Planet Image International Limited Reports the First Half of Fiscal Year 2024 Unaudited Financial Results

XINYU, China, Sept. 13, 2024 /PRNewswire/ — Planet Image International Limited (“Planet Image,” the “Company,” “we,” “our,” or “us”) YIBO, an export-oriented manufacturer and seller of compatible toner cartridges based in China, the U.S. and Europe, today announced its unaudited financial results for the six months ended June 30, 2024.

First Half 2024 Financial Highlights

- Total revenues in the first half of 2024 were US$77.3 million, representing an increase of 4.1% from US$74.2 million in the same period of 2023.

- Gross profit in the first half of 2024 was US$28.2 million with a gross profit margin of 36.5%, compared to US$31.3 million with a gross profit margin of 42.2% in the same period of 2023.

- Income from operations in the first half of 2024 was US$5.8 million, representing a decrease of 40.8% from US$9.8 million in the same period of 2023.

- Net income in the first half of 2024 was US$4.3 million, representing an increase of 7.6% from US$4.0 million in the same period of 2023.

Management Commentary

Shaofang Weng, Chief Executive Officer of the Company, commented, “We are pleased to report a 4.1% growth in total revenues to US$77.3 million for the first half of 2024 and a 7.6% increase in net income compared to the same period last year. This growth was primarily driven by a 15.1% increase in offline sales to dealers, which reflects our success in supporting dealers with online sales operations through enhanced warehousing, logistics, and IT systems. North America remained a key market, contributing 61% of our total revenues, with a 3.8% year-over-year increase, fueled by our ability to attract more local dealers with preferential pricing. Additionally, our market expansion in China and Brazil led to a 76.7% increase in revenue from other markets, now representing 5% of our total revenues. Our flexible strategies have enabled us to maintain a competitive edge amid challenging economic conditions in Europe and the US. Looking ahead, we will continue to explore strategic opportunities to optimize production, expand product offerings, and strengthen our sales channels globally.”

First Half 2024 Financial Results

Revenues

Total revenues increased by 4.1% to US$77.3 million for the first half of 2024 from US$74.2 million for the same period of 2023. The increase in total revenues was mainly due to an increase in revenues from our offline sales to dealers and online sales to retail customers, partially offset by the decrease in our offline sales to original design manufacturing (“ODM”) customers.

Comparison by Sales Channel

The following table sets forth our revenue by sales channel for the periods indicated.

|

For the six months ended |

Change |

|||||||||||

|

2023 |

2024 |

Amount |

% |

|||||||||

|

Offline sales to dealers |

$ |

39,689 |

$ |

45,668 |

$ |

5,979 |

15.1 % |

|||||

|

Offline sales to ODM customers |

29,042 |

25,711 |

(3,331) |

(11.5) % |

||||||||

|

Online sales to retail customers |

5,474 |

5,885 |

411 |

7.5 % |

||||||||

|

$ |

74,205 |

$ |

77,264 |

$ |

3,059 |

4.1 % |

||||||

Revenue from offline sales to dealers increased by 15.1% from US$39.7 million for the first half of 2023 to US$45.7 million for the same period of 2024, mainly because we continuously expanded our local sales to dealers with online sales operations, utilized our warehousing, logistics and IT system and obtained more orders from dealers. Along with our dealers’ expansion in their online sales business, we achieved significant growth in sales of products to dealers.

Revenue from offline sales to ODM customers decreased by 11.5% from US$29.0 million for the first half of 2023 to US$25.7 million for the same period of 2024, which was primarily attributable to less sale orders from some customers having concerns over longer transportation turnover due to limited ocean freight capacity under unfavorable political environment.

Revenue from online sales increased by 7.5% from US$5.5 million for the first half of 2023 to US$5.9 million for the same period of 2024, which was primarily due to more new household supply products, such as electric appliances and articles for daily use, being sold through online channels. Such products were manufactured by third parties and procured by the Company for resale in the U.S. and European markets.

Comparison by Area

The majority of our revenue for the six months ended June 30, 2023 and 2024 was generated from North America and Europe. The following table sets forth the disaggregation of revenue by area:

|

For the six months ended |

Change |

|||||||||||||||

|

2023 |

2024 |

Amount |

% |

|||||||||||||

|

(in thousands of US$) |

||||||||||||||||

|

North America |

$ |

45,779 |

$ |

47,503 |

$ |

1,724 |

3.8 |

% |

||||||||

|

Europe |

26,251 |

25,918 |

(333) |

(1.3) |

% |

|||||||||||

|

Others |

2,175 |

3,843 |

1,668 |

76.7 |

% |

|||||||||||

|

Total |

$ |

74,205 |

$ |

77,264 |

$ |

3,059 |

4.1 |

% |

||||||||

Revenue generated from North America increased by 3.8% from US$45.8 million for the first half of 2023 to US$47.5 million for the same period of 2024, which was primarily attributable to our market expansion in the U.S. and increased sales by attracting more local dealers with preferential pricing, our well-developed warehousing, logistics and IT system and our advanced products.

Revenue generated from Europe slightly decreased by 1.3% from US$26.3 million for the first half of 2023 to US$25.9 million for the same period of 2024, as we did not significantly reduce the prices of our products compared with other competitors while faced with intense price competition, which resulted in customer attrition in Europe.

Revenue generated from others increased by 76.7% from US$2.2 million for the first half of 2023 to US$3.8 million for the same period of 2024, resulting from our market expansion in China and Brazil.

Cost of Revenues

Cost of revenues increased by 14.3% to US$49.0 million for the first half of 2024 from US$42.9 million for the same period of 2023. This increase was mainly attributable to the increase of material costs, ocean freight costs and tariff under unstable political and economic environment.

Gross Profit

Gross profit decreased to US$28.2 million for the first half of 2024 from US$31.3 million for the same period of 2023. Gross margin was 36.5% in the first half of 2024 compared to 42.2% in the same period of 2023, which was primarily due to (i) a decrease of the average sales price to attract more customers; (ii) an increase of sales of household supply products, such as electric appliances and articles for daily use, with relatively low gross margin; and (iii) an increase of ocean freight costs.

Operating Expenses

Total operating expenses increased by 4.4% to US$22.4 million for the first half of 2024 from US$21.4 million for the same period of 2023.

- Selling expenses in the first half of 2024 increased by 8.0% to US$15.8 million from US$14.6 million in the same period of 2023, which was primarily driven by the increase of freight expenses charged by warehouses of online platforms.

- General and administrative expenses in the first half of 2024 increased by 11.8% to US$3.7 million from US$3.3 million in the same period of 2023, which was primarily driven by the increase in payroll expenses of increased headcounts and more expected credit losses accrued.

- Research and development expenses in the first half of 2024 decreased by 16.8% to US$3.0 million from US$3.6 million for the same period of 2023, primarily due to less materials consumed in research projects undertaken in the first half of 2024.

Other Income and Expenses

- Our other non-operating income increased by 33.7% from US$0.8 million for the first half of 2023 to US$1.0 million for the same period of 2024, which was primarily attributable to more sales of scrap and waste as well as more packing, labeling and other services to offline dealer customers.

- Fair value loss on derivative instruments was US$1.2 million for the first half of 2024 compared to US$5.5 million for the same period of 2023, primarily due to fluctuations of exchange rate.

- Interest expenses, net decreased by US$0.6 million from US$0.8 million for the first half of 2023 to US$0.2 million for the same period of 2024, primarily due to a decrease of interest expenses of US$0.4 million because new loan agreements entered into in the first half of 2024 carried a lower interest rate on average compared with those entered into in the same period of 2023, and an increase of interest income of US$0.2 million with increased cash in bank.

Net Income

Net income was US$4.3 million for the first half of 2024, compared to US$4.0 million for the same period of 2023. Net income per share was US$0.08 for the first half of 2024, compared to US$0.09 for the same period of 2023.

Financial Conditions

As of June 30, 2024, the Company had cash and cash equivalents of $53.5 million, compared to $45.1 million as of December 31, 2023. Account receivable, net was $37.4 million as of June 30, 2024, compared to $31.3 million as of December 31, 2023. As of June 30, 2024, the Company had current assets of $129.2 million and current liabilities of $85.0 million, resulting in working capital of $44.2 million, as compared with current assets of $118.6 million, current liabilities of $82.4 million, and working capital of $36.2 million as of December 31, 2023.

Exchange Rate

This announcement contains translations of amounts in Renminbi (“RMB”), Hong Kong Dollar (“HKD”), Great Britain Pounds (“GBP”), Euros (“EUR”) into U.S. dollars (“US$”).

The following table outlines the currency exchange rates that were used in creating the consolidated financial statements, which is derived from company’s own simple exchange rate conversion:

|

As of |

|||||||

|

December 31, 2023 |

June 30, 2024 |

||||||

|

Period end RMB: USD exchange rate |

US$1=RMB7.0800 |

US$1=7.1276 |

|||||

|

Period end EUR: USD exchange rate |

US$1=EUR0.9009 |

US$1=0.9259 |

|||||

|

Period end GBP: USD exchange rate |

US$1=GBP0.7874 |

US$1=0.7874 |

|||||

|

For the six months ended |

|||||||

|

June 30, 2023 |

June 30, 2024 |

||||||

|

Period Average RMB: USD exchange rate |

US$1=RMB6.9396 |

US$1=7.1023 |

|||||

|

Period Average EUR: USD exchange rate |

US$1=EUR0.9245 |

US$1=0.9223 |

|||||

|

Period Average GBP: USD exchange rate |

US$1=GBP0.8108 |

US$1=0.7874 |

|||||

Transfer of Mezzanine Equity

On September 30, 2019, the Company issued 10,526,300 ordinary shares to Xinyu High-Tech Investment Co., Ltd. (“Gaoxin” or the “Holder”) in exchange for an RMB100.0 million (approximately US$14.1 million) investment in the Company. The ordinary shares issued to Gaoxin are subject to redemption upon the occurrence of any of the following events (referred to as a “Redemption Event”): (1) the Company fails to successfully complete its initial public offering on either Hong Kong Stock Exchange or Nasdaq Capital Market and New York Stock Exchange before March 31, 2023; (2) its initial public offering price per share is lower than or equal to 1.15 times of the share price paid by Gaoxin; or (3) the shares held by Gaoxin could not trade immediately after completion of the Company’s initial public offering or Gaoxin does not receive the shortest applicable lock-up period for its shares. The date specified in the first Redemption Event was extended for eighteen months to September 30, 2024 through a supplementary agreement entered into between the Company and Gaoxin dated February 18, 2023, without any other modification on the remaining terms. The 10,526,300 ordinary shares were subsequently converted into 10,526,300 Class A ordinary shares of the Company in October 2021.

The Company accounts for these redeemable Class A ordinary shares in accordance with ASC 480 “Distinguishing Liabilities from Equity.” Class A ordinary shares subject to conditional redemption rights that are either within the control of the holder or subject to redemption upon the occurrence of uncertain events not solely within the Company’s control is classified as mezzanine equity.

On January 25, 2024, the Company successfully completed its initial public offering on the Nasdaq Capital Market. As a result, the mezzanine equity was reclassified as equity of the Company.

About Planet Image International Limited

Planet Image is a leading export-oriented manufacturer and seller of compatible toner cartridges based in China, the U.S. and Europe. It primarily develops and manufactures toner cartridges that are compatible with and can be used in a wide range of commonly available models of laser printers from different manufacturers, on a white-label or third-party brand basis or under its self-owned brands. It has a wide international footprint through established sales channels, with products sold to customers in over 48 countries, and sales in the U.S. and Europe representing the majority of its revenue. More information, please visit http://www.yibomk.com/.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical fact in this press release are forward-looking statements, including but not limited to, the intent, belief or current expectations of Planet Image and members of its management, as well as the assumptions on which such statements are based. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy and financial needs, including the expectation that the offering will be successfully completed. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s annual report on Form 20-F and in its other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

Investor Relations:

Sherry Zheng

Weitian Group LLC

Phone: 718-213-7386

Email: shunyu.zheng@weitian-ir.com

|

PLANET IMAGE INTERNATIONAL LIMITED |

|||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||||

|

(Amount in thousands of U.S. dollars, except share and per share data) |

|||||||

|

As of |

|||||||

|

December 31, |

June 30, |

||||||

|

2023 |

2024 |

||||||

|

(Unaudited) |

|||||||

|

Assets |

|||||||

|

Current assets: |

|||||||

|

Cash and cash equivalents |

$ |

45,126 |

$ |

53,455 |

|||

|

Restricted cash |

19,040 |

15,908 |

|||||

|

Accounts receivable, net |

31,302 |

37,442 |

|||||

|

Inventories, net |

17,451 |

17,405 |

|||||

|

Prepaid expenses and other current assets |

5,670 |

5,039 |

|||||

|

Total current assets |

118,589 |

129,249 |

|||||

|

Non-current assets: |

|||||||

|

Property, plant and equipment, net |

8,509 |

8,243 |

|||||

|

Right-of-use assets |

1,874 |

1,240 |

|||||

|

Deferred tax assets |

1,036 |

329 |

|||||

|

Other non-current assets |

259 |

198 |

|||||

|

Total non-current assets |

11,678 |

10,010 |

|||||

|

TOTAL ASSETS |

$ |

130,267 |

$ |

139,259 |

|||

|

Liabilities, Mezzanine Equity and Shareholders’ Equity |

|||||||

|

Current liabilities: |

|||||||

|

Short-term borrowings |

$ |

26,222 |

$ |

30,305 |

|||

|

Accounts payable |

22,513 |

26,746 |

|||||

|

Bank acceptance notes payable |

13,279 |

14,280 |

|||||

|

Amounts due to related parties, current |

260 |

207 |

|||||

|

Accrued expenses and other current liabilities |

14,707 |

9,368 |

|||||

|

Derivative liabilities |

2,259 |

1,569 |

|||||

|

Operating lease liabilities – current |

1,257 |

915 |

|||||

|

Taxes payable |

1,872 |

1,653 |

|||||

|

Total current liabilities |

82,369 |

85,043 |

|||||

|

Non-current liabilities: |

|||||||

|

Operating lease liabilities – non-current |

683 |

335 |

|||||

|

Total non – current liabilities |

683 |

335 |

|||||

|

TOTAL LIABILITIES |

83,052 |

$ |

85,378 |

||||

|

Commitments and Contingencies |

|||||||

|

Mezzanine equity |

|||||||

|

Redeemable ordinary shares (10,526,300 and nil Class A |

14,104 |

– |

|||||

|

Shareholders’ equity |

|||||||

|

Preferred shares (par value of HK$0.0001 per share; |

– |

– |

|||||

|

Class A ordinary shares (par value of HK$0.0001 per share; |

– |

1 |

|||||

|

Class B ordinary shares (par value of HK$0.0001 per share; |

1 |

1 |

|||||

|

Additional paid-in capital |

833 |

17,411 |

|||||

|

Statutory reserve |

3,193 |

3,193 |

|||||

|

Retained earnings |

26,024 |

30,321 |

|||||

|

Accumulated other comprehensive income |

3,060 |

2,954 |

|||||

|

Total shareholders’ equity |

33,111 |

53,881 |

|||||

|

TOTAL LIABILITIES, MEZZANINE EQUITY AND |

$ |

130,267 |

$ |

139,259 |

|||

|

PLANET IMAGE INTERNATIONAL LIMITED |

|||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND |

|||||||

|

(Amount in thousands of U.S. dollars, except share and per share data) |

|||||||

|

For the six months ended June 30, |

|||||||

|

2023 |

2024 |

||||||

|

Net revenues |

$ |

74,205 |

$ |

77,264 |

|||

|

Cost of revenues |

(42,923) |

(49,044) |

|||||

|

Gross profit |

31,282 |

28,220 |

|||||

|

Operating expenses: |

|||||||

|

Selling expenses |

(14,599) |

(15,761) |

|||||

|

General and administrative expenses |

(3,284) |

(3,671) |

|||||

|

Research and development expenses |

(3,565) |

(2,966) |

|||||

|

Total operating expenses |

(21,448) |

(22,398) |

|||||

|

Income from operations |

9,834 |

5,822 |

|||||

|

Other income/(expenses): |

|||||||

|

Other non-operating income, net |

754 |

1,008 |

|||||

|

Government subsidy |

307 |

149 |

|||||

|

Fair value loss on derivative instruments |

(5,542) |

(1,156) |

|||||

|

Foreign exchange loss |

(481) |

(507) |

|||||

|

Interest expense, net |

(785) |

(217) |

|||||

|

Total other expenses, net |

(5,747) |

(723) |

|||||

|

Income before income tax expense |

4,087 |

5,099 |

|||||

|

Income tax expense |

(93) |

(802) |

|||||

|

Net income |

3,994 |

4,297 |

|||||

|

Other comprehensive income |

|||||||

|

Foreign currency translation adjustment |

670 |

(106) |

|||||

|

Total comprehensive income |

$ |

4,664 |

$ |

4,191 |

|||

|

Net income per share |

|||||||

|

Basic and Diluted |

$ |

0.09 |

$ |

0.08 |

|||

|

Weighted average shares |

|||||||

|

Basic and Diluted |

42,105,300 |

52,263,976 |

|||||

![]() View original content:https://www.prnewswire.com/news-releases/planet-image-international-limited-reports-the-first-half-of-fiscal-year-2024-unaudited-financial-results-302248066.html

View original content:https://www.prnewswire.com/news-releases/planet-image-international-limited-reports-the-first-half-of-fiscal-year-2024-unaudited-financial-results-302248066.html

SOURCE Planet Image International Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

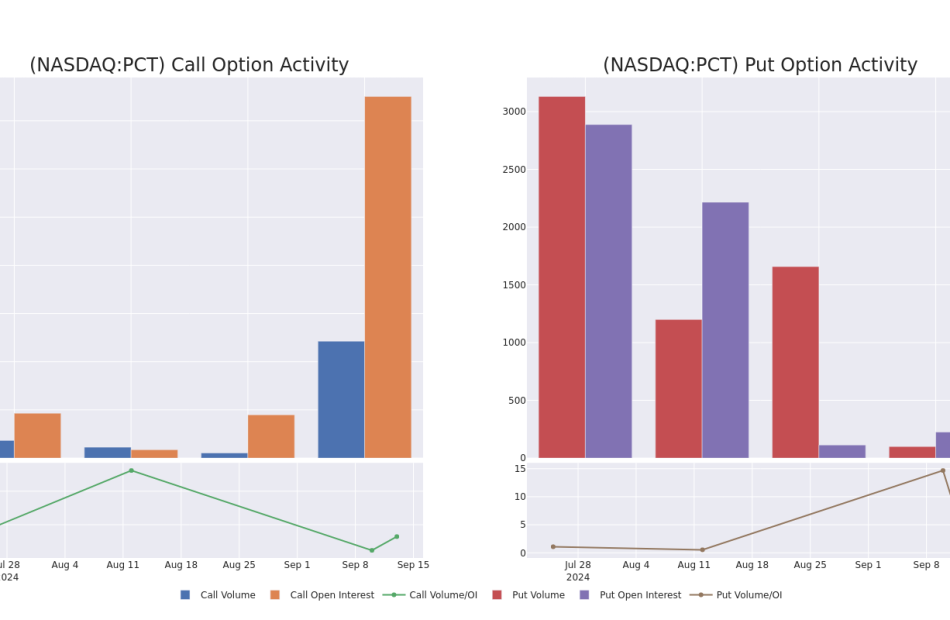

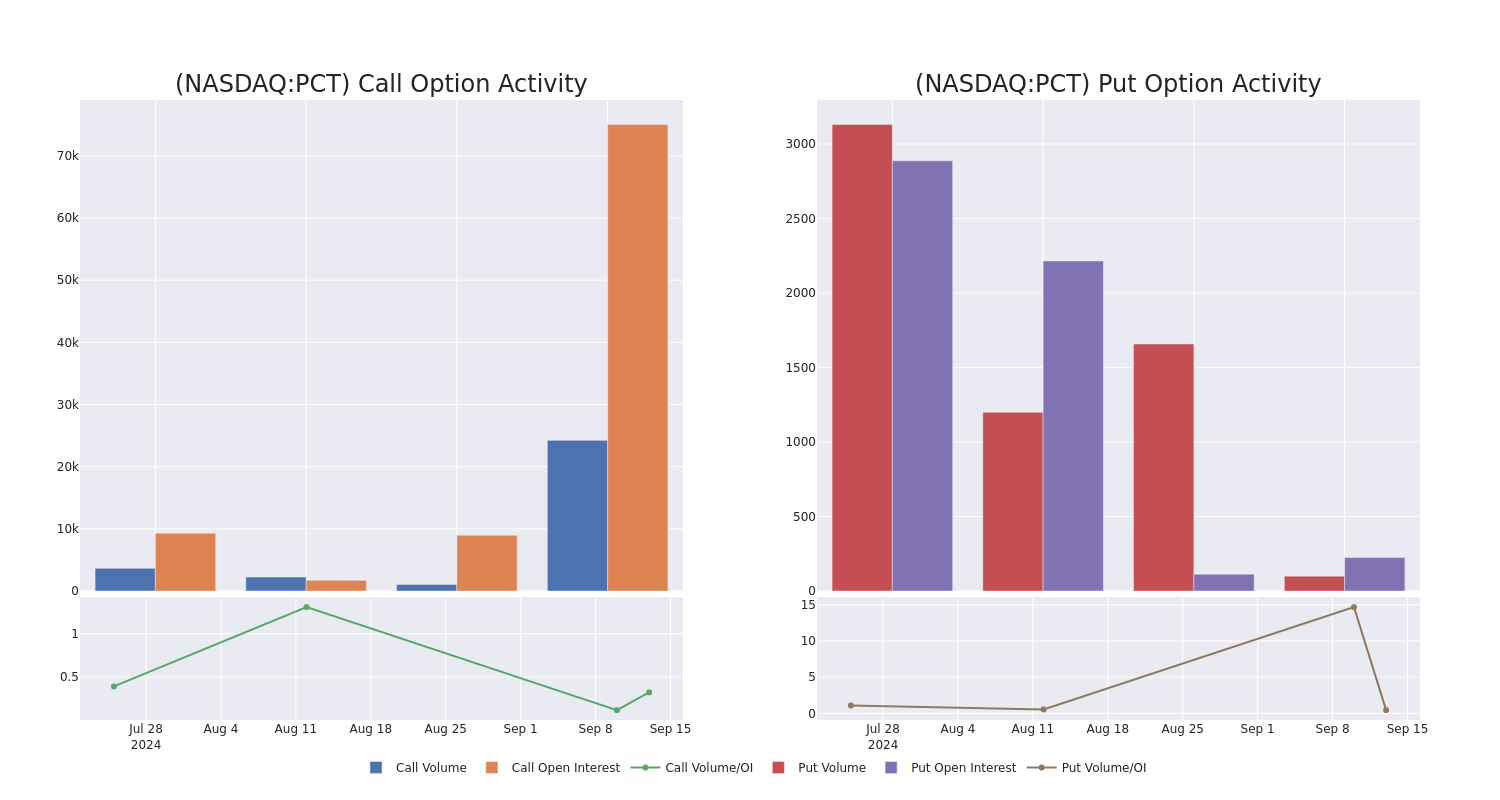

A Closer Look at PureCycle Technologies's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on PureCycle Technologies PCT.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with PCT, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 25 options trades for PureCycle Technologies.

This isn’t normal.

The overall sentiment of these big-money traders is split between 48% bullish and 44%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,500, and 24, calls, for a total amount of $2,027,947.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $12.0 for PureCycle Technologies during the past quarter.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PureCycle Technologies’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PureCycle Technologies’s substantial trades, within a strike price spectrum from $5.0 to $12.0 over the preceding 30 days.

PureCycle Technologies 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $4.6 | $4.3 | $4.3 | $5.00 | $215.0K | 12.9K | 1.0K |

| PCT | CALL | TRADE | NEUTRAL | 01/17/25 | $2.95 | $2.65 | $2.8 | $7.00 | $195.9K | 15.6K | 416 |

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $4.4 | $4.3 | $4.3 | $5.00 | $175.8K | 12.9K | 1.1K |

| PCT | CALL | TRADE | BULLISH | 10/18/24 | $2.65 | $2.5 | $2.6 | $6.00 | $130.0K | 5.8K | 1.5K |

| PCT | CALL | TRADE | BULLISH | 10/18/24 | $2.6 | $2.45 | $2.6 | $6.00 | $130.0K | 5.8K | 1.5K |

About PureCycle Technologies

PureCycle Technologies Inc holds a license to commercialize the only patented solvent-based purification recycling technology, developed by The Procter & Gamble Company (P&G), for restoring waste polypropylene (PP) into a virgin-like resin. The proprietary process removes color, odor, and other contaminants from recycled feedstock resulting in virgin-like polypropylene suitable for any PP market.

Having examined the options trading patterns of PureCycle Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is PureCycle Technologies Standing Right Now?

- Trading volume stands at 9,171,600, with PCT’s price up by 10.25%, positioned at $8.82.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 54 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PureCycle Technologies with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Silver Miner ETFs Notch Best Week Since April 2020 As Rate-Cut Bets Boost Precious Metals: 5 Stocks Surge Over 20% This Week

Silver mining stocks have recorded their best weekly performance in over four years, with some exchange-traded funds (ETFs) delivering their highest gains since inception.

A perfect storm of rising gold prices, expectations of a Federal Reserve interest rate cut, and a condition of structural global silver supply shortage has propelled prices above $30 per ounce, driving an almost 10% surge this week alone.

Several silver-focused ETFs have outperformed the broader market, benefiting from the rapid rise in prices. Here’s a breakdown of their weekly performance as of 3 p.m. ET on Friday:

| ETF | Performance (5D) | Best Week Since |

|---|---|---|

| iShares MSCI Global Silver Miners Fund SLVP | +16.8% | Early April 2020 |

| Global X Silver Miners ETF SIL | +16.7% | Fund Inception (2010) |

| Themes Silver Miners ETF AGMI | +13.0% | Fund Inception (2024) |

Worsening Silver Shortage

The silver market’s supply and demand dynamics are only tightening, pushing prices higher. A Silver Institute survey highlighted a growing supply deficit, with demand expected to outstrip supply by 265 million ounces (oz.) this year, marking the steepest shortage since 2020.

In 2024, industrial demand for the metal is forecasted to rise to 710.9 million oz., up from 654 million oz. in 2023, driven largely by increased use in photovoltaic cells for solar energy production.

This demand spike is colliding with a flat supply, creating a structural deficit that’s driving prices upward.

Fed Rate Cuts Could Fuel Further Gains

Investor sentiment around silver and other precious metals is being buoyed by expectations of a near-term Federal Reserve interest rate cut.

With inflation data aligning with a broader disinflationary trend, market odds currently point to a 49% chance of a 50-basis-point cut during next week’s Fed meeting, with the remaining expectations on a 25-basis-point cut, as per CME FedWatch.

Falling Treasury yields and a weaker dollar have further supported precious metals.

Gold prices have soared to fresh all-time highs, surpassing $2,560/oz., with silver rallying alongside, notching five consecutive positive trading days this week—its longest winning streak since July.

Top-Performing Miners

Silver mining stocks have outpaced the metal itself, with some posting massive gains. Here are the five top-performing miners this week:

| Name | Price Chg. % (5D) |

| Coeur Mining, Inc. CDE | 37.22% |

| Gatos Silver, Inc. GATO | 33.87% |

| Hycroft Mining Holding Corporation HYMC | 28.16% |

| Hecla Mining Company HL | 25.05% |

| AYA Gold & Silver Inc. AYASF | 22.94% |

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXTR INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that Extreme Networks, Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Sept. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising — Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Extreme Networks, Inc. (“Extreme Networks” or “the Company”) EXTR and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Extreme Networks securities between July 27, 2022, and January 30, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/EXTR.

Case Details

The Complaint alleges that throughout the class period, Defendants made false and misleading statements to the market. Specifically, the Complaint alleges that: (1) Extreme Networks suffered from weak client demand trends due to customers ordering more product than necessary in the wake of the COVID-19 pandemic; (2) the Company attempted to offset the negative organic demand trends with backlog orders exceeding the proportion it represented to investors; (3) based on these facts, the Company’s public statements were false and materially misleading throughout the class period; and (4) when the market learned the truth about Extreme Networks, investors suffered damages.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/EXTR or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in Extreme Networks you have until October 15, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AGNC Investment Corp. Declares Monthly Common Stock Dividend of $0.12 per Common Share for September 2024

BETHESDA, Md., Sept. 13, 2024 /PRNewswire/ — AGNC Investment Corp. AGNC announced today that its Board of Directors has declared a cash dividend of $0.12 per share of common stock for September 2024. The dividend is payable on October 9, 2024 to common stockholders of record as of September 30, 2024.

For further information or questions, please contact Investor Relations at (301) 968-9300 or IR@AGNC.com.

ABOUT AGNC INVESTMENT CORP.

Founded in 2008, AGNC Investment Corp. AGNC is a leading investor in Agency residential mortgage-backed securities (Agency MBS), which benefit from a guarantee against credit losses by Fannie Mae, Freddie Mac, or Ginnie Mae. We invest on a leveraged basis, financing our Agency MBS assets primarily through repurchase agreements, and utilize dynamic risk management strategies intended to protect the value of our portfolio from interest rate and other market risks.

AGNC has a track record of providing favorable long-term returns for our stockholders through substantial monthly dividend income, with over $13 billion of common stock dividends paid since inception. Our business is a significant source of private capital for the U.S. residential housing market, and our team has extensive experience managing mortgage assets across market cycles. To learn more about The Premier Agency Residential Mortgage REIT, please visit www.AGNC.com, follow us on LinkedIn and X, and sign up for Investor Alerts.

CONTACT:

Investor Relations – (301) 968-9300

![]() View original content:https://www.prnewswire.com/news-releases/agnc-investment-corp-declares-monthly-common-stock-dividend-of-0-12-per-common-share-for-september-2024–302248033.html

View original content:https://www.prnewswire.com/news-releases/agnc-investment-corp-declares-monthly-common-stock-dividend-of-0-12-per-common-share-for-september-2024–302248033.html

SOURCE AGNC Investment Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JOHN CHRISTOPHER PERRY Executes Sell Order: Offloads $3.74M In Broadridge Financial Soln Stock

A substantial insider sell was reported on September 12, by JOHN CHRISTOPHER PERRY, President at Broadridge Financial Soln BR, based on the recent SEC filing.

What Happened: PERRY opted to sell 17,534 shares of Broadridge Financial Soln, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $3,741,859.

At Friday morning, Broadridge Financial Soln shares are up by 0.55%, trading at $211.68.

All You Need to Know About Broadridge Financial Soln

Broadridge Financial Solutions, which was spun off from ADP in 2007, is a leading provider of investor communications and technology-driven solutions to banks, broker/dealers, asset managers, wealth managers, and corporate issuers. Broadridge is composed of two segments: investor communication solutions, or ICS, and global technology and operations, or GTO.

Broadridge Financial Soln’s Financial Performance

Revenue Growth: Broadridge Financial Soln displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 5.73%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: With a low gross margin of 35.55%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Broadridge Financial Soln’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 2.75.

Debt Management: With a high debt-to-equity ratio of 1.65, Broadridge Financial Soln faces challenges in effectively managing its debt levels, indicating potential financial strain.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 35.93, Broadridge Financial Soln’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 3.85 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 18.49 reflects market recognition of Broadridge Financial Soln’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Broadridge Financial Soln’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FULC Stock Falls as Muscle Disorder Study Misses Primary Goal

Shares of Fulcrum Therapeutics, Inc. FULC plunged 61.1% on Sept. 12 after the company announced disappointing top-line data from the phase III REACH study, which evaluated its pipeline candidate, losmapimod, for treating patients with facioscapulohumeral muscular dystrophy (FSHD), a rare and debilitating disease.

Currently, there are no treatments approved for the given indication.

The study did not meet its primary endpoint as treatment with losmapimod failed to demonstrate a change from baseline in relative surface area (RSA), a measure of reachable workspace (RWS), compared with placebo at week 48.

The study also failed to achieve nominal statistical significance on the secondary endpoints.

Year to date, shares of Fulcrum have plunged 49% compared with the industry’s decline of 0.8%.

Image Source: Zacks Investment Research

Data From FULC’s REACH study

Data from the REACH study showed that treatment with losmapimod led to a 0.013 improvement in RSA compared to a 0.010 improvement in RWS for patients who received a placebo at week 48. This was the study’s primary endpoint.

Also, patients receiving losmapimod demonstrated an increase of 0.42% in muscle fat infiltration while an increase of 0.57% in MFI was observed for patients who received placebo at week 48.

Meanwhile, patients who were treated with losmapimod demonstrated a 9.63% improvement in abductor strength compared with a 2.24% improvement in the placebo arm.

There were no statistically significant differences observed in the two patient-reported outcomes secondary endpoints of the REACH study.

Following the disappointing data observed in the REACH study, FULC decided to stop the further development of losmapimod in FSHD.

What’s Next for FULC in Terms of Pipeline Development

Fulcrum is developing another pipeline candidate, pociredir, in an early-stage study for treating patients with sickle cell disease, an inherited blood disorder. The phase Ib PIONEER study evaluates pociredir in SCD.

The FDA has already granted a Fast Track designation and Orphan Drug designation to pociredir for the treatment of patients with SCD.

SCD has a significant unmet medical need, and if successfully developed and upon potential approval, pociredir has the potential to boost FULC’s prospects in the days ahead.

As of June 30. 2024, Fulcrum had $273.8 million in cash, cash equivalents and marketable securities. The company plans to use the funds to advance pociredir in the treatment of SCD and other pipeline development activities.

Zacks Rank & Other Stocks to Consider

Fulcrum currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the biotech sector are Illumina, Inc. ILMN and Krystal Biotech, Inc. KRYS, each sporting a Zacks Rank #1 at present.

In the past 60 days, estimates for Illumina’s 2024 earnings per share have moved up from $1.18 to $3.62. Earnings per share estimates for 2025 have improved from $2.93 to $4.43. Year to date, shares of ILMN have lost 9.3%.

ILMN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 463.46%.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have increased from $1.98 to $2.38. Earnings per share estimates for 2025 have improved from $4.33 to $7.31. Year to date, shares of KRYS have risen 57.7%.

KRYS’ earnings beat estimates in three of the trailing four quarters while missing on the remaining occasion, the average surprise being 45.95%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RBC Global Asset Management Inc. announces the final valuation of RBC Target 2024 Canadian Government Bond ETF and RBC Target 2024 Canadian Corporate Bond Index ETF

TORONTO, Sept. 13, 2024 /CNW/ – RBC Global Asset Management Inc. (“RBC GAM Inc.”) today announced the final valuation of RBC Target 2024 Canadian Government Bond ETF RGQL and RBC Target 2024 Canadian Corporate Bond Index ETF RQL (together, the “RBC ETFs”).

As announced earlier this year, the RBC ETFs will mature effective the close of business today, Friday, September 13, 2024. The RBC ETFs were voluntarily delisted from the Toronto Stock Exchange, at the request of RBC GAM Inc., effective market close on Tuesday, September 11, 2024.

The proceeds from the liquidation of the assets, less all liabilities and expenses incurred in connection with the maturity of the RBC ETFs (the “Maturity Proceeds”) are as follows:

|

Fund Name |

Fund Ticker |

Final Distribution |

Post Per Unit |

Maturity Per Unit |

|

|

Income Per Unit |

Capital Gain Per Unit |

||||

|

RBC Target 2024 Canadian Government |

RGQL |

$0.000 |

$0.0000 |

$20.3748 |

$20.3748 |

|

RBC Target 2024 Canadian Corporate |

RQL |

$0.000 |

$0.0000 |

$20.3325 |

$20.3325 |

The Maturity Proceeds paid to each unitholder is the sum of the Final Distribution (if any) per unit, plus the Post Distribution NAV per unit indicated in the table above and represents the remaining net assets of the applicable RBC ETF.

Each unitholder will receive the Maturity Proceeds on a pro rata basis and no further action is required by unitholders.

The Maturity Proceeds will be paid out to CDS Clearing and Depository Services Inc. and will be received by unitholders based on individual brokerage processing times.

For further information regarding RBC ETFs, please visit www.rbcgam.com/etfsolutions.

Commissions, management fees and expenses all may be associated with investments in ETFs. Please read the applicable prospectus or ETF Facts document before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns. Index returns do not represent RBC ETF returns. RBC ETFs are managed by RBC GAM Inc., a member of the RBC GAM group of companies and an indirect wholly-owned subsidiary of Royal Bank of Canada.

RBC Target 2024 Canadian Government Bond ETF and RBC Target 2024 Canadian Corporate Bond Index ETF do not seek to deliver a predetermined amount at maturity, and the amount an investor receives may be more or less than their original investment.

RBC Target 2024 Canadian Corporate Bond Index ETF was developed solely by RBC GAM Inc. and is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). All rights in the FTSE Canada 2024 Maturity Corporate Bond Index vest in the relevant LSE Group company which owns the FTSE Canada 2024 Maturity Corporate Bond Index. “FTSE®” is a trade mark of the relevant LSE Group company and is used by any other LSE Group company under license.

The FTSE Canada 2024 Maturity Corporate Bond Index is calculated by or on behalf of FTSE Global Debt Capital Markets Inc. or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the FTSE Canada 2024 Maturity Corporate Bond Index or (b) investment in or operation of RBC Target 2024 Canadian Corporate Bond Index ETF. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from RBC Target 2024 Canadian Corporate Bond Index ETF or the suitability of the FTSE Canada 2024 Maturity Corporate Bond Index for the purpose to which it is being put by RBC GAM Inc.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 100,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 18 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact.

About RBC Global Asset Management

RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC). RBC GAM is a provider of global investment management services and solutions to institutional, high-net-worth and individual investors through separate accounts, pooled funds, mutual funds, hedge funds, exchange-traded funds and specialty investment strategies. RBC Funds, RBC ETFS, BlueBay Funds and PH&N Funds are offered by RBC Global Asset Management Inc. (RBC GAM Inc.) and distributed through authorized dealers in Canada. The RBC GAM group of companies, which includes RBC GAM Inc. (including PH&N Institutional) and RBC Indigo Asset Management Inc., manage approximately $660 billion in assets and have approximately 1,600 employees located across Canada, the United States, Europe and Asia.

SOURCE RBC Global Asset Management Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c0137.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c0137.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hershey Stock Drops Despite Market Gains: Important Facts to Note

Hershey HSY closed the latest trading day at $198.46, indicating a -0.08% change from the previous session’s end. The stock’s change was less than the S&P 500’s daily gain of 0.75%. On the other hand, the Dow registered a gain of 0.58%, and the technology-centric Nasdaq increased by 1%.

Heading into today, shares of the chocolate bar and candy maker had lost 0.99% over the past month, lagging the Consumer Staples sector’s gain of 3.54% and the S&P 500’s gain of 4.03% in that time.

The investment community will be paying close attention to the earnings performance of Hershey in its upcoming release. The company is expected to report EPS of $2.78, up 6.92% from the prior-year quarter. Meanwhile, the latest consensus estimate predicts the revenue to be $3.13 billion, indicating a 3.39% increase compared to the same quarter of the previous year.

In terms of the entire fiscal year, the Zacks Consensus Estimates predict earnings of $9.50 per share and a revenue of $11.36 billion, indicating changes of -0.94% and +1.78%, respectively, from the former year.

Investors should also note any recent changes to analyst estimates for Hershey. Such recent modifications usually signify the changing landscape of near-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook.

Research indicates that these estimate revisions are directly correlated with near-term share price momentum. To take advantage of this, we’ve established the Zacks Rank, an exclusive model that considers these estimated changes and delivers an operational rating system.

The Zacks Rank system, running from #1 (Strong Buy) to #5 (Strong Sell), holds an admirable track record of superior performance, independently audited, with #1 stocks contributing an average annual return of +25% since 1988. Over the last 30 days, the Zacks Consensus EPS estimate has moved 0.11% lower. Hershey is currently a Zacks Rank #4 (Sell).

Looking at its valuation, Hershey is holding a Forward P/E ratio of 20.91. This represents a premium compared to its industry’s average Forward P/E of 19.09.

It is also worth noting that HSY currently has a PEG ratio of 5.77. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company’s expected earnings growth rate into account. The average PEG ratio for the Food – Confectionery industry stood at 3.92 at the close of the market yesterday.

The Food – Confectionery industry is part of the Consumer Staples sector. Currently, this industry holds a Zacks Industry Rank of 234, positioning it in the bottom 8% of all 250+ industries.

The Zacks Industry Rank is ordered from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

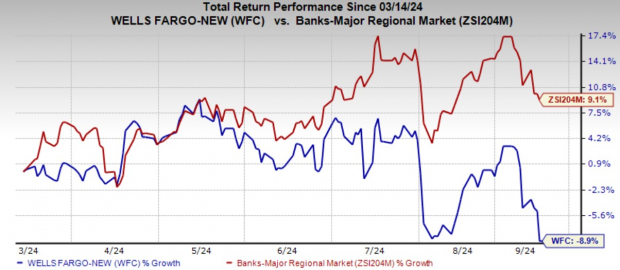

WFC Signs Agreement With OCC to Fix AML Program, Stock Dips 4%

Shares of Wells Fargo & Company lost 4% following the announcement of a formal agreement with the Office of the Comptroller of the Currency concerning the bank’s anti-money laundering (AML) and sanctions risk management practices.

The agreement points out flaws in the bank’s anti-money laundering internal controls and risk management procedures in several areas, such as the reporting of suspicious activity and currency transactions, customer due diligence and the bank’s customer identification and beneficial ownership initiatives.

The bank first disclosed this probe in its second-quarter Securities and Exchange Commission (SEC) filing, where it mentioned that it is in “resolution discussions” with the U.S. SEC about an investigation related to the cash sweep options it provides to new investment advisory clients.

Wells Fargo has taken a significant step in strengthening its AML and sanctions risk management capabilities with the official agreement with the OCC. The latest agreement is in line with the bank’s continuous efforts to enhance its risk management system and adhere to regulatory requirements.

WFC’s management stated, “We have been working to address a substantial portion of what’s required in the formal agreement, and we are committed to completing the work with the same sense of urgency as our other regulatory commitments.”

Other Details of WFC’s Agreement With OCC

The agreement mandates the establishment of a Compliance Committee to oversee Wells Fargo’s adherence to its terms. Specifically, the action plan should be targeted at areas, such as front-line risk management, independent risk management, independent testing, customer identification and suspicious activity detection.

The agreement stipulates that the bank must improve its AML and sanctions risk management procedures, get the OCC to approve its program for evaluating the AML and sanctions risks of new offerings, and notify the OCC prior to expanding any of those products.

WFC’s Other Regulatory Issues

Since September 2016, WFC faced significant challenges with numerous penalties and sanctions, including a cap on the asset position by the Federal Reserve.

The bank faced another class action lawsuit in July 2024, alleging that it mismanaged its employee health insurance plan, forcing thousands of U.S.-based employees to overpay for prescription medications. Per the former employees, Wells Fargo’s health plan pays inflated prices to pharmacy benefit managers, who negotiate with drugmakers, health insurance plans and pharmacies to set prescription drug prices.

In June 2024, WFC faced a proposed class action lawsuit alleging the bank for taking part in a $300-million Ponzi scheme. This scheme affected more than 1,000 investors, mainly senior citizens, and left them without substantial life savings. The lawsuit filed stated that WFC knew about the fraudulent activities from 2011 to 2021, and the company provided substantial assistance to the perpetrators while reaping benefits from the scam.

Over the past six months, shares of WFC have lost 8.9% against the industry’s growth of 9.1%.

Image Source: Zacks Investment Research

Wells Fargo currently carries a Zacks Rank #3 (Hold).

Other Finance Firms Under Litigation Probes

On Sept. 11, 2024, The Toronto-Dominion Bank TD agreed to pay a $28 million penalty in response to the Consumer Financial Protection Bureau (CFPB) order concerning credit reporting issues. The bank has been accused of mishandling customers’ credit information and failing to make necessary amendments to its practices.

TD signed a consent agreement with the CFPB admitting that it provided false information to consumer reporting companies, at times intentionally, and acknowledging its shortcomings in rectifying the failures that took place.

Earlier this month, in a settlement with the California Department of Justice over crypto withdrawals, Robinhood Markets, Inc.‘s HOOD cryptocurrency platform is set to pay $3.9 million. Per the claims, HOOD prevented its customers from withdrawing cryptocurrency from their accounts between 2018 and 2022.

Per California’s Attorney General Rob Bonta, HOOD violated California law as it failed to deliver cryptocurrencies that its customers bought, and because of this, customers were unable to withdraw their assets, forcing them to sell the same to exit the platform.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.