WFC Signs Agreement With OCC to Fix AML Program, Stock Dips 4%

Shares of Wells Fargo & Company lost 4% following the announcement of a formal agreement with the Office of the Comptroller of the Currency concerning the bank’s anti-money laundering (AML) and sanctions risk management practices.

The agreement points out flaws in the bank’s anti-money laundering internal controls and risk management procedures in several areas, such as the reporting of suspicious activity and currency transactions, customer due diligence and the bank’s customer identification and beneficial ownership initiatives.

The bank first disclosed this probe in its second-quarter Securities and Exchange Commission (SEC) filing, where it mentioned that it is in “resolution discussions” with the U.S. SEC about an investigation related to the cash sweep options it provides to new investment advisory clients.

Wells Fargo has taken a significant step in strengthening its AML and sanctions risk management capabilities with the official agreement with the OCC. The latest agreement is in line with the bank’s continuous efforts to enhance its risk management system and adhere to regulatory requirements.

WFC’s management stated, “We have been working to address a substantial portion of what’s required in the formal agreement, and we are committed to completing the work with the same sense of urgency as our other regulatory commitments.”

Other Details of WFC’s Agreement With OCC

The agreement mandates the establishment of a Compliance Committee to oversee Wells Fargo’s adherence to its terms. Specifically, the action plan should be targeted at areas, such as front-line risk management, independent risk management, independent testing, customer identification and suspicious activity detection.

The agreement stipulates that the bank must improve its AML and sanctions risk management procedures, get the OCC to approve its program for evaluating the AML and sanctions risks of new offerings, and notify the OCC prior to expanding any of those products.

WFC’s Other Regulatory Issues

Since September 2016, WFC faced significant challenges with numerous penalties and sanctions, including a cap on the asset position by the Federal Reserve.

The bank faced another class action lawsuit in July 2024, alleging that it mismanaged its employee health insurance plan, forcing thousands of U.S.-based employees to overpay for prescription medications. Per the former employees, Wells Fargo’s health plan pays inflated prices to pharmacy benefit managers, who negotiate with drugmakers, health insurance plans and pharmacies to set prescription drug prices.

In June 2024, WFC faced a proposed class action lawsuit alleging the bank for taking part in a $300-million Ponzi scheme. This scheme affected more than 1,000 investors, mainly senior citizens, and left them without substantial life savings. The lawsuit filed stated that WFC knew about the fraudulent activities from 2011 to 2021, and the company provided substantial assistance to the perpetrators while reaping benefits from the scam.

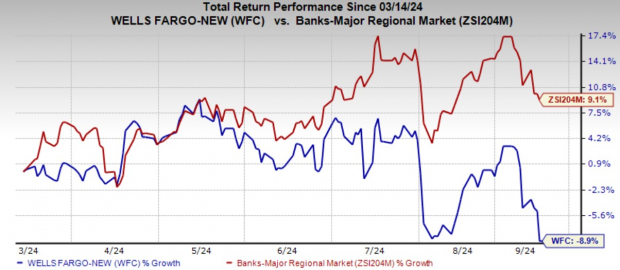

Over the past six months, shares of WFC have lost 8.9% against the industry’s growth of 9.1%.

Image Source: Zacks Investment Research

Wells Fargo currently carries a Zacks Rank #3 (Hold).

Other Finance Firms Under Litigation Probes

On Sept. 11, 2024, The Toronto-Dominion Bank TD agreed to pay a $28 million penalty in response to the Consumer Financial Protection Bureau (CFPB) order concerning credit reporting issues. The bank has been accused of mishandling customers’ credit information and failing to make necessary amendments to its practices.

TD signed a consent agreement with the CFPB admitting that it provided false information to consumer reporting companies, at times intentionally, and acknowledging its shortcomings in rectifying the failures that took place.

Earlier this month, in a settlement with the California Department of Justice over crypto withdrawals, Robinhood Markets, Inc.‘s HOOD cryptocurrency platform is set to pay $3.9 million. Per the claims, HOOD prevented its customers from withdrawing cryptocurrency from their accounts between 2018 and 2022.

Per California’s Attorney General Rob Bonta, HOOD violated California law as it failed to deliver cryptocurrencies that its customers bought, and because of this, customers were unable to withdraw their assets, forcing them to sell the same to exit the platform.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply