Affirm's Survey Reveals 0% APR Option Impact, CEO Outlines Growth Plan

Affirm Holdings, Inc. AFRM recently unveiled results from its latest survey, highlighting consumer shopping behaviors before the holiday season of 2024. The study of 2,000 Americans unveiled how the 0% annual percentage rate (APR) options would influence consumers while making purchase decisions and how confident they are about budgeting. This bodes well for a company like Affirm, offering flexible and transparent payment solutions.

The survey revealed that 48% of respondents are influenced by the availability of 0% APR. Benefits of 0% APR include saving on interest costs, the ability to afford bigger purchases, and greater ease while budgeting, according to 28%, 19%, and 17% of respondents, respectively.

Additionally, 42%, 28% and 25% of consumers view 0% APR offers as suitable for purchasing furniture or appliances, electronics, and everyday items, respectively. This highlights the growing inclination toward AFRM’s solutions, poising it well for the future. The survey also highlighted that despite current macroeconomic concerns, 70% of Americans feel more confident in their ability to manage finances compared to the previous year.

In a recent Goldman Sachs Communacopia and Tech Conference, AFRM’s CEO Max Levchin emphasized the company’s evolution beyond its origin as a buy now, pay later solution to a broader payments company. Levchin also mentioned that Affirm aims to become a modern alternative to American Express Company AXP with a “pro-consumer attitude.” Affirm aims to leverage artificial intelligence to enhance employee productivity rather than reduce jobs.

Leveraging its expanded network with more merchants, customers and enhanced offerings should aid AFRM in achieving its goal of being profitable for the first time in the fourth quarter of fiscal 2024. AFRM also raised its outlook for fiscal 2025 GMV to be more than $33.5 billion, highlighting confidence in its prospects.

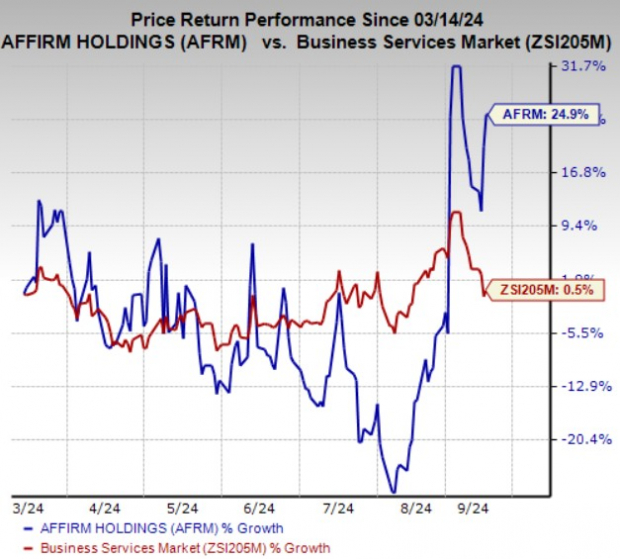

AFRM’s Zacks Rank and Price Performance

Affirm currently has a Zacks Rank #2 (Buy). In the past six months, shares of Affirm have gained 24.9% compared with 0.5% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Other Stocks to Consider

Investors can look at some other top-ranked stocks from the broader Business Services space like Fidelity National Information Services, Inc. FIS and Paysign, Inc. PAYS. Each stock presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Fidelity National’s current-year earnings indicates a 50.5% year-over-year jump. FIS beat earnings estimates in two of the trailing four quarters and missed twice. The consensus estimate for current-year revenues is pegged at $10.2 billion.

The Zacks Consensus Estimate for Paysign’s current-year bottom line indicates 75% year-over-year growth. The consensus estimate for PAYS’ current-year revenues is pegged at $58 million, suggesting 22.6% year-over-year growth.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply