3 Dividend King Consumer Staples Stocks That Could Make You a Millionaire

It is unlikely that any one single stock will get your portfolio to millionaire status, at least not without you taking on a huge amount of risk. A far better (and less-risky) approach is to buy a collection of well-run stocks. What better place to look than Dividend Kings, which have proven their ability to reward investors by increasing dividends for five decades (or more).

Right now you might want to look at consumer staples icons Coca-Cola (NYSE: KO), PepsiCo (NASDAQ: PEP), and Hormel Foods (NYSE: HRL). There’s a different reason to like each one of these three Dividend Kings.

1. Coca-Cola is a steady grower

Every company’s business waxes and wanes over time. But some seem to manage to keep steadily growing with a normal sine curve that moves reliably higher over time. Coca-Cola is one of those companies, and it’s a big reason why it’s been a long-term holding for Warren Buffett’s Berkshire Hathaway for decades. The fact that the Coca-Cola name is one of the best-known beverage brands in the world means you probably already know what it does.

Because it’s well known, Coca-Cola stock rarely goes on sale and it isn’t exactly cheap today. The stock’s price-to-sales and price-to-earnings ratios are both a little above their five-year averages. The 2.7% dividend yield is also below the five-year average. A big price rally over the past year or so is largely responsible for this. However, the company’s clout in the industry and its long history of growth make it a worthwhile foundational investment choice.

Notably, Coca-Cola’s earnings growth has averaged 10% annualized over the past five years. That may not last, but it speaks to what the company can do when it is hitting on all cylinders. If you don’t mind paying a fair price for a great company, Coca-Cola should be in your millionaire-maker portfolio. And if the stock price falls, well, take the opportunity to increase your stake in this beverage giant.

2. PepsiCo is more attractively priced

PepsiCo is No. 2 to Coca-Cola on the beverage front, but it is the No. 1 in salty snacks (with its Frito-Lay brand). On top of those two businesses, it also has a packaged food division (Quaker Oats). It is a food industry giant, with the kind of scale, distribution, and marketing prowess that makes it a vital partner to retailers around the world. It, too, has proven its ability to steadily grow its business over the long term. Remember, like Coca-Cola and Hormel, PepsiCo is a Dividend King.

Another key reason to add PepsiCo to the consumer staples mix in your portfolio is that it is more reasonably priced today. The stock’s P/S ratio is below its five-year average and its P/E ratio is basically at the five-year average. The stock’s 3% dividend yield, meanwhile, is above the five-year average. All in, PepsiCo looks fairly priced to a little cheap right now.

PepsiCo’s business isn’t growing as strongly as Coca-Cola’s at the moment. That said, over the past decade revenue has grown at 3% a year with earnings expanding at 4%. That’s pretty solid for a consumer staples company. And while PepsiCo’s earnings growth has been weaker than Coca-Cola’s of late, even great companies go through weak periods. That’s often a good time for long-term investors to jump aboard.

3. Hormel is in the dog house

Hormel is a pure-play food maker. It has been shifting its portfolio around over the past few years to focus on branded food items, adding brands like Wholly Guacamole, Planters, and Columbus to its already strong roster of iconic brands, like SPAM and its namesake Hormel, among others. Innovation has long been a strong suit for Hormel and is one of the many reasons why it is such a valuable partner to retailers.

That said, Hormel hasn’t been hitting it out of the park lately, as it is stuck in a bit of a rut. The consumer staples company hasn’t been as successful at passing its rising costs on to consumers, has been hampered by the impact of avian flu, has struggled with a slow pandemic recovery in China, and bought Planters right as the nut segment of the snack category started to slow down. Any one of these issues could be brushed off, but all four at once have Wall Street concerned about the future. Still, it seems highly likely that Dividend King Hormel will, eventually, muddle through just fine. But it may take a little time.

That’s an opportunity for investors who think in decades and not days. Hormel’s P/S and P/E ratios are both below their five-year averages. Its 3.5% dividend yield is well above its five-year average. It is the value play in this trio, with recovery potential as management slowly deals with the list of problems that currently have investors down.

Slow and steady wins the race

If you are looking at the companies here, Coca-Cola, PepsiCo, and Hormel, and thinking that they aren’t going to get you to millionaire status overnight, well, you’re right. They won’t. They are reliable businesses that throw off cash to investors year in and year out, allowing shareholders to build wealth over time. They are the kind of boring, foundational stocks that underpin seven-figure portfolios all across Wall Street (remember, Buffett has owned Coca-Cola for decades). Each one is slightly different. Each one trades at a slightly different valuation. But all three are the kinds of stocks that will let you sleep well at night while you build generational wealth and a reliable income stream, particularly if you put them all together in one diversified portfolio.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Reuben Gregg Brewer has positions in Hormel Foods. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

3 Dividend King Consumer Staples Stocks That Could Make You a Millionaire was originally published by The Motley Fool

Donald Trump's Pet-Eating Claims Shaking Up Springfield, Ohio

The tranquil town of Springfield, Ohio, has been disrupted by Donald Trump‘s baseless allegations about Haitian immigrants consuming pets. The claim was made during last week’s presidential debate, causing turmoil in the community.

What Happened: Springfield, a town situated between Dayton and Columbus, has turned into a hub of tension and misinformation following Trump’s comments, reports Business Insider.

The Springfield, OH Community Facebook group, previously a platform for local dialogue, has now become a battlefield for intense debates and the dissemination of false information.

The situation took a turn for the worse when Trump mentioned Springfield in his debate with Kamala Harris. Even though fact-checkers and city officials refuted the claims, the damage had already been inflicted.

“In Springfield, they are eating the dogs. The people who came in, they are eating the cats. They’re eating — they’re eating the pets of the people that live there,” Trump said during the debate.

Concerns are rising among locals like Sara Bear, who fears that their town of approximately 60,000 inhabitants will now be known as a “cat-meme town full of hateful bigots,” reports Insider.

The tense environment has resulted in restaurants receiving hoax calls inquiring about cats on the menu and even a bomb threat targeted at Haitian immigrants, leading to a temporary shutdown of Springfield City Hall.

Other residents, such as Jessica Eikleberry and Olivia Parkinson, are worried about the town’s reputation and safety being significantly jeopardized, with heightened racial tensions and fears for the safety of people of color. The town’s image is also impacting local businesses and potentially discouraging people from relocating to or remaining in Springfield.

Despite the prevailing situation, some residents like Marjory Wentworth are making efforts to support the Haitian community, who feel they are being exploited and vilified for political advantages. Haitian immigrant Marco Lapaix voiced his fear and annoyance but underscored the importance of fighting for acceptance.

Why It Matters: The incident in Springfield, Ohio underscores the power of public figures’ words and their potential to incite division and unrest.

The unfounded claims have not only disrupted the peace of the town but also threatened the safety and harmony of its diverse community.

The situation serves as a stark reminder of the need for responsible and accurate public discourse, especially from influential figures.

Read Next:

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AGNC Investment Corp. Declares Third Quarter Dividends on Preferred Stock

BETHESDA, Md., Sept. 13, 2024 /PRNewswire/ — AGNC Investment Corp. AGNC (“AGNC” or the “Company”) announced today that its Board of Directors has declared cash dividends on the outstanding depositary shares1 of the following series of preferred stock for the third quarter 2024:

|

Series of Preferred Stock |

Ticker |

Per Annum |

Dividend Per |

|||

|

7.00% Series C Fixed-to-Floating Rate |

AGNCN |

10.65872%2 |

$0.68097 |

|||

|

6.875% Series D Fixed-to-Floating Rate |

AGNCM |

9.87972%3 |

$0.63120 |

|||

|

6.50% Series E Fixed-to-Floating Rate |

AGNCO |

6.50 % |

$0.40625 |

|||

|

6.125% Series F Fixed-to-Floating Rate |

AGNCP |

6.125 % |

$0.3828125 |

|||

|

7.750% Series G Fixed-Rate Reset |

AGNCL |

7.750 % |

$0.48438 |

|

1. |

Each depositary share represents a 1/1,000th interest in a share of preferred stock. |

|

2. |

The Series C Depositary Shares accrue dividends at a floating rate equal to Three-Month CME Term SOFR plus 0.26161% plus 5.111%. The dividend rate for the dividend period ending October 14, 2024 is 10.65872% per annum. |

|

3. |

The Series D Depositary Shares accrue dividends at a floating rate equal to Three-Month CME Term SOFR plus 0.26161% plus 4.332%. The dividend rate for the dividend period ending October 14, 2024 is 9.87972% per annum. |

The dividend for each series of outstanding preferred stock is payable on October 15, 2024 to holders of record as of October 1, 2024.

For further information or questions, please contact Investor Relations at (301) 968-9300 or IR@AGNC.com.

ABOUT AGNC INVESTMENT CORP.

Founded in 2008, AGNC Investment Corp. AGNC is a leading investor in Agency residential mortgage-backed securities (Agency MBS), which benefit from a guarantee against credit losses by Fannie Mae, Freddie Mac, or Ginnie Mae. We invest on a leveraged basis, financing our Agency MBS assets primarily through repurchase agreements, and utilize dynamic risk management strategies intended to protect the value of our portfolio from interest rate and other market risks.

AGNC has a track record of providing favorable long-term returns for our stockholders through substantial monthly dividend income, with over $13 billion of common stock dividends paid since inception. Our business is a significant source of private capital for the U.S. residential housing market, and our team has extensive experience managing mortgage assets across market cycles. To learn more about The Premier Agency Residential Mortgage REIT, please visit www.AGNC.com, follow us on LinkedIn and X, and sign up for Investor Alerts.

CONTACT:

Investor Relations – (301) 968-9300

![]() View original content:https://www.prnewswire.com/news-releases/agnc-investment-corp-declares-third-quarter-dividends-on-preferred-stock-302248043.html

View original content:https://www.prnewswire.com/news-releases/agnc-investment-corp-declares-third-quarter-dividends-on-preferred-stock-302248043.html

SOURCE AGNC Investment Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

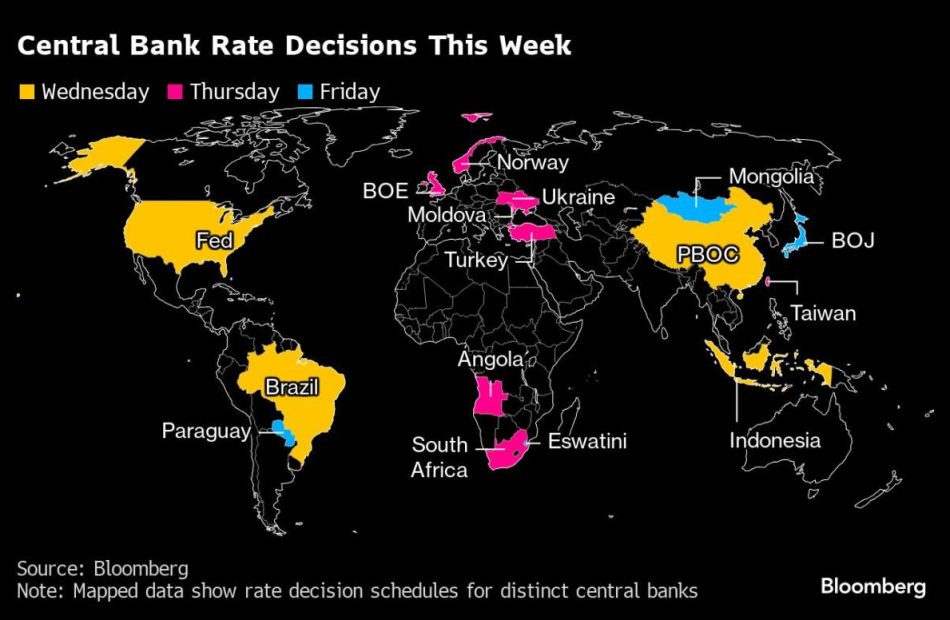

World Braces for Fed Easing Amid 36-Hour Rate Rollercoaster

(Bloomberg) — The world economy’s tectonic plates will shift this week when a US easing cycle begins, just as officials from Europe to Asia set policy against a backdrop of brittle markets.

Most Read from Bloomberg

A 36-hour monetary rollercoaster will start with the Federal Reserve’s probable decision to cut interest rates on Wednesday, and finish on Friday with the outcome of the Bank of Japan’s first meeting since it raised borrowing costs and helped sow the seeds of a global selloff.

Along the way, central banking peers in the Group of 20 and beyond that are poised to adjust their own policy levers include Brazil, where officials may tighten for the first time in 3 1/2 years, and the Bank of England. The UK central bank faces a delicate judgment on the pace of its balance-sheet unwind, and may also signal how ready it is to ease further.

South African policymakers are anticipated to cut borrowing costs for the first time since 2020, while counterparts in Norway and Turkey may keep them unchanged.

The Fed decision will take center stage, with jittery traders debating whether officials will judge a quarter-point cut to be adequate medicine for an economy showing signs of losing momentum, or whether they’ll opt for a half-point move instead. Clues on the Fed’s future intentions will also be pivotal.

But for all the end to suspense that the US announcement will bring, investors are likely to stay on edge at least until the BOJ is done, in a decision that’s bound to be scrutinized for clues on its next hike.

What Bloomberg Economics Says:

“We think Fed Chair Jerome Powell supports a 50-basis point cut. However, the lack of a clear signal from New York Fed President John Williams before the pre-meeting blackout period makes us think Powell doesn’t have the full committee’s support.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

Focusing minds will be memories of market ructions a few weeks ago amid the unwind of yen-centered carry trades after its rate increase in July.

And that’s not all: China could be in the limelight too, with a monetary announcement by officials there anticipated at some point — days after data showed that the world’s second-biggest economy is suffering signs of spiraling deflation.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

US and Canada

When Fed policymakers sit down Tuesday for the start of their two-day meeting, they’ll have fresh figures on the state of consumer demand. While overall retail sales in August were likely held back by slower activity at auto dealers, receipts at other merchants probably posted a healthy advance.

Despite signs of consumer resilience, a Fed report out the same day is expected to show lingering malaise in factory output. Looming November elections and still-high borrowing costs are restraining capital spending.

On Wednesday, government figures are seen showing that housing starts firmed up last month after sliding in July to the lowest level since May 2020. National Association of Realtors data on Thursday will probably show contract closings on previously owned home sales remained weak, though.

Canada’s inflation reading for August is likely to show continued deceleration in both headline and core measures. A slight uptick wouldn’t knock the Bank of Canada off its easing path, however, while cooler-than-expected data may boost calls for deeper rate cuts.

Asia

BOJ chief Kazuo Ueda is bound to get a lot of attention after the board sets policy on Friday.

While economists are unanimous in predicting no change to borrowing costs, how the governor characterizes the trajectory could jolt Japan’s currency, which has already spooked yen-carry traders by outperforming its peers so far this month.

Elsewhere, 1-year medium-term lending and loan prime rates in China are expected to be kept unchanged, and Indonesia’s central bank is tipped to hold its policy rate steady for a fifth month. Authorities in Taiwan decide the discount rate on Thursday.

On the data front, Japan’s key consumer inflation gauge is seen ticking higher a tad in August, backing the case for the BOJ to eye a rate hike in coming months.

Japan, Singapore, Indonesia and Malaysia will release trade figures, while New Zealand is set to report second-quarter data that may show the economy contracted a smidgeon versus the prior quarter.

Europe, Middle East, Africa

Several central bank decisions are scheduled in the wake of the Fed’s likely easing. Given their dependence on dollar-denominated energy exports, Gulf states may follow the US lead automatically with rate cuts of their own.

Here’s a quick roundup of other announcements due in Europe, the Middle East and Africa, mainly on Thursday:

-

While no rate change is expected from the BOE, investors await a crucial judgment on whether it will accelerate the wind-down of its bond portfolio to keep gilt sales steady before a year when an unusually high amount of debt matures. Hints on the pace of future rate cuts will also be eagerly awaited, amid speculation that officials will soon ramp up easing to aid the economy.

-

Norges Bank is seen keeping its deposit rate at 4.5%, with analysts focusing on any adjustments to projections for easing early next year. While slowing inflation has increased bets on a first cut in December, Norwegian officials may stick to their hawkish stance with the labor market robust and the krone near multi-year lows.

-

Central banks in Ukraine and Moldova are also scheduled for decisions.

-

Turning south, Turkey’s central bank is set to keep its key rate at 50% for a sixth straight meeting as it waits for inflation to slow further. The pace of annual price growth has dropped from 75% in May, but remains as high as 52%. Officials hope to get it close to 40% by year-end.

-

With data on Wednesday predicted to show South Africa’s inflation slowed to 4.5% in August, the central bank may cut borrowing costs for the first time since 2020 a day later. Governor Lesetja Kganyago has said the institution will adjust rates once price growth is firmly at the 4.5% midpoint of its target range, where it prefers to anchor expectations. Forward-rate agreements, used to speculate on borrowing costs, are fully pricing in a chance of a 25-basis-point rate cut.

-

Angola’s decision may be a close call between a hike and a hold. While inflation is easing, the currency has weakened almost 7% since August against the dollar.

-

On Friday, Eswatini, whose currency is pegged to South Africa’s rand, is expected to follow its neighbor and lower rates.

Elsewhere, comments from European Central Bank officials may be scrutinized for any hints on the path of future easing after a second cut to borrowing costs. Several governors are scheduled to appear, and President Christine Lagarde will deliver a speech in Washington on Friday.

Other things to watch include euro-area consumer confidence on Friday, and outside the currency zone, Swiss government forecasts on Thursday.

Turning south, data on Sunday are expected to show Israel’s inflation remained steady at 3.2% in August, still above the government’s target of 1% to 3%. The economy is weakening, but the war in Gaza is causing supply-side constraints and government spending is soaring, keeping inflationary pressures high.

In Nigeria on Monday, data will likely show inflation slowed for a second straight month in August, to 32.3%. That’s as the impact on prices of a currency devaluation and temporary removal of fuel subsidies last year continue to wane.

The measures were part of reforms introduced by President Bola Tinubu after he took office in May 2023.

Latin America

Brazil’s central bank meets against the backdrop of an overheating economy, above-target inflation, unmoored CPI expectations and government fiscal largesse.

Putting it all together, investors and analysts expect to see tighter monetary policy for first time in 3 1/2 years on Wednesday. The consensus is for a 25 basis-point hike to 10.75%, with another 75 basis points of tightening to follow by year-end, taking the key rate to 11.5%.

Six July economic reports from Colombia should underscore the resilience of domestic demand that has analysts marking up their third- and fourth-quarter growth forecasts.

The pace of retail sales may build on June’s positive print, which snapped a 16-month slide, while the early consensus has GDP-proxy data showing a rebound in activity after June’s mild slump.

Paraguay’s rate setters meet with inflation running slightly above the 4% target. Analysts surveyed by the central bank see a 25 basis-point cut by year-end.

After roughly 10 months of President Javier Milei’s so-called shock therapy, this week is set to offer some telling data on the state of Argentina’s economy.

Budget data may show the government posted an eighth straight monthly budget surplus in August, while that same scorched-earth austerity contributed to a third straight quarterly contraction in output.

–With assistance from Brian Fowler, Vince Golle, Robert Jameson, Laura Dhillon Kane, Jane Pong, Piotr Skolimowski and Monique Vanek.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Turkey's Spy Chief Meets With Hamas To Discuss Cease-Fire In Gaza: Reports

Ibrahim Kalin, head of Turkey’s National Intelligence Agency, met with representatives from the Palestinian militant group Hamas in Ankara, Turkey’s capital, to discuss the negotiations for a cease-fire in Gaza, according to media reports.

Kalin met with a delegation from the Hamas political bureau leadership, Turkish news channel TRT Haber said, citing Turkish security sources, Reuters reported.

Turkey denounced Israel’s assault on Gaza. Turkey’s intelligence agency has been in contact with those involved in the conflict — Hamas, Israel, Qatar and the U.S. — as it carries out intensive diplomacy for a ceasefire in Gaza, TRT Haber said.

The war between Israel and Hamas began Oct. 7, 2023, when Hamas attacked Israel, killing 1,200 people and taking about 250 hostages, according to Israeli tallies.

Read Also: Gaza Cease-Fire By Ramadan Hopes Fade: Biden Sends Special Envoy To Lebanon

Israel’s subsequent assault on Gaza has killed more than 41,000 Palestinians, according to its health ministry.

International mediators last week completed a new proposal aimed at forming a cease-fire deal between Israel and Hamas as Israel’s Prime Minister Benjamin Netanyahu refuses to cede control of Gaza’s border with Egypt.

Israel’s military and Hamas temporarily paused fighting in the Gaza Strip for three days a couple of weeks ago to allow about 640,000 children to get vaccinated against polio.

Price Action: Aerospace and defense stocks saw gains and losses on Friday as talks to end the fight take place.

- Lockheed Martin Corporation LMT edged up 0.29% to close at $569.91

- Boeing Co BA slipped 3.69% to end the trading day at $156.77

- Northrup Grumman Corporation NOC gained 0.24% to close at $519.78

Oil stocks traded up:

- BP p.l.c. BP gained 0.82% to close at $31.84

- Equinor ASA EQNR rose 1.05% to close at $25.09

- Suncor Energy Inc. SU went up 0.41% to finish the trading day at $36.44

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Do You Know If You're Wealthy Or Just 'Rich'? Here's The Difference And How Much You Need To Be Both

There’s a lot of talk about being rich or wealthy. While the terms are used interchangeably, they aren’t the same. Sure, both involve having a lot of money, but how that money works for you and your future is where the real difference comes in.

Don’t Miss:

Rich vs. Wealthy: What’s the Difference?

Being rich usually means having a high income or a sudden windfall. For example, in 2023, the average personal income in the U.S. was $59,384. But to be in the top 1%, you must make an average annual income of $819,324 a year. That’s rich – but not necessarily wealthy.

Wealth, on the other hand, isn’t just about how much money you make. It’s more about the assets you’ve built up – like investments, real estate or owning a business – that can generate income even if you’re not working. It’s about having enough to cover your lifestyle for the long haul.

According to the 2024 Charles Schwab Modern Wealth Survey, people believe it takes $2.5 million to be considered wealthy in today’s economy.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Are You Spending or Building?

Rich people often focus on earning a lot of money and spending it on luxury cars, expensive trips and big houses. They can afford a high-end lifestyle, but they’re also often tied to keeping that high income coming in to support it. If their income were to stop, their lifestyle might take a hit.

Wealthy people, on the other hand, focus on building a portfolio of assets that generate income independently. This could be through investments in stocks, bonds, rental properties or businesses. Wealthy individuals aren’t as dependent on their jobs or a single source of income because their assets work for them.

Trending:Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

The Mindset Shift

One big difference is mindset. Being rich is often about living in the moment – earning and spending a lot. There’s less focus on what happens down the road. Wealthy people, however, think long-term. They’re saving, investing and growing their money so they can have financial security for the rest of their lives and possibly for future generations, too.

Time and Compound Interest

Here’s a key factor: time. Wealth isn’t built overnight but over the years, thanks to the power of compound interest. Compound interest is the idea that your money makes money and that money makes more money over time. Someone focusing on being rich may get there quickly, but someone building wealth knows patience pays off.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Measuring the Difference

Rich people are often measured by their income. Wealthy people, though, are measured by their net worth – how much they own minus how much they owe. A person can earn a huge salary but not wealthy if they have high debt or no savings. Financial independence is a better measure of wealth – can you live comfortably without working because your assets provide enough income? That’s real wealth.

At the end of the day, being rich might get you the finer things in life, but being wealthy is about financial freedom. It’s having the ability to do what you want with your time and money without being tied to a paycheck. So, the real question is: are you just rich or are you building wealth that will last?

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Do You Know If You’re Wealthy Or Just ‘Rich’? Here’s The Difference And How Much You Need To Be Both originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Buffett Buys $345 Million More of His Favorite Stock and Dumps $7 Billion of This Key Holding

Apparently, Warren Buffett sees something coming. Since mid-July, his company, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has been dumping one of its largest holdings, Bank of America (NYSE: BAC), off-loading more than $7 billion worth of shares in just under two months. Why?

Buffett’s affinity for Bank of America seems to be waning

The megabank is a longtime favorite of Buffett and one of Berkshire’s largest holdings; for years, it occupied the No. 2 spot behind only Apple. He first purchased shares in 2007, just before the financial crisis of 2008.

Ouch! True to his philosophy, however, Buffett knew Bank of America was a good company and that it would recover.

Although he sold about half of his position after the crash, taking a hit of about $100 million, he invested a much larger $5 billion directly into the company a few years later to help bolster the struggling bank. In exchange, Berkshire received preferred shares and warrants to buy 700 million shares at just over $7 any time before 2021. Buffett saw that Bank of America was a solid profit-generating company and things would turn around.

And they did. He exercised the warrants six years later for a paper profit of $12 billion. Not a bad deal. Since then, he has been the biggest shareholder in Bank of America and has been a net buyer of the stock — until now. Why?

We can’t know for sure, unfortunately, but here’s a credible theory. Bank profits are cyclical and tend to outperform the market during times of expansion and underperform during slowdowns and recessions.

Considering the uncertain future of the U.S. economy, troubling economic signals like recent jobs reports, consumer credit at record levels, and the market showing “casino-like” qualities according to Buffett himself, Berkshire seems to be positioning itself defensively, rapidly increasing its cash reserves. And Bank of America is not the only stock it is selling.

Of course, it could be simple profit taking. Buffett might expect capital gains taxes to increase soon. It could be a mixture of all of the above.

One thing is for certain: There is one stock that Buffett consistently loves to buy and still does, despite being a net seller of assets for some time now.

Buffett believes in his company and its stock

It’s clear that one stock Buffett and his company believe in is their own. As of the last quarterly report, he repurchased $345 million worth of Berkshire shares, bringing 2024’s total purchases to nearly $3 billion. Since 2018, the company has bought back nearly $80 billion of its own shares. That indicates a strong belief in its future. It’s also how the company helps reward shareholders, increasing their stake in the company as the share count declines.

Berkshire doesn’t offer a dividend. Instead, it helps boost its stock price by repurchasing shares even though it’s not obligated to. It happens when Buffett believes the stock is trading under its intrinsic value.

So if he’s buying back Berkshire shares, it has the implicit blessing of one of the best investors in history. Under his leadership, Berkshire has become the first U.S. non-tech company to cross the $1 trillion mark in market capitalization, although it has since slipped back under that level.

Berkshire holds a diversified portfolio managed by one of the smartest teams in the business and has beaten the market handily year after year. I will say that it is currently trading above its average price to book value, but not by enough to be of too much concern. I still think it’s likely to beat the market; it seems Buffett does, too.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Buffett Buys $345 Million More of His Favorite Stock and Dumps $7 Billion of This Key Holding was originally published by The Motley Fool

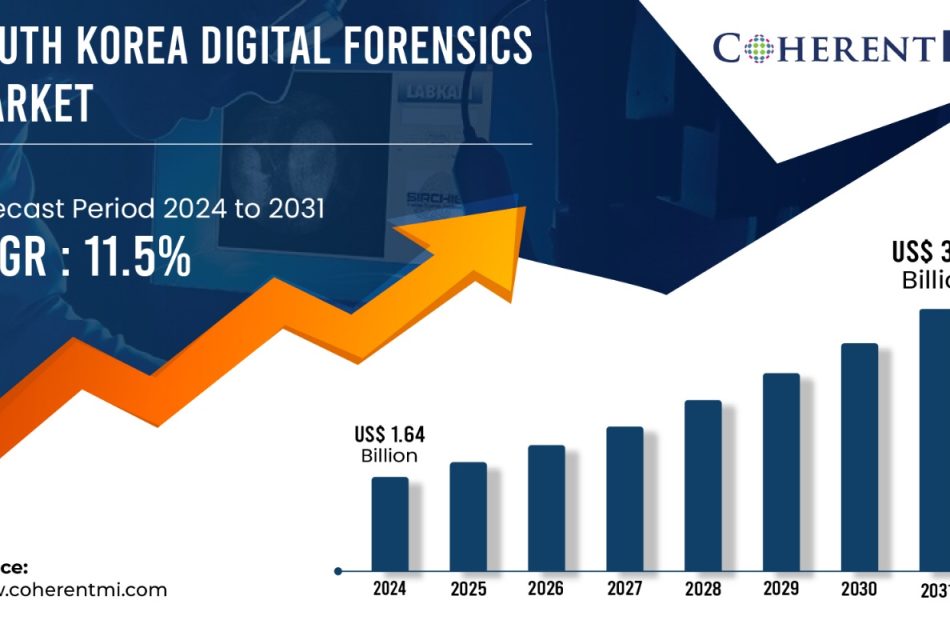

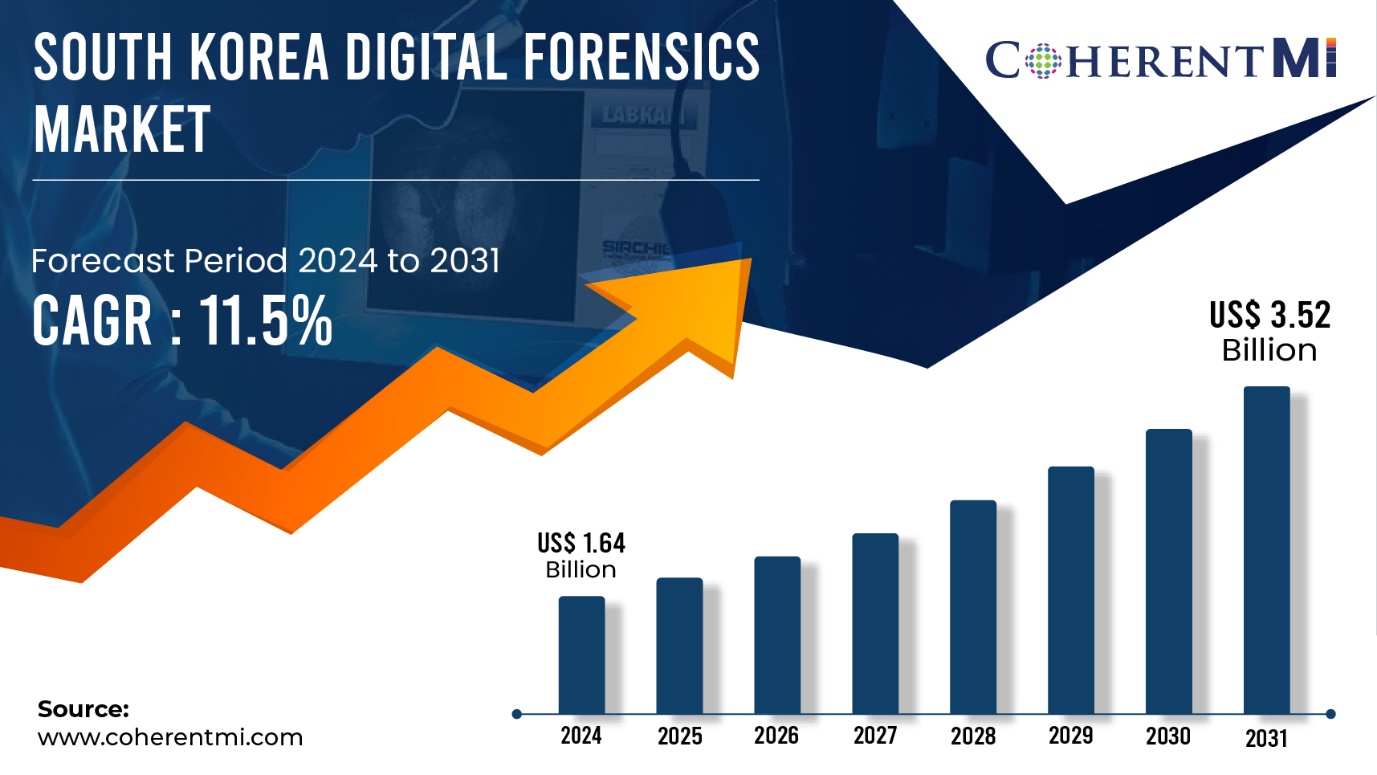

South Korea Digital Forensics Market to Hit US$ 3.52 Billion by 2031 at 11.5% CAGR, Says CoherentMI

Burlingame, Sept. 13, 2024 (GLOBE NEWSWIRE) — CoherentMI published a report, titled, South Korea Digital Forensics Market is estimated to value at US$ 1.64 Billion in the year 2024 and is anticipated to reach US$ 3.52 Billion by 2031, at a CAGR of 11.5% during forecast period 2024-2031. With rising digitalization across various industry verticals in South Korea, incidents of cybercrimes have also increased exponentially over the years. Organizations across banking, finance, healthcare and other sectors are increasingly focusing on protecting sensitive data and investigating cyber threats. This has propelled the demand for professional digital forensics services that can retrieve hidden electronic data from computers, mobiles and other devices to solve cybercrime cases.

Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2024: | US$ 1.64 Billion |

| Estimated Value by 2031: | US$ 3.52 Billion |

| Growth Rate: | Poised to grow at a CAGR of 11.5% |

| Historical Data: | 2019–2023 |

| Forecast Period: | 2024–2031 |

| Forecast Units: | Value (USD Million/Billion) |

| Report Coverage: | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered: | By Forensic Type, By Component, By Verticals |

| Geographies Covered: | South Korea |

| Major Players: | AhnLab, FireEye, IBM Corporation., Guidance Software, Inc., OpenTextCorp., FireEye, HancomWITH and Among Others. |

| Growth Drivers: | • Increasing cyber-attacks on enterprises in South Korea |

| • Increasing adoption of digital forensic techniques in the BFSI sector | |

| Restraints & Challenges: | • Lack of awareness of digital forensics technology among SMEs |

Market Dynamics:

The South Korea digital forensics market is expected to witness significant growth, owing to increasing number of cybercrimes in the country. According to statistics, the number of cybercrimes reported in South Korea increased from 78,385 cases in 2018 to 95,172 cases in 2019. With rapid digitalization and increasing internet penetration, the cases of cyberbullying, hacking, data theft, and financial fraud have increased sharply. As a result, the demand for digital forensics solutions to collect, examine, and analyze digital evidence from computing devices such as smartphones, laptops, and servers is growing significantly. Moreover, increasing investments by law enforcement agencies to strengthen their digital investigation capabilities is also fueling the market growth.

Key Market Takeaways:

- The South Korea digital forensics market size is anticipated to witness a CAGR of 11.2% during the forecast period 2024-2031, owing to growing cyber threats and digital transformation in the country.

- On the basis of forensic type, the computer forensics segment is expected to hold a dominant position, owing to a large volume of electronic evidence involving computers in cybercrime investigations.

- On the basis of component, the services segment is expected to hold the largest share due to increasing demand for forensic consulting, investigation, training and education from law enforcement agencies and enterprises.

- On the basis of verticals, the government and defense segment is expected to hold the major market share due to initiatives towards strengthening cybersecurity and increasing reliance on digital forensics solutions.

- Regionally, South Korea is expected to hold a dominant position over the forecast period due to stringent cyber regulations, robust law enforcement agencies and digital infrastructure in the country.

- Key players operating in the South Korea digital forensics market include AhnLab, FireEye, IBM Corporation., Guidance Software, Inc., OpenTextCorp. These players are focusing on developing innovative forensic solutions and adopting organic and inorganic growth strategies to strengthen their market presence.

Market Trends:

Mobile device forensics and cloud forensics are the major trends witnessed in the South Korea digital forensics market. With increasing usage of smartphones and tablets, mobile device forensics solutions that can extract, recover, analyze and preserve deleted data from mobile devices are gaining more importance. Additionally, as more data is being stored on cloud systems, cloud forensics solutions are being increasingly used to investigate data breach incidents involving cloud applications and services. Major players in the market are focusing on developing advanced mobile and cloud forensics solutions to leverage lucrative business opportunities.

Recent Developments:

- On April 22 2021, Plainbit Co., Ltd., has signed a memorandum of understanding with FRONTEO Inc. FRONTEO Inc. is an overseas subsidiary of FRONTEO Korea, Inc., based in Minato-ku, Tokyo. The partnership aims to strengthen digital forensic services through collaborative business initiatives, facilitating mutual exchange and cooperation between the two companies. FRONTEO specializes in digital forensic services, while Plainbit focuses on enhancing digital forensic capabilities through collaborative business initiatives.

Get a detailed analysis on regions, market segments, and companies: https://www.coherentmi.com/industry-reports/south-korea-digital-forensics-market

South Korea Digital Forensics Market Opportunities:

Computer Forensics: The computer forensics segment held the largest market share in 2024 owing to increasing cases of cybercrimes involving computers. Computer forensics aids in investigating computer related crimes by analyzing data stored on computers and recovering digital evidence. It allows examination of digital media in a forensically sound manner and law enforcement agencies heavily rely on computer forensics for examining digital devices seized from crime scenes.

Network Forensics: Network forensics is anticipated to witness substantial growth during the forecast period due to rising network intrusions and data breaches. It involves monitoring and analyzing network traffic for potential security issues and policy violations. Network forensics provides insights into network security incidents, data leakage and helps identify compromised accounts. The technology assists in conducting post-intrusion analysis and network traffic reconstruction to gather digital evidence from network infrastructure.

South Korea Digital Forensics Market Segmentation:

- By Component:

- By Forensic Type:

- Computer Forensics

- Network Forensics

- Mobile Device Forensics

- Cloud Forensics

- By Verticals:

- Government and Defense

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Retail

- Healthcare

- Others

The research provides answers to the following key questions:

- What is the estimated growth rate of the market for the forecast period 2024-2031?

- What will be the market size during the estimated period?

- What are the key driving forces responsible for shaping the fate of the South Korea Digital Forensics market during the forecast period?

- Who are the major market vendors and what are the winning strategies that have helped them occupy a strong foothold in the South Korea Digital Forensics market?

- What are the prominent market trends influencing the development of the South Korea Digital Forensics market across different regions?

- What are the major threats and challenges likely to act as a barrier in the growth of the South Korea Digital Forensics market?

- What are the major opportunities the market leaders can rely on to gain success and profitability?

Purchase Latest Edition of this Research Report @ https://www.coherentmi.com/industry-reports/south-korea-digital-forensics-market/buynow

Key insights provided by the report that could help you take critical strategic decisions?

- Regional report analysis highlighting the consumption of products/services in a region also shows the factors that influence the market in each region.

- Reports provide opportunities and threats faced by suppliers in the South Korea Digital Forensics industry around the world.

- The report shows regions and sectors with the fastest growth potential.

- A competitive environment that includes market rankings of major companies, along with new product launches, partnerships, business expansions, and acquisitions.

- The report provides an extensive corporate profile consisting of company overviews, company insights, product benchmarks, and SWOT analysis for key market participants.

- This report provides the industry’s current and future market outlook on the recent development, growth opportunities, drivers, challenges, and two regional constraints emerging in advanced regions.

Browse Related Reports:

United States Racing Drones Market: The United States Racing Drones Market is estimated to be valued at USD 353.01 Mn in 2024 and is expected to reach USD 1,333.19 Mn by 2031, growing at a CAGR of 18.1% from 2024 to 2031.

New Zealand Power Tool Market: New Zealand Power Tool Market is estimated to be valued at US$ 167.2 million in 2024 and is expected to reach US$ 286.1 million by 2031, exhibiting a compound annual growth rate (CAGR) of 8% from 2024 to 2031.

Philippines Robot as a Service Market: Philippines robot as a service market is estimated to be valued at US$ 298.9 Million in 2024, and is expected to reach US$ 918.8 Million by 2031, growing at a compound annual growth rate (CAGR) of 17.4% from 2024 to 2031.

UAE Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market: The UAE Dark Kitchens/Ghost Kitchens/Cloud Kitchens market size was valued at US$ 330.3 million in 2023 and is expected to reach US$ 821.5 million by 2030, grow at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030.

Author of this marketing PR:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Contact Us: Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Swifties Rally For Kamala Harris: Taylor Swift Superfan Organizes Online Push For Democratic Ticket

Following Kamala Harris’ announcement of her presidential run, 29-year-old superfan Irene Kim, who dedicates up to 14 hours daily to pop superstar Taylor Swift communities and has attended over five Eras Tour concerts, mobilized with fellow enthusiasts to boost Harris’ campaign through social media, memes, montages, and newsletters.

Now serving as the executive director of the Swifties for Kamala campaign, Kim joined the effort to see the U.S. elect its first female president, believing Kamala Harris will safeguard the rights of Americans, reported BBC.

Meanwhile, at MTV’s 2024 Video Music Awards (VMAs), Swift encouraged attendees to register to vote.

The General Services Administration reported that 337,826 visitors were referred to the voter information website via Swift’s custom link shared on Instagram as of 2 p.m. EDT on Wednesday, reported The Hill.

This surge occurred less than 24 hours after Swift’s endorsement after the debate between Harris and Donald Trump.

Also Read: Taylor Swift’s Endorsement Of Kamala Harris Drives Over 330K Visitors To Vote.Gov

With over 3,500 volunteers, the Swifties for Kamala appears to be a well-established political force. Since they started tracking donations on August 1, they have raised more than $165,000 for the campaign, BBC added.

The Swifties for Kamala group operates independently and is volunteer-led, though they have maintained communication with the Harris campaign.

According to Kim, their discussions are more relaxed than anticipated and focus on online efforts and translating those into tangible real-world actions.

Can Swifties Shift Election?

In 2020, Swift backed the Joe Biden-Harris ticket, and during the 2018 midterms, she endorsed two Democratic candidates from Tennessee.

Swift’s endorsement comes on the heels of her album “The Tortured Poets Department” which experienced a 600% sales jump months after its release.

The group has garnered hundreds of thousands of views on TikTok, but it’s unclear if these viewers are all US-based or if they were already inclined to vote for Kamala Harris.

However, in a tight election where a few hundred thousand votes in key states could make a difference, any increase in voter registration and turnout could potentially sway the outcome, BBC noted.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 of the Safer Dividend Stocks to Buy and Hold Forever

There is no risk-free investment, and any claim to the contrary is probably a scam. But some businesses look solid enough to still be strong in five, 10, or even 20 years. Companies in this category aren’t run of the mill, and they are worth the effort it takes to find them.

For those who need inspiration, let’s consider two excellent candidates: Microsoft (NASDAQ: MSFT) and Coca-Cola (NYSE: KO). These longtime market leaders, both of which are also top dividend stocks, are worth holding on to for good. Read on to find out more.

1. Microsoft

A list of businesses whose products millions of people use every day will prominently feature Microsoft. The company is by far the leader in computer operating systems (OS) and one of the biggest players in gaming. Its competitive advantage in both areas should help it remain a leader for a long time.

Its operating system carries high switching costs. Many of its software programs are invaluable to students, professors, and businesses in their day-to-day activities — think Excel, Teams, Word, and more. Jumping ship to one of its competitors isn’t easy. Microsoft also benefits from the network effect in gaming: The more games its devices and consoles have, the more it attracts gamers.

That said, the biggest growth driver isn’t gaming or its OS. That title goes to the company’s cloud computing arm, which has gained even more momentum thanks to the recent rise of artificial intelligence (AI), with various AI tools on its Azure cloud platform. In its latest period (the fourth quarter of its fiscal 2024, ended June 30), Microsoft’s revenue grew by 15% year over year to $64.7 billion. Azure revenue grew almost twice as fast — at 29%. CEO Satya Nadella said of Azure: “Our share gains accelerated this year driven by AI.”

Indeed, the company has been closing in on the leader in cloud computing, Amazon (NASDAQ: AMZN), for some time now. Cloud computing represents an important long-term opportunity for Microsoft.

With an incredibly strong underlying business — Microsoft has a AAA rating, the highest possible, from Standard & Poor’s — and a competitive edge, the company seems likely to remain successful for many more years. It should also continue rewarding investors with payout hikes. The stock’s forward yield of 0.72% might not be impressive, but its dividend has increased by 142% in the past decade. And there is, no doubt, more to come.

2. Coca-Cola

Coca-Cola might not seem like an exciting investment in the age of AI and other cutting-edge technology. But a “boring” company that sells a vast portfolio of drinks in many different categories worldwide might be precisely what the doctor ordered, at least for those risk-averse, long-term income seekers.

The company’s brands include some of the best known in the business, beyond its namesake drink. With Minute Maid juices, Dasani water, Powerade sports drinks, Gold Peak iced tea — even alcohol and coffee — its highly diversified lineup has something for almost everyone. The worldwide popularity of the brand is a potent competitive advantage: It’s hard to find a country where at least some of Coke’s products aren’t sold.

The result is steady and predictable financial results (the pandemic was an understandable exception). Some of its products have lost popularity due to health-related concerns, but management is getting around that problem through diversification across multiple drink categories and healthier, low-sugar versions. It’s the kind of adaptability we should expect from a company that has been in business for more than 100 years and will likely remain so for many more years.

What about the dividend? It has one of the most incredible streaks on the market, having increased its payout annually for 62 consecutive years; its forward yield of 2.71% is above the S&P 500‘s average of 1.32%. It’s hard to see that dividend streak ending anytime soon, meaning investors can safely hold Coca-Cola’s stock in their portfolios.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 of the Safer Dividend Stocks to Buy and Hold Forever was originally published by The Motley Fool