City Office REIT Announces Dividends for Third Quarter 2024

VANCOUVER, Sept. 13, 2024 /PRNewswire/ — City Office REIT, Inc. CIO (“City Office,” “CIO” or the “Company”) announced today that its Board of Directors has authorized a quarterly dividend amount of $0.10 per share of common stock and common unit of partnership interest for the third quarter of 2024.

Additionally, the Board of Directors authorized a regular quarterly dividend of $0.4140625 per share of the Company’s 6.625% Series A Cumulative Redeemable Preferred Stock.

The dividends will be payable on October 24, 2024 to all stockholders, preferred stockholders and operating partnership unitholders, as applicable, of record as of the close of business on October 10, 2024.

About City Office REIT, Inc.

City Office REIT is an internally-managed real estate company focused on acquiring, owning and operating office properties located predominantly in Sun Belt markets. City Office currently owns or has a controlling interest in 5.6 million square feet of office properties. The Company has elected to be taxed as a real estate investment trust for U.S. federal income tax purposes.

Forward-looking Statements

This press release contains both historical and “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as “approximately,” “anticipate,” “assume,” “believe,” “budget,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will” and similar expressions, and variations or negatives of these words. They are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement. Factors that could cause actual results to differ materially include, among other things, changes to CIO’s expected liquidity position and the risk factors set forth in CIO’s Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent filings with the Securities and Exchange Commission. The statements made herein speak only as of the date of this press release, and, except as required by law, CIO does not undertake any obligation to publicly update or revise any forward-looking statements.

Contact

City Office REIT, Inc.

Anthony Maretic, CFO

+1-604-806-3366

investorrelations@cityofficereit.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/city-office-reit-announces-dividends-for-third-quarter-2024-302245358.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/city-office-reit-announces-dividends-for-third-quarter-2024-302245358.html

SOURCE City Office REIT, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXTR STOCK ALERT: Extreme Networks, Inc. Investors are Notified of Imminent October 15 Deadline in Class Action; Inform BFA Law if you Incurred Losses (Nasdaq:EXTR)

NEW YORK, Sept. 15, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Extreme Networks, Inc. EXTR and certain of the Company’s senior executives.

If you invested in Extreme, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/extreme-networks-inc.

Investors have until October 15, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Extreme common stock. The case is pending in the U.S. District Court for the Northern District of California and is captioned Steamfitters Local 449 Pension & Retirement Security Funds v. Extreme Networks, Inc., No. 24-cv-05102.

What is the Lawsuit About?

The complaint alleges that Extreme overstated the strong demand for its products and that its record backlog would accelerate growth. In truth, it is alleged that demand for Extreme’s products had declined as its clients ordered more product than needed in the wake of the COVID-19 pandemic to avoid supply shortages. As a result, the backlog cannibalized rather than accelerated growth.

On January 25, 2023, Extreme announced the resignation of the Company’s CFO as well as a significant decrease in the Company’s backlog. This news caused the price of Extreme stock to decline by $2.81 per share, or nearly 15%, to close at $16.50 per share on January 25, 2023.

On November 1, 2023, Extreme reported its financial results for 1Q24. In connection with the results, Extreme revealed that drawing down its backlog resulted in an “air pocket of demand” among end customers that resulted in a “more tempered” revenue growth outlook of “mid-to-high single digits” for FY24, and that Extreme was now expecting a normalized backlog of between $75 million to $100 million “by the end of Q4 fiscal ‘24.” This news caused the price of Extreme stock to decline by $2.76 per share, or over 13%, to close at $17.86 per share on November 1, 2023.

Then, on January 31, 2024, Extreme reported disappointing financial results and operational trends for 2Q24. Extreme further revealed that its product backlog had already normalized during the quarter and that the Company made the “conscious decision to put channel digestion behind [it] in the March quarter.” This news caused the price of Extreme stock to decline by $4.05 per share, or over 24%, to close at $12.59 per share on February 2, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/extreme-networks-inc.

What Can You Do?

If you invested in Extreme, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/extreme-networks-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/extreme-networks-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Murray Lampert Design, Build, Remodel: Maximizing Your Home's Potential: The San Diego Remodeling Guide

SAN DIEGO, Sept. 14, 2024 /PRNewswire/ — As homeowners in San Diego, we’re fortunate to live in one of the most desirable locations in the country. With our perfect weather and stunning landscapes, it’s no wonder many of us are looking to make the most of our living spaces. Whether you’re considering a remodel to create additional living space for your growing family or planning to add square footage as an investment, this guide will help you navigate the process and make informed decisions.

The San Diego Advantage

San Diego’s real estate market continues to be robust, making home improvements a smart investment. Not only can you enhance your quality of life, but you can also significantly increase your property’s value. With the city’s strict zoning laws and the scarcity of new developable land, improving your existing home is often the most practical and cost-effective way to get the space you need.

Design-Build vs. Owner-Build: What’s the Difference?

When embarking on a remodeling project, one of the first decisions you’ll face is whether to go with a design-build firm or manage the project yourself. Let’s break down the pros and cons:

Design-Build Advantages:

- Streamlined process with a single point of contact

- Cohesive team working together from start to finish

- Typically faster completion times

- Better budget control and fewer surprises

- Expertise in navigating San Diego’s unique building codes and regulations

Owner-Build Considerations:

- Potentially lower costs if you have construction experience, and don’t make mistakes.

- More direct control over every aspect of the project

- Requires significant time commitment and project management skills

- Likely longer timelines due to resources and unexpected challenges.

- Increased responsibility for ensuring code compliance, and payments for mistakes made in-field.

- Limited or no warranty or support.

For most San Diego homeowners, partnering with a reputable design-build firm offers the smoothest path to achieving their remodeling goals. These firms bring a wealth of local knowledge and experience, ensuring your project not only meets your needs but also complies with all local regulations.

Spotlight on Excellence: Murray Lampert Design, Build, Remodel

When it comes to design-build firms in San Diego, one name stands out for its longevity, expertise, and commitment to customer satisfaction: Murray Lampert Design, Build, Remodel. With nearly five decades of experience serving the San Diego community, Murray Lampert has established itself as the premier choice for homeowners looking to transform their living spaces.

What sets Murray Lampert apart?

- Family-Owned and Operated: As a family business, Murray Lampert understands the importance of home. Their slogan, “Our Family, Your Home,” reflects their personal commitment to each project.

- Comprehensive Design Development: Unlike some competitors who may rush through the planning phase or provide less un-front value. Murray Lampert places a strong emphasis on thorough design development. This attention to detail often results in smoother projects and fewer costly changes down the line.

- Local Expertise: With 49 years of accredited experience in San Diego, Murray Lampert has an unparalleled understanding of local building codes, permit processes, and architectural styles that are indicative to San Diego’s costal lifestyle, and historical preservation.

- BBB Affiliation: As an affiliate of the Better Business Bureau, Murray Lampert demonstrates its commitment to ethical business practices and customer satisfaction.

- Transparent Pricing: Murray Lampert’s comprehensive approach ensures that homeowners understand the full scope and cost of their project from the start, avoiding unexpected expenses. Some firms may seem less expensive initially.

The Murray Lampert Difference

Choosing Murray Lampert means partnering with a team that treats your home as if it were their own. Their design-build process is tailored to San Diego’s unique environment and lifestyle, ensuring that your remodel not only adds value but also enhances your enjoyment of our beautiful city.

From coastal cottages in La Jolla to mid-century modern homes in Point Loma, Murray Lampert has the expertise to handle a wide range of projects. Whether you’re looking to add a second story, create an open-concept living area, or build an accessory dwelling unit (ADU), their team will guide you through every step of the process.

Making the Most of Your Remodel

Regardless of which firm you choose, here are some tips to make the most of your San Diego home remodel:

- Consider Indoor-Outdoor Living: San Diego’s climate is perfect for blending interior and exterior spaces. Think about adding sliding glass doors, patios, or rooftop decks to maximize your living area.

- Prioritize Energy Efficiency: With California’s focus on sustainability, incorporating energy-efficient features can not only reduce your bills but also increase your home’s value.

- Plan For the Future: If you’re adding square footage, consider how your needs might change over time. Flexible spaces that can be adapted to different uses are always a smart investment.

- Don’t Forget the Details: In San Diego’s competitive real estate market, small touches like high-quality finishes and smart home technology can make a big difference.

- Respect Your Neighborhood: While personalizing your space is important, consider how your remodel fits within the context of your neighborhood. A cohesive look can boost curb appeal and property value.

With the right design, Design-Build is an exciting journey, specially creating a space that you’ll love in a city as beautiful as San Diego. By choosing a reputable design-build firm like Murray Lampert, you’re not just improving your home; you’re investing in your future and enhancing your San Diego lifestyle. Remember, when it comes to transforming your living space, experience matters. With Murray Lampert’s nearly five decades of serving San Diego families, you can trust that your home is in good hands.

So, whether you’re dreaming of a spacious kitchen for entertaining, a serene master suite retreat, or a versatile home office with ocean views, take the first step towards making it a reality. Your perfect San Diego home awaits – and with the right team, the journey can be as rewarding as the destination.

Visit us online: https://murraylampert.com/our-process/

Stay connected with Murray Lampert Design Build Remodel on Social Media.

Facebook: Murray Lampert Design, Build, Remodel | San Diego CA | Facebook

Instagram: Murray Lampert (@murraylampert) • Instagram photos and videos

X: Murray Lampert (@murraylampert) / X

Houzz: MURRAY LAMPERT DESIGN, BUILD, REMODEL – Project Photos & Reviews – San Diego, CA US | Houzz

![]() View original content:https://www.prnewswire.com/news-releases/murray-lampert-design-build-remodel-maximizing-your-homes-potential-the-san-diego-remodeling-guide-302248363.html

View original content:https://www.prnewswire.com/news-releases/murray-lampert-design-build-remodel-maximizing-your-homes-potential-the-san-diego-remodeling-guide-302248363.html

SOURCE Murray Lampert Design, Build, Remodel

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China’s startup scene is dead as investors pull out—’Today, we are like lepers’

The number of new companies that are started in China annually has collapsed as fundraising by Chinese venture capital firms has similarly imploded.

A recent Financial Times report described a dire Chinese startup landscape, with founders, investors, and VCs offering bleak comments on condition of anonymity.

“The whole industry has just died before our eyes,” a Beijing-based executive told the FT. “The entrepreneurial spirit is dead. It is very sad to see.”

According to data from IT Juzi cited in the report, the number of companies founded in China so far this year is just 260, on track to dip below 2023’s tally of 1,202 and a 99% decline from a peak of 51,302 in 2018.

VC fundraising has taken a similar dive. Yuan-denominated funds have raised the equivalent of $5.38 billion year to date, down from a peak of nearly $125 billion in 2017. Meanwhile, dollar-denominated funds have raised less than $1 billion, down from a high of $17.3 billion in 2022, according to Prequin.

The implosion of China’s startup creation comes as the economy has shown no signs of halting its slowdown, with fresh data on Saturday pointing to continued cooling across the board.

Meanwhile, Beijing’s industrial policies have exacerbated imbalances in the economy that are contributing to the slump. And President Xi Jinping’s crackdown on the private sector, anti-corruption campaign, and “common prosperity” drive have chilled entrepreneurial activity as well.

Sources also told the FT that state-run VCs have recently ramped up efforts to claw back their investments from startups that became insolvent or didn’t go public by a certain time. Stricter requirements that force founders to be personally on the hook for any loans have prevented VC deals too. As a result, foreign and domestic investors have slashed their exposure.

“In the past, US limited partners looking at Asia only wanted to meet China funds. Other markets like India struggled to get their attention,” one investor told the FT. “Today, we are like lepers. They don’t want to touch us with a 10-foot pole.”

As more investors bail, state-run funds have taken on a bigger role and now account for about 80% of the capital in the market, according to the report.

These funds are also requiring investment managers to guarantee returns, spurring them to seek low-risk opportunities or direct money to Beijing’s established priorities.

“It is contradictory to the VC spirit of engaging in high-risk and high-potential ventures,” a Chinese innovation expert told the FT. “In a portfolio of 10 companies, you would expect one or two to be a mega success and the rest to die. But now VC firms have to explain to the state why their companies failed and why they have lost the country’s money.”

This story was originally featured on Fortune.com

The stock market risks keeping Wall Street's biggest bulls up at night

-

The bulls on Wall Street have been largely right about the stock market over the past two years.

-

Business Insider asked three bullish stock strategists what they consider the biggest risks.

-

They worry about geopolitical tensions, a market melt-up scenario, and Fed policy.

With the S&P 500 trading less than 1% below its record highs, there’s plenty to be bullish about on Wall Street.

Inflation is falling back to the Federal Reserve’s long-term target, interest rate cuts appear imminent, and corporate earnings, the consumer, and the broader economy are all proving resilient.

But there are plenty of risks, too, with some economists worried about a cooling labor market and a potential recession.

Yet, those economists have been largely wrong about what could sink the stock market and economy.

Business Insider talked to several people who have been right so far in the past few years, including three bullish strategists, to gauge what’s worrying them about the stock market as it cruises to fresh records.

Here’s what they had to say.

BMO’s Brian Belski

For BMO chief investment strategist Brian Belski, his big concern is that he’s betting against fewer people in the market as overwhelmingly bearish sentiment just a few months ago has now flipped bullish.

“In May/June, when you had a lot of bears or those that had been late to jump on the bull parade all of a sudden switch their forecasts and kind of chase markets up, which is pretty, I mean pretty, pretty, pretty classic,” Belski told Business Insider.

He added: “I just think that too many people are bullish again.”

Though it sounds counterintuitive, Belski is worried about the stock market moving significantly higher, not lower, from here, because that would set up a prime environment for a sharp pullback down the road.

“I don’t want to see a super spike now. I think the faster the market goes up right now, that would worry me,” Belski said.

And with many investors feeling bullish about stocks, the market is more vulnerable to a sell-off if there’s a macro surprise that badly misses estimates.

“From a sentiment perspective, we’re one bad macro data point away from a pullback,” Belski said.

As to what that macro data point could be, a surprise surge in inflation, a really bad jobs report, or a big miss from Nvidia all come to mind for Belski.

Yardeni Research’s Eric Wallerstein

Eric Wallerstein, chief market strategist at Yardeni Research, told Business Insider that there are two tail risks that could halt the stock market’s advance that should be on investors’ radars.

The first one is rising geopolitical tensions.

“Let’s say the Middle East blows out, Russia-Ukraine, China-Taiwan, like just the overall geopolitical scene is much more tense,” Wallerstein said.

On top of that, populist movements and nationalism are gaining popularity in countries around the world, and that’s not great for a globalized economy, according to Wallerstein.

“That just leads to a world with less strand and less growth,” Wallerstein said.

The second risk is, similar to Belski’s concern, a 1990’s type melt-up in the stock market.

“The idea is, valuations expand and you kind of get a blow off top, because the market gets too ebullient, and then that creates the conditions to get a bear market,” Wallerstein said.

And the Fed could pour gasoline onto the fire if it cuts interest rates aggressively, according to Wallerstein.

“If they do cut that much, which is such an extreme path of policy, I think that blow off top becomes increasingly likely, and it’s definitely something we’re worried about,” Wallerstein said.

While riding a bubble on the way up isn’t a bad thing, it’s the sharp and quick downturn that often follows a bubble peak that could lead to a period of significant underperformance for investors.

Carson Group’s Sonu Varghese

Sonu Varghese, global macro strategist at Carson Group, told Business Insider that he has been “thinking about rising risks for a few months now.”

“We still like equities and haven’t changed our overweight, but we’ve increased our exposure to diversifiers like long-term treasuries and low volatility equities,” Varghese said.

Varghese’s more defensive portfolio posture is driven mostly by what a policy mistake from the Federal Reserve could look like.

With the inflation fight largely over, and labor market trends broadly weakening, “policy is too tight,” Varghese said.

“The risk is that the Fed doesn’t act aggressively enough to arrest the labor market downtrend, and instead follows a gradual approach to rate cuts that leaves them further behind the curve. Which also means they’ll have to do larger catch up cuts later on (a re-run of what happened in 2022, but from the opposite side,” Varghese explained.

While he sees no risk of an imminent recession, he said the risk of a recession will rise within the next six to 12 months if the Fed falls far behind the curve.

“That could potentially impact equities – bad economic data will likely be traded as bad news by investors,” Varghese warned.

To be clear, all three of these strategists are sticking with stocks and still have a bullish view of what lies ahead for the market.

But even they worry about the neverending list of potential risks.

Read the original article on Business Insider

MXL STOCK ALERT: MaxLinear, Inc. Investors are Informed of Ongoing Securities Fraud Investigation; Inform BFA Law if you Incurred Losses (Nasdaq:MXL)

NEW YORK, Sept. 15, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces an investigation into MaxLinear, Inc. MXL for potential violations of the federal securities laws.

If you invested in MaxLinear, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/maxlinear-inc.

Why Did MaxLinear’s Stock Drop?

MaxLinear provides integrated radio-frequency analog and mixed-signal semiconductor products for broadband communications applications.

After the market closed on July 24, 2024, MaxLinear announced earnings results for its second quarter of 2024 and that net revenue for the quarter was just $92 million, down 50% year-over-year. The company attributed the decline at least in part to prolonged burn-off of excess customer inventory leading to weakened demand.

The news caused a precipitous decline in the price of MaxLinear stock. The price of the company’s stock closed at $22.29 per share on July 24, 2024. Prior to the market open on July 25, 2024, MaxLinear stock was trading in the range of $16.40 per share, a decline of $5.89 per share, or 26%.

Click here for more information: https://www.bfalaw.com/cases-investigations/maxlinear-inc.

What Can You Do?

If you invested in MaxLinear, Inc. you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/maxlinear-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/maxlinear-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This Stock Will Become Warren Buffett's Next Coca-Cola

Coca-Cola (NYSE: KO) is not the biggest position in Warren Buffett’s portfolio, but it is one of the billionaire’s favorites — and one that likely will remain there at current levels.

Buffett started buying shares of the world’s biggest nonalcoholic beverage maker in 1987 and continued adding to the position for a period of seven years. Those 400 million shares haven’t budged since. In fact, he has even described his holding on to Coca-Cola as “a Rip Van Winkle slumber.”

Buffett, known to drink several cans of Coke a day, clearly loves the product, and he also loves the fact that others feel the same way, too. This brand strength offers the company a moat, or competitive advantage, a key element Buffett looks for in a company. On top of this, the beverage giant has grown earnings over time and rewards investors with dividends.

For these reasons, Coca-Cola is likely here to stay in its position in the Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) portfolio. But it might not be the only stock to win Buffett’s permanent loyalty. In fact, a stock that he just reduced his position in could actually join Coke as one of Berkshire Hathaway’s “forever” holdings. My prediction is this stock will become Buffett’s next Coca-Cola …

Buffett recently sold some shares of this stock

So, which stock am I talking about? Well, it’s another company that’s a household name, though it operates in the technology industry rather than the beverage sector: Apple (NASDAQ: AAPL).

But wait a minute, you might be saying, Buffett sold some of his shares in the iPhone maker during the second quarter. Isn’t that a bad sign?

Not necessarily. At the Berkshire Hathaway annual meeting in May, Buffett signaled that his Apple sales are linked to locking in the current 21% capital gains tax rate, and not due to a loss of faith in the company. He expects the tax rate to go up, considering the current size of the federal deficit. Even counting the sale of 49% of his Apple position, Buffett said it is “extremely likely” that at the end of the year, it will be Berkshire’s largest common-stock holding.

The recent sale in Apple brings the holding down to 400 million shares. Sound familiar? That’s the same number of shares Berkshire holds in Coca-Cola. This, of course, is an interesting detail to point out, but I’m not basing my prediction on it. I have a stronger argument for why Buffett could view Apple as his next Coca-Cola.

A “brilliant CEO”

And this has to do with his confidence in the way the company is run and its solid earnings record. In Buffett’s 2021 shareholder letter, he referred to Tim Cook as Apple’s “brilliant CEO” and praised his decision to repurchase Apple shares. Share buybacks increase the ownership of current holders without them paying a dime.

These repurchases helped Berkshire increase its holding from 5.2% of Apple in 2018, when it completed its purchases of the stock, to 5.4% by 2020. Berkshire started buying Apple shares back in 2016.

Cook’s expertise also has guided Apple along the path of double-digit earnings growth over the past five years. And, like Coca-Cola, Apple has a significant moat, with users of the iPhone flocking to the company each time a new version is released. Last year, for the first time ever, Apple won the top seven spots on the list of the top-selling smartphones that’s compiled by Counterpoint, a technology market research firm.

An “enduring moat”

“A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital,” Buffett wrote in his 2007 letter to shareholders, emphasizing the importance of this when choosing investments.

Lastly, one more thing about Apple could help it become the “second Coca-Cola” in the Berkshire Hathaway portfolio: the company’s commitment to dividends. Berkshire Hathaway has averaged about $775 million annually in Apple dividends since 2018.

Technology companies aren’t known to pay out tremendous dividends since they invest a lot back into growth, so Apple’s dividend isn’t the biggest on the block. But the company has steadily paid one since 2012. And at $1 per share annually, for a dividend yield of 0.4%, it’s an attractive part of the complete package.

All of this prompts me to predict that, like Coca-Cola, Apple will be a permanent fixture in the Berkshire Hathaway portfolio. And thanks to its strong earnings track record, strong moat, and dividend policy, this tech stock makes a great addition to any portfolio needing the fantastic combination of growth and safety.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Prediction: This Stock Will Become Warren Buffett’s Next Coca-Cola was originally published by The Motley Fool

Palantir is totally misunderstood on Wall Street, and shares will soar, BofA says

Data-mining software company Palantir Technologies is popular among retail investors, but Bank of America said it’s still misunderstood by many on Wall Street.

In a note on Tuesday, analysts pointed out that a 1980 estimate of cell phone users by 2000 was just 900,000. The actual number of mobile subscriptions that year was more than 100 million. Meanwhile, such early forecasts also failed to see the advent of mobile apps and smart devices.

“We view Palantir’s (PLTR) capabilities, technology and path forward facing a similar fundamental misunderstanding,” wrote BofA analysts led by Mariana Perez Mora. “The upcoming S&P 500 inclusion provides a watershed moment for institutional investors to revisit what they ‘know’ about PLTR.”

BofA reiterated its buy rating on Palantir stock and raised its price target to $50 from $30. The new target represents 40.5% upside from the stock’s closing price on Friday. And that comes after shares had already jumped on news last week that the company would join the S&P 500 later this month and have more than doubled in the year to date.

A key misunderstanding on Wall Street is Palantir’s unconventional sales strategy, which has engineers playing a key role. While investors have said the approach limits scalability and profitability, BofA disagrees.

“We think this method makes PLTR solutions significantly more relevant to the users and gives PLTR stronger pricing power,” the note said. “The engineers create intimacy with the customer’s mission and help shape the product to add real value.”

Meanwhile, as Palantir racks up more customers in the public and private sectors, BofA sees a huge opportunity for the company to become the common data operational system for the U.S. government and large U.S. businesses.

Palantir is known for its work in defense and intelligence but has also been expanding in the commercial space.

Celebrating Palantir’s inclusion in the S&P 500, CEO Alex Karp took a victory lap in a video posted on Tuesday. He also nodded to Wall Street’s misconceptions about the company, which developed and offered products a decade ahead of rivals, allowing entire enterprises to use AI and large language models.

“It’s still radical to the point where people do not completely comprehend,” Karp said. “They do not comprehend how we could’ve turned a switch and gone to GAAP profitability. And gone from what adults, professional managers, and some analysts thought was a Frankenstein monster powered by a freak show leader—me—to a dynamic, clearly profitable company worthy of and admitted to the S&P 500.”

Along the way, Palantir charted its own course, ignoring what conventional wisdom preached, he added, while also applauding retail investors who maintained faith in the company.

“All of you who are inside the company and around the world should celebrate that the rebels won,” he said.

This story was originally featured on Fortune.com

Chinese Stock Traders Ponder Just How Bad the Economy Can Get

(Bloomberg) — A slew of poor economic data from China is deepening pessimism among equities traders wondering what it’d take for authorities to initiate forceful stimulus.

Most Read from Bloomberg

Figures released Saturday showed Chinese factory output, consumption and investment all slowed more than forecast for August, and the jobless rate unexpectedly rose to a six-month high. Home prices declined from the previous month.

“The fear is that the authorities are losing control of the economy and they won’t admit it,” said Gary Dugan, chief executive officer of the Global CIO Office. “The market looks set to go to significantly lower levels in the absence of real, substantial new policies.”

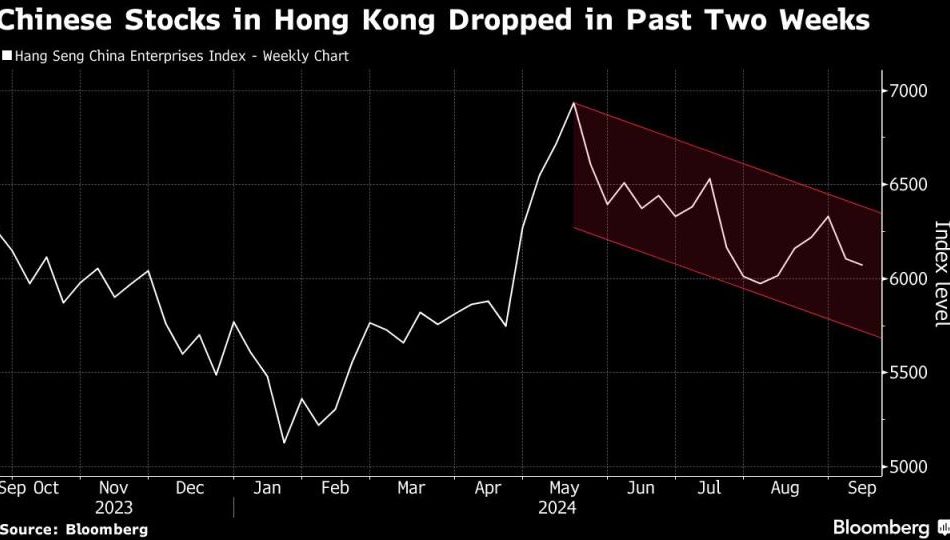

Concern that Beijing doesn’t have the stomach to turn things around has weighed on the nation’s equities. The CSI 300 Index fell to its lowest since early 2019 last week. In Hong Kong, the Hang Seng China Enterprises Index has dropped 13% from a high in May.

Any reaction in Chinese stocks on Monday will be focused on Hong Kong, with mainland financial markets closed until Wednesday due to holidays.

Authorities have shown a reluctance to unleash big-bang fiscal stimulus ever since they acted to deflate a property bubble, which has led to the current crisis. Support measures such as interest-rate cuts and state funds’ purchases of exchange-traded funds have done little to revive sentiment.

The result has been an exodus from the nation’s equity markets. In all, some $6.8 trillion has been wiped out from the market value of Chinese and Hong Kong stocks since a peak reached in 2021.

Saturday’s figures suggest the main driver of the Chinese economy this year — bolstered by exports and government support — is losing steam. Industrial output expanded at a slower rate than economists had expected, extending a weakening streak to the fourth month, the longest stretch since September 2021.

The economic data “probably makes the markets feel like authorities are asleep at the wheel,” said Kyle Rodda, a senior market analyst at Capital.Com Inc. in Melbourne.

The People’s Bank of China last week indicated it will step up its fight against deflation and prepare additional policies to revive the economy, after credit data showed private confidence remained weak despite previous interest-rate cuts.

Still, stimulus can only go so far in China’s current business climate, according to veteran emerging-market investor Mark Mobius.

“The real problem is that the entrepreneurial impetus is missing, with lots of businessmen unwilling to invest,” he said. “It will be necessary for the government to loosen up on private enterprise restrictions and regulations so the private sector can be stimulated and help grow the economy.”

—With assistance from April Ma.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Icahn Enterprises wins dismissal of investor lawsuit

(Reuters) -Carl Icahn’s investment company Icahn Enterprises won the dismissal of a lawsuit claiming it artificially inflated its share price by issuing unsustainably high dividends to help the billionaire investor obtain large amounts of personal loans.

In a decision on Friday, U.S. District Judge K. Michael Moore in Miami said shareholders in the proposed class action failed to show that the company made material misrepresentations or omissions and did so with an intent to defraud.

Lawyers for the shareholders did not immediately respond to requests for comment. A spokesman for Icahn Enterprises did not immediately respond to a similar request. Moore gave the shareholders until Oct. 14 to file an amended complaint.

Icahn Enterprises shares have fallen more than three-quarters since May 2023, when the short-selling firm Hindenburg Research questioned its dividends and Icahn’s borrowing, and accused Icahn of overseeing a “Ponzi-like economic structure.”

Last month Icahn agreed without admitting wrongdoing to pay $2 million to settle U.S. Securities and Exchange Commission civil charges that he failed to disclose his significant borrowing against the shares.

The shareholders said Icahn Enterprises’ true health became evident as its Auto Parts Plus business went bankrupt, the company slashed its dividend and Icahn renegotiated his loans.

Icahn owns about 85% of his company’s shares, and personally lost many billions of dollars as the share price fell.

In his 28-page decision, Moore cited the company’s disclosures that it could lower dividends, and said its general disclosures about Carl Icahn’s borrowing were sufficient to alert investors to the risks.

He also said Icahn Enterprises’ 2021 annual report disclosed Carl Icahn’s share pledges, and that there were no allegations that any defendant conducted insider trading.

“This conduct suggests that the individual defendants, including Icahn, believed in the long-term value of IEP and is inconsistent with the theory that defendants were engaged in a scheme to artificially inflate the stock price for personal gain,” Moore wrote.

The case is Kosowsky v Icahn Enterprises LP et al, U.S. District Court, Southern District of Florida, No. 23-21773.

(Reporting by Jonathan Stempel in New York; editing by Diane Craft)