Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever

In one sense, there’s no such thing as easy money. However, once you have money accumulated to invest, it can be easy to make more. That’s the key to generating passive income.

Some investment options require constant monitoring. You might not be able to hang onto them for long. However, others are excellent long-term picks.

Want decades of passive income? Here are three stocks to buy now and hold forever.

1. AbbVie

AbbVie (NYSE: ABBV) is one of the biggest biopharmaceutical companies in the world with its market cap hovering around $345 billion. Its product lineup includes four blockbuster drugs and several others with the potential to generate sales of $1 billion or more.

You might not be overly impressed by AbbVie’s forward dividend yield of 3.17%. However, the company’s dividend track record is impressive. AbbVie has increased its dividend for 52 consecutive years, making it a member of the elite group of stocks known as Dividend Kings.

The main knock against AbbVie is that its revenue and earnings have fallen due to biosimilar competition for its top-selling drug Humira. Investors have nothing to worry about, though. AbbVie expects to quickly return to growth thanks to other rising stars in its lineup, including the two successors to Humira — Rinvoq and Skyrizi.

I would even argue that AbbVie’s handling of the loss of patent exclusivity for Humira underscores why this is a great stock to generate passive income over the long term. The company’s strategy to extend Humira’s marketplace dominance while it invested in developing new drugs and made shrewd acquisitions shows that it should be able to successfully navigate future patent cliffs.

2. Brookfield Infrastructure

Brookfield Infrastructure‘s (NYSE: BIP) (NYSE: BIPC) name sums up its business: infrastructure. The company owns cell towers, data centers, electricity transmission lines, pipelines, rail, semiconductor manufacturing foundries, toll roads, and more.

Because of its roots as a limited partnership (LP), Brookfield Infrastructure pays distributions instead of dividends. Whatever you call them, they’re attractive. The forward distribution yield for the LP (which trades under the BEP ticker) is 5.12%, while the yield for the corporate entity (which trades under the BEPC ticker) is 4.04%.

Those distributions are highly dependable, too. Brookfield Infrastructure has increased its distributions for 15 consecutive years. The company expects to keep that trend going with annual distribution growth of between 5% and 9%.

Brookfield Infrastructure also has a solid, repeatable strategy for long-term growth. The company acquires infrastructure assets that are attractively valued. It then enhances the businesses’ value using its operational expertise. Finally, the company sells mature assets with limited growth potential to fund new investments.

3. Verizon Communications

Most Americans are likely at least somewhat familiar with Verizon Communications (NYSE: VZ). The company is one of the largest telecommunications providers in the world.

Verizon offers a forward dividend yield of 6.27%, the highest of the three stocks on this list. The telecom giant has increased its dividend for 18 consecutive years. With Verizon’s improving free cash flow, I expect this streak of dividend hikes will continue.

Income investors aren’t the only ones who have something to like with Verizon. The stock should also appeal to value investors with its low forward price-to-earnings ratio of 9.3.

Admittedly, Verizon probably won’t deliver sizzling organic growth. However, the company is well positioned to grow via acquisitions. As a case in point, Verizon plans to buy Frontier Communications for $20 billion in an all-cash transaction. This deal will greatly expand Verizon’s fiber footprint in the U.S.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keith Speights has positions in AbbVie, Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, and Verizon Communications. The Motley Fool recommends Brookfield Infrastructure Partners and Verizon Communications. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever was originally published by The Motley Fool

Eco Oro Announces Change in Management Team and Board

VANCOUVER, British Columbia, Sept. 13, 2024 (GLOBE NEWSWIRE) — Eco Oro Minerals Corp. EOM (the “Company“) announced today that Paul Robertson has resigned as Chief Executive Officer of the Company. Eric Tsung, the current Chief Financial Officer of the Company, will assume the role of Chief Executive Officer with immediate effect. Eric will continue in the role of Chief Financial Officer, a position he had held since August 3, 2017. The Company also announced today that Pierre Amariglio has tendered his resignation as member of the Company’s board of directors.

Company Profile

Eco Oro Minerals Corp. is a publicly-traded company and its arbitration against the Republic of Colombia is its core focus.

SOURCE Eco Oro Minerals Corp.

For further information: Eco Oro Minerals Corp.

Tel: +1 604 682 8212, TF: +1 855 682 8212.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Retirees in These 9 States Risk Losing Some of Their Social Security Checks

Social Security is an important piece of nearly every American’s retirement budget. Around half of households with someone age 65 or older receive at least 50% of their income from Social Security and about one-quarter receive at least 90% of their income from the program.

With the importance of Social Security benefits for so many retirees, it’s important to keep every penny of them if possible. Unfortunately, for those living in nine states, there’s a chance they’ll see a reduction in those monthly checks. Depending on your income, your state might tax a portion of your benefits.

Here’s what you need to know.

How to keep more of your Social Security benefits

Before focusing on individual states, everyone collecting Social Security should know how their benefits are taxed by the federal government.

The U.S. government uses a metric called “combined income” to determine what portion, if any, of your Social Security benefits are subject to income tax. Combined income is the sum of half your Social Security income, your adjusted gross income, and any untaxed interest income. If your income exceeds the thresholds detailed below, you’ll have to pay ordinary income tax on a portion of your benefits.

|

Taxable Portion of Benefits |

Combined Income, Individual |

Combined Income, Married Filing Jointly |

|---|---|---|

|

0% |

Less than $25,000 |

Less than $32,000 |

|

Up to 50% |

$25,000 to $34,000 |

$32,000 to $44,000 |

|

Up to 85% |

Over $34,000 |

Over $44,000 |

Data source: Social Security Administration.

You’ll notice those thresholds are extremely low. That’s because Congress hasn’t updated those numbers for inflation since they were first created in the 1980s and 1990s. As such, more and more retirees are losing more and more of their benefits to taxes every year.

You can avoid paying some taxes on your Social Security income with good tax planning, though. If you can get more of your retirement savings into Roth accounts, withdrawals from those accounts won’t count toward your combined income.

Still, you’ll have to be very mindful of your capital gains and traditional retirement account withdrawals plus any interest earned on your cash holdings. Every penny counts when it comes to keeping your Social Security benefits tax-free.

If that wasn’t enough to worry about, retirees in nine states also have to consider the potential burden of state taxes.

9 states that tax Social Security

Many states don’t tax Social Security benefits, and the number of states that do keeps getting smaller. For example, Missouri and Nebraska eliminated their Social Security taxes in recent years (effective in 2024), and Kansas eliminated it this year (effective immediately). There are just nine remaining states that will tax Social Security in 2024.

If you live in one of the following states, be sure to take your time to do the additional research to see how the state tax law effects your situation. You might find it beneficial to consult a professional tax planner to help you reduce your tax bill either this year or in the future. It pays to plan ahead for taxes in retirement.

Here are the basics for each state.

Colorado: Taxpayers under the age of 65 with more than $20,000 in taxable benefits on their federal income tax return will owe state income taxes on the amount above that threshold. Retirees 65 or older are exempt from taxes on Social Security benefits. The state tax rate is 4.4%.

Connecticut: Any Social Security income included on your federal income tax return might be subject to taxes in Connecticut if your adjusted gross income exceeds $75,000 for individuals or $100,000 for joint filers. However, the amount is limited to 25% of your benefits received regardless of what percentage is included on your federal return. The tax rate ranges from 2% to 4.5%.

Minnesota: Taxpayers can deduct up to $4,560 as an individual or $5,840 for a married couple filing jointly in Social Security from their taxable income. That amount is reduced for residents with adjusted gross incomes above $78,000 for an individual or $100,000 for a married couple before phasing out completely at incomes of $118,000 or $140,000, respectively. The tax rate ranges from 6.8% to 9.85%.

Montana: Any Social Security income on a federal income tax return is subject to state income tax. The tax rate ranges from 4.7% to 5.9%.

New Mexico: Taxpayers with adjusted gross incomes exceeding $100,000 for individuals or $150,000 for married couples filing jointly will owe taxes on any Social Security income also taxed at a federal level. The tax rate ranges from 4.9% to 5.9%.

Rhode Island: Taxpayers below their full retirement age, as defined by Social Security, with an adjusted gross income above a certain threshold will owe taxes on any portion of Social Security income also included on their federal income tax return. Those thresholds were $101,000 for individuals or $126,250 for married couples filing jointly in 2023, but they get adjusted for inflation each year. The tax rate ranges from 4.75% to 5.99%.

Utah: Taxpayers with an adjusted gross income exceeding $45,000 for individuals or $75,000 for married couples filing jointly will owe taxes on any Social Security income included on their federal tax return. Those below the threshold qualify for a credit to offset the taxes. The tax rate is 4.65%.

Vermont: Taxpayers with an adjusted gross income above $50,000 for individuals or $65,000 for married couples filing jointly will owe income tax on at least a portion of any Social Security income included on their federal income tax return. The tax rate ranges from 3.35% to 8.75%.

West Virginia: A total of 65% of any Social Security income included on a federal income tax return is subject to state income tax. Social Security taxation will phase out over time: 35% is taxable in 2025 and 0% is taxable starting in 2026. The tax rate ranges from 2.55% to 5.525%.

How to decide which state to retire to

It’s true, retirees in the above nine states face the added challenge of state taxes potentially cutting into their all-important Social Security retirement benefits. But Social Security taxes are not a good reason to choose which state to live in for your retirement.

First off, tax laws change all the time. The current trend is that more and more states are eliminating taxes on Social Security income. It’s quite possible all of the above states will eventually get rid of the tax. West Virginia already has the legislation in place to eliminate it by 2026.

More important considerations include the cost of living and what the community has to offer to retirees. If you want to live happily, eking out a few extra dollars in tax savings won’t compare to a 15% reduction in your cost of living and a vibrant senior community with social activities. Those factors could have a much bigger impact on your quality of life than worrying about your tax bill come April.

That said, if the state you want to live in taxes your Social Security income, there are many different ways to avoid the tax bill without changing where you live. The earlier you plan for potential taxes in retirement, the better you’ll be able to reduce or avoid the burden entirely. As mentioned, a professional planner could be worth the price if you live in any of the above states and you’re worried about taxes.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Retirees in These 9 States Risk Losing Some of Their Social Security Checks was originally published by The Motley Fool

Why the stock market's AI trade came back to life this week

-

AI stocks like Nvidia, Super Micro Computer, and Broadcom soared nearly 20% this week.

-

The rally was sparked as Oracle and Nvidia executives addressed concerns about AI returns.

-

Oracle shares surged by 24% after Larry Ellison’s bullish comments on AI’s long-term potential.

The stock market’s artificial-intelligence trade was revived this week, with shares of AI stalwarts like Nvidia, Super Micro Computer, and Broadcom soaring by nearly 20%.

AI-related names and semiconductor shares were caught in a slump after Nvidia reported its second-quarter earnings two weeks ago. Nvidia shares slid sharply after the company failed to meet sky-high expectations, leading investors to question how much further the AI trade could possibly run after a yearslong hot streak.

Questions about the return on the billions of dollars’ worth of investment in AI by big firms led to a sell-off in the space.

But the market staged a comeback this week as key players separately addressed some burning questions from investors about what to expect from big AI spend.

At midday on Friday, shares of Nvidia and Oracle were 16% higher for the week, while Super Micro Computer stock was up by 19% and Broadcom had risen by 21%.

Helping drive the week’s resurgence were the billionaire investor Larry Ellison, Oracle’s cofounder and chairman, and Jensen Huang, Nvidia’s cofounder and CEO.

Both executives addressed concerns about the return on investment for AI infrastructure spend, and investors seem to be taking their word for it.

Oracle’s Ellison: ‘This race goes on forever’

Oracle reported solid earnings after the market close on Monday. On the earnings call, Ellison talked up AI’s immense potential.

Discussing the sustainability of AI-infrastructure spending, which has exploded in recent years, Ellison argued that it’s not going to stop.

“This race goes on forever, to build a better and better neural network,” Ellison said. “And the cost of that training gets to be astronomical.”

He added: “I think this is an ongoing battle for technical supremacy that will be fought by a handful of companies and maybe one nation-state over the next five years at least, but probably more like 10. So this business is just growing larger and larger and larger. There’s no slowdown or shift coming.”

After those bullish comments, Oracle shares soared by as much as 24% at their intraday peak on Friday.

At its analyst day this week, Oracle gave investors long-term annual revenue guidance of $104 billion by 2029, with earnings per share set to grow by more than 20% between now and then.

“This matched the bullishness the Company has been coyly hinting at for a number of months now; this was the upside to expectations that justifies continued multiple expansion, in our view,” the KeyBanc analyst Jackson Ader said in a note.

Ellison said that building an AI training model for cloud companies would cost upward of $100 billion.

“That’s over the next four, five years for anyone who wants to play in that game,” he said. “That’s a lot of money, and it doesn’t get easier.”

That should be great news for Nvidia, which is the main supplier of AI-enabling GPUs that cloud companies use to build their models.

Nvidia’s Huang: ‘You get a 10x savings’

At a Goldman Sachs conference on Wednesday, Huang was directly asked about concerns related to customers’ return on investment in AI spending, and Huang gave a direct answer.

“The return on that is fantastic because the demand is so great that for every dollar they spend with us translates to $5 worth of rentals,” Huang said of the cloud hyperscalers buying his company’s chips. “And that’s happening all over the world, and everything is all sold out.”

On top of that, Huang said companies were seeing immense cost savings with Nvidia’s GPUs thanks to computation inflation found with CPUs.

By running Nvidia’s GPU accelerators relative to traditional CPUs, Huang said, “you reduce the computing time by about 20 times, and so you get a 10x savings.”

Shares of Nvidia have surged by 12% since Huang took the stage at Goldman’s conference on Wednesday morning.

The AI rally spread throughout the tech sector this week, with semiconductor stocks seeing renewed interest and a nearly 10% surge.

Read the original article on Business Insider

Nick Segal, Shaun Alan-Lee, and Jane Dorian Introduce Luxury White-Glove, Service-Oriented Real Estate Team to Los Angeles Marketplace

BEVERLY HILLS, Calif., Sept. 13, 2024 /PRNewswire/ — Powerhouse agents and visionary leaders Nick Segal, Shaun Alan-Lee, and Jane Dorian proudly present The Advisory—a service-oriented team within Carolwood Estates, a boutique brokerage nestled in the heart of Beverly Hills. With over six decades of combined experience, The Advisory is a masterclass in transactional excellence and white-glove service, having closed over $1.5 billion in sales across Los Angeles and Santa Barbara. Nick Segal, a luminary in the realm of real estate, has earned the industry’s most prestigious honors, including the coveted William Mar Garland Award. With a legacy of founding and leading two successful brokerages, Segal’s unparalleled leadership ensures The Advisory sets the gold standard in luxury real estate.

“Before one can say they are of service, one needs to fully embrace its consciousness, in both mindset and in action towards that selfless action of service,” said Segal. “Each member of The Advisory understands and is fully committed to this service consciousness because we know it works for both our clients and our team. Our clients consistently experience a greater peace of mind and a quiet confidence that all of their needs and concerns are being met with professional and strategic acumen forged by years of experience and positive results. And from that client satisfaction, with each successful closed transaction, so too are our needs met thereafter.”

The current real estate climate, shaped by the recent NAR ruling, demands a heightened level of professionalism and adept innovation. The Advisory is meeting this challenge head-on with its proprietary technology that offers interactive refinement functionality, precision valuations, and real-time “Heat Mapping” intelligence. These insights empower clients with objective data, ensuring that decisions are made with clarity and confidence rather than subjective opinion.

“Collaborating to create The Advisory with Nick Segal and Jane Dorian is not just a strategic move; it’s a pledge to deliver unparalleled excellence,” states Shaun Alan-Lee. “This partnership unites exceptional talent and a shared vision to revolutionize client experiences. We’re not simply combining forces; we’re establishing a new standard for elite real estate service. Together, we’re poised to positively impact the market and deliver phenomenal results for our clientele.”

Central to The Advisory’s ethos is a commitment to offering refined client services beyond the four walls of a transaction. The team’s exclusive offering, The Black Book Reserve, epitomizes their dedication to client care. This white-glove concierge service provides clients with access to a range of tailored solutions, from securing trusted house managers for extended absences and coordinating comprehensive packing and relocation services to on-demand, hired security. The Black Book Reserve goes beyond the traditional bounds of real estate, catering to The Advisory’s discerning national and international clientele.

“There are no two other people that I respect more than Nick and Shaun. We are so aligned when it comes to core values and work ethic. It’s truly a partnership made in heaven,” adds Jane Dorian.

In its inaugural year, The Advisory was recognized on REAL TRENDS’ “The Thousand List”, ranking No. 6 in Beverly Hills and distinguishing itself among the nation’s Top 1% producing teams across the nation.

The Advisory

310.935.0432

inquiries@theadvisoryre.com

theadvisoryre.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/nick-segal-shaun-alan-lee-and-jane-dorian-introduce-luxury-white-glove-service-oriented-real-estate-team-to-los-angeles-marketplace-302247920.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nick-segal-shaun-alan-lee-and-jane-dorian-introduce-luxury-white-glove-service-oriented-real-estate-team-to-los-angeles-marketplace-302247920.html

SOURCE The Advisory

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia, NetApp And 2 Other Stocks Executives Are Selling

The Nasdaq 100 closed higher by around 1% during Thursday’s session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company’s prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

NVIDIA

- The Trade: NVIDIA Corporation NVDA President and CEO Jen Hsun Huang sold a total of 240,000 shares at an average price of $109.39. The insider received around $26.3 million from selling those shares.

- What’s Happening: Nvidia CEO Jensen Huang recently said some Nvidia customers are becoming frustrated and tensions are rising due to the limited supply of the company’s latest Blackwell chips.

- What NVIDIA Does: Nvidia is a leading developer of graphics processing units.

Lantronix

- The Trade: Lantronix, Inc. LTRX 10% owner Bernhard Bruscha sold a total of 8,435 shares at an average price of $4.00. The insider received around $33,740 from selling those shares.

- What’s Happening: On Sept. 5, Lantronix posted upbeat quarterly sales.

- What Lantronix Does: Lantronix Inc is a networking company. It provides secure data access and management solutions for the Internet of Things (IoT) and information technology assets.

Janus Henderson

- The Trade: Janus Henderson Group PLC JHG CFO Roger MJ Thompson sold a total of 18,000 shares at an average price of $35.49. The insider received around $638,856 from selling those shares.

- What’s Happening: On Sept. 12, Wells Fargo analyst Michael Brown initiated coverage on Janus Henderson Group with an Equal-Weight rating and announced a price target of $37.

- What Janus Henderson Does: Janus Henderson Group provides investment management services to retail intermediary (55% of managed assets), self-directed (24%) and institutional (21%) clients.

NetApp

- The Trade: NetApp Inc NTAP EVP, CFO Michael J Berry sold a total of 15,000 shares at an average price of $114.32. The insider received around $1.7 million from selling those shares.

- What’s Happening: On Aug. 28, NetApp posted upbeat quarterly earnings.

- What NetApp Does: NetApp Inc is a provider of enterprise data management and storage solutions.

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock can climb for the next 12 months, S&P Global analyst says

-

Nvidia’s stock rally has another 12-18 months left to go, according to S&P Global’s Andrew Chang.

-

The stock has at least another year of “strong runaway” amid big demand for its chips, Chang said.

-

He aired concerns over AI investment pulling back in future quarters, which could impact shares.

Nvidia stock has a lot more room to climb — and shares of the market’s most popular chip maker are bound to soar for at least another year, according to Andrew Chang, a technology director at S&P Global Ratings.

The banking veteran pointed to recent comments from Jensen Huang, who sparked a sharp rally in NVDA shares this week after speaking at a Goldman Sachs conference in San Francisco. The Nvidia CEO issued more guidance on consumer demand and, in particular, demand for Blackwell, the company’s next-gen GPU.

His comments bolster predictions of continued upside for Nvidia, Chang said in an interview with Schwab Network on Friday.

“It just confirms our view that we have strong runway for at least the next 12 months,” Chang said.

Nvidia’s partners are also showing signs of strong chip demand. Oracle, which has an ongoing partnership with Nvidia, bumped up its revenue forecasts after beating earnings for the first quarter. The software firm also doubled its planned capital expenditures for the fiscal year — which are all bullish signs for Nvidia.

“All of these are great data points that, at least for the next 12 to 18 months, things look great,” Chang said of the Jensen Huang-led firm.

Still, he acknowledged some concerns investors have been airing. Some have floated worries that Nvidia’s growth is unsustainable, given the stock’s monster 2,514% gain over the last five years.

Some analysts have warned demand for Nvidia’s chips may not hold strong in the coming years, as the firm’s largest customers could eventually turn into competitors. Apple and Microsoft, two huge customers of Nvidia’s GPUs, are reportedly working on their own AI chips.

“Ultimately, if Oracle, if Microsoft, if Amazon don’t see the ROI that they expect, they’re going to cut orders. So hyperscale, demand volatility is something that really concerns us,” Chang said. “But, you know, these data center players have been known to order a bunch and then pause for several quarters. That’s what we’re looking out for.”

Investors will also need to be on the lookout for tighter regulation of AI. Nvidia was recently targeted by the Department of Justice in a fresh antitrust probe, Bloomberg reported, and it’s just a “matter of time” before other countries follow suit and try to regulate the technology, Chang said.

Nvidia stock sold off in the weeks following its earnings report at the end of August, but the stock staged a fresh rally this week alongside other tech stalwarts including Oracle and Super Micro Computer.

Wall Street remains generally bullish on Nvidia. According to Nasdaq data, analysts have issued an average price target of $153 a share, implying a 29% upside from current levels.

Read the original article on Business Insider

These 2 Biotech Stocks Are Set to Soar

Investing in biotech companies, especially relatively small ones, can be a double-edged sword. Their shares often soar on strong clinical trial or regulatory news, but they can lose much of their value overnight if a study’s results don’t go their way. That makes many biotech stocks somewhat risky investments, but some could deliver excellent results for those who can stomach the risk.

Two biotech companies whose shares could gain significant traction in the months and years ahead are Viking Therapeutics (NASDAQ: VKTX) and Sarepta Therapeutics (NASDAQ: SRPT).

1. Viking Therapeutics

Viking Therapeutics is a clinical-stage biotech whose stock rose significantly this year. The drugmaker owes that run-up to its leading candidate, VK2735, a potential GLP-1 weight loss therapy that produced strong results in a phase 2 study. At least two scenarios could lead to Viking’s shares soaring even more in the coming months and years.

The first scenario involves Viking Therapeutics advancing VK2735 to late-stage studies and the medicine proving safe and effective. The biotech could then get a foothold in the fast-growing weight loss market. It’s hard to come up with accurate estimates years before a drug might hit the market, but William Blair analyst Andy Hsieh has projected that VK2735 could generate about $21.6 billion in annual sales at its peak. If this prediction is anywhere close to the truth, Viking’s shares could maintain their momentum for a while. The stock could also skyrocket if the company becomes an acquisition target.

Many prominent drugmakers are racing to join the lucrative market for effective new weight loss treatments. Yet few have produced the kinds of clinical trial results this mid-cap company has. Buying out Viking Therapeutics would be a quick way for one of them to acquire a promising pipeline candidate in this niche and the team that developed it.

Viking is also working on an oral version of VK2735. And elsewhere in its pipeline, a phase 2 clinical trial of VK2809 produced positive results as a potential therapy for metabolic dysfunction-associated steatohepatitis (MASH), another condition with a high unmet need. The Food and Drug Administration (FDA) approved the first MASH therapy earlier this year, but there is room in the marketplace for more.

If Viking Therapeutics can make steady progress with its leading candidates, the stock could produce further outsized returns. However, this biotech stock is somewhat risky: If VK2735’s clinical results fail to impress, its share price could fall off a cliff. Invest accordingly.

2. Sarepta Therapeutics

Sarepta Therapeutics specializes in developing medicines for Duchenne muscular dystrophy, a rare, pediatric, progressive neuromuscular disorder.

The company’s most important product is Elevidys, a gene therapy for Duchenne muscular dystrophy. Elevidys recently earned traditional FDA approval for ambulatory patients and accelerated approval for non-ambulatory patients. This means that Sarepta Therapeutics will have to prove its efficacy in non-ambulatory patients in a post-marketing study to get the full blessing of regulators.

So far, Elevidys is performing well and helping Sarepta deliver strong results. In the second quarter, its total revenue increased by 39% year over year to $362.9 million. Earnings per share of $0.07 were much better than its loss per share of $0.27 in the prior-year period. The company’s shares have performed better than the broader market so far in 2024, but things could get even better if it does earn full approval for Elevidys for non-ambulatory Duchenne muscular dystrophy patients. Elevidys is already contributing significantly to strong financial results.

But this regulatory win could improve things. It’s also worth noting that Sarepta is looking to diversify its lineup. All four of its approved therapies treat Duchenne muscular dystrophy, but in January it started a phase 3 study for a potential therapy for Limb-Girdle muscular dystrophy. Overall, Sarepta Therapeutics has more than 40 candidates for conditions across the rare disease spectrum — not bad for a biotech worth just under $13 billion.

The company’s shares could deliver above-average returns if it keeps developing innovative therapies for diseases with high unmet needs.

Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

These 2 Biotech Stocks Are Set to Soar was originally published by The Motley Fool

Digital Health Market Size on Track to Reach USD 1.1 Trillion by 2031, Driven by 13.1% CAGR Growth| Exclusive Research Report by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 13, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global digital health market (mercado de salud digital) was worth US$ 382.5 Billion in 2022 and is expected to reach US$ 1.1 Tn by the year 2031 at a CAGR of 13.1 % between 2023 and 2031.

Digital health is a comprehensive concept that merges the latest technological advancements with healthcare practices to empower individuals to take control of their health and well-being. From wearable devices that monitor vital signs to ingestible sensors that provide real-time data on bodily functions, digital health represents the future of personalized healthcare.

Digital health represents a transformative shift in the healthcare industry, utilizing advanced technologies to improve health outcomes, enhance patient care, and streamline healthcare delivery.

For Complete Report Details, Request Sample Copy from Here: https://www.transparencymarketresearch.com/digital-health-market.html

Digital Health Market Outline

Digital health encompasses a range of innovations including wearable devices, mobile health applications, artificial intelligence (AI), telemedicine, electronic health records (EHRs), and more. As the global healthcare landscape evolves, the digital health market is poised for significant growth, driven by the increasing demand for personalized care, rise of chronic diseases, and the push for more efficient healthcare systems.

The rapid technological advancements in both – developed and developing nations have led to surge in smartphone usage. With improved internet connectivity and a global shift towards digitalization, digital health services have become increasingly accessible.

Research states that in 2023, healthcare accounted for approximately 10% of the global GDP, a figure that is anticipated to grow annually as health remains a top priority for governments worldwide. Rising awareness and an emphasis on healthcare infrastructure have driven significant increases in spending in this sector.

Moreover, modern lifestyles marked by hectic schedules and increased pollution have contributed to various health challenges, particularly among millennials. The growing prevalence of chronic diseases, exacerbated by urban living, is prompting both – individuals and organizations to adopt proactive health measures. By 2031, global spending on diabetes alone is projected to rise by USD 1 trillion.

Digital health services are addressing these healthcare needs by offering solutions such as virtual consultations, digital prescriptions, and advanced healthcare analytics, thereby making healthcare more accessible and efficient. Mobile applications like Practo and CardMedic enable users to consult doctors virtually via chat or video calls, eliminating the need for in-person clinic visits.

Additionally, apps like MyFitnessPal and Lifesum support users in maintaining proper nutrition and staying fit, helping to promote overall wellness.

Digital Health Market Regional Insights?

- North America generated the largest market value during the projected period. The region is also expected to maintain its dominance during the forecast period.

The digital health market in North America is experiencing significant growth, driven by a combination of technological advancements, changing consumer behaviors, and a supportive regulatory environment. One of the primary factors is the widespread adoption of advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics. These technologies are enhancing the capabilities of digital health solutions, enabling more accurate diagnoses, personalized treatment plans, and predictive analytics. The integration of these technologies into healthcare is not only improving patient outcomes but also driving the demand for digital health tools across the region.

Another key driver is the increasing prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and obesity, which are particularly common in North America. The growing burden of these diseases has led to a greater emphasis on preventive care and chronic disease management. Digital health solutions, including remote monitoring devices, telemedicine, and mobile health applications, are being increasingly adopted to manage these conditions effectively. This shift towards proactive health management is contributing to the expansion of the digital health market.

Recent Key Developments

In August 2024, Pfizer launched a new digital platform, PfizerForAll, aimed at simplifying the process of accessing healthcare for millions of Americans. This platform provides an integrated experience for managing health and wellness, particularly for those affected by common illnesses and seeking adult vaccinations.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=12473<ype=S

Market Segmentation

Product

- Healthcare Information Systems

- EHR/EMR

- Clinical Decision Support System (CDSS)

- mHealth

- Connected Medical Devices

- mHealth Applications

- Fitness App

- Medical Reference

- Wellness

- Medical Condition Management

- Nutrition

- Remote Consultation

- Reminders and Alerts

- Diagnostics

- Others

- Telehealth

- Population Health Management

- Others

Wearable Devices

- Diagnostic and Monitoring Devices

- Digital Therapeutic Devices

- Pain Management Devices

- Rehabilitation Devices

- Respiratory Therapy Devices

- Insulin Pumps

Component

End-user

- B2C

- B2B

- Provides

- Payers

- Employers

- Pharmaceutical Companies

- Others

More Trending Reports by Transparency Market Research –

- Infant Resuscitators Market – The global infant resuscitators market (mercado de reanimadores infantiles) was valued at US$ 253.1 million in 2022. It is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2031, reaching over US$ 401.4 million by the end of 2031.

- Mechanical Thrombectomy Devices Market – The mechanical thrombectomy devices market (Mercado de dispositivos de trombectomía mecánica.) was valued at US$ 1.1 billion in 2022. It is expected to grow at a CAGR of 6.4% from 2023 to 2031, reaching over US$ 1.8 billion by the end of 2031.

- Sanitization Robots Market – The sanitization robots market (mercado de robots de higienización) was valued at US$ 927.3 million in 2022. It is projected to advance at an impressive CAGR of 19.2% from 2023 to 2031, reaching over US$ 4.8 billion by 2031.

- Microcatheter Market – The global microcatheter market (mercado de microcatéteres) was valued at US$ 799.7 million in 2022. It is estimated to grow at a CAGR of 5.3% from 2023 to 2031, reaching approximately US$ 1.3 billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

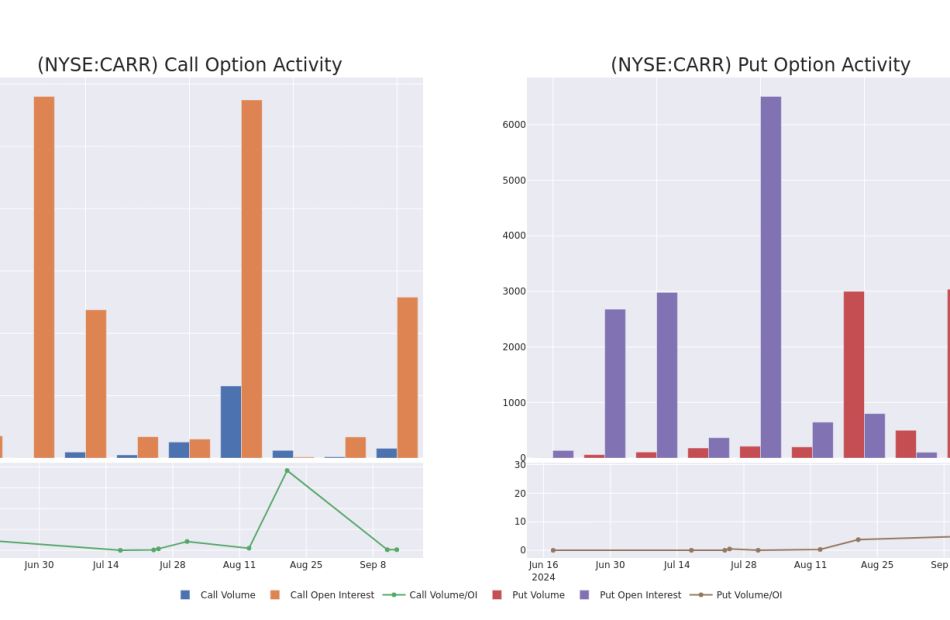

Carrier Global's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bullish stance on Carrier Global CARR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CARR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Carrier Global.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 33%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $415,927, and 5 are calls, for a total amount of $230,990.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $57.5 to $80.0 for Carrier Global over the last 3 months.

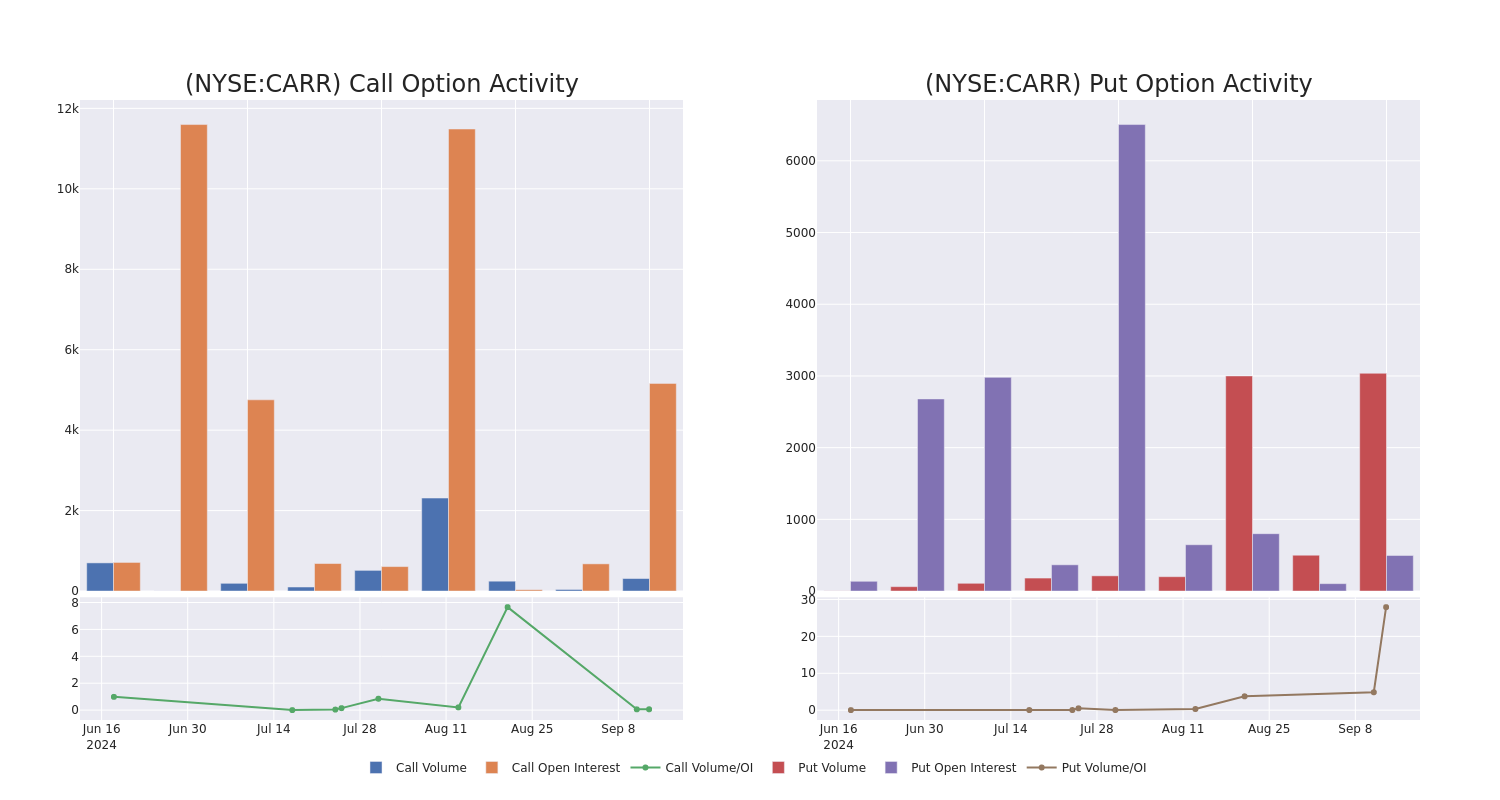

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Carrier Global stands at 707.38, with a total volume reaching 3,348.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carrier Global, situated within the strike price corridor from $57.5 to $80.0, throughout the last 30 days.

Carrier Global 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CARR | PUT | SWEEP | BEARISH | 12/20/24 | $6.7 | $5.2 | $6.4 | $80.00 | $277.5K | 29 | 432 |

| CARR | CALL | TRADE | BULLISH | 01/17/25 | $21.1 | $20.7 | $21.1 | $57.50 | $101.2K | 227 | 51 |

| CARR | PUT | SWEEP | BEARISH | 10/18/24 | $1.8 | $1.7 | $1.7 | $75.00 | $62.8K | 76 | 601 |

| CARR | PUT | TRADE | NEUTRAL | 10/18/24 | $1.05 | $0.95 | $1.0 | $72.50 | $50.0K | 391 | 1.7K |

| CARR | CALL | TRADE | NEUTRAL | 01/17/25 | $6.9 | $6.7 | $6.79 | $75.00 | $33.9K | 695 | 2 |

About Carrier Global

Carrier Global manufactures heating, ventilation, and air conditioning, refrigeration, and fire and security products. The HVAC business serves both residential and commercial markets (HVAC segment sales mix is 60% commercial and 40% residential). Carrier’s refrigeration segment consists of its transportation refrigeration, Sensitech supply chain monitoring, and commercial refrigeration businesses. The firm’s fire and security business manufactures fire detection and suppression, access controls, and intrusion detection products. In April 2023, Carrier announced that it plans to divest its fire and security and commercial refrigeration businesses. The firm also acquired Germany-based Viessmann for approximately $13 billion.

Current Position of Carrier Global

- With a trading volume of 4,870,063, the price of CARR is up by 1.51%, reaching $76.51.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 41 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carrier Global options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.