'Do You Want To Look Inside? No, I'll Take It' – Shaq Bought A House On The Spot Because It Was Right Across From Paula Abdul's

When Shaquille O’Neal was searching for a home in Los Angeles after joining the Lakers, he made one of the most impulsive real estate decisions ever. Instead of spending time checking out the house’s details, Shaq was sold by one piece of information: it was right across the street from pop star Paula Abdul’s house.

Don’t Miss:

In an interview, Shaq recounted how it all went down. He was house hunting in L.A., and while he wasn’t particularly impressed with the home he was looking at, the real estate agent mentioned something that sealed the deal instantly. “Paula Abdul lives across the street,” the agent said. Without a second thought, Shaq responded, “I’ll take it!” He didn’t even bother to look inside before making his decision.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

At the time, Paula Abdul, a former Laker Girl turned pop sensation, was one of the biggest names in entertainment. She and Shaq shared the same business manager and were friends. But despite Shaq’s admitted admiration, they never dated. Instead, they became friendly neighbors.

Paula has fun memories of living across the street from the NBA legend. She joked about how Shaq’s many cars took up all the space on the street, sometimes forcing her to move them just to get out of her own driveway. She even had to stand on her tiptoes to drive his massive vehicles.

See Also: These five entrepreneurs are worth $223 billion –they all believe in one platform that offers a 7-9% target yield with monthly dividends

“I didn’t know [he] came with like 18 billion cars,” she recalled. “I had to get the keypad code, so I could go and get his car keys and move his cars,” she continued.

His pet turtles also frequently escaped and wandered into her yard. They’d end up in her koi pond, and “his mom Lucille would come and visit, she’d be chasing them with a frying pan outside yelling at him.”

But one of the most memorable moments came on New Year’s Eve, when Shaq showed up at Paula’s house in a flashy pink pinstripe suit, complete with a matching hat. He hoisted her over his shoulder and brought her to his party, even though she was still in sweats. Knowing Shaq’s infamous midnight tradition – mooning everyone at the party – Paula cleverly hid under the dining room table to avoid being part of his antics.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

While their time as neighbors brought plenty of laughs and entertaining stories, it’s clear that Shaq’s decision to buy a house simply because it was near Paula Abdul is one for the books. Sometimes, when you know, you just know – even if you haven’t stepped inside yet!

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Director Of Daktronics Makes $84K Buy

A new SEC filing reveals that Kevin P. McDermott, Director at Daktronics DAKT, made a notable insider purchase on September 11,.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday unveiled that McDermott made a notable purchase of 7,160 shares of Daktronics, valuing at $84,989.

As of Thursday morning, Daktronics shares are up by 0.9%, currently priced at $12.3.

All You Need to Know About Daktronics

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Daktronics: Delving into Financials

Decline in Revenue: Over the 3 months period, Daktronics faced challenges, resulting in a decline of approximately -2.77% in revenue growth as of 31 July, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 26.4%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Daktronics’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -0.11.

Debt Management: Daktronics’s debt-to-equity ratio is below the industry average. With a ratio of 0.32, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 58.05, Daktronics’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.7, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 6.15, Daktronics could be considered undervalued.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Magnificent S&P 500 Dividend Stocks Down 45% to Buy and Hold Forever

There are a few things that United Parcel Service (NYSE: UPS), Walt Disney (NYSE: DIS), and Ford Motor Company (NYSE: F) have in common. They are Wall Street juggernauts, components of the S&P 500. The stocks all pay a dividend; two of the three currently top a 5% yield.

They’re also out of favor. UPS, Disney, and Ford are trading 22%, 28%, and 29% below their 52-week highs. Stretch out the timeline, and the three stocks are trading 45% to 60% below their all-time highs set in either 2021 or 2022. This isn’t a problem. It’s an opportunity. Let’s dive into why these are three great dividend-paying S&P 500 stocks that you can hold for the long haul.

1. United Parcel Service

Brown has been more black and blue lately. The provider of parcel delivery and supply chain solutions saw its revenue slide 9% to $91 billion last year. Profitability took an even bigger hit.

The near-term challenges are real. Striking a five-year deal with the UPS Teamsters union last summer locks its workforce in place through mid-2028, but it comes at the expense of a margin-gnawing spike in labor costs over the past year. The increases will continue through the next four years, but it will be more manageable.

It’s no fun when an income statement is burning at both ends, and this could be particularly problematic for income investors. UPS has increased its quarterly distributions for 15 consecutive years. The rising payouts and shrinking share price find the shares yielding 5% right now. Is this sustainable if business continues to contract as expenses keep expanding?

This doesn’t have to be an accordion of cacophony. UPS rolled out layoffs earlier this week after a much larger sea of pink slips earlier this year. Analysts see a return to revenue growth in the second half of this year, followed by a bottom-line recovery in 2025. If they’re right, UPS will have wiggle room to keep its streak of dividend hikes coming. You can also pick up UPS at a reasonable 14 times next year’s projected earnings.

2. Disney

Another household name with an attractively depressed share price is Disney. The media stock is moving lower for the sixth consecutive month. You can buy Disney for less than 19 times forward earnings.

There are a lot of things going well for the company, despite its stock chart going the other way. Disney returned to box office dominance this summer with the world’s two highest-grossing films of 2024, and it has two movies coming out over the holidays that should fare even better. Disney+ is finally profitable. There are some near-term hiccups at its theme parks and a more long-lasting problem with its legacy media networks, but the sum of all of these mouse parts points to healthy growth in the near future.

Disney’s current yield of 1% is much lower than the other names on this list, but the entertainment bellwether did boost its semiannual distributions by 50% earlier this year. The bullish play here will still be in the form of capital appreciation over dividend checks.

3. Ford

The highest yield and lowest earnings multiple on the list belongs to Ford, but let’s start with a brake check. Growth has slowed to single-digit upticks at the automaker for three consecutive quarters. Trading at a P/E ratio of 11 sounds great until you realize that it’s based on its market cap of $42 billion. Ford’s enterprise value is $168 billion once you consider its debt.

The car market is cyclical, and Ford is struggling to get the balance right between its electric vehicles and its more traditional rides. The current 5.7% yield will reward patient investors, but the hefty disbursements are at the mercy of Ford stepping on the accelerator again and controlling costs. Analysts see flat revenue and earnings growth for Ford next year, and we know how drivers feel about flats. The bullish catalyst here is that falling interest rates could spur fresh interest in big-ticket purchases. Aren’t you due for a new car? Ford hopes that you turn to the iconic car manufacturer.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Rick Munarriz has positions in Walt Disney. The Motley Fool has positions in and recommends Walt Disney. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

3 Magnificent S&P 500 Dividend Stocks Down 45% to Buy and Hold Forever was originally published by The Motley Fool

Gold Miners Eye Best 1-Day Rally In 6 Months As Gold Hits Fresh Record Highs: 'Today's Environment Closely Resembles The 1970s'

Gold mining stocks, as tracked by the VanEck Gold Miners ETF GDX, are enjoying a stellar rally, rising 4.3% by 11 a.m. ET, on track for its largest one-day gain since early March.

The rally in miners was driven by a surge in gold prices, which jumped 1.6% to reach an all-time high of over $2,550 per ounce on Thursday, fueled by economic data and central bank interest rate decisions.

In the U.S., the latest producer inflation report for August showed mixed results. Both the headline and core Producer Price Index (PPI) exceeded monthly expectations, but on an annual basis, they fell short.

The European Central Bank (ECB) reduced its deposit facility rate by 25 basis points, bringing it to 3.5%. The ECB noted it is “appropriate to take another step in moderating the degree of monetary policy restriction.”

This move has increased demand for gold as a safe-haven asset amid lower interest rates in Europe and expectations for a similar 25-basis-point drop in the U.S. fed funds rate next week.

Otavio Costa, macro strategist at Crescat Capital, highlighted that Barrick Gold Corp. GOLD, the second-largest gold miner globally, has reported its lowest annual gold production in more than 20 years.

“From this perspective, today’s environment closely resembles the 1970s,” Costa wrote in a post on social media platform X.

Back then low gold prices led major mining companies to shift their focus to other metals, just before gold experienced one of the most significant bull runs in history.

Today, miners are once again diversifying into base metals, not due to low gold prices, but to capitalize on the growing demand for materials critical to electrification, like copper.

However, this time the shift isn’t driven by low prices, but by a strategic move to increase exposure to base metals like copper, which are crucial for electrification and have attracted institutional capital.

Costa argues that neglect of gold, in favor of base metals, is a potential opportunity. With fewer companies exploring and developing new gold projects, he sees several pathways for gold prices to rise, making gold-only investments particularly attractive.

However, Costa sees the limited supply as a bullish catalyst for gold, stating, “I believe it’s time to be greedy when others are being fearful.”

| NAME | % RETURN (1-DAY) |

| Coeur Mining, Inc. CDE | 14.52 |

| B2Gold Corp. BTG | 10.04 |

| First Majestic Silver Corp. AG | 9.96 |

| Endeavour Silver Corp. EXK | 9.94 |

| Equinox Gold Corp. EQX | 8.09 |

| OceanaGold Corporation OGC | 7.18 |

| New Gold Inc. NGD | 7.01 |

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meta, Snap, And TikTok Come Together To Combat Suicide And Self-Harm Content Online: Will Share 'Signals'

Meta Platforms, Inc. META, Snap Inc. SNAP, and ByteDance-owned TikTok have announced a joint initiative to combat the spread of suicide and self-harm content online.

What Happened: On Thursday, the tech giants launched a new program named Thrive, aimed at halting the dissemination of graphic content that depicts or encourages self-harm and suicide.

Thrive allows them to exchange “signals” to notify each other about such content on their platforms.

The Mental Health Coalition, a charity organization committed to destigmatizing mental health discussions, has partnered with the three companies to develop this initiative.

According to a blog post shared by Meta, the tech giant has already taken steps to make such content less accessible on its platform. “Between April and June this year, we took action on over 12 million pieces of suicide and self-harm content on Facebook and Instagram.:

However, it aims to maintain a space for users to share their experiences with mental health, suicide, and self-harm, provided they do not promote or provide graphic descriptions of these issues.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: This initiative comes in the wake of increasing concerns about the safety of social media platforms for young users. Last year in November, a Meta whistleblower raised alarms about the safety of Instagram for teenagers.

Similarly, in January 2024, the Attorney General of Iowa initiated a lawsuit against TikTok, accusing the platform of misleading parents about the extent of inappropriate content accessible to young users.

Earlier this year in June, the Los Angeles Board of Education voted to limit phone usage among students during the school day, reflecting growing concerns about the impact of digital content on young minds.

In September, YouTube, owned by Alphabet Inc., also restricted access to certain health and fitness videos for teenagers to protect them from developing negative self-perceptions.

Photo Courtesy: Shutterstock.com

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gartner EVP Sold $246K In Company Stock

Making a noteworthy insider sell on September 11, Akhil Jain, EVP at Gartner IT, is reported in the latest SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday outlined that Jain executed a sale of 500 shares of Gartner with a total value of $246,000.

Tracking the Thursday’s morning session, Gartner shares are trading at $499.77, showing a down of 0.0%.

Get to Know Gartner Better

Based in Stamford, Conn., Gartner provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Breaking Down Gartner’s Financial Performance

Revenue Growth: Gartner’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 6.11%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 67.82%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 2.95, Gartner showcases strong earnings per share.

Debt Management: Gartner’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 4.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 47.55 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 6.51 is above industry norms, reflecting an elevated valuation for Gartner’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 29.17, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BMTC GROUP INC. ANNOUNCES FINANCIAL RESULTS FOR THE SEMESTER ENDED JULY 31st, 2024.

MONTRÉAL, Sept. 12, 2024 /CNW/ –

Results

For the six month period ended July 31, 2024, the Company’s revenues increased by $2,361,000 to $306,538,000 compared to $304,177,000 recorded for the corresponding period of 2023, an increase of 0.8%. Of this increase, $1,607,000 comes from investment property income from the new real estate division. Therefore, the retail operation revenues of the Tanguay division increased by 0.2%. Same-store-sales increased by 2.2% for the six month period ended July 31, 2024. Net earnings for the six month period ended July 31 ended April 30, 2024, amounted to $20,925,000 compared to $41,380,000 recorded for the corresponding period of 2023. Basic net earnings per share amounted to $0.64 compared to $1.25 recorded for the corresponding period of 2023. During the corresponding period of 2023, the Company proceeded with the sale of its Montreal distribution center resulting in an after-tax gain of $50,962,000 or $1.54 per basic share, which explains the significant difference in the Company’s net income for the current year. The operating earnings at the end of the first quarter of 2024 partly reflect the impact of the synergies created following the operational and commercial reorganization carried out in May 2023 with its Tanguay division and should have a greater effect on the yearly financial results of January 31, 2025.

For the six month period ended July 31, 2024, the share repurchase program contributed to an increase of $0.01 on basic net earnings per share. As for the corresponding period of 2023, the share repurchase program had no impact on basic net earnings per share.

During the period ended July 31, 2024, the Company disposed of fixed assets in the amount of $6,948,000, resulting in an after-tax gain of $5,459,000, or $0.17 per basic share. This amount includes an after-tax gain of $2,097,000, or $0.06 per basic share, received as an additional settlement obtained by winning the case relating to the expropriation of the former Kirkland store by the Réseau express métropolitain (REM) in 2019. Finally, this amount also includes the sale of its Trois-Rivières store for an amount of $4,500,000, resulting in after-tax gain of $3,362,000, or $0.01 per basic share.

During the corresponding period of 2023, the Company proceeded with the sale of its Montreal distribution center for an amount of $66,500,000 resulting in an after-tax gain of $50,962,000 or $1.54 per basic share.

The variation in adjusted net earnings for non-recurring elements would be $25,048,000 or $0.77 per basic share for six month period ended July 31, 2024, as well as the comparable period ended July 31, 2023, are explained as follows:

|

(Unaudited and $ in thousands) |

|||||||||

|

July 31, 2024 |

July 31, 2023 |

||||||||

|

Net earnings |

20 925 |

41 380 |

|||||||

|

Gain on disposal of fixed assets (after-tax) |

(5 459) |

(50 962) |

|||||||

|

Adjusted net earnings |

15 466 |

(9 582) |

|||||||

|

Minus: Adjusted net earnings for the previous year |

(9 582) |

||||||||

|

Variation |

25 048 |

||||||||

The variations in net adjusted earnings is allocated as follows :

|

(Unaudited and $ in thousands) |

|||||||||

|

Increase |

Increase |

||||||||

|

Increase |

Increase |

(decrease) |

(decrease) |

||||||

|

(decrease) |

(decrease) |

immeubles de |

In adjusted |

||||||

|

In retal |

In investments |

In investment |

net |

||||||

|

As at April 30, 2024 |

4 867 |

9 958 |

(419) |

14 406 |

|||||

|

As at July 31, 2024 |

6 653 |

4 455 |

(466) |

10 642 |

|||||

|

Total |

11 520 |

14 413 |

(885) |

25 048 |

|||||

Annual financial information

($ in thousands, except for per share amounts)

|

January 31, 2024 |

January 31, 2023 |

||||||

|

Revenue |

578 945 |

717 972 |

|||||

|

Net earnings |

47 427 |

40 838 |

|||||

|

Total assets |

621 029 |

581 694 |

|||||

|

Net earnings per share basic and diluted |

1,44 |

1,23 |

|||||

|

Dividends per share |

0,36 |

0,36 |

|||||

Financial position and dividends

Cash and investments, net of bank overdraft, decreased by $76,528,000 during the six month period ended July 31, 2024. This decrease is linked to the acquisition of the RONA distribution center on April 15, 2024, the transaction was paid in full in cash from investments held by the Company. Investments consist of treasuries bearing interest, government and corporate bonds, common and preferred shares, which at the close of the six month period ended July 31, 2024, had a market value of $186,814,000 (including cash).

The Company created a real estate division at the end of the 2024 financial year, therefore as of the 1st quarter ended April 30, 2024, the Company presents its results in a segment manner identifying income from investment properties. Real estate activities include the ownership of buildings in Quebec with the intention of carrying out development or obtaining rental income from them. Details are presented in Note 4 and Note 10 to the unaudited interim consolidated financial statements as at July 31, 2024.

As at July 31, 2024, the working capital showed a surplus of $9,323,000, a decrease of $810,000 compared to the year ended January 31, 2024. The Company’s shareholders’ equity increased from $476,897,000 as at January 31, 2024, to $488,509,000 as at July 31, 2024. As at July 31, 2024, the book value per share stood at $15.06 compared to $14.59 as at January 31, 2024.

Pursuant to the normal course issuer-bid put in place on April 15, 2023, and renewed on April 15, 2024, accordingly, 254,950 common shares were repurchased and cancelled by the Company. As a result of this change, the Company had as at July 31, 2024, 32,430,100 common shares issued and outstanding.

During the period ended July 31, 2024, no options were granted. The Company may still grant pursuant to the Stock Option Plan a total of 5,710,864 options, representing 17.61% of the issued and outstanding shares of the Company.

Quarterly results

(Unaudited and $ in thousands, except for per share amounts)

|

April 30, |

April 30, |

July 31, |

July 31, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

$ |

$ |

$ |

$ |

||||||

|

Revenue |

137 144 |

135 102 |

169 394 |

169 075 |

|||||

|

Net earnings |

1 461 |

38 017 |

19 464 |

3 363 |

|||||

|

Net basic earnings per share |

0,04 |

1,15 |

0,60 |

0,10 |

|||||

|

October 31, |

October 31, |

January 31, |

January 31, |

||||||

|

2023 |

2022 |

2024 |

2023 |

||||||

|

$ |

$ |

$ |

$ |

||||||

|

Revenue |

140 078 |

175 559 |

134 690 |

147 815 |

|||||

|

Net earnings |

(8 449) |

13 847 |

14 496 |

11 938 |

|||||

|

Net basic earnings per share |

(0,25) |

0,42 |

0,44 |

0,36 |

|||||

For the three month period ended July 31, 2024, the Company’s revenues increased by $319,000 to $169,394,000, compared to $169,075,000 recorded for the corresponding 2023 period, a 0.2% increase. Of this increase, $1,368,000 comes from investment property income from the new real estate division. Therefore, the retail operation revenues of the Tanguay division decreased by 0.6%. Same-store-sales increased by 0.6% for the three month period ended July 31, 2024. Net earnings for the three month period ended July 31, 2024, amounted to $19,464,000 compared to $3,363,000 recorded for the corresponding 2023 period. Basic net earnings per share increased to $0.60 compared to $0.10 for the corresponding 2023 period. The operating earnings at the end of the first quarter of 2024 partly reflect the impact of the synergies created following the operational and commercial reorganization carried out in May 2023 with its Tanguay division and should have a greater effect on the yearly financial results of January 31, 2025.

For the three month period ended July 31, 2024, as well as for the corresponding period of 2023, the share repurchase program had no impact on basic net earnings per share.

During the period ended July 31, 2024, the Company disposed of fixed assets in the amount of $6,948,000, resulting in an after-tax gain of $5,459,000, or $0.17 per basic share. This amount includes an after-tax gain of $2,097,000, or $0.06 per basic share, received as an additional settlement obtained by winning the case relating to the expropriation of the former Kirkland store by the Réseau express métropolitain (REM) in 2019. Finally, this amount also includes the sale of its Trois-Rivières store for an amount of $4,500,000, resulting in after-tax gain of $3,362,000, or $0.01 per basic share.

The variation in adjusted net earnings for non-recurring elements would be $10,642,000 or $0.33 per basic share for the three month period ended July 31, 2024, as well as the comparable 2023 period, are explained as follows:

|

(Unaudited and $ in thousands) |

|||||||||

|

Net earnings |

19 464 |

3 363 |

|||||||

|

Gain on disposal of land (after-tax) |

(5 459) |

– |

|||||||

|

Adjusted net earnings |

14 005 |

3 363 |

|||||||

|

Minus: Adjusted net earnings for the previous year |

3 363 |

||||||||

|

Variation |

10 642 |

||||||||

Operations

BMTC Group Inc.

Tanguay division

The Company has decided to make significant changes to transform its former Brault & Martineau and EconoMax stores into Tanguay store in order to provide a better product and service offering and a unique customer experience in its market. These renovations across our entire network were initially estimated at $28,000,000, but as of January 31, 2024, the amount was reassessed downward to $20,000,000. During the year ended January 31, 2024, $15,500,000 of these costs were recorded in operating expenses in the Consolidated Statements of Earnings and Other Comprehensive Income, and an additional $1,542,000 of theses costs were incurred for the six month period ended July 31, 2024.

At the end of April 2024, the Company finalised the purchase of land in Lévis located in the Quebec region, for an amount of $20,223,000.

Real estate division

On April 15th, 2024, the Company finalised the purchase of the RONA distribution center bearing the civic address 2055, boulevard des Entreprises in the city of Terrebonne. The transaction was in the amount of $96,000,000 before taxes which includes a lease-back agreement with RONA. The transaction was paid in full in cash from investments held by the Company. The Company intends to continue on a long-term basis to create lease revenues with this property. The Company is currently evaluating renovations costs in order to make the distribution center more efficient by automating it in order to create greater lease value.

The Company entered into a partnership agreement with Urbania, who will be responsible for the development and construction of its property at 500 boulevard Le Corbusier in Laval into several residential rental towers. The Company intends to finance this real estate project at 75% with a long-term mortgage. The estimated value of the entire project is approximately $600,000,000. The Company created a new subsidiary, Le Corbusier-Concorde S.E.C. for this real estate project on January 31st, 2022. This real estate project should begin in the summer of 2025 as we are still waiting on approval of all permits with the city of Laval before we begin the construction phase. Once construction begins, the project should span over a period of 8 to 10 years with the construction of 5 rental residential towers for a total of approximately 1,200 doors.

As announced on February 1, 2023, the Company concluded the sale of its distribution center in Montreal for an amount of $66,500,000, resulting in an after-tax gain of $50,962,000, or $1.54 per basic share. The Company remains a tenant and uses this distribution center for its operations in the Montreal metropolitan region. The initial lease was for 2 years and in February 2024, the Company renewed its lease.

The Company intends to proceed with the real estate development of several rental residential towers on its property located at 125 boul. Desjardins Est in Sainte-Thérèse. This real estate project is currently in the exploratory phase and the Company has identified a potential developer for the project. We should be able to announce during this financial year the details of this real estate project.

Management discussion and outlook for the Future of the Company

In the last few years, e-commerce has developed exponentially in Quebec. The Company continues to focus on online sales by actively pursuing the improvement of its digital platforms, its live chat initiative with online customers as well as the improvement of our telephone sales department.

It is also Management’s opinion that the digital platforms of our banner is essential in order to allow the Company to increase its market shares as well as to allow customers to start their shopping experience online to then complete their purchases in one of our stores with the help of our sales representatives.

It is difficult to predict future consumer behavior, however the results for the 1st quarter of 2024 are encouraging. The economic downturn we have experienced over the past year is the result of high inflation and rising interest rates. The most sensitive sectors, such as real estate and financed products, are the most affected and are expected to continue to experience a slowdown, which could have an impact on the Company’s results.

Management remains confident that, thanks to its effective management, the operational and commercial reorganization carried out in May 2023 and the solidity of its financial structure, the Company will be able to maintain its objectives which consist of increasing its market share in Quebec and its profitability, even in a more difficult market.

Caution regarding forward-looking statements

This press release contains certain forward-looking statements with respect to the Company. These forward-looking statements are identified by the use of terms and phrases such as “anticipate”, “believe”, “estimate”, expect”, “intend”, “may”, “plan”, “predict”, “project”, “will”, “would”, as well as the opposites of these terms and similar terminology, including references to assumptions.

Forward-looking statements, by their nature, necessarily involve risks and uncertainties that could cause actual results to differ materially from those contemplated by these forward-looking statements. Results indicated in forward-looking statements may differ materially from actual results for a number of reasons, which the Company has identified in the 2024 Annual Information Form under “Narrative Description of the Business – Risk Factors”, and other risks detailed from time to time in the Company’s continuous disclosure documents.

The reader is cautioned that the factors we refer above are not exhaustive of the factors that may affect any of the Company’s forward-looking statements. The reader is also cautioned to consider these and other factors carefully and not to put undue reliance on forward-looking statements.

The Company made a number of assumptions in making forward-looking statements in this press release. The Company considers the assumptions on which these forward-looking statements are based to be reasonable.

These statements reflect current expectations regarding future events and operating performance and speak only as of the date of release of this press release and represent the Company’s expectations as of that date. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Non International Financial Reporting Standards (IFRS) financial measures

The Company discloses adjusted net earnings, which includes or excludes certain amounts that are not considered representative of the performance measures and financial recurrence of the Company. Management believes that this measure is useful in understanding and analyzing the operational performance of the Company and that it can provide additional information.

Adjusted net earnings as well as same store revenues are not an earnings measure recognized by IFRS and do not have a standardized meanings prescribed by IFRS. Therefore, adjusted net earnings and same store revenues as discussed in this press release may not be compared to similar measures presented by other issuers. These measures of performance should not be considered as alternatives to indicators of performance calculated according to IFRS, but rather as a source of additional information.

The Company discloses in this press release under the section “Results” a reconciliation between net earnings and adjusted net earnings.

BMTC Group Inc. (hereinafter “Company”) is a company governed the Business Companies Act (Quebec). Its registered office and principal place of business is located at 8500 Place Marien, Montréal East, Quebec, H1B 5W8. Its common shares are listed on the Toronto Stock Exchange. The structure of BMTC Group Inc. is now formed of the Tanguay division and its subsidiaries Le Corbusier-Concorde S.E.C. and 9519-2340 Québec Inc. (collectively designated as the “Company”), manages and operates a retail network of furniture, household appliances and electronic products, in Quebec.

SOURCE BMTC Group Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c2993.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c2993.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

William James Wartinbee III Implements A Sell Strategy: Offloads $103K In Gartner Stock

Revealing a significant insider sell on September 11, William James Wartinbee III, EVP at Gartner IT, as per the latest SEC filing.

What Happened: III’s recent move involves selling 210 shares of Gartner. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value is $103,275.

Gartner shares are trading down 0.0% at $499.77 at the time of this writing on Thursday morning.

About Gartner

Based in Stamford, Conn., Gartner provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Understanding the Numbers: Gartner’s Finances

Revenue Growth: Gartner displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 6.11%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: With a high gross margin of 67.82%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Gartner’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 2.95.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 4.53, caution is advised due to increased financial risk.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: Gartner’s current Price to Earnings (P/E) ratio of 47.55 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 6.51, Gartner’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 29.17, Gartner demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

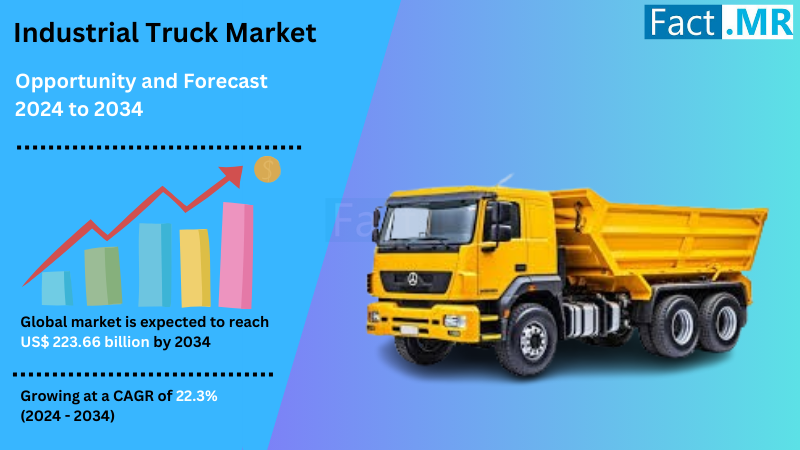

Industrial Truck Market is Expected to Reach a Valuation of US$ 223.66 billion at a CAGR of 22.3% by 2034 | Fact.MR Report

Rockville, MD, Sept. 12, 2024 (GLOBE NEWSWIRE) — As per a new study released by Fact.MR, a leading market research and competitive intelligence provider, the global industrial truck market is projected to reach a value of US$ 29.96 billion in 2024 and advance at a CAGR of 22.3% from 2024 to 2034.

Constant growth of the e-Commerce industry, rapid advancements in factory automation, and ongoing improvements in supply chain logistics are significantly boosting global demand for industrial vehicles. Industrial trucks have become crucial tools across various sectors as companies strive for higher production and efficiency.

Market expansion is particularly being fueled by the rise of mega-warehouses and distribution centers designed to support online retail. Concurrently, emerging economies are also experiencing increased adoption of these vehicles due to their expanding industrial and logistical sectors. Technological innovations are further driving demand, with electric and autonomous industrial trucks gaining popularity among businesses focused on environmental sustainability and operational efficiency. These smart vehicles, equipped with sensors and artificial intelligence, are revolutionizing material handling processes.

Economic recovery following the COVID-19 pandemic has been driving investments in manufacturing and infrastructure, further increasing the need for industrial trucks. As industries worldwide continue to modernize and expand, these versatile machines are solidifying their role as vital components in the modern industrial landscape.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=4813

Key Takeaways from Market Study:

- The global industrial truck market is forecasted to reach US$ 223.66 billion by the end of 2034.

- The South Korea market is forecasted to expand at a CAGR of 18.8% from 2024 to 2034.

- The market in North America is projected to expand at a CAGR of 22.5% through 2034.

- East Asia is evaluated to hold a global market share of 39.3% by 2034.

- The United States is projected to occupy a share of 88.6% in North America by 2034. The market has been analyzed to reach a valuation of US$ 52.31 billion by the end of 2034.

- Based on power source, the electric segment is evaluated to expand at a CAGR of 22.3% and hold a market share of 71.3% by 2034.

“Industrial trucks are being used in drug manufacturing and distribution centers for careful handling of sensitive materials. This is a key trend benefitting manufacturers in several parts of the world,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Industrial Truck Market:

Anhui Heli Co., Ltd.; BYD Company Limited; Crown Equipment Corporation; Doosan Corporation; Industrial Vehicle; Hyster-Yale Materials Handling, Inc.; Hyundai Heavy Industries Co., Ltd.; Jungheinrich AG; KION Group AG; Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Toyota Industries Corporation; Doosan Corporation; Godrej & Boyce Mfg. Co. Ltd.; Caterpillar; Clark Material Handling Co. Ltd.; Hangcha Group Co. Ltd.; Lonking Forklift Company Ltd.; EP Equipment Ltd.

AI-Driven Systems and Autonomous Guided Vehicles Enhancing Material Handling Efficiency and Safety:

Artificial intelligence-driven systems and autonomous guided vehicles (AGVs) are two examples of advanced automation technologies that significantly improve material handling processes’ efficiency and safety. Trucks that run on electricity or hydrogen fuel cells are becoming more and more popular because they provide environmentally acceptable options that comply with strict environmental laws and business sustainability objectives. In the long term, these renewable energy solutions minimize operating expenses in addition to reducing emissions.

By combining telematics with the Internet of Things (IoT), real-time fleet management and predictive maintenance become feasible, minimizing downtime and enhancing vehicle utilization. Ergonomic designs and advanced safety features such as 360-degree cameras and collision avoidance systems are improving operator comfort and workplace safety.

Modular and flexible truck designs allow companies to quickly adapt to evolving operational needs. These innovations are driving a surge in industrial vehicle demand, fueling market expansion, and transforming logistics and storage as businesses seek to modernize their material handling capabilities.

Industrial Truck Industry News:

- In order to load and unload wooden items at locations in Austria and the Czech Republic, Cargotec Corporation and Pfeifer Holding GmbH, a prominent European timber supplier, reached an agreement in March 2022 for the provision of three medium-sized electric forklift trucks.

- Crown Equipment Corporation debuted its new Wave Work Assist Vehicle in January 2022. It is equipped with the most recent V-Force lithium-ion technology batteries, which provide increased battery efficiency.

- 22 new electric forklift models were introduced by Toyota Material Handling, a division of Toyota Industries Corporation, in January 2022. Four operator compartments and versions with 24V, 36V, and 48V options are part of the enlarged range.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=4813

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the industrial truck market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product (hand trucks, pallet jacks, walkie stackers, pallet trucks, platform trucks, counterbalanced lift trucks, reach trucks, turret trucks, order pickers, sideloaders, tow tractors, personnel & burden carriers, automatic guided vehicles), power source (electric, conventional, manual), capacity (below 2.5 tons, above 2.5 tons), and end use (logistics, retail, manufacturing), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Truck Cranes Market: Worldwide sales of truck cranes are estimated at US$ 9.1 billion for 2023 and are forecasted to reach US$ 14.9 billion by the end of 2033. Over the next ten years, the global truck cranes market is predicted to expand steadily at 5% CAGR.

Heavy Duty Truck Market: The global heavy duty truck market is evaluated at US$ 194.82 billion in 2024. According to projections by Fact.MR in its latest market study, worldwide sales of heavy-duty trucks are forecasted to increase at a CAGR of 4.6% and reach US$ 305.46 billion by 2034-end.

Lift Trucks Market: The global lift trucks market accounts for a valuation of US$ 48.52 billion in 2022 and is projected to reach US$ 94.56 billion by the end of 2032. This is because worldwide sales of lift trucks are predicted to increase at a noteworthy CAGR of 6.9% from 2022 to 2032.

Forklift Truck Market: The global forklift truck market size is estimated to be valued at US$ 62,252.2 million in 2024. Sales of forklift trucks are expected to incline at a CAGR of 7.5% through 2034. A valuation of US$ 128,303.7 million is anticipated for the forklift truck market by 2034.

Forklift Truck Safety Solution Market: The global forklift truck safety solution market is estimated at US$ 6.65 billion in 2024. Worldwide demand for forklift truck safety solutions is projected to increase at a noteworthy CAGR of 12.9% and reach a market value of US$ 22.37 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IBEX Announces Record Fourth Quarter and Fiscal Year 2024 Financial Results

- Record full-year Net Income, EPS, Adjusted Net Income, Adjusted EPS, and Free Cash Flow

- 18 new client relationships won primarily with retail, healthcare, and gaming companies, compared to 10 in the prior year

- Repurchased 1.3 million shares at a total cost of $21.7 million during fiscal year 2024, representing 7.8% of our shares outstanding at June 30, 2024

WASHINGTON, Sept. 12, 2024 (GLOBE NEWSWIRE) — IBEX Limited (“ibex”), a leading provider in global business process outsourcing and end-to-end customer engagement technology solutions, today announced financial results for its fourth quarter and fiscal year ended June 30, 2024.

| ($ millions, except per share amounts) | Three months ended June 30, |

Twelve months ended June 30, |

|||||||||||||||||||

| 2024 | 2023 | Change | 2024 | 2023 | Change | ||||||||||||||||

| Revenue | $ | 124.5 | $ | 124.4 | 0.1 | % | $ | 508.6 | $ | 523.1 | (2.8)% | ||||||||||

| Net income | $ | 9.8 | $ | 4.5 | 118.3 | % | $ | 33.7 | $ | 31.6 | 6.6 | % | |||||||||

| Net income margin | 7.9 | % | 3.6 | % | 430 bps | 6.6 | % | 6.0 | % | 60 bps | |||||||||||

| Adjusted net income (1) | $ | 10.2 | $ | 6.2 | 63.7 | % | $ | 38.4 | $ | 36.9 | 3.8 | % | |||||||||

| Adjusted net income margin (1) | 8.2 | % | 5.0 | % | 320 bps | 7.5 | % | 7.1 | % | 40 bps | |||||||||||

| Adjusted EBITDA (1) | $ | 17.9 | $ | 15.4 | 16.1 | % | $ | 65.2 | $ | 66.6 | (2.1)% | ||||||||||

| Adjusted EBITDA margin (1) | 14.4 | % | 12.4 | % | 200 bps | 12.8 | % | 12.7 | % | 10 bps | |||||||||||

| Earnings per share – diluted | $ | 0.56 | $ | 0.24 | 133.3 | % | $ | 1.84 | $ | 1.67 | 10.2 | % | |||||||||

| Adjusted earnings per share – diluted (1) | $ | 0.58 | $ | 0.33 | 75.8 | % | $ | 2.10 | $ | 1.96 | 7.1 | % | |||||||||

| (1)See accompanying Exhibits for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. | |||||||||||||||||||||

“We achieved record results across key financial metrics including full year net income, EPS, adjusted net income, adjusted EPS, and free cash flow, and had a strong fourth quarter that exceeded our expectations,” said Bob Dechant, ibex CEO. “Our revenues for the fourth quarter were encouraging, and we are happy to report that we pivoted back to year-on-year growth,” said Dechant.

“Our new logo engine continued to win signature new clients with three wins in the quarter including a leading gaming company. These wins total 18 for the year highlighting our differentiation and our ability to take on and beat our much larger competition. Our pipeline for customer facing AI led solutions continues to expand and position us well as we move into FY25. ibex AI solutions complement our agent-led BPO services with AI voice and chat bots for high-volume low-complexity contacts. I am excited to announce that we closed our first significant customer-facing AI opportunity with a leading client which will drive a new revenue stream for us.” Added Dechant, “The fourth quarter completes a strong second half and finish for the year and gives us great momentum as we enter our FY 2025.”

Fourth Quarter Financial Performance

Revenue

- Revenue of $124.5 million, up slightly from the prior year quarter. Growth in Retail and E-commerce, Travel, Transportation and Logistics, and HealthTech was offset by declines in FinTech, Telecommunications, and Technology verticals.

Net Income and Earnings Per Share

- Net income increased to $9.8 million compared to $4.5 million in the prior year quarter. Diluted earnings per share increased to $0.56 compared to $0.24 in the prior year quarter. The increase was primarily the result of improved gross margin performance on the year over year growth of delivery in our offshore regions, cost optimization efforts, lower income tax expense, and fewer diluted shares outstanding compared to the prior year quarter.

- Net income margin increased to 7.9% compared to 3.6% in the prior year quarter.

- Non-GAAP adjusted net income increased to $10.2 million, compared to $6.2 million in the prior year quarter.

- Non-GAAP adjusted diluted earnings per share increased to $0.58, compared to $0.33 in the prior year quarter (see Exhibit 1 for reconciliation). The increase per share was primarily attributable to the impact of improved operating margins, a lower tax rate, and lower share count.

Non-GAAP adjusted EBITDA

- Adjusted EBITDA increased to $17.9 million, compared to $15.4 million in the prior year quarter (see Exhibit 2 for reconciliation), driven by higher operating margins and continuing cost optimization efforts undertaken during the year.

- Adjusted EBITDA margin increased to 14.4%, compared to 12.4% in the prior year quarter (see Exhibit 2 for reconciliation).

Fiscal Year 2024 Financial Performance

Revenue

- Revenue decreased 2.8% to $508.6 million from $523.1 million due to lower volumes in certain verticals and the migration from onshore to higher margin offshore and nearshore regions.

- Growth in our Retail & E-commerce, HealthTech, and Travel, Transportation & Logistics verticals partially offset the above-mentioned revenue declines, particularly in the Telecommunication and FinTech verticals.

Net Income and Earnings Per Share

- Net income and diluted earnings per share increased to $33.7 million and $1.84, both new record highs, respectively, compared to $31.6 million and $1.67, respectively, in the prior year. The increase was driven by higher gross profit margins from the growth of delivery in our higher margin regions, lower taxes, higher interest income, and fewer diluted shares outstanding.

- Net income margin was 6.6%, compared to 6.0% in the prior year.

- Non-GAAP adjusted net income and diluted adjusted earnings per share increased to $38.4 million and $2.10, respectively, compared to $36.9 million and $1.96, respectively, in the prior year (see Exhibit 1 for reconciliation).

Adjusted EBITDA

- Adjusted EBITDA decreased slightly to $65.2 million, compared to $66.6 million in the prior year (see Exhibit 2 for reconciliation), primarily driven by lower overall revenue and investments in technology, largely offset by improved gross margin driven by the migration from onshore to offshore higher margin regions and ongoing cost optimization efforts.

- Adjusted EBITDA margin was 12.8%, up 10 basis points from the prior year (see Exhibit 2 for reconciliation).

Cash Flow and Balance Sheet

- Net cash from operating activities decreased to $35.9 million, compared to $41.9 million in the prior year.

- Capital expenditures were $8.9 million compared to $19.0 million in the prior year.

- Full year free cash flow increased to $27.0 million, compared to $22.9 million in the prior year (see Exhibit 3 for reconciliation).

- Cash and cash equivalents improved to $62.7 million, compared to cash and cash equivalents of $57.4 million.

- Total debt was $1.5 million compared to total debt of $1.0 million last year.

- Net cash improved to $61.2 million, up from $56.4 million in the prior year (see Exhibit 4 for reconciliation).

Fiscal Year and First Quarter Fiscal 2025 Business Outlook

“Our record financial results were largely due to the continued growth of our high margin services and geographies which drove operating performance improvement across all our regions. In the last half of fiscal year 2024, we delivered an adjusted EBITDA margin of 14.8%, placing ibex among the top performers of our industry. Our record year of generating Free Cash Flow has put us into an ideal position to continue to invest in our infrastructure, advanced AI capabilities, and our sales and marketing to accelerate future revenue growth. Importantly, it has also enabled us to execute meaningful share repurchases, representing approximately 8% of our shares outstanding, to return value to our shareholders,” said Taylor Greenwald, CFO of ibex.

“We view this most recent quarter as an inflection point for a return to top-line growth. We remain confident in the trajectory of our business.”

- For fiscal year 2025, revenue is expected to be in the range of $510 to $525 million. Adjusted EBITDA is expected to be in the range of $67 to $69 million.

- For the first quarter fiscal 2025 revenue is expected to be in the range of $124 to $126 million. Adjusted EBITDA is expected to be in the range of $14.5 to $15.5 million.

- Capital expenditures are expected to be in the range of $15 to $20 million.

Conference Call and Webcast Information

IBEX Limited will host a conference call and live webcast to discuss its fourth quarter of fiscal year 2024 financial results at 4:30 p.m. Eastern Time today, September 12, 2024. We will also post to this section of our website the earning slides, which will accompany our conference call and live webcast, and encourage you to review the information that we make available on our website.

Live and archived webcasts can be accessed at: https://investors.ibex.co/.

Financial Information

This announcement does not contain sufficient information to constitute an interim financial report as defined in Financial Accounting Standards ASC 270, “Interim Reporting.” The financial information in this press release has not been audited.

Non-GAAP Financial Measures

We present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. We also use these measures internally to establish forecasts, budgets and operational goals to manage and monitor our business, as well as evaluate our underlying historical performance, as we believe that these non-GAAP financial measures provide a more helpful depiction of our performance of the business by encompassing only relevant and manageable events, enabling us to evaluate and plan more effectively for the future. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies, have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of our operating results as reported in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). Non-GAAP financial measures and ratios are not measurements of our performance, financial condition or liquidity under U.S. GAAP and should not be considered as alternatives to operating profit or net income / (loss) or as alternatives to cash flow from operating, investing or financing activities for the period, or any other performance measures, derived in accordance with U.S. GAAP.

ibex is not providing a quantitative reconciliation of forward-looking non-GAAP adjusted EBITDA margin to the most directly comparable GAAP measure because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable effort. These items include, but are not limited to, non-recurring expenses, foreign currency gains and losses, and share-based compensation expense. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance period.

About ibex

ibex helps the world’s preeminent brands more effectively engage their customers with services ranging from customer support, technical support, inbound/outbound sales, business intelligence and analytics, digital demand generation, and CX surveys and feedback analytics.

Forward Looking Statements

In addition to historical information, this release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. These statements include, but are not limited to, statements regarding our future financial and operating performance, including our outlook and guidance, and our strategies, priorities and business plans. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Factors that could impact our actual results include: our ability to attract new business and retain key clients; our profitability based on our utilization, pricing and managing costs; the potential for our clients or potential clients to consolidate; our clients deciding to enter into or further expand their insourcing activities and current trends toward outsourcing services may reverse; general economic uncertainty in global markets and unfavorable economic conditions, including inflation, rising interest rates, recession, foreign exchange fluctuations and supply-chain issues; our ability to manage our international operations, particularly in the Philippines, Jamaica, Pakistan and Nicaragua; natural events, health epidemics, geopolitical conditions, including developing or ongoing conflicts, widespread civil unrest, terrorist attacks and other attacks of violence involving any of the countries in which we or our clients operate; our ability to anticipate, develop and implement information technology solutions that keep pace with evolving industry standards and changing client demands, including the effective adoption of Artificial Intelligence into our offerings; our ability to recruit, engage, motivate, manage and retain our global workforce; our ability to comply with applicable laws and regulations, including those regarding privacy, data protection and information security, employment and anti-corruption; the effect of cyberattacks or cybersecurity vulnerabilities on our information technology systems; our ability to realize the anticipated strategic and financial benefits of our relationship with Amazon; the impact of tax matters, including new legislation and actions by taxing authorities; and other factors discussed in the “Risk Factors” described in our periodic reports filed with the U.S. Securities and Exchange Commission (“SEC”), including our annual reports on Form 10-K, quarterly reports on Form 10-Q, and past filings on Form 20-F, and any other risk factors we include in subsequent filings with the SEC. Because of these uncertainties, you should not make any investment decisions based on our estimates and forward-looking statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements for any reason after the date of this press release whether as a result of new information, future events or otherwise.

IR Contact: Michael Darwal, EVP, Investor Relations, ibex, michael.darwal@ibex.co

Media Contact: Daniel Burris, Senior Director PR and Communication, ibex, daniel.burris@ibex.co

| IBEX LIMITED AND SUBSIDIARIES Consolidated Balance Sheets (Unaudited) (in thousands) |

|||||||

| June 30, 2024 |

June 30, 2023 |

||||||

| Assets | |||||||

| Current assets | |||||||

| Cash and cash equivalents | $ | 62,720 | $ | 57,429 | |||

| Accounts receivable, net | 98,366 | 86,364 | |||||

| Prepaid expenses | 7,712 | 6,616 | |||||

| Due from related parties | 192 | 43 | |||||

| Tax advances and receivables | 9,080 | 5,965 | |||||

| Other current assets | 1,888 | 2,190 | |||||

| Total current assets | 179,958 | 158,607 | |||||

| Non-current assets | |||||||

| Property and equipment, net | 29,862 | 41,151 | |||||

| Operating lease assets | 59,145 | 70,919 | |||||

| Goodwill | 11,832 | 11,832 | |||||

| Deferred tax asset, net | 4,285 | 4,585 | |||||

| Other non-current assets | 8,822 | 6,230 | |||||

| Total non-current assets | 113,946 | 134,717 | |||||

| Total assets | $ | 293,904 | $ | 293,324 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities | |||||||

| Accounts payable and accrued liabilities | $ | 16,719 | $ | 18,705 | |||

| Accrued payroll and employee-related liabilities | 30,674 | 29,360 | |||||

| Current deferred revenue | 4,749 | 6,413 | |||||

| Current operating lease liabilities | 12,051 | 13,036 | |||||

| Current maturities of long-term debt | 660 | 413 | |||||

| Due to related parties | 60 | 2,314 | |||||

| Income taxes payable | 6,083 | 3,020 | |||||

| Total current liabilities | 70,996 | 73,261 | |||||

| Non-current liabilities | |||||||

| Non-current deferred revenue | 1,128 | 1,383 | |||||

| Non-current operating lease liabilities | 53,441 | 64,854 | |||||

| Long-term debt | 867 | 600 | |||||

| Other non-current liabilities | 1,673 | 3,262 | |||||

| Total non-current liabilities | 57,109 | 70,099 | |||||

| Total liabilities | 128,105 | 143,360 | |||||

| Stockholders’ equity | |||||||

| Common stock | 2 | 2 | |||||

| Additional paid-in capital | 210,200 | 204,734 | |||||

| Treasury stock | (25,367 | ) | (3,682 | ) | |||

| Accumulated other comprehensive loss | (7,913 | ) | (6,312 | ) | |||

| Accumulated deficit | (11,123 | ) | (44,778 | ) | |||

| Total stockholders’ equity | 165,799 | 149,964 | |||||

| Total liabilities and stockholders’ equity | $ | 293,904 | $ | 293,324 | |||

| IBEX LIMITED AND SUBSIDIARIES Consolidated Statements of Comprehensive Income (Unaudited) (in thousands, except per share data) |

|||||||||||||||

| Three months ended June 30, |

Twelve months ended June 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | $ | 124,531 | $ | 124,431 | $ | 508,569 | $ | 523,118 | |||||||

| Cost of services (exclusive of depreciation and amortization presented separately below) | 85,373 | 87,356 | 356,536 | 374,992 | |||||||||||

| Selling, general and administrative | 21,681 | 23,717 | 93,143 | 88,663 | |||||||||||

| Depreciation and amortization | 4,608 | 5,052 | 19,461 | 18,985 | |||||||||||

| Total operating expenses | 111,662 | 116,125 | 469,140 | 482,640 | |||||||||||

| Income from operations | 12,869 | 8,306 | 39,429 | 40,478 | |||||||||||

| Interest income | 542 | 249 | 2,071 | 640 | |||||||||||

| Interest expense | (175 | ) | (239 | ) | (514 | ) | (792 | ) | |||||||

| Income before income taxes | 13,236 | 8,316 | 40,986 | 40,326 | |||||||||||

| Provision for income tax expense | (3,391 | ) | (3,806 | ) | (7,331 | ) | (8,744 | ) | |||||||

| Net income | $ | 9,845 | $ | 4,510 | $ | 33,655 | $ | 31,582 | |||||||

| Other comprehensive income / (loss) | |||||||||||||||

| Foreign currency translation adjustments | $ | (1,313 | ) | $ | (72 | ) | $ | (1,623 | ) | $ | (2,234 | ) | |||

| Unrealized (loss) / gain on cash flow hedging instruments, net of tax | (181 | ) | (254 | ) | (111 | ) | 515 | ||||||||

| Actuarial gain / (loss) on defined benefit plan | 133 | (31 | ) | 133 | (31 | ) | |||||||||

| Total other comprehensive loss | (1,361 | ) | (357 | ) | (1,601 | ) | (1,750 | ) | |||||||

| Total comprehensive income | $ | 8,484 | $ | 4,153 | $ | 32,054 | $ | 29,832 | |||||||

| Net income per share | |||||||||||||||

| Basic | $ | 0.57 | $ | 0.25 | $ | 1.90 | $ | 1.74 | |||||||

| Diluted | $ | 0.56 | $ | 0.24 | $ | 1.84 | $ | 1.67 | |||||||

| Weighted average common shares outstanding | |||||||||||||||

| Basic | 17,170 | 18,259 | 17,704 | 18,200 | |||||||||||

| Diluted | 17,639 | 18,989 | 18,255 | 18,893 | |||||||||||

| IBEX LIMITED AND SUBSIDIARIES Consolidated Statements of Cash Flows (Unaudited) (in thousands) |

|||||||||||||||

| Three months ended June 30, |

Twelve months ended June 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||

| Net income | $ | 9,845 | $ | 4,510 | $ | 33,655 | $ | 31,582 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||

| Depreciation and amortization | 4,608 | 5,052 | 19,461 | 18,985 | |||||||||||

| Noncash lease expense | 3,297 | 3,510 | 13,205 | 14,456 | |||||||||||

| Warrant contra revenue | 290 | 234 | 1,183 | 1,090 | |||||||||||

| Deferred income tax | (242 | ) | 1,511 | 344 | 4,529 | ||||||||||

| Share-based compensation expense | 1,024 | 633 | 3,765 | 4,606 | |||||||||||

| Allowance of expected credit losses | (29 | ) | 190 | 33 | 295 | ||||||||||

| Impairment losses | 275 | — | 1,532 | — | |||||||||||

| Loss on lease terminations | — | 251 | — | 251 | |||||||||||

| Gain on sale of subsidiaries | — | — | — | (246 | ) | ||||||||||

| Change in assets and liabilities: | |||||||||||||||

| Decrease / (increase) in accounts receivable | 4,873 | 5,549 | (12,068 | ) | (12,297 | ) | |||||||||

| (Increase) / decrease in prepaid expenses and other current assets | (2,167 | ) | (775 | ) | (7,517 | ) | 1,467 | ||||||||

| Increase / (decrease) in accounts payable and accrued liabilities | 90 | 2,324 | (2,246 | ) | (3,753 | ) | |||||||||

| Decrease in deferred revenue | (821 | ) | (2,076 | ) | (1,919 | ) | (4,797 | ) | |||||||

| Decrease in operating lease liabilities | (3,621 | ) | (3,478 | ) | (13,528 | ) | (14,309 | ) | |||||||

| Net cash inflow from operating activities | 17,422 | 17,435 | 35,900 | 41,859 | |||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||||

| Purchase of property and equipment | (2,220 | ) | (3,721 | ) | (8,855 | ) | (18,952 | ) | |||||||

| Cash outflow from sale of subsidiaries, net of cash received | — | — | — | (85 | ) | ||||||||||

| Net cash outflow from investing activities | (2,220 | ) | (3,721 | ) | (8,855 | ) | (19,037 | ) | |||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||||

| Proceeds from line of credit | 85 | 58 | 238 | 43,448 | |||||||||||

| Repayments of line of credit | (86 | ) | (56 | ) | (291 | ) | (54,597 | ) | |||||||

| Repayment of debt | — | — | — | (3,795 | ) | ||||||||||

| Proceeds from the exercise of options | 4 | 226 | 366 | 2,053 | |||||||||||

| Principal payments on finance leases | (148 | ) | (94 | ) | (490 | ) | (447 | ) | |||||||

| Purchase of treasury shares | (3,005 | ) | — | (21,556 | ) | (276 | ) | ||||||||

| Net cash (outflow) / inflow from financing activities | (3,150 | ) | 134 | (21,733 | ) | (13,614 | ) | ||||||||