Empty Nesters: Don't Fall Into This Common Retirement Trap

Saving for retirement is a lifelong undertaking. It involves keeping your retirement goals in mind as you have children, get different jobs and move from place to place. However, a recent study from the Center for Retirement Research at Boston College shows that many parents may not be keeping up with their retirement savings goals after their children leave home. Parents who consistently fall short of retirement savings goals may be unable to cover regular expenses. The study suggests a number of reasons why empty-nester parents neglect retirement savings, including the fact that such parents tend to work slightly less. Because retirement saving is a marathon, not a sprint, it’s important to make sure you’re staying on top of your retirement savings goals even after your children have left home. A financial advisor can help keep you stay on track.

Empty Nesters Are Falling Behind: Report Findings

The report done by the Center for Retirement Research at Boston College examined how empty nester parents adjust their savings, consumption and earnings after children leave the house. The report aims to reconcile the fact that some studies have shown that empty nester parents reduce consumption and increase savings while others have shown that savings don’t increase.

The authors of the study offered up three possible explanations to reconcile these inconsistencies:

-

Empty nester parents could pay down debts after children leave home

-

Parents could continue to provide financial support to children after they’ve left

-

Empty nesters tend to adjust their earnings and work hours after children leave home

Surprisingly, the study found that overall, parents don’t tend to pay down debts and parents typically don’t continue to provide meaningful financial support to their children after they’ve left home. What they did find was significant evidence to show that empty-nester parents reduce their working hours and earn about $2,000 less per year after children no longer live with them.

This study also found that consumption, relative to income, decreased by about 6% for empty-nester parents. However, net worth remained unchanged, leaving a question mark as to why such parents aren’t saving more.

Why Do Empty Nesters Save Less For Retirement?

There are a number of possible explanations when it comes to figuring out why empty-nester parents don’t seem to be saving as much as they should. A consistent finding of the study was that empty-nester parents tend to work less and therefore earn less. Despite the fact that consumption is also lower, a change in nominal income has the potential to throw off savings targets and goals. If someone who normally contributes $2,000 per year to retirement begins earning $2,000 less annually, it’s easy to see how he may forgo saving that $2,000 altogether, even if he’s consuming less overall.

It’s also important to note that the findings of the study aren’t a foregone conclusion. Empty-nester parents who decide to work less and still support children who left home will have less money to save for retirement. The same goes for parents who decide to pay down debts more quickly after their children have left.

What Can You Do?

There isn’t one single reason why empty-nester parents tend to save less for retirement after their children have left home, so it’s not necessarily an easy fix for anyone. However, there are always steps you can take to make sure that you as an empty nester keep up with your retirement goals.

First of all, it could be a good idea to work with a financial advisor to help you stay on track when it comes to retirement saving goals, even when big life changes happen, like kids leaving the house or a reduction in your working hours and income.

It’s also a good idea to be meticulous about your retirement savings. For many, a big event like children leaving home can cause you to focus your attention elsewhere, and retirement savings can fall by the wayside. By keeping your finances in line in a spreadsheet or with another financial organization app, you can make sure that you’re hitting your retirement saving goals on a monthly and yearly basis.

Empty nesters can also try these strategies:

Maximize your IRA or 401(k). Retirement planning often starts at work. If you have access to a 401(k) or similar workplace retirement plan, use it. A recent study from Vanguard says that roughly one-third (34%) of Americans are leaving free money on the table by saving below the employee match. Empty nesters over 50 can make catch-up contributions.

Put money into a health savings account. An HSA lets you invest money for future medical expenses, while getting special tax breaks – your contributions reduce your taxable income and your money grows tax-free. In January 2021, there were January 2021, $82.2 billion was invested in 30 million HSA accounts. This was a 25% year-over-year jump in assets and a 6% jump in total accounts.

Guarantee an additional income stream with an annuity. Annuities are insurance products that pay out the full amount of principal and interest over a specific period of time. You can delay taxes on earnings and sometimes extend it to beneficiaries. An annuity could also allow you to take Social Security benefits at a later age and therefore maximize your benefit. A financial advisor could help you invest in an annuity later in life as you continue working and if you have other retirement income.

Delay your Social Security benefits until age 70. Waiting until full retirement age will allow you to get 100% of your retirement benefits. However, by retiring at age 70, you could get 132% or your regular monthly benefit amount. So while you will get fewer Social Security benefit checks in your lifetime, they would be one-third larger.

Hire a financial advisor. A financial advisor can help you with the numerous aspects of your retirement, from Social Security to taxes to income streams. Get matched with up to three financial advisors for free with SmartAsset’s free tool.

Bottom Line

There are a number of very real reasons why empty nesters tend to save less for retirement. The financial burden and stress of raising a family can often make saving for the future seem like more of an afterthought. However, it’s important not to forgo saving for retirement entirely after your children leave the house. Even if you decide to work less or pay down debts, make sure that you’re keeping your retirement savings goals in mind so that you don’t end up in a situation where you don’t have enough to support yourself during retirement.

Tips for Saving for Retirement

-

Saving for retirement through the ups and downs of life isn’t always an easy task. A financial advisor may be able to help guide you through difficult choices. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Going about saving for retirement on your own is always an option. If you’re planning by yourself, SmartAsset has you covered with a number of free online retirement resources. Check out our free retirement calculator today.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/BraunS, ©iStock.com/TheKoRp, ©iStock.com/Ridofranz

The post Empty Nester? This Avoidable Mistake Could Jeopardize Your Retirement appeared first on SmartAsset Blog.

Boeing Worker's 'Strike At Midnight' Threatens Aircraft Production As Financial Risks Loom After 30,000 Workers Vote For Industrial Action

Boeing Co. BA faces potential disruptions in its aircraft production as workers decide on a strike.

What Happened: Over 30,000 Boeing employees are set to strike on Friday after rejecting a proposed labor contract, reported CNBC.

Workers in Seattle and Oregon voted 94.6% against the tentative agreement, which was presented by Boeing and the International Association of Machinists and Aerospace Workers. The vote to strike was even higher, at 96%, far surpassing the two-thirds majority needed for a work stoppage.

“We strike at midnight,” declared IAM District 751 President Jon Holden during a press conference. He described the action as an “unfair labor practice strike,” citing issues such as “discriminatory conduct, coercive questioning, unlawful surveillance, and unlawful promise of benefits.”

The rejected proposal included a 25% wage increase and enhancements to health-care and retirement benefits. However, the union had aimed for approximately 40% raises, arguing that the offer did not adequately address the rising cost of living.

Boeing CEO Kelly Ortberg, who has been in his role for only five weeks, had urged workers to accept the contract to avoid jeopardizing the company’s recovery efforts.

The financial impact of the strike will depend on its duration, with Jefferies aerospace analyst Sheila Kahyaoglu estimating a 30-day strike could cost Boeing $1.5 billion.

Why It Matters: The strike comes at a critical time for Boeing, which has been grappling with production delays and quality control issues. On Wednesday, Boeing reported that it delivered 40 commercial jets in August, an improvement from the same month last year. However, the company is still dealing with the aftermath of a manufacturing defect that affected its 737 MAX production.

Moreover, on Tuesday, Boeing informed suppliers of a six-month delay in reaching a key production milestone for its 737 MAX. The new target is to achieve a monthly output of 42 jets by March 2025, instead of the previous goal of September.

The labor unrest adds another layer of complexity to Boeing’s challenges. On Monday, union workers expressed dissatisfaction with the tentative labor agreement, hoping for higher wage increases and better pensions. This sentiment was reflected in the overwhelming rejection of the contract and the high vote to strike.

Price Action: Boeing’s stock closed at $162.77 on Thursday, up 0.89%. In after-hours trading, the stock dipped 0.17%. Year-to-date, Boeing’s stock has decreased significantly by 35.35%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Empire Company Reports Voting Results

STELLARTON, NS, Sept. 12, 2024 /CNW/ – Empire Company Limited (“Empire” or the “Company”) EMP announced the voting results for the election of its directors at its Annual General Meeting (the “Meeting”) held today.

There were 98,121,279 Class B shares (over 99.9% of outstanding Class B shares) represented by proxy at the Meeting of which 100% of the Class B shares were voted in favour of each director nominee, and no Class B shares were withheld from voting on any nominee.

In addition to the election of directors, the Class B shareholders also voted on fixing the maximum number of directors at 18, on the remuneration of directors, on the appointment of PricewaterhouseCoopers LLP as auditors for fiscal 2024 and to authorize the Board of Directors to fix the auditors’ remuneration. 100% of the Class B shares represented at the Meeting were voted in favour of these motions.

The advisory resolution on the Company’s approach to executive compensation was voted on by both Non-Voting Class A and Class B shareholders. There were 111,408,916 Non-Voting Class A shares (78.10% of the Non-Voting Class A shares outstanding) represented by proxy at the Meeting of which 95.90% were voted in favour of the motion. 100% of the Class B shares represented at the Meeting were voted in favour of the advisory resolution.

Additionally, Empire shareholders voted Lisa Lisson to the Board of Directors for the first time. Ms. Lisson, who was appointed to the Board in June 2024, has had a distinguished career with Federal Express Corporation since joining the company in 1992, including as the first female President of FedEx Express Canada. She currently serves as President of Air Operations for Federal Express Corporation.

ABOUT EMPIRE

Empire Company Limited EMP is a Canadian company headquartered in Stellarton, Nova Scotia. Empire’s key businesses are food retailing, through wholly-owned subsidiary Sobeys Inc., and related real estate. With approximately $31.5 billion in annual sales and $16.9 billion in assets, Empire and its subsidiaries, franchisees and affiliates employ approximately 128,000 people.

Additional financial information relating to Empire, including the Company’s Annual Information Form, can be found on the Company’s website at www.empireco.ca or at www.sedarplus.ca.

SOURCE Empire Company Limited

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c5263.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c5263.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sam-Altman Founded Worldcoin Soars On OpenAI's o1 Announcement, XRP Rides On Grayscale Trust Launch

Worldcoin WLD/USD and XRP XRP/USD were among the biggest gainers Thursday even as the broader market moved sideways.

What happened: WLD, the native currency of the blockchain-based identity verification project, popped more than 9%, emerging as the best-performing cryptocurrency in the last 24 hours.

The coin’s trading volume jumped 86% to $$182 million, reflecting huge demand from investors.

The rally followed the launch of a new model, ‘o1′, by OpenAI, marking a step toward the company’s goal of achieving human-like artificial intelligence. Recall that OpenAI CEO Sam Altman launched the Worldcoin project last year.

Apart from Worldcoin, XRP recorded healthy gains, jumping 4.42% in the last 24 hours. The seventh-largest cryptocurrency was the market’s biggest large-cap gainer in this period.

The positive momentum came on the heels of asset management giant Grayscale Investments launching a new XRP Trust. The trust aimed to expose accredited investors to the price moves of XRP.

Grayscale dissolved its earlier XRP trust in January 2021 after the SEC filed a lawsuit against Ripple Labs, the firm using XRP for its product offerings.

Price Action: At the time of writing, WLD was exchanging hands at $1.53, while XRP was valued at $0.562, according to data from Benzinga Pro.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Farmer Brothers reports fourth quarter and full year fiscal 2024 financial results

Fiscal year 2024 gross margin increase of 560 basis points year-over-year to 39.3%

Reported full year net loss of $3.9 million, increased full year adjusted EBITDA1 to $558,000

Fiscal 2024 net sales of $341.1 million

FORT WORTH, Texas, Sept. 12, 2024 (GLOBE NEWSWIRE) — Farmer Bros. Co. FARM today reported its fourth quarter and full year fiscal 2024 financial results for the period ended June 30, 2024. The company filed its Form 10-K, which can be found on the Investor Relations section of the company’s website.

“This past year was a transformative one for Farmer Brothers,” said President and Chief Executive Officer John Moore. “The decision to sell our direct ship business and focus on our more profitable DSD business helped significantly improve our gross margins and drive adjusted EBITDA profitability and overall operational efficiency. While we are proud of the significant progress we have made to date, there is still much more to be done as we complete our SKU rationalization and brand pyramid efforts, further streamline our operations and focus on driving customer growth and retention. We remain confident we are building a foundation which will generate long-term, sustainable growth and value creation for our shareholders.”

Fiscal 2024 business highlights

- Strengthened executive team with appointments of President and Chief Executive Officer John Moore and Chief Financial Officer Vance Fisher.

- Concluded its co-manufacturing agreement with TreeHouse Foods as part of the sale of its direct ship business and made significant progress on transition to focus on direct store delivery (DSD) business.

- Streamlined operations by restructuring sales organization, reducing SKU redundancies and centralizing production in Portland, Oregon.

- Upgraded technology infrastructure to enhance customer service, pricing approach and inventory management capabilities.

Fourth quarter fiscal 2024 financial results

- Net sales were $84.4 million for the fourth quarter of fiscal 2024, a decrease of $1.1 million, or 1%, compared to the fourth quarter of fiscal 2023.

- Gross profit for the fourth quarter of fiscal 2024 was $32.8 million, or 38.8%, compared to gross profit of $27.8 million, or 32.5%, for the fourth quarter of fiscal 2023.

- Net loss for the fourth quarter of fiscal 2024 was $4.6 million, compared to a net loss of $16.9 million for the fourth quarter of fiscal 2023. The $4.6 million net loss for the fourth quarter of fiscal 2024 included a $1.1 million of gain from the sale of assets and $400,000 of non-cash stock compensation. The $16.9 million net loss for the fourth quarter of fiscal 2023 included a $2.5 million loss from the sale of assets and $2.1 million of non-cash stock compensation.

- Adjusted EBITDA was a loss of $1.6 million for the fourth quarter of fiscal 2024, an increase of $5.6 million, compared to the fourth quarter of fiscal 2023.

1 This is a non-GAAP financial measure. See “non-GAAP financial measures” and “reconciliation of net loss to non-GAAP adjusted EBITDA loss” below.

Full year fiscal 2024 financial results

- Net sales for fiscal 2024 were $341.1 million, an increase of $1.1 million, or 0.3%, compared to fiscal 2023.

- Gross profit for fiscal 2024 was $133.9 million compared to $114.6 million in fiscal 2023. Gross margin increased 560 basis points in fiscal 2024 to 39.3%, compared to 33.7% in fiscal 2023.

- Net loss for fiscal 2024 was $3.9 million, compared to a net loss of $34 million for fiscal 2023. The $3.9 million net loss for fiscal 2024 included a $18.1 million gain from sale of assets, $3.8 million of non-cash stock compensation, $3 million of severance costs and a $1.2 million loss related to sale of business. The $34 million net loss for fiscal 2023 included a $5.1 million gain from the sale of assets, $8.2 million of non-cash stock compensation, $1.6 million of severance costs and $1.9 million of gain related to the settlement of the Boyd’s acquisition.

- Adjusted EBITDA was $558,000 for fiscal 2024, an increase of $14.7 million compared to fiscal 2023.

Balance Sheet and Liquidity

As of June 30, 2024, the company had $5.8 million of unrestricted cash and cash equivalents, $23.3 million in outstanding borrowings and $27.8 million of borrowing availability under its revolving credit facility.

Investor Conference Call

Farmer Brothers will publish its fourth quarter and full year fiscal 2024 financial results for the period ended June 30, 2024, with the filing of its Form 10-K, which will be posted on the Investor Relations section of the company’s website after the close of market Thursday, Sept. 12.

The company will host an audio-only investor conference call and webcast at 5 p.m. Eastern on Thursday, Sept. 12 to provide a review of the quarter and full fiscal year, as well as a business update. Callers who pre-register will be emailed dial-in details and a unique PIN to gain immediate access to the call and bypass the live operator. An audio-only replay of the webcast will be archived for at least 30 days on the Investor Relations section of the company’s website and will be available approximately two hours after the end of the live webcast.

About Farmer Brothers

Founded in 1912, Farmer Brothers Coffee Co. is a national coffee roaster, wholesaler, equipment servicer and distributor of coffee, tea and culinary products. The company’s product lines include organic, Direct Trade and sustainably produced coffee, as well as tea, cappuccino mixes, spices and baking/biscuit mixes.

Farmer Brothers Coffee Co. delivers extensive beverage planning services and culinary products to a wide variety of U.S.-based customers, ranging from small independent restaurants and foodservice operators to large institutional buyers, such as restaurant, department and convenience store chains, hotels, casinos, healthcare facilities and gourmet coffee houses, as well as grocery chains with private brand coffee and consumer branded coffee and tea products and foodservice distributors. The company’s primary brands include Farmer Brothers, Boyd’s, Cain’s, China Mist and West Coast Coffee.

Forward-looking Statements

This press release and other documents we file with the Securities and Exchange Commission (the “SEC”) contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, that are based on current expectations, estimates, forecasts and projections about us, our future performance, our financial condition, our products, our business strategy, our beliefs and our management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. These forward-looking statements can be identified by the use of words, like “anticipates,” “estimates,” “projects,” “expects,” “plans,” “believes,” “intends,” “will,” “could,” “may,” “assumes” and other words of similar meaning. These statements are based on management’s beliefs, assumptions, estimates and observations of future events based on information available to our management at the time the statements are made and include any statements that do not relate to any historical or current fact. These statements are not guarantees of future performance and they involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from what is expressed, implied or forecast by our forward-looking statements due in part to the risks, uncertainties and assumptions set forth in this press release and Part I, Item 1A. Risk Factors as well as Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, of our annual report on Form 10-K for the fiscal year ended June 30, 2023, filed with the SEC on Sept. 12, 2023, as amended by the Form 10-K/A filed with the SEC on Oct. 27, 2023 (as amended, the 2023 Form 10-K), as well as those discussed elsewhere in this press release and other factors described from time to time in our filings with the SEC.

Factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, severe weather, levels of consumer confidence in national and local economic business conditions, developments related to pricing cycles and volumes, the impact of labor market shortages, the increase of costs due to inflation, an economic downturn caused by any pandemic, epidemic or other disease outbreak, the success of our turnaround strategy, the impact of capital improvement projects, the adequacy and availability of capital resources to fund our existing and planned business operations and our capital expenditure requirements, our ability to meet financial covenant requirements in our credit facility, which could impact, among other things, our liquidity, the relative effectiveness of compensation-based employee incentives in causing improvements in our performance, the capacity to meet the demands of our customers, the extent of execution of plans for the growth of our business and achievement of financial metrics related to those plans, our success in retaining and/or attracting qualified employees, our success in adapting to technology and new commerce channels, the effect of the capital markets, as well as other external factors on stockholder value, fluctuations in availability and cost of green coffee, competition, organizational changes, the effectiveness of our hedging strategies in reducing price and interest rate risk, changes in consumer preferences, our ability to provide sustainability in ways that do not materially impair profitability, changes in the strength of the economy, including any effects from inflation, business conditions in the coffee industry and food industry in general, our continued success in attracting new customers, variances from budgeted sales mix and growth rates, weather and special or unusual events, as well as other risks, uncertainties and assumptions described in the 2023 Form 10-K and other factors described from time to time in our filings with the SEC.

Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this press release and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise, except as required under federal securities laws and the rules and regulations of the SEC.

Investor Relations Contact

Ellipsis

Investor.relations@farmerbros.com

646-776-0886

Media contact

Brandi Wessel

Director of Communications

405-885-5176

bwessel@farmerbros.com

| FARMER BROS. CO. CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (In thousands, except share and per share data) |

|||||||||||||||

| Three Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net sales | $ | 84,396 | $ | 85,496 | $ | 341,094 | $ | 339,964 | |||||||

| Cost of goods sold | 51,630 | 57,679 | 207,201 | 225,351 | |||||||||||

| Gross profit | 32,766 | 27,817 | 133,893 | 114,613 | |||||||||||

| Selling expenses | 28,401 | 25,072 | 111,371 | 103,151 | |||||||||||

| General and administrative expenses | 9,583 | 10,324 | 41,649 | 37,561 | |||||||||||

| Net gains from sale of assets | (1,071 | ) | 2,544 | (16,877 | ) | (5,140 | ) | ||||||||

| Operating expenses | 36,913 | 37,940 | 136,143 | 135,572 | |||||||||||

| Loss from operations | (4,147 | ) | (10,123 | ) | (2,250 | ) | (20,959 | ) | |||||||

| Other (expense) income: | |||||||||||||||

| Interest expense | (1,857 | ) | (3,007 | ) | (7,835 | ) | (9,162 | ) | |||||||

| Other, net | 1,394 | (4,160 | ) | 6,224 | (4,242 | ) | |||||||||

| Total other (expense) income | (463 | ) | (7,167 | ) | (1,611 | ) | (13,404 | ) | |||||||

| Loss from continuing operations before taxes | (4,610 | ) | (17,290 | ) | (3,861 | ) | (34,363 | ) | |||||||

| Income tax expense (benefit) | (18 | ) | (438 | ) | 14 | (325 | ) | ||||||||

| Loss from continuing operations | $ | (4,592 | ) | $ | (16,852 | ) | $ | (3,875 | ) | $ | (34,038 | ) | |||

| Loss from discontinued operations, net of income taxes | $ | — | $ | (29,925 | ) | $ | — | $ | (45,142 | ) | |||||

| Net loss | $ | (4,592 | ) | $ | (46,777 | ) | $ | (3,875 | ) | $ | (79,180 | ) | |||

| Net loss available to common stockholders | $ | (4,592 | ) | $ | (46,777 | ) | $ | (3,875 | ) | $ | (79,180 | ) | |||

| Loss from continuing operations available to common stockholders per common share, basic and diluted | $ | (0.22 | ) | $ | (0.84 | ) | $ | (0.19 | ) | $ | (1.74 | ) | |||

| Loss from discontinued operations available to common stockholders per common share, basic and diluted | $ | — | $ | (1.49 | ) | $ | — | $ | (2.30 | ) | |||||

| Net loss available to common stockholders per common share, basic and diluted | $ | (0.22 | ) | $ | (2.33 | ) | $ | (0.19 | ) | $ | (4.04 | ) | |||

| Weighted average common shares outstanding—basic and diluted | 20,793,956 | 20,088,604 | 20,873,266 | 19,621,992 | |||||||||||

| FARMER BROS. CO. CONSOLIDATED BALANCE SHEETS (UNAUDITED) (In thousands, except share and per share data) |

|||||||||||||

| June 30, | |||||||||||||

| 2024 | 2023 | ||||||||||||

| ASSETS | |||||||||||||

| Current assets: | |||||||||||||

| Cash and cash equivalents | $ | 5,830 | $ | 5,244 | |||||||||

| Restricted cash | 175 | 175 | |||||||||||

| Accounts and notes receivable, net of allowance for credit losses of $710 and $416, respectively | 35,147 | 45,129 | |||||||||||

| Inventories | 57,230 | 49,276 | |||||||||||

| Short-term derivative assets | 11 | 68 | |||||||||||

| Prepaid expenses | 4,236 | 5,334 | |||||||||||

| Assets held for sale | 352 | 7,770 | |||||||||||

| Total current assets | 102,981 | 112,996 | |||||||||||

| Property, plant and equipment, net | 34,002 | 33,782 | |||||||||||

| Intangible assets, net | 11,233 | 13,493 | |||||||||||

| Right-of-use operating lease assets | 35,241 | 24,593 | |||||||||||

| Other assets | 1,756 | 2,917 | |||||||||||

| Total assets | $ | 185,213 | $ | 187,781 | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||||

| Current liabilities: | |||||||||||||

| Accounts payable | 48,478 | 60,088 | |||||||||||

| Accrued payroll expenses | 10,782 | 10,082 | |||||||||||

| Right-of-use operating lease liabilities – current | 14,046 | 8,040 | |||||||||||

| Short-term derivative liability | 730 | 2,636 | |||||||||||

| Other current liabilities | 2,997 | 4,519 | |||||||||||

| Total current liabilities | 77,033 | 85,365 | |||||||||||

| Long-term borrowings under revolving credit facility | 23,300 | 23,021 | |||||||||||

| Accrued pension liabilities | 12,287 | 19,761 | |||||||||||

| Accrued postretirement benefits | 789 | 763 | |||||||||||

| Accrued workers’ compensation liabilities | 2,378 | 3,065 | |||||||||||

| Right-of-use operating lease liabilities | 21,766 | 17,157 | |||||||||||

| Other long-term liabilities | 2,111 | 537 | |||||||||||

| Total liabilities | $ | 139,664 | $ | 149,669 | |||||||||

| Commitments and contingencies (Note 19) | |||||||||||||

| Stockholders’ equity: | |||||||||||||

| Common stock, $1.00 par value, 50,000,000 shares authorized; 21,264,327 and 20,142,973 shares issued and outstanding at June 30, 2024 and 2023, respectively | 21,265 | 20,144 | |||||||||||

| Additional paid-in capital | 79,963 | 77,278 | |||||||||||

| Accumulated deficit | (30,354 | ) | (26,479 | ) | |||||||||

| Accumulated other comprehensive loss | (25,325 | ) | (32,831 | ) | |||||||||

| Total stockholders’ equity | $ | 45,549 | $ | 38,112 | |||||||||

| Total liabilities and stockholders’ equity | $ | 185,213 | $ | 187,781 | |||||||||

| FARMER BROS. CO. | |||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||

| (In thousands) | |||||||

| For the Years Ended June 30, | |||||||

| 2024 | 2023 | ||||||

| Cash flows from operating activities: | |||||||

| Net loss | $ | (3,875 | ) | $ | (79,180 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities | |||||||

| Depreciation and amortization | 11,588 | 22,168 | |||||

| Gain on settlement related to Boyd’s acquisition | — | (1,917 | ) | ||||

| Deferred income taxes | — | (735 | ) | ||||

| Net (gains) losses from sale of assets | (18,091 | ) | 22,275 | ||||

| Net losses (gains) on derivative instruments | 113 | 7,504 | |||||

| ESOP and share-based compensation expense | 3,806 | 8,311 | |||||

| Provision for credit losses | 748 | 743 | |||||

| Change in operating assets and liabilities: | |||||||

| Accounts receivable, net | 10,448 | (939 | ) | ||||

| Inventories | (7,954 | ) | 19,785 | ||||

| Derivative assets, net | 565 | (6,235 | ) | ||||

| Other assets | 2,335 | (945 | ) | ||||

| Accounts payable | (11,777 | ) | 7,087 | ||||

| Accrued expenses and other | (2,053 | ) | (4,802 | ) | |||

| Net cash used in operating activities | $ | (14,147 | ) | $ | (6,880 | ) | |

| Cash flows from investing activities: | |||||||

| Sale of business | (1,214 | ) | 92,226 | ||||

| Purchases of property, plant and equipment | (13,843 | ) | (15,016 | ) | |||

| Proceeds from sales of property, plant and equipment | 29,780 | 11,235 | |||||

| Net cash provided by investing activities | $ | 14,723 | $ | 88,445 | |||

| Cash flows from financing activities: | |||||||

| Proceeds from Credit Facilities | 6,279 | 54,000 | |||||

| Repayments on Credit Facilities | (6,000 | ) | (139,579 | ) | |||

| Payment of financing costs | (76 | ) | (368 | ) | |||

| Payments of finance lease obligations | (193 | ) | (193 | ) | |||

| Net cash provided by (used in) financing activities | $ | 10 | $ | (86,140 | ) | ||

| Net increase (decrease) in cash and cash equivalents and restricted cash | $ | 586 | $ | (4,575 | ) | ||

| Cash and cash equivalents and restricted cash at beginning of period | $ | 5,419 | $ | 9,994 | |||

| Cash and cash equivalents and restricted cash at end of period | $ | 6,005 | $ | 5,419 | |||

| Supplemental disclosure of cash flow information: | |||||||

| Cash paid for interest | $ | 2,803 | $ | 11,760 | |||

| Cash paid for income taxes | 164 | 177 | |||||

| Supplemental disclosure of non-cash investing and financing activities: | |||||||

| Non-cash additions to property, plant and equipment | 167 | 124 | |||||

| Non-cash issuance of ESOP and 401(K) common stock | 595 | 938 | |||||

| Right-of-use assets obtained in exchange for new operating lease liabilities | 13,508 | 3,517 | |||||

| Conversion of preferred shares | — | 399 | |||||

Non-GAAP Financial Measures

Non-GAAP Financial Measures

In addition to net loss determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we use the following non-GAAP financial measures in assessing our operating performance:

“EBITDA” is defined as loss from continuing operations excluding the impact of:

- income tax expense (benefit);

- interest expense; and

- depreciation and amortization expense.

“EBITDA Margin” is defined as EBITDA expressed as a percentage of net sales.

“Adjusted EBITDA” is defined as loss from continuing operations excluding the impact of:

- income tax expense (benefit);

- interest expense;

- depreciation and amortization expense;

- 401(k) and share-based compensation expense;

- net gains from sales of assets;

- severance costs;

- loss related to sale of business; and

- gain on settlement with Boyd’s sellers.

“Adjusted EBITDA Margin” is defined as Adjusted EBITDA expressed as a percentage of net sales.

For purposes of calculating EBITDA and EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin, we have excluded the impact of interest expense resulting from non-cash pretax pension and postretirement benefits. For purposes of calculating Adjusted EBITDA and Adjusted EBITDA Margin, we are also excluding the impact of severance and the loss related to sale of business as these items are not reflective of our ongoing operating results.

We believe these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management utilizes these measures, in addition to GAAP measures, when evaluating and comparing the Company’s operating performance against internal financial forecasts and budgets.

We believe that EBITDA facilitates operating performance comparisons from period to period by isolating the effects of certain items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. These potential differences may be caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense). We also present EBITDA and EBITDA Margin because (i) we believe that these measures are frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry, (ii) we believe that investors will find these measures useful in assessing our ability to service or incur indebtedness, and (iii) we use these measures internally as benchmarks to compare our performance to that of our competitors.

EBITDA, EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin, as defined by us, may not be comparable to similarly titled measures reported by other companies. We do not intend for non-GAAP financial measures to be considered in isolation or as a substitute for other measures prepared in accordance with GAAP. This calculation is for continuing operations only.

Set forth below is a reconciliation of loss from continuing operations to EBITDA (non-GAAP):

| Three Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Loss from continuing operations | $ | (4,592 | ) | $ | (16,852 | ) | $ | (3,875 | ) | $ | (34,038 | ) | |||

| Income tax expense (benefit) | (18 | ) | (438 | ) | 14 | (325 | ) | ||||||||

| Interest expense (1) | 657 | 1,841 | 2,991 | 4,499 | |||||||||||

| Depreciation and amortization expense | 2,913 | 3,412 | 11,588 | 12,939 | |||||||||||

| EBITDA | $ | (1,040 | ) | $ | (12,037 | ) | $ | 10,718 | $ | (16,925 | ) | ||||

| EBITDA Margin | (1.2 | )% | (14.1 | )% | 3.1 | % | (5.0 | )% | |||||||

_______________

(1) Excludes interest expense related to pension plans and postretirement benefits.

Set forth below is a reconciliation of loss from continuing operations to Adjusted EBITDA (non-GAAP):

| Three Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Loss from continuing operations | $ | (4,592 | ) | $ | (16,852 | ) | $ | (3,875 | ) | $ | (34,038 | ) | |||

| Income tax expense (benefit) | (18 | ) | (438 | ) | 14 | (325 | ) | ||||||||

| Interest expense (1) | 657 | 1,841 | 2,991 | 4,499 | |||||||||||

| Depreciation and amortization expense | 2,913 | 3,412 | 11,588 | 12,939 | |||||||||||

| 401(k) and share-based compensation expense | 438 | 2,141 | 3,762 | 8,212 | |||||||||||

| Net (gains) loss from sale of assets | (1,071 | ) | 2,544 | (18,091 | ) | (5,140 | ) | ||||||||

| Severance costs | 99 | 177 | 2,955 | 1,617 | |||||||||||

| Loss related to sale of business (3) | — | — | 1,214 | — | |||||||||||

| Gain on settlement with Boyd’s sellers (2) | — | — | — | (1,917 | ) | ||||||||||

| Adjusted EBITDA | $ | (1,574 | ) | $ | (7,175 | ) | $ | 558 | $ | (14,153 | ) | ||||

| Adjusted EBITDA Margin | (1.9)% | (8.4)% | 0.2 | % | (4.2)% | ||||||||||

_______________

(1) Excludes interest expense related to pension plans and postretirement benefits.

(2) Result of the settlement related to the acquisition of Boyd Coffee Company which included the cancellation of shares of Series A Preferred Stock and settlement of liabilities.

(3) Result of the settlements related to the sale of the company’s direct ship business, which included gains related to coffee hedges and settlement of liabilities.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Johnson & Johnson

Whales with a lot of money to spend have taken a noticeably bullish stance on Johnson & Johnson.

Looking at options history for Johnson & Johnson JNJ we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $552,410 and 5, calls, for a total amount of $522,817.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $170.0 for Johnson & Johnson over the last 3 months.

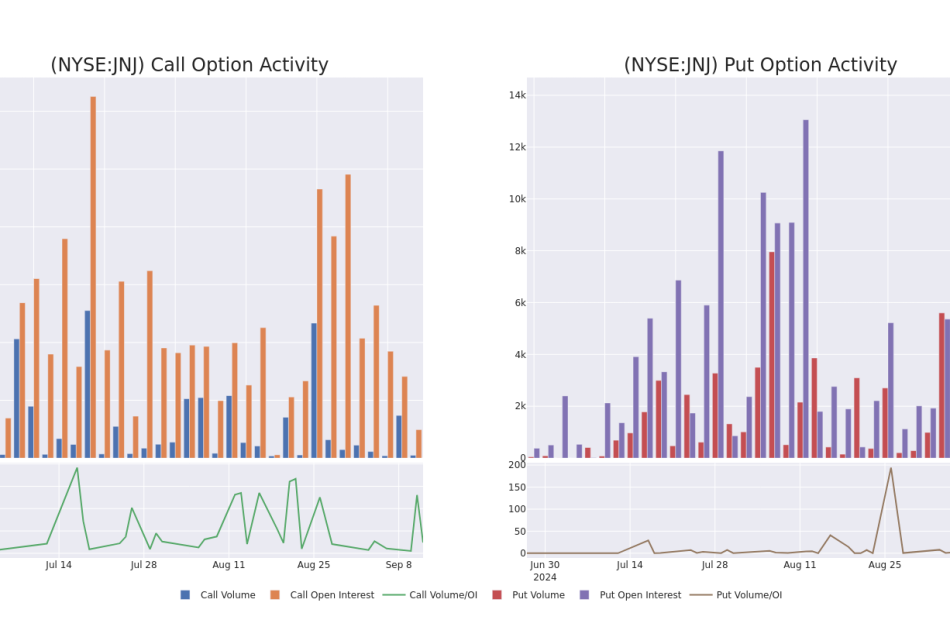

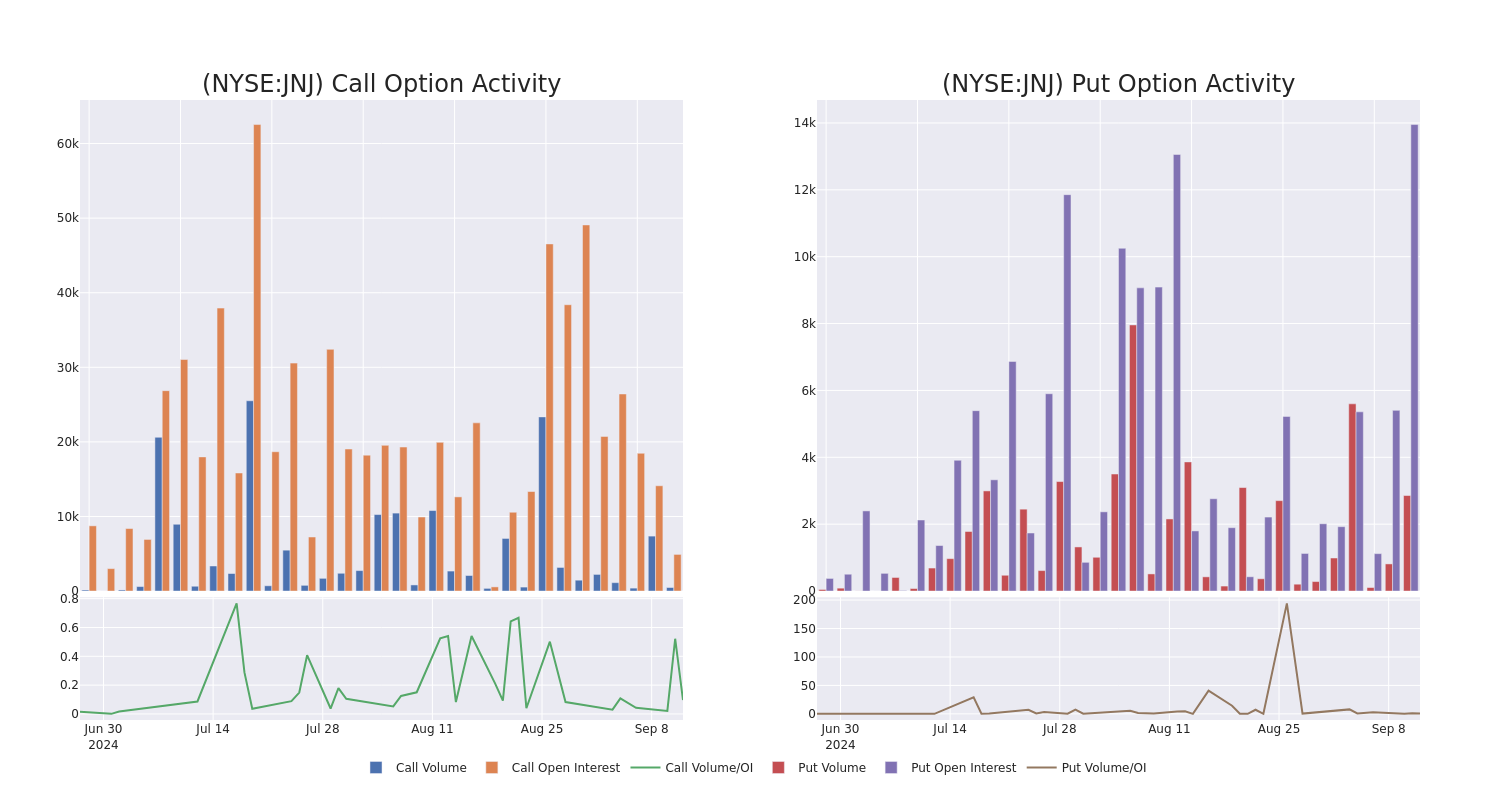

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Johnson & Johnson’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Johnson & Johnson’s whale activity within a strike price range from $155.0 to $170.0 in the last 30 days.

Johnson & Johnson 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | PUT | TRADE | BULLISH | 01/17/25 | $4.65 | $4.55 | $4.56 | $160.00 | $410.4K | 4.8K | 1.2K |

| JNJ | CALL | TRADE | BULLISH | 04/17/25 | $15.7 | $15.15 | $15.59 | $155.00 | $144.9K | 7 | 93 |

| JNJ | CALL | SWEEP | BEARISH | 01/17/25 | $13.5 | $13.45 | $13.45 | $155.00 | $121.0K | 3.3K | 114 |

| JNJ | CALL | TRADE | BULLISH | 06/20/25 | $13.7 | $12.75 | $13.7 | $160.00 | $119.1K | 1.4K | 87 |

| JNJ | CALL | SWEEP | NEUTRAL | 09/19/25 | $10.65 | $9.4 | $9.6 | $170.00 | $80.6K | 8 | 95 |

About Johnson & Johnson

Johnson & Johnson is the world’s largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company’s sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

After a thorough review of the options trading surrounding Johnson & Johnson, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Johnson & Johnson’s Current Market Status

- With a trading volume of 4,494,400, the price of JNJ is down by -0.11%, reaching $164.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 33 days from now.

Professional Analyst Ratings for Johnson & Johnson

2 market experts have recently issued ratings for this stock, with a consensus target price of $215.0.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $215.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $215.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Johnson & Johnson with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DHL sues MyPillow, alleging company founded by Mike Lindell owes $800,000

MINNEAPOLIS (AP) — Package delivery company DHL is suing MyPillow, alleging the company synonymous with its founder, chief pitchman and election denier Mike Lindell owes nearly $800,000 for unpaid bills.

The lawsuit is the latest legal dispute to emerge against MyPillow and Lindell, a prominent supporter of Donald Trump who has helped amplify the former president’s false claims that the 2020 election was stolen from him.

In the lawsuit filed in Hennepin County District Court in Minneapolis on Monday, the DHL eCommerce unit alleges that MyPillow is in violation of a contract that requires the Minnesota-based company to pay for all parcel delivery services within 15 days of being billed. The lawsuit says they reached a settlement in May 2023 that required MyPillow to pay $775,000 in 24 monthly installments starting in April of this year.

But the lawsuit alleges that MyPillow has made only partial payments on that settlement, totaling $64,583.34, with the last one received on June 6. DHL says it notified MyPillow that it was in default on July 2. The lawsuit seeks $799,925.59, plus interest and attorney fees.

Lindell told The Associated Press on Thursday that he didn’t know what the lawsuit was about, but that his company decided to stop using DHL over a year ago in a dispute over shipments that he said was DHL’s fault.

Lawsuits and billing disputes are nothing new for the “MyPillow Guy.” He’s being sued for defamation by two voting machine companies. Lawyers who were originally defending him in those cases quit over unpaid bills.

A credit crunch last year disrupted cash flow at MyPillow after it lost Fox News as one of its major advertising platforms and was dropped by several national retailers. A judge in February affirmed a $5 million arbitration award to a software engineer who challenged data that Lindell said proved that China interfered in the 2020 election.

Shereta D. Williams's Recent Buy: Acquires $84K In Daktronics Stock

A notable insider purchase on September 11, was reported by Shereta D. Williams, Director at Daktronics DAKT, based on the most recent SEC filing.

What Happened: Williams demonstrated confidence in Daktronics by purchasing 7,160 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the transaction is $84,989.

During Thursday’s morning session, Daktronics shares down by 0.0%, currently priced at $12.19.

Unveiling the Story Behind Daktronics

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Daktronics’s Economic Impact: An Analysis

Decline in Revenue: Over the 3 months period, Daktronics faced challenges, resulting in a decline of approximately -2.77% in revenue growth as of 31 July, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: With a low gross margin of 26.4%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Daktronics’s EPS reflects a decline, falling below the industry average with a current EPS of -0.11.

Debt Management: With a below-average debt-to-equity ratio of 0.32, Daktronics adopts a prudent financial strategy, indicating a balanced approach to debt management.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Daktronics’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 58.05.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.7, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 6.15, Daktronics could be considered undervalued.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Essential Transaction Codes Unveiled

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Berkshire Hathaway’s Jain Sells Over Half of Class A Shares

(Bloomberg) — Berkshire Hathaway Inc.’s vice chair of insurance operations, Ajit Jain, sold $139 million worth of his Class A shares in Warren Buffett’s conglomerate.

Most Read from Bloomberg

Jain, one of Buffett’s top lieutenants, disposed of 200 of the Class A shares for about $695,418 each, according to a regulatory filing Wednesday. The disposal means the longterm executive is left with control of 166 such shares, 61 of which he directly owns.

When reached by phone, Jain declined to comment. Berkshire Hathaway didn’t immediately respond to a request for comment.

The move marks a shift for Jain, who added 50 Class A shares to his holding between March 2023 and March this year. Still, he has been trimming his Class B stake in the conglomerate over the years, selling more than 70,000 such shares from March 2020 to March 2024, according to past proxy filings.

The executive joined Berkshire Hathaway in 1986 to work on the conglomerate’s insurance operations, which include car insurer GEICO.

Buffett has long praised Jain, saying in 2017 that he’s probably made more money for Berkshire than Buffett has. In 2018, Jain and Greg Abel were named vice chairmen of the firm, with Abel, who’s a decade younger than Jain, eventually being tapped as Buffett’s successor.

Investors have questioned whether Jain would stick around to help Abel run things once Buffett, now 94, leaves the firm. Jain still owns more Class B shares than Abel.

“We continue to be comfortable that the interests of Mr. Jain and Mr. Abel are aligned with shareholders,” James Shanahan, an analyst at Edward Jones who covers Berkshire Hathaway, told Bloomberg.

(Updates with additional context starting in fourth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

After Trump, Marjorie Taylor Greene Slams Joe Biden For Rising Costs: Has Inflation Really Been The 'Worst In Our Nation's History' As Ex-President Claims?

Republican Rep. Marjorie Taylor Greene (R-Ga.) has joined former President Donald Trump in criticizing President Joe Biden over the nation’s inflation levels.

What Happened: Greene voiced her concerns about the state of the economy under Biden’s leadership on Thursday on X.

“Inflation has increased nearly 20% in the past 4 years – that’s a major problem for businesses and families trying to keep up with rising costs of energy, food, and other expenses. The Biden/Harris admin has put America last for four years and the American people are being crushed. We must reverse course,” she wrote.

Greene’s statement comes after Trump’s recent critique of Biden during Tuesday debate with Vice President Kamala Harris. Trump has consistently overstated the inflation rates during Biden’s term, claiming it is the worst in history.

However, Forbes reports that while inflation did reach a 40-year peak of 9.1% in June 2022, it had previously escalated to over 14% in the 1980s, 11.1% in 1974, 10.9% in 1942, and 17.8% in 1917. As of July, inflation has decreased to 2.9% year-over-year, the lowest level since March 2021.

Some economists argue that inflation is not solely the responsibility of presidents, as it is often a global phenomenon influenced by various factors, including the independent Federal Reserve’s control over interest rates. However, presidential fiscal policies can contribute to inflation.

Why It Matters: The U.S. annual inflation rate in August fell to its lowest point since February 2021, indicating a further easing of pressure on the cost of goods and services for U.S. consumers. However, core inflation pressures remain stubborn at 3.2% as shelter costs surged at their fastest monthly pace since January 2024, fueling gains in the dollar and sending Treasury yields climbing.

Expectations for a significant 50-basis-point rate cut at the Sept. 18 FOMC meeting dropped to just 15%, down from 34% a day earlier, as per CME Group’s FedWatch tool.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.