T. Rowe Price's August AUM Balance Improves 1.6% Sequentially

T. Rowe Price Group, Inc. TROW announced its preliminary assets under management of $1.61 trillion for August 2024. The figure reflected a sequential increase of 1.6%.

TROW experienced net outflows of $5.3 billion in August 2024.

Breakdown of TROW’s AUM Performance

At the end of August, TROW’s equity products aggregated $825 billion, which increased 1.4% from the previous month’s level. Fixed income (including money market) rose marginally to $183 billion. Further, multi-asset products were $553 billion, which increased 2.2% from the previous month.

Alternative products of $51 billion increased 2% from the prior month’s level.

T. Rowe Price registered $474 billion in target date retirement portfolios in August 2024, which increased 2.2% from the prior month.

Our Take on TROW

The company’s solid AUM balance, broadening distribution reach and efforts to diversify business through acquisitions are likely to support its top-line growth in the long term. However, the company’s overdependence on investment advisory fees is concerning. Also, T. Rowe Price’s bottom-line growth continues to be under pressure due to high costs.

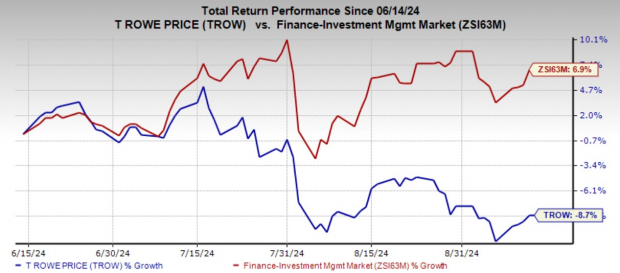

Over the past three months, shares of T. Rowe Price have lost 8.7% against the industry’s 6.9% growth.

Image Source: Zacks Investment Research

Currently, TROW carries a Zacks Rank #3 (Hold).

Performance of Other Asset Managers

Franklin Resources, Inc. BEN reported its preliminary AUM of $1.68 trillion as of Aug. 31, 2024. This reflected an increase of 1.1% from the prior month’s level.

The improvement in BEN’s AUM balance was due to the impact of positive markets, partially offset by long-term net outflows.

Cohen & Steers, Inc. CNS reported a preliminary AUM of $88.1 billion as of Aug. 31, 2024. This reflected a rise of 4.1% from the prior month’s level.

The increase in CNS’ AUM balance was driven by the market appreciation of $3.7 billion and net inflows of $8 billion, partially offset by distributions of $152 million.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply