Zebra Technologies Unveils Retail Efficiency Solutions at ZONE

Zebra Technologies Corporation ZBRA has introduced three new solutions, namely, the Zebra Kiosk System, Zebra Workcloud Actionable Intelligence 7.0 and the ET6x Windows rugged tablets at the annual ZONE customer conference.

At Zebra Technologies’ ZONE event, retailers connect with customers, partners and prospects to explore industry challenges and opportunities with keynote presentations focusing on key topics, including inventory management, loss prevention and efficiency improvement. In this event, the company introduced its expanded range of integrated hardware and software solutions, utilizing AI, cloud and machine learning to enhance workflow efficiencies and elevate customer and associate experiences in modern retail environments.

ZBRA’s Kiosk System is a versatile, modular solution made to address self-service needs across retail and other sectors, anchored by the KC50 Android Kiosk Computer available in 15″ and 22″ screen sizes. This system, which includes tap-to-pay, works with all major payment terminals and has a voice assistant, thereby making checkout easier and allowing staff to focus on more important tasks. Built on Qualcomm’s advanced chipset and Zebra’s Enterprise Android platform with Mobility DNA, the product ensures seamless connectivity, security and management, with flexible deployment options and the ability to add components like barcode scanners, payment terminals or a TD50 15″ touch display for a dual-display setup.

Zebra Workcloud Actionable Intelligence 7.0 brings a next-gen, AI-powered analytics platform tailored for the modern store, leveraging Google Cloud’s serverless query engine for unmatched speed and performance. The update automates data analysis, task management and action verification, enabling users to quickly identify hidden insights and streamline workflows, ultimately enhancing productivity and uncovering opportunities beyond human detection.

The ET6x Windows rugged tablets, powered by Intel’s Core Ultra platform with a dedicated Neural Processing Unit, enhance AI capabilities across industries such as retail, logistics and field services. These advanced features improve performance and efficiency for various applications. The tablets also come with the Zebra Control Hub for streamlined configuration and management, featuring an advanced AI-enabled touchscreen for improved accuracy, AI-powered audio for better communication and flexible usage options.

ZBRA’s Zacks Rank and Price Performance

ZBRA currently carries a Zacks Rank #3 (Hold).

Zebra Technologies is focusing on advancing digital capabilities, optimizing the supply chain and expanding data analytics capabilities to engage with its customers. Higher sales of mobile computing products are supporting the Enterprise Visibility & Mobility segment’s sales.

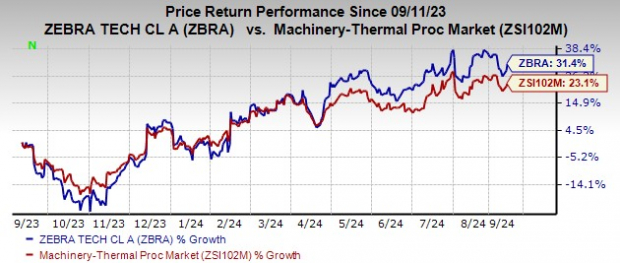

In the past year, the company’s shares have gained 31.4% compared with the industry’s 23.1% growth.

Image Source: Zacks Investment Research

Weak demand for printing solutions is affecting the company’s Asset Intelligence & Tracking segment. Low demand for RFID products is also concerning. High debt levels are also likely to raise the company’s financial obligations and hurt profitability. Given its diverse presence, forex woes remain concerning.

Stocks to Consider

Some better-ranked companies are discussed below.

Flowserve Corporation FLS currently carries a Zacks Rank #2 (Buy).

FLS delivered a trailing four-quarter average earnings surprise of 18.2%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2024 earnings has increased 3.8%.

Crane Company CR presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 2%.

Parker-Hannifin Corporation PH currently carries a Zacks Rank of 2. PH delivered a trailing four-quarter average earnings surprise of 2.6%.

In the past 60 days, the consensus estimate for Parker-Hannifin’s fiscal 2025 earnings has increased 1.1%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply