DAVA INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Endava plc Investors with Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Sept. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising — Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Endava plc (“Endava” or “the Company”) DAVA and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Endava securities between May 23, 2023, and February 28, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/DAVA.

Case Details

The Complaint alleges that defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (1) demand for Endava’s services was declining; (2) Endava’s clients delayed or canceled projects; and (3) as a result, Endava’s fiscal 2023 and 2024 revenue and earnings would be adversely affected.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/DAVA or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in Endava you have until October 25, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ATLAS REAL ESTATE PARTNERS WITH PROPERTY MELD TO ELEVATE PROPERTY OPERATIONS

RAPID CITY, S.D., Sept. 13, 2024 /PRNewswire/ — Atlas Real Estate, a fully vertically integrated single family rental owner and operator specializing in property management and institutional acquisitions and dispositions, is proud to announce its strategic partnership with Property Meld, the industry leading property maintenance software solution. This collaboration aims to streamline property operations, enhance resident satisfaction, and deliver greater value to investors.

As the real estate industry evolves, Atlas continues to prioritize operational efficiency and customer satisfaction. By incorporating Property Meld’s innovative software into their property management operations, Atlas will be able to increase efficiency while reducing costs for their investors.

“Investing more into Property Operations has been critical for us to drive up resident satisfaction and renewals while simultaneously keeping costs down for our investors,” said Tony Julianelle, CEO of Atlas Real Estate. “Our partnership with Property Meld enables us to harness technology that aligns with our vision of delivering exceptional results.”

Property Meld’s mission is to deliver superior customer outcomes by optimizing property maintenance workflows, minimizing delays, and enhancing transparency between property managers and residents. Their platform simplifies operations and provides real-time communication, empowering property managers to handle maintenance efficiently while ensuring a seamless and satisfying experience for renters. Through this approach, Property Meld aligns its technology with the needs of customers, driving better results and improving overall satisfaction.

“Atlas embodies what it means to be a data-driven organization who aligns the outcome of the customers with their business goals. We’re thrilled to be working with them to continue to level up Property Operations,” said Ray Hespen, CEO and Co-founder of Property Meld.

The partnership between Atlas and Property Meld marks a significant step in their shared goal of transforming the property management experience for both renters and investors, reinforcing their commitment to innovation and excellence.

About Atlas Real Estate: Atlas Real Estate is a Denver-based vertically integrated owner/operator of single family rentals specializing property management, and institutional acquisitions and dispositions. Atlas manages properties across the country, offering clients and investors a unique approach driven by data and expertise.

About Property Meld: Property Meld is a leading property maintenance software provider focused on improving the efficiency and communication of maintenance operations. Their technology ensures faster response times, better tenant satisfaction, and lower operating costs for property management teams.

For more information, please visit www.realatlas.com and www.propertymeld.com.

Contact: Madison Zimmerman, Property Meld

Phone: (605) 431-0265

Email: madison@propertymeld.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/atlas-real-estate-partners-with-property-meld-to-elevate-property-operations-302248100.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/atlas-real-estate-partners-with-property-meld-to-elevate-property-operations-302248100.html

SOURCE Property Meld

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Albemarle Stock Drops Despite Market Gains: Important Facts to Note

Albemarle ALB closed the latest trading day at $88.50, indicating a -0.9% change from the previous session’s end. This change lagged the S&P 500’s daily gain of 0.75%. On the other hand, the Dow registered a gain of 0.58%, and the technology-centric Nasdaq increased by 1%.

The specialty chemicals company’s shares have seen an increase of 22.58% over the last month, surpassing the Basic Materials sector’s gain of 0.53% and the S&P 500’s gain of 4.03%.

The investment community will be closely monitoring the performance of Albemarle in its forthcoming earnings report. The company is forecasted to report an EPS of -$0.03, showcasing a 101.09% downward movement from the corresponding quarter of the prior year. Meanwhile, the Zacks Consensus Estimate for revenue is projecting net sales of $1.39 billion, down 39.92% from the year-ago period.

For the full year, the Zacks Consensus Estimates are projecting earnings of $0.70 per share and revenue of $5.61 billion, which would represent changes of -96.85% and -41.62%, respectively, from the prior year.

Additionally, investors should keep an eye on any recent revisions to analyst forecasts for Albemarle. These revisions help to show the ever-changing nature of near-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook.

Empirical research indicates that these revisions in estimates have a direct correlation with impending stock price performance. To exploit this, we’ve formed the Zacks Rank, a quantitative model that includes these estimate changes and presents a viable rating system.

The Zacks Rank system, running from #1 (Strong Buy) to #5 (Strong Sell), holds an admirable track record of superior performance, independently audited, with #1 stocks contributing an average annual return of +25% since 1988. Over the last 30 days, the Zacks Consensus EPS estimate has moved 29.26% lower. Albemarle is holding a Zacks Rank of #3 (Hold) right now.

Looking at its valuation, Albemarle is holding a Forward P/E ratio of 128.49. This valuation marks a premium compared to its industry’s average Forward P/E of 16.26.

Meanwhile, ALB’s PEG ratio is currently 8.03. The PEG ratio bears resemblance to the frequently used P/E ratio, but this parameter also includes the company’s expected earnings growth trajectory. The Chemical – Diversified was holding an average PEG ratio of 1.12 at yesterday’s closing price.

The Chemical – Diversified industry is part of the Basic Materials sector. This group has a Zacks Industry Rank of 213, putting it in the bottom 16% of all 250+ industries.

The Zacks Industry Rank assesses the strength of our separate industry groups by calculating the average Zacks Rank of the individual stocks contained within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

T. Rowe Price's August AUM Balance Improves 1.6% Sequentially

T. Rowe Price Group, Inc. TROW announced its preliminary assets under management of $1.61 trillion for August 2024. The figure reflected a sequential increase of 1.6%.

TROW experienced net outflows of $5.3 billion in August 2024.

Breakdown of TROW’s AUM Performance

At the end of August, TROW’s equity products aggregated $825 billion, which increased 1.4% from the previous month’s level. Fixed income (including money market) rose marginally to $183 billion. Further, multi-asset products were $553 billion, which increased 2.2% from the previous month.

Alternative products of $51 billion increased 2% from the prior month’s level.

T. Rowe Price registered $474 billion in target date retirement portfolios in August 2024, which increased 2.2% from the prior month.

Our Take on TROW

The company’s solid AUM balance, broadening distribution reach and efforts to diversify business through acquisitions are likely to support its top-line growth in the long term. However, the company’s overdependence on investment advisory fees is concerning. Also, T. Rowe Price’s bottom-line growth continues to be under pressure due to high costs.

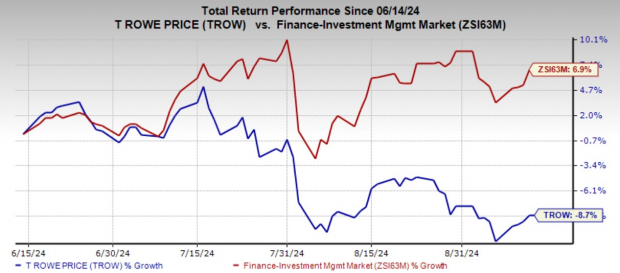

Over the past three months, shares of T. Rowe Price have lost 8.7% against the industry’s 6.9% growth.

Image Source: Zacks Investment Research

Currently, TROW carries a Zacks Rank #3 (Hold).

Performance of Other Asset Managers

Franklin Resources, Inc. BEN reported its preliminary AUM of $1.68 trillion as of Aug. 31, 2024. This reflected an increase of 1.1% from the prior month’s level.

The improvement in BEN’s AUM balance was due to the impact of positive markets, partially offset by long-term net outflows.

Cohen & Steers, Inc. CNS reported a preliminary AUM of $88.1 billion as of Aug. 31, 2024. This reflected a rise of 4.1% from the prior month’s level.

The increase in CNS’ AUM balance was driven by the market appreciation of $3.7 billion and net inflows of $8 billion, partially offset by distributions of $152 million.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump says he is not selling his shares of media company

By Alexandra Ulmer

RANCHO PALOS VERDES, California (Reuters) -Republican presidential candidate Donald Trump said on Friday he will not sell his shares in the company that owns his Truth Social platform when limits on selling are lifted in the coming days, driving up the stock after a recent selloff.

Shares of Trump Media & Technology Group surged as much as 30% following his comments before closing with a 12% gain for the day.

Trump owns about 57% of Trump Media, which saw its shares slump this week following his televised debate with Democratic rival Vice President Kamala Harris.

Friday’s leap in the stock follows weeks of steady declines ahead of key dates this month when Trump and other company insiders will be allowed to sell their shares.

“No, I’m not selling,” the former president said in answer to a question asked by Reuters. “I’m not leaving. I love it. I think it’s great.”

Trump Media saw its value balloon to nearly $10 billion following its stock market listing in March. Trump Media’s stock is popular among retail traders and is seen as a speculative bet on his chances of securing a second four-year term as president.

However, since its listing, Trump Media shares have lost most of their value, with losses accelerating in recent weeks after President Joe Biden gave up his reelection bid and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election.

According to provisions related to Trump Media’s listing, Trump and other insiders will be allowed to sell stock beginning later this month, potentially flooding the market with additional shares.

If the stock price remains at or above $12 for any 20 trading days commencing Aug. 22, then Trump will be free to sell shares beginning on Sept. 20. Otherwise, he is eligible to sell shares beginning on Sept. 26.

The stock ended at $17.97 on Friday following Trump’s comments, making his stake worth about $2 billion. Forbes values Trump’s wealth at $3.7 billion.

Trump Media’s revenue is equivalent to two Starbucks coffee shops, and strategists say its $3.6 billion stock market value is detached from its day-to-day business. It lost $869,900 in its most recent reported quarter ended June 30.

“There are no fundamentals behind this company. It doesn’t have a path to profitability. It’s just driven by commentary, and by hopes and dreams,” said Dennis Dick, a trader at Triple D Trading.

The upcoming lock-up expiry related to Trump’s shares is “something a lot of people on the street have been watching for weeks, if not since its inception now,” said Jay Woods, chief global strategist at Freedom Capital Markets, ahead of Trump’s statement that he would not sell.

A New York judge earlier this month delayed Trump’s sentencing in his hush money criminal case to Nov. 12, after the election, months after the U.S. Supreme Court’s landmark decision on presidential immunity, easing at least for the short term pressure over legal fees.

The Nasdaq stock exchange halted trading in Trump Media’s shares for two five-minute periods following Trump’s comments, a common occurrence during bouts of volatility.

“What right do they have to do this?,” Trump later posted on Truth Social, while also threatening to move his company’s listing to the New York Stock Exchange.

(Reporting by Alexandra Ulmer; writing and additional reporting by Noel Randewich in Oakland, California; additional reporting by Medha Singh in Bengaluru; editing by Megan Davies, David Ljunggren, Jonathan Oatis and Deepa Babington)

Rent Support for Survivors of Gender-Based Violence in Prince Edward Island

CHARLOTTETOWN, PE, Sept. 13, 2024 /CNW/ – The federal and provincial governments announced an enhancement to the Canada Housing Benefit (CHB) that will provide financial support for Survivors of Gender-Based Violence. The two governments are investing nearly $6 million each to help survivors cover housing expenses such as rent, mortgage payments, and property taxes.

This was announced today by Sean Casey, Member of Parliament for Charlottetown, the Honourable Rob Lantz, provincial Minister of Housing, Land and Communities, and the Honourable Natalie Jameson, provincial Minister responsible for the Status of Women.

Prince Edward Island is the fourth province in Canada to partner with the federal government through the CHB for Survivors of Gender-Based Violence program. This benefit is expected to support approximately 195 people in need. They will be able to receive up to $7,200 annually ($600 per month), and a one-time non-repayable damage deposit of up to $2,000.

The CHB for survivors of gender-based violence is an enhancement to the existing CHB that provides support to women, children and 2SLGBTQI+ people find a safe and affordable place to call home. While this CHB funding is specifically for survivors of gender-based violence, provinces and territories will have the flexibility to use their share of funding to support survivors of gender-based violence or other priority vulnerable populations with direct- assistance.

Quotes:

“Everyone deserves safe and accessible housing. With this agreement, our government is making an estimated 195 households more affordable. This new funding will support families and individuals that have experienced gender-based violence by providing housing that is safe and secure. We must uplift and support those most vulnerable throughout our communities.” – Sean Casey, Member of Parliament for Charlottetown, on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“This direct portable shelter subsidy for households will help reduce financial barriers to individuals and help them leave an unsafe situation that has exposed them to abuse. This partnership is about much more than supporting bricks and mortar, it is about offering hope, safety and a path forward for survivors of gender-based violence.” – Honourable Rob Lantz, provincial Minister of Housing, Land and Communities

“This benefit will help reduce critical barriers for individuals who are making the courageous decision to leave a situation that has exposed them to violence and provide financial stability in a time of trauma and upheaval. We all need to work together to address and eliminate gender-based violence.” – Honourable Natalie Jameson, provincial Minster responsible for the Status of Women

Quick facts:

- The federal government announced in November 2017 that it would invest $2 billion in a new Canada Housing Benefit (CHB) as part of the National Housing Strategy (NHS). Provinces and territories are cost-matching this funding for a total $4 billion investment over eight years, starting in 2020-21.

- The CHB provides funding directly to households in need to help them afford their housing costs.

- The federal government worked with provinces and territories to create 13 CHB initiatives, one for each jurisdiction. These initiatives were co-developed to prioritize vulnerable groups in each jurisdiction. The provinces and territories are responsible for delivering the CHB in their jurisdictions.

- The CHB for Survivors of Gender-Based Violence (SGBV) is an enhancement to the already existing CHB.

- Budget 2021 included an additional $315.4 million over seven years for the CHB to provide financial assistance for low-income women and children fleeing violence.

- In November 2022, the National Action Plan to End Gender-Based Violence (Action Plan) was introduced. It defines gender-based violence as that which is “based on gender norms and unequal power dynamics, perpetrated against someone based on their gender, gender expression, gender identity, or perceived gender. It may take many forms, including physical, economic, sexual, as well as emotional (psychological) abuse.” This may include intimate partner violence and human trafficking.

- Prince Edward Island survivors of gender-based violence can access the program by self-referring to the PEI Housing Corporation or by referral through participating community partners.

- For more information on how to apply and eligibility requirements, visit PrinceEdwardIsland.Ca/Housing or contact the PEI Housing Corporation toll-free at 1-877-368-5770 or by email at housing@gov.pe.ca.

Additional Information:

- Visit Canada.ca/housing for the most requested Government of Canada housing information.

- CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford and that meets their needs. For more information, visit www.placetocallhome.ca.

- Visit National Action Plan to End Gender-Based Violence to learn more about the plan.

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c3496.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c3496.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: Kimberly E Ritrievi Cashes Out $302K In Tetra Tech Stock

Disclosed on September 12, Kimberly E Ritrievi, Director at Tetra Tech TTEK, executed a substantial insider sell as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Ritrievi sold 6,500 shares of Tetra Tech. The total transaction value is $302,120.

Tracking the Friday’s morning session, Tetra Tech shares are trading at $46.06, showing a down of 0.0%.

Delving into Tetra Tech’s Background

Tetra Tech Inc provides consulting and engineering services for environmental, infrastructure, resource management, energy, and international development markets. It specializes in providing water-related services for public and private clients. It designs infrastructure, facilities, and other structures with complex plans and resource management. Tetra Tech has two reportable segments. Its Government Services Group (GSG) reportable segment primarily includes activities with U.S. government clients (federal, state and local) and activities with development agencies worldwide. Commercial/International Services Group (CIG) reportable segment primarily includes activities with U.S. commercial clients and international clients other than development agencies.

Tetra Tech’s Economic Impact: An Analysis

Revenue Growth: Tetra Tech’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 11.2%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Exploring Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 16.6%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Tetra Tech’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.32.

Debt Management: Tetra Tech’s debt-to-equity ratio is below the industry average. With a ratio of 0.63, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 42.64 is lower than the industry average, implying a discounted valuation for Tetra Tech’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 2.44 is lower than the industry average, implying a discounted valuation for Tetra Tech’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Tetra Tech’s EV/EBITDA ratio, surpassing industry averages at 24.15, positions it with an above-average valuation in the market.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Transaction Codes Worth Your Attention

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Tetra Tech’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ROOTS REPORTS SECOND QUARTER FISCAL 2024 RESULTS

TORONTO, Sept. 13, 2024 /CNW/ – Roots (“Roots,” “Roots Canada” or the “Company”) ROOT, a premium outdoor-lifestyle brand, announced today financial results for its second quarter ended August 3, 2024 (“Q2 2024”). All financial results are reported in Canadian dollars unless otherwise stated. Certain metrics, including those expressed on an adjusted or comparable basis, are non-IFRS measures or supplementary financial measures. See “Non-IFRS Measures and Industry Metrics”.

“Our second-quarter results demonstrate stable comparable sales and an improvement compared to Q1 2024, alongside growth in product margins and net income, despite the challenging consumer environment,” commented Meghan Roach, President & CEO, Roots Corporation.

“We were also pleased to see growth during the “back-to-school” period, underscoring the strength of our product portfolio and the effectiveness of our ongoing initiatives in branding, marketing, and enhancing the in-store experience; however, it is early in the quarter.”

Second Quarter Highlights

- Sales were $47.7 million compared to $49.4 million in Q2 2023

- DTC sales were $36.4 million compared to $37.1 million in Q2 2023, with nearly flat comparable sales of (0.2%), improving from Q1 2024 comparable sales of (8.2%)

- Gross margin was 56.4%, up 90bps compared to 55.5% Q2 2023

- Net income (loss) totaled ($5.2) million, an improvement from ($5.3) million in Q2 2023

- Net income (loss) per share of ($0.13), flat to Q2 2023

- Adjusted EBITDA amounted to ($3.1) million versus ($3.0) million in Q2 2023

- Net debt reduced 19.9% year-over-year to $40.8 million

- Inventory was $44.0 million, a 21% reduction compared to $55.9 million in Q2 2023

|

SELECT FINANCIAL INFORMATION (in ‘000s of CAD$, except where noted) |

Second quarter ended |

Year-to-date |

||||

|

August 3, |

July 29, |

Change |

August 3, |

July 29, |

Change |

|

|

Total sales |

47,747 |

49,404 |

(3.4 %) |

85,208 |

90,900 |

(6.3 %) |

|

Direct-to-Consumer (“DTC”) sales |

36,417 |

37,103 |

(1.8 %) |

67,822 |

72,509 |

(6.5 %) |

|

Partners & Other (“P&O”) sales |

11,330 |

12,301 |

(7.9 %) |

17,386 |

18,391 |

(5.5 %) |

|

Gross profit |

26,920 |

27,441 |

(1.9 %) |

49,021 |

51,922 |

(5.6 %) |

|

Gross margin |

56.4 % |

55.5 % |

90 bps2 |

57.5 % |

57.1 % |

40 bps2 |

|

Selling, General and Administrative |

31,845 |

32,338 |

(1.5 %) |

63,827 |

65,344 |

(2.3 %) |

|

Net income (loss) |

(5,236) |

(5,334) |

1.8 % |

(14,131) |

(13,300) |

(6.2 %) |

|

Net income (loss) per share |

($0.13) |

$(0.13) |

– |

($0.35) |

$(0.32) |

(9.4 %) |

|

Adjusted EBITDA |

(3,131) |

(2,983) |

(5.0 %) |

(11,090) |

(8,831) |

(25.6 %) |

|

Free Cash Flow1 |

(8,954) |

(7,173) |

(24.8 %) |

(23,567) |

(22,044) |

(6.9 %) |

|

Net debt |

– |

– |

– |

40,774 |

50,921 |

(19.9 %) |

|

1 Free cash flow is a supplementary financial measure that reflects cash flow generated from ongoing operations, calculated as our cash from operating activities less cash used in investing activities and the payment of principal on lease liabilities net of lease incentives. See “Non-IFRS Measures and Industry Metrics”. |

|

2 Basis points (“bps”). |

“We ended the second quarter in a healthy inventory position, addressing the core inventory shortfall while maintaining lower year-over-year inventory levels,” said Leon Wu, Chief Financial Officer. “We are pleased with the improving sales trends, while also growing product margins and remaining disciplined on costs, resulting in the continued strengthening of our balance sheet.”

SECOND QUARTER OVERVIEW

Total sales were $47.7 million in Q2 2024, representing a decrease of 3.4% from $49.4 million in the second quarter of fiscal 2023 (“Q2 2023”).

DTC sales (corporate retail store and eCommerce sales) were $36.4 million, down 1.8% from $37.1 million in Q2 2023. DTC comparable sales were nearly flat, at (0.2%), driven by strengthening of sales in certain core fleece collections as the quarter progressed, as inventory was replenished, partially offset by declines in primarily off-price focused store locations due to improved inventory health. In addition, DTC sales were impacted by the closure of select stores since Q2 2023, as part of our ongoing store fleet optimization initiatives to consolidate less profitable stores and drive same-store sales growth.

P&O sales (wholesale Roots branded products, licensing to select manufacturing partners and the sale of certain custom products) amounted to $11.3 million in Q2 2024 and $12.3 million in Q2 2023. This was driven by lower sales to our international operating partner in Taiwan, as a result of earlier timing of certain orders that benefited Q2 2023, partially offset by increased royalties from the licensing of the Roots brand to select manufacturing partners.

Gross profit reached $26.9 million in Q2 2024 compared to $27.4 million in Q2 2023, representing a year-over-year decrease of 1.9%. Gross margin was 56.4% in Q2 2024 compared to 55.5% in Q2 2023.

DTC gross margin was 61.7% in Q2 2024, down 100 bps from 62.7% in Q2 2023. DTC gross margin increased by 230 bps from product margin expansion, comprised of improved product costing and lower discounting. This was offset by the combined impacts of an unfavourable foreign exchange impact on U.S. dollar purchases, the timing of certain import duty recoveries received, and lower benefits from the reversal of non-cash accounting inventory provisions accrued.

SG&A expenses totaled $31.8 million in Q2 2024 compared to $32.3 million in Q2 2023, representing a year-over-year decrease of 1.5%. Decreases in SG&A expenses were driven from ongoing cost management initiatives, including lower store occupancy costs, and lower variable selling costs. This was partially offset by higher store personnel costs as a result of legislative minimum wage increases in 2023.

Net income (loss) totaled ($5.2) million, or ($0.13) per share, in Q2 2024, improving from a net income (loss) of ($5.3) million, or ($0.13) per share, in Q2 2023.

Adjusted EBITDA amounted to ($3.1) million in Q2 2024 as compared to ($3.0) million in Q2 2023.

YEAR-TO-DATE RESULTS

For the first six months of fiscal 2024, total sales amounted to $85.2 million, representing a decrease of 6.3% compared to the first six months of fiscal 2023, which amounted to $90.9 million. DTC sales decreased 6.5% to $67.8 million, while P&O sales decreased by 5.5% to $17.4 million. Gross profit stood at $49.0 million, or 57.5% of sales, down from $51.9 million, or 57.1% of sales, last year.

Net income (loss) was ($14.1) million, or ($0.35) per share, compared to ($13.3) million, or ($0.32) per share, last year.

Adjusted EBITDA totaled ($11.1) million as compared to ($8.8) million in the corresponding period in 2023.

FINANCIAL POSITION

Inventory was $44.0 million at the end of Q2 2024, as compared to $55.9 million at the end of Q2 2023, representing a decrease of $11.9 million or 21.3%. The year-over-year decrease reflects the improved inventory health of the business, resulting from the sell-through of prior markdown and pack-and-hold collections in 2023, partially offset by the replenishment of certain core collections towards the end of the quarter.

Free cash flow was ($9.0) million in Q2 2024, as compared to ($7.2) million in Q2 2023, resulting from a return to seasonal inventory purchase cadences. Inventory purchases were reduced in Q2 2023 as a result of higher than desired inventory levels entering fiscal 2023.

As at August 3, 2024, Roots had net debt of $40.8 million, improving from $50.9 million a year earlier. The Company’s leverage ratio, defined as total net debt to trailing 12-months Adjusted EBITDA, was 2.3x as at Q2 2024. Roots has $44.5 million outstanding under its credit facilities and total liquidity of $62.4 million, including net cash and borrowing capacity available under its revolving credit facility.

CONFERENCE CALL AND WEBCAST INFORMATION

Roots will hold a conference call to review its second quarter 2024 results on September 13, 2024, at 8:00 a.m. ET. All interested parties can join the call by dialing 1-437-900-0527 or 1-888-510-2154 and using conference ID: 42913. Please dial in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until September 20, 2024, at midnight, and can be accessed by dialing 1-289-819-1450 or 1-888-660-6345 and entering the replay passcode: 42913 #.

A live audio webcast of the conference call will be available on the Events and Presentations section of the Company’s investor website at https://investors.roots.com or by following the link here. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available on the Company’s website for one year.

NON-IFRS MEASURES AND INDUSTRY METRICS

This press release makes reference to certain non-IFRS measures including certain metrics specific to the industry in which we operate. These measures are not recognized measures under International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), do not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures are not intended to represent, and should not be considered as alternatives to net income or other performance measures derived in accordance with IFRS as measures of operating performance or operating cash flows or as a measure of liquidity. In addition to our results determined in accordance with IFRS, we use non-IFRS financial measures including “EBITDA”, “Adjusted EBITDA”, and “Net Debt”; and non-IFRS ratio: “leverage ratio”. This press release also makes reference to “gross margin”, “DTC gross margin”, and “comparable sales”, which are commonly used metrics in our industry but that may be calculated differently compared to other companies. Gross margin, DTC gross margin and comparable sales are considered supplementary financial measures under applicable securities laws.

We believe these non-IFRS measures and industry metrics provide useful information to both management and investors in measuring our financial performance and condition and highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. For further information regarding these non-IFRS measures, please refer to “Cautionary Note-Regarding Non-IFRS Measures and Industry Metrics” in our management’s discussion and analysis for Q2 2024, which is incorporated by reference herein and is available on SEDAR+ at www.sedarplus.ca or the Company’s Investor Relations website at https://investors.roots.com.

Reconciliation of net income (loss) to EBITDA and Adjusted EBITDA:

|

CAD $000s |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

|||

|

Net income (loss) |

(5,236) |

(5,334) |

(14,131) |

(13,300) |

|||

|

Add the impact of: |

|||||||

|

Interest expense (a) |

2,177 |

2,303 |

4,304 |

4,572 |

|||

|

Income taxes expense (recovery) (a) |

(1,866) |

(1,866) |

(4,979) |

(4,694) |

|||

|

Depreciation and amortization (a) |

7,302 |

7,351 |

14,543 |

14,888 |

|||

|

EBITDA |

2,377 |

2,454 |

(263) |

1,466 |

|||

|

Adjust for the impact of: |

|||||||

|

SG&A: Rent expense excluded from net income (loss) as a |

(5,892) |

(5,861) |

(11,481) |

(11,560) |

|||

|

SG&A: Purchase accounting adjustments(b) |

(7) |

(13) |

(13) |

(21) |

|||

|

SG&A: Stock option expense(c) |

46 |

133 |

137 |

233 |

|||

|

SG&A: Changes in key personnel(d) |

343 |

304 |

532 |

1,049 |

|||

|

SG&A: Non-recurring legal fee(e) |

2 |

– |

(2) |

2 |

|||

|

Adjusted EBITDA(f) |

(3,131) |

(2,983) |

(11,090) |

(8,831) |

|

_______________ |

|

|

Notes: |

|

|

(a) |

The impact of IFRS 16 – Leases (“IFRS 16”) in Q2 2024 and Q2 2023 was: (i) a decrease to SG&A expenses of $1,390 and $1,428, respectively, which comprised the impact of depreciation and lease modifications on the right-of-use (“ROU“) assets, net of the exclusion of rent payments from SG&A expenses, (ii) a decrease in interest expense of $1,242 and $1,134, respectively, arising from interest expense recorded on the lease liabilities in the period, and (iii) a deferred tax expense (recovery) impact of $40 and $77, respectively, based on tax attributes on the ROU assets and lease liabilities balances recorded. The impact of IFRS 16 in YTD 2024 and YTD 2023 was: (i) a decrease to SG&A expenses of $2,487 and $2,533, respectively, which comprised the impact of depreciation and lease modifications on the ROU assets, net of the exclusion of rent payments from SG&A expenses, (ii) an increase in interest expense of $2,533 and $2,294, respectively, arising from interest expense recorded on the lease liabilities in the period, and (iii) a deferred tax expense (recovery) impact of $(12) and $63, respectively, based on tax attributes on the ROU assets and lease liabilities balances recorded. |

|

(b) |

As a result of the Company’s acquisition of assets from Roots Canada Ltd., Roots U.S.A. Inc., and Roots America L.P., and the outstanding shares of Roots International ULC effective December 1, 2015 (the “Acquisition”), the Company recognized an intangible asset for lease arrangements in the amount of $6,310, which when excluding the impacts of IFRS 16, is amortized over the life of the leases and included in SG&A expenses. |

|

(c) |

Represents non-cash share-based compensation expense in respect of our Legacy Equity Incentive Plan, Legacy Employee Option Plan, and Omnibus Equity Incentive Plan. |

|

(d) |

Represents expenses incurred in respect of the Company’s efforts to recruit for vacancies in key management positions and severance costs associated with employee separations relating to such positions. |

|

(e) |

Represents non-recurring legal costs that are outside the scope of normal operations. |

|

(f) |

Adjusted EBITDA excludes the impact of IFRS 16. If the impact of IFRS 16 was included for Q2 2024 and Q2 2023, Adjusted EBITDA would have been $2,768 and $2,891, respectively. If the impact of IFRS 16 was included for YTD 2024 and YTD 2023, Adjusted EBITDA would have been $404 and $2,750, respectively. |

Reconciliation of long-term debt to net debt and leverage ratio:

|

As at |

|||||

|

CAD $000s |

August 3, |

July 29, |

February 3, |

||

|

Long-term debt(1) |

$ 43,128 |

$ 55,500 |

$ 45,010 |

||

|

Add: bank indebtedness |

350 |

831 |

– |

||

|

Less: cash |

(2,704) |

(5,410) |

(28,033) |

||

|

Net debt |

$ 40,774 |

$ 50,921 |

$ 16,977 |

||

|

Trailing 12-month Adjusted EBITDA |

17,596 |

21,969 |

26,967 |

||

|

Leverage ratio |

2.3x |

2.3x |

0.6x |

||

|

(1) |

Total long-term debt of $43,128 at August 3, 2024 is net of $1,064 unamortized long-term debt financing costs. As at July 29, 2023, total long-term debt of $55,500 is net of $1,428 unamortized long-term debt financing costs. As at February 3, 2024, total long-term debt of $45,010 is net of $1,194 unamortized long-term debt financing costs. |

ABOUT ROOTS

Established in 1973, Roots is a global lifestyle brand. Starting from a small cabin in northern Canada, Roots has become a global brand with over 100 corporate retail stores in Canada, two stores in the United States, and an eCommerce platform, roots.com. We have more than 100 partner-operated stores in Asia, and we also operate a dedicated Roots-branded storefront on Tmall.com in China. We design, market, and sell a broad selection of products in different departments, including women’s, men’s, children’s, and gender-free apparel, leather goods, footwear, and accessories. Our products are built with uncompromising comfort, quality, and style that allows you to feel At Home With Nature™. We offer products designed to meet life’s everyday adventures and provide you with the versatility to live your life to the fullest. We also wholesale through business-to-business channels and license the brand to a select group of licensees selling products to major retailers. Roots Corporation is a Canadian corporation doing business as “Roots” and “Roots Canada”.

FORWARD-LOOKING INFORMATION

Certain information in this press release contains forward-looking information. This information is based on management’s reasonable assumptions and beliefs in light of the information currently available to us and is made as of the date of this press release. Actual results and the timing of events may differ materially from those anticipated in the forward-looking information as a result of various factors. Information regarding our expectations of future results, performance, achievements, prospects or opportunities or the markets in which we operate is forward-looking information. Statements containing forward-looking information are not facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances. Many factors could cause our actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements.

See “Forward-Looking Information” and “Risk Factors” in the Company’s current Annual Information Form for a discussion of the uncertainties, risks and assumptions associated with these statements. Readers are urged to consider the uncertainties, risks and assumptions carefully in evaluating the forward-looking information and are cautioned not to place undue reliance on such information. We have no intention and undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities law.

SOURCE Roots Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c8707.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c8707.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cytokinetics's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bearish on Cytokinetics CYTK, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CYTK often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for Cytokinetics. This is not a typical pattern.

The sentiment among these major traders is split, with 22% bullish and 66% bearish. Among all the options we identified, there was one put, amounting to $78,210, and 8 calls, totaling $454,049.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $55.0 and $75.0 for Cytokinetics, spanning the last three months.

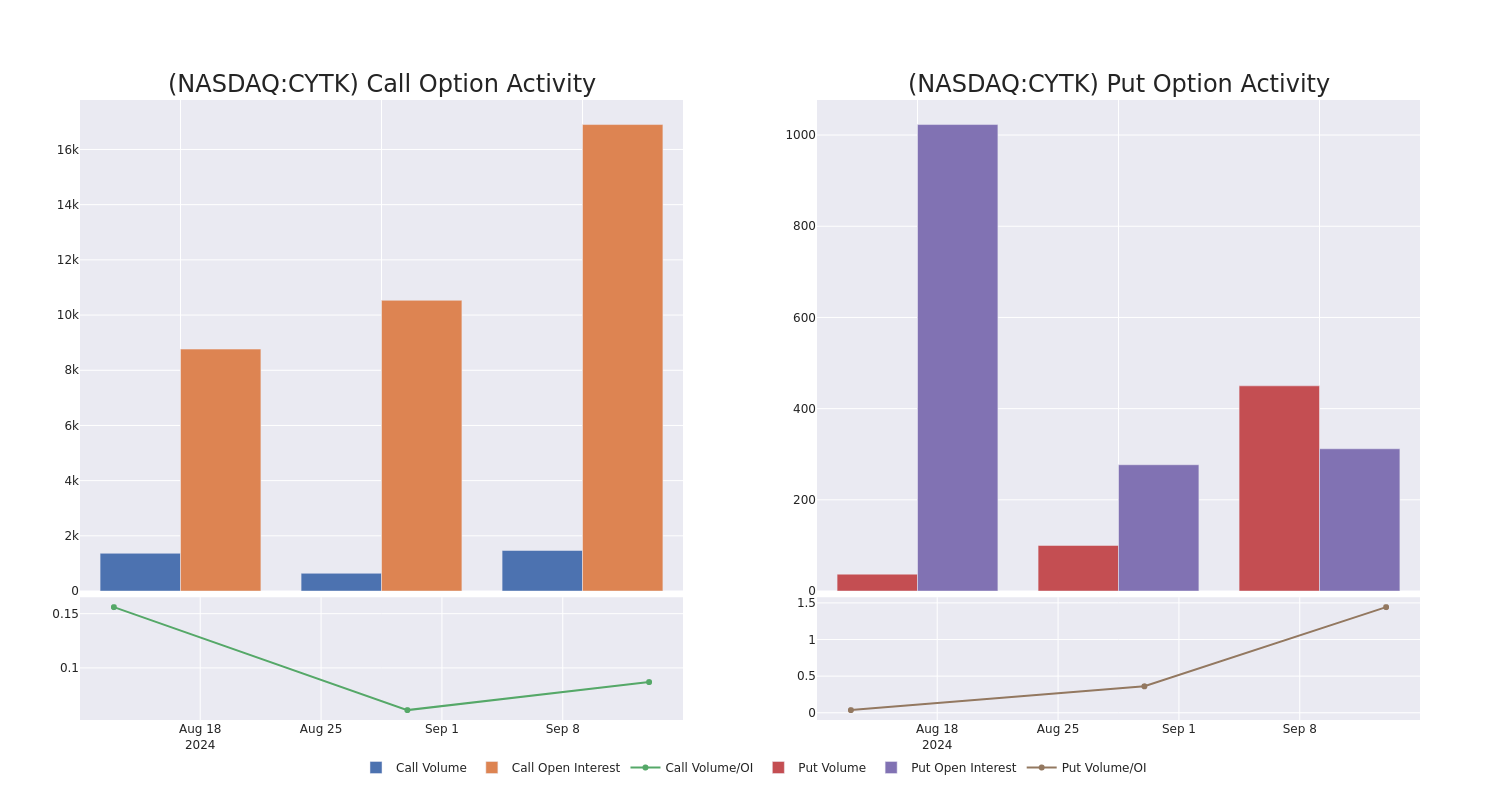

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Cytokinetics options trades today is 2869.17 with a total volume of 1,920.00.

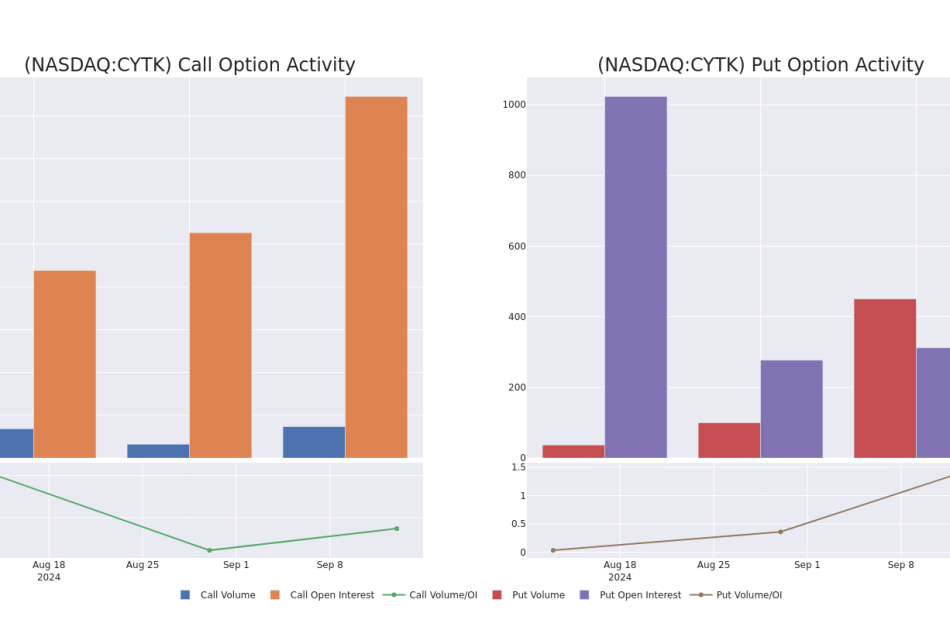

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cytokinetics’s big money trades within a strike price range of $55.0 to $75.0 over the last 30 days.

Cytokinetics Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CYTK | CALL | SWEEP | BULLISH | 10/18/24 | $4.6 | $4.1 | $4.6 | $55.00 | $108.2K | 4 | 408 |

| CYTK | CALL | TRADE | BEARISH | 01/17/25 | $5.7 | $5.2 | $5.2 | $75.00 | $79.5K | 13.0K | 348 |

| CYTK | PUT | SWEEP | BEARISH | 10/18/24 | $3.3 | $2.9 | $3.3 | $55.00 | $78.2K | 312 | 450 |

| CYTK | CALL | TRADE | BEARISH | 01/17/25 | $5.6 | $5.2 | $5.2 | $75.00 | $52.0K | 13.0K | 303 |

| CYTK | CALL | SWEEP | NEUTRAL | 01/17/25 | $8.8 | $8.6 | $8.6 | $60.00 | $46.4K | 1.4K | 32 |

About Cytokinetics

Cytokinetics Inc is a biotechnology company that develops muscle biology-driven treatments for diseases characterized by reduced muscle function, muscle weakness, and fatigue. The company develops treatments for diseases such as amyotrophic lateral sclerosis, heart failure, spinal muscular atrophy, and chronic obstructive pulmonary diseases. The treatment is based on small molecules specifically engineered to increase muscle function and contractility. The company is developing muscle-directed investigational medicines that may potentially improve the health span of people with devastating cardiovascular and neuromuscular diseases of impaired muscle function.

Having examined the options trading patterns of Cytokinetics, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Cytokinetics’s Current Market Status

- Currently trading with a volume of 246,671, the CYTK’s price is up by 3.37%, now at $55.88.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 48 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cytokinetics options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.