Here's Why Investors Should Retain American Airlines Stock Now

American Airlines’ AAL efforts to expand and enhance its global network are commendable. The company’s proactive initiative to create 500 new aviation jobs is serving well for the company and the economy. However, AAL has been grappling with soft market conditions and increased operating costs.

Factors Favoring AAL

American Airlines’ initiative to create nearly 500 new aviation maintenance jobs and expand heavy check maintenance work at its bases in Charlotte, NC; Pittsburgh, PA, and Tulsa, OK, represents a significant boost to both the company and the local economies. The addition of more than 385 licensed aviation maintenance technician positions highlights the airline’s commitment to enhancing its maintenance capabilities and infrastructure. This expansion will not only strengthen AAL’s maintenance operations but also contribute to job growth in these regions, offering high-paying, skilled positions.

The company’s efforts to expand its network are encouraging. In August 2024, American Airlines announced five new routes to Europe, including nonstop flights to Edinburgh, Scotland, for the first time since 2019. This expansion underscores AAL’s commitment to growing its extensive global network, providing customers with more diverse travel options and unique connections.

American Airlines: Risks to Watch

The northward movement in operating expenses is hurting AAL’s bottom line, challenging its financial stability. The surge in operating expenses was caused by a rise in fuel and labor costs. In the second quarter of 2024, total operating expenses rose by 9% compared to the second-quarter 2023 actuals.

Labor costs, accounting for 30.5% of the total operating expenses, rose 8.8% year over year, whereas fuel expenses jumped by 12.4% year over year.

Soft economic conditions continue to adversely impact AAL’s prospects. The company’s high level of debt limits its financial flexibility.

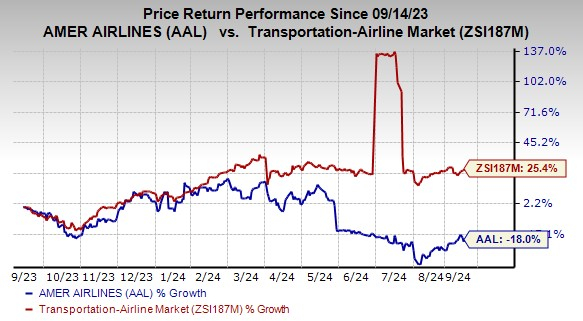

Shares of American Airlines have declined 18% year over year against its industry’s 25.4% growth.

Image Source: Zacks Investment Research

Zacks Rank

AAL currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include C.H. Robinson Worldwide CHRW and Westinghouse Air Brake Technologies WAB.

C.H. Robinson Worldwide currently sports a Zacks Rank #1 (Strong Buy). CHRW has an expected earnings growth rate of 25.2% for the current year.

The company has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 7.3%. Shares of CHRW have risen 10.6% in the past year.

WAB carries a Zacks Rank #2 (Buy) at present and has an expected earnings growth rate of 26% for the current year.

The company has a discouraging track record with respect to the earnings surprise, having surpassed the Zacks Consensus Estimate in three of the trailing four quarters. The average beat is 11.8%. Shares of WAB have climbed 55.3% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply