2 Stocks That Could Skyrocket in 2025

The stock market has sold off over the last month, but some companies are showing improving business fundamentals that could support substantial share price gains over the next year. Here are two promising comeback stocks to buy before 2025.

1. Carnival

Carnival (NYSE: CCL) is the leading cruise ship operator, and it continues to see significant improvement in profits that could support share price gains over the next year. The stock trades at a low forward price-to-earnings ratio of just 13.5, which seems unjustified given the favorable demand trends for cruises looking ahead to 2025.

Management has made great progress in improving operations and adjusting its fleet to boost margins. Despite higher fuel costs, the company reported record operating profit of $560 million in the second quarter — up fivefold over 2023 levels.

These trends should continue. Carnival is experiencing high demand for 2025 cruises without any increases to capacity, which should keep ticket pricing up, and that’s great for profits. The launch of Celebration Key next year, an exclusive destination from Carnival, is a major growth catalyst that should drive strong returns on investment for the company.

Over the long term, the company is clearly positioning for balanced revenue and earnings growth. Carnival is benefiting from favorable demand trends in the cruise travel market, which is growing faster than the $1.9 trillion global travel industry.

Investors have an opportunity to invest in this leading brand at a very attractive valuation. As Carnival continues to report strong demand and increases in operating profit, investors should expect the stock to break out to new highs over the next year.

2. Roku

Roku (NASDAQ: ROKU) is one of the leading streaming platforms, with a user base of more than 83 million households. It continues to see solid growth and engagement from users, and this bodes well for its ability to monetize the platform through digital advertising.

The stock has fallen 86% from its 2021 peak, but now trades at a reasonable price-to-free cash flow multiple of 29. Roku generated adjusted trailing-12-month free cash flow of $317 million on $3.7 billion of revenue, which shows the company starting to build a profitable operation after struggling a few years ago.

Wall Street is significantly undervaluing Roku’s growth in customer accounts and future opportunities to rake in lucrative ad revenue. In the second quarter, the number of streaming households on the platform grew 14% year over year, which is very strong growth for a stock trading at such a low valuation.

Roku’s total revenue grew consistent with its household increase, and the upcoming general election should drive strong ad spending on the platform and accelerate revenue growth in the fourth quarter. Looking ahead to next year, management wants to leverage the Roku home screen to drive more ad sales. The home screen is viewed by 120 million people across its households every day.

Roku will have great momentum heading into 2025. With millions of households onboard, the company is in a prime position to welcome more ad buyers as it continues to grow its installed base of users. The stock looks like a dark horse candidate to surprise to the upside next year with significant gains for investors.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Roku. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

2 Stocks That Could Skyrocket in 2025 was originally published by The Motley Fool

Major Central Banks Slash Rates In Sync, But One Holdout Threatens To Derail Bulls' Momentum: 'Carry Trade Is Still Unwinding'

The world’s leading central banks have opened a fresh phase of interest rate cuts, spurred by a softening in inflation across advanced economies.

With inflation sliding closer to target levels, policymakers are keen to unwind some of the policy restrictiveness that’s become a drag on growth.

But a significant outlier on the global monetary scene is raising eyebrows—and concerns—for an interest-rate-fueled rally in the stock market.

On Thursday, the European Central Bank (ECB) took its turn, delivering a second 25 basis point rate cut following a similar move in June.

While ECB President Christine Lagarde stopped short of promising more cuts, she hinted that future decisions would be data-driven.

However, Frankfurt doesn’t have the luxury of dragging its feet: growth is already on life support, and Germany, the region’s economic heavyweight, is teetering on the edge of a recession.

“We still think that data will end up pushing the ECB to accelerate the cutting cycle,” said Bank of America’s European economist Ruben Segura-Cayuela in a post-meeting note.

Global Central Banks In Sync, Almost

Earlier this month, the Bank of Canada trimmed its key interest rate by 25 basis points to 4.25%. Policymakers there flagged concerns about missing their inflation targets on the downside—something that would have been unthinkable just a year ago, when inflation overshoot was the name of the game.

Meanwhile, an interest rate cut from the Federal Reserve next week is practically a done deal.

The only questions lingering for markets now are the magnitude and pace: Will the Fed cut by 25 or 50 basis points? Will it move at every meeting or take a more gradual, every-other-meeting approach?

The Bank of England remains a tight call, with economists forecasting a razor-thin 5-4 vote in favor of a rate cut next week.

“At this stage, markets are only discussing the magnitude and sequencing of this cut and those to follow. But regardless of the outcome, global monetary policy convergence is set to begin,” Bank of America economist Antonio Gabriel noted recently.

According to Bank of America this newfound global monetary coordination is likely to weaken the dollar from its historically elevated levels, but any dollar decline could be tempered by potential U.S. policy shifts after the upcoming election.

The Bank of Japan’s Outlier Stance: A Wildcard For Markets

The one glaring outlier in this synchronized easing spree? The Bank of Japan (BOJ).

Tokyo has clearly decided it’s not playing by the same rulebook.

While the world’s major central banks are cutting, the BOJ hiked rates in July—its second hike this year following a move in March—and signaled that more hikes could be on the horizon. With annual inflation running at 2.8%, well above the BOJ’s 2% target, Japan’s monetary policy looks set on a divergent path.

BOJ Governor Kazuo Ueda reiterated earlier this month that the BOJ would continue raising rates if the economy and inflation behave as expected.

Ed Yardeni, the veteran market strategist, weighed in on this divergence, pointing to the ripple effects it’s having across markets: “The carry trade is still unwinding. Expectations that the Fed will lower rates while the BOJ continues to hike have boosted the yen, forcing traders to unwind their carry trades.”

For those not fluent in financial jargon, the carry trade refers to the strategy of borrowing yen at near-zero interest rates to invest in higher-yielding assets elsewhere, such as long-term Treasuries or even stocks. Now, with the yen appreciating, those trades are being unwound, sparking a rout in some of the market’s most richly valued stocks.

Yardeni highlighted a key inverse correlation between the yen and the Nasdaq 100, which has been holding since the start of the year.

Whenever the Japanese currency, as tracked by the Invesco CurrencyShares Japanese Yen Trust FXY, strengthens, the latter, as monitored through the Invesco QQQ Trust, Series 1 QQQ, weakens.

Chart: Inverse Relationship Between Japanese Yen And U.S. Tech Stocks

Read now:

Image created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Great Elm Capital Corp. Announces Conditional Redemption of 6.75% Notes due 2025

PALM BEACH GARDENS, Fla., Sept. 12, 2024 (GLOBE NEWSWIRE) — Great Elm Capital Corp. (the “Company” or “GECC“) GECC announced today that it has caused notices to be issued to the holders of its 6.75% Notes due 2025 ((CUSIP No. 390320 406, NASDAQ:GECCM) (the “Notes“) regarding the Company’s exercise of its conditional option to redeem, in whole, the issued and outstanding Notes, pursuant to Section 1104 of the Indenture, dated as of September 18, 2017, by and between the Company and Equiniti Trust Company, LLC (f/k/a American Stock Transfer & Trust Company, LLC), as trustee (the “Trustee“), and Section 1.01(h) of the Second Supplemental Indenture, dated as of January 19, 2018, by and between the Company and the Trustee. The Company will redeem all of the issued and outstanding Notes on October 12, 2024 (the “Redemption Date“), subject to the condition precedent that the Company closes its public offering of 8.125% Notes due 2029 (the “2029 Notes Offering“). At the Company’s discretion, the Redemption Date may be delayed until such time (including more than 60 days after the date hereof) as the 2029 Notes Offering has been completed, or the redemption of the Notes may not occur and the notices to the holder of the Notes may be rescinded if the 2029 Notes Offering is not completed by the Redemption Date or by the date to which the Redemption Date is delayed. The Notes will be redeemed at 100% of their principal amount, plus accrued and unpaid interest thereon from September 30, 2024, through, but excluding, the Redemption Date (the “Redemption Price“). Questions relating to the notice of redemption should be directed to Equiniti Trust Company, LLC via telephone at 1 (800) 937–5449.

About Great Elm Capital Corp.

GECC is an externally managed business development company that seeks to generate both current income and capital appreciation through debt and income generating equity investments, including investments in specialty finance businesses.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,” “seek,” “continue,” “upside,” “potential” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, fluctuations in interest rates, inflationary pressure, the price of GECC common stock and the performance of GECC’s portfolio and investment manager. Information concerning these and other factors can be found in GECC’s Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Media & Investor Contact:

Investor Relations

investorrelations@greatelmcap.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asian markets trade mixed after Wall Street climbs closer to its record high

HONG KONG (AP) — Asian stocks were mixed Friday after stocks in the United States pulled closer to their records following a couple of economic reports that came in close to expectations.

U.S. futures were little changed and oil prices rose.

Japan’s benchmark Nikkei 225 slipped 0.9% in morning trading to 36,491.80 after a 3.4% increase Thursday.

The Japanese yen strengthened against the greenback, with the USD/JPY falling to 141.05 from 141.79 in Friday’s early trading, adding pressure on the nation’s export trade.

“The Bank of Japan is not expected to make any rate move at its meeting next week, but there may be some hawkish pricing brewing for policymakers to lay the groundwork for further rate hikes in December and beyond,” said IG market analyst Yeap Jun Rong.

Industrial production figures of Japan that reflect the manufacturing demand were set for release later Friday, which could further affect the cost of yen.

Hong Kong’s Hang Seng added 1.1% to 17,422.75, while the Shanghai Composite edged down 0.1% to 2,714.77.

China is set to release its monthly economic data on Saturday, with market predictions that the three key indicators — industrial production, fixed asset investment, and retail sales — will show a slowdown.

Elsewhere, Australia’s S&P/ASX 200 rose 0.3% to 8,096.00. South Korea’s Kospi shed 0.1% to 2,568.41.

On Thursday, the S&P 500 rose 0.7% to 5,595.76, climbing back to within 1.3% of its record set in July following a shaky summer. It’s on track for a fourth winning week in the past five.

The Dow Jones Industrial Average added 0.6% to 41,096.77, and the Nasdaq composite gained 1% to 17,569.68.

Nvidia was the strongest force lifting the S&P 500, rising another 1.9% to bring its gain for the week to nearly 16%. The chip company’s stock has stabilized recently after falling more than 20% during the summer on worries investors had taken it too high in their frenzy around artificial intelligence.

One report said the number of U.S. workers applying for unemployment benefits last week ticked up, though it remains low relative to history. Another said prices charged at the wholesale level were 1.7% higher in August than a year before. That’s a slowdown from July’s inflation rate, but an underlying measure that economists see as a better predictor of future trends also ticked up more than expected.

The inflation data was similar to Wednesday’s report on prices at the U.S. consumer level. It kept traders betting the Fed will deliver a traditional-sized cut of a quarter of a percentage point next week, instead of the larger half-point that some had been expecting.

While lower interest rates help goose the economy and investment prices, they can also give inflation more fuel.

In the bond market, the yield on the 10-year Treasury edged up to 3.68% from 3.66% late Wednesday. It’s steadying a bit after sliding since April on expectations for coming cuts to rates. That easing helped pull the average rate on a 30-year mortgage in the U.S. this week to its lowest level in 19 months, according to Freddie Mac.

In energy trading, benchmark U.S. crude gained 31 cents to $68.28 a barrel. Brent crude, the international standard added 31 cents to $72.28 a barrel.

The euro cost $1.1086, inching up from $1.1074.

___

AP Business Writers Stan Choe contributed from New York.

Zebra Technologies Unveils Retail Efficiency Solutions at ZONE

Zebra Technologies Corporation ZBRA has introduced three new solutions, namely, the Zebra Kiosk System, Zebra Workcloud Actionable Intelligence 7.0 and the ET6x Windows rugged tablets at the annual ZONE customer conference.

At Zebra Technologies’ ZONE event, retailers connect with customers, partners and prospects to explore industry challenges and opportunities with keynote presentations focusing on key topics, including inventory management, loss prevention and efficiency improvement. In this event, the company introduced its expanded range of integrated hardware and software solutions, utilizing AI, cloud and machine learning to enhance workflow efficiencies and elevate customer and associate experiences in modern retail environments.

ZBRA’s Kiosk System is a versatile, modular solution made to address self-service needs across retail and other sectors, anchored by the KC50 Android Kiosk Computer available in 15″ and 22″ screen sizes. This system, which includes tap-to-pay, works with all major payment terminals and has a voice assistant, thereby making checkout easier and allowing staff to focus on more important tasks. Built on Qualcomm’s advanced chipset and Zebra’s Enterprise Android platform with Mobility DNA, the product ensures seamless connectivity, security and management, with flexible deployment options and the ability to add components like barcode scanners, payment terminals or a TD50 15″ touch display for a dual-display setup.

Zebra Workcloud Actionable Intelligence 7.0 brings a next-gen, AI-powered analytics platform tailored for the modern store, leveraging Google Cloud’s serverless query engine for unmatched speed and performance. The update automates data analysis, task management and action verification, enabling users to quickly identify hidden insights and streamline workflows, ultimately enhancing productivity and uncovering opportunities beyond human detection.

The ET6x Windows rugged tablets, powered by Intel’s Core Ultra platform with a dedicated Neural Processing Unit, enhance AI capabilities across industries such as retail, logistics and field services. These advanced features improve performance and efficiency for various applications. The tablets also come with the Zebra Control Hub for streamlined configuration and management, featuring an advanced AI-enabled touchscreen for improved accuracy, AI-powered audio for better communication and flexible usage options.

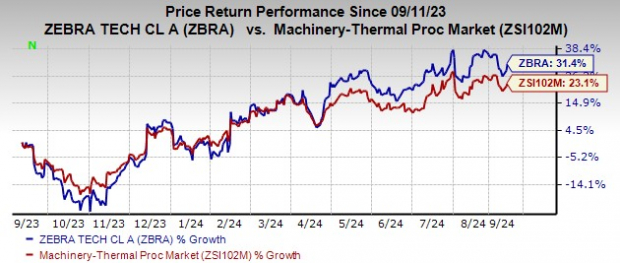

ZBRA’s Zacks Rank and Price Performance

ZBRA currently carries a Zacks Rank #3 (Hold).

Zebra Technologies is focusing on advancing digital capabilities, optimizing the supply chain and expanding data analytics capabilities to engage with its customers. Higher sales of mobile computing products are supporting the Enterprise Visibility & Mobility segment’s sales.

In the past year, the company’s shares have gained 31.4% compared with the industry’s 23.1% growth.

Image Source: Zacks Investment Research

Weak demand for printing solutions is affecting the company’s Asset Intelligence & Tracking segment. Low demand for RFID products is also concerning. High debt levels are also likely to raise the company’s financial obligations and hurt profitability. Given its diverse presence, forex woes remain concerning.

Stocks to Consider

Some better-ranked companies are discussed below.

Flowserve Corporation FLS currently carries a Zacks Rank #2 (Buy).

FLS delivered a trailing four-quarter average earnings surprise of 18.2%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2024 earnings has increased 3.8%.

Crane Company CR presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 2%.

Parker-Hannifin Corporation PH currently carries a Zacks Rank of 2. PH delivered a trailing four-quarter average earnings surprise of 2.6%.

In the past 60 days, the consensus estimate for Parker-Hannifin’s fiscal 2025 earnings has increased 1.1%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Japan Criminalizes Cannabis With 7-Year Prison Sentence, Medical Marijuana Remains Legal

Japan is set to make a significant shift in its cannabis policy by criminalizing personal use while simultaneously legalizing medical products derived from the plant.

According to Kyodo News, the health ministry confirmed Thursday that these changes, aimed at regulating cannabis use and expanding access to cannabis-derived medicines, will take effect on December 12.

See Also: Japan Could Become First To Allow CBD In Food

Japan Will Criminalize Cannabis Use

Although Japan has long banned the possession and cultivation of marijuana, the country had yet to penalize its use. This loophole was initially left to protect hemp farmers, who might inadvertently absorb trace amounts of cannabis compounds while cultivating the plant for industrial purposes.

However, growing concerns about drug abuse, particularly among young people, have prompted Japan to reverse its stance.

Under the revised laws, using cannabis will be illegal, with violators facing up to seven years in prison. Authorities say this harsh stance will address the rise in drug misuse and serve as a deterrent. Japan’s strict drug policies have long been known for their zero-tolerance approach, but this move marks a new era of control over even personal use.

Medical Marijuana

In contrast, Japan is opening the door to medical marijuana products. The revised laws will permit the use of cannabis-derived medicines, a significant step for patients who have been advocating for broader access to treatments.

While cannabis-based drugs have thus far been limited to clinical trials, the new legal framework will allow for their prescription and wider use in medical care.

Patient groups have been particularly vocal in pushing for cannabidiol (CBD) medicines, which are already approved in many parts of the world, including Europe and the United States.

These drugs are used to treat conditions like severe epilepsy. The legal change offers hope for patients who have struggled to find effective treatments under Japan’s restrictive drug policies.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Australia Office Furniture Market to Hit US$ 1.44 Billion by 2031 at 2.4% CAGR, Says CoherentMI

Burlingame, Sept. 12, 2024 (GLOBE NEWSWIRE) — According to CoherentMI, Australia Office Furniture Market is estimated to value at US$ 1.14 Billion in 2024 and is anticipated to reach a value of US$ 1.44 Billion by 2031 at a CAGR of 2.4% during forecast period 2024 and 2031. Australia has seen steady economic growth over the past few years leading to expansion of corporate offices and commercial real estate sector. Many large companies are undertaking office renovations and upgrades to provide modern workspaces. This has fueled the demand for new office furniture including seating solutions, storage units, meeting and conference room furniture.

Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2024: | US$ 1.14 Billion |

| Estimated Value by 2031: | US$ 1.44 Billion |

| Growth Rate: | Poised to grow at a CAGR of 2.4% |

| Historical Data: | 2019–2023 |

| Forecast Period: | 2024–2031 |

| Forecast Units: | Value (USD Million/Billion) |

| Report Coverage: | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered: | By Product Type, By End User |

| Geographies Covered: | Australia |

| Major Players: | IKEA Pty Limited, Harvey Norman Holdings Limited, Living Edge (Aust) Pty Ltd, Fantastic Furniture, Amart Furniture Pty Limited and Among Others. |

| Growth Drivers: | • Increasing number of startups and SMEs |

| • Growth in the commercial construction sector | |

| Restraints & Challenges: | • Trade barriers and high taxation |

Market Dynamics:

The Australia office furniture market is driven by rising demand for ergonomic furniture from organizations focusing on employee well-being. Productivity levels have increased manifold due to the use of ergonomic office furniture. Additionally, growing adoption of activity-based working is augmenting the demand for versatile and collaborative furniture. However, availability of low-cost alternatives from Asian countries is a major challenge for industry players.

Key Market Takeaways:

- The Australia office furniture market size is anticipated to witness a CAGR of 2.4% during the forecast period 2024-2031, owing to rapid growth of corporate sector in the region.

- On the basis of service, marketing assistance segment is expected to hold a dominant position, owing to increasing focus of businesses on raising brand awareness.

- By distribution channel, home center & hardware segment is anticipated to dominate the market, due to the availability of a wide variety of options under one roof.

- Regionally, North America is expected to hold a dominant position over the forecast period, due to high adoption of advanced furniture in corporate offices.

- Key players operating in the Australia office furniture market include IKEA Pty Limited, Harvey Norman Holdings Limited, Living Edge (Aust) Pty Ltd, Fantastic Furniture, Amart Furniture Pty Limited and Among Others. These major players are focusing on strategic partnerships and collaborations to strengthen their presence in the market.

Market Trends:

The Australia office furniture market is witnessing growing demand for environment-friendly green furniture. Manufacturers are increasingly using materials that have lesser environmental impact such as recycled wood, metal, and plastic. Besides, focus on innovation and development of multifunctional and smart furniture integrated with technologies is a key trend in the market. Smart furniture embedded with sensors allows remote monitoring of occupancy and adjusts accordingly. Furthermore, growing popularity of standing desks and other active workstations to promote employee wellness is gaining traction in the market.

Marketing Assistance:

Under marketing assistance segment, marketing strategy development services are anticipated to hold the dominant position, owing to growing need of businesses to devise robust marketing plans. These services help companies enhance their brand value and increase sales.

Mentoring:

Within mentoring, one-on-one mentoring is expected to be the leading sub-segment. One-on-one mentoring offers personalized guidance to mentees and helps them gain practical knowledge and expertise in their domain of work.

Get a detailed analysis on regions, market segments, and companies: https://www.coherentmi.com/industry-reports/australia-office-furniture-market

Australia Office Furniture Market Segmentation:

- By Product Type:

- Seating

- Desks & Tables

- Workstation

- Accessories

- Storage Units

- By End User:

- Corporate Offices

- Others

- Government Offices

The research provides answers to the following key questions:

- What is the estimated growth rate of the market for the forecast period 2024-2031?

- What will be the market size during the estimated period?

- What are the key driving forces responsible for shaping the fate of the Australia Office Furniture market during the forecast period?

- Who are the major market vendors and what are the winning strategies that have helped them occupy a strong foothold in the Australia Office Furniture market?

- What are the prominent market trends influencing the development of the Australia Office Furniture market across different regions?

- What are the major threats and challenges likely to act as a barrier in the growth of the Australia Office Furniture market?

- What are the major opportunities the market leaders can rely on to gain success and profitability?

Purchase Latest Edition of this Research Report @ https://www.coherentmi.com/industry-reports/australia-office-furniture-market/buynow

Key insights provided by the report that could help you take critical strategic decisions?

- Regional report analysis highlighting the consumption of products/services in a region also shows the factors that influence the market in each region.

- Reports provide opportunities and threats faced by suppliers in the Australia Office Furniture industry around the world.

- The report shows regions and sectors with the fastest growth potential.

- A competitive environment that includes market rankings of major companies, along with new product launches, partnerships, business expansions, and acquisitions.

- The report provides an extensive corporate profile consisting of company overviews, company insights, product benchmarks, and SWOT analysis for key market participants.

- This report provides the industry’s current and future market outlook on the recent development, growth opportunities, drivers, challenges, and two regional constraints emerging in advanced regions.

Browse Related Reports:

Malaysia Mobile Phone Accessories Market: The Malaysia Mobile Phone Accessories Market is estimated to be valued at USD 2.54 Bn in 2024 and is expected to reach USD 4.02 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.78% from 2024 to 2031.

United States Lyocell Fabric Market: The United States Lyocell Fabric Market is estimated to be valued at USD 171.0 Mn in 2024 and is expected to reach USD 290.3 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8% from 2024 to 2031.

Australia Honey Market: The Australia Honey Market is estimated to be valued at USD 711 Mn in 2024 and is expected to reach USD 1,226.5 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2031.

Australia Knife Market: The Australia Knife Market is estimated to be valued at USD 15.5 Mn in 2024 and is expected to reach USD 20.4 Mn by 2031, growing at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2031.

Author of this marketing PR:

Money Singh is a seasoned PR writer with over four years of experience in the market research sector. Known for her strong SEO background, she skillfully blends SEO strategies with insightful content. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

IKEA Pty Limited, Harvey Norman Holdings Limited, Living Edge (Aust) Pty Ltd, Fantastic Furniture, Amart Furniture Pty Limited and Among Others.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Credit Acceptance 10% Owner Sold $541K In Company Stock

Thomas W Smith, 10% Owner at Credit Acceptance CACC, executed a substantial insider sell on September 11, according to an SEC filing.

What Happened: Smith’s decision to sell 1,200 shares of Credit Acceptance was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $541,208.

Monitoring the market, Credit Acceptance‘s shares down by 0.0% at $420.93 during Thursday’s morning.

About Credit Acceptance

Credit Acceptance Corp is a consumer finance company that specializes in automobile loans. These loans are offered through a U.S. nationwide network of automobile dealers that benefit from sales of vehicles to consumers who could otherwise not obtain financing. The company also benefits from repeat and referral sales, and from sales to customers responding to advertisements for financing, but qualify for traditional financing. The company derives its revenue from finance charges, premiums earned on the reinsurance of vehicle service contracts, and other fees. Of these, financing charges, including servicing fees, are by far a source of revenue.

Financial Milestones: Credit Acceptance’s Journey

Revenue Growth: Credit Acceptance’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 12.42%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Navigating Financial Profits:

-

Gross Margin: The company sets a benchmark with a high gross margin of 62.24%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Credit Acceptance exhibits below-average bottom-line performance with a current EPS of -3.83.

Debt Management: Credit Acceptance’s debt-to-equity ratio surpasses industry norms, standing at 3.82. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 30.04 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.7 is above industry norms, reflecting an elevated valuation for Credit Acceptance’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 40.63, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Understanding Crucial Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Credit Acceptance’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morning bid: Super-sized Fed cut climbs back on the table

A look at the day ahead in European and global markets from Kevin Buckland

European traders who went to bed thinking a quarter-point Fed rate cut was a lock for next week may well have had a rude awakening on this Friday the 13th, with the odds for a super-sized half-point reduction back at nearly a coin toss.

It started with separate reports in the Financial Times and the Wall Street Journal that both said the Sept. 18 decision remained “a close call”. Then former New York Fed President Bill Dudley, who remains highly influential, said at an event in Singapore that there’s “a strong case” for a 50 bps reduction.

That put the dollar on the defensive, as it slipped back towards its lowest level this year against the yen and lost additional ground on the euro. Two-year Treasury yields were back below 3.6% in Asian hours.

Gold pushed to a new all-time peak at $2,570.

Reactions in the equities markets were mixed. Hong Kong’s Hang Seng was up more than 1% and Australian stocks were also higher.

But for the Nikkei, a decline was pretty much a given with the yen that much stronger. South Korea also slumped and mainland Chinese stocks struggled. It’s worth noting that all three of those markets are heading into a long holiday weekend, with South Korean traders not back at work until next Thursday.

A very early look at pan-European STOXX 50 futures was positive, pointing up 0.3%.

There’s little on the data docket in Europe on Friday to distract from Fed-focused speculation, which has boosted the chance of a 50 bps cut to 43% versus 28% early in the Asian morning. Some CPI prints are continuing to roll in, including from France and Greece. Data is also due on the euro region’s industrial production.

No central bank speeches are on the calendar, with the Fed and the Bank of England – which will announce policy next Thursday, with no change expected – in blackout periods. Meanwhile, the ECB has moved mostly into the rear-view mirror after Thursday’s well-telegraphed rate cut, and no clear guidance from President Christine Lagarde on when to expect the next one.

Key developments that could influence markets on Friday:

-France, Greece, Poland, Slovakia CPI (August)

-Euro zone industrial production (July)

(By Kevin Buckland; Editing by Edmund Klamann)

Hospital Lights Market Size to Hit USD 14.7 billion by 2034, at a 5.8% CAGR | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 12, 2024 (GLOBE NEWSWIRE) — The global hospital lights market (병원 조명 시장) is estimated to flourish at a CAGR of 5.8% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for hospital lights is estimated to reach US$ 14.7 billion by the end of 2034.

A key driver is the increasing emphasis on circadian lighting. Hospitals are recognizing the impact of lighting on patients’ circadian rhythms and overall well-being. Circadian lighting mimics natural daylight patterns, promoting better sleep, reducing anxiety, and improving patient outcomes. As awareness of circadian lighting benefits grows, demand for hospital lighting solutions designed to support patients’ biological rhythms is on the rise.

An emerging driver is the integration of UV-C disinfection technology into hospital lighting systems. UV-C light has proven efficacy in killing bacteria, viruses, and other pathogens, offering an additional layer of infection control in healthcare settings. Hospital lighting fixtures equipped with UV-C lamps can help reduce healthcare-associated infections, improving patient safety and reducing healthcare costs.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/hospital-lighting-market.html

The adoption of human-centric lighting is gaining traction in the hospital sector. Human-centric lighting considers not only circadian rhythms but also factors like color temperature and intensity to create lighting environments that support human health and performance. Hospitals are investing in human-centric lighting solutions to enhance staff productivity, reduce fatigue, and create more comfortable healing environments for patients.

Key Findings of the Market Report

- Surgical lamps lead the hospital lights market, essential for precision illumination in operating rooms, ensuring optimal visibility during surgical procedures.

- LED lighting dominates the hospital lights market, offering superior energy efficiency, longevity, and customizable lighting solutions for healthcare facilities worldwide.

- Operating rooms lead the hospital lights market point of use segment, demanding specialized lighting solutions for surgical precision and patient safety.

Hospital Lights Market Growth Drivers & Trends

- Increasing focus on patient comfort and well-being drives demand for advanced hospital lighting solutions.

- Technological advancements in LED lighting enhance energy efficiency and reduce operating costs for healthcare facilities.

- Growing adoption of smart lighting systems enables customization and remote control of hospital lighting environments.

- Rising healthcare infrastructure investments globally spur market growth.

- Stringent regulatory standards for hospital lighting promote innovation and ensure compliance with safety and quality requirements.

Global Hospital Lights Market: Regional Profile

- North America leads the market, driven by robust healthcare spending, advanced hospital infrastructure, and a high demand for innovative medical technologies. Market leaders like Philips Lighting and GE Healthcare dominate this region, offering a wide range of hospital lighting solutions tailored to the needs of healthcare facilities.

- In Europe, stringent regulations regarding healthcare facility standards and energy efficiency drive market growth. Companies such as Signify N.V. and Zumtobel Group AG capitalize on these trends, providing cutting-edge LED lighting systems and smart lighting solutions for hospitals and healthcare institutions.

- The Asia Pacific region presents significant growth opportunities fueled by expanding healthcare infrastructure, increasing healthcare expenditure, and a rising focus on patient safety and comfort. Countries like China, India, and Japan are key growth hubs, with companies like Cree, Inc. and OSRAM Licht AG catering to the region’s evolving healthcare needs with innovative hospital lighting solutions.

Hospital Lights Market (Mercado de luces hospitalarias): Competitive Landscape

In the competitive landscape of the hospital lights market, key players vie for market share with innovative lighting solutions tailored to the unique needs of healthcare facilities. Companies such as Philips Lighting, GE Healthcare, and Signify N.V. dominate the market with comprehensive product portfolios encompassing LED surgical lights, examination lights, and ambient lighting systems.

Emerging players like Cree, Inc. and Zumtobel Group AG are disrupting the market with advancements in energy-efficient lighting technologies and customizable lighting designs. With a focus on enhancing patient care, improving staff productivity, and ensuring optimal surgical outcomes, competition in the hospital lights market remains fierce and dynamic. Some prominent players are as follows:

- Acuity Brands Inc.

- Wolfspee Inc.

- Drägerwerk AG & Co. KGaA

- Eaton

- General Electric Company

- Herbert Waldmann GmbH & Co.

- Baxter

- Hubbell

- KLS Martin Group

- Koninklijke Philips N.V.

- Zumtobel Group AG

- Trilux GmbH & Co. Kg

Product Portfolio

- Acuity Brands Inc. offers a diverse portfolio of innovative lighting solutions, ranging from LED fixtures to advanced controls and IoT-enabled smart lighting systems. Their cutting-edge technologies enhance energy efficiency, sustainability, and occupant comfort in commercial, industrial, and residential spaces.

- Wolfspeed Inc. specializes in wide bandgap semiconductor solutions, delivering industry-leading power and radio frequency devices for automotive, industrial, and telecommunications applications. Their high-performance components enable next-generation power electronics and wireless communication systems, driving efficiency and reliability.

- Drägerwerk AG & Co. KGaA is a global leader in medical and safety technology, offering a comprehensive portfolio of respiratory and anesthesia devices, gas detection systems, and personal protective equipment. Their innovative solutions safeguard lives in healthcare, industrial and first responder environments, ensuring safety and security.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/hospital-lighting-market.html

Hospital Lights Market: Key Segments

By Product

- Troffers

- Surface-mounted Lights

- Surgical Lamps

- Others

By Technique

- Fluorescent

- LED

- Halogen

- Others

By Point of Use

- Patient Wards and ICUs

- Operating Rooms

- Examination Rooms

- Others

By Region

- North America

- South America

- Asia Pacific

- Europe

- Middle East & Africa

More Trending Reports by Transparency Market Research –

Nano-magnetic Devices Market (ナノ磁性デバイス市場) – The global nano-magnetic devices market is projected to advance at a CAGR of 5.8% from 2024 to 2034

EMI Filters Market (سوق مرشحات EMI) – The global EMI filters market is projected to expand at a CAGR of 4.1% during the forecast period from 2023 to 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.