US satellite-TV providers DirecTV and Dish are in talks to merge again, source says

By Anirban Sen

(Reuters) – Telecom operator AT&T and its joint-venture partner TPG are in early-stage talks to merge their DirecTV satellite TV service with EchoStar owned Dish, a person familiar with the matter told Reuters on Friday.

The two companies first attempted to merge back in 2002 when the U.S. Justice Department blocked the tie-up. The combined entity would create the largest pay-TV service provider in the U.S. at about 16 million subscribers, if the talks are successful. The potential deal would likely attract antitrust scrutiny again although it might be able to clear regulatory hurdles this time as the industry has expanded substantially since then and DirecTV and Dish now compete against the likes of Comcast, Charter, Amazon Prime, YouTube TV, and Netflix. A merger would enhance the combined company’s ability to negotiate with programmers, much like DirecTV is doing with Disney right now as the two sides are locked in a carriage dispute.

For Dish, the deal would allow them to focus all of their investments on building out their 5G wireless network.

“Rumors about a potential transaction involving DirecTV and Dish are nothing new, but we don’t comment on rumors and speculation,” a spokesperson for DirecTV said in an emailed statement to Reuters.

DirecTV and Dish have held on-and-off talks over the years since their first attempt to merge was blocked in 2002.

EchoStar closed its acquisition of Dish in late 2023.

Dish did not immediately respond to Reuters requests for comments outside of business hours. TPG and AT&T declined to comment.

DirecTV is facing a public battle with Disney that has led to 11 million DirecTV customers losing access to ESPN in the middle of the U.S. Open tennis tournament.

The dispute is taking place against the backdrop of a competing plan by Disney, Fox and Warner Bros Discovery to launch a streaming video joint venture devoted to sports, called Venu Sports.

The launch was temporarily blocked by a court injunction as part of a lawsuit filed by sports streaming rival FuboTV accusing the media companies of anticompetitive behavior.

Bloomberg reported on the talks between Dish and DirecTV earlier on Friday.

(Reporting by Anirban Sen, Additional reporting by Urvi Dugar, Harshita Meenaktshi and Dawn Chmielewski; Editing by Sandra Maler, Rosalba O’Brien and Michael Perry)

Federal Marshals Raid Legal Medical Marijuana Shop In Texas: Why The Big Guns? Advocates Say 'It's Absurd'

Green Goddess Revival, a medical marijuana dispensary in Denton Texas, was the target of a law enforcement raid on Thursday in which $10,000 in products were seized, business owners said. A warrant to search stated it was targeting noncompliant THC products. Denton is among several Texas towns that will vote this November to approve adult-use cannabis.

Photos posted on social media depicted Denton County Sheriff’s Office personnel, one of whom was wearing a U.S. Marshals Service Joint East Texas Fugitive Task Force vest.

“It is absurd to see US Marshalls Fugitive Task Force raiding a hemp shop in Denton, Texas in 2024,” wrote the Texas Cannabis Collective on X.

“People literally come in everyday almost in years because we provide them with medicine that gives them their life back. We’re a local shop that gives product to people for almost nothing if needed and has supported the community for years,” continued the Cannabis Collective. Texas approved a limited medical marijuana program in 2015.

What Happened: Store manager Jack Howell told the Denton Record-Chronicle Friday that the officers told him they’d received a complaint about someone smoking weed outside the shop. Howell questioned the legitimacy of the officers’ statement, saying that a now-former employee was smoking a joint outside the shop when plainclothes officers approached her and asked to search the shop. She said no and was arrested on an unrelated outstanding warrant.

License And Paperwork All In Order

Howell said the Green Goddess Revival’s paperwork was in order to prove that products contained less than 0.3% of THC, which is permissible in Texas and meets the standards for medical marijuana.

An officer of the Eastern District of Texas denied that an officer in the photo was a member of the federal task force but was not operating in that capacity when they raided the legal medical marijuana shop.

Then There’s Texas AG Ken Paxton

Meanwhile, Texas Attorney General Ken Paxton launched lawsuits over voter-approved marijuana decriminalization initiatives underway in five Texas towns, some of which have been thrown out by judges. Denton, population 150,000, is among those towns. Paxton argues that these local initiatives violate state law are unconstitutional and that the five mostly small cities are being run by “criminal extremists.”

Now Read:

Photo: Texas Cannabis Collective

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gartner Insider Trades Send A Signal

Making a noteworthy insider sell on September 12, James C Smith, Board Member at Gartner IT, is reported in the latest SEC filing.

What Happened: Smith’s recent move involves selling 2,128 shares of Gartner. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $1,064,319.

The latest market snapshot at Friday morning reveals Gartner shares down by 0.0%, trading at $505.67.

Discovering Gartner: A Closer Look

Based in Stamford, Conn., Gartner provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Gartner: Delving into Financials

Revenue Growth: Gartner’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 6.11%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Exploring Profitability:

-

Gross Margin: With a high gross margin of 67.82%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Gartner’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.95.

Debt Management: Gartner’s debt-to-equity ratio stands notably higher than the industry average, reaching 4.53. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 48.11, Gartner’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 6.59, Gartner’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 29.5, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Could Palantir Stock Help You Become a Millionaire?

Palantir (NYSE: PLTR) has emerged as one of the stock market’s artificial intelligence (AI) darlings.

The tech company is known for its complex data analytics platforms. It got its start in the aftermath of 9/11 by providing software to federal intelligence agencies that helped them sift through mountains of data and make connections that could help them prevent further terrorist attacks.

Today, it’s considered a leader in AI software with the Palantir Artificial Intelligence Platform (AIP), which allows users to build AI apps to expedite workflows or to assist with processes like inventory management or procurement.

Palantir stock is up by more than 400% since the start of 2023, making it one of the top-performing AI stocks since the launch of ChatGPT. That bull run was recently capped off by news that the company would be added to the S&P 500.

In the wake of the stock’s surge, investors might be wondering if it’s too late to buy Palantir. Could the AI company still deliver returns from here that could make you a millionaire?

The Palantir growth story

Some AI stocks such as Nvidia have put up blockbuster growth, but Palantir’s emergence has been slower. The company was founded in 2003 and went public in 2020. It’s on track to earn $2.75 billion in revenue this year.

In the second quarter, its revenue grew 27% to $678.1 million, and the company is now highly profitable, with an adjusted operating margin of 37% in the quarter, or a 16% margin on a generally accepted accounting principles (GAAP) basis. Profits have surged because the company’s business model is highly scalable — its operating expenses rose just 7% in the quarter.

Historically, Palantir’s business has largely come from federal government contracts, but it is diversifying its customer base with strong growth in the commercial division. In the second quarter, its commercial revenue jumped by 33% to $307 million — 45% of Palantir’s total revenue — and its commercial customer count jumped by 83% to 295.

Overall, its recent results have been virtually flawless, with steady growth, growing profitability, improved guidance, and a diversifying customer base. Palantir’s performance is especially impressive in an environment where software stocks have struggled, and a large number are trading well below their pandemic-era peaks.

CEO Alex Karp characterized the company’s growth as “driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic.”

Can Palantir make you a millionaire?

Palantir’s share price growth from the all-time low it hit in late December 2022 has already helped some investors take significant steps toward millionaire status. While the business is firing on all cylinders, there are some legitimate concerns about its valuation.

Currently, the stock trades at a price-to-sales ratio of 82.6 and a trailing price-to-earnings ratio of 205, though considering its growth expectations, that ratio should come down reasonably quickly.

Other AI stocks like Nvidia seem to have plateaued for now as investors are concerned that cloud infrastructure companies are overspending on AI and that stock prices have gotten ahead of the growth in the underlying businesses.

As a software company, Palantir doesn’t really face that concern. Demand for its products is separate from the rest of the generative AI sector, but slowing growth could spark similar concerns. Palantir is at risk of being affected by headwinds in the broader economy, as its customers and potential customers could pull back on spending on a new technology.

Palantir also now has a market cap near $80 billion, so multibagger growth will be more difficult from here, but the company’s competitive advantages should ensure its continued growth.

If you’re looking for AI stocks or growth stocks to drive your portfolio toward $1 million, then investing in Palantir makes sense. However, making that position part of a portfolio diversified with other AI stocks seems like a better course of action. Additionally, buying Palantir opportunistically if it pulls back could deliver handsome rewards.

Overall, based on its recent results and the stock’s performance, Palantir has earned a place in any AI-focused growth stock portfolio.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Could Palantir Stock Help You Become a Millionaire? was originally published by The Motley Fool

Biden Slams Trump's Offensive Remarks About Haitian Immigrants: 'This Has To Stop — What He's Doing — Has To Stop'

President Joe Biden has publicly denounced former President Donald Trump for his derogatory comments about Haitian immigrants, labeling the Republican nominee’s remarks as “simply wrong.”

What Happened: During a Black Excellence brunch hosted at the White House Friday, Biden refuted Trump’s baseless assertion, made during the presidential debate, that Haitian immigrants are stealing and consuming pets.

This falsehood has also been propagated by other top-tier Republicans, including vice presidential candidate Sen. JD Vance (R-Ohio), reported CNN.

“I want to take a moment to say something. Like so many Americans — like [press secretary] Karine [Jean-Pierre], as you point out, a proud Haitian American, a community that’s under attack in our country right now,” he said.

Adding, “This has to stop — what he’s doing — has to stop.”

At the conclusion of Congressional Black Caucus Week, Biden expressed appreciation for the support he has received from the Black community throughout his political career.

He also recognized the significant role Black Americans have played in the nation’s history and development.

Vice President Kamala Harris was unable to attend the brunch due to scheduling conflicts, as per her office. Biden mentioned that she had intended to be present, the report noted.

Why It Matters: This incident follows a series of controversial statements made by Trump during a televised debate with Vice President Harris.

Trump alleged that immigrants in Springfield, Ohio, were abducting and consuming pets. Harris responded by labeling Trump “extreme” and laughed at his comments.

The debate, held at the National Constitution Center in Philadelphia, was the first and potentially only face-off between Trump and Harris.

During the debate, Trump focused on immigration issues, blaming the Biden administration for a perceived increase in crime and drug problems due to their immigration policies.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photos courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Richmond American Debuts New Models in Plumas Lake

Four inspired model homes now open for tours at Seasons at Riverton

PLUMAS LAKE, Calif., Sept. 13, 2024 /PRNewswire/ — Richmond American Homes of California, a subsidiary of M.D.C. Holdings, Inc., is pleased to announce the opening of four new model homes at Seasons at Riverton (RichmondAmerican.com/SeasonsAtRiverton) in Plumas Lake. Prospective homebuyers and area agents are encouraged to tour the new Agate, Ammolite, Elderberry and Ruby floor plans at this exciting new masterplan.

Featuring two vibrant communities, Seasons at Riverton offers ranch and two-story homes from the builder’s popular Seasons™ Collection (RichmondAmerican.com/Seasons), designed to maximize space and make homeownership more attainable for a variety of buyers.

About Seasons at Riverton North & South:

- New ranch and two-story homes from the $500s

- Seven inspired Seasons™ Collection floor plans

- Up to 5 bedrooms & approx. 3,040 sq. ft.

- 3-car & RV garages available

- Close proximity to highways & notable schools

- Short drive to popular shops & restaurants

- Near Beale Air Force Base & Toyota Amphitheatre

- Designer-curated fixtures & finishes

- Four models open for tours

Seasons at Riverton is located at 1699 Bond Way (Leighton Grove and River Oaks Boulevard) in Plumas Lake. Call 530.491.7104 or visit RichmondAmerican.com for more information or to schedule an appointment.

About M.D.C. Holdings, Inc.

M.D.C. Holdings, Inc. was founded in 1972. MDC’s homebuilding subsidiaries, which operate under the name Richmond American Homes, have helped more than 240,000 homebuyers achieve the American Dream since 1977. One of the largest homebuilders in the nation, MDC is committed to quality and value that is reflected in each home its subsidiaries build. The Richmond American companies have operations in Alabama, Arizona, California, Colorado, Florida, Idaho, Maryland, Nevada, New Mexico, Oregon, Pennsylvania, Tennessee, Texas, Utah, Virginia and Washington. Mortgage lending, insurance and title services are offered by the following MDC subsidiaries, respectively: HomeAmerican Mortgage Corporation, American Home Insurance Agency, Inc. and American Home Title and Escrow Company. For more information, visit MDCHoldings.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-debuts-new-models-in-plumas-lake-302248039.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-debuts-new-models-in-plumas-lake-302248039.html

SOURCE M.D.C. Holdings, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

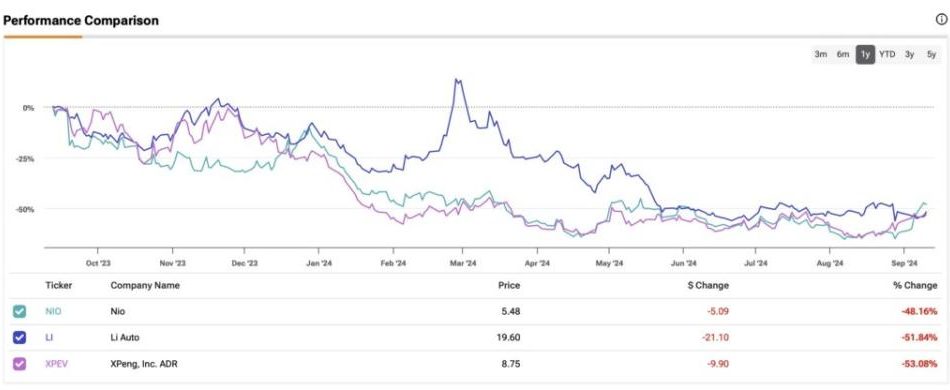

NIO, LI, or XPEV: Which Chinese EV Maker Is the Best Pick?

The Chinese electric vehicle (EV) market has grown rapidly, becoming the largest in the world. However, this growth has led to fierce competition, which has pressured margins and stock prices of major players. In this article, using the TipRanks Stock Comparison tool, I’ll explain why I rate Li Auto (LI) as a Buy and view it as a better investment than Nio (NIO) and XPeng (XPEV), which I rate Hold and Sell, respectively.

Nio (NIO)

My Hold rating on Nio stems from the company’s consistent quarterly losses, driven by intense competition in the EV sector. As a prominent player in the premium Chinese EV market, Nio is recognized for its high-end electric SUVs and innovative battery-swapping system. However, Nio holds just 2.1% of the domestic market share in China. This limited market presence may hinder the company’s path to sustained profitability and effective scaling.

For Q2 2024, Nio reported an adjusted net loss of RMB 4.535 billion (around $624.1 million). This was a 16.7% decrease from the previous year. Recent delivery data is more encouraging. From January to August of this year, Nio delivered 128,100 vehicles, representing a 35.8% yearly increase. This performance helped regain investor confidence, as evidenced by a prolonged rally in the company’s shares, which rose over 14% following the Q2 results.

NIO’s Valuation, Momentum, and Wall Street Consensus

Nio’s valuation shows a price-to-sales (P/S) ratio of nearly 1.2x, above the industry average, but suggests some de-risking. However, this does not necessarily indicate a Buy signal. The primary concern is the price-to-book (P/B) ratio of 5.1x, which is much higher than its Chinese peers, given its asset base.

In terms of momentum, the stock has surged nearly 50% since late August of this year. Nonetheless, technical indicators, such as an RSI of 76.27, suggest that the stock might be overbought. Despite this, Nio’s share price remains above both the short-term and long-term moving averages, which signals a continued bullish trend.

Additionally, Wall Street’s consensus on NIO is a Moderate Buy, with six of eleven analysts bullish, four neutral, and one bearish. The average price target is $5.97, implying potential upside of 8.84%.

Li Auto (LI)

I am most bullish on Li Auto due to the company’s superior margins compared to other Chinese EV manufacturers. Li Auto stands out in the Chinese EV market for its extended-range vehicles that combine electric power with a small gasoline engine.

In its most recent quarter (Q2 2024), Li Auto achieved a vehicle margin of 18.7%. Although this represents a decline from 21% in the same quarter of 2023, it remains the highest margin among its peers. For comparison, Nio reported a vehicle margin of 12.2%, while XPeng had a margin of 6.4% in its most recent quarter.

Despite the drop in margins—reflecting the competitive nature of the EV market—Li Auto remained profitable in Q2, reporting gross profits at RMB 6.2 billion (approximately $850 million), a 16.9% increase compared to Q1. This performance positions Li Auto as one of the lower-risk investment options within its segment.

LI’s Valuation, Momentum, and Wall Street Consensus

Another factor in my bullish outlook on Li Auto is its valuation. Despite its profitability and strong margins, Li Auto is one of the most attractively valued EV companies in its sector. It trades at a P/S ratio of 1.1x. Additionally, its P/B ratio is 2.3x, which is less than half of Nio’s but higher than XPeng’s.

Regarding technical indicators, with the share price being down 53% over the past twelve months, Li Auto’s stock trades below its 100-day moving average, which is $21.28. This suggests that the stock might be in a recovery phase or attempting to stabilize after a prolonged bearish period.

Moreover, Wall Street’s consensus is largely bullish, with a Moderate Buy rating. Six out of nine analysts recommend a buy, and the average price target is $26.82, suggesting upside potential of 38.14%.

XPeng (XPEV)

Lastly, I remain bearish on XPeng stock due to its persistent execution issues and poor margins, making it the least favorable of the trio. XPeng is known for its focus on smart, connected, and affordable EVs, emphasizing technology and innovation in autonomous driving.

XPeng significantly lags behind Nio and Li Auto in vehicle margins at 6.4% and faces a bleak Q3 delivery outlook, with only 12.5% year-over-year growth projected. Much of this growth depends on the sales of its new Mona M03, priced from less than $17,000. Although the company has already received over 10,000 non-refundable orders for the vehicle, there is uncertainty about whether it can meet its delivery numbers each month. Additionally, profitability remains in question if actual deliveries fall short of expectations.

XPEV’s Valuation, Momentum, and Wall Street Consensus

Contributing to my bearish outlook, I find it perplexing that XPeng, despite having lower vehicle margins compared to its peers, trades at a P/S ratio of 1.6x—higher than both Nio and Li Auto. While its P/B ratio of 1.7x is lower than its peers, this may reflect concerns about the company’s financial health. With $5.14 billion in cash and equivalents and other near-cash assets (ended June 30, 2024), XPeng could face financial strain, as analysts do not expect profitability until at least 2026.

On the positive side, XPeng’s stock trades below its 200-day moving average but above shorter-term averages. This suggests short-term bullish momentum within a broader bearish trend, possibly signaling market indecision.

Contrary to my pessimistic view, analysts’ consensus is bullish on XPeng’s stock. It holds a “Moderate Buy” rating, with seven out of ten analysts recommending a Buy. The average price target is $11.55, suggesting potential upside of 26.51%.

Conclusion: LI Auto Is My Top Pick

Investing in Chinese EV stocks has been risky, with several headwinds driving industry-wide selloffs. Among the players, I view Li Auto stock as the least risky and rate it a Buy, thanks to its reasonable valuation and strong margins. In contrast, Nio’s profitability challenges warrant a cautious outlook, while XPeng’s low margins support a bearish stance.

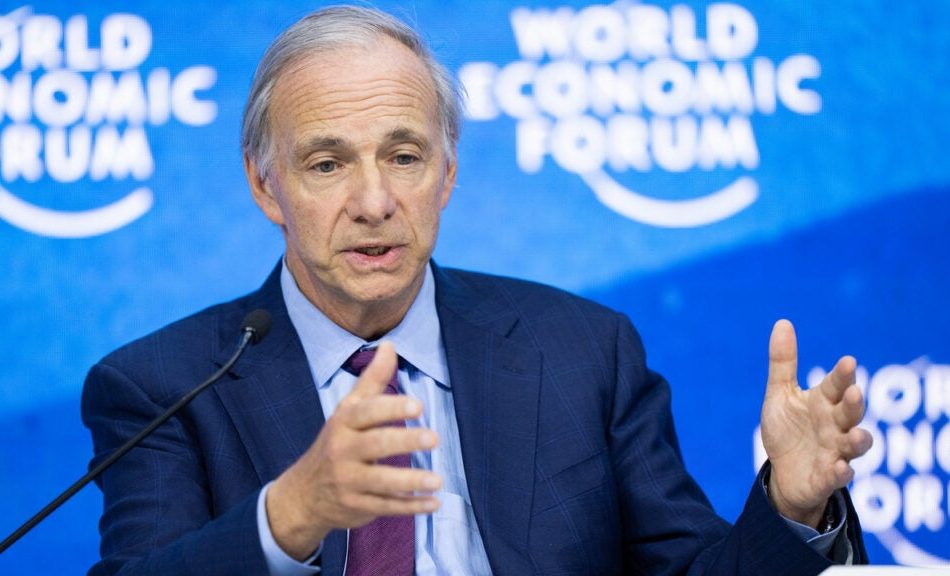

Billionaire Ray Dalio Warns Potential Election Chaos Likely If Loser, Particularly Trump, Rejects Outcome – 'My Great Fear Is for Democracy'

Billionaire investor and founder of Bridgewater Associates Ray Dalio warns that the US election could cause chaos if the loser, especially Donald Trump, refuses to concede, resulting in a cutthroat all-or-nothing approach from both sides.

In a recent interview with the BBC, Dalio highlighted that many people from states such as California, New York, and New Jersey are likely to move to states like Florida and Texas, driven partly by tax considerations and partly by differing values.

“My great fear is for democracy,” Dalio told BBC.

In an interview with the Financial Times earlier this year, Dalio suggested that the chance of a civil conflict in the U.S. could be as high as 40%, reflecting his serious worries about the nation’s current state. He clarified that this civil war wouldn’t involve physical violence but rather an intensification of political polarization.

In this scenario, individuals would relocate to states that better align with their values and ignore federal decisions made by opposing political factions, as he explained to the Financial Times.

Check This Out: Ray Dalio: US ‘On The Brink’ Of Civil War, But Not One Where People’ Grab Guns And Start Shooting’

During a week marked by the televised debate between Kamala Harris and Donald Trump, Dalio expressed his deep concern for the future of democracy, regardless of the outcome on November 4.

“This reminds me of the 1930 to ’45 period in which there was an economic crisis followed by democracies becoming dictatorships,” Dalio told BBC.

Dalio noted that Germany, Italy, Spain, and Japan experienced the breakdown of their parliamentary systems due to internal conflicts among the far left, far right, communism, and fascism, and he observed that modern versions of these issues are currently emerging.

According to a December Gallup survey, only 28% of US adults are currently satisfied with how democracy functions in the country, marking a new low compared to the previous low of 35% recorded shortly after the January 6, 2021, Capitol attack. Satisfaction levels vary significantly between political affiliations, with 38% of Democrats and just 17% of Republicans expressing contentment. Additionally, those with less formal education tend to be less satisfied with the state of democracy.

“I do not know how this election is going to turn out and how these things will turn out. I do know that we have an exceptionally high probability of instability”, Dalio informed the BBC.

Why Dalio’s Views Are Significant?

There is some indication that migration in the US based on personal values is already underway, as predicted by Dalio. For instance, in July, Elon Musk declared his decision to relocate the headquarters of his companies, X and SpaceX, from California to Texas, BBC added.

Musk cited new regulations in California that prohibit schools from informing parents if their children wish to change their gender identity as a key reason for the move.

Reflecting on his predictive track record, Dalio told the BBC, “I’ve been right in the markets about 65% of the time.”

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Suze Orman Believes 'Everyone Should Absolutely' Own Bitcoin

Suze Orman, the personal finance expert and podcaster, has a message for investors: buy more Bitcoin. Her stance puts her at odds with many of her peers in the financial advisory world.

“Everybody should absolutely have exposure to Bitcoin,” Orman said in a recent CNBC interview. But she was quick to add a caveat: “Put as much money in there as you’re OK losing.”

Orman’s endorsement comes as Bitcoin’s value has more than doubled in the past year to $57,756. The cryptocurrency’s price surge has reignited debates about its role in investment portfolios.

Don’t Miss:

Unlike some Bitcoin proponents, Orman doesn’t see it as a hedge against inflation or a replacement for traditional currency. Instead, she’s betting on its appeal to younger investors.

“As younger people make more money and mature, Bitcoin will be one of their investments of choice,” Orman said. Her view aligns with CNBC’s recent data showing that millennials and Gen Z account for 70% of cryptocurrency ownership.

Trending: If you invested $100 in DOGE when Elon Musk first tweeted about it in 2019, here’s how much you’d have today.

Orman’s stance contradicts the opinions of well-known financial figures. Perhaps most notably, Berkshire Hathaway CEO Warren Buffett dismissed Bitcoin, saying he wouldn’t pay $25 for the entire world supply. Another well-known financial advisor, Dave Ramsey, compared cryptocurrency investment to speculating on unstable currencies.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Despite the endorsement, Orman remains cautious. She prefers investing in Bitcoin through exchange-traded funds (ETFs) – approved by the SEC earlier this year – rather than owning it directly. The approach, she says, offers more security and simplicity.

“I feel better owning an ETF because I would never want to see an FTX happen again,” Orman said, referring to the high-profile collapse of the crypto exchange.

Orman’s advice comes with clear warnings. She views Bitcoin as speculative, telling investors to be prepared for volatility. “This is an investment that you’re either going to lose it all, or you’re going to let it run until it’s worth $100,000 or $200,000,” she said.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Financial experts often suggest limiting high-risk assets to no more than 5% of an investment portfolio. Orman’s approach aligns with the conservative stance of investing only in what one can afford to lose.

As cryptocurrencies continue to gain mainstream attention, Orman’s perspective offers a middle ground between outright rejection and unchecked enthusiasm.

“Because the younger generation has a fascination with it – and you see the energy – a whole lot of people [have] interest in it. Eventually, it could very well catch fire,” she said to CNBC.

Her nuanced stance reflects the landscape facing today’s investors as they navigate the potential risks and rewards of digital assets.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Why Suze Orman Believes ‘Everyone Should Absolutely’ Own Bitcoin originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Kirsten M Volpi Sells $89K Worth Of Tetra Tech Shares

Disclosed on September 12, Kirsten M Volpi, Board Member at Tetra Tech TTEK, executed a substantial insider sell as per the latest SEC filing.

What Happened: Volpi’s decision to sell 1,950 shares of Tetra Tech was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $89,700.

Tracking the Friday’s morning session, Tetra Tech shares are trading at $46.09, showing a up of 0.08%.

About Tetra Tech

Tetra Tech Inc provides consulting and engineering services for environmental, infrastructure, resource management, energy, and international development markets. It specializes in providing water-related services for public and private clients. It designs infrastructure, facilities, and other structures with complex plans and resource management. Tetra Tech has two reportable segments. Its Government Services Group (GSG) reportable segment primarily includes activities with U.S. government clients (federal, state and local) and activities with development agencies worldwide. Commercial/International Services Group (CIG) reportable segment primarily includes activities with U.S. commercial clients and international clients other than development agencies.

Tetra Tech’s Financial Performance

Revenue Growth: Over the 3 months period, Tetra Tech showcased positive performance, achieving a revenue growth rate of 11.2% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 16.6%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Tetra Tech’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.32.

Debt Management: Tetra Tech’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.63.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 42.64, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.44 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 24.15, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Tetra Tech’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.