Market Whales and Their Recent Bets on FTNT Options

Investors with significant funds have taken a bullish position in Fortinet FTNT, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in FTNT usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 8 options transactions for Fortinet. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 50% being bullish and 37% bearish. Of all the options we discovered, 7 are puts, valued at $514,902, and there was a single call, worth $25,800.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $75.0 for Fortinet over the last 3 months.

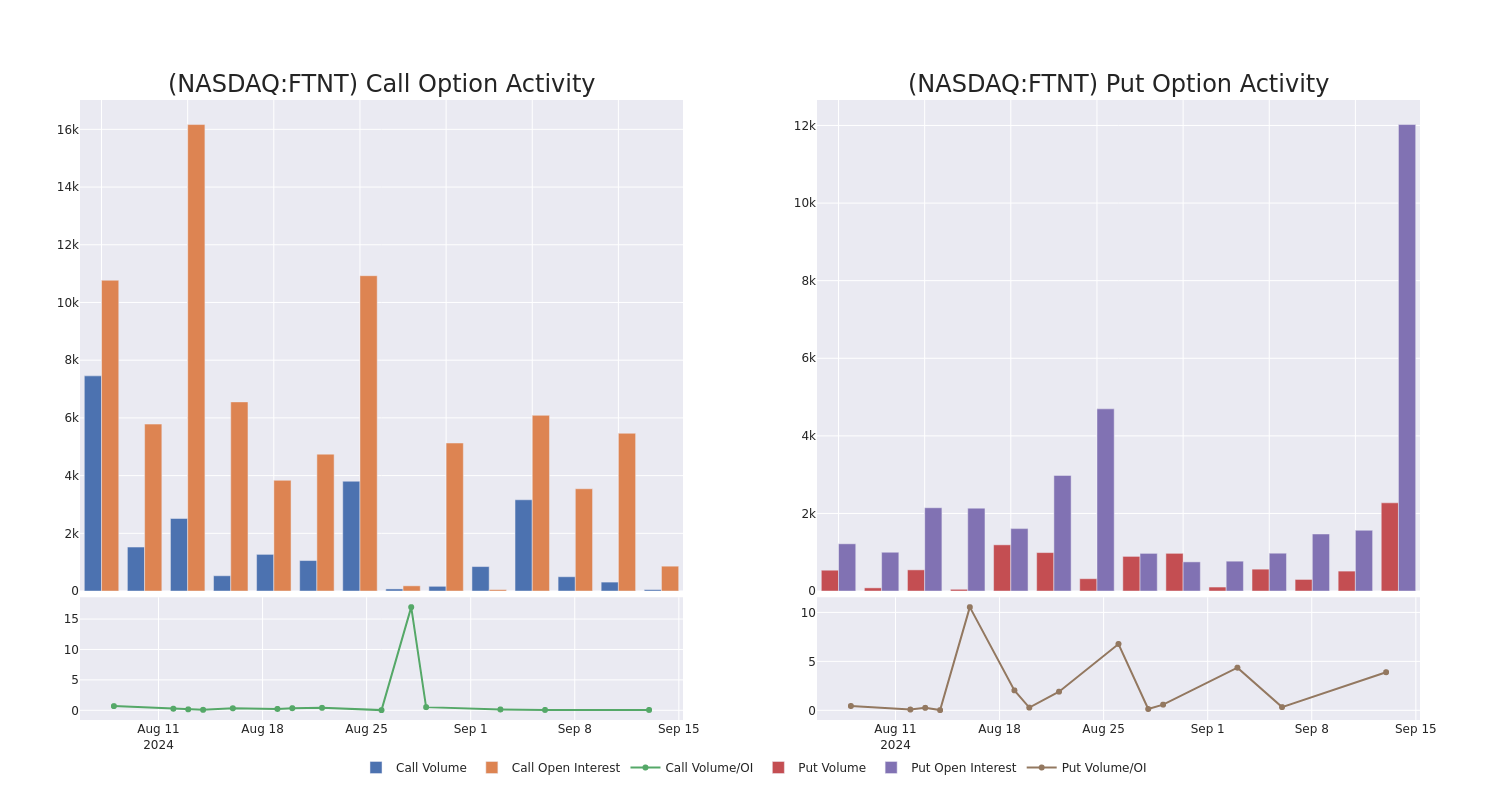

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Fortinet’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Fortinet’s whale trades within a strike price range from $70.0 to $75.0 in the last 30 days.

Fortinet Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FTNT | PUT | TRADE | NEUTRAL | 03/21/25 | $7.0 | $6.65 | $6.85 | $75.00 | $274.0K | 221 | 405 |

| FTNT | PUT | SWEEP | BULLISH | 01/17/25 | $5.3 | $5.2 | $5.2 | $75.00 | $69.1K | 2.1K | 145 |

| FTNT | PUT | SWEEP | BULLISH | 01/17/25 | $5.35 | $5.3 | $5.3 | $75.00 | $44.5K | 2.1K | 290 |

| FTNT | PUT | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.35 | $3.35 | $70.00 | $37.5K | 2.1K | 113 |

| FTNT | PUT | SWEEP | BULLISH | 10/18/24 | $1.59 | $1.2 | $1.22 | $72.50 | $35.1K | 2.7K | 286 |

About Fortinet

Fortinet is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, zero-trust access, and security operations. The firm derives a majority of its revenue through sales of its subscriptions and support-based business. The California-based firm has more than 700,000 customers across the world.

Having examined the options trading patterns of Fortinet, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Fortinet

- With a trading volume of 4,572,848, the price of FTNT is up by 0.7%, reaching $75.01.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 48 days from now.

Professional Analyst Ratings for Fortinet

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $76.0.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Fortinet, targeting a price of $76.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Fortinet options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply