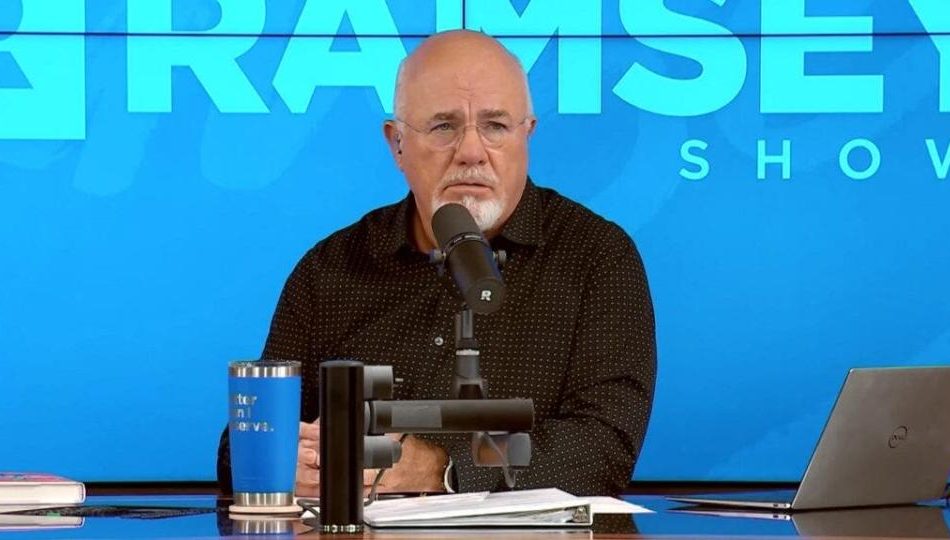

Dave Ramsey Says You're Wasting $5,000 A Year If You 'Spend $13.70 A Day On Things You Don't Need'

Financial expert Dave Ramsey has a clear message for anyone trying to figure out why they’re not making progress with their money: You could be wasting $5,000 a year on things you don’t need. In a recent tweet, Ramsey pointed out that spending just $13.70 daily on unnecessary purchases adds up to that much in a year.

Don’t Miss:

It might not seem like much at first glance – after all, what’s $13.70 a day? Maybe it’s a coffee, a takeout lunch, or something you picked up online without thinking twice. Ramsey’s point is that those small, everyday expenses can silently drain your bank account over time, preventing you from reaching bigger financial goals.

The Impact of Small Spending

How to waste $5,000 a year:

Spend $13.70 a day on things you don’t need.— Dave Ramsey (@DaveRamsey) September 3, 2024

Ramsey’s tweet puts into perspective how easy it is to lose track of your spending when done in small amounts. Many people don’t realize how quickly those “little” purchases can add up. $13.70 a day may not feel like much, but when multiplied by 365 days, you’ve spent $5,000 on things you likely didn’t need.

Trending: Teens may never need wisdom teeth removed thanks to this MedTech Company – Be an early investor for just $300 for 100 shares!

For someone struggling to save for an emergency fund, pay off debt, or build long-term wealth, that $5,000 could make a significant difference. Many people think they’re not spending much on a daily basis, but once they take a closer look, they realize how many small purchases are eating away at their finances.

Simple Changes, Big Results

Ramsey offers straightforward advice to cut back on unnecessary spending: Be purposeful. Ensure your money is going toward something worthwhile, like paying off debt, saving for a down payment on a home, or setting up an emergency fund. Create a budget, keep track of your expenditure, and monitor it.

See Also: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

What Could You Do With $5,000?

Think about what an extra $5,000 a year could do for you. Maybe it’s the difference between living paycheck to paycheck and having a savings cushion. It could help pay off high-interest debt, contribute to retirement, or allow you to take a vacation without going into credit card debt.

Ramsey often declares that “Your number one wealth-building tool is your income,” emphasizing that true financial success comes from prudent saving and investing, not indebting oneself to creditors like Sallie Mae or Best Buy.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Ramsey examines how common it has become to rely on debt to fund wants and investments, pointing out that “when you give your income to someone else, you don’t have it anymore.”

He challenges the idea that debt is normal, particularly calling out the flawed thinking behind student loans and credit card rewards. With humor, he says, “Oh, Sallie Mae’s been with us for 15 freaking years in our spare bedroom,” highlighting how long student debt can weigh people down.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Says You’re Wasting $5,000 A Year If You ‘Spend $13.70 A Day On Things You Don’t Need’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CT Scanners Market is projected to reach USD 11.5 Billion, rising at a 5.0% CAGR from 2024 to 2034: Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 12, 2024 (GLOBE NEWSWIRE) — The global CT scanners market (CT 스캐너 시장) was projected to attain US$ 6.6 billion in 2023. It is anticipated to garner a 5.0% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 11.5 billion.

Globally, 3D imaging systems are being used widely. Benefits from 3D imaging systems include less phototoxicity, faster imaging times, and the capacity to reconstruct untextured surfaces.

CT Scanners with 3D imaging capabilities provide priceless quantitative information and insights into the interior structure of core materials. The most recent market insights for CT Scanners show that new-generation photon counting is becoming more widely used, which makes low-dose CT Scanners easier to use for pediatric patients.

Analysis of coronary artery abnormalities and blockages that were previously not readily evident is now possible thanks to the most recent 64-slice CT scanner technology. The technology enables the CT scanner to quickly acquire many pictures in order to examine the condition more thoroughly.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/ct-scanners.html

Key Findings of the Market Report

- Reducing the number of deaths can be achieved via timely detection of specific illnesses.

- By facilitating accurate diagnosis of certain conditions, CT scans assist avoid needless medical interventions.

- CT scans can offer comprehensive details on the many targeted diseases that affect both adults and children. This makes it possible for medical professionals to choose the best course of action.

- The business growth for CT Scanners is being driven by the increasing use of CT Scanners to monitor certain illnesses.

Market Trends for CT Scanners

- In order to minimize complications, patients and healthcare professionals are choosing minimally invasive diagnostic and therapeutic methods more frequently. Procedures that are less intrusive cause less tissue damage and hasten the healing process.

- A key component of minimally invasive surgeries is the CT scanner. They support medical professionals in evaluating the anatomy of their patients and spotting any issues. These scans also aid in identifying crucial structures that must be avoided and the best course of action.

- CT scans’ real-time imaging capabilities provide accurate needle placement, preventing the need for repeated insertion attempts. CT Scanners are used to assist ensure accurate and flawless medicine injections into afflicted regions during pain management treatments like facet joint injections.

- This means that the market for CT Scanners is being supported by a rise in the need for less intrusive diagnostic treatments.

Global Market for CT Scanners: Regional Outlook

- In 2023, North America accounted for a major portion of the global market share. Over the course of the projected period, the region is anticipated to keep its leading position.

- The North America market is expanding due to a rise in the number of patients undergoing diagnostic imaging treatments and a strong uptake of technologically sophisticated devices.

- Data from the Organization for Economic Co-operation and Development (OECD) indicate that the United States did around 8.5 million CT scans in 2021.

- The increasing awareness of chronic illnesses among the European population has resulted in a constant increase in the market share of CT Scanners in the area.

- The availability of cutting-edge healthcare infrastructure in France, Germany, Italy, and the United Kingdom is also improving European market dynamics. The market for CT Scanners in Asia Pacific is expected to grow significantly between 2024 and 2034, driven mostly by the increasing use of sophisticated diagnostic systems in nations like China and India. The rise in the frequency of chronic illnesses is also contributing to the region’s market data.

Global CT Scanners Market (Mercado de escáneres CT): Key Players

In order to increase their worldwide reach, companies in the CT scanner market are launching new products. Siemens Healthineers AG, for example, unveiled the Somatom X.ceed, a high-resolution CT scanner designed specifically for precise treatments and prompt diagnosis in the most demanding clinical domains, in May 2021.

Wipro GE Healthcare said in April 2022 that it has introduced its next-generation, revolutionary Aspire CT scanner in India. The following companies are well-known participants in the global CT scanners market:

- Accuray Incorporated

- Carestream Health Inc.

- GE Healthcare

- Hitachi Ltd.

- Koning Corporation

- Koninklijke Philips N.V.

- Medtronic PLC

- Neusoft Corporation

- Planmed Oy

- Samsung Electronics Co. Ltd.

- Shenzhen Anke High-Tech Co. Ltd.

- Shimadzu Corporation

- Siemens AG

- Toshiba Corporation

Key developments by the players in this market are:

- At the European Congress of Radiology (ECR) in March 2023, Canon Medical unveiled the Aquilion Serve, an 80/160-slice computed tomography scanner. It permits axial, AP, and lateral view previews to happen simultaneously.

- The SCENARIA View Focus Edition Computed Tomography (CT) System, one of the premium scanners with an advanced heart motion correction function dubbed Cardio StillShot, was unveiled by Fujifilm Healthcare Americas Corporation in November 2022.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/ct-scanners.html

Global CT Scanners Market Segmentation

Product Type

- C-Arm CT Scanners

- O-Arm CT Scanners

Technology

- High-Slice CT

- Mid-Slice CT

- Low-Size CT

- Cone Beam CT (CBCT)

Modality

- Standalone CT Scanners

- Portable CT Scanners

End User

- Hospitals

- Diagnostic Centers

- Research & Academic Institutions

- Ambulatory Care Centers

- Veterinary Clinics & Hospitals

- Others

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Have a Look at More Valuable Insights of Healthcare

Hybrid Operating Room Market (ハイブリッド手術室市場): The global Hybrid Operating Room Market is expected to grow at a CAGR of 7.7% from 2022 to 2031. The hybrid operating room is a surgical theatre or space with medical equipment such as fix C-arms, MRI scanners, and CT scanners used for interventional imaging procedures or minimally invasive surgeries.

Wearable Breast Pumps Market (Marché des tire-lait portables): The global wearable breast pumps market was estimated at a value of US$ 554.5 million in 2022. It is anticipated to register a 8.2% CAGR from 2023 to 2031 and by 2031, the market is likely to attain US$ 1.2 billion by 2032.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I Have $750K in My Roth and $1,800 Monthly Social Security – Is It Enough to Retire at 65?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Can you retire at 65 with $750,000 in a Roth IRA and $1,800 in monthly Social Security?

Based on median incomes and the 10x rule, most people will need about $740,000 to finance a secure retirement. So in theory, a $750,000 Roth IRA and $1,800 in Social Security benefits will be enough for many individuals to retire. But there are many things to consider to ensure sustained comfort throughout retirement based on your specific circumstances.

A financial advisor can help you plan for retirement. Match with a fiduciary advisor today.

Plan for Portfolio Income

Whether a $750,000 Roth IRA and $1,800 in Social Security will be enough for you depends on your perspective and expectations for retirement, said Tim Mauer, chief advisory officer at Signature FD.

After all, it all depends on how you manage your money.

Continued investment is one of the most commonly overlooked issues in retirement. For example, say you hold this portfolio in cash and withdraw the standard 4% per year. That would give you $30,000 per year for 25 years, or $2,500 per month, plus the $1,800 per month from Social Security. This might be enough to live on, but as CEO of Total Wealth Academy Steve Davis points out, you may not live particularly well. “Yes, you could retire, but to what?” he said. “Just living paycheck to paycheck. No money for romance, travel or fun. That is not what the golden years are supposed to be.”

“The whole problem is the ineffective belief that you can save your way to retirement,” he added. “It doesn’t work. As soon as you retire, you are praying to die before you run out of money. The effective thing would be to invest that money into income-producing assets like real estate. Now you have money for romance, travel and fun. Building a second stream of income is the way to do it, just like Warren Buffett said.”

If you need help building a retirement income plan or identifying new streams of income, consider speaking with a financial advisor.

Manage Risk

But investing in assets that generate income can come with added risk. The more money your portfolio generates, the more you may be exposed to risk and volatility. To manage that, Maurer recommends what he calls a “bucket” approach.

“The conversation might start with the question of, how much do you need on a monthly basis?” he said. “How much income do you want to set up that is not going to be exposed to market volatility?”

That’s what he calls the “live bucket.” This is the money that you place in an annuity or in bonds – safe assets that will reliably cover your costs of living. For example, say that you need $3,000 per month to pay the bills. You put some of your Roth IRA into a lifetime annuity that pays $1,200 per month so that, combined with Social Security, you will have an indefinite minimum income.

Then you might take the rest of your Roth IRA and put it in a “growth” bucket. This money can cover luxuries, inflation and other changing needs. And if you’re interested in the bucket approach or another retirement income strategy, consider matching with a financial advisor.

“That’s the money that you can feel free to put in the market and expose to volatility, but because you have the live bucket you don’t have to worry so much.”

Manage Your Spending

Finally, in addition to growing your money, it’s important to keep an eye on your spending.

Bryan Cannon, author of “Retirement Unplanned: An Expert Guide For Navigating The Crossroads of Retirement With Confidence,” said retiring on $750,000 and $1,800 in Social Security “largely depends on the individual’s anticipated retirement expenses and desired lifestyle, which should be carefully budgeted.”

Among other issues, he recommends planning specifically for healthcare costs and potential emergencies or other unexpected expenses. Do your best, too, he said to pay off any debt before retiring and reducing your monthly overhead. Basically, as much as possible, eliminate bills and commitments.

Doing this will give you more flexibility for growth since you don’t need as much money dedicated to non-discretionary spending. It will also help insulate you from inflation, since you will have the option of spending less as prices rise.

“Overall retiring successfully at 65 with those assets and income is very possible,” Cannon said. “However, it requires a well-thought-out financial plan tailored to individual circumstances and goals.”

A financial advisor can help you build a budget in retirement and assess your spending needs.

Bottom Line

Retiring with $750,000 in a Roth IRA and $1,800 in monthly Social Security is entirely possible, but that doesn’t mean that your work is over. Your lifestyle in retirement will depend entirely on how you manage this portfolio.

Roth IRA Tips

-

A Roth IRA can be a powerful retirement savings vehicle, because it’s funded with after-tax dollars, which allows your money to grow tax-free.. Here’s what you should know before you go out and get yourself one.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Tinpixels, ©iStock.com/Inside Creative House, ©iStock.com/adamkaz

The post I Have $750K in a Roth IRA and Will Receive $1,800 Monthly From Social Security. Can I Retire at 65? appeared first on SmartReads by SmartAsset.

Globus Maritime Limited Reports Financial Results for the Second Quarter and Six-month period ended June 30, 2024

GLYFADA, Greece, Sept. 12, 2024 (GLOBE NEWSWIRE) — Globus Maritime Limited (“Globus”, the “Company”, “we”, or “our”) GLBS, a dry bulk shipping company, today reported its unaudited consolidated financial results for the second quarter and six-month period ended June 30, 2024.

- Revenue

- $9.5 million in Q2 2024

- $17.2 million in H1 2024

- Net income

- $3.3 million net income in Q2 2024

- $3 million net income in H1 2024

- Adjusted EBITDA

- $4 million in Q2 2024

- $6 million in H1 2024

- Time Charter Equivalent

- $14,578 per day in Q2 2024

- $13,246 per day in H1 2024

Current Fleet Profile

As of the date of this press release, Globus’ subsidiaries own and operate seven dry bulk carriers, consisting of one Supramax, four Kamsarmax and two Ultramax.

| Vessel | Year Built | Yard | Type | Month/Year Delivered | DWT | Flag |

| River Globe | 2007 | Yangzhou Dayang | Supramax | Dec 2007 | 53,627 | Marshall Is. |

| Galaxy Globe | 2015 | Hudong-Zhonghua | Kamsarmax | October 2020 | 81,167 | Marshall Is. |

| Diamond Globe | 2018 | Jiangsu New Yangzi Shipbuilding Co. | Kamsarmax | June 2021 | 82,027 | Marshall Is. |

| Power Globe | 2011 | Universal Shipbuilding Corporation | Kamsarmax | July 2021 | 80,655 | Marshall Is. |

| Orion Globe | 2015 | Tsuneishi Zosen | Kamsarmax | November 2021 | 81,837 | Marshall Is. |

| GLBS Hero | 2024 | Nihon Shipyard Co., Ltd. | Ultramax | January 2024 | 64,000 | Marshall Is. |

| GLBS Might | 2024 | Nantong Cosco KHI Ship Engineering Co., Ltd. | Ultramax | August 2024 | 64,000 | Marshall Is. |

| Weighted Average Age: 7.9 Years as at September 12, 2024 | 507,313 | |||||

Current Fleet Deployment

All our vessels are currently operating on short-term time charters (“on spot”).

Management Commentary

“We are pleased to deliver once again positive half year results whilst maintaining a healthy balance sheet and remaining committed to renew and expand our fleet with modern and fuel-efficient vessels.

The chartering market so far in 2024, albeit not spectacular, has been relatively healthy. Various dynamics and cargo flows keep shifting constantly, we have managed to remain profitable and keep our operating costs at reasonable levels and the fleet utilization high. Notwithstanding the significant geopolitical challenges around the world, we are navigating through these challenges without having to forego market opportunities that may appear.

2024 so far has been a significant year for the Company, having taken delivery of two newbuilding Ultramaxes and expecting to take delivery of a third one shortly. In addition to these vessels, we also have two newbuilding vessels being built in Japan to be delivered in 2026. At the same time, we have disposed of a 2005 Panamax for a gain. Furthermore, we managed to finance the new vessels acquired under what we view as favorable terms and conditions.

It is so satisfactory to see our new vessels competitive and sought after by reputable charterers and currently trading at premiums to the BSI 58 index; additionally, and so far, they have proven to be significantly more efficient than the older Supramaxes replaced in the fleet.

We continue to evaluate newbuildings of larger size as well as alternative fuel options and at the same time keep an eye in the secondhand market examining possibilities for further expansion of the fleet with fuel-efficient vessels.

Internal discussions are ongoing regarding the options we see in the market, the prices and the delivery positions. At the same time, we are exploring various financing opportunities that open up to new markets across the globe. Our goal is to create and expand shareholder value while maintaining a healthy balance sheet as well as meeting or exceeding the safety and quality standards of our industry and customers.”

Recent Developments

Delivery of new building vessel

On January 22, 2024, the Company paid the remaining $18.5 million at Nihon Shipyard Co. in Japan and on January 25, 2024, the Company took delivery of a new Ultramax with carrying capacity of approximately 64,000 DWT, of which the Company had previously announced on May 10, 2022, and was named “m/v GLBS Hero”. The total cost of the new vessel was approximately $37.5 million.

On August 12, 2024, the Company paid the remaining $18.0 million at Nantong Cosco KHI Ship Engineering Co., Ltd. and on August 20, 2024, the Company took delivery of a new Ultramax with carrying capacity of approximately 64,000 DWT, of which the Company had previously announced on August 23, 2023, and was named “m/v GLBS Might”. The total cost of the new vessel was approximately $35.3 million.

Debt financing & Financial Liability

On February 23, 2024, the Company, through its subsidiary Daxos Maritime Limited, entered into a $28 million sale and leaseback agreement with SK Shipholding S.A., a subsidiary of Shinken Bussan Co., Ltd. of Japan, with respect to the approximately 64,000 dwt bulk carrier “GLBS Might” which was delivered from the relevant shipyard on August 20, 2024. The Company has an obligation to purchase back the vessel at the end of the ten-year charter period. On February 28, 2024, the Company drew down the amount of $2.8 million, being the 10% deposit of the purchase price and on August 16, 2024, the Company drew down the remaining 90% of the purchase price, being $25.2 million.

On May 23, 2024, the Company reached an agreement with Marguerite Maritime S.A., a Panamanian subsidiary of a Japanese leasing company unaffiliated with us, for a loan facility of $23 million bearing interest at Term SOFR plus a margin of 2.3% per annum. This loan agreement provides that it is to be repaid by 20 consecutive quarterly instalments of $295,000 each, and $17.1 million to be paid together with the 20th (and last) instalment. The proceeds of this financing will be used for general corporate purposes. As collateral for the loan, among other things, a mortgage over the m/v GLBS Hero was granted, and a general assignment was granted over the earnings, the insurances, any requisition compensation, any charter and any charter guarantee with respect to the m/v GLBS Hero. Globus Maritime Limited guaranteed the loan. On May 30, 2024, the Company drew down the amount of $22.65 million, being the loan amount minus the upfront fee of $0.35 million.

Sale of vessel

On May 28, 2024, the Company, through a wholly owned subsidiary, entered into an agreement to sell the 2005-built Moon Globe for a gross price of $11.5 million, before commissions, to an unaffiliated third party. The vessel was delivered to its new owners on July 8, 2024.

Miscellaneous Developments

On March 13, 2024, the Company awarded a consultant affiliated with our chief executive officer a one-time bonus of $3 million, half of which is payable immediately upon the delivery of the newbuilding vessel Hull NE442 (i.e., the vessel being constructed by Nantong Cosco Khi Ship Engineering pursuant to the agreement dated May 13, 2022) and the balance at the delivery of Hull NE443 (i.e., the vessel being constructed by Nantong Cosco Khi Ship Engineering pursuant to the other agreement dated May 13, 2022), in each case assuming Athanasios Feidakis remains Chief Executive Officer at each such relevant time, i.e. August 20, 2024 and September 20, 2024, respectively.

Following the successful delivery of the newbuilding vessel Hull NE442, named GLBS Might, the Company paid the $1.5 million bonus on August 26, 2024, to the consultant as per the aforementioned award.

On March 13, 2024, the Board of Directors adopted the Globus Maritime Limited 2024 Equity Incentive Plan, or the Plan. The purpose of the Plan is to provide Company’s officers, key employees, directors, consultants and service provider, whose initiative and efforts are deemed to be important to the successful conduct of Company’s business, with incentives to (a) enter into and remain in the service of the Company or affiliates, (b) acquire a proprietary interest in the success of the Company, (c) maximize their performance and (d) enhance the long-term performance of the Company. The number of common shares reserved for issuance under the Plan is 2,000,000 shares. No shares have been issued under the plan.

Earnings Highlights

| Three months ended June 30, |

Six months ended June 30, |

|||||||

| (Expressed in thousands of U.S dollars except for daily rates and per share data) | 2024 | 2023 | 2024 | 2023 | ||||

| Revenue | 9,516 | 7,835 | 17,229 | 16,414 | ||||

| Net income/(loss) | 3,279 | (1,161 | ) | 2,980 | 1,425 | |||

| Adjusted EBITDA (1) | 3,966 | 907 | 5,974 | 2,248 | ||||

| Basic income/(loss) per share (2) | 0.16 | (0.06 | ) | 0.14 | 0.07 | |||

(1) Adjusted EBITDA is a measure not in accordance with generally accepted accounting principles (“GAAP”). See a later section of this press release for a reconciliation of Adjusted EBITDA to net income/(loss) and net cash generated from operating activities, which are the most directly comparable financial measures calculated and presented in accordance with the GAAP measures.

(2) The weighted average number of shares for the six-month period ended June 30, 2024, and 2023 was 20,582,301. The weighted average number of shares for the three-month period ended June 30, 2024, and 2023 was 20,582,301.

Second quarter of the year 2024 compared to the second quarter of the year 2023

Net income for the second quarter of the year 2024 amounted to $3.3 million or $0.16 basic income per share based on 20,582,301 weighted average number of shares compared to net loss of $1.2 million or $0.06 basic loss per share based on 20,582,301 weighted average number of shares for the same period last year.

Revenue

During the three-month period ended June 30, 2024, and 2023, our Revenues reached $9.5 million and $7.8 million, respectively. The 22% increase in Revenues was mainly attributed to the increase in the average time charter rates achieved by our vessels during the second quarter of 2024 compared to the same period in 2023. Daily Time Charter Equivalent rate (TCE) for the second quarter of 2024 was $14,578 per vessel per day against $8,244 per vessel per day during the same period in 2023 corresponding to an increase of 77%.

First half of the year 2024 compared to the first half of the year 2023

Net income for the six-month period ended June 30, 2024, amounted to $3 million or $0.14 basic income per share based on 20,582,301 weighted average number of shares, compared to $1.4 million for the same period last year or $0.07 basic income per share based on 20,582,301 weighted average number of shares.

Revenue

During the six-month period ended June 30, 2024, and 2023, our Revenues reached $17.2 million and $16.4 million, respectively. The 5% increase in Revenues was mainly attributed to the increase in the average time charter rates achieved by our vessels during the six-month period ended June 30, 2024, compared to the same period in 2023. Daily Time Charter Equivalent rate (TCE) for the six-month period of 2024 was $13,246 per vessel per day against $8,518 per vessel per day during the same period in 2023, corresponding to an increase of 56%, which is attributed to the better conditions throughout the bulk market for the first half of 2024.

Fleet Summary data

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| Ownership days (1) | 637 | 793 | 1,250 | 1,603 | ||||||||

| Available days (2) | 637 | 748 | 1,250 | 1,531 | ||||||||

| Operating days (3) | 635 | 730 | 1,239 | 1,507 | ||||||||

| Fleet utilization (4) | 99.7% | 97.6% | 99.1% | 98.5% | ||||||||

| Average number of vessels (5) | 7.0 | 8.7 | 6.9 | 8.9 | ||||||||

| Daily time charter equivalent (TCE) rate (6) | $14,578 | $8,244 | $13,246 | $8,518 | ||||||||

| Daily operating expenses (7) | $5,060 | $5,464 | $5,082 | $5,522 | ||||||||

Notes:

(1) Ownership days are the aggregate number of days in a period during which each vessel in our fleet has been owned by us.

(2) Available days are the number of ownership days less the aggregate number of days that our vessels are off-hire due to scheduled repairs or repairs under guarantee, vessel upgrades or special surveys.

(3) Operating days are the number of available days less the aggregate number of days that the vessels are off-hire due to any reason, including unforeseen circumstances but excluding days during which vessels are seeking employment.

(4) We calculate fleet utilization by dividing the number of operating days during a period by the number of available days during the period.

(5) Average number of vessels is measured by the sum of the number of days each vessel was part of our fleet during a relevant period divided by the number of calendar days in such period.

(6) TCE rates are our voyage revenues less net revenues from our bareboat charters less voyage expenses during a period divided by the number of our available days during the period which is consistent with industry standards. TCE is a measure not in accordance with IFRS.

(7) We calculate daily vessel operating expenses by dividing vessel operating expenses by ownership days for the relevant time period.

Selected Consolidated Financial & Operating Data

| Three months ended |

Six months ended |

|||||||

| June 30, |

June 30, | |||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| (In thousands of U.S. dollars, except per share data) | (unaudited) | (unaudited) | ||||||

| Consolidated Condensed Statements of Operations: | ||||||||

| Revenue | 9,516 | 7,835 | 17,229 | 16,414 | ||||

| Voyage and Operating vessel expenses | (3,362 | ) | (5,915 | ) | (6,842 | ) | (12,048 | ) |

| General and administrative expenses | (2,148 | ) | (998 | ) | (4,380 | ) | (2,112 | ) |

| Depreciation and amortization | (2,130 | ) | (2,329 | ) | (4,385 | ) | (4,767 | ) |

| Reversal of Impairment | 1,891 | – | 1,891 | 4,400 | ||||

| Other (expenses)/income & gain from sale of vessel, net | (40 | ) | 56 | (33 | ) | 65 | ||

| Interest expense/income, finance cost and foreign exchange (losses) / gains, net | (578 | ) | (503 | ) | (1,042 | ) | (1,009 | ) |

| Gain on derivative financial instruments, net | 130 | 693 | 542 | 482 | ||||

| Net income/(loss) for the period | 3,279 | (1,161 | ) | 2,980 | 1,425 | |||

| Basic net income/(loss) per share for the period (1) | 0.16 | (0.06 | ) | 0.14 | 0.07 | |||

| Adjusted EBITDA (2) | 3,966 | 907 | 5,974 | 2,248 | ||||

(1) The weighted average number of shares for the six-month period ended June 30, 2024, and 2023 was 20,582,301. The weighted average number of shares for the three-month period ended June 30, 2024, and 2023 was 20,582,301.

(2) Adjusted EBITDA represents net earnings before interest and finance costs net, gains or losses from the change in fair value of derivative financial instruments, foreign exchange gains or losses, income taxes, depreciation, depreciation of dry-docking costs, amortization of fair value of time charter acquired, impairment and gains or losses on sale of vessels. Adjusted EBITDA does not represent and should not be considered as an alternative to net income/(loss) or cash generated from operations, as determined by IFRS, and our calculation of Adjusted EBITDA may not be comparable to that reported by other companies. Adjusted EBITDA is not a recognized measurement under IFRS.

Adjusted EBITDA is included herein because it is a basis upon which we assess our financial performance and because we believe that it presents useful information to investors regarding a company’s ability to service and/or incur indebtedness and it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under IFRS. Some of these limitations are:

- Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt;

- Adjusted EBITDA does not reflect changes in or cash requirements for our working capital needs; and

- Other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business.

The following table sets forth a reconciliation of Adjusted EBITDA to net income/(loss) and net cash generated from operating activities for the periods presented:

| Three months ended |

Six months ended |

|||||||

| June 30, |

June 30, | |||||||

| (Expressed in thousands of U.S. dollars) | 2024 | 2023 | 2024 | 2023 | ||||

| (Unaudited) | (Unaudited) | |||||||

| Net income/(loss) for the period | 3,279 | (1,161 | ) | 2,980 | 1,425 | |||

| Interest expense/income, finance cost and foreign exchange (losses) / gains, net | 578 | 503 | 1,042 | 1,009 | ||||

| Gain on derivative financial instruments, net | (130 | ) | (693 | ) | (542 | ) | (482 | ) |

| Depreciation and amortization | 2,130 | 2,329 | 4,385 | 4,767 | ||||

| Reversal of Impairment loss | (1,891 | ) | – | (1,891 | ) | (4,400 | ) | |

| Gain from sale of vessel | – | (71 | ) | – | (71 | ) | ||

| Adjusted EBITDA | 3,966 | 907 | 5,974 | 2,248 | ||||

| Payment of deferred dry-docking costs | (10 | ) | (2,441 | ) | (537 | ) | (6,387 | ) |

| Net decrease/(increase) in operating assets | 1,131 | 912 | (126 | ) | 988 | |||

| Net (increase)/decrease in operating liabilities | 1,169 | (1,036 | ) | 2,371 | (1,082 | ) | ||

| Provision for staff retirement indemnities | (35 | ) | (1 | ) | 32 | 26 | ||

| Foreign exchange (losses)/gains net, not attributed to cash & cash equivalents | 13 | (10 | ) | 13 | (17 | ) | ||

| Net cash generated from/(used in) operating activities | 6,234 | (1,669 | ) | 7,727 | (4,224 | ) | ||

| Three months ended |

Six months ended |

|||||||

| June 30, |

June 30, | |||||||

| (Expressed in thousands of U.S. dollars) | 2024 | 2023 | 2024 | 2023 | ||||

| (Unaudited) | (Unaudited) | |||||||

| Statement of cash flow data: | ||||||||

| Net cash generated from/ (used in) operating activities | 6,234 | (1,669 | ) | 7,727 | (4,224 | ) | ||

| Net cash (used in) / generated from investing activities | (10,121 | ) | 14,059 | (29,244 | ) | 10,705 | ||

| Net cash generated from/ (used in) financing activities | 17,964 | (5,313 | ) | 18,080 | (6,080 | ) | ||

| As at June 30, | As at December 31, | |||

| (Expressed in thousands of U.S. Dollars) | 2024 | 2023 | ||

| (Unaudited) | ||||

| Consolidated Condensed Balance Sheet Data: | ||||

| Vessels and other fixed assets, net | 164,830 | 147,803 | ||

| Cash and cash equivalents (including current restricted cash) | 74,370 | 77,822 | ||

| Other current and non-current assets & Held for sale | 17,115 | 5,776 | ||

| Total assets | 256,315 | 231,401 | ||

| Total equity | 178,950 | 175,970 | ||

| Total debt & Finance liabilities, net of unamortized debt discount | 72,305 | 52,259 | ||

| Other current and non-current liabilities | 5,060 | 3,172 | ||

| Total equity and liabilities | 256,315 | 231,401 | ||

About Globus Maritime Limited

Globus is an integrated dry bulk shipping company that provides marine transportation services worldwide and presently owns, operates and manages a fleet of seven dry bulk vessels that transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally. Globus’ subsidiaries own and operate seven vessels with a total carrying capacity of 507,313 Dwt and a weighted average age of 7.9 years as at September 12, 2024.

Safe Harbor Statement

This communication contains “forward-looking statements” as defined under U.S. federal securities laws. Forward-looking statements provide the Company’s current expectations or forecasts of future events. Forward-looking statements include statements about the Company’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts or that are not present facts or conditions. Words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. The Company’s actual results could differ materially from those anticipated in forward-looking statements for many reasons specifically as described in the Company’s filings with the Securities and Exchange Commission. Accordingly, you should not unduly rely on these forward-looking statements, which speak only as of the date of this communication. Globus undertakes no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this communication or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks Globus describes in the reports it will file from time to time with the Securities and Exchange Commission after the date of this communication.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NJ Governor Signs Bill Tightening Rules On Hemp: Industry Stakeholders Protest, Big Alcohol Celebrates

New Jersey Governor Phil Murphy signed Senate Bill No. 3235 into law, introducing strict regulations for intoxicating hemp products, including Delta-8 THC and THC-infused beverages.

The bill, which places these products under the purview of the New Jersey Cannabis Regulatory Commission (CRC), marks a significant shift in the regulation of hemp-derived THC products.

The bill itself sparked debate among hemp industry stakeholders, who are being partially outlawed. Late amendments to the legislation have raised concerns that the alcohol industry is benefiting from regulatory advantages that cannabis businesses do not receive.

Outcry Among Hemp Industry

For hemp industry stakeholders who have been following state guidelines and voluntarily implementing safety measures, the new law comes as a blow. Many complain that they have been unfairly impacted by legislation that was meant to crack down on unregulated products, not those adhering to responsible practices.

“We are good actors. We followed the process the state put forward to enter this business… and here we are,” said Philip Petracca, owner of Bella Ray Beverage, a THC drink startup.

Petracca, like many others, has invested heavily in the industry, but now faces being outlawed by new regulation, reported Asbury Park Press.

New Amendments Favor Alcohol Industry

Murphy acknowledged that late-stage changes to the bill granted alcohol licensees—such as liquor stores and distributors—allowing them to sell intoxicating hemp beverages without being subject to the same stringent regulations as cannabis businesses.

These amendments have sparked controversy among cannabis industry stakeholders, who argue that the bill creates an uneven playing field.

In his official statement, Murphy expressed concern over the added advantage given to alcohol licensees. “Late amendments to this bill in the Legislature opened the door to the sale and distribution of intoxicating hemp beverages by holders of plenary wholesale licenses and plenary retail distribution licenses for alcoholic beverages, in addition to licensed cannabis businesses.”

Read Also: Gov. Murphy ‘Honored’ As NJ Black-Owned Cannabis Cultivator Names Strain After Him

Cannabis Companies Are Not Receiving Fair Treatment

Murphy said these licensees may not be held to the same regulatory standards as cannabis businesses, creating a loophole. Murphy himself seems to be aware of the situation, judging from comments he made.

“The bill also does not explicitly require alcohol licensees that sell or distribute intoxicating hemp products to comply with the many regulatory requirements that apply to cannabis businesses,” the governor said.

Cannabis in New Jersey is purported to be $1.1 billion-dollar highly regulated market in which business are obliged to meet requirements that include rigorous testing, labeling and sales restrictions – all key components of the CRC’s regulatory framework. Whereas, alcohol businesses could be exempt from them under this new law.

Murphy expressed concerns about the CRC’s ability to oversee this new market segment, especially without additional resources.

“I am concerned that the bill requires the New Jersey Cannabis Regulatory Commission…to establish a new regulatory program for alcohol licensees selling intoxicating hemp beverages but does not provide the Commission with the resources necessary,” the governor said.

Despite these concerns, amendments to New Jersey’s hemp regulation bill remained in the signed version of the bill.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Why Murphy Signed The Bill Despite Concerns

Despite the bill’s potential impact on fairness in the industry, Murphy ultimately decided that the public health risks posed by unregulated intoxicating hemp products were too great to ignore.

“The status quo is untenable, and this bill will put an end to it,” he said.

Murphy addes that the bill’s immediate impact on public safety outweighed its imperfections. “Because the bill would address this present danger, I have concluded that the wiser course is to sign the bill now and commit to working with the Legislature to address the technical issues and other challenges in separate legislation.”

As a result, intoxicating hemp products like Delta-8 and THC seltzers will be pulled from shelves within 30 days, awaiting new CRC regulations.

Once these guidelines are in place, hemp products that do comply will return to the market but will be restricted to licensed cannabis businesses or alcohol licensees.

Cover: Gov Murphy and Prolific Growhouse’s CEO David Nicolas by Edwin Torres/ Courtesy of N.J. Governor’s Office

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Intel Stock a Hidden Gem or a Value Trap?

Legacy chipmaker Intel (INTC) has shed 60% on a year-to-date basis due to the company’s lackluster performance in 2024 and the sizable losses it has been posting. While the bulls think Intel is a hidden gem with deep value, the bears believe it’s a value trap. So, what is it exactly? That’s what I am going to try to answer in this article.

To understand Intel’s situation better, it is important to note that the company, known for its computer processors and the x86 architecture (the instruction set that dominates personal computers even today), has recently been dethroned from its kingpin status in the chips industry. It simply failed to keep up with the competition, but let’s save the historic missteps for another time.

Consequently, I am bearish on Intel because of its sizable losses, its significant cash burn, and poor execution.

Intel Faces Widening Losses

Central to my negative stance on Intel is the fact that the company’s losses are widening. Although I said I’d save the missteps for another time, understanding the reason behind these losses is important before we jump into the numbers.

Going back to the early 2000s, Intel was the go-to shop for anyone looking for advanced chips, and business was booming. The company was the first to market with the latest chips up until it got too comfortable with its status as a chip kingpin. For instance, in 2014, when Barrack Obama was in office, Intel delayed the opening of a key location called Fab 42 due to a temporary slowdown in the PC market. Little did it know, this decision would cost it losing out to an emerging foundry company that was half its size at the time.

Long story short, Intel lost its place to the Street’s favorite foundry operator Taiwan Semiconductor Manufacturing Company (TSM). Now let’s dive into the numbers.

In Q2 2024, Intel posted a loss per share of $0.38 and missed Street estimates by $0.27. Moreover, its revenue also fell by 1% year over year to $12.8 billion, again falling short of market expectations by $148 million. Intel’s foundry business is the major concern, as it posted an operating loss of $2.83 billion, more than the loss of $1.86 billion a year ago.

Adding to this, Intel’s share capital is increasing, which is just bad for a loss-making company. Its diluted shares increased to 4.26 billion from 4.19 billion a year ago. So not only are you getting more losses, but you’re also getting diluted. Now the bulls will argue that Intel Products is profitable, and it was, with $2.9 billion in operating income in Q2, up from $2.5 billion a year ago. However, that just doesn’t do it for me. It’s not enough to offset the losses that Intel Foundry has been posting.

Moreover, Intel has been playing catch-up for quite some time now and it’s still not close to its competitors. The losses that this semiconductor giant has been posting are mainly due to the hefty investments it’s making to desperately win its place back. Its CapEx exceeded $11.6 billion during Q2 2024 while it only made $1.06 billion in operating cash flow. This represents an alarmingly high burn rate, even with the partner contributions of $11.8 billion.

Intel Cuts Costs and Suspends Dividend

Moving forward, I am not a fan of the decisions Intel’s management made after posting another disappointing quarter. While the company may be trying to be smart with capital allocation, it just doesn’t have a good track record. It has repeatedly delayed facilities and laid off staff in the past whenever it faced a challenge. During the Q2 2024 earnings call, Intel said it’s going to lay off 15% of its workers by the end of 2025 to cut costs.

Furthermore, Intel said it will suspend its dividend at the beginning of Q4 2024, a move that wasn’t received well by the income investors that held the stock. The company explained that it has to invest that money into CapEx to catch up to rivals. It already has a substantial PP&E portion on the cash flow statement, and although it fell year over year, its cash generation is just not enough to justify it.

Additionally, considering how Intel’s semiconductor fabrication plants have been delayed in the past, I do not have a lot of confidence in management’s ability to be on schedule this time around.

Intel Is a Value Trap

As I mentioned before, I agree with the bears who believe Intel is a value trap right now, but let me show you how. The bulls are arguing that Intel is trading at less than its book value (0.7x TTM P/B), so if it were to liquidate its business, they would have some sort of margin of safety. Let me settle this with a short exercise.

If you turn to the balance sheet, you’ll see that Intel has about $206.2 billion in total assets, of which $27.4 billion is just goodwill and another $4.3 billion is in intangible assets. So there is about $32 billion that can’t be capitalized in a liquidation scenario.

Now, if you look at the current assets of $50.8 billion and then take away the current liabilities of $32 billion and debt of $48.3 billion, you end up with -$29.5 billion. Therefore, Intel’s negative net worth in a liquidation scenario does not give any investor a margin of safety.

Finally, let’s say you are valuing Intel based on cash flow. I see that the stock is trading at 10.2 times its projected operating cash flow, a 51% discount to its sector. Can it produce enough cash flow over the next, say, 10 years? I am not comfortable with assigning Intel multiples and growth rates and projecting so far out into the future, given the company’s execution in the past and how it’s struggling right now.

From where I stand right now, I see a business that has seen its cash flow, net income, and sales consistently decline over the past decade. Therefore, Intel, in my humble opinion, is a value trap and not in deep value territory.

Analysts’ View Intel Stock as a Hold

On the Street, INTC stock sports a consensus “Hold” rating based on 1 Buy, 26 Hold, and 6 Sell recommendations. The average INTC price target of $26.09 implies an upside of 32.8% from current levels.

The Bottom Line

In summary, Intel’s substantial year-to-date losses, increasing cash burn, and management’s questionable decisions paint a troubling picture. Despite the low valuation and potential appeal to value investors, the company’s financial instability and past missteps indicate it’s more of a value trap than a genuine bargain. The widening losses and high burn rate from significant investments highlight the risks. Additionally, the suspension of dividends and ongoing operational delays add to the concerns. Given Intel’s declining financial metrics and ineffective recovery efforts, I remain cautious and skeptical about its potential for a turnaround.

Black Coffee Market to Reach $203.1 Billion, Globally, by 2033 at 10.7% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 12, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Black Coffee Market by Type (Dark roast coffee, Black instant coffee, Black silk coffee, Black iced coffee, Black ground coffee and Organo gold black coffee), and Application (Drink-to-go, Supermarket service, Conventional store service and Personal use): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the black coffee market was valued at $74.1 billion in 2023, and is estimated to reach $203.1 billion by 2033, growing at a CAGR of 10.7% from 2024 to 2033.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A39310

Prime determinants of growth

Rise in inclination of consumers toward high-end and specialty coffee types, including single-origin and artisanal blends, significantly influences the dynamics of the industry. Demand for black coffee is further boosted by growing knowledge of the health advantages of black coffee consumption, including its potential benefits for metabolism and antioxidants. Primary coffee chains’ and brands’ market development initiatives, together with rise in urbanization and disposable incomes in emerging markets, are primary factors driving the market growth. Furthermore, as ready-to-drink black coffee products gain popularity and brewing innovations adapt to changing consumer lifestyles, the global black coffee market continues to grow and diversify.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $74.1 Billion |

| Market Size in 2033 | $203.1 Billion |

| CAGR | 10.7% |

| No. of Pages in Report | 250 |

| Segments Covered | Type, Application, and Region. |

| Drivers | Growth in Specialty Coffee |

| Cultural and Social Factors | |

| Globalization of Coffee Culture | |

| Opportunities | Innovation in Products |

| Health and Wellness Trends | |

| Restraints | Price Volatility |

| Competition from Alternatives |

Segment Highlights

By type, the black instant coffee segment dominated the market with the highest share in 2023. The ease of preparation and convenience of black instant coffee is contributing to its growing popularity globally. There is increase in demand for instant black coffee, particularly in cities where people are looking for convenient coffee options without compromising flavor. Important industry participants are putting more of an emphasis on improving the variety and quality of their instant black coffee options to satisfy a wide range of customer preferences. Convenience and quality are becoming more important in coffee consumption trends, and this is reflected in the growing market for black instant coffee, which is being propelled by innovations in formulation and packaging.

Procure Complete Report (250 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/black-coffee-market

By application, the drink-to-go segment dominated the market with the highest share in 2023. The “drink-to-go” segment includes ready-to-drink (RTD) beverages intended for rapid consumption outside of conventional coffee establishments. These drinks are usually available in cans or bottles, which make them convenient for people who are often on the go and want good coffee. Major companies like Dunkin’ and Starbucks have benefited from this trend by launching RTD choices based on espresso and cold brew. Urbanization, shifting lifestyles, and the need for convenient yet high-quality coffee experiences are the main factors driving the segment’s rise. Globally, this market segment is still growing, especially in cities where consumers are used to making purchases while on the go.

Regional Outlook

The black coffee market is expanding rapidly in all countries due to consumers’ growing inclination toward specialty and premium coffee. A robust demand for artisanal black coffee variants is present in the U.S., where it is encouraged by a booming café culture and advancements in useful brewing techniques. Major brands are extending their reach through local partnerships and online channels as black coffee consumption surges in China due to urbanization and increased disposable incomes. Diverse coffee cultures found in Southeast Asian, Japanese, and Australian countries as well as other countries in the Asia-Pacific region contribute to a dynamic market environment that combines traditional brewing methods with contemporary consumption trends, such as ready-to-drink formats and specialty blends.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A39310

Players: –

- Starbucks

- UCC

- Pacific Coffee

- Royal Kona

- Chameleon

- Craftsman of Coffee

- Kohana Coffee

- Califia Farms

- High Brew

- Volcanica Coffee

The report provides a detailed analysis of these key players in the global black coffee market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Development:

- In February 2023, Luckin Coffee focused on offering urban customers superior black coffee experiences by growing its network of outlets throughout secondary cities.

- In July 2023, Costa Coffee formed a strategic alliance with a regional distribution company to strengthen its position in China’s black coffee industry with an emphasis on retail expansion.

- In November 2023, Haier Group purchased a minority investment in a well-known Chinese coffee maker to take advantage of the rising demand for home brewing supplies.

- In March 2023, the Philippine Coffee Board worked with regional farmers to promote sustainable agricultural methods for the production of black coffee to increase productivity and quality.

Trending Reports in Industry:

Coffee Concentrates Market Size, Share, Competitive Landscape, 2023-2032

Instant Coffee Market: Global Opportunity Analysis and Industry Forecast, 2023-2032

Organic Coffee Market Opportunity Analysis and Industry Forecast, 2023-2033

Ground Coffee Market Size, Share Analysis and Growth Forecast, 2023 – 2033

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Blog: https://www.alliedmarketresearch.com/resource-center/trends-and-outlook/food-and-beverages

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kamala Harris Opposed $14.1B Nippon Steel Acquisition Of US Steel Labeled By United Steelworkers As 'Doomed' — Union Boss Says Executives Using 'Oldest Tricks In The Book'

After Nippon Steel‘s NPSCY last-ditch efforts to win over workers for its $14.1 billion acquisition of United States Steel Corporation X, United Steelworkers, a general trade union says that the takeover proposal is a “doomed deal” and the union willing to fight any foreign ownership in the U.S. based company.

What Happened: Dave McCall Union President expressed opposition to the deal in a written memo sent to relevant parties on Thursday. The memo was also sent to the White House after President Joe Biden and Vice President Kamala Harris expressed disagreement with the foreign acquisition of a Pittsburgh-based company. Bloomberg accessed and reported the memo.

“In its desperate attempt to save a doomed deal, US Steel executives have turned to one of the oldest tricks in the book: attempting to divide USW members and retirees to distract us from the multi-million-dollar payoffs they stand to gain personally,” McCall wrote in the memo.

Earlier this week, some workers supported the deal, and the new owner after U.S. Steel warned that the failure of the takeover might cause some plants to shut down.

“Many people profess to want what is best for our employees, and that is why we negotiated a deal with a partner who will bring $2.7 billion of transformative investments in USW-represented facilities, keeping them in operation for decades to come,” U.S. Steel commented on McCall’s memo.

Why It Matters: The Japanese steelmaker has engaged with the USW leadership 32 times, through face-to-face meetings, emails, and phone calls.

The USW, boasting 850,000 members, has consistently opposed Nippon Steel’s plans. The union’s influence in key states could potentially impact the outcome of the U.S. presidential election in November. Both U.S. Vice President Harris and former President Donald Trump have voiced concerns over the proposed takeover.

Amid the mixed views over the deal by union members and other stakeholders, The Committee on Foreign Investment, the legislative committee responsible for reviewing the deal is yet to send a recommendation on the deal as of Wednesday, according to a U.S. official.

Last week, Shigeru Ishiba, a leading candidate to become Japan’s next prime minister, expressed his concerns over The potential decision by the U.S. to prevent Nippon Steel from acquiring U.S. Steel. He labeled the potential U.S. action as “very unsettling” and cautioned that it could “undermine the trust of its allies.”

Price Action: U.S. Steel was up 4.04% and traded at $34.74 on Thursday. In after-hours trading, the stock dipped 0.98%. U.S. Steel has seen a decline of 27.56% this year, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Weller Development Partners Showcases Resort Renderings and Masterplan for Six Senses Grand Bahama

A Sustainable Approach to Design, Community Development and Tourism

BETHESDA, Md., Sept. 12, 2024 /PRNewswire/ — Weller Development Partners and Pegasus Capital Advisors, developers of Six Senses Grand Bahama, today unveiled the resort renderings and masterplan for the $250M+ development. The 50-acre resort community with 70 resort villas and 28 branded residences will focus on sustainability, resilience, and wellness and will immediately establish a vibrant community and hospitality offering that will redefine luxury living and tourism in The Bahamas and the Caribbean.

Weller Development Partners unveils renderings and masterplan for the $250M+ Six Senses Grand Bahama development.

Designed by award-winning architecture firm Gensler, the resort features an array of amenities, including a signature Six Senses Spa, multiple restaurants, event spaces, beach club, destination dining, and a panoramic oceanfront pool. The resort has been designed to blend with the lush, native landscape and flora and to take full advantage of uninterrupted ocean and canal views, waterfront access, pristine sandy white beaches, and turquoise seas. The seamless pairing of raised structures within the natural environment will create an unparalleled experience for residents and resort guests.

“We are excited to reveal the Six Senses Grand Bahama resort designs and masterplan,” commented Marc Weller, Founding Partner and President of Weller Development Partners. “We have assembled a world-class design team, with Olson Kundig working on the residences and Gensler on the resort. The architectural design and the overall masterplan reflect the core values of our partnership with Six Senses and shared focus on wellness, sustainable design and a connection with nature and the community. We believe Six Senses Grand Bahama has the potential to set a new benchmark for sustainable living and ecotourism models in The Bahamas and the Caribbean, not only through its design, but also through its operations and programming.”

Neil Jacobs, Six Senses CEO, said: “The Six Senses Grand Bahama masterplan demonstrates our commitment to creating a vibrant, year-round community, with the canals and waterway providing a unique version of the front porch. Integrating intentionally designed and efficiently built structures within the majestic natural landscape establishes a framework for guests to connect or disconnect, explore or escape, allow a sun-soaked lunch to tumble into dinner, and access a whole range of crafted experiences and wellness programming. Sustainability and resiliency measures reinforce the plan, ensuring its viability for years to come.”

With careful reverence for the natural landscape, the resort masterplan honors the Grand Bahamian culture, carefully marrying the island’s Lucayan heritage and embracing the local community’s approach to living lightly on the land.

“The Six Senses Grand Bahama resort achieves a complex balance of many critical elements,” stated David Darlington, Principal, Regional Hospitality Leader at Gensler. “Weaving sustainable, performance-driven, efficient architecture together with the natural environment allows us to deliver a new standard of luxury, one that both heightens the experience for the guest, while minimizing the lasting impact on the environment.”

Sustainability and resiliency measures include targeting LEED Silver certification by using locally sourced construction materials where possible, replacing invasive species with native flora, and installing energy conservation efforts such as passive shading, high-efficiency MEP systems, and renewable energy use. Resiliency efforts include significant beach restoration and replenishment, a reinforced dune system along the property’s sea-side coastline, filling upland areas to increase site elevation, and building foundations that raise the Finished Floor Elevation (FFE) substantially above finished grade.

These measures to minimize environmental impact will set the bar for future sustainable tourism models on Grand Bahama and across the Caribbean. The development will also create hundreds of employment opportunities for the local community, contributing to the region’s long-term economic growth trajectory.

Construction is slated to begin at the end of 2024, with an anticipated opening in 2026.

For more information on Six Senses Residences Grand Bahama visit: grandbahamaresidences.com

About Weller Development Partners:

Weller Development Partners is a dynamic and innovative full-service development firm focused on luxury hospitality, residential, experiential placemaking, and large-scale mixed-use projects. Led by Founding Partner and President Marc Weller, our leadership team offers a wide range of expertise and experience to tackle the most complex real estate developments. At the heart of the company ethos is a triple-bottom-line approach to development, designing strategies that are financially viable and provide returns to investors while also providing benefits to the surrounding communities and the environment. With an extensive portfolio of luxury hospitality properties, distinctive mixed-use development projects, and a proven track record of successful and celebrated ventures, Weller Development Partners delivers value and results, no matter the complexity or odds.

Disclaimer:

WDS Discovery LTD., being the current owner and developer of the Six Senses Residences Grand Bahama (the “Residential Project”), is solely responsible for the development, marketing and sale of branded residences located at the Six Senses Grand Bahama (the “Units”). The Units are not owned, developed or sold by InterContinental Hotels Group PLC, Six Senses Americas IP, LLC, or any of their affiliates (collectively “IHG”). There exists no joint venture, partnership, ownership or similar relationship between WDS Discovery LTD. and IHG.

WDS Discovery LTD., at its sole discretion, may make alterations to the internal design of the residences at the Residential Project that may differ from that shown or described in this document and/or represented in any other marketing materials and/or displays including, but without limitation, to any advertising, marketing and/or sales concepts, programs or materials, or any other content to be posted on any website maintained by WDS Discovery LTD.. Unit designs and materials presented herein (if any) are representative of the intended end product. Actual constructed Unit may vary in materials and furnishings.

The usage of the name “Six Senses” and related marks is strictly governed by certain agreements between WDS Discovery LTD. and IHG. The “Six Senses” name, design, logomarks, trademarks and related marks are the exclusive properties of IHG. The purchasers or owners of the Units shall acquire no interest of any kind or nature in the “Six Senses” brand, logomarks or related trademarks and may use the “Six Senses” name solely for the limited purpose of identifying the location of the Unit. IHG’s role as licensor of the “Six Senses” brand for the Residential Project is not in perpetuity and may end at any time without notice to or consent of purchasers or owners of the Units, in which event the “Six Senses” brand will be disassociated from the Residential Project and the Units and no reference to the “Six Senses” brand shall be applied to the Residential Project or the Units.

In addition, by consenting to WDS Discovery LTD.’s limited use of IHG’s trade and logo marks, IHG does not make any representation or warranty, express or implied, as to the accuracy, currency, reliability or completeness of the information in this document, and IHG is not responsible or liable in any way whatsoever for any claim, loss or damage arising out of or related to information set out in this document.

Contact:

Jaime Waltos

jaime.waltos@warschawski.com

(443) 797 3020

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/weller-development-partners-showcases-resort-renderings-and-masterplan-for-six-senses-grand-bahama-302247009.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/weller-development-partners-showcases-resort-renderings-and-masterplan-for-six-senses-grand-bahama-302247009.html

SOURCE Weller Development Partners

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RADIANT LOGISTICS ANNOUNCES RESULTS FOR THE FOURTH FISCAL QUARTER AND YEAR ENDED JUNE 30, 2024

Financial results inflect to the positive with sequential quarterly improvement;

Continued progress in green-field and strategic operating partners acquisitions;

Debt free and well positioned for further growth as market conditions improve

RENTON, Wash., Sept. 12, 2024 /PRNewswire/ — Radiant Logistics, Inc. RLGT, a technology-enabled global transportation and value-added logistics services company, today reported financial results for the three and twelve months ended June 30, 2024.

Financial Highlights – Three Months Ended June 30, 2024

- Revenues of $206.0 million for the fourth fiscal quarter ended June 30, 2024, down $26.2 million or 11.3%, compared to revenues of $232.2 million for the comparable prior year period. On a sequential basis, revenues for the fourth fiscal quarter ended June 30, 2024, were up $21.4 million or 11.6% compared to revenues of $184.6 million for the third fiscal quarter ended March 31, 2024.

- Gross profit of $57.3 million for the fourth fiscal quarter ended June 30, 2024, down $5.7 million or 9.0%, compared to gross profit of $63.0 million for the comparable prior year period. On a sequential basis, gross profit for the fourth fiscal quarter ended June 30, 2024, was up $8.5 million or 17.4%, compared to gross profit of $48.8 million for the third fiscal quarter ended March 31, 2024.

- Adjusted gross profit, a non-GAAP financial measure, of $60.6 million for the fourth fiscal quarter ended June 30, 2024, down $5.7 million or 8.6%, compared to adjusted gross profit of $66.3 million for the comparable prior year period. On a sequential basis, adjusted gross profit for the fourth fiscal quarter ended June 30, 2024, was up $7.5 million or 14.1%, compared to adjusted gross profit of $53.1 million for the third fiscal quarter ended March 31, 2024.

- Net income attributable to Radiant Logistics, Inc. of $4.8 million, or $0.10 per basic and fully diluted share for the fourth fiscal quarter ended June 30, 2024, up $1.7 million or 54.8%, compared to $3.1 million, or $0.07 per basic and $0.06 per fully diluted share for the comparable prior year period. On a sequential basis, net income attributable to Radiant Logistics, Inc. for the fourth fiscal quarter ended June 30, 2024, was up $5.5 million or 785.7%, compared to a net loss attributable to Radiant Logistics, Inc. of $0.7 million for the third fiscal quarter ended March 31, 2024.

- Adjusted net income, a non-GAAP financial measure, of $7.0 million, or $0.15 per basic and $0.14 per fully diluted share for the fourth fiscal quarter ended June 30, 2024, up $0.5 million or 7.7%, compared to adjusted net income of $6.5 million, or $0.14 per basic and $0.13 per fully diluted share for the comparable prior year period. On a sequential basis, adjusted net income for the fourth fiscal quarter ended June 30, 2024, was up $3.4 million or 94.4%, compared to adjusted net income of $3.6 million for the third fiscal quarter ended March 31, 2024. Adjusted net income is calculated by applying a normalized tax rate of 24.5% and excluding other items not considered part of regular operating activities.

- Adjusted EBITDA, a non-GAAP financial measure, of $9.1 million for the fourth fiscal quarter ended June 30, 2024, down $0.1 million or 1.1%, compared to adjusted EBITDA of $9.2 million for the comparable prior year period. On a sequential basis, adjusted EBITDA for the fourth fiscal quarter ended June 30, 2024, was up $3.9 million or 75.0%, compared to adjusted EBITDA of $5.2 million for the third fiscal quarter ended March 31, 2024.

- Adjusted EBITDA margin (adjusted EBITDA expressed as a percentage of adjusted gross profit), a non-GAAP financial measure, up to 15.0% or 110 basis points, for the fourth fiscal quarter ended June 30, 2024, compared to adjusted EBITDA margin of 13.9% for the comparable prior year period. On a sequential basis, adjusted EBITDA margin for the fourth fiscal quarter ended June 30, 2024 of 15.0% was up 520 basis points when compared to the 9.8% adjusted EBITDA margin for the third fiscal quarter ended March 31, 2024.

Acquisition Recap

Effective October 1, 2023, the Company acquired the operations of Daleray Corporation (“Daleray”), a Fort Lauderdale, Florida based, privately held company that has operated under the Company’s Distribution By Air brand since 2014.

Effective February 1, 2024, the Company acquired Select Logistics, Inc. and Select Cartage, Inc. (collectively “Select”), both Miami, Florida based, privately held companies that have operated as part of the Company’s Adcom Worldwide brand since 2007. Both Daleray and Select are being combined to operate as Radiant Global Logistics and will leverage their combined expertise and in-depth knowledge to solidify the Company’s cruise logistics service offerings in south Florida.

Effective April 1, 2024, the Company acquired the assets and operations of Viking Worldwide, Inc.(“Viking“), a Minnesota based, privately held company with operations in both Minneapolis, Minnesota and Houston, Texas that has operated under the Company’s Service by Air brand since 2012. Viking services a diversified account base specializing in the high-tech, brand management, life- sciences, and trade show industries. Viking continues to operate under the Service by Air brand and is expected to complete its transition to the Radiant brand over the course of 2024 as Viking’s Minneapolis operations combine with existing Company-owned operations in the area.