a weighted average price of $15.22 and 5,000 Class B Shares at a weighted average price of $15.37, for a total cash consideration of $17.7 million.

On July 26, 2024, the Corporation authorized its broker to repurchase shares between July 29, 2024, and September 13, 2024, inclusively, in accordance with parameters set by the Corporation. Subsequent to the end of the third quarter of fiscal 2024, the Corporation repurchased 773,797 Class A Subordinated Voting Shares and 2,000 Class B Shares for a total cash consideration of $12.5 million.

Additional information

Conference Call

Upon releasing its 2024 third quarter results, the Corporation will hold a conference call for the financial community on September 12, 2024, at 8:00 a.m. The dial-in numbers are 1-289-514-5100 or 1-800-717-1738. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on TC Transcontinental’s website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514-954-3581.

Profile

TC Transcontinental is a leader in flexible packaging in North America and in retail services in Canada and is Canada’s largest printer. The Corporation is also the leading Canadian French-language educational publishing group. Since 1976, TC Transcontinental’s mission has been to create quality products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are the strong values held by the Corporation and its employees. TC Transcontinental’s commitment to its stakeholders is to pursue its business activities in a responsible manner.

Transcontinental Inc. TCL, known as TC Transcontinental, has approximately 7,600 employees, the majority of which are based in Canada, the United States and Latin America. TC Transcontinental generated revenues of $2.9 billion during the fiscal year ended October 29, 2023. For more information, visit TC Transcontinental’s website at www.tc.tc.

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation’s objectives, strategy, anticipated financial results and business outlook. The Corporation’s future performance may also be affected by a number of factors, many of which are beyond the Corporation’s will or control. These factors include, but are not limited to the impact of digital product development and adoption as well as regulations or legislation regarding door-to-door distribution on the printing of paper flyers or printed advertising materials, inflation and recession risks, economic conditions and geopolitical uncertainty, environmental risks as well as adoption of new regulations or amendments and changes to consumption habits, risk of an operational disruption that could be harmful to its ability to meet deadlines, the worldwide outbreak of a disease, a virus or any other contagious disease could have an adverse impact on the Corporation’s operations, the ability to generate organic long-term growth and face competition, a significant increase in the cost of raw materials, the availability of those materials and energy consumption could have an adverse impact on the Corporation’s activities, the ability to complete acquisitions and properly integrate them, cybersecurity, data protection, warehousing and usage, the impact of digital product development and adoption on the demand for printed products other than flyers, the failure of patents, trademarks and confidentiality agreements to protect intellectual property, a difficulty to attract and retain employees in the main operating sectors, the safety and quality of packaging products used in the food industry, bad debts from certain customers, import and export controls, duties, tariffs or taxes, exchange rate fluctuations, increase in market interest rates with respect to our financial instruments as well as availability of capital at a reasonable cost, the legal risks related to its activities and the compliance of its activities with applicable regulations, the impact of major market fluctuations on the solvency of defined benefit pensions plans, changes in tax legislation and disputes with tax authorities or amendments to statutory tax rates in force, the impact of impairment tests on the value of assets and a conflict of interest between the controlling shareholder and other shareholders. The main risks, uncertainties and factors that could influence actual results are described in the Management’s Discussion and Analysis for the year ended October 29, 2023 and in the latest Annual Information Form.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of non-recurring or other unusual items, nor of disposals, business combinations, mergers or acquisitions which may be announced or entered into after the date of September 11, 2024. The forward-looking statements in this press release are made pursuant to the “safe harbour” provisions of applicable Canadian securities legislation. The forward-looking statements in this release are based on current expectations and information available as at September 11, 2024. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation’s management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

For information:

CONSOLIDATED STATEMENTS OF EARNINGS

Unaudited

(in millions of Canadian dollars, unless otherwise indicated and per share data)

| Three months ended | Nine months ended | ||||||||

| July 28, | July 30, | July 28, | July 30, | ||||||

| 2024 | 2023 | 2024 | 2023 | ||||||

| Revenues | $ | 700.0 | $ | 706.7 | $ | 2,063.6 | $ | 2,160.9 | |

| Operating expenses | 579.0 | 598.8 | 1,736.4 | 1,859.9 | |||||

| Restructuring and other costs (revenues) | (0.5 | ) | 12.6 | 26.8 | 24.6 | ||||

| Impairment of assets | — | — | 7.5 | — | |||||

| Operating earnings before depreciation and amortization | 121.5 | 95.3 | 292.9 | 276.4 | |||||

| Depreciation and amortization | 52.3 | 56.1 | 162.7 | 178.4 | |||||

| Operating earnings | 69.2 | 39.2 | 130.2 | 98.0 | |||||

| Net financial expenses | 15.6 | 16.1 | 43.9 | 48.0 | |||||

| Earnings before income taxes | 53.6 | 23.1 | 86.3 | 50.0 | |||||

| Income taxes | 9.8 | 2.1 | 12.4 | 5.6 | |||||

| Net earnings | 43.8 | 21.0 | 73.9 | 44.4 | |||||

| Non-controlling interests | 0.2 | 0.1 | 0.5 | 0.3 | |||||

| Net earnings attributable to shareholders of the Corporation | $ | 43.6 | $ | 20.9 | $ | 73.4 | $ | 44.1 | |

| Net earnings attributable to shareholders of the Corporation per share – basic and diluted | $ | 0.50 | $ | 0.24 | $ | 0.85 | $ | 0.51 | |

| Weighted average number of shares outstanding – basic and diluted (in millions) | 86.4 | 86.6 | 86.5 | 86.6 | |||||

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Unaudited

(in millions of Canadian dollars)

| Three months ended | Nine months ended | |||||||||||

| July 28, |

July 30, | July 28, |

July 30, | |||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| Net earnings | $ | 43.8 | $ | 21.0 | $ | 73.9 | $ | 44.4 | ||||

| Other comprehensive income (loss) | ||||||||||||

| Items that may be subsequently reclassified to net earnings | ||||||||||||

| Net change related to cash flow hedges (1) | ||||||||||||

| Net change in the fair value of designated derivatives – foreign exchange risk | (3.1 | ) | 5.1 | 0.7 | 10.5 | |||||||

| Net change in the fair value of designated derivatives – interest rate risk | (2.3 | ) | 4.7 | (1.1 | ) | 4.8 | ||||||

| Reclassification of the net change in the fair value of designated derivatives | ||||||||||||

| recognized in net earnings during the period | 0.2 | 0.5 | 1.8 | 1.0 | ||||||||

| Related income taxes (recovery) | (1.3 | ) | 2.7 | 0.4 | 4.3 | |||||||

| (3.9 | ) | 7.6 | 1.0 | 12.0 | ||||||||

| Cumulative translation differences | ||||||||||||

| Net unrealized exchange gains (losses) on the translation of | ||||||||||||

| the financial statements of foreign operations | 22.9 | (32.7 | ) | 7.5 | (30.0 | ) | ||||||

| Net (losses) gains on hedge of the net investment in foreign operations | (8.3 | ) | 11.4 | (1.1 | ) | 8.6 | ||||||

| Related income taxes (recovery) | (1.5 | ) | (1.4 | ) | (1.5 | ) | 0.4 | |||||

| 16.1 | (19.9 | ) | 7.9 | (21.8 | ) | |||||||

| Items that will not be reclassified to net earnings | ||||||||||||

| Changes related to defined benefit plans | ||||||||||||

| Actuarial gains (losses) on defined benefit plans | 3.5 | (3.8 | ) | (4.2 | ) | (6.4 | ) | |||||

| Related income taxes (recovery) | 0.9 | (1.0 | ) | (1.2 | ) | (1.7 | ) | |||||

| 2.6 | (2.8 | ) | (3.0 | ) | (4.7 | ) | ||||||

| Other comprehensive income (loss) | 14.8 | (15.1 | ) | 5.9 | (14.5 | ) | ||||||

| Comprehensive income | $ | 58.6 | $ | 5.9 | $ | 79.8 | $ | 29.9 | ||||

| (1) For the three-month and nine-month periods ended July 30, 2023, amounts of $0.9 million and $1.8 million, respectively, were reclassified to Net change in the fair value of designated derivatives – foreign exchange risk and Net change in the fair value of designated derivatives – interest rate risk. These amounts were previously reported under Reclassification of the net change in the fair value of designated derivatives recognized in net earnings during the period. These reclassifications had no impact on comprehensive income or net earnings | ||||||||||||

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Unaudited

(in millions of Canadian dollars)

| Accumulated | |||||||||||||||||||

| other | Non- | ||||||||||||||||||

| Share | Contributed | Retained | comprehensive | controlling | Total | ||||||||||||||

| capital | surplus | earnings | income | Total | interests | equity | |||||||||||||

| Balance as at October 29, 2023 | $ | 636.6 | $ | 0.9 | $ | 1,226.8 | $ | 37.0 | $ | 1,901.3 | $ | 4.9 | $ | 1,906.2 | |||||

| Net earnings | — | — | 73.4 | — | 73.4 | 0.5 | 73.9 | ||||||||||||

| Other comprehensive income | — | — | — | 5.9 | 5.9 | — | 5.9 | ||||||||||||

| Shareholders’ contributions and | |||||||||||||||||||

| distributions to shareholders | |||||||||||||||||||

| Share redemptions | (9.8 | ) | — | (25.3 | ) | — | (35.1 | ) | — | (35.1 | ) | ||||||||

| Dividends | — | — | (58.4 | ) | — | (58.4 | ) | — | (58.4 | ) | |||||||||

| Balance as at July 28, 2024 | $ | 626.8 | $ | 0.9 | $ | 1,216.5 | $ | 42.9 | $ | 1,887.1 | $ | 5.4 | $ | 1,892.5 | |||||

| Balance as at October 30, 2022 | $ | 636.6 | $ | 0.9 | $ | 1,219.0 | $ | 20.7 | $ | 1,877.2 | $ | 4.8 | $ | 1,882.0 | |||||

| Net earnings | — | — | 44.1 | — | 44.1 | 0.3 | 44.4 | ||||||||||||

| Other comprehensive loss | — | — | — | (14.5 | ) | (14.5 | ) | — | (14.5 | ) | |||||||||

| Shareholders’ contributions and | |||||||||||||||||||

| distributions to shareholders | |||||||||||||||||||

| Dividends | — | — | (58.5 | ) | — | (58.5 | ) | — | (58.5 | ) | |||||||||

| Balance as at July 30, 2023 | $ | 636.6 | $ | 0.9 | $ | 1,204.6 | $ | 6.2 | $ | 1,848.3 | $ | 5.1 | $ | 1,853.4 | |||||

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

Unaudited

(in millions of Canadian dollars)

| As at | As at | |||

| July 28, | October 29, | |||

| 2024 | 2023 | |||

| Current assets | ||||

| Cash | $ | 79.9 | $ | 137.0 |

| Accounts receivable | 457.9 | 514.7 | ||

| Income taxes receivable | 33.6 | 37.0 | ||

| Inventories | 399.4 | 391.1 | ||

| Prepaid expenses and other current assets | 24.3 | 20.6 | ||

| 995.1 | 1,100.4 | |||

| Property, plant and equipment | 774.3 | 796.5 | ||

| Right-of-use assets | 96.9 | 98.6 | ||

| Intangible assets | 397.4 | 447.1 | ||

| Goodwill | 1,195.6 | 1,194.9 | ||

| Deferred taxes | 30.1 | 30.4 | ||

| Other assets | 30.9 | 32.4 | ||

| $ | 3,520.3 | $ | 3,700.3 | |

| Current liabilities | ||||

| Accounts payable and accrued liabilities | $ | 415.5 | $ | 465.5 |

| Income taxes payable | 19.3 | 24.8 | ||

| Deferred revenues and deposits | 11.7 | 10.4 | ||

| Current portion of long-term debt | 199.8 | 2.1 | ||

| Current portion of lease liabilities | 22.8 | 23.5 | ||

| 669.1 | 526.3 | |||

| Long-term debt | 667.1 | 937.8 | ||

| Lease liabilities | 93.5 | 94.6 | ||

| Deferred taxes | 74.1 | 89.8 | ||

| Other liabilities | 124.0 | 145.6 | ||

| 1,627.8 | 1,794.1 | |||

| Equity | ||||

| Share capital | 626.8 | 636.6 | ||

| Contributed surplus | 0.9 | 0.9 | ||

| Retained earnings | 1,216.5 | 1,226.8 | ||

| Accumulated other comprehensive income | 42.9 | 37.0 | ||

| Attributable to shareholders of the Corporation | 1,887.1 | 1,901.3 | ||

| Non-controlling interests | 5.4 | 4.9 | ||

| 1,892.5 | 1,906.2 | |||

| $ | 3,520.3 | $ | 3,700.3 | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

(in millions of Canadian dollars)

| Three months ended | Nine months ended | |||||||||||

| July 28, |

July 30, | July 28, |

July 30, | |||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| Operating activities | ||||||||||||

| Net earnings | $ | 43.8 | $ | 21.0 | $ | 73.9 | $ | 44.4 | ||||

| Adjustments to reconcile net earnings and cash flows from operating activities: | ||||||||||||

| Impairment of assets | — | — | 7.5 | — | ||||||||

| Depreciation and amortization | 52.3 | 56.1 | 162.7 | 178.4 | ||||||||

| Financial expenses on long-term debt and lease liabilities | 11.5 | 14.4 | 35.2 | 42.3 | ||||||||

| Net (gains) losses on disposal of assets | (5.3 | ) | 0.4 | (5.6 | ) | 1.2 | ||||||

| Income taxes | 9.8 | 2.1 | 12.4 | 5.6 | ||||||||

| Net foreign exchange differences and other | 0.5 | (2.6 | ) | (1.4 | ) | (0.7 | ) | |||||

| Cash flows generated by operating activities before changes in non-cash operating | ||||||||||||

| items and income taxes paid | 112.6 | 91.4 | 284.7 | 271.2 | ||||||||

| Changes in non-cash operating items | (7.3 | ) | 26.0 | (28.2 | ) | (2.4 | ) | |||||

| Income taxes paid | (7.0 | ) | (8.3 | ) | (27.8 | ) | (42.7 | ) | ||||

| Cash flows from operating activities | 98.3 | 109.1 | 228.7 | 226.1 | ||||||||

| Investing activities | ||||||||||||

| Business combinations, net of acquired cash | — | 0.6 | — | 0.3 | ||||||||

| Acquisitions of property, plant and equipment | (23.8 | ) | (37.6 | ) | (75.9 | ) | (123.7 | ) | ||||

| Disposals of property, plant and equipment and other | 7.3 | — | 8.8 | — | ||||||||

| Increase in intangible assets | (6.8 | ) | (6.5 | ) | (21.4 | ) | (24.8 | ) | ||||

| Cash flows from investing activities | (23.3 | ) | (43.5 | ) | (88.5 | ) | (148.2 | ) | ||||

| Financing activities | ||||||||||||

| Reimbursement of long-term debt | (0.2 | ) | (0.6 | ) | (2.2 | ) | (2.2 | ) | ||||

| Net (decrease) increase in credit facilities | (1.3 | ) | (26.7 | ) | (75.4 | ) | 30.6 | |||||

| Financial expenses paid on long-term debt and credit facilities | (6.1 | ) | (9.4 | ) | (27.7 | ) | (34.3 | ) | ||||

| Repayment of principal on lease liabilities | (5.6 | ) | (6.3 | ) | (17.2 | ) | (18.6 | ) | ||||

| Interest paid on lease liabilities | (0.8 | ) | (0.8 | ) | (2.5 | ) | (2.5 | ) | ||||

| Dividends | (19.4 | ) | (19.5 | ) | (58.4 | ) | (58.5 | ) | ||||

| Share redemptions | (17.7 | ) | — | (17.7 | ) | — | ||||||

| Cash flows from financing activities | (51.1 | ) | (63.3 | ) | (201.1 | ) | (85.5 | ) | ||||

| Effect of exchange rate changes on cash denominated in foreign currencies | 0.9 | (0.2 | ) | 3.8 | 0.4 | |||||||

| Net change in cash | 24.8 | 2.1 | (57.1 | ) | (7.2 | ) | ||||||

| Cash at beginning of the period | 55.1 | 36.4 | 137.0 | 45.7 | ||||||||

| Cash at end of period | $ | 79.9 | $ | 38.5 | $ | 79.9 | $ | 38.5 | ||||

| Non-cash investing activities | ||||||||||||

| Net change in capital asset acquisitions financed by accounts payable | $ | (2.3 | ) | $ | 1.0 | $ | (11.6 | ) | $ | 1.9 | ||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HBAN Stock Rises on North & South Carolina Branch Expansion

Huntington Bancshares Inc.‘s HBAN shares rose 2.5% in yesterday’s trading session after the company announced its plans to expand its banking franchise in North Carolina and South Carolina. The bank intends to add more than 350 employees across varied business divisions and launch roughly 55 retail branches within the next five years.

The first branches will be located in Charlotte, Raleigh and Winston-Salem in North Carolina and Charleston, Columbia and Greenville in South Carolina. The bank is currently searching for branch sites, with construction anticipated to begin in 2026.

This move is in alignment with the other banks penetrating the Carolina market, given a rise in the regional population. JPMorgan JPM and Comerica Inc. CMA have expanded into the region to deepen their presence.

HBAN’s Expansion History in Carolinas Market

Last year, HBAN announced its plans to expand its commercial banking presence in Charlotte. The move aimed at tapping into the high deposit levels in Carolinas. It planned to add a team of experienced bankers to establish relationships with customers in Charlotte to boost its capital and liquidity.

Since the aforementioned announcement, the bank has established five units and 120 relationships in the Carolinas market with an emphasis on verticals like the middle market, small business administration and health care lending.

Similarly, JPM announced its plans to further strengthen its presence in the North and South Carolina regions by establishing new branches and increasing corporate office space in the region. By 2025, the bank intends to have more than 100 branches across both states. Also, CMA announced its focus on Southeast markets in 2022 through the addition of offices in South Carolina and Georgia.

Huntington’s Strategic Rationale Behind This Expansion

The company’s expansion will enable clients across the Carolinas to leverage Huntington’s expertise and comprehensive range of personal, wealth, business and commercial banking services.

This move furthers the company’s presence and investment in the region and supports the bank’s strategic plan and long-term growth strategy. The bank aims to capture an estimated $8 billion long-term deposit market.

Huntington’s full-scale retail expansion into the Carolinas complements its ongoing multi-million dollar and multi-year plan to expand its banking franchise in numerous strategic markets, including Denver, Minneapolis and Chicago.

Brant Standridge, consumer and regional banking president at Huntington, stated, “The Carolinas is a fast-growing, highly dynamic region and we are proud to deepen our presence and bring our expertise and capabilities to even more customers in this market.” He added, “the bank’s foray into consumer lending, wealth management and consumer deposits will support continued commercial banking growth in the region.”

Final Thoughts on HBAN’s Expansion Efforts

This strategic initiative aligns with the company’s inorganic expansion strategy to gain market share and enhance its profitability. Such moves will bolster the bank’s competitive position. In fact, Huntington is one of the top 20 bank holding companies in the United States and remains focused on acquiring the industry’s best deposit franchise.

The bank’s total deposits witnessed a compound annual growth rate of 16.4% over the four years ended 2023. The uptrend continued in the first half of 2024.

Strengthening the commercial banking business will further enhance the deposit franchise of Huntington. This makes the ongoing expansion efforts a strategic fit for the company.

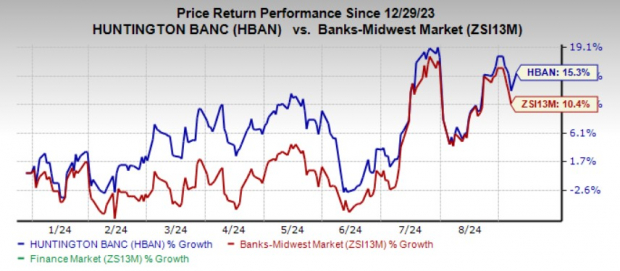

Year to date, shares of Huntington have risen 15.3% compared with the industry’s gain of 10.4%.

Image Source: Zacks Investment Research

Currently, HBAN carries a Zacks Rank #2 (Buy).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why You Should Buy Kronos Worldwide Stock Right Now

Kronos Worldwide, Inc. KRO is expected to benefit from higher demand for titanium dioxide (TiO2) and easing pricing pressure this year. Cost-reduction initiatives are also expected to support margins.

We are positive about KRO’s prospects and believe that the time is right for you to add the stock to your portfolio as it looks promising and is poised to carry the momentum ahead.

Let’s take a look into the factors that make this Zacks Rank #2 (Buy) stock a compelling choice for investors right now.

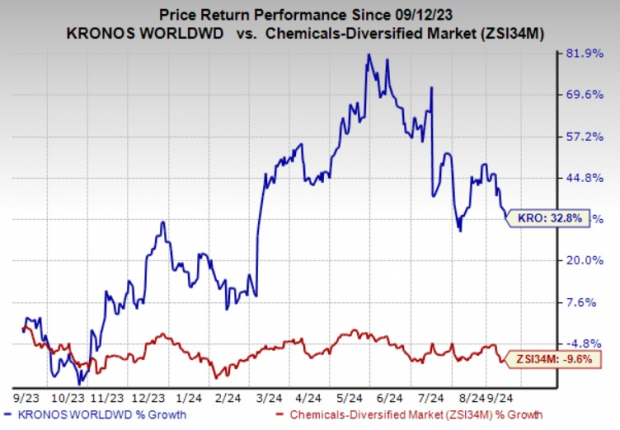

Kronos Worldwide’s Stock Outperforms Industry

KRO has outperformed the industry it belongs to over the past year. The company’s shares have rallied 32.8% compared with a 9.6% decline of the industry.

Image Source: Zacks Investment Research

Solid Earnings Growth Prospects for KRO

The Zacks Consensus Estimate for earnings for 2024 for Kronos Worldwide is currently pegged at 88 cents, reflecting an expected year-over-year growth of 304.7%. Earnings are also expected to register a 288.9% growth in third-quarter 2024.

KRO’s Earnings Estimates Northbound

Earnings estimates for KRO have been going up over the past 60 days. The Zacks Consensus Estimate for 2024 has increased by 3.5%. The consensus estimate for the third quarter has also been revised 9.7% upward over the same time frame. The favorable estimate revisions instill investor confidence in the stock.

Higher TiO2 Demand, Cost Actions Aid Kronos Worldwide

Kronos is well-positioned to gain from higher demand for TiO2 in major markets. Per the company, TiO2 consumption has increased at a compound annual growth rate of around 2% since 2000. Western Europe and North America account for roughly 14% and 15% of global TiO2 consumption, respectively. These regions are expected to continue to be the biggest consumers of TiO2. Markets for TiO2 are growing in South America, Eastern Europe, the Asia Pacific region and China.

The company expects sales volumes in 2024 to exceed 2023 levels factoring in the recently experienced improved demand and expectations that demand will continue to improve this year.

Kronos Worldwide is also taking actions to reduce costs and align production and inventories to expected demand levels, which are expected to support its margins. It has increased its production rates in sync with current and expected near-term demand improvement. It expects its production rates for the balance of 2024 to be higher than the level witnessed in 2023.

The company’s internal cost initiatives are also expected to continue to support margins in 2024. Reduced energy costs along with its cost-cutting initiatives and the realization of selling price increases are likely to result in improved margins on a year-over-year basis this year. The company has undertaken TiO2 selling price hikes, which need to be sustained to attain margins in line with historical levels. KRO expects to report higher operating results on a year-over-year basis for full-year 2024 based on the expected improved demand, higher selling prices and reduced production costs.

Stocks to Consider

Other top-ranked stocks in the Basic Materials space are, Hawkins, Inc. HWKN, IAMGOLD Corporation IAG and Eldorado Gold Corporation EGO, each sporting a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14, indicating a rise of 15.3% from year-ago levels. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days. The stock has rallied around 103% in the past year.

The consensus estimate for IAMGOLD’s current-year earnings has increased by 46.4% in the past 60 days. IAG beat the consensus estimate in each of the last four quarters with the average surprise being 200%. Its shares have shot up 111% in the past year.

The Zacks Consensus Estimate for Eldorado Gold’s current year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.3%. The company’s shares have rallied roughly 69% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Coinbase Glb's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Coinbase Glb COIN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with COIN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 73 uncommon options trades for Coinbase Glb.

This isn’t normal.

The overall sentiment of these big-money traders is split between 41% bullish and 36%, bearish.

Out of all of the special options we uncovered, 16 are puts, for a total amount of $1,542,978, and 57 are calls, for a total amount of $3,680,090.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $85.0 to $450.0 for Coinbase Glb over the recent three months.

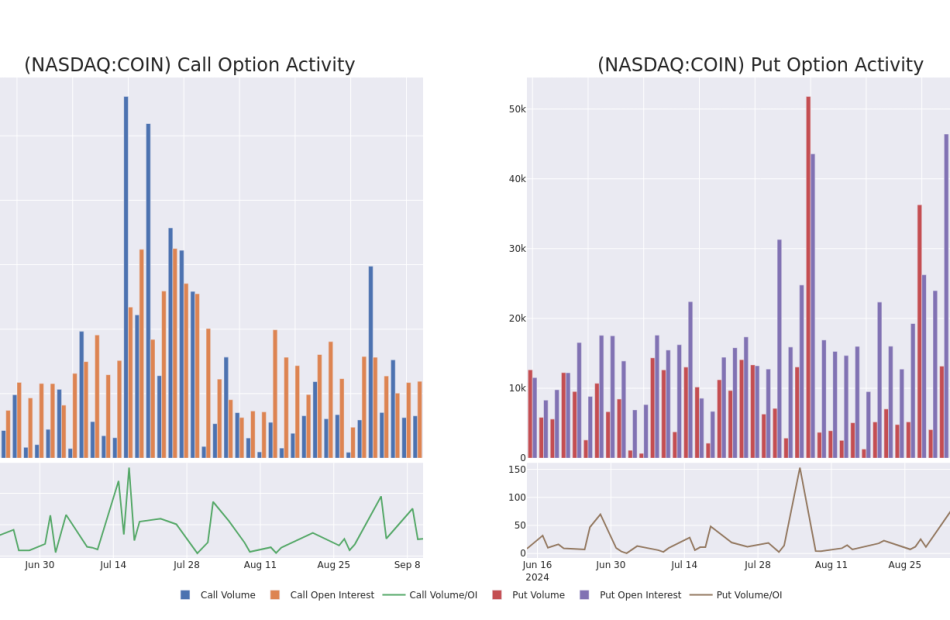

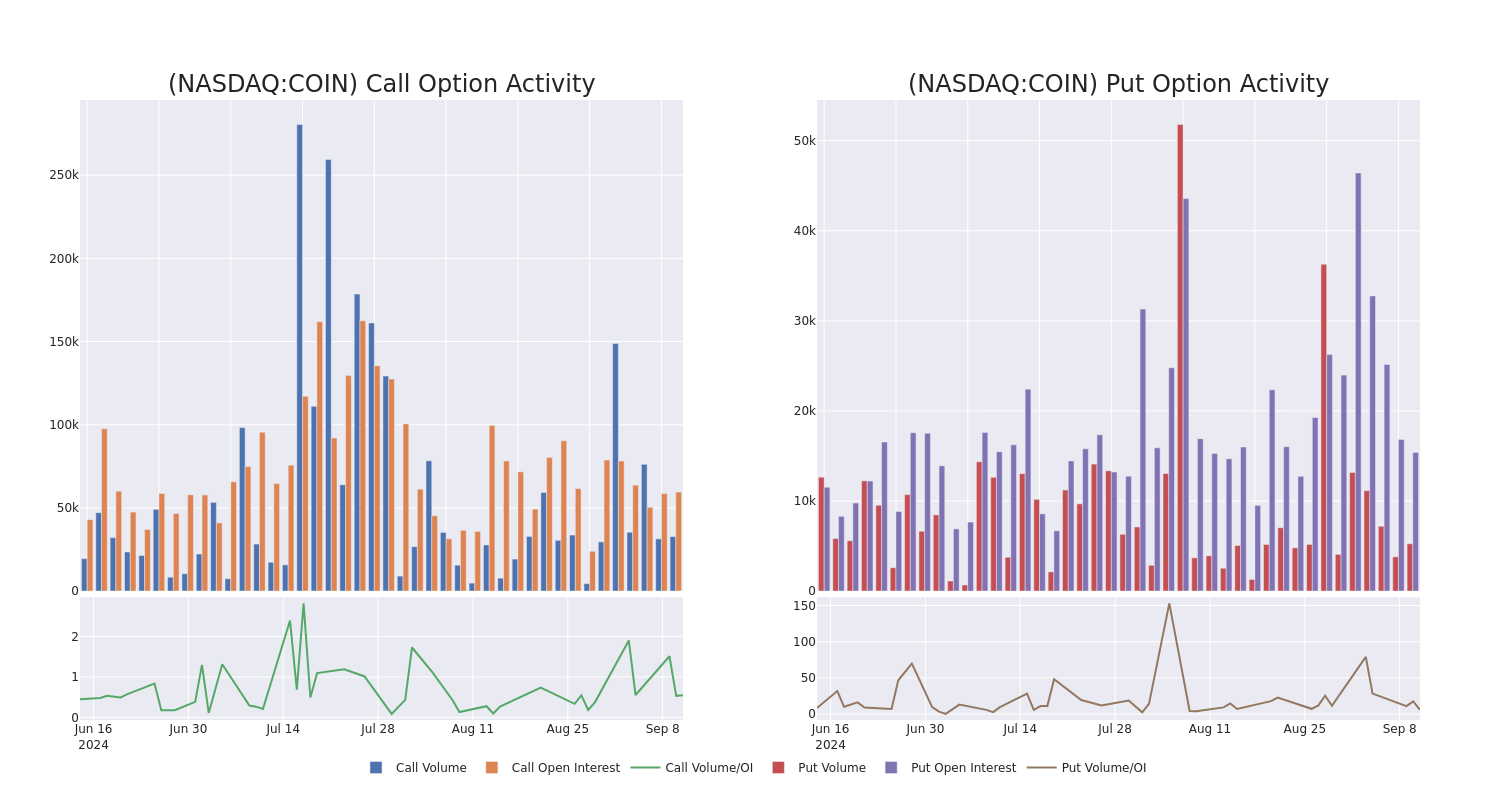

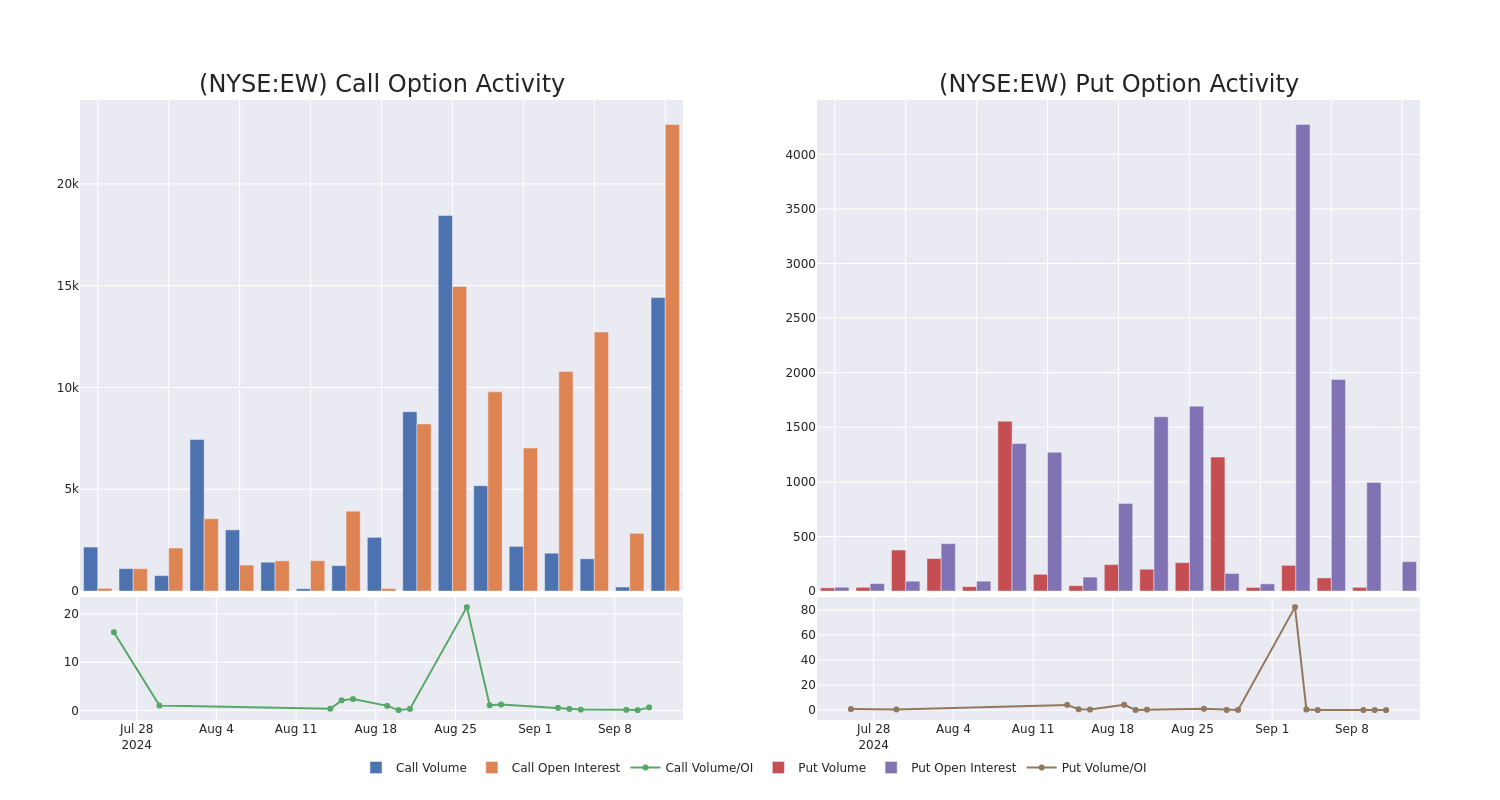

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Coinbase Glb’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Coinbase Glb’s whale activity within a strike price range from $85.0 to $450.0 in the last 30 days.

Coinbase Glb Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COIN | CALL | TRADE | BULLISH | 11/15/24 | $25.35 | $24.75 | $25.15 | $150.00 | $412.4K | 136 | 565 |

| COIN | CALL | SWEEP | BEARISH | 11/15/24 | $14.6 | $14.3 | $14.3 | $175.00 | $357.4K | 2.9K | 1.9K |

| COIN | CALL | TRADE | BEARISH | 11/15/24 | $25.5 | $24.85 | $24.85 | $150.00 | $323.0K | 136 | 236 |

| COIN | PUT | TRADE | BEARISH | 06/20/25 | $19.45 | $18.7 | $19.2 | $120.00 | $288.0K | 613 | 155 |

| COIN | PUT | TRADE | BEARISH | 01/17/25 | $14.05 | $13.65 | $14.05 | $130.00 | $238.8K | 870 | 175 |

About Coinbase Glb

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

Coinbase Glb’s Current Market Status

- Currently trading with a volume of 5,163,517, the COIN’s price is down by -0.86%, now at $157.1.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 50 days.

What The Experts Say On Coinbase Glb

In the last month, 1 experts released ratings on this stock with an average target price of $169.0.

- Showing optimism, an analyst from Barclays upgrades its rating to Equal-Weight with a revised price target of $169.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Coinbase Glb, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oxford: Owner of Tommy Bahama, Lilly Pulitzer and Johnny Was Reports Second Quarter Results

ATLANTA, Sept. 11, 2024 (GLOBE NEWSWIRE) — Oxford Industries, Inc. OXM today announced financial results for its second quarter of fiscal 2024 ended August 3, 2024.

Consolidated net sales in the second quarter of fiscal 2024 of $420 million were comparable to sales in the second quarter of fiscal 2023. EPS on a GAAP basis was $2.57 compared to $3.22 in the second quarter of fiscal 2023. On an adjusted basis, EPS was $2.77 compared to $3.45 in the second quarter of fiscal 2023.

Tom Chubb, Chairman and CEO, commented, “Consumer sentiment in the second quarter continued to decline from levels earlier in the year reaching an eight month low in July. The decline led to market conditions that were weaker than expected with more consumers looking for deals and promotions as evidenced by increased sales in our outlet locations and during promotional events. Despite the challenging consumer environment, our teams continue to focus on our strategy of delivering new and compelling products and experiences for our customers. The current macroeconomic environment does not diminish our enthusiasm or commitment to our strategy to drive long-term shareholder value.

However, given the continued choppiness in the market and uncertain macroeconomic conditions, we have lowered our fiscal 2024 sales and EPS guidance to reflect current industry trends. Amidst this difficult environment, we are actively seeking opportunities to reduce SG&A spend without impairing our long-term growth prospects as our playbook to achieving forecasted results will be, as always, protecting the strength and integrity of our brands and avoiding short-sighted reactions to current market conditions. From a cash flow perspective, we expect strong 2024 cash flow from operations, as evidenced by the repayment of our outstanding debt balance at the end of the second quarter. Simultaneously, we continue to invest in supporting the future of our business to deliver profitable growth on a sustained basis.”

Mr. Chubb concluded, “Our teams have navigated challenging economic cycles before and I am confident that we have the right people and strategies in place to emerge on the other side of this difficult market with the health of our brands intact and our consumer connections as strong as ever.”

Second Quarter of Fiscal 2024 versus Fiscal 2023

| Net Sales by Operating Group | Second Quarter | ||

| ($ in millions) | 2024 | 2023 | % Change |

| Tommy Bahama | $245.1 | $245.4 | (0.1%) |

| Lilly Pulitzer | 91.7 | 91.3 | 0.4% |

| Johnny Was | 50.3 | 52.0 | (3.4%) |

| Emerging Brands | 32.9 | 31.6 | 4.3% |

| Other | (0.1) | (0.1) | NM |

| Total Company | $419.9 | $420.3 | (0.1%) |

- Consolidated net sales of $420 million were comparable to sales of $420 million in the second quarter of fiscal 2023.

- Full-price direct-to-consumer (DTC) sales increased 1% to $305 million versus the second quarter of fiscal 2023.

- Full-price retail sales of $152 million were 1% higher than the prior-year period.

- E-commerce sales of $153 million were comparable to last year.

- Outlet sales were $21 million, a 4% increase versus prior-year results.

- Food and beverage sales of $29 million were comparable to last year.

- Wholesale sales of $65 million were 5% lower than the second quarter of fiscal 2023.

- Full-price direct-to-consumer (DTC) sales increased 1% to $305 million versus the second quarter of fiscal 2023.

- Gross margin was 63.1% on a GAAP basis, compared to 63.9% in the second quarter of fiscal 2023. The decrease in gross margin was primarily due to full-price retail and e-commerce sales representing a lower proportion of net sales at Tommy Bahama, Lilly Pulitzer and Johnny Was with more sales occurring during promotional and clearance events. This decrease was partially offset by a $1 million lower LIFO accounting charge. Adjusted gross margin, which excludes the effect of LIFO accounting, decreased to 63.3% compared to 64.3% on an adjusted basis in the prior-year period.

- SG&A was $217 million compared to $205 million last year. This increase was primarily driven by expenses related to 30 new store openings since the second quarter of fiscal 2023, pre-opening expenses related to additional stores planned to open during the remainder of fiscal 2024, including 4 new Tommy Bahama Marlin Bars, and the addition of Jack Rogers. On an adjusted basis, SG&A was $213 million compared to $202 million in the prior-year period.

- Royalties and other operating income of $4 million were comparable to the second quarter of fiscal 2023.

- Operating income was $53 million, or 12.5% of net sales, compared to $68 million, or 16.1% of net sales, in the second quarter of fiscal 2023. On an adjusted basis, operating income decreased to $57 million, or 13.5% of net sales, compared to $73 million, or 17.3% of net sales, in the second quarter of fiscal 2023. The decreased operating income includes the impact of lower gross margin and higher SG&A as the Company continues to invest in the business.

- Interest expense was less than $1 million compared to $1 million in the prior year period. The decreased interest expense was primarily due to a lower average outstanding debt balance during the second quarter of fiscal 2024 than the second quarter of fiscal 2023. Strong cash flows allowed for the repayment of our long-term debt balance during the second quarter of fiscal 2024.

- The effective tax rate in the second quarter of fiscal 2024 of 22.5% was comparable to the second quarter of fiscal 2024. Both periods benefited primarily from discrete tax benefits for stock-based compensation.

Balance Sheet and Liquidity

Inventory decreased $22 million, or 14%, on a LIFO basis and $13 million, or 6%, on a FIFO basis compared to the end of the second quarter of fiscal 2023. Inventory decreased in all operating groups except Johnny Was primarily due to the continued initiatives to closely manage inventory purchases and reduce on-hand inventory levels.

During the first half of fiscal 2024 cash flow from operations was $122 million compared to $153 million in the first half of fiscal 2023. The cash flow from operations in the first half of fiscal 2024 provided sufficient cash to fund $54 million of capital expenditures, $22 million of dividends and $29 million of debt repayment.

During the second quarter of fiscal 2024, the Company repaid its remaining long-term debt and had no borrowings outstanding, compared to $48 million of borrowings outstanding at the end of the second quarter of fiscal 2023. The Company had $18 million of cash and cash equivalents versus $8 million of cash and cash equivalents at the end of the second quarter of fiscal 2023.

Dividend

The Board of Directors declared a quarterly cash dividend of $0.67 per share. The dividend is payable on November 1, 2024 to shareholders of record as of the close of business on October 18, 2024. The Company has paid dividends every quarter since it became publicly owned in 1960.

Outlook

For fiscal 2024 ending on February 1, 2025, the Company revised its sales and EPS guidance. The Company now expects net sales in a range of $1.51 billion to $1.54 billion as compared to net sales of $1.57 billion in fiscal 2023. In fiscal 2024, GAAP EPS is expected to be between $6.28 and $6.58 compared to fiscal 2023 GAAP EPS of $3.82. Adjusted EPS is expected to be between $7.00 and $7.30, compared to fiscal 2023 adjusted EPS of $10.15.

For the third quarter of fiscal 2024, the Company expects net sales to be between $310 million and $325 million compared to net sales of $327 million in the third quarter of fiscal 2023. Earnings on a GAAP basis per share are expected to be in a range of a loss of $0.16 to net earnings of $0.04 in the third quarter compared to GAAP net earnings per share of $0.68 in the third quarter of fiscal 2023. Adjusted EPS is expected to be between $0.00 and $0.20 compared to adjusted EPS of $1.01 in the third quarter of fiscal 2023.

The Company anticipates interest expense of $2 million in fiscal 2024, including the $1 million in the first half of fiscal 2024, with interest expense expected to be less than $1 million in each of the third and fourth quarters of fiscal 2024. The Company’s effective tax rate is expected to be approximately 24% for the full year of fiscal 2024.

Capital expenditures in fiscal 2024, including the $54 million in the first half of fiscal 2024, are expected to be approximately $150 million compared to $74 million in fiscal 2023. This is a reduction from the Company’s prior estimate due to the timing of cash flows related to investments for future growth, including the timing of spend associated with a multi-year project to build a new distribution center in Lyons, Georgia to ensure best-in-class direct to consumer throughput capabilities for our brands. The planned year-over-year increase in capital expenditures includes approximately $75 million now budgeted in fiscal 2024 for the distribution center project. Additionally, we will invest in new brick and mortar locations, relocations and remodels of existing locations resulting in a year-over-year net increase of full price stores of approximately 30 by the end of fiscal 2024, which includes an additional approximately 15 planned to open in the second half of the year. We will also continue with our investments in our various technology systems initiatives, including e-commerce and omnichannel capabilities, data management and analytics, customer data and insights, cybersecurity, automation including artificial intelligence and infrastructure.

Conference Call

The Company will hold a conference call with senior management to discuss its financial results at 4:30 p.m. ET today. A live web cast of the conference call will be available on the Company’s website at www.oxfordinc.com. A replay of the call will be available through September 25, 2024 by dialing (412) 317-6671 access code 13748517.

About Oxford

Oxford Industries, Inc., a leader in the apparel industry, owns and markets the distinctive Tommy Bahama®, Lilly Pulitzer®, Johnny Was®, Southern Tide®, The Beaufort Bonnet Company®, Duck Head® and Jack Rogers® lifestyle brands. Oxford’s stock has traded on the New York Stock Exchange since 1964 under the symbol OXM. For more information, please visit Oxford’s website at www.oxfordinc.com.

Basis of Presentation

All per share information is presented on a diluted basis.

Non-GAAP Financial Information

The Company reports its consolidated financial statements in accordance with generally accepted accounting principles (GAAP). To supplement these consolidated financial results, management believes that a presentation and discussion of certain financial measures on an adjusted basis, which exclude certain non-operating or discrete gains, charges or other items, may provide a more meaningful basis on which investors may compare the Company’s ongoing results of operations between periods. These measures include adjusted earnings, adjusted earnings per share, adjusted gross profit, adjusted gross margin, adjusted SG&A, and adjusted operating income, among others.

Management uses these non-GAAP financial measures in making financial, operational, and planning decisions to evaluate the Company’s ongoing performance. Management also uses these adjusted financial measures to discuss its business with investment and other financial institutions, its board of directors and others. Reconciliations of these adjusted measures to the most directly comparable financial measures calculated in accordance with GAAP are presented in tables included at the end of this release.

Safe Harbor

This press release includes statements that constitute forward-looking statements within the meaning of the federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. We intend for all forward-looking statements contained herein, in our press releases or on our website, and all subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf, to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (which Sections were adopted as part of the Private Securities Litigation Reform Act of 1995). Such statements are subject to a number of risks, uncertainties and assumptions including, without limitation, demand for our products, which may be impacted by macroeconomic factors that may impact consumer discretionary spending and pricing levels for apparel and related products, many of which may be impacted by inflationary pressures, elevated interest rates, concerns about the stability of the banking industry or general economic uncertainty, and the effectiveness of measures to mitigate the impact of these factors; possible changes in governmental monetary and fiscal policies, including, but not limited to, Federal Reserve policies in connection with continued inflationary pressures and the impact of the 2024 U.S presidential election; competitive conditions and/or evolving consumer shopping patterns, particularly in a highly promotional retail environment; acquisition activities (such as the acquisition of Johnny Was), including our ability to integrate key functions, recognize anticipated synergies and minimize related disruptions or distractions to our business as a result of these activities; supply chain disruptions; costs and availability of labor and freight deliveries, including our ability to appropriately staff our retail stores and food & beverage locations; costs of products as well as the raw materials used in those products, as well as our ability to pass along price increases to consumers; energy costs; our ability to respond to rapidly changing consumer expectations; unseasonal or extreme weather conditions or natural disasters; the ability of business partners, including suppliers, vendors, wholesale customers, licensees, logistics providers and landlords, to meet their obligations to us and/or continue our business relationship to the same degree as they have historically; retention of and disciplined execution by key management and other critical personnel; cybersecurity breaches and ransomware attacks, as well as our and our third party vendors’ ability to properly collect, use, manage and secure business, consumer and employee data and maintain continuity of our information technology systems; the effectiveness of our advertising initiatives in defining, launching and communicating brand-relevant customer experiences; the level of our indebtedness, including the risks associated with heightened interest rates on the debt and the potential impact on our ability to operate and expand our business; changes in international, federal or state tax, trade and other laws and regulations, including the potential for increases or changes in duties, tariffs or quotas; the timing of shipments requested by our wholesale customers; fluctuations and volatility in global financial and/or real estate markets; our ability to identify and secure suitable locations for new retail store and food & beverage openings; the timing and cost of retail store and food & beverage location openings and remodels, technology implementations and other capital expenditures; the timing, cost and successful implementation of changes to our distribution network; pandemics or other public health crises; expected outcomes of pending or potential litigation and regulatory actions; the increased consumer, employee and regulatory focus on sustainability issues and practices; the regulation or prohibition of goods sourced, or containing raw materials or components, from certain regions and our ability to evidence compliance; access to capital and/or credit markets; factors that could affect our consolidated effective tax rate; the risk of impairment to goodwill and other intangible assets such as the recent impairment charges incurred in our Johnny Was segment; and geopolitical risks, including ongoing challenges between the United States and China and those related to the ongoing war in Ukraine, the Israel-Hamas war and the conflict in the Red Sea region. Forward-looking statements reflect our expectations at the time such forward-looking statements are made, based on information available at such time, and are not guarantees of performance.