Billionaire Bill Gates Has 69% of His Foundation's $48 Billion Portfolio Invested in Just 3 Phenomenal Stocks

When Bill Gates became a billionaire in 1987, he was the youngest person to reach that milestone. He reached billionaire status at 23, and 12 years later became the first centibillionaire, achieving a $100 billion net worth well ahead of anyone else.

Gates and his then-wife Melinda established a charitable foundation in 2000 to enhance healthcare and reduce poverty around the world, the Bill and Melinda Gates Foundation. Over the past 25 years, Gates has donated much of his wealth to the foundation, and he plans to donate the entirety of his assets to charity throughout his lifetime.

Gates’ fellow centibillionaire Warren Buffett has also pledged donations to the Gates Foundation since 2006, but those contributions will end after his death. Buffett also served as a trustee for the foundation until 2021, and likely influenced how the trust invests its funds.

The trust’s equity portfolio is currently valued around $48 billion, but more than two-thirds of that amount, about 69%, is invested in just three stocks.

1. Microsoft (31%)

Gates donated $20 billion to his foundation in 2022, and it appears a large chunk of the donation came in the form of Microsoft (NASDAQ: MSFT) stock. Gates is still one of the largest shareholders in the company he founded, and the company’s stock still accounts for a large portion of his wealth. The trust added about 38 million shares to its portfolio in 2022, worth about $8.9 billion at the time.

The trust fund still has almost 35 million shares of the stock left in its portfolio, and the value has climbed to $14.8 billion. Holding on to those Microsoft shares has worked out well for the foundation (and Gates). The stock is up more than 60% since July of 2022, when Gates made his donation.

Microsoft’s strong performance over the last two years can be attributed to its role in the growth of generative artificial intelligence. The company increased its investment in generative AI leader OpenAI in early 2023, and it became a top cloud computing platform for AI developers as a result of its close ties with company. Microsoft’s cloud platform, Azure, saw AI customers grow nearly 60% year over year in its most recent quarter, surpassing 60,000 total.

Meanwhile, Microsoft is injecting AI capabilities into its industry leading enterprise software — 77,000 organizations use its Copilot software to improve productivity and creativity across Github, Office, and their own native applications. And the number of customers continues to grow quickly, up 60% sequentially in the most recent quarter.

Shares of Microsoft currently trade around 32 times forward earnings estimates. That’s certainly a premium to the S&P 500, but its stock deserves a premium price. Its position as a leading cloud platform for AI developers combined with the massive enterprise software customer base to sell Copilot into gives it a long runway for growth. On top of that, its cash position and free-cash-flow generation gives it plenty of capital to deploy to take advantage of growth opportunities.

2. Berkshire Hathaway Class B shares (23%)

As mentioned, Warren Buffett is a regular donor to the Gates Foundation, and his most recent donation arrived last quarter in the form of 9.9 million Class B shares of Berkshire Hathaway (NYSE: BRK.B). Buffett uses the ability to convert super-voting Berkshire Hathaway Class A (NYSE: BRK.A) shares to Class B shares before donating in order to maintain control of the company.

Buffett’s donation pushed the trust’s position in Berkshire Hathaway to nearly 25 million shares. Those shares are worth about $11.2 billion today.

But the trust’s Berkshire position will likely shrink over the next year. Buffett’s donation stipulates that the Gates Foundation must spend every penny he donates plus an additional 5% of its net assets. Gates has pledged to increase the foundation’s spending from $6 billion in 2022 to $9 billion by 2026, and plans to spend $8.6 billion in 2024.

Berkshire Hathaway has outperformed the market in 2024, up about 26% as of this writing. Strong operating performance and investment management has resulted in far better performance than the average value stock. Around 60% of Berkshire’s value is tied to its cash and equities, while the other 40% is tied to its wholly owned businesses, including insurance operations and railroads.

With a current valuation above 1.6 times book value, the stock looks expensive. But with a delevered balance sheet for the first time in a long time, it may be worth the premium valuation because those assets could drive significantly better returns in the future.

3. Waste Management (15%)

Waste Management (NYSE: WM) is the leading waste hauler in the U.S. Not exactly the high-tech operation you might associate with Bill Gates. It is, however, the type of boring wide-moat business you’d associate with Warren Buffett.

The Gates Foundation Trust holds more than 35 million shares of Waste Management worth about $7.3 billion as of this writing. The stock has performed well in 2024, but took a step back after second-quarter numbers disappointed investors. The long-term outlook for the business remains strong, and the near term doesn’t look too bad either. Management ultimately raised its full-year guidance for EBITDA and free cash flow with its earnings results.

Waste Management benefits from its scale. It owns more landfills than its competitors and operates high-density routes (which means it can serve more businesses and households more efficiently). That position also gives it pricing power, and the free cash flow to grow via acquisition. Its most recent acquisition agreement with Stericycle is set to close in the fourth quarter.

The stock currently trades at an EV-to-EBITDA ratio of less than 17. That’s a price comparable to its closest competitors. But with its market-leading scale and ability to acquire smaller companies and potentially add value and exercise operating leverage, it should be able to outperform at this price.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adam Levy has positions in Microsoft. The Motley Fool has positions in and recommends Berkshire Hathaway and Microsoft. The Motley Fool recommends Waste Management and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates Has 69% of His Foundation’s $48 Billion Portfolio Invested in Just 3 Phenomenal Stocks was originally published by The Motley Fool

Donald Trump Dives Into New Crypto Project: 'Let's Make Crypto And America Great By Driving Mass Adoption Of Stablecoins'

Donald Trump has announced the launch of his decentralized finance (DeFi) crypto project, World Liberty Financial, slated for Monday.

What Happened: Trump revealed the launch date of his DeFi platform in a video update on social media platform X. The platform is designed to aid those who are underserved by the traditional banking system.

Trump invited the public to join him live on X Spaces for the project’s launch, emphasizing the project’s commitment to the future of crypto and the need to move away from the “slow and outdated big banks.”

“Join me live on Twitter Spaces at 8pm, September 16th, for the launch of World Liberty Financial. We’re embracing the future with crypto and leaving the slow and outdated big banks behind,” Trump said in the post.

World Liberty Financial issued a statement earlier this month highlighting its mission to promote stablecoins pegged to the US dollar and the concept of decentralized finance globally.

The project views stablecoins as the foundation of DeFi and aims to ensure that US dollar-pegged digital assets continue to be the global settlement layer for DeFi protocols.

“Our mission is crystal clear: make crypto and America great by driving the mass adoption of stablecoins and decentralized finance. We believe that DeFi is the future, and we’re committed to making it accessible and secure for everyone,” Trump added in the post.

Also Read: Trump Brothers’ Cryptocurrency Start-Up Rattles Father’s Crypto Allies: ‘This Is A Huge Mistake’

“By spreading U.S.-pegged stablecoins around the world, we ensure that the US dollar’s dominance continues, securing America’s financial leadership and influence on the global stage,” he said.

The project is working closely with cybersecurity firms and the prominent DeFi platform Aave (AAVE) to achieve its goals. Trump first announced the project in August, under the name The DeFiant Ones.

Why It Matters: The launch of World Liberty Financial marks a significant step in the integration of crypto into mainstream financial systems. With its focus on stablecoins and DeFi, the project aims to provide an alternative to traditional banking, particularly for those marginalized by the current system.

The collaboration with Aave, a leading player in the DeFi space, further underscores the project’s commitment to leveraging blockchain technology for financial inclusivity.

This move by Trump could potentially influence other high-profile individuals to explore and invest in the crypto and DeFi space, thereby driving its growth and adoption.

Read Next

Trump Vs Harris: Majority Of US Crypto Owners Support This Candidate

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Can Only Watch as His Media Stake Takes a $4 Billion Dive

(Bloomberg) — The paper fortune that former President Donald Trump amassed by taking a nascent media startup public is shriveling, and a race to the exits that begins as soon as Sept. 19 could shrink it even more.

Most Read from Bloomberg

Trump Media & Technology Group Corp., which owns the X-lookalike social media platform Truth Social, has shed nearly $6 billion in value over the past four months. Meanwhile, its largest shareholders have been unable to sell because of a lockup agreement from when the firm went public through a special-purpose acquisition company merger in March.

The stock was trading at its lowest level since then as recently as Thursday, erasing $4.1 billion in paper wealth for the Republican presidential candidate, who owns roughly 60% of the company. His stake is now worth about $2.1 billion.

“Buyer beware,” said Paul Karger, co-founder and managing partner at TwinFocus. “I’ve watched the fallout from many of these former SPACs, and it was just a race to the bottom where everyone was trying to get out at any price. And the stocks just collapsed.”

Trump isn’t alone in watching a paper empire collapse because of the lockup restrictions, which prevent insiders from selling until next week at the earliest. Andy Litinsky and Wes Moss, former contestants on Trump’s TV show The Apprentice who co-founded the company, and Patrick Orlando, whose fund, ARC Global Investments II LLC, sponsored the SPAC that merged with Trump Media, have seen more than $500 million in wealth wiped out.

Investors are bracing for a flurry of sales from Litinsky, Moss and Orlando given that none of them have roles at the company and all have been parties in a smattering of lawsuits surrounding their positions. Whether Trump or the other insiders will capitalize on the removal of the lockup as soon as the end of next week is unclear. But traders will be closely monitoring regulatory filings that would show any such sales.

As for the former president, he insists he has no plans to dump the shares.

“A lot of people think that I’ll sell my shares,” Trump said at an event on Friday. “You know, they’re worth billions of dollars, but I don’t want to sell my shares. I’m not going to sell my shares. I don’t need money. And it is great for me. It’s a great voice.”

The stock jumped following those comments, closing Friday up 12%.

Back To X

That said, Trump has done little to inspire investors to back his company. He returned to Elon Musk’s X on Aug. 12, posting more than 100 times in the weeks that followed. Trump Media shares plunged more than 10% on Wednesday following the former president’s disappointing debate against Democrat Kamala Harris.

The stock has tumbled to $17.97 from $40.58 on July 15, just after the assassination attempt on the presidential candidate at a rally in Pennsylvania, posting losses for seven straight weeks before recovering this week. The slide makes the company look more like the meme stock skeptics have described, with an over $3 billion valuation despite second-quarter revenues of less than $1 million.

“Trump Media never traded on the basis of its underlying economics,” said Stanford University law professor Michael Klausner.

Despite Friday’s rally, investors are preparing for the selling pressure that could come from the ending of the lock-up on Trump Media insiders. But the reality is, it’s difficult for shareholders with such large stakes to quietly unload their holdings.

“There’s not a lot of room for error here,” said Karger, who co-founded TwinFocus to advise ultra-high-net-worth individuals to manage their wealth. The Securities and Exchange Commission “will be all over this to make sure every T is crossed and I is dotted.”

This is particularly true for Trump, who holds nearly 115 million shares. If he did decide to sell, it would more than double the amount of stock that’s freely traded in the market, according to Jack Ablin, chief investment officer at Cresset Capital.

“It’s a publicly traded stock, but selling 60% of the company would require a disclosure and have to be done on a regularly scheduled program,” Ablin said in an interview. “It’s going to take a while. It’s not something he could simply hit the sell button on.”

SPAC Outlier

Trump Media’s route to the public market was an outlier even for the SPAC boom, which brought hundreds of smaller firms onto exchanges in deals with less regulatory scrutiny. Digital World Acquisition Corp., the SPAC that was founded and backed by Orlando, settled fraud charges with the SEC last year. Then, the regulator sued Orlando this summer, accusing him of misleading investors.

Those cases are separate from the series of lawsuits related to Trump, the stakes of Orlando’s ARC and Litinsky’s and Moss’s United Atlantic Ventures in the company, and the rules surrounding the restrictions of sales.

Earlier this year, Litinsky and Moss sued Trump over an attempt to dilute their stakes and pushing back from the lockup, which is common in SPAC deals. The duo were separately sued by Trump, who accused them of botching the setup for Trump Media prior to the SPAC merger and suggested that they shouldn’t get any stock in the company.

Meanwhile, Orlando has launched a suit arguing that he is entitled to nearly 2.5 million more shares than he was allotted because of a stock conversion ratio he maintains was incorrect.

Ultimately, the fate of Trump Media’s shares may be tied to the results of the November election, which at the moment appears to be neck-and-neck. Polling averages from Real Clear Politics show Harris with 48.5% support, giving her a 1.5 point lead over Trump, who’s at 47%.

“What happens to the value of the stock if Donald Trump loses his bid to be president?” Ablin said. “There’s a lot of risk with this thing. It’s really trading pretty much off of Donald Trump’s name — the ticker symbol is his initials for goodness sake.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The Smartest Dividend Stocks to Buy With $500 Right Now

For investors, dividend-paying stocks offer an immediate return, and those with consistent, rising payouts have performed even better, with less volatility than the benchmark S&P 500. One explanation could be that annual dividend increases compel management to maintain disciplined capital allocation while also signaling strong confidence to investors in the company’s future growth.

Let’s dive into two dividend-paying stocks, priced at a combined $500, that appear undervalued and either recently began paying dividends or have a strong history of increasing them.

1. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is down approximately 5% over the past month as the tech giant faces increasing calls for regulation in its search and advertising business. Additionally, investors fear Alphabet may be behind in the artificial intelligence (AI) arms race against competitor Microsoft, which owns a significant stake in Open AI, the company behind ChatGPT.

While long-term trepidation may be holding down the stock price, Alphabet’s business is generating more revenue and profit than ever before. Through the first half of 2024, the company generated $165.3 billion in net sales and $47.3 billion in net income, representing a year-over-year increase of 14.5% and 41.5%, respectively.

Alphabet’s balance sheet shows that as of its most recently reported quarter, the company held $88.9 billion in net cash. The excess cash likely gave management confidence to initiate its first-ever dividend earlier this year. The company currently pays a quarterly dividend of $0.20 per share, equating to an annual yield of 0.53%.

Notably, Alphabet’s payout ratio — the percentage of a company’s income paid out as dividends — is incredibly low at 2.8%, meaning management will have plenty of room to raise its dividend in the future.

Management also returns capital to shareholders through share repurchases, which increase investors’ ownership stakes without requiring additional purchases. In the first half of 2024, Alphabet spent $31.4 billion on share buybacks, lowering its outstanding shares by 1.2%. Given that Alphabet’s outstanding share count has decreased 10.9% over the past five years, and it announced a new $70 billion share repurchase in April, it looks as if management will continue to prioritize this capital allocation method for its shareholders for the foreseeable future.

Returning to the perceived threat to Alphabet’s business, management understands the significance of AI and is pouring cash into the transformative technology. CEO Sundar Pichai underscored Alphabet’s investments into AI on the company’s most recent earnings call, adding, “The one way I think about it is when you go through a curve like this, the risk of underinvesting is dramatically greater than the risk of overinvesting for us here.”

The company poured $25.2 billion in capital expenditures for the first half of 2024, most of which it earmarked for its AI development. For comparison, Alphabet spent $13.2 billion capital expenditures in the first half of 2023.

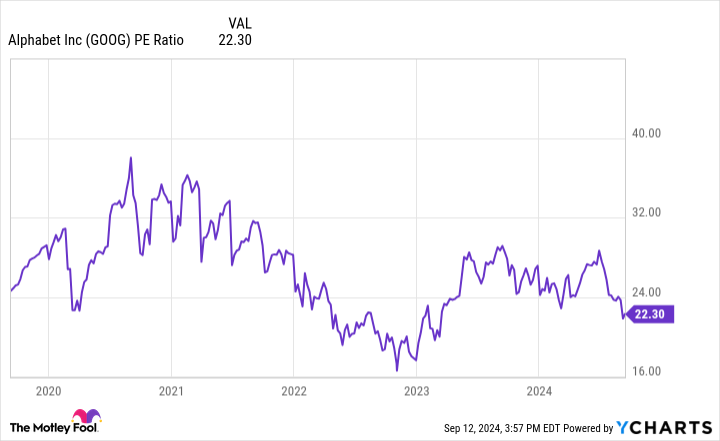

Even if it is considered behind in the AI boom, Alphabet remains a market leader in ads and search and owns valuable properties like YouTube. Based on the price-to-earnings (P/E) ratio, which compares a company’s earnings over the past 12 months to its stock price, Alphabet appears undervalued. That’s because the stock currently trades at roughly 22.3 times earnings, well below its five-year P/E ratio average of 26.8.

2. Caterpillar

Caterpillar (NYSE: CAT) stock has been stagnant of late, generating a total return of only 1.5% over the past six months. Still, the world’s largest construction equipment manufacturer is a dividend stalwart, paying a quarterly dividend since 1989 and raising it for 31 consecutive years. Today, Caterpillar pays a quarterly dividend of $1.41 per share, representing an annual dividend yield of roughly 1.7%. Additionally, with a payout ratio of 23.7%, investors can reasonably expect management to continue its impressive dividend hike streak in the coming years.

Similar to Alphabet, Caterpillar repurchases its stock hand over fist. Management lowered its outstanding shares by 2.9% in 2024 and 12.3% over the past five years.

Caterpillar’s management regularly states its plans to use “substantially all” of its free cash flow from machinery, energy, and transportation (ME&T) on dividends and share repurchases. For 2024, it projected that metric to be within the range of $7.5 billion to $10 billion. While an impressive outlook on the surface, Caterpillar generated $10 billion in ME&T free cash flow in 2023, which is perhaps why some investors are timid about the stock.

Yet, there is a reason behind the stagnation: Higher sustained interest rates are weighing on global demand for construction projections. As of its most recently reported quarter, Caterpillar generated $16.7 billion in net sales, and its backlog stood at $28.6 billion, representing a decrease of 4% and 7% year over year, respectively.

The good news is that interest rates are on track to ease in the coming months, which management believes will help some areas of its business, like building warehouses or other rate-sensitive projects. In the long term, Caterpillar will benefit from U.S. government-related infrastructure projects and demand for new housing in North America. Specifically, Caterpillar continues to receive a windfall from the $1.2 trillion Infrastructure Investment and Jobs Act signed into law in 2021 and the fact that America has underbuilt an estimated 4.5 million homes since the Great Recession.

Similar to Alphabet, Caterpillar also trades at a depressed valuation when compared to historical averages. Today, the construction-focused company trades at 15.5 times earnings, below its five-year P/E ratio median of 16.9.

CAT PE Ratio data by YCharts

Should you buy these dividend stocks?

Whether it’s the start of a dividend journey or 30-plus years into it, these two stocks are well positioned to continue to reward shareholders with a rising dividend. Again, according to research, this is a key factor in a stock outperforming the market over the long term. Couple that history with what appears to be fair valuations, and Alphabet and Caterpillar are two stocks to buy for any portfolio.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Collin Brantmeyer has positions in Alphabet, Caterpillar, and Microsoft. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The Smartest Dividend Stocks to Buy With $500 Right Now was originally published by The Motley Fool

Where Will Walgreens Boots Alliance Be in 3 Years?

While you’ve probably had a consistent experience going to the pharmacies operated by Walgreens Boots Alliance (NASDAQ: WBA) over the years, that doesn’t make it a company that’s in stasis. In fact, within the next three years, there’s a very high chance that it’ll be changing in a handful of ways that are relevant to investors.

But even if the retail experience doesn’t shift much, there’s reason to believe that the stock’s value will continue to deteriorate as a result of what its management plans to do. If all goes well, there could be a brighter future ahead in due time — but that is far from guaranteed.

Here’s a grounded projection for where the stock could be in late 2027.

Will the plan work?

The story of Walgreens’ recent past is a doleful one. Measured by total return, its shares are down by 76% over the past three years, and its quarterly operating income fell a staggering 92% in the same period, slipping to $67 million in its fiscal third quarter (ended May 31).

There’s likely more than one culprit for Walgreens’ operational challenges. Management points to tighter consumer budgets, presumably caused by inflation, as putting downward pressure on revenue in its retail segment. In contrast, its core pharmacy segment in the U.S. — which is to say, the main driver of people to visit its stores — is struggling with declining profitability. This is linked to its reimbursement from insurers bringing in less cash than before, as well as its sale leaseback real estate transactions being less lucrative.

Management sees these headwinds persisting into its next fiscal year, and it is reasonable to expect them to continue beyond that as well, as it has not yet proposed any concrete plan to mitigate them, aside from scaling down somewhat. Over the coming years, it expects to reposition or close 25% of its existing retail footprint. Around $1 billion in cost savings should be realized before the end of this fiscal year. Given that its trailing-12-month operating losses are just over $1.4 billion, that won’t be enough to stabilize the company.

In other words, it is very unlikely that this business will be able to grow its market share or top line anytime soon, as it will have fewer and fewer productive assets to operate. Further losses are likely, even if its operating efficiency improves in keeping with the cost-cutting campaign.

So, at least in the near term, expect it to sell off more of its equity investments to make up for its losses, as it has been doing over the last few years. That will further reduce its total assets, and reduce its financial flexibility to borrow money at an attractive interest rate, as it will have less collateral.

On the bright side, Walgreens’ healthcare segment, which delivers treatment direct to consumers, generated adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $23 million for the first time in Q3. Though getting things up and running cost plenty of scarce cash, over the next few quarters it may be a contributor to the bottom line instead of a detractor, which will be a desperately needed change.

Still, as the entire segment only brought in $2.1 billion in the third quarter, barely up at all from a year prior, it won’t be enough to carry the company’s shares aloft by much, if at all.

Check back in three years

Given how things are looking right now, the smart expectation for 2027 is for Walgreens to be a much smaller and somewhat more efficient operator that doesn’t really have any way of growing beyond its diminished state.

And, with $33.6 billion in debt, it may well have to further liquidate assets and dramatically curb its expenses by even more than it has planned to do so far. Over the last 12 months, it repaid $26.8 billion in debt while issuing $24.1 billion more. If it continues to deleverage at roughly the same rate moving forward, it will be many years before it reaches a more sustainable debt burden. And that’s a long-term impediment to growth, as well as to returning capital to shareholders.

In a best-case scenario, the company will be producing enough earnings in late 2027 to gear up for another growth push in the years after that, but it’s hard to know which segments it’ll be targeting or how effective its attempt will be given its diminished state. It is not at all certain that it will be in a better situation three years from now. Therefore, Walgreens is not a stock you should invest in today.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy stock in Walgreens Boots Alliance, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walgreens Boots Alliance wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Where Will Walgreens Boots Alliance Be in 3 Years? was originally published by The Motley Fool

FORD STOCK ALERT: Ford Motor Company Investors are Notified of Imminent October 7 Deadline in Class Action; Inform BFA Law if you Incurred Losses (NYSE:F)

NEW YORK, Sept. 15, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Ford Motor Company F and certain of the Company’s senior executives.

If you invested in Ford, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/ford-motor-company.

Investors have until October 7, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Ford securities. The case is pending in the U.S. District Court for the Eastern District of Michigan and is captioned Guzman v. Ford Motor Company, et al., No. 24-cv-12080.

What is the Lawsuit About?

Ford is an automotive manufacturing company that develops, delivers, and services a range trucks, cars, and luxury vehicles worldwide. The complaint alleges that during the relevant period, the company misrepresented its warranty reserves and that it had completed a sequence of organizational changes designed to ensure higher quality and lower costs. In truth, Ford was experiencing higher warranty costs, and the warranty reserves did not accurately reflect the quality issues in its vehicles.

On July 24, 2024, after the market closed, Ford announced second quarter 2024 financial results (the “2Q24 Press Release”). The 2Q24 Press Release revealed that the Company’s “[p]rofitability was affected by an increase in warranty reserves” and “higher warranty costs.” It was reported that, in the second quarter, Ford’s warranty and recall costs totaled $2.3 billion, $800 million more than the first quarter and $700 million more than a year ago. This news caused the price of Ford’s stock to decline by $2.51 per share, or over 18%, to close at $11.16 per share on July 25, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/ford-motor-company.

What Can You Do?

If you invested in Ford, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/ford-motor-company

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/ford-motor-company

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Economics Weekly Round-Up: Trump's Tariffs, Inflation Woes, And The US Debt Crisis

The past week was a whirlwind of economic debates and political finger-pointing. From the 2024 election debate to the ongoing inflation concerns, the economic landscape of the United States was under intense scrutiny.

Here’s a quick recap of the top stories that made headlines.

Harris Vs. Trump: The Unemployment Debate

Vice President Kamala Harris and former President Donald Trump clashed over unemployment rates during their first debate for the 2024 election. Harris accused Trump of leaving behind the “worst unemployment since the Great Depression.” Trump, on the other hand, proposed a tariff of at least 10% on imported goods to boost the economy.

Marjorie Taylor Greene Criticizes Biden’s Inflation Management

Republican Rep. Marjorie Taylor Greene joined Trump in criticizing President Joe Biden over the nation’s inflation levels. Greene expressed her concerns about the state of the economy under Biden’s leadership, citing a nearly 20% increase in inflation over the past four years.

Inflation Hits Lowest Level Since February 2021

The U.S. annual inflation rate in August fell to its lowest point since February 2021, indicating a further easing of pressure on the cost of goods and services for U.S. consumers. This development has strengthened convictions for interest rate cuts by the Federal Reserve.

Trump’s Tariff Plan Could Backfire

Donald Trump’s proposal to enforce dollar dominance in global trade might lead to economic disruption and potentially weaken the U.S. currency, warns Ulrich Leuchtmann, the head of foreign exchange research at Commerzbank AG. Trump’s threat to impose 100% tariffs on countries that avoid the dollar could result in “massive disruption” to the global economic system.

Peter Schiff And Dogecoin Influencer On US Debt

Influential economist Peter Schiff and Dogecoin influencer DogeDesigner highlighted the escalating national debt crisis in the U.S. They pointed out that the interest on U.S. debt has crossed $1 trillion for the first time, marking a 30% increase from the previous year.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Ananya Gairola

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intermodal gains share, but at what cost?

Chart of the Week: Total outbound loaded rail container volume, Intermodal spot rates – USA SONAR: ORAILL.USA, INTRM.USA

Intermodal demand is only 2% off the peak COVID-era value that it hit in late 2020, but spot rates are 42% lower than where they were at that point. Have the railroads solved all their problems?

Loaded intermodal — both domestic and international — container volumes are up 10% over 2023, but spot rates are down about 8%. This seems contradictory.

Demand typically correlates well with price changes in most commodities. That has not been the case in the domestic transportation market for a few years due to an oversupply of capacity.

Container import growth surged this summer and is nearly on par with the pandemic-era levels heading into fall. This is the primary driver feeding domestic freight demand growth in the U.S.

During the pandemic years, the rails were heavily criticized for their lack of ability to handle the record volumes coming in from the ports. Infrastructure around the railheads and ports took the brunt of the blame.

To be fair, the volumes were unprecedented and no one could have seen that coming. The railroads have also been incentivized to operate as lean as possible to improve their operating margins for their investors — something that makes them less adaptive.

Loss of share

The combination of historic demand increase and limited infrastructure led to extreme service failures and incentivized shippers to push a lot of their freight to the truckload market. Intermodal demand fell 13% from October of 2020 to 2021, while truckload tender volumes grew about 2%.

To regain market share, the rails had to invest in better infrastructure and containers to be prepared for future opportunities. That appears to be paying off as a new wave of imports hits the port markets.

Loaded container volumes were up 13% y/y at the end of August, whereas truckload tenders were only up 2%. Loaded domestic containers were up 10% while smaller international sizes were up 16%.

Self-defeating?

The market share gains are positive for the railroads and intermodal providers in general but may not be as self-serving as it seems. They are hauling more volume but preventing disruption in the truckload market, keeping rates low.

The intermodal market is dependent on the truckload market—the sector it is helping keep soft by absorbing some of the most capacity-disrupting freight—for intermodal’s ability to raise prices.

Intermodal is mostly long-haul, with the largest lane in the U.S. being Los Angeles to Chicago. This takes a single truck driver close to four days to cover and at least that much to get back. With the dominant flow of freight being west to east, it is challenging to find enough freight to get back to California profitably.

For shippers, this is a near-term victory, but the end game remains marginally improved. The improvements to the railroad and port infrastructures are definitively long-term gains of efficiency and may help soften future market shifts, but the intermodal market share gain is only a short-term mechanism for keeping the market loose.

The longer the truckload market remains in a state of oversupply, the more capacity will continue to exit. This will leave truckload capacity more vulnerable to demand shocks in the future. This will in turn push all rates higher.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

The post Intermodal gains share, but at what cost? appeared first on FreightWaves.

Australian Boomers Retiring With Less Than Half the Money Needed

(Bloomberg) — About two thirds of Australian baby boomers leaving the workforce don’t have enough pension savings to retire comfortably, according to research from the industry’s peak body.

Most Read from Bloomberg

Slightly more than 30% of Australians are able to afford a comfortable lifestyle in retirement, the Association of Superannuation Funds of Australia said. The median pension account balance for men aged 60-64 sat at A$205,385 ($137,690) as of June 2022 and A$153,685 for women the same age, a ways off the industry’s accepted comfortable retirement standard of A$690,000 for couples and A$595,000 for singles.

As the nation’s pension pool nears A$4 trillion, an estimated 2.5 million Australians are expected to retire in the next decade. The pension industry — known locally as superannuation — was made compulsory for all workers in 1992, with contributions equal to 3% of wages. The amount employers contribute has grown to 11.5% and will rise to 12% next year.

Still, as the pension system matures and balances increase, the portion of people retiring with enough money to fund a comfortable lifestyle will rise to 50% or more by 2050, ASFA Chief Executive Officer Mary Delahunty said in an interview.

“The people retiring now have not had a full benefit for their working life,” Delahunty said. “So they will still require a good level of government help, or help from the rest of us, to be able to retire with dignity.”

Anxiety around retirement savings persists even as Australia regularly ranks among the world’s top pension systems. Some 40% of Australians say they’ll never have enough money to retire despite the country boasting one of the world’s most envied pensions systems, according to a Natixis Investment Managers survey released last week.

“Lots of people are concerned about the comfort and ability of retirees at the moment because of the cost of living rises,” Delahunty said.

Balances were down slightly in the 12 months to June 2022 compared to the previous year due to poor investment returns, but have since averaged an annual return of more than 9%, Delahunty said.

Australia’s pension system is doing its part to relieve stress on the public purse. A 2023 government report found that despite the aging population, spending on pensions is projected to fall from 2.3% to 2% of gross domestic product within 40 years, as superannuation increasingly funds retirements.

Still, a gender pay gap has fueled disparity in every age cohort’s pension pot, Delahunty said. The average balance for men is A$182,667, compared to A$146,146 for women, according to ASFA.

A shortage of financial advisers also presents a challenge. The government has announced a range of proposed reforms for the sector.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Why Retirees Can't Rely on Medicare for Healthcare Expenses

For the average American, healthcare in retirement will cost more than they have in their entire savings account.

And unfortunately, Medicare won’t help.

Healthcare, of course, is the single biggest line item that most retirees need to prepare for. Recently, a study released by the EBRI (the Employee Benefit Research Institute) emphasized how important that is. The institute’s data finds that despite the coverage offered by Medicare, retirees should expect to pay significant out of pocket costs for their healthcare during retirement. These costs cover a range of expenses, including insurance premiums, program deductibles and prescription drug treatments.

For help planning your retirement, including how to pay for healthcare, consider working with a financial advisor.

Healthcare Cost Details

Exactly how healthcare costs for retirees can go ranges. One of the biggest challenges with determining retirement finances is the slipperiness of the data. A researcher’s results will change based on mortality assumptions, local costs of living, updated government programs, market returns and much more. The EBRI’s study attempts to correct for that, running a model that assumed the latest version of Medicare and a large population with varying lifespans based on standard demographics.

In that context, EBRI found that, even with supplemental insurance (generally known as “Medigap” insurance), on average men will need $166,000 in dedicated savings to pay for their healthcare needs in retirement. For women, with longer expected lifespans, that number climbs to $197,000, and an average $318,000 for two-person households.

These are large numbers on their own. What makes the EBRI’s findings even more stark, however, is how they compare with how much people have in total savings.

The median household at retirement age (65 years or older) has $87,725 in total savings. This is supplemented by Social Security income, which varies and pays more to higher-earning households. Regardless of supplemental income, though, most financial experts consider this far too low to pay for the average household’s costs in retirement.

It’s also less than half of what someone will need for their healthcare spending alone.

The Role of Medicare

Much of the reason for this has to do with the Medicare program.

Medicare has a reputation for simplicity. Many, if not most, Americans believe that this is a simple universal healthcare program for retirees. Yet the reality is that this program does not, and never has, provided comprehensive health insurance. Instead, it has always been a patchwork of options focused on paying for hospital stays and the occasional doctor’s visit. Although the government has updated some parts of this program over time, such as adding partial-payment for prescription drugs through Medicare D, individual retirees have always been expected to pick up the slack.

Most households cover this through a combination of supplemental insurance, Medicaid (which, remember, is a different program) and (while uncommon) employer health insurance plans. Together, it makes for a potentially expensive network of premiums and out-of-pocket spending.

Arguably the single biggest determinant of costs is which version of Medicare someone enrolls in. The program has two versions, known as Traditional and Advantage. Traditional Medicare includes hospital stays, doctor’s visits and some drug costs (Parts A, B and D respectively). It covers fewer services, and includes more out of pocket expenses, but it’s also accepted by virtually all providers.

Medicare Advantage includes coverage that Traditional Medicare does not, such as more prescription drugs and dental coverage. It has fewer out of pocket costs than Traditional Medicare, and more caps on overall spending. However the program is also run by private insurers, which leads to lower payments and higher overhead costs, so Advantage is also accepted by far fewer providers.

For retirees who can handle the reduced choice, the EBRI found that Medicare Advantage does make a big difference in overall spending. Men enrolled in this program only need around $96,000 to meet their spending needs in retirement, while women need $113,000 on average. While this is still more than most people have in total assets at age 65, it’s significantly less than the money spent by those enrolled in Traditional Medicare.

A financial advisor can help you navigate Medicare. Get matched with with SmartAsset’s free tool.

The Big Problem

Yet no version of Medicare offers comprehensive healthcare. From drug costs to long-term care, the program has hard limits. This is why, as one Kaiser Foundation study found, around 90% of all retirees have some form of supplemental health plans in place. Low-income retirees can qualify for Medicaid, while many other retirees choose to enroll in supplemental third party insurance plans known as “Medigap.” These are health insurance programs that cover costs that Medicare typically omits, and they tend to have premiums ranging from around $130 to $300 per month.

Whatever you choose, all retirement health programs come with additional cost. Even Medicare itself requires deductibles, copays and premiums, many of which come as a surprise to retirees who expect it to provide completely free health insurance. Supplemental insurance requires out of pocket costs, most Medicaid programs require some form of patient contributions, and often a retiree will need treatment that no program covers.

It adds up, and the EBRI expects that these costs will only continue to rise. As healthcare gets more expensive, lifespans get longer and both employers and the government consider cutbacks to traditional benefits programs, many households will need to prepare for health insurance to consume more of their retirement account than ever before. Consider speaking with a financial advisor about projections and options for your retirement.

The Bottom Line

A new study by the Employee Benefit Research Institute has some hard numbers about what it will cost to pay for your health care in retirement, costs which are larger than the average retirement account altogether.

Retirement Planning Tips

-

Medical expenses are, to a large degree, non-negotiable spending in retirement. So any good retirement plan should calculate exactly how much you’ll have left after paying the doctor.

-

A financial advisor will help you plan for your own retirement needs. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/PeopleImages, ©iStock.com/Drazen Zigic, ©iStock.com/interstid

The post Healthcare Will Cost More Than Most Retirees Have: Here’s Why Medicare Isn’t the Answer appeared first on SmartAsset Blog.