3 Ultra-Safe Dividend Stocks for Retirees to Buy and Hold

Dividend growth stocks can make for ideal investment options whether you’re a retiree or a long-term investor. The types of businesses that increase their payouts on a regular basis normally have a lot of consistency in their earnings from one year to the next, making them safe investments. That doesn’t mean that all dividend growth stocks are safe options, but many of them are.

Three of the safer ones you can put in your portfolio today are Abbott Laboratories (NYSE: ABT), Procter & Gamble (NYSE: PG), and Enbridge (NYSE: ENB). Here’s why these can be ideal investment options for investors who just want a stable dividend to collect and not worry about.

Abbott Laboratories

Healthcare giant Abbott Laboratories has a strong track record of paying and growing its dividend. It belongs to the exclusive club of Dividend Kings, which are stocks that have increased their payouts for at least 50 consecutive years. But that’s not why Abbott is a good option for income investors. Instead, it’s the stability that the business has through its diverse operations, and the promising growth opportunities that lay ahead.

During the first half of the year, the company generated positive year-over-year growth in all but one of its segments: diagnostics, which was down due to a decline in COVID-19 testing. And the company’s results remain strong enough to support its dividend, with Abbott’s payout ratio coming in at around 67%. That leaves room for the stock to continue raising its dividend, which today yields 1.9% — slightly better than the S&P 500‘s average of 1.3%.

One area where I see a lot of room for growth for Abbott is in diabetes care. The company’s continuous glucose monitoring devices have helped that area of its segment grow organically by more than 19% through the first two quarters of 2024. Diabetes is a huge issue for the healthcare industry, and Abbott’s devices can be an effective way for diabetics to stay on top of their glucose levels.

Abbott’s stock averages a beta value of 0.7, which suggests that it’s a stable investment when compared to the overall markets, making it an ideal option for risk-averse investors.

Procter & Gamble

Retirees can collect a slightly higher yield with Procter & Gamble stock, which pays 2.3%. Like Abbott, this too is a dividend growth stock with an impressive streak. Procter & Gamble has one of the longest streaks of dividend growth you can find — it has raised its dividend for 68 consecutive years.

What makes Procter & Gamble a solid option for income investors is the broad range of consumer brands in its portfolio. Whether it’s Head & Shoulders, Crest, or Pampers, the business is full of recognizable and iconic brands that can provide the company with relatively stable results from one year to the next.

This is the type of good, boring income stock you’ll want to own. In each of its last three fiscal years (ended in June), P&G has reported at least $80 billion in sales and more than $14 billion in profit. Its payout ratio is 64%, making the dividend very manageable for the company to maintain while also making it probable that the payments will continue rising in the future.

Enbridge

You can be a little greedy and go for a high-yielding stock such as Enbridge, knowing that you aren’t taking on much risk with this investment. While investors may scoff at the idea of owning an oil and gas stock given a long-run trend toward greener energy, that could still take decades to happen — and even then, oil and gas is still likely to play a vital role in the world’s energy needs.

Retirees are also going to be more focused on the near term. And for at least the foreseeable future, Enbridge is still a rock-solid dividend play. The Canadian-based pipeline company has increased its dividend payments for 29 straight years, and another hike could be coming up later this year.

This is another predictable investment to own. Last year, the company met its guidance for an incredible 18th consecutive year. That type of predictability is hard to come by in oil and gas, which is why the stock’s 6.7% yield is not as risky as it may appear to be. With a lot of fixed assets, Enbridge’s depreciation costs will always run high, which is why its payout ratio can often be at more than 100%.

But the company relies on distributable cash flow (DCF) to evaluate the safety of its dividend, which is an adjusted profit calculation that excludes maintenance capital spending, interest expense, tax, and other items. Last year, the company’s DCF grew to 11.3 billion Canadian dollars, up from CA$11 billion a year earlier.

Through the first half of the year, the company’s DCF per share has totaled CA$2.97, which is already nearly as much as the rate of its annual dividend payments — CA$3.66.

Enbridge is a solid, underrated dividend growth stock for retirees to buy and hold. While there may be a bit more volatility because it is an oil and gas stock, the underlying business is solid, and so too is Enbridge’s payout.

Should you invest $1,000 in Abbott Laboratories right now?

Before you buy stock in Abbott Laboratories, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Abbott Laboratories wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories and Enbridge. The Motley Fool has a disclosure policy.

3 Ultra-Safe Dividend Stocks for Retirees to Buy and Hold was originally published by The Motley Fool

Adobe Reports Q3 Earnings: What Key Metrics Have to Say

Adobe Systems ADBE reported $5.41 billion in revenue for the quarter ended August 2024, representing a year-over-year increase of 10.6%. EPS of $4.65 for the same period compares to $4.09 a year ago.

The reported revenue represents a surprise of +0.79% over the Zacks Consensus Estimate of $5.37 billion. With the consensus EPS estimate being $4.53, the EPS surprise was +2.65%.

While investors scrutinize revenue and earnings changes year-over-year and how they compare with Wall Street expectations to determine their next move, some key metrics always offer a more accurate picture of a company’s financial health.

As these metrics influence top- and bottom-line performance, comparing them to the year-ago numbers and what analysts estimated helps investors project a stock’s price performance more accurately.

Here is how Adobe performed in the just reported quarter in terms of the metrics most widely monitored and projected by Wall Street analysts:

- Business Unit – Digital Media – Creative ARR (Annualized Recurring): $13.45 billion versus the five-analyst average estimate of $13.46 billion.

- Business Unit – Digital Media – Total Digital Media ARR (Annual): $16.76 billion compared to the $16.71 billion average estimate based on four analysts.

- Business Unit – Digital Media – Document Services ARR (Annual): $3.31 billion versus the four-analyst average estimate of $3.25 billion.

- Revenue- Digital Media: $4 billion compared to the $3.97 billion average estimate based on seven analysts. The reported number represents a change of +11.2% year over year.

- Revenue- Publishing and Advertising: $59 million compared to the $60.35 million average estimate based on seven analysts. The reported number represents a change of -11.9% year over year.

- Revenue- Digital Experience: $1.35 billion compared to the $1.34 billion average estimate based on seven analysts. The reported number represents a change of +10.2% year over year.

- Revenue- Digital Media- Creative Cloud: $3.19 billion versus $3.18 billion estimated by five analysts on average. Compared to the year-ago quarter, this number represents a +9.6% change.

- Revenue- Digital Media- Document Cloud: $807 million versus the five-analyst average estimate of $790.70 million. The reported number represents a year-over-year change of +17.8%.

- Revenue- Services and other: $146 million versus $163.69 million estimated by four analysts on average. Compared to the year-ago quarter, this number represents a -10.4% change.

- Revenue- Products: $82 million compared to the $111.98 million average estimate based on three analysts. The reported number represents a change of -14.6% year over year.

- Digital Experience Subscription Revenue: $1.23 billion compared to the $1.21 billion average estimate based on three analysts. The reported number represents a change of +12.3% year over year.

- Net Revenue- Subscription: $5.18 billion versus $5.09 billion estimated by three analysts on average. Compared to the year-ago quarter, this number represents a +11.9% change.

Shares of Adobe have returned +7.5% over the past month versus the Zacks S&P 500 composite’s +4% change. The stock currently has a Zacks Rank #2 (Buy), indicating that it could outperform the broader market in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Ultra-High-Yield Dividend Stocks to Buy Now

Well-chosen dividend stocks can help you build bountiful streams of passive income that you can count on to grow steadily year after year. To aid your search for these wealth-builders, here are two high-yield stocks with proven histories of rewarding their investors with ample and dependable dividends.

No. 1 high-yield stock to buy: Verizon Communications

Verizon Communications (NYSE: VZ) excels at turning connectivity services into cash for its shareholders. The telecom leader is currently offering a great way to boost your passive income with its hefty dividend yield of 6.2%.

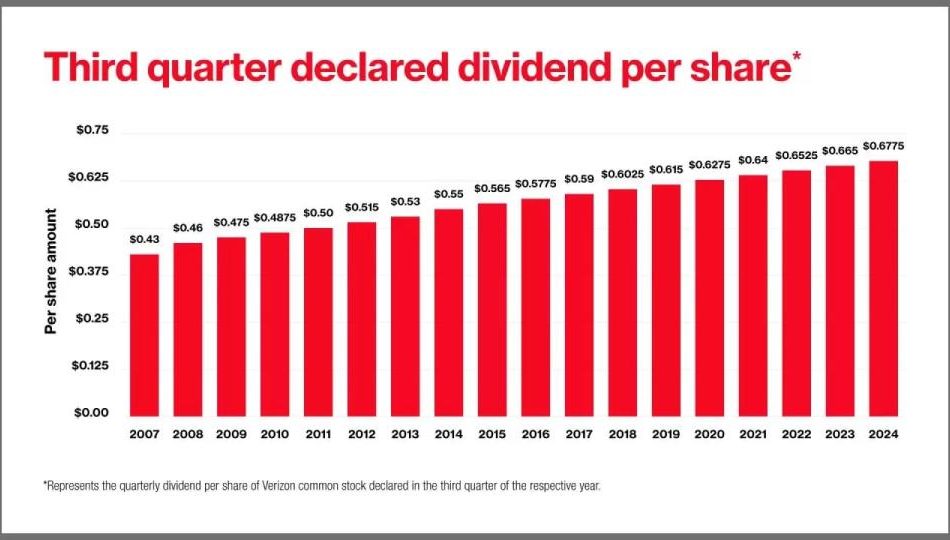

Verizon delivers fast 5G wireless services to over 114 million retail customers and 30 million business clients. With retention rates that are typically over 98%, these accounts produce reliable profits, which Verizon passes on to its shareholders via rising cash payments. The telecom giant generated nearly $14 billion of free cash flow over the trailing 12 months. That allowed Verizon to raise its dividend for the 18th straight year earlier this month.

The dividend stalwart also recently struck a $20 billion deal to acquire fiber internet provider Frontier Communications, which should help it extend this impressive dividend-growth streak. Management expects the deal to bolster Verizon’s ability to bundle home internet, TV, and phone services, which can reduce customer churn by as much as 50% compared to those who subscribe to its wireless service alone.

Frontier would add over 2 million fiber subscribers to Verizon’s roughly 7.4 million Fios internet connections. The combined company will have a potential fiber customer base of more than 25 million, based on the number of households connected to Verizon’s and Frontier’s fiber networks.

Verizon’s acquisition of Frontier is anticipated to close in about 18 months, subject to shareholder and regulatory approval. Verizon expects the deal to boost its adjusted earnings soon after closing.

No. 2 high-yield stock to buy: Realty Income

Real estate can be another excellent source of passive income. Realty Income (NYSE: O) offers investors an easy and low-risk way to cash in on this lucrative asset class.

Realty Income is structured as a real estate investment trust (REIT). That means it’s built to buy properties and pass the income it earns on to shareholders. With 650 consecutive months of cash payments, including 107 straight quarterly increases, Realty Income’s dividend is as reliable as they come.

The real estate giant owns over 15,000 commercial properties across the U.S. and Europe. It leases these properties to over 1,500 different tenants in 90 industries. This broad diversification is a key part of Realty Income’s prudent risk-management strategy.

A focus on businesses that tend to hold up well during challenging economic times also helps to reduce the risks for investors. Convenience stores, automotive repair shops, and grocery chains are well represented in Realty Income’s portfolio. It’s a smart strategy that’s helped the REIT sustain impressive occupancy rates of 96% or higher since 1992.

Today, Realty Income’s dividend yield stands at a solid 5%. With the Federal Reserve set to begin to reduce interest rates as early as this month, the REIT’s financing costs should decline in the coming year. That ought to make its real estate investments more profitable — and lead to higher dividend payments for investors who buy Realty Income’s shares today.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Realty Income. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks to Buy Now was originally published by The Motley Fool

Here's Why Investors Should Retain American Airlines Stock Now

American Airlines’ AAL efforts to expand and enhance its global network are commendable. The company’s proactive initiative to create 500 new aviation jobs is serving well for the company and the economy. However, AAL has been grappling with soft market conditions and increased operating costs.

Factors Favoring AAL

American Airlines’ initiative to create nearly 500 new aviation maintenance jobs and expand heavy check maintenance work at its bases in Charlotte, NC; Pittsburgh, PA, and Tulsa, OK, represents a significant boost to both the company and the local economies. The addition of more than 385 licensed aviation maintenance technician positions highlights the airline’s commitment to enhancing its maintenance capabilities and infrastructure. This expansion will not only strengthen AAL’s maintenance operations but also contribute to job growth in these regions, offering high-paying, skilled positions.

The company’s efforts to expand its network are encouraging. In August 2024, American Airlines announced five new routes to Europe, including nonstop flights to Edinburgh, Scotland, for the first time since 2019. This expansion underscores AAL’s commitment to growing its extensive global network, providing customers with more diverse travel options and unique connections.

American Airlines: Risks to Watch

The northward movement in operating expenses is hurting AAL’s bottom line, challenging its financial stability. The surge in operating expenses was caused by a rise in fuel and labor costs. In the second quarter of 2024, total operating expenses rose by 9% compared to the second-quarter 2023 actuals.

Labor costs, accounting for 30.5% of the total operating expenses, rose 8.8% year over year, whereas fuel expenses jumped by 12.4% year over year.

Soft economic conditions continue to adversely impact AAL’s prospects. The company’s high level of debt limits its financial flexibility.

Shares of American Airlines have declined 18% year over year against its industry’s 25.4% growth.

Image Source: Zacks Investment Research

Zacks Rank

AAL currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include C.H. Robinson Worldwide CHRW and Westinghouse Air Brake Technologies WAB.

C.H. Robinson Worldwide currently sports a Zacks Rank #1 (Strong Buy). CHRW has an expected earnings growth rate of 25.2% for the current year.

The company has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 7.3%. Shares of CHRW have risen 10.6% in the past year.

WAB carries a Zacks Rank #2 (Buy) at present and has an expected earnings growth rate of 26% for the current year.

The company has a discouraging track record with respect to the earnings surprise, having surpassed the Zacks Consensus Estimate in three of the trailing four quarters. The average beat is 11.8%. Shares of WAB have climbed 55.3% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Artificial Intelligence (AI) Stocks to Buy Before They Soar 98% and 1,040%, According to Certain Wall Street Analysts (Hint: Not Nvidia)

Semiconductor company Nvidia has led the S&P 500 higher this year amid mounting interest in artificial intelligence (AI). But we are still in the early stages of the AI boom, and certain Wall Street analysts are pounding the table on alternative investments. For example:

-

Gil Luria at DA Davidson expects SoundHound AI (NASDAQ: SOUN) to reach $9.50 per share in the next 12 months. That forecast implies 98% upside from its current share price of $4.80.

-

Ark Invest analysts led by Cathie Wood expect Tesla (NASDAQ: TSLA) to reach $2,600 per share by 2029. That forecast implies 1,040% upside from its current share price of $228.

Investors should never put too much confidence in price targets, but SoundHound AI and Tesla are worth further consideration. Here are the relevant details.

SoundHound AI: 98% implied upside

SoundHound specializes in conversational intelligence solutions, or voice artificial intelligence (AI) products, that can be incorporated into smart devices. Its technology has applications across various industries, from automotive and consumer electronics to restaurants and customer service. And the company has won several high-profile customers, such as Stellantis, Toast, and Qualcomm.

SoundHound is a small business competing against behemoths like Amazon and Microsoft. But management believes it has better technology and a more flexible platform than its competitors, which makes it easier for brands to build differentiated and customized voice AI solutions.

SoundHound is growing very quickly, but the company has yet to turn a profit. Revenue surged 54% to $13.5 million in the second quarter. Meanwhile, non-GAAP (generally accepted accounting principles) net income was negative $14.8 million, a slight improvement from negative $16 million in the prior year.

Earlier this year, SoundHound completed its $25 million acquisition of SYNQ3 Restaurant Solutions, a company that specializes in conversational intelligence for food and beverage brands. That deal established SoundHound as the largest provider of voice AI technology for restaurants. More recently, SoundHound completed its $80 million acquisition of Amelia, a recognized leader in enterprise conversational AI platforms, extending its purview in customer service.

Going forward, Wall Street expects revenue to increase at 96% annually through 2025, meaning analysts anticipate an acceleration in the coming quarters. That consensus estimate makes the current valuation of 24.2 time sales look tolerable. Patient investors comfortable with risk and volatility can consider buying a small position today, but not with the expectation of 98% upside in the next year.

Tesla: 1,040% implied upside

Tesla is the global leader in battery electric vehicles (BEVs), but its market share is declining across the United States and Europe. The company accounted for 17.6% of global BEV sales year to date through July, down 3.3 percentage points from the prior year.

But investors shouldn’t fret too much. Losing share is inevitable as the landscape becomes more competitive, and the challenging economic environment is currently pushing consumers toward cheaper options.

More importantly, Tesla believes full self-driving (FSD) technology will be its primary source of profitability in the future. The company already monetizes FSD through subscription sales, but CEO Elon Musk has discussed licensing the technology to other automakers. Additionally, Tesla plans to launch an autonomous ride-hailing business at some point. The company has not set a specific date, but information may be forthcoming when Tesla unveils its robotaxi on Oct. 10.

Tesla reported disappointing financial results in the second quarter. Revenue increased 2% to $25.5 billion, and GAAP net income declined 45% to $1.5 billion. The company has now missed earnings estimates in four consecutive quarters. Factors contributing to that trend include price cuts meant to stimulate demand and costs associated with the Cybertruck production ramp-up.

Looking ahead, Tesla is one of the companies best positioned to monetize autonomous driving technology. Its large, growing fleet of FSD-enabled vehicles supports data collection on a scale no other automaker can match, and quality data is essential for training machine learning models. Indeed, Ark Invest estimates Tesla is accumulating autonomous driving data 110 times faster than Alphabet‘s Waymo.

Wall Street expects Tesla’s adjusted earnings to increase at 21% annually through 2025. That estimate makes the current valuation of 98 times adjusted earnings look expensive. At that price, investors who buy shares today should do so in a very conservative fashion. That means start small and build the position over time.

Ark Invest’s price target implies a market capitalization above $9 trillion by 2029. I think Tesla may hit that milestone eventually, depending on how well it executes on its robotaxi vision, but I am skeptical about the timeline. The stock would need to return about 57% annually for Tesla to hit $9 trillion by 2029. So, I would advise investors to set their expectations much lower.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, Qualcomm, Tesla, and Toast. The Motley Fool recommends Stellantis and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks to Buy Before They Soar 98% and 1,040%, According to Certain Wall Street Analysts (Hint: Not Nvidia) was originally published by The Motley Fool

AMREP Reports First Quarter Fiscal 2025 Results

HAVERTOWN, Pa., Sept. 13, 2024 (GLOBE NEWSWIRE) — AMREP Corporation AXR today reported net income of $4,064,000, or $0.76 per diluted share, for its 2025 fiscal first quarter ended July 31, 2024 compared to net income of $1,346,000, or $0.25 per diluted share, for the same period of the prior year. Revenues were $19,091,000 for the first quarter of 2025 and $10,289,000 for the first quarter of 2024.

More information about the Company’s financial performance may be found in AMREP Corporation’s financial statements on Form 10-Q which have today been filed with the Securities and Exchange Commission and will be available on AMREP’s website (www.amrepcorp.com/sec-filings/). As a result of many factors, including the nature and timing of specific transactions and the type and location of land or homes being sold, revenues, average selling prices and related gross margins from land sales or home sales can vary significantly from period to period and prior results are not necessarily a good indication of what may occur in future periods.

AMREP Corporation, through its subsidiaries, is a major holder of land, leading developer of real estate and award-winning homebuilder in New Mexico.

| FINANCIAL HIGHLIGHTS | |||||||

| Three Months Ended July 31, | |||||||

| 2024 | 2023 | ||||||

| Revenues | $ | 19,091,000 | $ | 10,289,000 | |||

| Net income | $ | 4,064,000 | $ | 1,346,000 | |||

| Earnings per share – basic | $ | 0.77 | $ | 0.25 | |||

| Earnings per share – diluted | $ | 0.76 | $ | 0.25 | |||

| Weighted average number of common shares outstanding – basic | 5,309,000 | 5,292,000 | |||||

| Weighted average number of common shares outstanding – diluted | 5,353,000 | 5,325,000 | |||||

| CONTACT: | Adrienne M. Uleau Vice President, Finance and Accounting (610) 487-0907 |

|

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Whales and Their Recent Bets on FTNT Options

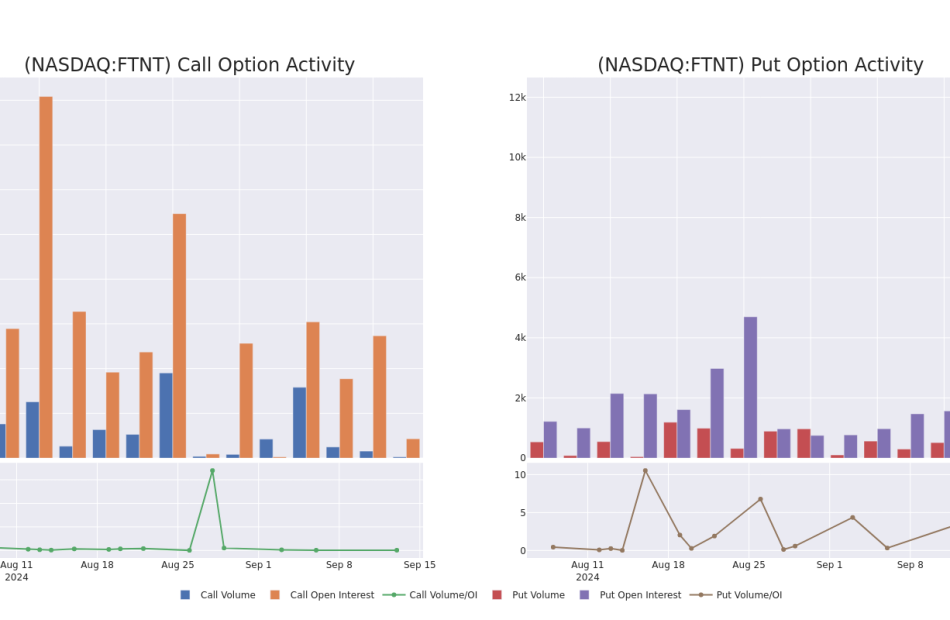

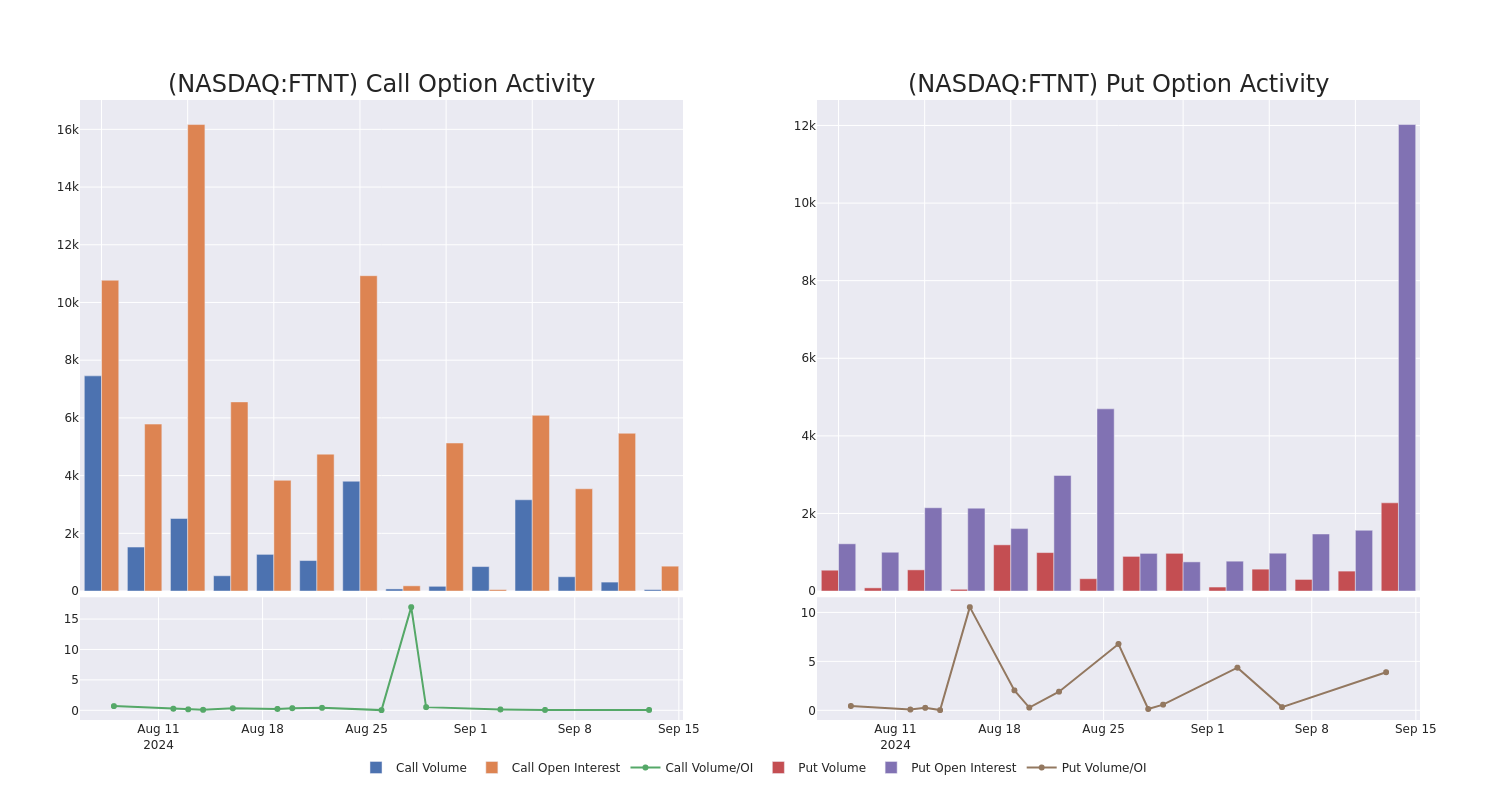

Investors with significant funds have taken a bullish position in Fortinet FTNT, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in FTNT usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 8 options transactions for Fortinet. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 50% being bullish and 37% bearish. Of all the options we discovered, 7 are puts, valued at $514,902, and there was a single call, worth $25,800.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $75.0 for Fortinet over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Fortinet’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Fortinet’s whale trades within a strike price range from $70.0 to $75.0 in the last 30 days.

Fortinet Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FTNT | PUT | TRADE | NEUTRAL | 03/21/25 | $7.0 | $6.65 | $6.85 | $75.00 | $274.0K | 221 | 405 |

| FTNT | PUT | SWEEP | BULLISH | 01/17/25 | $5.3 | $5.2 | $5.2 | $75.00 | $69.1K | 2.1K | 145 |

| FTNT | PUT | SWEEP | BULLISH | 01/17/25 | $5.35 | $5.3 | $5.3 | $75.00 | $44.5K | 2.1K | 290 |

| FTNT | PUT | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.35 | $3.35 | $70.00 | $37.5K | 2.1K | 113 |

| FTNT | PUT | SWEEP | BULLISH | 10/18/24 | $1.59 | $1.2 | $1.22 | $72.50 | $35.1K | 2.7K | 286 |

About Fortinet

Fortinet is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, zero-trust access, and security operations. The firm derives a majority of its revenue through sales of its subscriptions and support-based business. The California-based firm has more than 700,000 customers across the world.

Having examined the options trading patterns of Fortinet, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Fortinet

- With a trading volume of 4,572,848, the price of FTNT is up by 0.7%, reaching $75.01.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 48 days from now.

Professional Analyst Ratings for Fortinet

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $76.0.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Fortinet, targeting a price of $76.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Fortinet options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Magnificent Dividend Stocks That I'm "Never" Selling

You can never say never when it comes to investing. But when I look at my portfolio, I see Procter & Gamble (NYSE: PG), Hormel Foods (NYSE: HRL), and Hershey (NYSE: HSY) and I think of them as “never-sell” stocks. That’s true even though two of them are currently facing notable adversity (which might make them attractive buys for anyone who doesn’t own them).

Here’s why I’m holding on to this trio of reliable dividend-paying consumer staples stocks, and “never” selling.

Procter & Gamble proves the method

I wouldn’t fault someone for buying Procter & Gamble, usually just called P&G by investors, today. Although the 2.3% dividend yield is only middle of the road historically speaking, it suggests a fair valuation for one of the most iconic consumer staples companies on the planet. But not too long ago P&G was dealing with a bloated and stagnant business, weighed down by brands that weren’t really contributing to the top or bottom lines. At that point, P&G was deeply unloved and the yield was closer to 4%.

That’s when I bought Procter & Gamble, given its status as a Dividend King (with more than 50 years of annual dividend increases). P&G was in a nasty proxy battle with dissident shareholder Nelson Peltz, which it won (but still decided to give Peltz a board seat). The plan at the time was to slim down to focus only on its most important brands, with Peltz pushing for more of a connection between performance and pay. This all seemed reasonable to me, so I jumped in.

The plan worked and P&G turned its fortunes around. I’ve done quite well with that investment, essentially buying a great company when it was out of favor because of solvable short-term problems. Like all of life, companies work through a sine curve shifting between good times and bad times. So if you are patient you can sometimes find winners among unloved stocks.

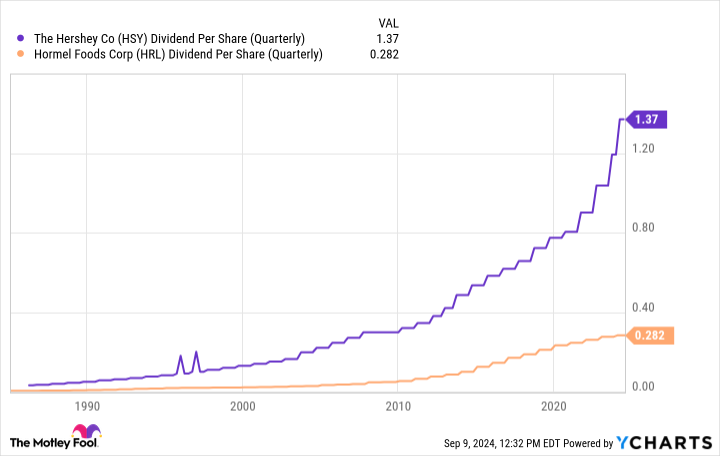

The key for me is to focus on longtime dividend payers that have historically high, or at least attractive, dividend yields. That is my indication of a high-quality stock that’s trading on the discount rack. This is where Hormel Foods and Hershey come into play.

Hormel and Hershey are out of favor now

Hormel and Hershey are facing some headwinds at the moment. The problems are unique to each (as well as to the problem P&G dealt with), but they don’t appear to be permanent issues. Hormel, for example, hasn’t been able to push through price increases as well as its peers in the face of elevated inflation. It also bought Planters nuts just as the nut segment of the snack business was slowing down, it has been bogged down by avian flu, and it is dealing with a slow pandemic recovery in China. Individually each of these issues would be a nuisance, but collectively they’ve caused investors to panic.

Hershey, meanwhile, has some operational shifts going on thanks to an updated distribution system. That resulted in customers stocking up in advance of the switch-over (just in case the new system failed), which caused a bit of turbulence in revenue. That should pass in time. It has also had to deal with declining demand for popcorn, which it is working through adequately enough by adjusting product sizes and prices.

Most notably, Hershey is being weighed down by the skyrocketing price of cocoa, a key ingredient in making its famous chocolate products. This particular issue has investors really worried because it seems likely that there’s been a step change in cocoa prices given troubled supply dynamics. Investors have been avoiding the shares out of fear that Hershey won’t be able to recoup its rising costs.

These negatives, however, have to be looked at within a broader context. Like P&G, Hormel is a Dividend King. And while Hershey’s dividend streak is only up to 15 years or so, the dividend has trended largely higher throughout its history with some streaks where it has remained the same. Simply put, both are reliable dividend stocks and have been so for a very long time. That’s only possible if a company is well-run and knows how to deal with the inevitable periods of adversity that come from time to time. I’m confident that both food makers will figure out how to survive while continuing to pay their dividends.

However, despite being great companies, a worried Wall Street has left the stocks with historically attractive dividend yields. Like P&G a few years ago, Hormel and Hershey appear to be on the sale rack. Hormel’s 3.5% yield is near the highest levels in recent history (that’s the deep discount bin). Hershey’s 2.7% yield is toward the high side, but not at an extreme level. It’s just attractively cheap, noting that it very rarely goes on sale at all.

I’ve stepped into both stocks. I’m up on Hershey, a fairly new investment for me, and I’m down slightly on Hormel, a stock I’ve owned for several years. I’m not going to sell either unless something very negative happens operationally at either one. That seems highly unlikely. What I believe is more likely is that these great food makers muddle through their problems while paying me well to wait for better times. Which is exactly what happened with P&G.

Time arbitrage is your secret weapon

If I were running a mutual fund or a hedge fund I would have to justify each and every stock I own to my investors. It would be kind of hard to justify Hershey or Hormel right now, given the generally negative view of them on Wall Street. Even if I loved the stocks, I might end up selling them so I wouldn’t have to deal with the questions. There are drawbacks to being a small, individual investor, but this dynamic isn’t one of them. In fact, the ability to buy and hold for the long term, which I call time arbitrage (I didn’t make up the term, I borrowed it somewhere along the line), is what lets me find gems that Wall Street is overlooking. It’s so simple, but because of the short-term focus on Wall Street, it’s actually a contrarian approach.

The key is to focus on good companies (which I use dividend history to identify) and only buy them when they are out of favor (with historically attractive yields) for what appear to be temporary or at least solvable reasons. And then hold on unless there’s a material negative operational change at the company. This is why I’m holding on to P&G, Hormel, and Hershey. The last two, as noted, still look pretty attractive today, if you’re interested.

Should you invest $1,000 in Procter & Gamble right now?

Before you buy stock in Procter & Gamble, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Procter & Gamble wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Reuben Gregg Brewer has positions in Hershey, Hormel Foods, and Procter & Gamble. The Motley Fool has positions in and recommends Hershey. The Motley Fool has a disclosure policy.

3 Magnificent Dividend Stocks That I’m “Never” Selling was originally published by The Motley Fool

Wall Street Aims For Fifth Straight Gain, Small Caps Soar As 2-Year Yields Hit 2-Year Lows, Adobe Sinks: What's Driving Markets Friday?

Wall Street is experiencing a risk-on session Friday, with all sectors of the S&P 500 index trading in the green as traders are energized by the now-imminent Federal Reserve rate cut, expected in less than a week.

Both the S&P 500 and Nasdaq 100 are on track for their fifth consecutive session of gains, pushing their weekly performances to 4% and 5.7%, respectively, and fully recouping last week’s losses.

Friday saw small-cap stocks build significant momentum, once again outperforming their large-cap counterparts amid the euphoria over the anticipated Fed rate cuts.

A large overnight bet by a trader on a 50-basis-point Fed rate cut sent the 2-year Treasury yield down by 7 basis points to 3.58%. This puts it on track to close at its lowest level since September 12, 2022.

Market-implied probabilities for a half-point cut surged to as high as 43%, according to CME FedWatch data.

Gold, as tracked by the SPDR Gold Trust GLD, continues to extend its historic highs, rising by 1%. Meanwhile, silver has roared ahead with a 3.3% gain, bringing its weekly performance to a stunning 16%, marking its best week since April 2020.

The rally in precious metals has been a boon for miners. The VanEck Gold Miners ETF GDX has extended its weekly gains beyond 10%, its best performance since March 2023.

Oil prices are cooling off, slipping by 0.4% after Thursday’s sharp rally. In the cryptocurrency market, Bitcoin gained 2.2%, climbing to $59,400 and is on track to close at its highest level since late August.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Russell 2000 | 2,182.68 | 2.4% |

| Dow Jones | 41,355.75 | 0.6% |

| S&P 500 | 5,620.96 | 0.5% |

| Nasdaq 100 | 19,484.48 | 0.3% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY was 0.4% higher to $561.37.

- The SPDR Dow Jones Industrial Average DIA rose 0.7% to $414.78.

- The tech-heavy Invesco QQQ Trust Series QQQ inched 0.2% higher to $474.18.

- The iShares Russell 2000 ETF IWM rallied 2.4% to $216.84.

- Both the Utilities Select Sector SPDR Fund XLU and the Materials Select Sector SPDR Fund XLB outperformed, up 1.2%. The Technology Select Sector SPDR Fund XLRE showed the smallest gains, up 0.3%.

Friday’s Stock Movers

- Adobe Inc. ADBE fell over 9%, despite reporting better-than-expected results last quarter, as revenue guidance missed forecasts.

- Boeing Inc. BA dropped 3.8% after 33,000 union workers launched a strike on Friday, rejecting the company’s proposed four-year contract amid ongoing challenges at the aircraft manufacturer.

- United Airlines Holdings, Inc. UAL gained nearly 2% after announcing an agreement with SpaceX to equip its fleet with Starlink’s high-speed Wi-Fi service.

- Warner Bros Discovery Inc. WBD rose over 9%, on track for the strongest 2-day rally since 2008, after announcing a multi-year partnership with Charter Communications Inc. CHTR.

- Garmin Ltd. GRMN dropped more than 6% after Barclays downgraded the stock from ‘Equal-Weight’ to ‘Underweight’ and slashed the price target from $181 to $133 per share.

Read now:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Greystone Logistics Reports Strong Year-End Earnings

TULSA, Okla., Sept. 13, 2024 (GLOBE NEWSWIRE) — Greystone Logistics, (“Greystone Logistics” or the “Company”) GLGI the leading manufacturer of recycled plastic pallets providing sustainable logistics solutions, is pleased to announce its year-end earnings for the fiscal year ending May 31, 2024. The company has achieved an impressive net income of $5,027,491, with EBITDA of $13,086,091 on sales of $61,780,715. The $.16 per share earnings highlights its resilience and commitment to innovation in a challenging economic climate.

Despite ongoing recessionary pressures and a notable hesitancy among buyers to issue purchase orders, Greystone has continued to excel in the market for its world-class recycled plastic shipping pallets. The company’s focus on sustainability and quality has allowed it to maintain a competitive edge, meeting the growing demand for eco-friendly shipping solutions.

Warren Kruger, President of Greystone Logistics, expressed his pride in the company’s performance. “We’ve had a tremendous year, demonstrating our ability to adapt and thrive even in the face of economic uncertainty. Our new 48×40 warehouse pallet is already generating sales at a pace of $5 million per year in revenue and with over $50 million in our sales pipeline, I anticipate a robust 2025. Cash on hand at year end was $5,798,641 insuring a level of safety and sufficient funds for our previously announced share buyback. We have now received the new tooling for our extruded hollow lumber pallet with product launch in the next 90 days and introduction at Pack Expo in Chicago in November. Our innovative approach to recycling plastic into durable shipping pallets not only supports our clients’ logistics needs but also helps reduce environmental impact. We are committed to providing sustainable solutions that benefit both our customers and the planet.”

Greystone Logistics remains dedicated to expanding its operations and enhancing its product offerings as it looks ahead to the coming year. The company’s strategic initiatives will focus on increasing production on new equipment with existing customers and closing sales in the pipeline.

As Greystone continues to lead the way in the logistics industry, it remains steadfast in its mission to deliver high-quality, sustainable products while navigating the complexities of the current economic landscape.

For more information about Greystone Logistics and its innovative products, please visit www.greystonepallets.com

About Greystone Logistics

Greystone Logistics is a “green” manufacturing company that reprocesses recycled plastic and designs, manufactures and sells high-quality 100% recycled plastic pallets that provide logistical solutions for a wide range of industries such as the food and beverage, automotive, chemical, pharmaceutical and consumer products. The Company’s technology, including a proprietary blend of recycled plastic resins used in the injection molding equipment and patented pallet designs, allows production of high-quality pallets more rapidly and at a lower cost than many other processes. The recycled plastic for Greystone’s pallets helps control material costs while reducing environmental waste and provides cost advantages over users of virgin resin.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “plan,” “potential,” “continue” or similar expressions. Such forward-looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors, risks and uncertainties are discussed in the Company’s filings with the Securities and Exchange Commission. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company’s control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Conference Call-Monday, September 16, 2024, at 1:30 PM ET, hosted by Warren Kruger, President and CEO. Conference ID is Greystone. Participant Dial-in information is Toll-Free Number, 888-999-6281, or Direct or International Number, +1-848-280-6550. A Q&A session will be available.

Non-GAAP Financial Measure

This press release contains disclosure of EBITDA, which is a non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission.

Contact

Brendan Hopkins

Investor Relations

Email: investorrelations@greystonelogistics.com

Phone : (407) 645-5295

https://www.greystonepallets.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.