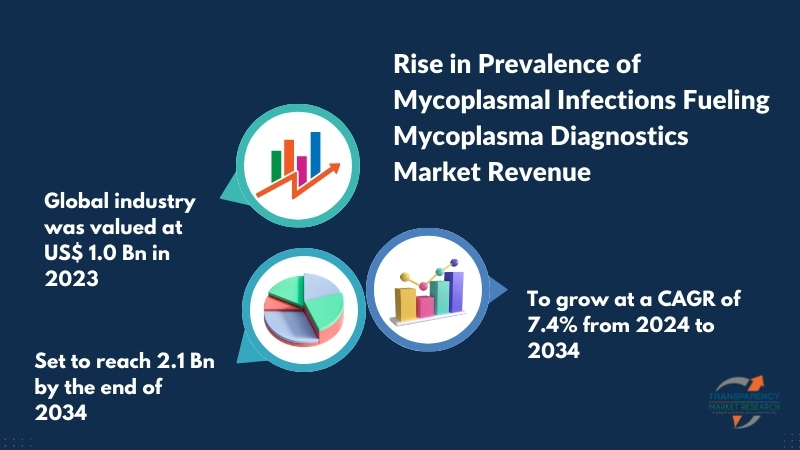

Mycoplasma Diagnostics Market Size is Expected to Reach USD 2.1 billion, Expanding at a CAGR of 7.4% by 2034: Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 13, 2024 (GLOBE NEWSWIRE) — The global mycoplasma diagnostics market (마이코플라스마 진단 시장) is estimated to flourish at a CAGR of 7.4% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for mycoplasma diagnostics is estimated to reach US$ 2.1 billion by the end of 2034.

The escalating threat of antimicrobial resistance among mycoplasma strains necessitates accurate and timely diagnostics to guide appropriate treatment, thus driving the demand for advanced diagnostic solutions.

Increased international travel facilitates the spread of mycoplasma infections across borders, heightening the need for robust diagnostic capabilities in various regions to contain outbreaks and prevent transmission.

Environmental shifts and interactions between human populations, animals, and ecosystems contribute to the emergence of zoonotic mycoplasma infections. This evolving landscape underscores the importance of comprehensive diagnostic approaches for early detection and surveillance.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/mycoplasma-diagnostics-market.html

Stringent regulatory requirements and quality assurance standards mandate the use of reliable mycoplasma diagnostics in pharmaceutical manufacturing, driving market growth as companies strive to comply with regulatory guidelines and ensure product safety.

The integration of AI algorithms and big data analytics into mycoplasma diagnostics offers opportunities for enhanced accuracy, efficiency, and predictive analytics, revolutionizing disease detection and management in the market.

Mycoplasma Diagnostics Market: Competitive Landscape

In the dynamic realm of mycoplasma diagnostics, competition thrives amidst a landscape shaped by innovation, technology, and regulatory dynamics. Key players such as Thermo Fisher Scientific, Merck KGaA, and Lonza Group AG dominate the market with robust diagnostic solutions. Emerging contenders like PromoCell GmbH and Sartorius AG bolster competition with niche offerings and strategic collaborations.

The market is characterized by a constant pursuit of novel methodologies, rapid testing solutions, and stringent quality standards. As industry leaders vie for market share, differentiation through advanced technologies, reliability, and comprehensive support services remains paramount in shaping the competitive landscape of mycoplasma diagnostics. Some prominent players are as follows:

- Merck & Co. Inc.

- Hoffmann-La Roche AG

- Agilent Technologies

- Sartorius AG

- Savyon Diagnostics

- Takara Bio Inc. (Takara Holding Company Inc.)

- Lonza Group

- Charles River Laboratories International, Inc.

- Thermo Fisher Scientific Inc.

- PromoCell GmbH

Product Portfolio

- Merck & Co. Inc. delivers innovative pharmaceuticals, vaccines, biologic therapies, and animal health products worldwide. With a legacy of over 130 years, it’s committed to advancing healthcare through cutting-edge research, addressing unmet medical needs, and improving lives globally with a diverse portfolio of high-quality healthcare solutions.

- Agilent Technologies empowers laboratories with advanced instrumentation, software, services, and solutions. From life sciences to chemical analysis, Agilent’s comprehensive portfolio facilitates research, diagnostics, and manufacturing processes worldwide. With a commitment to precision, reliability, and innovation, Agilent accelerates scientific discoveries and enhances productivity across diverse industries.

Key Findings of the Market Report

- Kits & reagents segment dominates the mycoplasma diagnostics market, offering essential tools for accurate detection and diagnosis of mycoplasma infections.

- PCR technology leads the mycoplasma diagnostics market due to its high sensitivity, specificity, and rapid detection capabilities, meeting diagnostic demands effectively.

- Diagnostic laboratories lead the mycoplasma diagnostics market due to their specialized testing capabilities and high demand for accurate diagnostic services.

Mycoplasma Diagnostics Market (Mercado de diagnóstico de micoplasma) Growth Drivers & Trends

- Rising prevalence of mycoplasma infections drives market growth, with increasing awareness and screening initiatives worldwide.

- Technological advancements in diagnostic techniques enhance accuracy and efficiency, fostering market expansion.

- Growing demand for rapid and point-of-care testing solutions accelerates market growth.

- Expansion of biopharmaceutical and biotechnology industries fuels demand for mycoplasma diagnostics in research and production settings.

- Collaborative efforts between healthcare organizations and diagnostic companies drive innovation and market penetration, contributing to sustained growth in mycoplasma diagnostics market.

Global Mycoplasma Diagnostics Market: Regional Profile

- In North America, stringent regulatory standards and a robust healthcare system propel market growth. With a concentration of key players like Thermo Fisher Scientific and Merck KGaA, the region boasts advanced diagnostic technologies and a high adoption rate of molecular diagnostic assays. Increasing research activities and investments in biotechnology further stimulate market expansion.

- Europe, with its sophisticated healthcare infrastructure and emphasis on research and development, emerges as a significant player in the mycoplasma diagnostics market.

- Countries like Germany, Switzerland, and the UK host prominent diagnostic companies such as Roche Diagnostics and Qiagen, driving innovation and market penetration. Supportive government initiatives and collaborations foster advancements in diagnostic methodologies and quality control measures.

- In the Asia Pacific, rapid economic growth, expanding healthcare expenditure, and rising awareness of infectious diseases fuel market growth. Countries like China, Japan, and India witness a surge in demand for diagnostic solutions, driven by increasing biopharmaceutical manufacturing and research activities. The presence of local players and strategic partnerships with global firms enhance market competitiveness and product accessibility in the region.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/mycoplasma-diagnostics-market.html

Mycoplasma Diagnostics Market: Key Segments

By Product

- Kits & Reagents

- Instruments

- Software & Services

By Technology

- PCR

- Immunoassay

- ELISA

- RIA

- DNA Staining

- Microbial Culture Techniques

- Others

By End User

- Hospitals

- Diagnostic Laboratories

- Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

Medical Grade Polyolefin Market (سوق البولي أوليفينات الطبية) is estimated to grow at a CAGR of 6.5% from 2023 to 2031 and reach US$ 5.5 Bn by the end of 2031.

Global Smart Medical Implants Market (スマート医療インプラント市場) Expected to Achieve US$ 24.8 Billion by 2031, with a Compound Annual Growth Rate (CAGR) of 18.1%: TMR Report

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Has Been a Net-Seller of Stocks to the Tune of $132 Billion Since October 2022 — But He Can't Stop Buying These 2 Stocks

For much of the last 60 years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been lapping Wall Street’s major stock indexes with ease.

The “Oracle of Omaha,” as he’s been affably dubbed by the investing community, has overseen an average annual return in his company’s Class A shares (BRK.A) that nearly doubles up the annualized total return of the benchmark S&P 500, including dividends, since the mid-1960s. More recently, he witnessed Berkshire reaching a trillion-dollar valuation, which is a mark only eight U.S.-listed companies have ever achieved.

Even though Warren Buffett is fallible — Berkshire took a sizable loss on its now-disposed stake in media stock Paramount Global earlier this year — his notable outperformance of the broad-market indexes has earned him quite the following from new and tenured investors alike.

But despite being a big proponent of the U.S. economy and long-term investing, Buffett’s buying activity over the last seven quarters has been exceptionally selective.

The Oracle of Omaha has been a big-time net-seller of stocks for seven consecutive quarters

Investors typically wait on the edge of their seats for Berkshire Hathaway’s quarterly Form 13F filing, which provides a detailed picture of which stocks Buffett and his most trusted investment aides, Todd Combs and Ted Weschler, have been buying and selling.

However, Berkshire’s cash flow statements, which can be found in its quarterly operating results, paint the clearest picture of how he and his team feel about stocks.

Beginning in the fourth quarter of 2022 (Oct. 1, 2022) and continuing through June 30, 2024 — a span of seven quarters — Berkshire’s brightest investment minds have been net sellers of stocks:

Cumulatively, Buffett has overseen the sale of almost $132 billion more in stocks than he and his team have purchased since October 2022.

The bulk of this selling activity can be traced to the No. 1 holding in Berkshire’s 45-stock, $308 billion investment portfolio, Apple (NASDAQ: AAPL). Buffett has been a seller of Apple stock in each of the past three quarters, with well over 500 million shares being shown the door.

Although the Oracle of Omaha continues to proclaim Apple is a wonderful company with a solid management team and market-leading share repurchase program, during Berkshire’s annual shareholder meeting, he opined that corporate tax rates were liable to climb from where they stand now. In other words, Buffett sees value in taking profits now and paying a lower tax rate.

We’ve also witnessed sizable selling activity in Berkshire’s former No. 2 holding, Bank of America (NYSE: BAC). Since mid-July, Buffett has disposed of more than 168 million shares of BofA, worth just shy of $7 billion. While this selling may also be tax-related, there’s a possibility it may be in response to the Federal Reserve kicking off a rate-easing cycle. No money-center bank is more interest-sensitive than Bank of America.

But in spite of this persistent selling in two core holdings, there are two stocks Warren Buffett simply can’t stop buying.

Occidental Petroleum

The first stock the Oracle of Omaha has been buying with consistency since the beginning of 2022 is oil and gas goliath Occidental Petroleum (NYSE: OXY). This “indefinite holding” has grown into an almost 255.3-million-share stake worth $13.3 billion in market value, as of the closing bell on Sept. 9.

The most logical reason for Buffett to pile into Occidental’s stock is the belief that the spot price for crude oil will remain elevated, or perhaps head even higher than it is now. Following three years of reduced capital spending by global energy companies during the COVID-19 pandemic’s height, crude oil supply remains largely constrained. When in-demand energy commodities are in short supply, it usually has a positive effect on price.

Though a higher spot price for crude oil is good news for all drilling companies, it’s particularly important for Occidental Petroleum. Occidental generates the lion’s share of its revenue from its high-margin drilling segment, which suggests that a higher spot price for oil can disproportionately benefit its operating cash flow, compared to its peers.

Buffett likely also appreciates the integrated nature of Occidental’s operating model. While it does bring in most of its revenue from drilling, its downstream chemical operations serve as a partial hedge in the event that the spot price of crude oil declines. When the price of oil falls, it lowers input costs for petrochemical operations, and generally increases demand for downstream-related products.

Occidental has meaningfully improved its balance sheet, too. Since acquiring Anadarko for $55 billion in 2019, it’s nearly halved its net debt to $18.39 billion, as of June 30. While there’s still work to be done to improve Occidental’s financial flexibility, a higher spot price for crude oil has certainly loosened the belt a bit.

Berkshire Hathaway

The other stock Warren Buffett can’t stop buying, despite being exceptionally selective with his purchasing activity of late, is (drum roll) shares of his own company!

Prior to mid-July 2018, the Oracle of Omaha and his right-hand man Charlie Munger (Munger passed away in November 2023 at the age of 99) were only allowed to repurchase Berkshire Hathaway’s stock if it fell to or below 120% of book value — no more than a 20% premium to book value, as of the most recent quarter. Unfortunately, shares never fell to or below this threshold, leading to no buybacks.

On July 17, 2018, Berkshire’s board amended the criteria governing share repurchases to allow Buffett and Munger more freedom to buy back their company’s stock. As long as Berkshire has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet, and Buffett believes shares are intrinsically cheap, repurchases can be made with no ceiling or end date.

Over the last six years, Buffett has overseen 24 consecutive quarters of buyback activity totaling almost $78 billion.

Since Berkshire Hathaway doesn’t pay a dividend, buybacks are the direct way Buffett rewards his shareholders. Reducing Berkshire’s outstanding share count is incrementally increasing the ownership stakes of the company’s investors, as well as encouraging the long-term ethos that Charlie Munger instilled in his four-plus decades at the company.

The other benefit of share repurchases is that, for businesses like Berkshire that have steady or growing net income (sans unrealized investment gains/losses), they often increase earnings per share (EPS). With almost $277 billion in available cash, Warren Buffett is strongly incented to continue buying shares of his own company.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett Has Been a Net-Seller of Stocks to the Tune of $132 Billion Since October 2022 — But He Can’t Stop Buying These 2 Stocks was originally published by The Motley Fool

REALTY ONE GROUP INTERNATIONAL'S PRESIDENT, CORY VASQUEZ, TAKES REINS IN NEW ERA OF GROWTH

Network of Raving Fans Fuels the Opening of New Realty ONE Group Locations Around the World

LAGUNA NIGUEL, Calif., Sept. 12, 2024 /PRNewswire/ — Realty ONE Group International, a modern, purpose-driven lifestyle brand and ONE of the fastest-growing franchisors in the world, is ambitiously entering a new era of growth pioneered by a dream team of leaders, including its new president, Cory Vasquez.

The UNBrokerage, as it’s known in real estate, just surpassed 20,000 real estate professionals worldwide as the brand’s popularity continues to soar because of its 100% commission model and comprehensive offering of business coaching, support, tools and marketing.

“We know we have the model of now and of the future and for so many Brokers who are nervous and uncertain, this is an easy plug-and-play to take their office and their real estate professionals to the next level,“ said Kuba Jewgieniew, CEO and Founder of Realty ONE Group International. “I’m proud of how this executive team, with Cory as our new President, is leading with calm and cleverly innovating new ways to keep growing the brand so we can help more people achieve greater success faster.”

Vasquez and industry legend Vinnie Tracey have been Co-Presidents for the last few months until Tracey’s official retirement this week. Tracey will remain an advisor to the thriving brand who recently welcomed 1,200 real estate professionals across ten branches in Florida last month. The conversion of ONE of the country’s top independent brokerages is proof that more entrepreneurs see Realty ONE Group as the model of the future.

Vasquez has almost thirty years of marketing, communications and management experience, nearly two decades of which are in real estate.

Realty ONE Group International claimed the No. 1 spot for real estate franchisors for the third year in a row on Entrepreneur’s highly competitive 2024 Franchise 500® list. The only modern, lifestyle brand in the industry now has more than 20,000 real estate professionals in more than 450 locations in 49 U.S. states, Washington D.C. and 20 more countries and territories.

Learn more at www.OwnAOne.com.

About Realty ONE Group International

Realty ONE Group International is one of the fastest growing, modern, purpose-driven lifestyle brands in real estate whose ONE Purpose is to open doors across the globe – ONE home, ONE dream, ONE life at a time. The organization has rapidly grown to more than 20,000 real estate professionals in over 450 locations across 20 countries and territories because of its proven business model, full-service brokerages, dynamic COOLTURE, superior business coaching through ONE University, outstanding support and its proprietary technology, zONE. Realty ONE Group International has been named the number ONE real estate brand by Entrepreneur Magazine for three consecutive years and continues to surge ahead, opening doors, not only for its clients but for real estate professionals and franchise owners. To learn more, visit www.RealtyONEGroup.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/realty-one-group-internationals-president-cory-vasquez-takes-reins-in-new-era-of-growth-302247003.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/realty-one-group-internationals-president-cory-vasquez-takes-reins-in-new-era-of-growth-302247003.html

SOURCE Realty ONE Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mission Produce Recent Insider Activity

Bryan E Giles, Chief Financial Officer at Mission Produce AVO, executed a substantial insider sell on September 12, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Giles sold 4,458 shares of Mission Produce. The total transaction amounted to $58,845.

The latest update on Friday morning shows Mission Produce shares down by 0.49%, trading at $13.19.

Unveiling the Story Behind Mission Produce

Mission Produce Inc is engaged in the business of producing and distributing avocados, serving retail, wholesale, and food service customers. Also, the company provides additional services like ripening, bagging, custom packing, and logistical management. The company’s operating segments include Marketing and Distribution and International Farming and Blueberries. It generates maximum revenue from the Marketing and Distribution segment. The Marketing and Distribution segment sources fruit mainly from growers and then distributes fruit through a distribution network.

Unraveling the Financial Story of Mission Produce

Revenue Growth: Mission Produce displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 23.95%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 11.42%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Mission Produce’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.17.

Debt Management: With a below-average debt-to-equity ratio of 0.45, Mission Produce adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 40.15 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.83 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Mission Produce’s EV/EBITDA ratio, surpassing industry averages at 12.88, positions it with an above-average valuation in the market.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Mission Produce’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Activity Update: Linda Marsh Executes Options Exercise, Resulting In $399K At Astrana Health

A substantial insider activity was disclosed on September 12, as Marsh, Director at Astrana Health ASTH, reported the exercise of a large sell of company stock options.

What Happened: A notable Form 4 filing on Thursday with the U.S. Securities and Exchange Commission revealed that Marsh, Director at Astrana Health, exercised stock options for 11,000 shares of ASTH, resulting in a transaction value of $399,520.

As of Friday morning, Astrana Health shares are down by 0.0%, with a current price of $51.67. This implies that Marsh’s 11,000 shares have a value of $399,520.

About Astrana Health

Astrana Health Inc is a patient-centered, physician-centric integrated population health management company. The company is working to provide coordinated, outcomes-based medical care cost-effectively. It is focused on physicians providing high-quality medical care, population health management, and care coordination for patients, particularly senior patients and patients with multiple chronic conditions. Its operating segment is the healthcare delivery segment.

Key Indicators: Astrana Health’s Financial Health

Revenue Growth: Astrana Health’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 39.65%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 15.11%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Astrana Health’s EPS reflects a decline, falling below the industry average with a current EPS of 0.4.

Debt Management: With a below-average debt-to-equity ratio of 0.7, Astrana Health adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 35.8, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.54 is lower than the industry average, implying a discounted valuation for Astrana Health’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 17.61, Astrana Health presents an attractive value opportunity.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Astrana Health’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can QGEN Stock Gain From the Expanded Bio-Manguinhos/Fiocruz Alliance?

QIAGEN N.V. QGEN announced the expansion of its strategic partnership with Bio-Manguinhos/Fiocruz, a leading vaccines and diagnostics supplier to the Brazilian Ministry of Health. Initiated in 2009, the expanded collaboration allows Bio-Manguinhos to launch an advanced PCR (Polymerase Chain Reaction)-based molecular screening platform to detect malaria alongside HIV, hepatitis B and C virus, a capability previously unavailable in Brazil’s blood donation program. The recent development will also support epidemiological surveillance of Brazil’s ongoing dengue epidemic by composing dengue molecular kits based on unique collaborative chemistry.

Following the news, shares of QGEN declined 0.6% to $45.57 at yesterday’s close. However, the company is accelerating the introduction of cutting-edge products and capabilities to the market through tailored OEM (Original Equipment Manufacturer) offerings and extensive support for companies in the life sciences research, biotechnology and diagnostics sectors. Hence, we expect the market sentiment to remain positive around this news.

More on QIAGEN’s Expanded Collaboration

Brazil’s national blood screening program was launched in 2010, the largest blood donation safety initiative in its history. The advanced Brazilian Nucleic Acid Test (NAT Plus) platform, which utilizes QIAGEN’s PCR reagents, was recently rolled out as part of the program. The latest advancement improves transfusional safety by detecting malaria and closing the “diagnostic window” between the time of infection and laboratory diagnosis. Since 2009, QIAGEN and Bio-Manguinhos have been partnering to equip the national blood screening program with advanced molecular testing solutions.

Image Source: Zacks Investment Research

Presently, the NAT Plus platform is operational in 30 laboratories and is critical to safeguarding blood supplies in regions where these diseases are not endemic. It supports health surveillance within the blood transfusion system, engaging over 300 trained professionals across 14 chemotherapy centers and processing 3.5 million samples annually. QIAGEN will supply critical molecular biology technologies, custom solutions and comprehensive training to facilitate Brazil’s public health initiative. Under the terms of this agreement, the company’s solutions will be included in the screening kits and private labeled under the Bio-Manguinhos’ brand.

The collaboration also emphasizes the pivotal role of QIAGEN’s Strategic Partnerships and OEM Division, supporting more than 400 partners globally.

Industry Prospects Favoring QGEN

A report from the SkyQuest Technology Group valued the global PCR molecular diagnostics market at $17.8 billion in 2021, forecasted to witness a compound annual growth rate of 12.8% through 2030. The market is a fast-growing sector, driven by the need for accurate and timely diagnostic testing. The rising incidences of infectious diseases, genetic disorders and cancer create a substantial market opportunity for PCR molecular diagnostics. Furthermore, the growing awareness and adoption of precision medicine approaches further contribute to the market’s potential for targeted therapies and personalized treatment regimens.

QIAGEN’s Recent Developments

Last week, QIAGEN teamed up with Eli Lilly and Company to support the development of a QIAstat-Dx in-vitro diagnostic to detect APOE (apolipoprotein E) genotypes in the diagnosis of Alzheimer’s disease. The panel will be integrated with QIAGEN’s multiplex testing platform QIAstat-Dx, marking the first publicly disclosed collaboration for a clinical application of the system in neurodegenerative diseases and adding to two more collaborations for diagnostics development programs with other companies.

QGEN’s Price Performance

In the past year, QGEN shares have gained 6% against the industry’s 2.2% fall.

QGEN’s Zacks Rank and Key Picks

QIAGEN currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Boston Scientific BSX, AxoGen AXGN and SiBone SIBN, each carrying a Zacks Rank #2 (Buy) at present.

Boston Scientific’s shares have gained 58.4% in the past year. Estimates for the company’s earnings per share have remained constant at $2.40 in 2024 and $2.71 in 2025 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.2%. In the last reported quarter, it posted an earnings surprise of 6.9%.

Estimates for AxoGen’s 2024 loss per share have remained constant at 1 cent in the past 30 days. Shares of the company have surged 145% in the past year compared with the industry’s growth of 15.5%. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.5%. In the last reported quarter, it delivered an earnings surprise of 200%.

Estimates for SiBone’s 2024 loss per share have remained constant at 89 cents in the past 30 days. Shares of the company have dropped 30.4% in the past year against the industry’s 15.5% growth. SIBN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.4%. In the last reported quarter, it delivered an earnings surprise of 15.4%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Medical Properties Trust's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Medical Properties Trust. Our analysis of options history for Medical Properties Trust MPW revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $85,830, and 6 were calls, valued at $631,265.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $2.5 and $12.0 for Medical Properties Trust, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Medical Properties Trust options trades today is 7186.71 with a total volume of 6,717.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Medical Properties Trust’s big money trades within a strike price range of $2.5 to $12.0 over the last 30 days.

Medical Properties Trust Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPW | CALL | TRADE | BULLISH | 12/20/24 | $4.0 | $3.7 | $3.9 | $2.50 | $195.0K | 0 | 0 |

| MPW | CALL | TRADE | BEARISH | 12/20/24 | $3.85 | $3.8 | $3.8 | $2.50 | $190.0K | 0 | 1.0K |

| MPW | CALL | SWEEP | BULLISH | 10/18/24 | $0.5 | $0.48 | $0.5 | $6.00 | $140.4K | 26.3K | 3.2K |

| MPW | PUT | SWEEP | BEARISH | 01/17/25 | $0.38 | $0.26 | $0.38 | $4.50 | $49.5K | 5.5K | 1.3K |

| MPW | PUT | TRADE | BEARISH | 01/17/25 | $6.05 | $5.35 | $6.05 | $12.00 | $36.3K | 156 | 60 |

About Medical Properties Trust

Medical Properties Trust Inc is a healthcare facility REIT. The company operates one segment, which owns and leases healthcare facilities. The vast majority of Medical’s revenue is generated in the United States, followed by Germany and the United Kingdom. It provides financing for a variety of facilities that require funds for acquisitions, sale-leasebacks, new developments, and expansion projects.

Having examined the options trading patterns of Medical Properties Trust, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Medical Properties Trust Standing Right Now?

- With a volume of 16,890,197, the price of MPW is up 11.61% at $6.25.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 41 days.

Expert Opinions on Medical Properties Trust

In the last month, 2 experts released ratings on this stock with an average target price of $6.25.

- In a positive move, an analyst from Colliers Securities has upgraded their rating to Buy and adjusted the price target to $6.

- An analyst from Truist Securities has decided to maintain their Hold rating on Medical Properties Trust, which currently sits at a price target of $6.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Medical Properties Trust with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biscuit Market is projected to experience significant growth, with an anticipated CAGR of 5.1% by the year 2032, reaching a valuation of USD 158.5 billion | States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 13, 2024 (GLOBE NEWSWIRE) — Global biscuit industry (비스킷 산업) revenues reached US$ 101.3 billion by 2023. A CAGR of 5.1% is estimated from 2024 to 2032 for the industry to reach US$ 158.5 billion. The industry is expected to grow as convenience food consumption increases, including biscuit consumption. Lifestyles that are busy and the need to maintain a healthy diet on the go have contributed to this trend.

With the growing popularity of premium biscuits, the market is anticipated to grow exponentially, driven by the emergence of new growth opportunities. Biscuit options with innovative, indulgent, and high-quality ingredients are more likely to be purchased by consumers.

Health and wellness are also expected to have an impact on the future of the biscuit market. In addition to highlighting nutritional qualities, brands are expected to market biscuits made with healthy ingredients.

Younger generations have a crucial role in maintaining the biscuit-baking tradition for the industry’s future. A biscuit-baking legacy becomes increasingly important as the elderly population ages.

In addition to continual product innovation, the future of the biscuits market will also be shaped by continuing product innovation. Among other things, manufacturers will likely introduce different types of flavors, packaging formats, and packaging variants to cater to the changing preferences of consumers.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/biscuits-market.html

Key Findings of the Market Report

- A growing health consciousness among consumers is likely to drive biscuit demand.

- In 2024, Asia Pacific will capture the largest global market share.

- Oats’ popularity and health benefits are expected to increase biscuit sales.

- Consumers increasingly choose pouches/packets packaging due to their convenience and portability.

- Based on distribution channels, the market for biscuits is likely to be dominated by hypermarkets/supermarkets.

Global Biscuits Market: Growth Drivers

- Changes in consumer preferences and lifestyles contribute to the demand for biscuits. On-the-go snacks like biscuits are becoming more popular with consumers. Consumers are becoming increasingly aware of health and wellness, which has led to a growing demand for healthier biscuits. As part of the program, there are biscuits with nutrients, low sugar content, and other health benefits for the users.

- Biscuit manufacturers are continuously innovating products to drive the market’s growth. The food industry continues introducing new flavors, varieties, and packaging formats to attract consumers’ attention and meet their evolving needs.

- In addition to supermarkets and hypermarkets, convenience stores, retail online stores, and other outlets, biscuits have been widely distributed in various channels, contributing to the growth of the biscuit market. As a result of this extensive distribution network, consumers can access the product easily.

- Biscuit sales have been positively affected by the increase in food consumption per capita, particularly in developing countries. Consumption of food products, including biscuits, has increased as disposable incomes increase.

Global Biscuits Market: Regional Landscape

- Biscuit consumption is largely centered in Asia Pacific. Several prominent biscuit producers and innovative small-scale bakers have contributed to expanding the biscuit market in the Asia Pacific. New tastes, variations, and packages are born from this competition and result in the release of new products.

- Sweet biscuits dominate the market for biscuits in Asia Pacific. In addition to being renowned for their increased sweetness, these biscuits can contain nuts, fruits, or bakery chips. In addition to being a popular breakfast option, they can also be enjoyed at any time.

- A growing demand for healthier biscuits in Asia Pacific is despite sweet biscuits dominating the market. Consumers are increasingly aware of the importance of nutrition and wellness, making healthy biscuits and low-sugar ones more popular.

Global Biscuits Market (Keksmarkt): Competitive Landscape

Consumer demands are helping leading companies launch new products to boost their product portfolios. Efforts are being made to implement business growth strategies to improve the company’s overall performance and increase its global presence. For customers to be attracted to biscuits, manufacturers offer a variety of flavors and invest in attractive packaging.

Key Players

- Britannia Industries Limited

- Lotus Bakeries NV Company

- Mondelez International, Inc.

- ITC Limited

- Campbell Soup

- Kraft Foods Group, Inc.

- Nestle SA

- The Kellogg Company

- National Biscuit Industries LTD SAOG

- Dali Food Group Co, Ltd.

- Brutons Biscuit Company

- The Hershey Company

- United Biscuits Company

- Kambly SA

- Others

Key Developments

- In January 2023, Lotus Bakeries, a Belgian biscuit maker, acquired Iqbar, an American maker of better-for-you bars. The investment comes as part of an undisclosed Series B funding round.

- In March 2024, Britannia Industries Ltd, an Indian biscuit maker, plans to enter high-margin chocolate, fresh dairy, and salty snack categories to bolster its portfolio further. An aggressive go-to-market strategy based on data-driven strategies is being developed by the maker of Marie Gold and Good Day biscuit brands in cooperation with Bain & Co.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/biscuits-market.html

Global Biscuits Market: Segmentation

Product Type

- Sweet Biscuits

- Savory

- Crackers

- Filled/Coated

- Wafers

- Others

Source Type

Flavor Type

- Plain

- Chocolate

- Sour Cream, Cheese, and Spiced

- Fruits and Nuts

- Others

Packaging

- Pouches/Packets

- Jars

- Boxes

- Peelpaq

- Others

Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia

- Oceania

- Middle East & Africa

More Trending Reports by Transparency Market Research –

Spring Water Market (Mercado de agua de manantial) – The global spring water market is anticipated to garner a revenue of US$ 497.37 Bn and rise at a CAGR of 8.3% during the estimated period from 2022 to 2032.

Vegan Chocolate Market (سوق الشوكولاتة النباتية) – The global vegan chocolate market was valued at US$ 532.7 Mn in 2022. It is estimated to grow at a CAGR of 10.5% from 2022 to 2032. The global vegan chocolate market is expected to reach US$ 1444.7 Mn by the end of 2032.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'No huge surprises': Why Apple stock hasn't moved much on iPhone 16 news

Apple’s artificial intelligence offering, Apple Intelligence, was the star of its annual iPhone event on Monday.

But for investors, the slow rollout of Apple Intelligence could pose a problem. While Apple’s iPhone 16 hits stores on Sept. 20, the software update required for Apple Intelligence won’t be available for US English users until October.

The disconnect between the hardware and software may have been one reason why Apple stock didn’t move much on the news. Shares of the iPhone maker were down by about 0.9% during the company’s “Glowtime” presentation in Cupertino, Calif., and they were up less than 1% over the three days since the event.

“No huge surprises,” Goldman Sachs senior equity research analyst Michael Ng told Yahoo Finance about the Apple iPhone unveiling. “I think it was straight down the fairway,” he said at the Goldman Sachs Communacopia and Technology Conference on Tuesday.

Ng, who has a Buy rating on Apple, said he’s “constructive” on the stock and that its performance is par for the course on iPhone rollout days.

His team estimated that Apple stock has historically underperformed the S&P 500 (^GSPC) by 70 basis points on launch days. On Monday, that underperformance hit 100 basis points, which Ng said was “mostly in line with historic events.”

Apple stock tends to perform better a month or even two months out from launch days. Last year, shares of Apple were off by 1% a day after the iPhone 15 was announced. 60 days later, the stock was up 6%, according to Bank of America data. In 2019, shares were up 3% the day after Apple revealed the iPhone 11 and gained 20% over the next two months.

“We think that there’s an underappreciated uplift in their normalized earnings power as more people start to upgrade their iPhones,” Ng said.

An upgrade cycle sooner or later?

The big question for Apple and its shareholders is whether AI will be enough to drive consumers to upgrade their smartphones.

“There’s a tremendous amount of debate about whether or not AI is going to be that demand driver,” Ng said. “I certainly believe that it is.”

Ng noted that investors have estimated an iPhone sell-through rate of about 225 million to 230 million units for the year. With some of the new features added, Ng’s team sees a run rate closer to 250 million to 260 million units.

Those estimates are driven not just by Apple Intelligence software but also by hardware changes to the phone itself.

“We’re going to see several different form factor changes over the next several years,” Ng said. “The iPhone 16 Pro and Pro Max have larger screen sizes than the iPhone 15, and the rumors for the next couple of years are that the iPhone 17 will be a thinner device [and] the iPhone 18 has the potential to be a foldable.”

Others think Apple’s upgrade cycle may take longer to play out as Apple develops its AI capabilities.

“I just think there’s no compelling reason that somebody should run out and buy a new iPhone 16,” Needham analyst Laura Martin told Yahoo Finance. “You should wait for the [iPhone] 17 because it’s going to have … cooler stuff and there will be more gen. AI capability.”

Apple stock’s performance is currently in line with the Nasdaq year to date. Two-thirds of Wall Street analysts have a Buy rating on the stock.

Read more coverage of the 2024 Goldman Sachs Communacopia and technology conference:

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Huawei Might Be Giving Apple A Run For Its Money In China, But Replacing The Tri-fold's Screen Could Cost You An iPhone Worth Of Cash

Huawei Technologies Co.’s Mate XT Ultimate Design might be challenging Apple Inc. AAPL in China, but its screen replacement could ironically set you back as much as a brand-new iPhone.

What Happened: China’s top smartphone maker Huawei has unveiled the cost of replacement parts for its dual-hinged, triple-screen folding phone.

The tri-fold phone which retails at around $2,809, could see owners shelling out an additional 7,999 yuan (about $1,125) for a replacement OLED panel if the folding screen incurs significant damage.

“This price is the preferential price that consumers can enjoy after choosing to recycle the old screen for free. If you do not accept the free recycling of the old screen, you need to pay 9,799 yuan,” the company stated.

The 9,799 yuan was around $1,378, at the time of writing.

Huawei does offer some cost-saving alternatives for screen repairs. A refurbished replacement screen is slightly cheaper at 6,999 yuan which is around $983.

Moreover, the company provides screen replacement insurance plans starting from 3,499 yuan (about $492) for a single screen replacement within the first year of purchase.

The screen replacement update was first noticed by The Verge.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The Mate XT Ultimate Design was launched by Huawei as a direct competitor to Apple’s iPhone 16 series.

The trifold phone, priced significantly higher than the iPhone 16 Pro Max’s $1,199 for 256 GB storage, marked Huawei’s intensified efforts to challenge Apple’s smartphone dominance.

The Mate XT, available in red and black, attracted 1.3 million orders within seven hours of opening reservations.

Meanwhile, the iPhone 16 series launch has disappointed many users in China due to its lack of AI features. The hashtag “iPhone 16 Chinese version doesn’t support AI yet” was trending on China’s social media platform Weibo after the tech giant’s “Glowtime” event.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.