Analyzing MetLife Stock: Is Buy Strategy the Right Move?

MetLife, Inc. MET benefits on the back of a well-performing Group Benefits business, acquisitions and partnerships, cost-cutting efforts and strong cash balance.

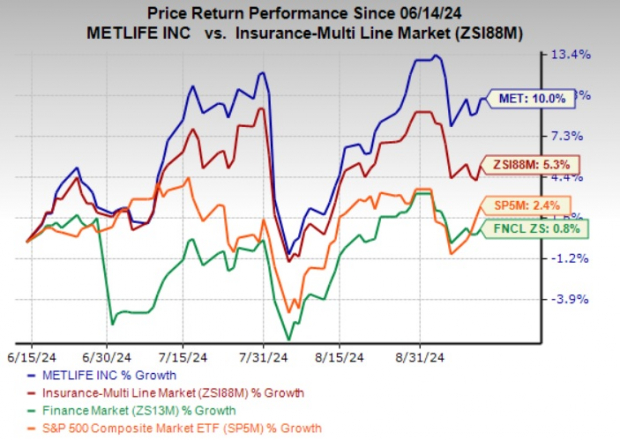

Zacks Rank & Price Performance

MetLife carries a Zacks Rank #2 (Buy) at present.

The stock has gained 10% in the past three months compared with the industry’s growth of 5.3%. The Zacks Finance sector and the S&P 500 composite index have returned 0.8% and 2.4%, respectively, in the said time frame.

Image Source: Zacks Investment Research

Favorable Style Score

MetLife carries an impressive Value Score of A. Value Score helps find stocks that are undervalued. Back-tested results show that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best opportunities in the value investing space.

Robust Growth Prospects

The Zacks Consensus Estimate for MetLife’s 2024 earnings is pegged at $8.67 per share, which indicates an improvement of 18.3% from the 2023 reported figure. The consensus mark for revenues is $73.2 billion, implying a rise of 2% from the 2023 figure. MET’s earnings estimates witnessed seven upward revisions over the past 60 days against no downward movement.

The consensus mark for 2025 earnings is pegged at $9.83 per share, suggesting an improvement of 13.4% from the 2024 estimate. The same for revenues is $76.5 billion, hinting at a 4.6% increase from the 2024 estimate.

Valuation

Price-to-book (P/B) is one of the multiples used for valuing insurance stocks. Compared with the multiline industry’s trailing 12-month P/B ratio of 2.57, MetLife has a reading of 1.92. It is quite evident that the stock is currently undervalued.

Image Source: Zacks Investment Research

Solid Return on Equity

Return on equity in the trailing 12 months is currently 21.4%, which is higher than the industry’s average of 16.2%. This substantiates the company’s efficiency in utilizing shareholders’ funds.

Business Tailwinds

A key revenue contributor is MetLife’s steady premiums, which have been recovering from pandemic-driven declines. Premiums are witnessing a steady increase in the Group Benefits business, wherein it rose 4% year over year in the first half of 2024. Growth has also been robust in its EMEA and Latin America segments, further contributing to the company’s revenue stream.

MetLife’s focus on streamlining its business, coupled with strategic acquisitions and partnerships, is expected to drive long-term growth. The company has expanded its presence in key areas like vision care and pet insurance through acquisitions, such as Versant Health and PetFirst. It has also strengthened its benefits offerings through partnerships with firms like Aura and Nayya.

A strategic push into private credit investments, marked by the acquisition of Raven Capital, and a collaboration with Fidelity Investments on a fixed immediate income annuity further diversify its business portfolio. Additionally, MetLife continues to reduce volatility by divesting capital-intensive units and intensifying focus on high-growth areas.

MetLife’s cost-saving measures have resulted in notable operational improvements. Between 2015 and 2020, the company saw an improvement of 230 basis points in its direct expense ratio. This efficiency trend has continued, with the direct expense ratio remaining below the guided 12.3% in the first half of 2024.

MetLife also benefits from a strong liquidity position, with short-term debt of $390 million as of June 30, 2024, significantly overshadowed by its $20.8 billion in cash and cash equivalents. This financial strength underpins shareholder returns through repurchases and dividend payments. In April 2024, management approved a 4.8% dividend increase.

Other Stocks to Consider

Some other top-ranked stocks in the insurance space include CNO Financial Group, Inc. CNO, MGIC Investment Corporation MTG and Palomar Holdings, Inc. PLMR, each sporting a Zacks Rank #1 at present.

The bottom line of CNO Financial outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 21.21%. The Zacks Consensus Estimate for CNO’s 2024 earnings suggests 11% year-over-year growth. The consensus mark for CNO Financial’s 2024 earnings has moved north by 3% in the past 30 days.

MGIC Investment’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 15.59%. The Zacks Consensus Estimate for MTG’s 2024 earnings indicates 9.1% year-over-year growth, while the same for revenues implies an improvement of 4.7%. MGIC Investment’s consensus mark for 2024 earnings has moved north by 2.2% in the past 30 days.

The bottom line of Palomar outpaced estimates in each of the trailing four quarters, the average surprise being 17.10%. The Zacks Consensus Estimate for PLMR’s 2024 earnings suggests 30.9% year-over-year growth, while the same for revenues implies an improvement of 41.6%. The consensus mark for Palomar’s 2024 earnings has moved north by 1.3% in the past 30 days.

Shares of CNO Financial, MGIC Investment and Palomar have gained 24.2%, 22.4% and 18.3%, respectively, in the past three months.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply