A Closer Look at PureCycle Technologies's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on PureCycle Technologies PCT.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with PCT, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 25 options trades for PureCycle Technologies.

This isn’t normal.

The overall sentiment of these big-money traders is split between 48% bullish and 44%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,500, and 24, calls, for a total amount of $2,027,947.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $12.0 for PureCycle Technologies during the past quarter.

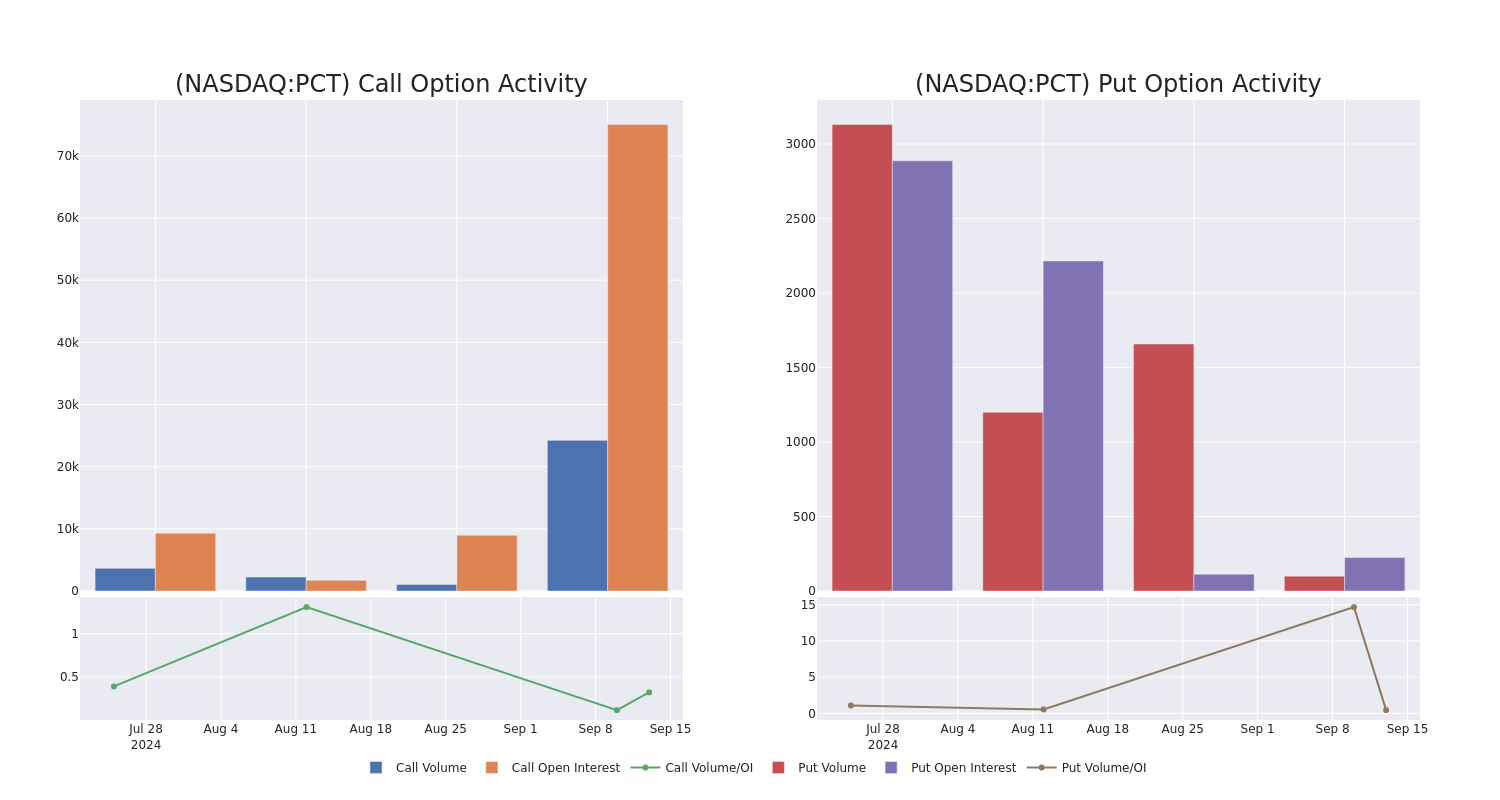

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PureCycle Technologies’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PureCycle Technologies’s substantial trades, within a strike price spectrum from $5.0 to $12.0 over the preceding 30 days.

PureCycle Technologies 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $4.6 | $4.3 | $4.3 | $5.00 | $215.0K | 12.9K | 1.0K |

| PCT | CALL | TRADE | NEUTRAL | 01/17/25 | $2.95 | $2.65 | $2.8 | $7.00 | $195.9K | 15.6K | 416 |

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $4.4 | $4.3 | $4.3 | $5.00 | $175.8K | 12.9K | 1.1K |

| PCT | CALL | TRADE | BULLISH | 10/18/24 | $2.65 | $2.5 | $2.6 | $6.00 | $130.0K | 5.8K | 1.5K |

| PCT | CALL | TRADE | BULLISH | 10/18/24 | $2.6 | $2.45 | $2.6 | $6.00 | $130.0K | 5.8K | 1.5K |

About PureCycle Technologies

PureCycle Technologies Inc holds a license to commercialize the only patented solvent-based purification recycling technology, developed by The Procter & Gamble Company (P&G), for restoring waste polypropylene (PP) into a virgin-like resin. The proprietary process removes color, odor, and other contaminants from recycled feedstock resulting in virgin-like polypropylene suitable for any PP market.

Having examined the options trading patterns of PureCycle Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is PureCycle Technologies Standing Right Now?

- Trading volume stands at 9,171,600, with PCT’s price up by 10.25%, positioned at $8.82.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 54 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PureCycle Technologies with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply