This Is What Whales Are Betting On Core Scientific

Investors with a lot of money to spend have taken a bearish stance on Core Scientific CORZ.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CORZ, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 13 options trades for Core Scientific.

This isn’t normal.

The overall sentiment of these big-money traders is split between 38% bullish and 61%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $120,400, and 12, calls, for a total amount of $1,014,743.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $10.5 for Core Scientific during the past quarter.

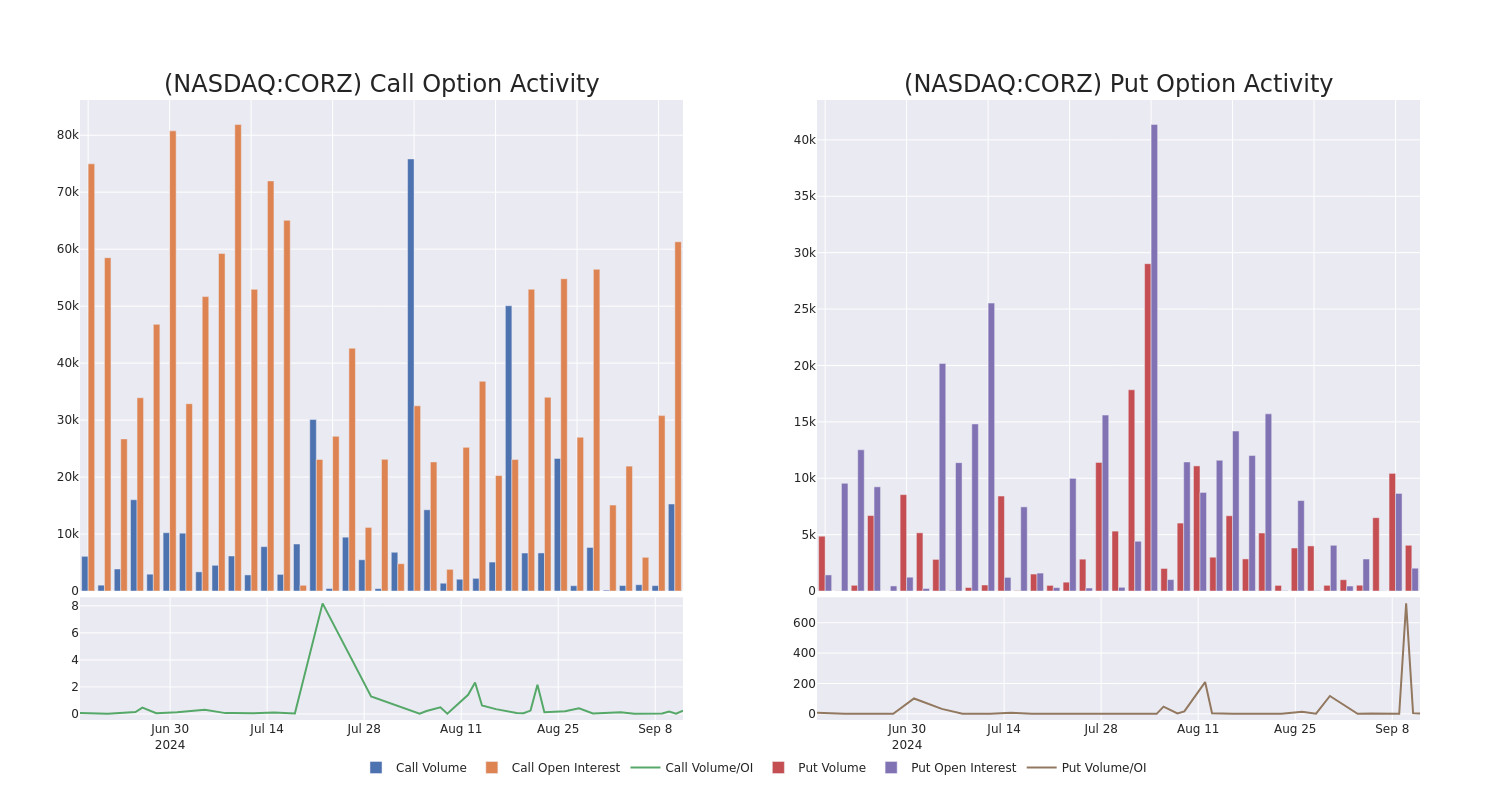

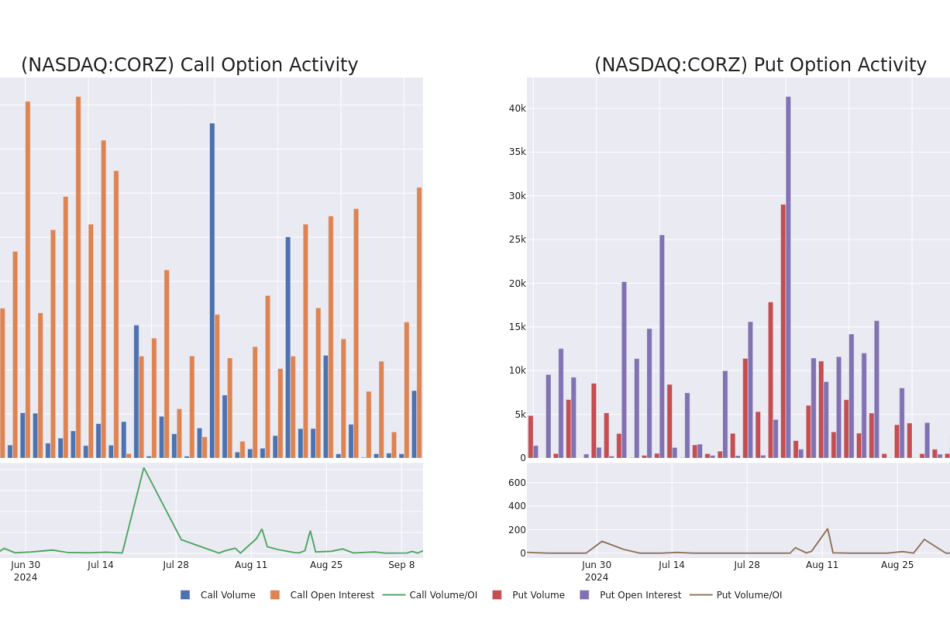

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Core Scientific’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Core Scientific’s whale trades within a strike price range from $5.0 to $10.5 in the last 30 days.

Core Scientific Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CORZ | CALL | SWEEP | BEARISH | 01/17/25 | $5.5 | $5.3 | $5.4 | $5.00 | $135.0K | 16.9K | 1.5K |

| CORZ | CALL | SWEEP | BEARISH | 01/17/25 | $5.6 | $5.4 | $5.5 | $5.00 | $134.7K | 16.9K | 1.2K |

| CORZ | CALL | TRADE | BULLISH | 01/17/25 | $5.3 | $5.2 | $5.3 | $5.00 | $132.5K | 16.9K | 750 |

| CORZ | CALL | SWEEP | BULLISH | 01/17/25 | $5.3 | $5.1 | $5.3 | $5.00 | $132.5K | 16.9K | 500 |

| CORZ | CALL | SWEEP | BEARISH | 01/17/25 | $5.1 | $4.9 | $5.0 | $5.00 | $125.0K | 16.9K | 250 |

About Core Scientific

Core Scientific Inc is engaged in Blockchain and AI Infrastructure, Digital Asset Self-Mining, Premium Hosting, Blockchain Technology, and Artificial Intelligence related services. The business operates in two segments being; Equipment Sales and Hosting which consists of blockchain infrastructure, third-party hosting business and equipment sales to customers. Mining segment consists of digital asset mining for its account. The blockchain business generates revenue from the sale of consumption-based contracts and by providing hosting services. The digital asset mining segment earns revenue from operating a firm’s owned computer equipment as part of a pool of users that process transactions conducted on one or more blockchain networks. In exchange, it receives digital currency assets.

After a thorough review of the options trading surrounding Core Scientific, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Core Scientific

- Currently trading with a volume of 5,310,319, the CORZ’s price is up by 3.76%, now at $10.35.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 62 days.

What Analysts Are Saying About Core Scientific

3 market experts have recently issued ratings for this stock, with a consensus target price of $17.666666666666668.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $16.

- Reflecting concerns, an analyst from Bernstein lowers its rating to Outperform with a new price target of $17.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $20.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Core Scientific with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply