CEO Of Mission Produce Makes $689K Sale

Stephen J Barnard, CEO at Mission Produce AVO, reported an insider sell on September 12, according to a new SEC filing.

What Happened: Barnard’s decision to sell 52,920 shares of Mission Produce was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $689,018.

In the Friday’s morning session, Mission Produce‘s shares are currently trading at $13.19, experiencing a down of 0.49%.

About Mission Produce

Mission Produce Inc is engaged in the business of producing and distributing avocados, serving retail, wholesale, and food service customers. Also, the company provides additional services like ripening, bagging, custom packing, and logistical management. The company’s operating segments include Marketing and Distribution and International Farming and Blueberries. It generates maximum revenue from the Marketing and Distribution segment. The Marketing and Distribution segment sources fruit mainly from growers and then distributes fruit through a distribution network.

Breaking Down Mission Produce’s Financial Performance

Revenue Growth: Over the 3 months period, Mission Produce showcased positive performance, achieving a revenue growth rate of 23.95% as of 31 July, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 11.42%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Mission Produce exhibits below-average bottom-line performance with a current EPS of 0.17.

Debt Management: Mission Produce’s debt-to-equity ratio is below the industry average. With a ratio of 0.45, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 40.15 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.83 is lower than the industry average, implying a discounted valuation for Mission Produce’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 12.88, Mission Produce demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Navigating the World of Insider Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Mission Produce’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Gainers And Losers From September 13, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

MasTec Stock Rallies 31% in the Past 6 Months: Is MTZ a Buy Right Now?

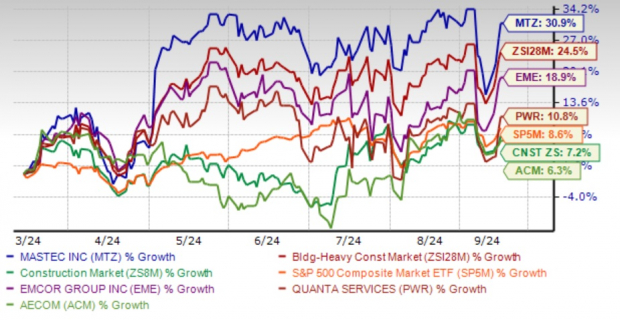

MasTec, Inc.‘s MTZ stock has gained nearly 31% in the past six months, outperforming the Zacks Building Products – Heavy Construction industry’s 24.5% growth, the broader Construction sector’s 7.2% increase and the S&P 500 index’s 8.6% rise.

This infrastructure construction company is banking on increasing demand for power, data capacity and network speed. Also, MTZ’s focus on strategic investments for portfolio diversification positions it well for satiating increased infrastructure demand globally. Moreover, the company is optimistic about its growth opportunities in 2025 and beyond, given the solid pipeline across its businesses and acquisition synergies.

MTZ stock also outpaced its competitors like EMCOR Group, Inc. EME, Quanta Services, Inc. PWR and AECOM ACM, which rallied 18.9%, 10.8% and 6.3%, respectively, in the six-month period.

Image Source: Zacks Investment Research

Technical indicators are supportive of MTZ’s strong performance. As of Thursday, the stock is trading at $110.40, comfortably above its 50-day moving average of $106.62.

Image Source: Zacks Investment Research

What’s Supporting MTZ Stock’s Outperformance?

Strong Outlook for 2024: MasTec’s robust 18-month backlog of $13.3 billion provides strong visibility into 2024. The company raised its full-year guidance, expecting consolidated revenues of $12.4 billion (prior expected $12.55 billion), up from $12 billion year over year. Adjusted EBITDA is projected to be $975 million, an increase from $860.3 million in 2023, with a margin improvement of 7.9% (up from 7.8% expected earlier and 7.2% reported in 2023).

Adjusted earnings per share are forecasted to be $3.03, up from $1.97 expected earlier. The Clean Energy and Infrastructure segment is expected to increase 10% in 2024, reaching $4.4 billion in revenues, with continued growth anticipated beyond 2024.

Solid Backlog Poses Strength for Future: As of June 30, 2024, MasTec’s Clean Energy and Infrastructure backlog increased 10.3% year over year and 4.6% sequentially, with a 1.2x book-to-bill ratio, providing strong visibility into future projects. The Power Delivery segment saw a 12% year-over-year increase and a 20% sequential growth in backlog, highlighted by a major 700-mile high-voltage transmission project starting in 2025. This project, one of the largest in the United States, will generate $300-$500 million annually through 2028, positioning the segment for strong growth.

The Communications segment saw a 1.7% sequential increase and 8.8% year-over-year backlog growth, with revenues expected to rise 4.5% in 2024. Adjusted EBITDA margins remain strong in the high single digits.

The company is optimistic about its growth opportunities. The robust demand for its services suggests the potential for double-digit revenues and earnings growth in 2025 and beyond. Despite short-term pressure in the power delivery segment, the long-term outlook is improving significantly. Meanwhile, the company continues to experience strong demand in both renewables and infrastructure projects. Based on anticipated bookings, it is well-positioned for substantial growth in 2025.

Image Source: MasTec Corporate Presentation

Expanding Communications Pipeline: MasTec has deepened its relationship with AT&T, its largest wireless client, as AT&T expanded the scope and geographic reach of MasTec’s core wireless services, in addition to a maintenance contract secured in the third quarter of 2023. This, combined with AT&T’s plan to replace Nokia equipment with Ericsson over the next five years, is expected to significantly boost MasTec’s wireless business. The impact will start in the second half of 2024, with segment revenues expected to grow by double digits in 2025.

MasTec is positioned for nearly 20% organic revenue growth in the second half of 2024. Additionally, the growing demand for wireline services and the anticipated Broadband Equity, Access, and Deployment (BEAD) program funding provide long-term visibility. New customers, including private equity-backed entrants, are showing strong interest in MasTec’s comprehensive solutions, enhancing its growth prospects in 2025 and beyond.

Strategic Acquisitions & Equity Investments: MasTec remains focused on bolt-on acquisitions, completing four in 2023 and five in 2022. Additionally, it holds equity stakes in several telecommunications entities that provide construction services to the company.

As of March 31, 2024, MasTec had $22 million in total investments, including $18 million for FM Tech. It also holds 49% equity interests in entities within its Communications and Power Delivery segments, with a $3 million investment and a 75% equity stake in Confluence Networks, LLC, an undersea fiber-optic systems developer, totaling $2.5 million.

Other Parameters Reflecting MTZ’s Solid Growth Prospect

Analysts are showing confidence in the stock, as indicated by recent upward revisions in earnings estimates. Over the last 60 days, forecasts for 2024 and 2025 have increased to $3.02 (from $2.94) and $4.35 (from $4.33), respectively.

The company also has a solid earnings surprise history. Its EPS surpassed the consensus estimate in three of the trailing four quarters and missed on one occasion, with the average surprise being 19.4%. Notably, the company currently has a VGM Score of A, which signifies that MTZ has solid growth prospects and the potential to outperform the market in the near term.

These positive trends signify bullish analysts’ sentiments, indicating robust fundamentals and the expectation of continued outperformance in the near term.

Is MasTec a Smart Investment Choice Today?

In the competitive non-residential services sector, MasTec, a leading infrastructure construction company with an $8.75 billion market cap, distinguishes itself. MTZ is strategically situated to capitalize on converging trends, providing multiple paths for near-and-long-term profitable growth. Its diversified portfolio with significant growth potential in all segments makes the stock the best investment option at the moment.

Also, upward revisions in earnings estimates reinforce its Zacks Rank #2 (Buy) rating, making MTZ an attractive addition to investors’ portfolios at present.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Federated Hermes Premier Municipal Income Fund commences tender offer for common shares

PITTSBURGH, Sept. 13, 2024 /PRNewswire/ — Federated Hermes Premier Municipal Income Fund FMN announced today that it commenced a tender offer for up to 32 percent of its outstanding common shares. The fund’s tender offer will expire on Oct. 11, 2024, at 5 p.m. ET. The fund is offering to purchase its outstanding common shares at a price per share equal to 99 percent of its net asset value per share in U.S. dollars as determined as of the end of regular trading on the NYSE on Oct. 11, 2024.

As described in the tender offer materials, if more than 32 percent of the fund’s outstanding common shares are duly tendered (and not withdrawn) prior to the expiration date, the fund will repurchase 32 percent of its outstanding common shares on a pro rata basis (with appropriate adjustment to avoid purchase of fractional common shares) upon the terms and subject to the conditions of the tender offer. Accordingly, there is no assurance that the fund will purchase all of a common shareholder’s tendered common shares. Additional terms and conditions of the tender offer are set forth in the fund’s tender offer materials, which are being distributed to common shareholders. There can be no assurance such terms and conditions will be satisfied. In addition, under certain circumstances, the fund may terminate or abandon the tender offer, as described in the tender offer materials, and there can be no assurance such circumstances will not arise.

The Board of Trustees of the fund, upon recommendation of the fund’s investment advisor, Federated Investment Management Company, approved the tender offer. The tender offer was considered as part of the Board’s ongoing review of available options to enhance value for the fund’s common shareholders, to address the discount at which the fund’s common shares have traded and to provide liquidity.

If, at the fund’s sole discretion, the tender offer is extended beyond Oct. 11, 2024, another press release will be issued to provide notification of the extension and the purchase price for tendered shares will be based on the net asset value per share in U.S. dollars as determined as of the end of regular trading on the NYSE on the last day of such extension. Questions about the tender offer can be directed to Georgeson LLC, the fund’s information agent for its tender offer, at toll free (866) 461-7055.

This announcement is not a recommendation, an offer to purchase, or a solicitation of an offer to sell shares of the fund. Any tender offer will be made only by an offer to purchase, a related letter of transmittal, and other documents, which have been filed with the Securities and Exchange Commission (SEC) as exhibits to the tender offer statement on Schedule TO and are available free of charge on the SEC’s website at www.sec.gov. Common shareholders should read the offer to purchase and tender offer statement on Schedule TO and related exhibits for the fund as the documents contain important information about the fund’s tender offer. The fund will also make available, without charge, the offer to purchase and the letter of transmittal. Investors can view additional portfolio information in the Products section of FederatedHermes.com/us.

Federated Hermes, Inc. FHI is a global leader in active, responsible investment management, with $782.7 billion in assets under management, as of June 30, 2024. We deliver investment solutions that help investors target a broad range of outcomes and provide equity, fixed-income, alternative/private markets, multi-asset and liquidity management strategies to more than 10,000 institutions and intermediaries worldwide. Our clients include corporations, government entities, insurance companies, foundations and endowments, banks and broker/dealers. Headquartered in Pittsburgh, Federated Hermes has more than 2,000 employees in London, New York, Boston and offices worldwide. For more information, visit FederatedHermes.com/us.

###

Certain statements made in this press release, such as those related to the tender offer and it providing shareholder value, reducing discount and providing liquidity, are forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause actual results or occurrences to be materially different from any future results or occurrences expressed or implied by such forward-looking statements. Any forward-looking statement, and any future results or occurrences, are inherently subject to significant business, market, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond the fund’s or its investment adviser’s control. Risks and uncertainties could vary significantly depending on various factors, such as market conditions, investment performance and investor behavior. Other risks and uncertainties include the risk factors discussed in the fund’s annual and semi-annual shareholder reports as filed with the Securities and Exchange Commission. As a result, no assurance can be given as to future results or occurrences, and none of the fund, its investment adviser, or any other person assumes responsibility for the accuracy and completeness, or updating, of such statements in the future.

![]() View original content:https://www.prnewswire.com/news-releases/federated-hermes-premier-municipal-income-fund-commences-tender-offer-for-common-shares-302248108.html

View original content:https://www.prnewswire.com/news-releases/federated-hermes-premier-municipal-income-fund-commences-tender-offer-for-common-shares-302248108.html

SOURCE Federated Hermes, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Delaware bankruptcy court says Yellow owes pensions, stock drops 90%

A Delaware bankruptcy court provided some clarity late Friday regarding $6.5 billion in withdrawal liability claims against Yellow Corp. The total amount the bankrupt less-than-truckload company will actually pay, however, remains to be decided. The mere fact that the estate will have to make good on some portion of the claims sent Yellow’s stock spiraling.

Shares of Yellow (OTC: YELLQ) fell 90% on Friday to 50 cents per share as stockholders realized their bet that the company’s asset value would exceed amounts owed to creditors may not come to fruition.

MFN Partners, which acquired a more than 40% equity stake in Yellow in the day’s leading up to a bankruptcy filing last summer, is the largest holder. However, the Boston-based private equity firm provided the company with bankruptcy financing during its liquidation, the interest and fees from which have helped offset its equity exposure.

The U.S. Treasury holds a 30% stake in Yellow. The equity was issued as part of a collateral package for a $700 million Covid-relief loan it provided to the company in 2020.

Multiemployer pension plans (MEPPs) to which Yellow once contributed claim the carrier’s abrupt shutdown a year ago means it’s now on the hook for its allocable share of unfunded vested benefits. However, Yellow has said that the plans are fully funded now, following a 2021 pension fund bailout package (the American Rescue Plan Act). Yellow contends its exposure is a fraction of the amounts claimed, if anything.

The legislation provided pension insurer Pension Benefit Guaranty Corp. the authority to craft guidelines to make sure the money would only be used to cover plan benefits and costs, and not to allow employers to skirt withdrawal liability.

Pension Benefit Guaranty Corp. created two regulations. The first said special financial assistance awarded to the MEPPs wouldn’t be recognized as a plan asset until the money was actually received. The second mandated the recognition of the funds would be phased in over time even though they were distributed in a lump sum.

The organization said the goal was to keep other contributing employers from using the bailout as a way to exit the plans. Immediate recognition would mean the MEPPs are fully funded, removing any unfunded vested benefits and consequently an employer’s withdrawal liability. That could have created a mass exodus from the plans, PBGC claimed.

Judge Craig Goldblatt’s Friday opinion sided with both the MEPPs and to an extent Yellow.

He said PBGC acted within its authority when putting up the guardrails on the program and that the MEPPs didn’t have to recognize the payments as an asset until received, and that they could be phased in. The implication is that Yellow is now responsible for some form of withdrawal liability to 11 different MEPPs that received government funds.

Central States Pension Fund holds nearly $5 billion in withdrawal liability claims against Yellow. It was awarded $35.8 billion in special financial assistance on Dec. 5, 2022, but didn’t receive the funds until Jan. 12, 2023, after its plan year ended. Yellow filed for bankruptcy on Aug. 6, 2023. The unfunded vested benefit calculation used plan year 2022 to determine the amount owed.

“The regulations implement Congress’s specific directive in the American Rescue Plan Act that special financial assistance be used only to pay plan benefits and costs,” Goldblatt said. “The regulations prevent such funds from instead being used, in effect, to reduce amounts that employers would otherwise be required to pay upon withdrawal from a plan.”

However, Goldblatt also entered a partial summary judgment in favor of Yellow, citing that the 20-year cap (established by the Employee Retirement Income Security Act) should be placed on the company’s total withdrawal exposure. Essentially, the court ruled that Yellow is responsible for 20 times its annual contribution amount per the statute. Past court filings from Yellow have estimated a total liability of roughly $1 billion when using the 20-year cap.

Yellow previously asserted discounting to present value should apply to the 20-year stream of payments. However, Goldblatt said its default on the contributions accelerates the amounts to “presently due and owing,” and no discounting is needed.

He also upheld an agreement inked between Yellow and Teamsters funds in New York and Western Pennsylvania. Yellow reentered those funds in 2013 under a deal in which it would contribute just 25% of the usual rate, but it would repay any withdrawal liabilities assuming a 100% contribution rate if it withdrew.

Goldblatt directed the parties to hash out the actual amounts due. He said the task may be “relatively easy to resolve” now that the court has ruled on the disputed legal questions.

Yellow still faces a much smaller pool of withdrawal liability claims from pensions that didn’t receive special financial assistance.

The 11 MEPPs party to the Friday opinion received more than $40 billion in assistance from the government.

More FreightWaves articles by Todd Maiden

The post Delaware bankruptcy court says Yellow owes pensions, stock drops 90% appeared first on FreightWaves.

Where Will Palantir Be in 10 Years?

Big data software stock Palantir (NYSE: PLTR) is having a moment today. Revenue is accelerating, profitability has flipped to the positive — somewhat of a rarity for a software stock — and the artificial intelligence revolution appears to be reinvigorating demand in its platforms.

Founded in 2003, Palantir began assisting the U.S. military and intelligence agencies during the War on Terror. But the company appears to be making a transition to become more of a commercially focused company now. That’s good news for shareholders, as the commercial market is far bigger.

The commercial business has been kick-started

Last quarter, Palantir showed a marked acceleration in its commercial business. Commercial revenue was up 33% to $307 million, making up 45.3% of revenue. That’s gaining fast on the traditional government segment, which held its own with a fine 23% growth to $371 million. Both segments accelerated relative to last year, enabling the company to more than double its growth rate relative to the year-ago quarter, from 13% growth in Q2 2023 to 27% total growth in Q2 2024.

That’s a rather stunning pickup in the growth rate, which typically gets harder, not easier, as a company gets bigger. But under the hood, things look even rosier in the forward outlook for commercial revenue, especially the dynamic U.S. market.

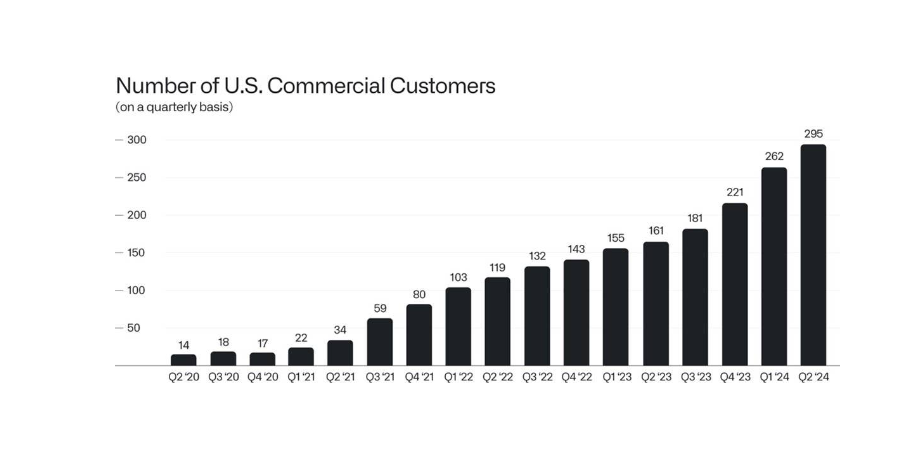

In Q2, U.S. commercial revenue grew 55% but would have been up 70% if not for discounted initial low-revenue deployments with “strategic” customers. The overall U.S. commercial customer count was up 83% to 295 commercial customers, with total customers up 41% year over year. Finally, U.S. commercial remaining deal value (RDV), which totals all the remaining value of outstanding contracts, was up a whopping 103% relative to the prior year.

Of note, the U.S. now accounts for just over 50% of total commercial revenue.

Acceleration coinciding with the unveiling of the AI Palantir (AIP) platform

In his letter to shareholders, CEO Alex Karp included this graphic about customer adoption:

As you can see, there appears to be a big acceleration in customer adoption starting around one year ago — exactly when Palantir launched its AIP platform. AIP is Palantir’s artificial intelligence software that helps companies harness the power of large language models (LLMs) and employ them within real-world contexts for businesses to generate tangible outcomes. CEO Alex Karp said that AIP is disrupting or “deprecating” enterprises’ back-end application development processes, akin to the way cloud computing disrupted traditional enterprise tech infrastructure.

From the looks of the chart above, it appears Karp and Palantir are onto something with AIP. In his letter to shareholders, Karp highlighted the ability of AIP to harness the power of large language models toward actual business outcomes, saying that using LLMs without the full context of the business and AIP won’t work:

Models with trillions of parameters may be able to flawlessly mimic Goethe, but without more, add little value to the enterprise. They have been born into this world without any sense of its contours or logic, or indeed a conception of truth or basic facts, let alone the collective knowledge of and insight into the operations of an organization with half a million employees…They are wild animals, whose power and capabilities must be tamed and harnessed. And we are now seeing what is possible once they are.

AIP is also leading to new vertical products

But the growth doesn’t stop there. Karp and his team also noted Palantir would be coming out with a new software platform called Warp Speed, built on top of AIP. Warp Speed will be a back-end platform specifically designed for modern industrial manufacturing businesses. “The American manufacturing operating system” is what Karp called it, built from Palantir’s past experience in the military and heavy industrial industries.

From the call with analysts, it appears Warp Speed will tie all the elements of manufacturing together, from the enterprise resource planning (ERP) system, to the Manufacturing Execution System (MES), to the Production Lifecycle Management system (PLM), to the Programmable Logic Controller (PLCs) for factory automation, to the workers on the factory floor.

With Warp Speed, Palantir is adapting AI for specific vertical industries in a way that has the potential to disrupt legacy enterprise software businesses — and those markets are quite large.

Peering into the decade ahead

The defense segment is still an important one for Palantir, and somewhat defines its corporate brand. However, it’s highly likely that the commercial segment will soon become its largest. Ten years out, it stands to dwarf the defense business, which is somewhat limited in its potential size.

Palantir made about $2.5 billion in revenue over the past 12 months, but is also profitable on a generally accepted accounting principles (GAAP) basis. Still, at 33 times sales, the stock is also extremely expensive.

But, given the much larger private sector relative to the U.S. and allied defense industries, Palantir’s accelerated commercial traction appears to have brightened its long-term growth prospects. If the commercial segment keeps growing as it is, Palantir could make a sizable dent in several enterprise software segments. For instance, in the context of Warp Speed, the ERP software market alone was $71 billion in 2023 but is projected to grow at a 14.4% rate through 2032, reaching $238 billion by that time, according to Fortune Business Insights.

Therefore, should Palantir stay on the cutting edge of AI-powered enterprise software with AIP, Warp Speed, and other future potential offerings, it may very well have a lot of runway in front of it, potentially justifying its current valuation.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Be in 10 Years? was originally published by The Motley Fool

Analyzing MetLife Stock: Is Buy Strategy the Right Move?

MetLife, Inc. MET benefits on the back of a well-performing Group Benefits business, acquisitions and partnerships, cost-cutting efforts and strong cash balance.

Zacks Rank & Price Performance

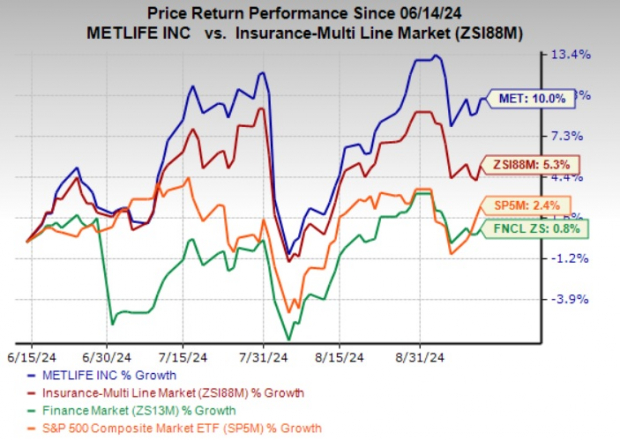

MetLife carries a Zacks Rank #2 (Buy) at present.

The stock has gained 10% in the past three months compared with the industry’s growth of 5.3%. The Zacks Finance sector and the S&P 500 composite index have returned 0.8% and 2.4%, respectively, in the said time frame.

Image Source: Zacks Investment Research

Favorable Style Score

MetLife carries an impressive Value Score of A. Value Score helps find stocks that are undervalued. Back-tested results show that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best opportunities in the value investing space.

Robust Growth Prospects

The Zacks Consensus Estimate for MetLife’s 2024 earnings is pegged at $8.67 per share, which indicates an improvement of 18.3% from the 2023 reported figure. The consensus mark for revenues is $73.2 billion, implying a rise of 2% from the 2023 figure. MET’s earnings estimates witnessed seven upward revisions over the past 60 days against no downward movement.

The consensus mark for 2025 earnings is pegged at $9.83 per share, suggesting an improvement of 13.4% from the 2024 estimate. The same for revenues is $76.5 billion, hinting at a 4.6% increase from the 2024 estimate.

Valuation

Price-to-book (P/B) is one of the multiples used for valuing insurance stocks. Compared with the multiline industry’s trailing 12-month P/B ratio of 2.57, MetLife has a reading of 1.92. It is quite evident that the stock is currently undervalued.

Image Source: Zacks Investment Research

Solid Return on Equity

Return on equity in the trailing 12 months is currently 21.4%, which is higher than the industry’s average of 16.2%. This substantiates the company’s efficiency in utilizing shareholders’ funds.

Business Tailwinds

A key revenue contributor is MetLife’s steady premiums, which have been recovering from pandemic-driven declines. Premiums are witnessing a steady increase in the Group Benefits business, wherein it rose 4% year over year in the first half of 2024. Growth has also been robust in its EMEA and Latin America segments, further contributing to the company’s revenue stream.

MetLife’s focus on streamlining its business, coupled with strategic acquisitions and partnerships, is expected to drive long-term growth. The company has expanded its presence in key areas like vision care and pet insurance through acquisitions, such as Versant Health and PetFirst. It has also strengthened its benefits offerings through partnerships with firms like Aura and Nayya.

A strategic push into private credit investments, marked by the acquisition of Raven Capital, and a collaboration with Fidelity Investments on a fixed immediate income annuity further diversify its business portfolio. Additionally, MetLife continues to reduce volatility by divesting capital-intensive units and intensifying focus on high-growth areas.

MetLife’s cost-saving measures have resulted in notable operational improvements. Between 2015 and 2020, the company saw an improvement of 230 basis points in its direct expense ratio. This efficiency trend has continued, with the direct expense ratio remaining below the guided 12.3% in the first half of 2024.

MetLife also benefits from a strong liquidity position, with short-term debt of $390 million as of June 30, 2024, significantly overshadowed by its $20.8 billion in cash and cash equivalents. This financial strength underpins shareholder returns through repurchases and dividend payments. In April 2024, management approved a 4.8% dividend increase.

Other Stocks to Consider

Some other top-ranked stocks in the insurance space include CNO Financial Group, Inc. CNO, MGIC Investment Corporation MTG and Palomar Holdings, Inc. PLMR, each sporting a Zacks Rank #1 at present.

The bottom line of CNO Financial outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 21.21%. The Zacks Consensus Estimate for CNO’s 2024 earnings suggests 11% year-over-year growth. The consensus mark for CNO Financial’s 2024 earnings has moved north by 3% in the past 30 days.

MGIC Investment’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 15.59%. The Zacks Consensus Estimate for MTG’s 2024 earnings indicates 9.1% year-over-year growth, while the same for revenues implies an improvement of 4.7%. MGIC Investment’s consensus mark for 2024 earnings has moved north by 2.2% in the past 30 days.

The bottom line of Palomar outpaced estimates in each of the trailing four quarters, the average surprise being 17.10%. The Zacks Consensus Estimate for PLMR’s 2024 earnings suggests 30.9% year-over-year growth, while the same for revenues implies an improvement of 41.6%. The consensus mark for Palomar’s 2024 earnings has moved north by 1.3% in the past 30 days.

Shares of CNO Financial, MGIC Investment and Palomar have gained 24.2%, 22.4% and 18.3%, respectively, in the past three months.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gran Tierra Energy Inc. Announces Pricing of an Additional $150 Million Aggregate Principal Amount of its 9.500% Senior Secured Amortizing Notes due 2029

CALGARY, Alberta, Sept. 13, 2024 (GLOBE NEWSWIRE) — Gran Tierra Energy Inc. (“Gran Tierra” or the “Company“) GTEGTEGTE today announced that it has priced its offering of an additional $150 million aggregate principal amount of its previously issued 9.500% Senior Secured Amortizing Notes due 2029 (the “Notes“) in a private placement to persons reasonably believed to be qualified institutional buyers in the United States pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act“), to non-U.S. persons in transactions outside the United States pursuant to Regulation S under the Securities Act, and pursuant to certain prospectus exemptions in Canada.

Gran Tierra previously had outstanding US$587,590,000 aggregate principal amount of 9.500% Senior Secured Amortizing Notes due 2029 (the “Original Notes“). The Notes will have the same terms and provisions as the Original Notes, except for the issue date and the issue price, and will form the same series as the Original Notes, including with respect to interest payments. Gran Tierra expects to close the offering on September 18, 2024. Gran Tierra expects to receive net proceeds, after initial purchasers’ discounts and commissions and estimated fees and offering expenses, of approximately US$136.0 million. Upon settlement, the Notes are expected to trade under the same CUSIP number as the Original Notes, except that the Notes sold pursuant to Regulation S under the Securities Act will have a different CUSIP number than the Original Notes until 40 days after the issue date of the Notes.

The Notes will be guaranteed by certain subsidiaries of Gran Tierra. Gran Tierra intends to use the net proceeds from the offering to finance the cash portion of the consideration payable for the shares under the terms of the proposed acquisition of the entire issued and to be issued share capital of i3 Energy plc, a public limited company organized under the laws of England and Wales, and any remaining net proceeds from the offering for general corporate purposes, which may include additional capital to appraise and develop exploration discoveries, repayment of other indebtedness, working capital and/or acquisitions.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the Notes, nor shall there be any sale of the Notes in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. The Notes will not be registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities laws.

The offering is being made, and the Notes are being offered and issued, only (a) in the United States to investors who are reasonably believed to be “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) in reliance upon the exemption from the registration requirements of the Securities Act, (b) outside the United States to investors who are persons other than “U.S. persons” (as defined in Rule 902 under the Securities Act) in reliance upon Regulation S under the Securities Act, and (c) pursuant to certain prospectus exemptions in Canada.

This press release is being issued pursuant to and in accordance with Rule 135c under the Securities Act.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 or “forward-looking information” within the meaning of applicable Canadian securities laws. All statements other than statements of historical facts included in this press release, and those statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “would,” “could,” “should,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “target,” “goal,” “guidance,” “budget,” “plan,” “objective,” “potential,” “seek,” or similar expressions or variations on these expressions are forward-looking statements. Gran Tierra can give no assurances that the assumptions upon which the forward-looking statements are based will prove to be correct or that, even if correct, intervening circumstances will not occur to cause actual results to be different than expected. Because forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause Gran Tierra’s actual results to differ materially from the forward-looking statements, including, but not limited to, statements related to Gran Tierra’s expectations regarding the completion, timing and size of the proposed offering and use of proceeds; and those factors set out in Part I, Item 1A, “Risk Factors” in Gran Tierra’s Annual Report on Form 10-K for the year ended December 31, 2023, and in Gran Tierra’s other filings with the U.S. Securities and Exchange Commission. Although Gran Tierra believes the expectations reflected in the forward-looking statements are reasonable, Gran Tierra cannot guarantee future results, level of activity, performance or achievements. Moreover, neither Gran Tierra nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. Investors should not rely upon forward-looking statements as predictions of future events. The information included herein is given as of the date of this press release and, except as otherwise required by the securities laws, Gran Tierra disclaims any obligation or undertaking to publicly release any updates or revisions to, or to withdraw, any forward-looking statement contained in this press release to reflect any change in Gran Tierra’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

ABOUT GRAN TIERRA ENERGY INC.

Gran Tierra Energy Inc. together with its subsidiaries is an independent international energy company currently focused on international oil and natural gas exploration and production with assets currently in Colombia and Ecuador. The Company is currently developing its existing portfolio of assets in Colombia and Ecuador and will continue to pursue additional growth opportunities that would further strengthen the Company’s portfolio. The Company’s common stock trades on the NYSE American, the Toronto Stock Exchange and the London Stock Exchange under the ticker symbol GTE.

For investor and media inquiries please contact:

Gary Guidry, President & Chief Executive Officer

Ryan Ellson, Executive Vice President & Chief Financial Officer

+1-403-265-3221

info@grantierra.com

SOURCE Gran Tierra Energy Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer: 'Hold On' To Builders FirstSource, 'Here's The Problem' With Viking Therapeutics

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is “great.“

On Aug. 1, Vertex Pharmaceuticals reported second-quarter revenues of $2.65 billion, almost in line with the consensus of estimate of $2.66 billion. Vertex raised its 2024 product revenue guidance from $10.55 billion-$10.75 billion to $10.65 billion-$10.85 billion.

Trending Now:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

When asked about Serve Robotics Inc. (NASDAQ:SERV) , he said, “We’re not recommending companies that lose a ton of money because it’s just not the right time.”

On Aug. 28, Serve Robotics announced closing of $20 million private placement & warrant exercise.

Read More:

-

Fractional real estate is the next big opportunity for building passive income — get started for just $100.

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

Builders FirstSource, Inc. (NYSE:BLDR) can “go higher,” Cramer said, “This is precisely the kind of stock you should be buying at this stage in the cycle. Hold on.”

On Aug. 6, Builders FirstSource reported second-quarter adjusted earnings per share of $3.50, beating the street view of $3.02. Quarterly sales of $4.456 billion missed the street view of $4.483 billion.

“Here’s the problem: it costs so much money to build the factories, they’re going to have to get a takeover to be able to do that,” Cramer said about Viking Therapeutics, Inc. (NASDAQ:VXTX) On July 24, Viking Therapeutics reported better-than-expected second-quarter EPS results.

A 9% Return In Just 3 Months

EquityMultiple’s ‘Alpine Note — Basecamp Series’ is turning heads and opening wallets. This short-term note investment offers investors a 9% rate of return (APY) with just a 3 month term and $5K minimum. The Basecamp rate is at a significant spread to t-bills. This healthy rate of return won’t last long. With the Fed poised to cut interest rates in the near future, now could be the time to lock in a favorable rate of return with a flexible, relatively liquid investment option.

What’s more, Alpine Note — Basecamp can be rolled into another Alpine Note for compounding returns, or into another of EquityMultiple’s rigorously vetted real estate investments, which also carry a minimum investment of just $5K. Basecamp is exclusively open to new investors on the EquityMultiple platform.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Jim Cramer: ‘Hold On’ To Builders FirstSource, ‘Here’s The Problem’ With Viking Therapeutics originally appeared on Benzinga.com

Rate-Cut Prospects Fuel Investor Risk Appetite, Gold Hits Record Highs, Harris Outperforms Trump: This Week In The Markets

The volatility that dominated markets in the early part of the month sharply reversed in the past week, driven by growing expectations of interest rate cuts that have bolstered investor risk appetite.

The latest batch of inflation statistics for August have given the green light for the Federal Reserve to proceed with an interest rate cut, which is highly likely to occur on Sept. 18.

The remaining question concerns the size of the cut — whether it will be 25 basis points or 50 basis points — though market consensus and recent comments from Fed officials suggest the more conservative 25 basis points is the likely scenario.

Risk assets experienced a significant rebound, with the S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, recovering losses from the prior week and notching five straight days of gains. A similar picture emerged for the Nasdaq 100, which marked the best week since October 2023.

Treasury yields fell substantially and the dollar weakened, driving the price of gold to fresh all-time highs.

Additionally, the week saw the first televised debate between Vice President Kamala Harris and former President Donald Trump, with polls indicating Harris outperformed, further widening her lead.

Gold mining stocks, as monitored through the VanEck Gold Miners ETF GDX, rallied this week, marking on Thursday their best one-day performance in six months as gold prices hit new record highs. A macro strategist highlighted striking similarities between today’s economic landscape and the turbulent 1970s.

Solar stocks, tracked by the Invesco Solar ETF TAN, surged as Vice President Harris emerged as the clear winner in her debate with Trump, bolstering confidence in clean energy policies. Several leading renewable energy companies saw sharp gains this week.

In an exclusive interview with Benzinga, a Lazard small-cap expert forecasted a 30-50% rally in the Russell 2000, fueled by declining interest rates and strengthening economic conditions. With the Federal Reserve poised to begin a rate-cutting cycle, small-cap stocks are anticipated to outperform, closing the performance gap with larger-cap counterparts.

U.S. autonomous vehicle sales are projected to reach 230,000 units by 2034, following renewed progress at Alphabet Inc.’s GOOG GOOGL Waymo and General Motors Co.’s GM Cruise. Advancements in technology and regulatory approvals are expected to drive the industry forward, boosting consumer adoption and market penetration.

Don’t miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile.

Get exclusive access to CEO presentations, 1:1 meetings with investors, and valuable insights from top financial experts. Whether you’re a trader, entrepreneur, or investor, this event offers unparalleled opportunities to grow your portfolio and network with industry leaders.

Secure your spot and get your tickets today!

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.