FULC Stock Falls as Muscle Disorder Study Misses Primary Goal

Shares of Fulcrum Therapeutics, Inc. FULC plunged 61.1% on Sept. 12 after the company announced disappointing top-line data from the phase III REACH study, which evaluated its pipeline candidate, losmapimod, for treating patients with facioscapulohumeral muscular dystrophy (FSHD), a rare and debilitating disease.

Currently, there are no treatments approved for the given indication.

The study did not meet its primary endpoint as treatment with losmapimod failed to demonstrate a change from baseline in relative surface area (RSA), a measure of reachable workspace (RWS), compared with placebo at week 48.

The study also failed to achieve nominal statistical significance on the secondary endpoints.

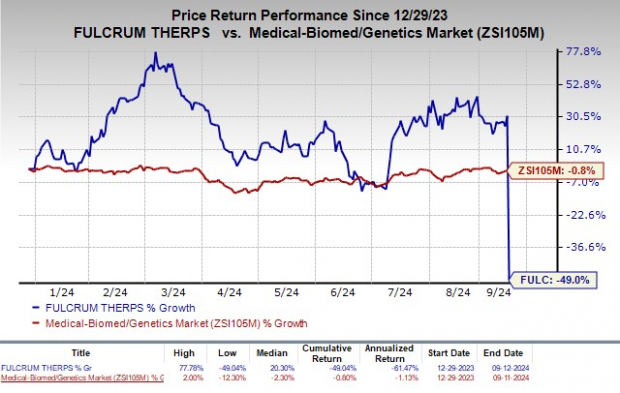

Year to date, shares of Fulcrum have plunged 49% compared with the industry’s decline of 0.8%.

Image Source: Zacks Investment Research

Data From FULC’s REACH study

Data from the REACH study showed that treatment with losmapimod led to a 0.013 improvement in RSA compared to a 0.010 improvement in RWS for patients who received a placebo at week 48. This was the study’s primary endpoint.

Also, patients receiving losmapimod demonstrated an increase of 0.42% in muscle fat infiltration while an increase of 0.57% in MFI was observed for patients who received placebo at week 48.

Meanwhile, patients who were treated with losmapimod demonstrated a 9.63% improvement in abductor strength compared with a 2.24% improvement in the placebo arm.

There were no statistically significant differences observed in the two patient-reported outcomes secondary endpoints of the REACH study.

Following the disappointing data observed in the REACH study, FULC decided to stop the further development of losmapimod in FSHD.

What’s Next for FULC in Terms of Pipeline Development

Fulcrum is developing another pipeline candidate, pociredir, in an early-stage study for treating patients with sickle cell disease, an inherited blood disorder. The phase Ib PIONEER study evaluates pociredir in SCD.

The FDA has already granted a Fast Track designation and Orphan Drug designation to pociredir for the treatment of patients with SCD.

SCD has a significant unmet medical need, and if successfully developed and upon potential approval, pociredir has the potential to boost FULC’s prospects in the days ahead.

As of June 30. 2024, Fulcrum had $273.8 million in cash, cash equivalents and marketable securities. The company plans to use the funds to advance pociredir in the treatment of SCD and other pipeline development activities.

Zacks Rank & Other Stocks to Consider

Fulcrum currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the biotech sector are Illumina, Inc. ILMN and Krystal Biotech, Inc. KRYS, each sporting a Zacks Rank #1 at present.

In the past 60 days, estimates for Illumina’s 2024 earnings per share have moved up from $1.18 to $3.62. Earnings per share estimates for 2025 have improved from $2.93 to $4.43. Year to date, shares of ILMN have lost 9.3%.

ILMN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 463.46%.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have increased from $1.98 to $2.38. Earnings per share estimates for 2025 have improved from $4.33 to $7.31. Year to date, shares of KRYS have risen 57.7%.

KRYS’ earnings beat estimates in three of the trailing four quarters while missing on the remaining occasion, the average surprise being 45.95%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply