Canaan May Find a Bottom Soon, Here's Why You Should Buy the Stock Now

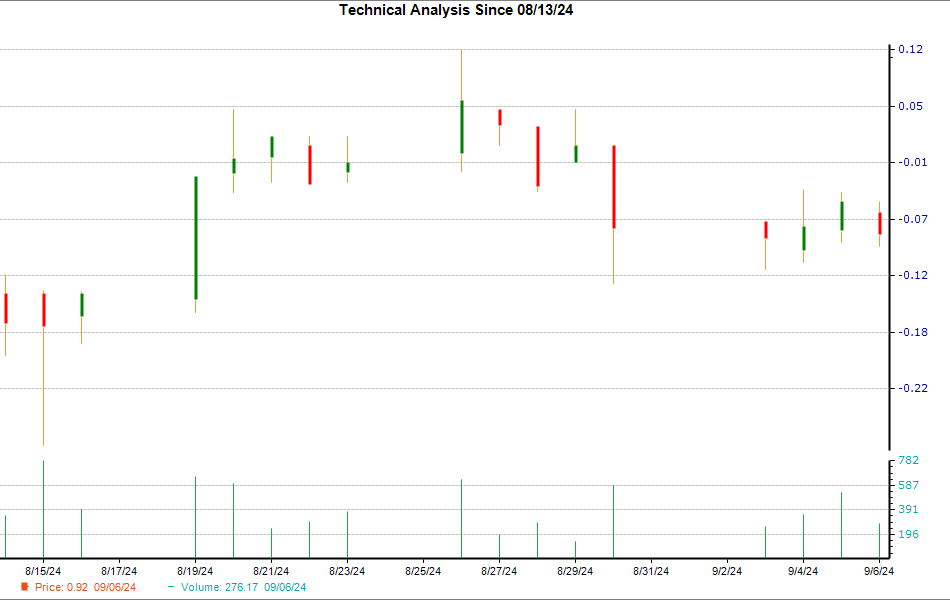

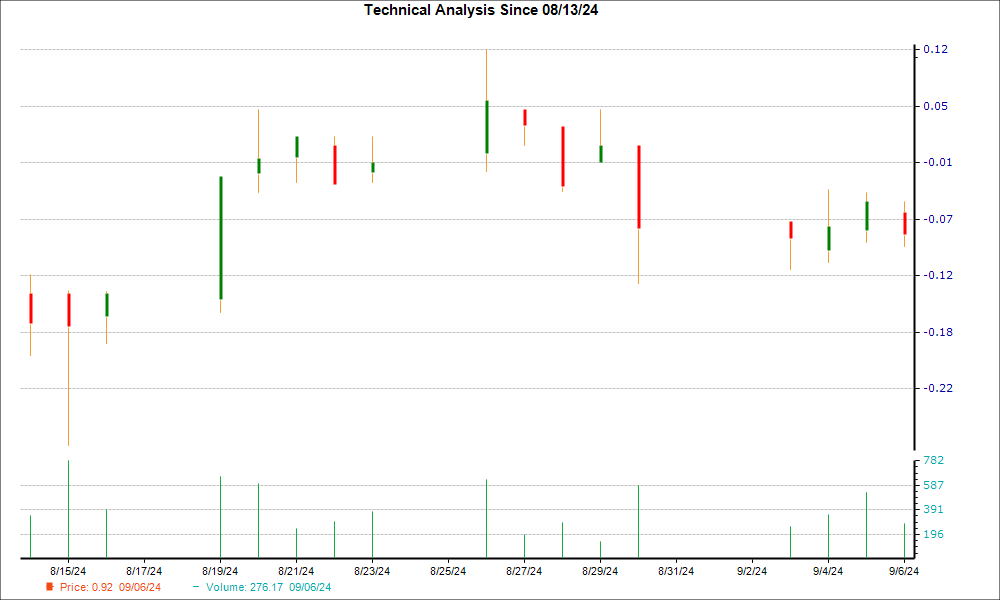

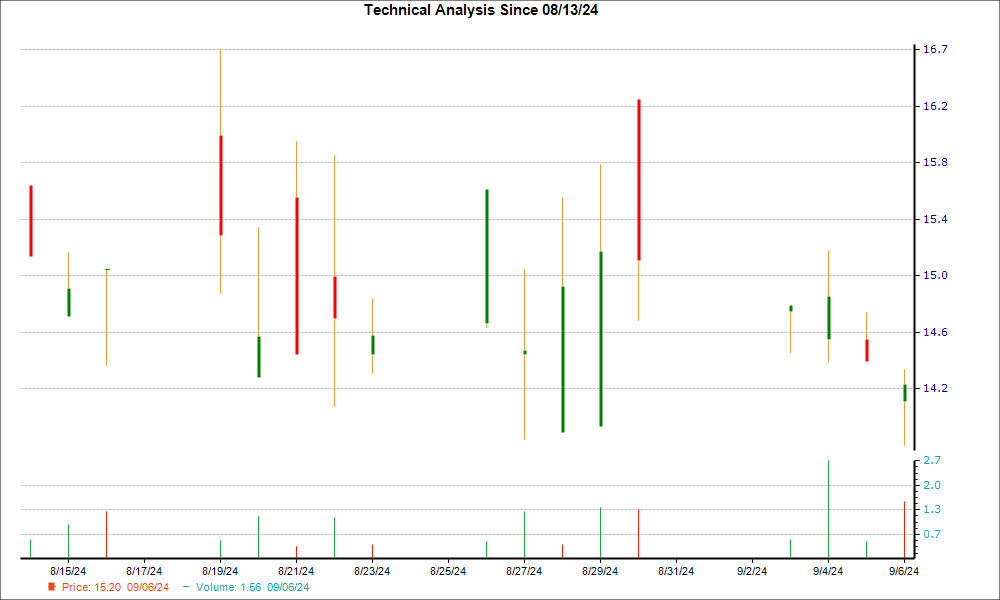

The price trend for Canaan CAN has been bearish lately and the stock has lost 8.1% over the past two weeks. However, the formation of a hammer chart pattern in its last trading session indicates that the stock could witness a trend reversal soon, as bulls might have gained significant control over the price to help it find support.

While the formation of a hammer pattern is a technical indication of nearing a bottom with potential exhaustion of selling pressure, rising optimism among Wall Street analysts about the future earnings of this cryptocurrency-mining computer maker is a solid fundamental factor that enhances the prospects of a trend reversal for the stock.

What is a Hammer Chart and How to Trade It?

This is one of the popular price patterns in candlestick charting. A minor difference between the opening and closing prices forms a small candle body, and a higher difference between the low of the day and the open or close forms a long lower wick (or vertical line). The length of the lower wick being at least twice the length of the real body, the candle resembles a ‘hammer.’

In simple terms, during a downtrend, with bears having absolute control, a stock usually opens lower compared to the previous day’s close, and again closes lower. On the day the hammer pattern is formed, maintaining the downtrend, the stock makes a new low. However, after eventually finding support at the low of the day, some amount of buying interest emerges, pushing the stock up to close the session near or slightly above its opening price.

When it occurs at the bottom of a downtrend, this pattern signals that the bears might have lost control over the price. And, the success of bulls in stopping the price from falling further indicates a potential trend reversal.

Hammer candles can occur on any timeframe — such as one-minute, daily, weekly — and are utilized by both short-term as well as long-term investors.

Like every technical indicator, the hammer chart pattern has its limitations. Particularly, as the strength of a hammer depends on its placement on the chart, it should always be used in conjunction with other bullish indicators.

Here’s What Makes the Trend Reversal More Likely for CAN

There has been an upward trend in earnings estimate revisions for CAN lately, which can certainly be considered a bullish indicator on the fundamental side. That’s because a positive trend in earnings estimate revisions usually translates into price appreciation in the near term.

Over the last 30 days, the consensus EPS estimate for the current year has increased 33.3%. What it means is that the sell-side analysts covering CAN are majorly in agreement that the company will report better earnings than they predicted earlier.

If this is not enough, you should note that CAN currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. And stocks carrying a Zacks Rank #1 or 2 usually outperform the market.

Moreover, the Zacks Rank has proven to be an excellent timing indicator, helping investors identify precisely when a company’s prospects are beginning to improve. So, for the shares of Canaan, a Zacks Rank of 2 is a more conclusive fundamental indication of a potential turnaround.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Investor Sentiment Softens As Institutional Confidence Wanes, Survey Shows

Cannabis investors should take note that investor sentiment in the industry has shifted from bullish to neutral, according to the latest ATB Cannabis Investor Sentiment Survey.

The report, based on responses from institutional investors, reveals that only 31.8% of investors remain optimistic about the multi-state operator (MSO) sector, a sharp drop from the 83.3% recorded six months ago.

The primary reason for this change is the delay in uplistings to major U.S. exchanges, and also in moving cannabis to Schedule III. As a result of shifting expectations, just 9.1% of respondents reported increasing their exposure to the MSO sector in the past six months, compared to 61.1% in the spring of 2024.

Cannabis Investor Sentiment Turns Neutral

Uplisting to U.S. exchanges remains the top priority for 59.1% of investors, down from 73.7% six months ago, signaling some hesitation. Rescheduling to Schedule III ranks second, with 31.8% of investors citing it as a major driver for future investments.

But, despite the noticeable decline among bulls, the sentiment has not fully transitioned to pessimism. In fact, the survey highlights a more neutral stance as investors adopt a wait-and-see approach.

Key catalyst, such as rescheduling cannabis and uplisting companies to NASDAQ and NYSE, might reignite investor interest and turn the tide for cannabis industry leaders.

“Investors are holding back due to the delays in these key developments,” states the report, shared via an email to Benzinga Cannabis.

Florida Legalization And Canadian Market Challenges

Some pessimism might also be affecting newer markets.

The survey also found that Florida’s cannabis legalization prospects have dimmed slightly, with investors assigning a 62% probability for adult-use legalization, down from 69% in the previous survey. This decline contrasts with expectations, as recent political discussions suggested growing support for legalization.

Despite the setback, many believe that the Florida market could still present opportunities in the coming years.

Meanwhile, the sentiment towards the Canadian cannabis market has worsened significantly.

In the survey, 39% of respondents reported becoming more bearish on Canadian companies, up from 29% six months ago. Failed excise tax reform and the inability to access the U.S. cannabis market have contributed to this negative outlook. Investors highlighted that without regulatory changes, Canadian cannabis companies are struggling to gain momentum.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

A Rebound For Investors Might Come

Although the current sentiment is neutral, some cannabis investors are optimistic about the potential for a rebound if these long-awaited changes materialize.

Should rescheduling occur, 53.3% of respondents believe that the AdvisorShares Pure US Cannabis ETF MSOS could rise above $20, a substantial increase from its current level of $6.86.

At the same time, a majority of respondents (59.1%) see Tier 1 MSOs as undervalued, suggesting a buying opportunity for those with a long-term view.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Stock Will Join the S&P 500 in September. History Says It Could Soar Afterward.

The S&P 500 (SNPINDEX: ^GSPC) index measures the performance of 500 U.S. companies that cover about 80% of domestic equities by market value. The index is generally considered the best barometer for the entire U.S. stock market.

Palantir Technologies (NYSE: PLTR) will join the S&P 500 on Monday, Sept. 23, as part of the index’s quarterly rebalancing. Also joining the index are Dell Technologies and Erie Indemnity. Those three companies will replace Etsy, American Airlines, and Bio-Rad Laboratories.

Palantir stock has advanced 124% over the past year amid widespread interest in artificial intelligence. And history says the stock could move even higher after the company joins the S&P 500 later this month.

History says Palantir stock could soar after its inclusion in the S&P 500

Since 2019, a total of 93 companies have been added to the S&P 500. Of those companies, 76 have been members of the index for at least a year. Here’s how those stocks performed during their first 12 months post inclusion:

-

Average return: 12%

-

Median return: 10%

The figures change slightly if we go further back. Since 2014, a total of 178 companies have been added to the S&P 500. Of those companies, 161 have been members of the index for at least a year. Here’s how those stocks performed during their first 12 months post inclusion:

-

Average return: 13%

-

Median return: 12%

In short, history says Palantir will achieve double-digit returns between 10% and 13% over the 12-month period following its inclusion in the S&P 500.

However, investors should bear in mind that every company is different, so generalizing about how new S&P 500 components will perform is unreliable. Moreover, joining the index has zero impact on fundamental financial metrics like revenue and earnings. A study published in 2011 by the Federal Reserve Bank of New York concluded that “index inclusion has no permanent effect on value.”

To that end, whether Palantir stock goes up or down after joining the S&P 500 depends on the company’s financial results and what investors are willing to pay in terms of valuation.

Palantir is a leader in artificial intelligence and machine learning

Palantir specializes in data analytics. Its Foundry and Gotham platforms let businesses collect data, develop machine learning models, and integrate those digital assets into an ontology. The ontology connects data and models to real-world decisions, such that users can surface insights through analytical applications to improve business outcomes. The company says its “key differentiator is a software architecture which revolves around the Palantir ontology.”

Last year, Palantir launched a new product called Artificial Intelligence Platform (AIP), which adds support for large language models and generative artificial intelligence (AI) to Foundry and Gotham. The company also revamped its go-to-market strategy around AIP by introducing bootcamps, interactive workshops that help customers develop relevant use cases within five days.

In August, Forrester Research recognized Palantir as a leader in artificial intelligence and machine learning platforms. Palantir received the highest score for its current product offering, but competitors Alphabet‘s Google and C3.ai scored higher in terms of product development strategy.

Palantir reported encouraging financial results in the second quarter, beating estimates on the top and bottom lines. Sales increased 27% to $678 million, marking the fifth straight sequential acceleration, and non-GAAP earnings jumped 80% to $0.09 per diluted share. Management also gave third-quarter guidance above what analysts anticipated.

“The persistent and unbridled demand for our software, for an effective enterprise platform that makes artificial intelligence capabilities useful to large institutions, shows no signs of relenting,” CEO Alex Karp commented in his shareholder letter.

Palantir stock trades at a very expensive valuation

Going forward, Wall Street expects Palantir’s adjusted earnings to increase at 22% annually through 2025. That consensus estimate makes the current valuation of 106 times adjusted earnings look expensive. Generally speaking, analysts agree with that assertion. Palantir has a median 12-month price target of $28 per share, which implies 18% downside from its current share price of $34. I would personally avoid this stock until it trades at a much more reasonable valuation.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Etsy and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Etsy, and Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

Palantir Stock Will Join the S&P 500 in September. History Says It Could Soar Afterward. was originally published by The Motley Fool

$4M Bet On This Energy Stock? Check Out These 3 Stocks Executives Are Buying

Although U.S. stocks closed higher on Thursday, there were a few notable insider trades.

When insiders purchase shares, it indicates their confidence in the company’s prospects or that they view the stock as a bargain. Either way, this signals an opportunity to go long on the stock. Insider purchases should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a buying decision.

Below is a look at a few recent notable insider purchases. For more, check out Benzinga’s insider transactions platform.

Permian Resources

- The Trade: Permian Resources Corporation PR Director William J Quinn acquired a total of 312,429 shares at an average price of $12.79. To acquire these shares, it cost around $3.99 million.

- What’s Happening: On Sept. 12, JP Morgan analyst Arun Jayaram maintained Permian Resources with an Overweight and lowered the price target from $20 to $17..

- What Permian Resources Does: Permian Resources Corp is an independent oil and natural gas company focused on generating outsized returns to stakeholders through the responsible acquisition, optimization and development of oil and liquids-rich natural gas assets.

PENN Entertainment

- The Trade: PENN Entertainment, Inc. PENN Director David A Handler acquired a total of 10,000 shares at an average price of $17.51. To acquire these shares, it cost around $175,100.

- What’s Happening: On Aug. 8, PENN Entertainment posted upbeat quarterly earnings.

- What PENN Entertainment Does: Penn Entertainment’s origins date back to its 1972 racetrack opening in Pennsylvania. Today, Penn operates 43 properties across 20 states and 12 brands, including Hollywood Casino and Ameristar.

Aptiv

- The Trade: Aptiv PLC APTV CEO and Chairman Kevin P Clark bought a total of 29,770 shares at an average price of $65.45. To acquire these shares, it cost around $1.95 million.

- What’s Happening: On Sept. 10, Deutsche Bank analyst Edison Yu reinstated Aptiv with a Hold and announced a $74 price target.

- What Aptiv Does: Aptiv’s signal and power solutions segment supplies components and systems that make up a vehicle’s electrical system, including wiring assemblies and harnesses, connectors, electrical centers, and hybrid electrical systems.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NUVVE ANNOUNCES 1-FOR-10 REVERSE STOCK SPLIT

SAN DIEGO, Sept. 13, 2024 /PRNewswire/ — Nuvve Holding Corp. (“Nuvve” or the “Company”) NVVE, a green energy technology company that provides a globally-available, commercial vehicle-to-grid (V2G) technology platform that enables electric vehicle (EV) batteries to store and resell unused energy back to the local electric grid and provides other grid services, today announced that it will effect a 1-for-10 reverse stock split of its common stock, to be effective as of 5:00 p.m. Eastern Time on Monday, September 16, 2024. Nuvve’s common stock will begin trading on a split-adjusted basis commencing upon market open on Tuesday, September 17, 2024.

Following the reverse stock split, the Company’s common stock will continue to trade on the Nasdaq Capital Market under the symbol “NVVE” with the new CUSIP number, 67079Y308. The CUSIP number for the Company’s publicly traded warrants will not change.

At the effective time of the reverse stock split, every 10 shares of Nuvve’s issued and outstanding common stock will be automatically converted into one issued and outstanding share of common stock without any change in the par value of $0.0001 per share. The reverse stock split will reduce the number of issued and outstanding shares of the Company’s common stock from approximately 6.5 million shares to approximately 0.7 million shares. The total authorized number of shares will not be reduced. Proportional adjustments will be made to the number of shares of common stock issuable upon exercise or vesting of the Company’s outstanding stock options, restricted stock units, and warrants, as well as the applicable exercise or conversion prices, and to the number of shares issuable under the Company’s equity incentive plans and other existing agreements. No fractional shares will be issued in connection with the reverse stock split, and fractional shares resulting from the reverse stock split will be rounded up to the nearest whole share.

At the Company’s special meeting of stockholders held on September 9, 2024, the Company’s stockholders voted to approve, among other things, a proposal granting the Company’s Board of Directors the discretion to amend the Company’s certificate of incorporation to effect a reverse stock split of the Company’s common stock at a ratio of not less than 1-for-2 and not more than 1-for-10. Following the annual meeting of stockholders, on September 10, 2024, the Company’s Board of Directors approved a 1-for-10 reverse stock split. The reverse stock split is intended for Nuvve to regain compliance with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market.

Nuvve’s transfer agent, Continental Stock Transfer & Trust Company, will provide information to stockholders regarding their stock ownership following the reverse stock split. Stockholders holding their shares in book-entry form or through a bank, broker or other nominee do not need to take any action in connection with the reverse stock split. Their accounts will be automatically adjusted to reflect the number of shares owned. Beneficial holders are encouraged to contact their bank, broker or other nominee with any procedural questions.

About Nuvve Holding Corp.

Nuvve Holding Corp. NVVE is leading the electrification of the planet, beginning with transportation, through its intelligent energy platform. Combining the world’s most advanced vehicle-to-grid (V2G) technology and an ecosystem of electrification partners, Nuvve dynamically manages power among electric vehicle (EV) batteries and the grid to deliver new value to EV owners, accelerate the adoption of EVs, and support the world’s transition to clean energy. By transforming EVs into mobile energy storage assets and networking battery capacity to support shifting energy needs, Nuvve is making the grid more resilient, enhancing sustainable transportation, and supporting energy equity in an electrified world. Since its founding in 2010, Nuvve has successfully deployed V2G on five continents and offers turnkey electrification solutions for fleets of all types. Nuvve is headquartered in San Diego, California, and can be found online at nuvve.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements or forward-looking information within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “expects,” “believes,” “aims,” “anticipates,” “plans,” “looking forward to,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “continue,” “seeks” or the negatives of such terms or other variations on such terms or comparable terminology, although not all forward-looking statements contain such identifying words. Forward-looking statements include, but are not limited to, statements concerning the expected timing and implementation of the reverse stock split and the commencement of trading of Nuvve’s post-split common stock and Nuvve’s ability to maintain compliance with Nasdaq’s continued listing requirements. Nuvve cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Nuvve. Such statements are based upon the current beliefs and expectations of management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Some of these risks and uncertainties can be found in Nuvve’s most recent Annual Report on Form 10-K and subsequent periodic reports filed with the Securities and Exchange Commission (SEC). All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. Nuvve does not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise except as required by law.

Nuvve Investor Contact

investorrelations@nuvve.com

+1 (619) 483-3448

Nuvve Press Contacts

press@nuvve.com

+1 (619) 483-3448

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/nuvve-announces-1-for-10-reverse-stock-split-302247063.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nuvve-announces-1-for-10-reverse-stock-split-302247063.html

SOURCE Nuvve Holding Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where to move your money when interest rates are poised to fall

With the Fed poised to cut interest rates next week, the ripple effect will show up in certificates of deposit and high-yield savings accounts, which currently offer rates of more than 5%.

They aren’t likely to fall dramatically following a rate cut but rather ease back closer to 4% and linger above the inflation rate for at least the next year. So these accounts should still be your go-to for your emergency fund or cash set aside for short-term expenses.

That said, the Fed’s anticipated action offers an opportunity to make some money moves that take advantage of the downward tilt in interest rates.

“The projected cutting may pull the rug from under the high-yield savings rates,” Preston D. Cherry, founder and president of Concurrent Financial Planning, told Yahoo Finance. “Now might be the best time we’ve seen in a few years to swap cash in high-yield savings for long-term bonds to lock in a higher yield for income payments for lifestyle and retirement portfolios.”

Since 2022, when the Fed began to raise short-term interest rates, bank savings accounts have been a better place to park your cash than bonds. That’s set to change.

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

Bonds are back

It’s a good time to shift to bonds for those nearing retirement who are looking to rebalance their retirement savings amid stock market volatility.

The best way to earn a high total return from a bond or bond fund is to buy it when interest rates are high but about to come down, Cherry said.

If you buy bonds toward the end of a period when rates are rising, you can lock in high coupon yields and enjoy the increase in the market value of your bond once rates start to come down.

And if you’re a bond lover, you’re up. After more than a decade of dismal bond yields, the two-fold impact of high rates right now and falling inflation offers an opportunity for investment income. When interest rates move lower, bond prices will rise. (Interest rates and bond prices move in opposite directions.)

“Adding low-price and higher-yield long-term bonds at current levels could add total return diversification value to your bond and overall investment portfolio, which has not been the case in recent past rate-raising environments,” Cherry said.

This is a narrow opportunity, though, before rates start dipping and bond prices go up.

“If you have adequate liquidity and won’t need to tap the money at a moment’s notice, then locking in bond yields now over a multiyear period can provide a more predictable income stream,” Greg McBride, chief financial analyst at Bankrate.com, told Yahoo Finance.

“As the Fed starts cutting interest rates, short-term yields will fall faster than long-term yields in the months ahead, so do this for the income rather than the expectation of capital gains,” he said.

Laddering provides a ‘more predictable income stream‘

One way savers can pivot as rates head down is to set up a bond or CD ladder with staggered maturities, instead of investing all your funds in a single CD or bond with one set term length. This tactic can provide “a more predictable income stream while providing regular access to principal,” McBride said.

I hold my personal savings, for example, in several buckets, including six-month and one-year CDs, a money market account, high-yield savings accounts, and a checking account.

The bulk of my retirement holding is stocks and bonds mainly through broad index funds. How you divide up your savings and investments between stock and bonds, mutual funds and money market funds, or high-yield savings accounts is a balance that only you will know you’re comfortable with, based on your risk tolerance and how soon you need to tap the funds.

Many retirees want a more conservative asset mix as they age so they don’t face that uneasy feeling when the stock market is shaky. That’s why near-retirees and retirees, in particular, who haven’t taken a gander at their asset allocations for a while should consider doing so.

Read more: CDs vs. bonds: What’s the difference, and which one is right for me?

How to put money in bonds for right now and retirement

Most 401(k) investors are in bond mutual funds for the fixed-income portion of their portfolios, which are highly diversified and usually invested in intermediate (five-year) high-quality government and corporate bonds.

Most of us aren’t researching and investing, for instance, in individual intermediate bonds. If you opt to do it yourself and choose individual bonds and hold them until they mature, you’ve got plenty to select from, of course. Fidelity offers over 100,000 bonds, including US Treasury, corporate, and municipal bonds. Most have mid- to high-quality credit ratings, but to me the sheer number of choices is mind-boggling.

So I buy shares in a wide range of individual bonds via a bond mutual fund or ETF to add a bond ballast to my retirement accounts. The Vanguard Total Bond Market ETF, for example, is a diversified, one-stop shop comprising more than 11,000 “investment grade” bonds — including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities — all with maturities of more than one year.

Right now, more than 60% of the Vanguard fund’s total assets are in government bonds, and its year-to-date return is 4.94%.

As Vanguard notes, this fund “may be more appropriate for medium- or long-term goals where you’re looking for a reliable income stream and is appropriate for diversifying the risks of stocks in a portfolio.”

For shorter-term goals, staying ahead of rates falling is smart to lock in alluring rates for money you might need sooner rather than later.

Cash has ‘zero risk’ of losing nominal value

The majority of financial advisers I spoke to didn’t suggest any knee-jerk actions ahead of the Fed meeting. In other words, don’t close your bank accounts.

“Inflation has certainly moderated, but in our opinion is not likely to be a further decline substantially,” said Peter J. Klein, chief investment officer and founder of ALINE Wealth.

If that’s the case, the Fed will not keep lowering interest rates but will hold them steady moving forward.

“Looking at the long arc of inflation history, one can see the changes … leading to sticky and persistent inflationary pressures. So, the notion that rates will come down substantially — and stay down — is not our base case,” Klein said.

That means that those savings you have in a federally insured, accessible bank account earning above the rate of inflation remain a good bet. That’s especially the case for those nearing or in near retirement who plan to tap that money for living expenses and don’t want the worry that comes from price fluctuations in stocks and bonds.

“Cash is the only asset that an investor can deploy in a portfolio that has zero risk of losing its nominal value,” Klein added.

Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist, and the author of 14 books, including “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Get Rich.” Follow her on X @kerryhannon.

Read the latest financial and business news from Yahoo Finance

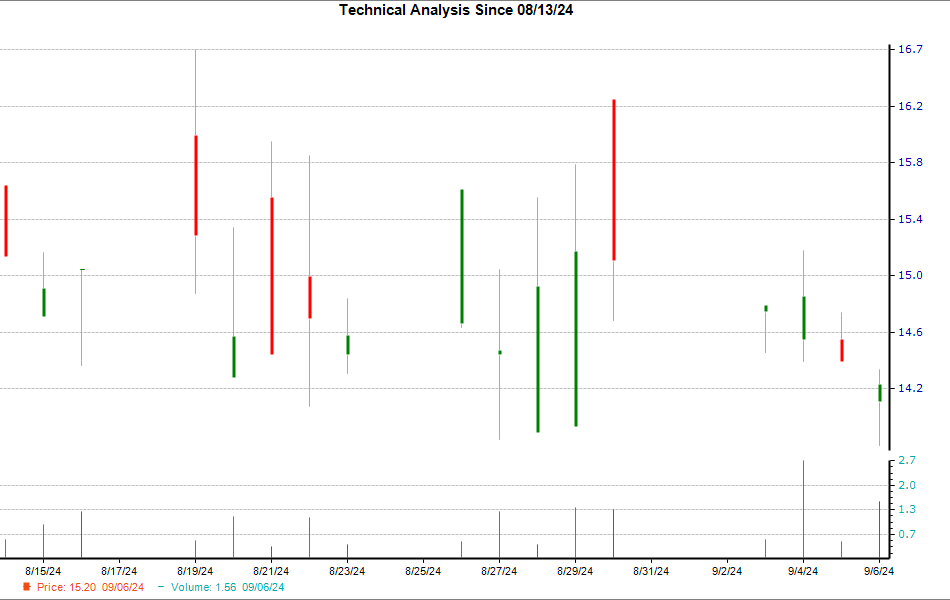

Hengan International Group Co. Forms 'Hammer Chart Pattern': Time for Bottom Fishing?

Shares of Hengan International Group Co., Ltd. Unsponsored ADR HEGIY have been struggling lately and have lost 7.1% over the past week. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. So, it could witness a trend reversal down the road.

While the formation of a hammer pattern is a technical indication of nearing a bottom with potential exhaustion of selling pressure, rising optimism among Wall Street analysts about the future earnings of this company is a solid fundamental factor that enhances the prospects of a trend reversal for the stock.

What is a Hammer Chart and How to Trade It?

This is one of the popular price patterns in candlestick charting. A minor difference between the opening and closing prices forms a small candle body, and a higher difference between the low of the day and the open or close forms a long lower wick (or vertical line). The length of the lower wick being at least twice the length of the real body, the candle resembles a ‘hammer.’

In simple terms, during a downtrend, with bears having absolute control, a stock usually opens lower compared to the previous day’s close, and again closes lower. On the day the hammer pattern is formed, maintaining the downtrend, the stock makes a new low. However, after eventually finding support at the low of the day, some amount of buying interest emerges, pushing the stock up to close the session near or slightly above its opening price.

When it occurs at the bottom of a downtrend, this pattern signals that the bears might have lost control over the price. And, the success of bulls in stopping the price from falling further indicates a potential trend reversal.

Hammer candles can occur on any timeframe — such as one-minute, daily, weekly — and are utilized by both short-term as well as long-term investors.

Like every technical indicator, the hammer chart pattern has its limitations. Particularly, as the strength of a hammer depends on its placement on the chart, it should always be used in conjunction with other bullish indicators.

Here’s What Makes the Trend Reversal More Likely for HEGIY

There has been an upward trend in earnings estimate revisions for HEGIY lately, which can certainly be considered a bullish indicator on the fundamental side. That’s because a positive trend in earnings estimate revisions usually translates into price appreciation in the near term.

The consensus EPS estimate for the current year has increased 0.3% over the last 30 days. This means that the Wall Street analysts covering HEGIY are majorly in agreement about the company’s potential to report better earnings than what they predicted earlier.

If this is not enough, you should note that HEGIY currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. And stocks carrying a Zacks Rank #1 or 2 usually outperform the market.

Moreover, the Zacks Rank has proven to be an excellent timing indicator, helping investors identify precisely when a company’s prospects are beginning to improve. So, for the shares of Hengan International Group Co. a Zacks Rank of 2 is a more conclusive fundamental indication of a potential turnaround.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Suze Orman Isn't Wasting Money On Insurance For Her Condo – 'I'm Not Paying $28,000 A Year When The Insurer Will Probably Contest Any Claim'

Suze Orman, the finance guru known for her sharp advice, has a bone to pick with home insurance companies. At 72, she’s decided enough is enough for the wild costs of insuring her Florida beachfront condo – and she’s speaking out.

Don’t Miss:

In an interview with DailyMail.com, Orman said she’s been quoted $28,000 yearly for home insurance on her 2,100-square-foot Florida condo. Let that sink in for a second. “$28,000 for a 2,100-square-foot condo. Are you kidding me?” she said, shocked by the price tag.

Luckily for Orman, she can self-insure, meaning she doesn’t need the policy. But her worry? Most Americans aren’t in the same boat, and she’s worried this insurance crisis could push the American dream of homeownership even further out of reach.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Orman didn’t hold back, explaining how climate change is wreaking havoc not just on the environment but on our wallets too. “Climate change is going to make a big difference in people’s desire to own their own home,” she said. “Look at what’s happening in Southern California. Look at the devastating hurricanes that are coming to places where hurricanes weren’t so prevalent before.”

And the numbers back her up. The National Oceanic and Atmospheric Administration (NOAA) reported 28 billion-dollar natural disasters across the U.S. last year. As you’d expect, this has sent insurance costs soaring. According to the National Association of Realtors, the average home insurance premium is now $2,377 a year – and rising. Homeowners can expect to pay 6% more by the end of the year.

In Florida, NAR reports the average insurance price to be around $11,700 for 2024. According to their estimates, Louisiana homeowners can expect to pay close to $8,000 by the end of the year. “It’s possible that the highest-risk areas will become uninsurable,” says Betsy Stella, vice president of Carrier Management and Operations at Insurify, as rising risks make coverage increasingly difficult to obtain.

See Also: Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

Orman warns that if these insurance prices keep climbing, many will think twice about homeownership. “Real estate is unpredictable. I never would have thought to advise homebuyers, ‘Oh, you better make sure you can afford a quadrupling of property insurance in the future,'” she added.

For many homeowners, though, there’s no escaping these costs. If you’re buying a home with a mortgage, you can’t close the deal without insurance. Orman, however, owns her condo outright, so she can opt out. Her choice? Skip the $28,000 a year premium. “I’m not paying $28,000 a year when the insurer will probably contest any claim I get anyway,” she said bluntly.

Wildfires, floods, and tornadoes are occurring more often, forcing insurers to raise premiums or leave the game altogether. Allstate recently approved a 34% increase for California homeowners, taking effect in November. In June, State Farm increased rates in the state by 30%.

Trending: The average American couple has saved this much money for retirement — How do you compare?

So, what’s the take-away here? Orman’s got a point. Climate change, rising repair costs, and an under-pressure insurance industry are reshaping what owning a home in America means. And while Orman has the means to skip the insurance headache, many others don’t. As she warns, the dream of owning a home might get much more complicated – and expensive.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Suze Orman Isn’t Wasting Money On Insurance For Her Condo – ‘I’m Not Paying $28,000 A Year When The Insurer Will Probably Contest Any Claim’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why GE Vernova Stock Jumped to a Record High on Thursday

TIMOTHY A. CLARY / AFP via Getty Images

GE Aerospace and GE Vernova chief executives and employees ring the opening bell at the New York Stock Exchange on April 2, 2024, when GE Vernova was listed

Key Takeaways

-

GE Vernova shares closed at their highest level since being spun off from General Electric in April.

-

The company said its offshore wind division should be profitable in the fourth quarter.

-

Strength in its power and electrification segments led the company to reaffirm its full-year guidance.

GE Vernova (GEV) closed at a record high Thursday after the recent General Electric spin-off reaffirmed its full-year financial guidance.

The energy company said Thursday at a Morgan Stanley investing conference that it expects revenue on the higher end of its previously disclosed $34 billion to $35 billion range, driven by strength in its power and electrification segments. Its offshore wind segment, which it projects to post a loss of $300 million in the third quarter, should be profitable by the fourth quarter.

Record Close Reached Thursday

Shares of GE Vernova climbed 2.9%, reversing an early-session decline, to close at $215.27.

The company began trading in April after General Electric spun off its energy division from the aerospace division, with the entities becoming GE Vernova and GE Aerospace (GE), respectively. GE Vernova’s shares are up more than 50% since their trading debut.

Read the original article on Investopedia.

General Mills Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

General Mills, Inc. GIS will release earnings results for its first quarter, before the opening bell on Thursday, Sept. 18.

Analysts expect the Minneapolis, Minnesota-based company to report quarterly earnings at $1.06 per share, down from $1.09 per share in the year-ago period. General Mills is projected to post revenue of $4.79 billion, according to data from Benzinga Pro.

On Sept. 12, General Mills announced agreements to sell its North American Yogurt business to Lactalis and Sodiaal.

General Mills shares fell 0.2% to close at $73.01 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Mizuho analyst John Baumgartner maintained a Neutral rating and cut the price target from $70 to $62 on July 3. This analyst has an accuracy rate of 68%.

- Evercore ISI Group analyst David Palmer maintained an In-Line rating and slashed the price target from $76 to $72 on June 28. This analyst has an accuracy rate of 65%.

- B of A Securities analyst Bryan Spillane maintained a Neutral rating and slashed the price target from $70 to $68 on June 27. This analyst has an accuracy rate of 66%.

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and cut the price target from $70 to $67 on June 27. This analyst has an accuracy rate of 63%.

- RBC Capital analyst Nik Modi reiterated a Sector Perform rating with a price target of $70 on June 27. This analyst has an accuracy rate of 67%.

Considering buying GIS stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.