Kratos Defense Provides Four Classes of Affordable Turbojet Engines

Kratos Defense & Security Solutions, Inc. KTOS recently announced that its unit, Technical Directions, Inc. (“TDI”), now offers four classes of its low-cost, high-performance turbojet engines ranging from 30 to 200 pounds of thrust with immediate availability.

The TDI-J45 30 lb thrust, TDI-J5 75 lb thrust, TDI-J7 100 lb thrust and TDI-J85 200 lb thrust are the four classes of TDI’s turbojet engines that are currently offered. The turbojet engines are suitable for deployment in cruise missiles, loitering munitions systems and other vital defense systems.

About Kratos’ Unmanned Systems Division

Part of Kratos Defense, Kratos Unmanned Systems Division is a company that develops cutting-edge unmanned systems and technology for a range of defense and security applications. It delivers state-of-the-art solutions in fields like unmanned aerial systems (UAS), unmanned ground vehicles (UGV) and unmanned maritime systems.

The division provides a variety of unmanned systems for both military and commercial use, including robotic systems, autonomous platforms and high-performance drones. Their products enhance operational effectiveness and safety while reducing costs. The division makes investments in research and development to maintain its leadership position in unmanned technology. This involves working on next-generation systems and exploring new applications to meet evolving needs in defense and security.

What Lies Ahead for KTOS?

Against the backdrop of the heightening geopolitical uncertainties around the world, several countries have been strengthening their defense arsenal. The demand for military weapons, especially missiles, has increased in the defense industry, with defense players developing new and advanced missiles to meet the rising demand.

The Grand View Research firm projects the global missile market to witness a CAGR of 7.4% over the 2024-2030 period. Growth potential in the missile market should bode well for Kratos Defense, which has a handful of combat-proven missiles in its product portfolio, like Patriot, AN/TPY-2 THAAD, TPQ-53, TPS-77, TPS-78 and SBIRS.

Opportunities for KTOS’ Peers

Considering the solid growth opportunities offered by the global missile market, other defense primes like Lockheed Martin LMT, RTX Corporation RTX and Northrop Grumman NOC, with a strong presence in this space, should benefit.

Lockheed Martin offers a variety of combat-proven missiles like AGM-158 XR Cruise Missiles, the GMLRS go-to guided missile and ATACMS Advanced Military Rocket Technology, a leading-edge military rocket solution designed for precision and effectiveness in military operations.

LMT boasts a long-term (three to five years) earnings growth rate of 4.7%. The Zacks Consensus Estimate for LMT’s 2024 sales implies an improvement of 5.3% from the previous year’s level.

RTX Corporation is one of the biggest suppliers of combat missiles for the U.S. Army. Its product portfolio includes SM-6 Missile, Tomahawk Cruise Missile, AIM-9X SIDEWINDER Missile, Naval Strike Missile and many more.

RTX boasts a long-term earnings growth rate of 10.4%. The Zacks Consensus Estimate for the company’s 2024 sales indicates year-over-year growth of 7%.

Northrop Grumman manufactures high-speed, long-range strike weapons with deadly capabilities at standoff range. Its portfolio of missiles includes Advanced Anti-Radiation Guided Missile Extended Range, Advanced Anti-Radiation Guided Missile, Advanced Reactive Strike and Stand-In Attack Weapon Missile.

NOC boasts a long-term earnings growth rate of 8.7%. The Zacks Consensus Estimate for the company’s 2024 sales suggests year-over-year growth of 5.4%.

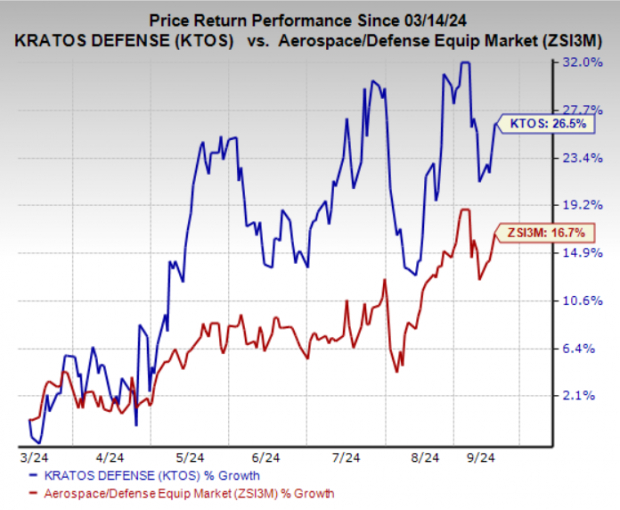

KTOS Stock Outperforms Industry

In the past six months, shares of Kratos Defense have risen 26.5% compared with the industry’s average return of 16.7%.

Image Source: Zacks Investment Research

KTOS’ Zacks Rank

Kratos Defense currently carries a Zacks Rank #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Grosvenor appoints Michael Ward to lead North American Structured Development Finance Programme

Vancouver, BC, Sept. 13, 2024 (GLOBE NEWSWIRE) — Grosvenor, an international property owner and developer with a 70+-year track record in North America, has announced Michael Ward as Managing Director, Co-Investment. Based in Vancouver, BC, Michael will lead the company’s Structured Development Finance (SDF) Programme which supplements Grosvenor’s core urban property development and investment activities in the US and Canada by providing capital to leading residential developers in its chosen markets.

With 20+ years of experience in property development, Michael has been directly involved in the delivery of 14 mixed-use and residential projects throughout North America. Most of these projects involved partnerships with large institutional Canadian pension funds, family offices and high-net-worth individuals. Michael’s most recent role at Grosvenor involved guiding the strategic direction of the firm’s Vancouver development programme valued at CAD$5.3bn and advancing capital partner relationships.

Jamie Delmotte, Chief Co-Investment Officer for Grosvenor’s North American property business said, “Not only does Michael’s new role and responsibility reflect Grosvenor’s commitment to internal promotion, but his movement into SDF is also a natural progression given his vast industry experience, relationships and market knowledge. His work establishing and building partnerships has been vital to our growth to date and I look forward to what the future holds for the Programme under his leadership.”

Michael Ward added: “Being on the Development side of our business for over two decades, I value the opportunity to lead this important business line and feel well-suited to the task – working with our developer partners to ensure the delivery of best-in-class properties across our key markets and leading a team of professionals to outperform return expectations for our partners.”

Michael joined Grosvenor’s Vancouver office in 2002 following an internship he completed the year before. He held a succession of development roles in the firm’s Washington, D.C. and Calgary offices before returning to Vancouver in 2014. Here he expanded the development team and oversaw notable projects including the delivery of the multi-award-winning Grosvenor Ambleside, Connaught and The Pacific. Michael also held the role of General Manager of Grosvenor’s Vancouver office between 2014 – 2022.

The SDF Programme, which operates from Grosvenor and partner capital, is actively fund raising for the fourth iteration of the True North partnership, timed to take advantage of the current dislocation in core gateway markets where Grosvenor is active. The Programme seeks opportunities to work with developers on the new construction of mixed-use developments, apartments, condominiums, and townhomes located in Vancouver, Toronto, California, Washington, D.C., and Seattle.

Grosvenor established the SDF Programme nearly 25 years ago to help address the structural shortage in supply of quality urban infill housing in gateway cities in the US and Canada. Since 2000, the SDF business has acted as a capital provider to 79 residential development projects with 9,500+ residential units. Lending over $625m to-date, Grosvenor’s SDF projects represent $5bn in gross development value.

Michael will manage a team of 7 professionals who are based in Grosvenor’s Vancouver, BC, San Francisco and Washington, D.C. offices. Educated at the University of British Columbia, Michael is a member of the Urban Land Institute (ULI) and is a ‘Business in Vancouver 40 Under Forty’ recipient. He has also been involved with numerous community organizations in Vancouver providing advice as to their real estate needs and participating in the selection of recipients for the Coast Mental Health – Courage to Come Back Awards.

About Grosvenor

Grosvenor has operated a diversified real estate business in North America since 1952. We focus on vibrant urban locations, making a positive difference to local neighbourhoods and communities.

As of December 31, 2023, we had assets under management of US$3.8bn/C$5.0bn, including 71 high-quality properties, and is executing on a US$4.9bn/C$6.5bn development pipeline across its active markets. Consistent with the firm’s farsighted approach to ownership and development, we value long-term partnerships; across our nine active capital partners, the average relationship is 18 years.

Follow us on

LinkedIn: Grosvenor

Instagram: ThisisGrosvenor

Great Ink Communications Tom Nolan, Eric Waters +1 212-741-2977 Grosvenor@GreatInk.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Is Betting Big In Deere Options

Financial giants have made a conspicuous bullish move on Deere. Our analysis of options history for Deere DE revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $790,985, and 3 were calls, valued at $161,944.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $300.0 to $420.0 for Deere over the last 3 months.

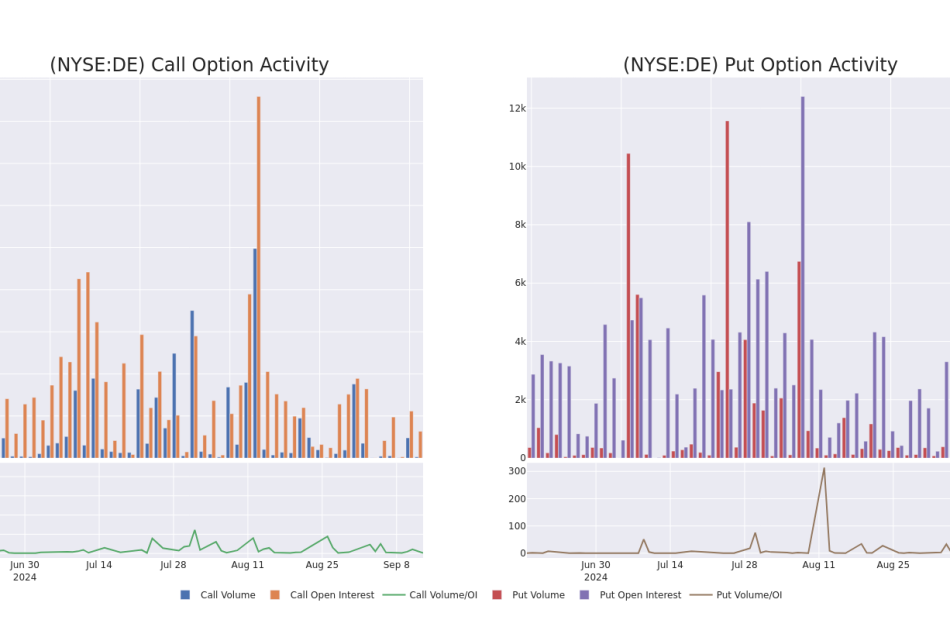

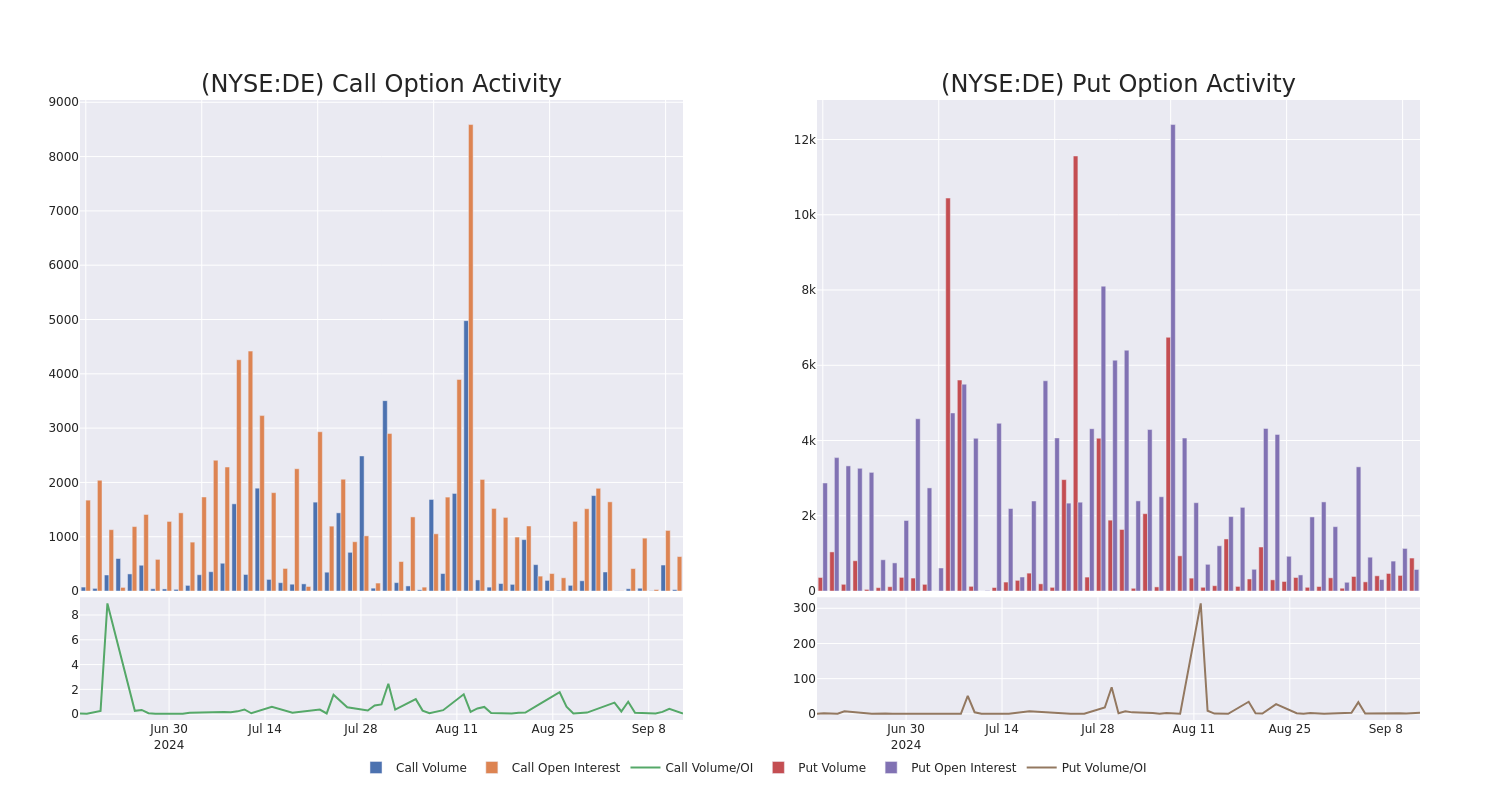

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Deere stands at 241.6, with a total volume reaching 903.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Deere, situated within the strike price corridor from $300.0 to $420.0, throughout the last 30 days.

Deere 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | PUT | TRADE | NEUTRAL | 12/18/26 | $19.85 | $16.6 | $18.2 | $300.00 | $364.0K | 265 | 200 |

| DE | PUT | TRADE | BULLISH | 01/16/26 | $12.45 | $11.95 | $11.95 | $300.00 | $212.7K | 308 | 250 |

| DE | PUT | TRADE | BEARISH | 06/20/25 | $6.45 | $4.5 | $6.45 | $300.00 | $93.5K | 308 | 150 |

| DE | CALL | SWEEP | NEUTRAL | 06/18/26 | $48.35 | $43.75 | $43.75 | $420.00 | $87.9K | 13 | 0 |

| DE | PUT | TRADE | BULLISH | 01/16/26 | $12.4 | $11.95 | $11.95 | $300.00 | $83.6K | 308 | 71 |

About Deere

Deere is the world’s leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

After a thorough review of the options trading surrounding Deere, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Deere’s Current Market Status

- Currently trading with a volume of 374,320, the DE’s price is up by 1.38%, now at $392.33.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 68 days.

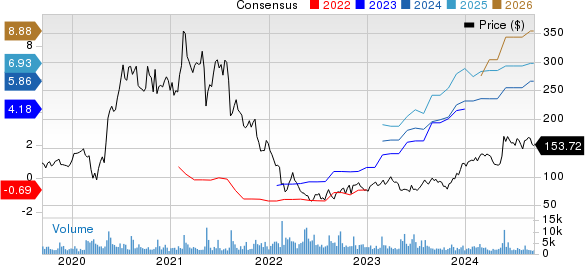

What Analysts Are Saying About Deere

In the last month, 5 experts released ratings on this stock with an average target price of $410.2.

- An analyst from Evercore ISI Group persists with their In-Line rating on Deere, maintaining a target price of $378.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Deere with a target price of $410.

- An analyst from Citigroup persists with their Neutral rating on Deere, maintaining a target price of $395.

- Reflecting concerns, an analyst from Truist Securities lowers its rating to Buy with a new price target of $443.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Deere, which currently sits at a price target of $425.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Deere with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Steven M Burdick Offloads $1.72M Worth Of Tetra Tech Stock

On September 12, a recent SEC filing unveiled that Steven M Burdick, EVP at Tetra Tech TTEK made an insider sell.

What Happened: Burdick opted to sell 36,830 shares of Tetra Tech, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $1,715,173.

At Friday morning, Tetra Tech shares are down by 0.0%, trading at $46.06.

Get to Know Tetra Tech Better

Tetra Tech Inc provides consulting and engineering services for environmental, infrastructure, resource management, energy, and international development markets. It specializes in providing water-related services for public and private clients. It designs infrastructure, facilities, and other structures with complex plans and resource management. Tetra Tech has two reportable segments. Its Government Services Group (GSG) reportable segment primarily includes activities with U.S. government clients (federal, state and local) and activities with development agencies worldwide. Commercial/International Services Group (CIG) reportable segment primarily includes activities with U.S. commercial clients and international clients other than development agencies.

Breaking Down Tetra Tech’s Financial Performance

Revenue Growth: Tetra Tech’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 11.2%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Insights into Profitability:

-

Gross Margin: The company shows a low gross margin of 16.6%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Tetra Tech’s EPS is below the industry average. The company faced challenges with a current EPS of 0.32. This suggests a potential decline in earnings.

Debt Management: Tetra Tech’s debt-to-equity ratio is below the industry average. With a ratio of 0.63, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 42.64, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 2.44, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 24.15, Tetra Tech demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Tetra Tech’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will WIX's Efforts to Expand AI Product Line-Up Boost its Stock?

Wix.com Ltd. WIX has launched its latest artificial intelligence Theme Assistant that provides users with personalized recommendations and real-time advice, allowing them to easily customize their website’s theme. This tool is part of a broader suite of innovations from Wix aimed at supporting users throughout every phase of their online journey, from initial ideas to final execution.

As website designing becomes more complicated day by day, users frequently encounter difficulties aligning their choices with their vision. The AI Theme Assistant addresses this by offering conversational guidance throughout the design process, assisting with color palettes, fonts and themes, and even extracting colors from logos, added WIX.

AI Theme Assistant is integrated directly into the Wix Editor and it provides real-time suggestions and directs users to relevant areas in the Wix dashboard. By recommending features and advising on theme elements, the assistant simplifies design decisions, giving users control while enhancing their site’s aesthetic.

Wix highlighted that integrating AI into web design adds significant value for its users. The theme assistant helps users achieve a cohesive and unified look for their websites, ensuring a consistent appearance throughout.

WIX to Gain From Product Line-Up Expansion

Wix’s performance is being cushioned by higher adoption of the product portfolio, especially various AI products. WIX is also embedding AI assistants across its platform and has released 17 AI business assistants so far.

It continues to add new products to gain on the AI boom. In July 2024, Wix unveiled a new suite of AI-powered tools aimed at streamlining content creation. These tools are designed to suggest relevant blog topics, generate content and create images tailored to the target audience. This new feature allows users to quickly transform ideas into almost-ready articles, cutting down on the time and effort needed to produce engaging content.

In June 2024, the company launched advanced AI creation capabilities for its mobile app builder. The initiative is set to empower users to effortlessly craft professional and fully customizable applications. In the same month, the company also extended the availability of its AI Website Builder in different languages. Apart from English, AI Website Builder is now available to global users in French, German, Portuguese, Spanish, Italian, Japanese, Turkish and Korean languages. The initiative aids users in building websites in their preferred language.

Additionally, it launched the AI Portfolio Creator, a groundbreaking tool that leverages the power of AI to aid users in crafting and showcasing an online professional portfolio in May 2024. The AI Portfolio Creator effectively streamlines the portfolio creation experience by allowing users to smoothly upload and organize large-scale image collections with just a few clicks.

WIX is focusing on generative AI as it represents a significant business growth driver. In the second quarter of 2024, bookings revenues came at $458.4 million. This 15% year-over-year improvement was driven by solid uptake of WIX Studio, AI product suite and expanding commerce platform in this quarter. The expansion of the AI product portfolio is expected to drive the top line for WIX and further boost the stock.

WIX’s Zacks Rank & Stock Price Performance

WIX currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 64.1% in the past year compared with the sub-industry’s growth of 20.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Unisys Corporation UIS, ANSYS, Inc. ANSS and Adobe Inc. UIS presently sports a Zacks Rank #1 (Strong Buy), whereas ANSS & ADBE carry a Zacks Rank #2 (Buy).

Unisys Corporation delivered an earnings surprise of 87.7%, on average, in the trailing four quarters. In the last reported quarter, UIS pulled off an earnings surprise of 143.2%. It has a long-term earnings growth expectation of 15%.

ANSYS delivered an earnings surprise of 4.8%, on average, in three of the trailing four quarters. In the last reported quarter, ANSS pulled off an earnings surprise of 28.9%. It has a long-term earnings growth expectation of 6.4%.

Adobe delivered an earnings surprise of 2.7%, on average, in the trailing four quarters. In the last reported quarter, ADBE pulled off an earnings surprise of 2.1%. It has a long-term earnings growth expectation of 13%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intel is in trouble. Here are 5 things tech companies can learn to avoid the same struggles

For nearly 30 years, Intel was the world’s biggest chipmaker. A decade ago, things began to shift, though—and these days, the company’s very future is at a crossroads.

Most Read from Fast Company

Financials for the past two quarters have fallen far, far short of expectations. In the most recent quarter, Intel reported earnings of just 2 cents per share, versus an expected 10 cents, and the company suspended its dividend. Now, after shedding more than 15% of its workforce, Intel is looking at how best to continue.

A three-day series of meetings began Tuesday with Intel’s board of directors beginning to explore options on how to move forward—something that could result in additional layoffs, the sale of subsidiaries, or even, perhaps, splitting up Intel’s core operations.

What started as a slow-motion fall from grace has become one that moves at lightning speed. But as Intel works to course correct, there are lessons other tech companies can learn from its problems.

Capital is king

Intel at one point saw cash flow of $10 billion (or more) per year. By 2022, though, that had turned negative, and it has only gotten worse over the past two years. That downward spiral of cash flow has hamstrung the company’s ability to fund its core operations.

Capital spending and risk go hand in hand—and Intel made some gambles chasing AI chips, including investing $100 billion in U.S. manufacturing and introducing laptop chips with dedicated AI processors. The company, however, was too far behind to make any sort of notable impact, which cost it time and money. And any payoff from that is far from imminent.

There’s a difference between spending money now to earn a lot more later and just burning cash. And leaders need to have the presence of mind to realize when they’ve switched from one of those scenarios to another.

Know when to pivot

Changing course can be humbling. It signals to both investors and employees that you made a mistake. But failing to do so can be fatal. Intel is making some money from its existing businesses, but not enough to support the capital outlay needed to expand its manufacturing and supply chain. The company’s failure to enact a new plan earlier likely cost it billions.

“While the overall strategy might have made sense at the outset, the current runway of the business doesn’t seem to give enough support to get it to the end anymore,’’ Bernstein Societe Generale Group analyst Stacy Rasgon wrote in a note last week.

Intel has been slow to pivot before. The company failed to see changes in consumer demand that started to happen in the late 2000s. Rather than focusing on the rise in demand for mobile chips, it stayed laser focused on the PC business (and the profits that segment was contributing to the bottom line at the time). It also insisted on making its own processors while rivals outsourced the work. More recently, Intel completely missed the rise of AI-focused chips, giving Nvidia a chance to pull far ahead.

“If you have a linear way of thinking, you think ‘what I’m doing, I’m going to continue to do,’ but technology has a way of changing those things,” Ram Chellappa, a professor at Emory University’s Goizueta School of Business, tells Fast Company.

Staying ahead of the curve is hard, but catching up is a lot harder

Intel CEO Pat Gelsinger is under the microscope these days, but virtually no one blames him for all of the company’s current problems. He joined Intel in 2021, hoping to get the company back on track after previous management’s missteps. Getting Intel back to a level of prominence is taking longer and costing a lot more than expected, however—and R&D costs are just going to climb higher as it plays catch-up.

“This is not the safe space they had before, and those things are being reflected in the financials,” says Chellappa.

Once lost, investor confidence is almost impossible to regain

Intel’s problems have cascaded in the past several quarters, but the warning signs have been there for a while—and investors have seen them. Over the past five years, shares are down 63%. Over the past year, they have fallen 50% and year-to-date, the company’s stock is down nearly 60%.

The Dow Jones Industrial Average is even thinking about removing the company from its index. Investors, meanwhile, now value the company far less than the value of its facilities and other assets on its balance sheet.

Job cuts and turnaround plans will help to some degree, but until Intel shows it can be a real player in the AI space or introduces a product that will play a significant role in future technologies, it will be hard to woo back investors who have walked away.

When under a microscope, don’t tout a product until you’re positive it’s ready

One of Intel’s hopes for the future has been turning the company into a fabless design studio, which it hoped would lure away business from Taiwan’s TSMC. Those efforts hit a roadblock earlier this month, though, after chip designer Broadcom tested Intel’s process and said Intel was not yet ready for large-scale production.

Intel says the system will be ready by next year, but the setback could have long-lasting effects as trust in Intel’s manufacturing sinks.

This post originally appeared at fastcompany.com

Subscribe to get the Fast Company newsletter: http://fastcompany.com/newsletters

WBTN INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that WEBTOON Entertainment, Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Sept. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising–Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against WEBTOON Entertainment, Inc. (“Webtoon” or “the Company”) WBTN and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Webtoon securities pursuant to the registration statement and prospectus issued in connection with the Company’s June 27, 2024 initial public offering (“IPO”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/WBTN.

Case Details

The Complaint alleges that the Registration Statement made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, the Complaint alleges that Defendants failed to disclose to investors: (1) that the Company experienced a deceleration in advertising revenue growth; (2) that the Company experienced a deceleration in IP adaptations revenue; (3) that the Company experienced exposure to weaker foreign currencies which offset revenue growth; (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/WBTN or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in Webtoon you have until November 5, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Homeowners Have Never Been Richer, Data Shows: 'Another Reason To Question Recession Narrative'

Homeowners have more real estate equity than ever before, according to data from the federal government and an investment group.

Total homeowner’s equity in the U.S. reached $35.1 trillion in this year’s second quarter, data from the Federal Reserve showed.

It fell as low as $29.8 trillion in the last quarter of 2022, but that is way above a most recent low of $8.22 trillion in the first quarter of 2012, according to the Fed data.

Homeowner’s equity has skyrocketed 15,845% over the past seven decades from $219 billion in 1951.

Another indicator of homeowner wealth is that households have the least mortgage debt relative to their property value in almost 70 years as homes appreciate in value and homeowners pay down their mortgages, according to data from Bespoke Investment Group.

Household mortgage debt as a percentage of real estate value has halved from 53% in December 2011 to 27.3% in 2021.

“Consumer balance sheets are rock solid, which is another reason to question the narrative of impending recession,” Bespoke said.

Mortgage rates fell to their lowest point in more than 18 months last week. That’s encouraging homebuyers to refinance the amount they have left to pay on their home loans.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.29 percent from 6.43 percent, marking the sixth straight week in declining rates, according to the Mortgage Bankers Association (MBA).

Price Action: Mortgage lenders saw losses and gains into Friday’s early-afternoon trading.

- Rocket Companies Inc. RKT rose 6.11% to $19.90

- Bank of America BAC slipped 0.46% to $38.60

- Better Home & Finance Holding Company BETR gained 1.04% to $16.50

Read Now:

Image: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mission Produce Board Member Sold $1.37M In Company Stock

Revealing a significant insider sell on September 12, Jay A Pack, Board Member at Mission Produce AVO, as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Pack sold 104,111 shares of Mission Produce. The total transaction value is $1,368,018.

Monitoring the market, Mission Produce‘s shares down by 0.98% at $13.12 during Friday’s morning.

About Mission Produce

Mission Produce Inc is engaged in the business of producing and distributing avocados, serving retail, wholesale, and food service customers. Also, the company provides additional services like ripening, bagging, custom packing, and logistical management. The company’s operating segments include Marketing and Distribution and International Farming and Blueberries. It generates maximum revenue from the Marketing and Distribution segment. The Marketing and Distribution segment sources fruit mainly from growers and then distributes fruit through a distribution network.

Mission Produce: Financial Performance Dissected

Revenue Growth: Mission Produce displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 23.95%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 11.42%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Mission Produce’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.17.

Debt Management: Mission Produce’s debt-to-equity ratio is below the industry average at 0.45, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: Mission Produce’s P/E ratio of 40.15 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.83, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Mission Produce’s EV/EBITDA ratio of 12.88 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Mission Produce’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

526K Reasons To Be Bullish On Arcosa Stock

A new SEC filing reveals that STEVEN DEMETRIOU, Director at Arcosa ACA, made a notable insider purchase on September 12,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that DEMETRIOU purchased 6,000 shares of Arcosa. The total transaction amounted to $526,200.

Monitoring the market, Arcosa‘s shares up by 2.07% at $89.59 during Friday’s morning.

Get to Know Arcosa Better

Arcosa Inc is a manufacturer and producer of infrastructure-related products and services. It operates in three segments: Construction Products, Engineered Structures, and Transportation Products. The Construction Products segment produces and sells construction aggregates and manufactures and sells trench shields and shoring products and services for infrastructure-related projects. The Transportation Products segment manufactures and sells products for the inland waterway and rail transportation industries. The Engineered Structures segment manufactures and sells products for energy-related businesses, including structural wind towers, telecommunication structures, steel utility structures for electricity transmission and distribution, and storage and distribution containers.

Unraveling the Financial Story of Arcosa

Revenue Growth: Arcosa displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 13.66%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Navigating Financial Profits:

-

Gross Margin: Achieving a high gross margin of 20.76%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): With an EPS below industry norms, Arcosa exhibits below-average bottom-line performance with a current EPS of 0.93.

Debt Management: With a below-average debt-to-equity ratio of 0.29, Arcosa adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Arcosa’s P/E ratio of 29.06 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 1.76, Arcosa’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 12.71, Arcosa presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Important Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Arcosa’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.