Sanara Stock Gains From New US Distribution Deal With ChemoMouthPiece

Sanara MedTech Inc. SMTI, along with InfuSystem Inc., recently entered into an exclusive U.S. distribution agreement with ChemoMouthpiece, LLC. Sanara will execute the terms of the agreement with the help of SI Healthcare Technologies (SI Technologies), which is a 50/50 joint venture between SMTI and InfuSystem.

ChemoMouthpiece owns and manufactures a clinically validated product named Chemo Mouthpiece — an oral cryotherapy device that brings relief to oral mucositis-affected patients. This device perfectly aligns with Sanara’s skincare strategy. The company further aims to provide the device to oncology patients undergoing chemotherapy.

Following the announcement, shares of Sanara rose 0.5% to $33.51 yesterday. With the company gaining a high level of synergies from its collaborations within the skincare market, we expect market sentiment to remain positive around this development.

About Sanara’s Distribution Agreement With ChemoMouthpiece

Under the agreement, SI Technologies will be the exclusive distributor of ChemoMouthpiece’s kits in the United States. SI Technologies plans to market and distribute the product to approximately 3,000 cancer centers through InfuSystem’s existing sales team. It will purchase the product kits from ChemoMouthpiece at a fixed price and pay a royalty on net revenues for the use of the product’s intellectual property.

For investors’ note, the Chemo Mouthpiece is FDA 501(k) approved.

Financial Details

Sanara invested $5 million for a 6.6% ownership in ChemoMouthpiece. Sanara has drawn $15.5 million on its term loan with CRG Servicing, LLC and will fund this investment as part of that draw.

SI Technologies will have the option to purchase the U.S. business of ChemoMouthpiece, including all U.S. intellectual property related to the product. The purchase option will expire on Jan. 31, 2029.

More on the News

Oral mucositis causes painful mouth ulcers, which are a common complication of chemotherapy and radiation. The oral cryotherapy device is expected to reduce material costs for oncology treatment centers, improve patient quality of life and allow for continued treatment of cancer therapy for patients. ChemoMouthpiece is planning to publish studies in the future to reinforce the efficacy of the device.

Pickwick Capital Partners, LLC, served as the exclusive advisor to ChemoMouthpiece on this transaction.

Recent Development by Sanara

Earlier this year, Sanara signed an exclusive license agreement with Tufts University (Tufts) to develop and commercialize patented technology covering 18 unique collagen peptides.

Although Sanara has established itself as a leader in bioactive collagen peptides with CellerateRX Surgical Powder, the company expects to expand the CellerateRX product line and develop new bioactive collagen peptide-based applications. The recently licensed technology from Tufts helped the company to expand its offering of collagen products.

Image Source: Zacks Investment Research

Industry Prospects Favor Sanara

Per a Global Market Insights report, the oral mucositis treatment market was valued at $1.6 billion in 2023 and is expected to witness a CAGR of 7.1% from 2024 to 2032.

Market growth can be attributed to the ongoing advancements in cancer therapy and the increasing prevalence of cancer. Moreover, the rising geriatric population, along with the growing demand for targeted therapies, helps the market surge.

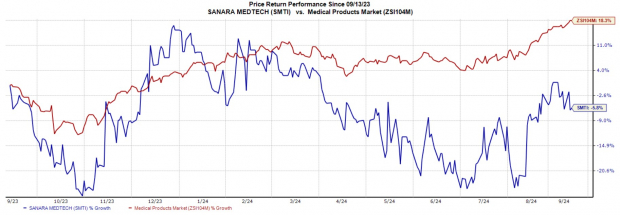

Price Performance by Sanara

In the past year, shares of SMTI have lost 5.8% against the industry’s 18.4% growth.

SMTI’s Zacks Rank and Key Picks

Sanara currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Intuitive Surgical ISRG, TransMedics Group TMDX and Boston Scientific. While Intuitive Surgical and TransMedics currently sport a Zacks Rank #1 (Strong Buy) each, Boston Scientificcarries a Zacks Rank #2 (Buy).

Intuitive Surgical’s shares have surged 62.2% in the past year. Estimates for the company’s earnings have moved north 5.1% to $1.65 per share for 2024 in the past 30 days.

ISRG’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 8.97%. In the last reported quarter, it posted an earnings surprise of 16.34%.

Estimates for TransMedics’ 2024 EPS have moved up 125% to 27 cents in the past 30 days. Shares of the company have soared 143.8% in the past year compared with the industry’s 15.8% growth.

TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for Boston Scientific’s 2024 EPS have increased 1.7% to $2.40 in the past 30 days. In the past year, shares of BSX have risen 55.9% compared with the industry’s 18.3% growth.

In the last reported quarter, BSX delivered an earnings surprise of 6.90%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.18%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply