Chinese Premier Li Qiang cements ties with Saudi Arabia, UAE, including on new energy

Chinese Premier Li Qiang returned from his visit to Saudi Arabia and United Arab Emirates on Friday after forging closer ties with both Gulf states.

Pledges for closer cooperation included the new energy sector, described by a Chinese analyst as “crucial” to the Middle Eastern economy.

Li travelled to the United Arab Emirates on Wednesday evening after wrapping up a two-day visit to Saudi Arabia. He met UAE President Sheikh Mohamed bin Zayed Al Nahyan in the capital Abu Dhabi the following day, with both leaders pledging to enhance the comprehensive strategic partnership between their countries.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

According to a readout from the Chinese foreign ministry, Li called for deeper cooperation in new energy, electric vehicles, high-end manufacturing, biomedicine, digital economy and other fields, and for reinforcing collaboration in investment and traditional sectors like oil and gas.

“The two countries should jointly make a forward-looking layout of emerging industries and future industries, and cultivate more new economic growth points,” Li was quoted as saying during what was his first visit to the UAE since taking office.

His trip came three months after Sheikh Mohamed’s state visit to China and meeting with President Xi Jinping, when both sides vowed closer cooperation, including in cutting-edge technologies.

Cooperation between China and the UAE, a US ally, has reached unprecedented heights in fields ranging from trade and investment to sensitive technology and defence, despite growing scrutiny from Washington.

According to Chinese foreign ministry data, bilateral trade volume reached a record US$50 billion in the first half of this year.

Li began his Middle East trip with a visit to Saudi Arabia, where he met Crown Prince Mohammed bin Salman in Riyadh on Wednesday.

Li called for closer collaboration in traditional sectors such as petrochemicals and infrastructure construction, while broadening cooperation in emerging fields such as new energy, information and communications, and the digital and green economies.

Middle East affairs specialist Wen Shaobiao at the Shanghai International Studies University said that Li’s visit was focused on strengthening economic relations with two wealthy Gulf nations.

“China hopes that deeper economic cooperation between China and these two Gulf states can catalyse and drive such collaborations between China and the Middle East region,” Wen said.

“The expansion of cooperation on electric vehicles (EVs) would capitalise on China’s production strengths and expand its burgeoning EV industry chain further into the Middle East.”

China’s leading EV companies such as BYD and Nio have already entered the UAE market. And last year, the UAE set up the world’s largest single-site solar power plant – a flagship project under Beijing’s Belt and Road Initiative.

China has a marked trade surplus with the UAE, but growing Chinese investments are narrowing the gap. Last year, China’s investments in the UAE increased by more than 16 per cent to US$1.3 billion.

This came as the UAE saw investments in China grow by 120 per cent, accounting for 90 per cent of Arab states’ investments in the country.

The UAE has largely been seen as the first destination in the Middle East for China’s new energy market – a booming industry that has been accused of “overcapacity” and targeted for tariffs by the West.

Li’s trip to Saudi Arabia also touched upon cooperation on new energy, a promising area described by Wen as “crucial” to the regional economy.

“Cooperation in new and green energy is crucial, particularly for the sustainable development and energy transition of Middle Eastern countries. China, which leads in the green energy sector with an extensive industry chain, would bring substantial benefits to the region,” Wen said.

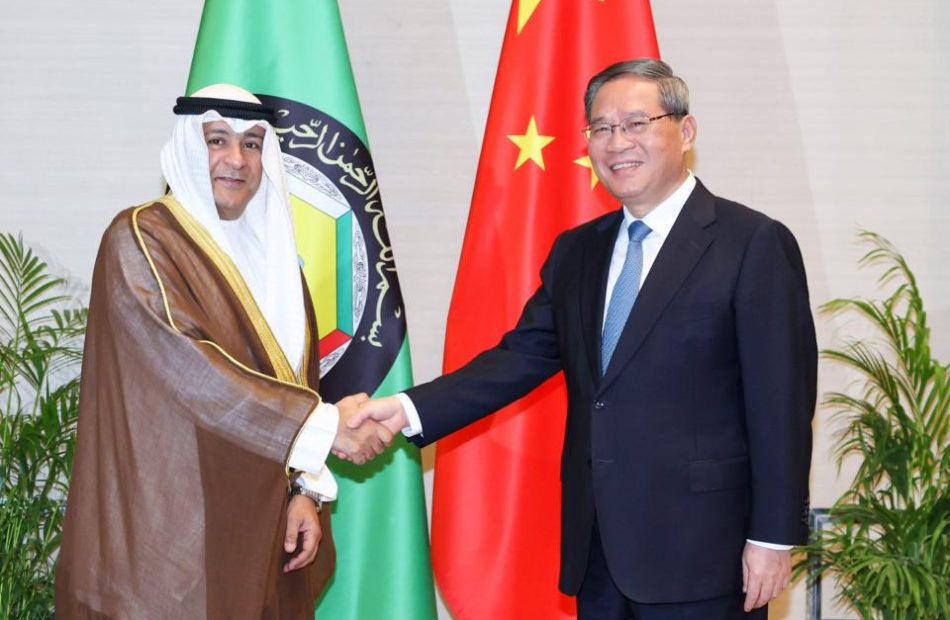

Chinese Premier Li Qiang meets GCC Secretary General Jasem Mohamed Albudaiwi in Riyadh, Saudi Arabia. Photo: Xinhua alt=Chinese Premier Li Qiang meets GCC Secretary General Jasem Mohamed Albudaiwi in Riyadh, Saudi Arabia. Photo: Xinhua>

China has been actively working to strengthen its influence and solidify relationships in the Gulf Cooperation Council (GCC) – made up of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE – while seeking to secure a foothold through a free-trade agreement that has been in talks for years.

Li’s trip to Saudi Arabia included a meeting with GCC Secretary General Jasem Mohamed Albudaiwi.

According to a Chinese foreign ministry statement, Albudaiwi said he looked forward to reaching an agreement on the China-GCC free trade agreement “as soon as possible”.

Wen said there were significant motivations for both China and the Gulf countries to conclude the deal.

The Gulf nations aim to diversify their economies beyond reliance on fossil fuels, while the free trade deal with China could be an exemplary project to illustrate the high quality of China’s belt and road strategy, Wen said.

“Given these incentives, it is likely that the trade negotiations will pick up pace soon.”

Addressing a UAE-China business forum during his visit to Abu Dhabi, Li called on both sides to seize the moment to boost the quality of bilateral trade and economic cooperation.

“Companies from both nations should … capitalise on the robust, mutual commitment to bilateral cooperation by engaging in new opportunities brought by the construction of high-quality [belt and road projects],” Li said.

“This will further integrate both countries into the global industrial and supply chains. Additionally, by leveraging the close alignment of bilateral development strategies, businesses can identify potential areas for future collaborations.”

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Trump Vs. Harris Presidential Debate, Sanders On Healthcare Disparity, And More: This Week In Politics

As the weekend wraps up, we look back at the major stories that made headlines. From the much-anticipated Trump vs Harris debate to Bernie Sanders’ remarks on healthcare disparity, and Mark Cuban’s praise for Elon Musk’s AI, it’s been a busy few days. Let’s dive into the details.

Trump vs Harris: The Debate Verdict

The first presidential debate between Republican candidate Donald Trump and his rival Vice President Kamala Harris concluded. Despite accusations of bias from ABC News, early reactions suggest Harris emerged victorious. A CNN flash poll revealed that 63% of registered voters who watched the debate picked Harris as the winner, compared to 37% for Trump. Interestingly, prior expectations for the debate winner were evenly split. Read the full article here.

Bernie Sanders on Healthcare Disparity

Senator Bernie Sanders recently voiced his concerns about the state of healthcare in the United States. He highlighted the stark difference in health outcomes between the rich and the poor, stating that the poor in America live 10 to 15 years less than their wealthier counterparts. Read the full article here.

Trump’s Stand on Federal Rate Cuts

Former President Donald Trump expressed his opinion on the Federal Reserve’s monetary policy. He said that he believes presidents should have a say in interest rate decisions and is against rate cuts ahead of the 2024 presidential election. This stance contradicts the expectations of investors and Congress members who anticipate a rate cut next week. Read the full article here.

Nate Silver on the Presidential Debate

Veteran pollster Nate Silver shared his insights on the first presidential debate. He pointed out that the consensus is in favor of Harris, who seems to have won the night. Silver also noted a shift in betting market odds, with Harris now on par with Trump. Read the full article here.

Mark Cuban Praises Elon Musk’s AI

Billionaire entrepreneur Mark Cuban has publicly commended Elon Musk‘s AI chatbot, Grok. Cuban referred to Grok for an accurate representation of Vice President Kamala Harris’ stance on immigration. Read the full article h

Read Next: Benzinga Bulls And Bears: Nvidia, Apple, Lucid And — Dogecoin Surges On Elon Musk’s Joke

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Anan Ashraf.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BC's Rental Protection Fund Announces Acquisition of 147 more affordable rental units across the Lower Mainland

VANCOUVER, British Columbia, Sept. 13, 2024 (GLOBE NEWSWIRE) — Today, the Rental Protection Fund (the Fund) announces three acquisitions in communities throughout the Lower Mainland. In Vancouver, a four-storey, 24-unit rental building will be protected in the Marpole neighbourhood. In Burnaby, the affordability of 79 more homes will be secured through non-profit ownership, and in Maple Ridge 44 townhomes, that will all remain affordable to families.

“Every dollar invested in the Rental Protection Fund is worth at least three dollars towards solving the housing crisis,” said Katie Maslechko, CEO of the Rental Protection Fund. “With each acquisition, the non-profit now has equity they can leverage to provide even more housing without displacement, and the former owner has freed up capital they can redeploy into new supply – all while delivering housing security for thousands. It is a proven model with a profound impact, and given the stakes, is one of the most strategic housing investments you can make.”

Parkwood Gardens, Burnaby

Burnaby is facing a severe shortage of childcare and affordable rental housing. The City has the second highest rental prices in Canada, and, in the southeast Highgate/Edmonds neighborhood, the fewest childcare spaces per capita in Burnaby. The acquisition of Parkwood Gardens addresses both of these growing needs. Comprised of 79 units renting at about half the local market rates and a 25-space childcare facility accessible to the neighbourhood. The homes at Parkwood Gardens are large, family-friendly units, with 75 of the 79 units having three bedrooms. Catalyst Community Developments Society, the new non-profit owner of the property, is committed to maintaining the affordability of the units and providing long-term rent stability for Parkwood Gardens’ residents.

Catalyst acquired Parkwood Gardens in May 2024 with approximately $15.9 million in capital contributions from the Rental Protection Fund and more than $18,000 per home in grants to support building renewal. This property is also a strategic acquisition, adjacent to 1.5 acres of vacant city-owned land, and is well-positioned to deliver more affordable housing in the future.

“Catalyst is thrilled to be operating more homes in Burnaby,” said Luke Harrison, CEO of Catalyst Community Developments Society. “This acquisition of 79 homes by a non-profit was impossible without the collaboration of the new Rental Protection Fund and an accommodating vendor that shared our objective of ensuring Parkwood Gardens remains affordable to its current community members.”

Since 2013, Catalyst has partnered with community organizations, non-profits, municipal governments and market developers to create or acquire housing that will deliver on their mission. The organization is committed to building community by developing, owning, and operating vibrant, affordable, and inspiring places to live and work.

Brookside Gardens, Maple Ridge

Brookside Gardens is uniquely suited for families and is the only purpose-built rental townhome housing in Maple Ridge. All 44 units are large three-bedroom homes with fenced yards and space for families with children and multi-generational households to grow and thrive.

Homes that meet the needs of growing families are in short supply across Metro Vancouver and finding affordable family-oriented homes is even more challenging. Rents at Brookside Gardens are approximately 46% below market rates, with a three-bedroom townhome renting for an average of under $1900 per month. Connective will continue to keep these homes affordable to families by capping rent increases below the annual allowable increase and prioritizing new tenants with household incomes below the BC Housing Income Limit.

“I was pleased that Connective has purchased this complex. The staff that I have met have been friendly and helpful,” shared Brookside Gardens resident, Sandy Burley. “It is nice to know Connective has made a commitment to keep their homes affordable, with everything going up in price it is sometimes hard to afford everything.”

Connective has nearly 100 years’ experience as a steward of affordable housing in BC and the Yukon. With more than 1000 units under ownership and management, this organization draws on deep experience in the sector, well-refined growth and management policies, and an economy of scale that allows them to keep administrative and maintenance costs low.

“This exciting addition to Connective’s affordable housing portfolio allows us to apply our expertise in response to an identified community need. Brookside Gardens, as the only purpose-built rental townhomes in Maple Ridge, are an important resource for families looking to build a life in the region,” said Mark Miller, CEO of Connective. “We’re grateful to the Government of British Columbia and the Rental Protection Fund for allowing us to secure its affordability and shield generations of residents from potential displacement or redevelopment.”

The Rental Protection Fund provided a capital grant of $8.9 million to Connective Support Society for the purchase of Brookside Gardens at 20834 Dewdney Trunk Road. The property was acquired from CAPREIT – one of the largest institutional housing operators in Canada – at below the appraised value. CAPREIT invested in regular maintenance and upgrades between tenancies, ensuring the homes remained in excellent condition. This enabled Connective to acquire the property without the need for a renewal grant.

8820 Cartier Street, Vancouver

8820 Cartier Street is the first acquisition through the Rental Protection Fund in the City of Vancouver. Despite the high land values common in the city, Lookout Housing and Health Society successfully secured this property below both list price and the appraised value showing the Fund’s commitment to value and social outcome-driven investment.

The Rental Protection Fund provided a capital contribution of just over $5.3 million and a renewal grant of $240,000 towards the purchase of this property. Lookout also contributed $40,000 of their own equity towards building upgrades and renovations.

In a city where finding a safe and affordable home is becoming increasingly difficult, rents at 8820 Cartier Street are on average 62% below the market rates for the neighbourhood. The average rents in the building are affordable to households earning approximately $46,000 per year, well below median renter incomes for the region. Now part of the community housing sector, this property fills a critical gap in the housing continuum, allowing individuals and families who may currently be living in supportive housing but no longer rely on these supports to access safe and secure housing at rents they can afford. This creates a positive ripple effect by freeing up supportive housing spaces, allowing people to move off the streets into homes with the services and support they need.

“The support received from the Rental Protection Fund to preserve affordable housing is critical for non-profit organizations like Lookout Housing and Health Society,” said Shayne Williams, CEO of Lookout Group of Non-Profits. “These investments help address the need for the full continuum of housing in communities like Vancouver, where it’s needed most.”

Since 1971, Lookout Housing and Health Society has offered services that meet the needs of the most vulnerable citizens in our community. The organization’s mission is to be a social safety net providing a range of housing, health, and support services that promote improved wellbeing for those in need. Lookout serves thousands of individuals annually through its 144 programs in 19 municipalities across Vancouver, Fraser Valley and Vancouver Island.

This announcement follows two others last month in Victoria and North Vancouver and brings the number of homes protected in the Lower Mainland to 676 announced to date. The Rental Protection Fund has approved funding for nearly 1500 homes in 19 communities across British Columbia, with more announcements to follow as these homes move into the community housing sector.

Through one-time capital contributions provided by the Fund, non-profits and housing co-operatives can secure, revitalize, and safeguard current rental units against escalating market rents. With the anticipated launch of the Federal Rental Protection Fund, and opportunity for recapitalization support from the Provincial Government, the Fund will be able to continue to expand its role – and the community housing sector – ensuring the affordable rental homes we have today homes remain affordable for generations to come.

Media Contact:

Rental Protection Fund

Public Affairs

media@rentalprotectionfund.ca

About The Rental Protection Fund:

Endorsed by the provincial government with a groundbreaking investment of $500 million, the Rental Protection Fund stands as B.C.’s direct response to the housing crisis. Under the leadership of CEO Katie Maslechko, the Fund is dedicated to protecting tenants and ensuring the availability of affordable rental homes for future generations. By providing capital contributions to non-profit housing organizations and cooperatives, it facilitates the acquisition of existing rental buildings. This initiative is committed to maintaining housing affordability and stability for renters in B.C. in the long run. Those who wish to have a property considered for acquisition through the Rental Protection Fund can submit them at www.RentalProtectionFund.ca

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir's Billionaire Chairman Just Filed to Sell $1 Billion in Stock. Should Investors Follow Suit?

Share prices of Palantir Technologies (NYSE: PLTR) have approximately doubled so far in 2024. Coincidentally, co-founder and Chairman Peter Thiel recently filed to sell Palantir shares he owns, which are valued at nearly $1 billion. More specifically, the billionaire entrepreneur (who also helped co-found PayPal) has adopted what is referred to as a Rule 10b5-1 plan to sell nearly 28.6 million Palantir shares by the end of 2025.

Thiel appears to be taking this opportunity to lock in the profits these shares have accumulated. The question for investors is: Should they follow suit?

Thiel’s Rule 10b5-1 plan

Before discussing the investment thesis on Palantir, let’s look at what Thiel is doing by implementing a Rule 10b5-1 plan. This rule was designed to help company insiders sell shares in such a way that they won’t be accused of illegal insider trading. Predetermined selling instructions are given by a company insider and then executed by a brokerage. Some of the instructions are made public. Insiders can set parameters for when a stock can be sold, such that it must be at a certain price or just on set dates. They can set it up to sell a set amount of shares or a certain dollar amount.

After the plan is established, there’s a cooling-off period before any trades are made. Changes to the plan can only be made during an open trading window and when the insider has no material non-public information that could impact the stock price. Thiel’s sales will be done through Rivendell 7, which is one of four investment vehicles he owns that holds Palantir stock.

Thiel has set up Rule 10b5-1 plans to sell Palantir stock before. He adopted a plan in December 2023 to sell 20 million shares, which was disclosed in February 2024. His first trade under that plan was for over 7 million shares at an average price of $24.79 on March 12. The plan then enacted a trade of nearly 13 million shares at an average price of $21.11 on May 10. This prior plan had an end date of March 2025 but was finished much sooner.

Thiel currently owns around 99.5 million shares of Palantir through his Rivendell 7, Rivendell 25, PLTR Holdings, and STS Holdings investment vehicles. If the plan is executed, it will reduce his overall holdings in Palantir by close to 29% to 70.9 million shares. At the start of 2024, Thiel owned 148.9 million Palantir shares, so he has been looking to significantly reduce his stake over the next 16 months or so.

Should investors follow Thiel and take profits?

Palantir was trading at around $6 a share when 2023 began, so the stock (now valued at around $35 a share) has been on an incredible run over a relatively short period. Given the stock’s strong performance, it’s perhaps not surprising that Thiel is taking some money off the table. For investors who have large gains in the stock, it certainly can be prudent portfolio management to follow suit and take some gains.

Palantir has proven that it’s a company with great technology that has assisted the government in mission-critical tasks over the years, including fighting terrorism and helping track the spread of COVID-19. Meanwhile, its artificial intelligence (AI) platform is being used by companies across industries with various use cases.

However, the company’s valuation appears to be well ahead of itself at present. After its huge run, the stock now trades at a forward price-to-sales ratio (P/S) of over 27.5 based on analyst estimates for 2024. That’s a huge multiple typically reserved only for companies that are seeing hypergrowth, which Palantir is not.

In fact, Palantir’s government business segment has proven to be a bit lumpy. Last year, government revenue grew just 14%, which held overall revenue growth to just 17%.

Government revenue growth has accelerated, which led to Palantir’s overall revenue growth climbing by 27% year over year last quarter. That’s solid growth but still not the hypergrowth Palantir would need to see to justify its current valuation.

Palantir has the makings of a great company, but at some point, valuation matters. Current investors might want to consider taking a cue from the company’s co-founder and lightening up their positions, locking in some of the profits.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Geoffrey Seiler has positions in PayPal. The Motley Fool has positions in and recommends Palantir Technologies and PayPal. The Motley Fool recommends the following options: short September 2024 $62.50 calls on PayPal. The Motley Fool has a disclosure policy.

Palantir’s Billionaire Chairman Just Filed to Sell $1 Billion in Stock. Should Investors Follow Suit? was originally published by The Motley Fool

Nvidia Stock vs. Palantir Stock: Wall Street Says Buy One and Sell the Other

Consultancy PwC estimates artificial intelligence (AI) will contribute more than $15 trillion to the global economy by 2030. Investors hoping to benefit are piling into AI stocks, and Nvidia (NASDAQ: NVDA) and Palantir Technologies (NYSE: PLTR) have been two of the most popular choices.

In the last two years, Nvidia shares surged 728%, and Palantir shares advanced 348%. But Wall Street analysts expect the stocks to move in opposite directions over the next 12 months, as detailed below:

Here’s what investors should know about these AI stocks.

1. Nvidia

Nvidia is best known for its graphics processing units (GPUs), chips that have become the industry standard in accelerating complex data center workloads such as training machine learning models and running AI applications. In March, Forrester Research wrote, “Nvidia sets the pace for AI infrastructure worldwide. Without Nvidia GPUs, modern AI wouldn’t be possible.”

However, the chipmaker is truly formidable because it provides a full-stack computing platform that comprises adjacent hardware, software, and services. Nvidia has secured leadership in generative AI networking gear, and its first server central processing unit (CPU) is ramping toward a multibillion-dollar product line, according to CEO Jensen Huang.

Likewise, Nvidia says its software and services business will approach a $2 billion revenue run rate this year due to strength from its AI Enterprise offering. Nvidia AI Enterprise is a software platform that streamlines data preparation and model training, as well as the development and deployment of AI applications. The platform includes frameworks that address specific use cases, including conversational agents, recommender systems, and autonomous robotics.

Nvidia reported strong financial results in the second quarter of fiscal 2025 (ended July 2024). Revenue increased 122% to $30 billion on strong demand for AI hardware and software, and non-GAAP (generally accepted accounting principles) earnings surged 152% to $0.68 per diluted share. More importantly, the company is well positioned to maintain that momentum.

Nvidia’s next generation of data center GPUs, called Blackwell, will ramp up later this year, and the market is rife with anticipation. Earlier this year, CEO Jensen Huang predicted, “The Blackwell architecture platform will likely be the most successful product in our history.”

Looking ahead, Wall Street expects Nvidia’s adjusted earnings to grow at 49% annually through fiscal 2026 (ends January 2026). That estimate makes the current valuation of 54 times adjusted earnings seem reasonable. Patient investors should consider purchasing a small position in Nvidia stock today.

2. Palantir Technologies

Palantir sells data analytics software. Its platforms help enterprises manage data, develop machine learning models, and integrate those digital assets into applications that improve decision-making. Palantir describes its core software products, Foundry and Gotham, as operating systems that connect data, decisions, and operations. Use cases range from managing supply chains to mitigating financial risk to optimizing manufacturing.

Last year, Palantir added support for large language models and generative AI to Gotham and Foundry with AIP (Artificial Intelligence Platform). The company also reoriented its go-to-market strategy around the new product with AIP Bootcamps, instructional events where potential customers learn to use AIP on their own data in a matter of days.

In August, Forrester Research recognized Palantir as a leader among AI and machine learning platform vendors. Analysts wrote, “Palantir is quietly becoming one of the largest players in this market.” Palantir was awarded the highest score for its current product offering, but competitors Alphabet and C3.ai earned higher scores for their growth strategy.

Palantir reported encouraging financial results in the second quarter. Its customer count increased by 41% to 593, and the average customer spent 14% more over the past year. In turn, revenue increased 27% to $678 million, the fifth sequential acceleration, and non-GAAP net income jumped 80% to $0.09 per diluted share.

Going forward, CEO Alex Karp expects the company to maintain its momentum. “The persistent and unbridled demand for our software, for an effective enterprise platform that makes artificial intelligence capabilities useful to large institutions, shows no signs of relenting.”

The problem is valuation. Wall Street forecasts adjusted earnings growth of 22% annually through 2025. That makes the current valuation of 109 times adjusted earnings look pricey. Personally, I agree with Wall Street. Palantir looks overvalued, and I would not be surprised to see a substantial correction in the future. Investors should consider trimming their positions.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Nvidia and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

Nvidia Stock vs. Palantir Stock: Wall Street Says Buy One and Sell the Other was originally published by The Motley Fool

Nvidia Stock Split Update: Down 2% Since June, History Says the AI Stock Will Do This Next

For many investors, Nvidia (NASDAQ: NVDA) has emerged as the quintessential artificial intelligence (AI) stock. That’s because the company’s graphics processing units (GPUs) are the industry standard in accelerating complex data center tasks, such as training machine learning models and running AI applications.

Nvidia shares have surged 780% since the generative AI application ChatGPT went viral in late 2022. That event triggered a tidal wave of AI infrastructure spending that is still building momentum, and Nvidia has been one of the biggest beneficiaries. In turn, the stock has become a staple of the AI trade.

Nvidia reset its soaring share price in June by conducting a 10-for-1 stock split. Shares have since tumbled about 2%, but history says Nvidia stock may have further to fall.

Stock-split stocks like Nvidia typically outperform the S&P 500

Generally speaking, companies conduct forward stock splits after substantial share price appreciation, which itself is suggestive of compelling growth prospects and a competitive edge. Companies that possess those qualities tend to produce above-average returns for shareholders.

Indeed, Bank of America reviewed data back to 1980 and found a correlation. Companies that split their stock returned an average of 25.4% during the 12 months after announcing the split. By comparison, the S&P 500 returned an average of 11.9% during the same period.

Here’s what that could mean: Nvidia announced its latest stock split after the market closed on May 22, 2024. The stock traded at a split-adjusted $95 per share. History says its share price will increase 25.4% to $119 by May 2025. But the stock already trades at $119 per share, leaving zero implied upside (or downside) over the next eight months.

Nvidia has performed poorly following past stock splits

We can also make predictions about Nvidia’s future performance by reviewing company-specific data. For instance, the chipmaker completed five stock splits prior to the most recent one. The chart below shows how the stock performed during the 12 months and 24 months following those five splits.

|

Stock Split Date |

12-Month Return |

24-Month Return |

|---|---|---|

|

June 2000 |

28% |

(52%) |

|

September 2001 |

(72%) |

(49%) |

|

April 2006 |

1% |

(6%) |

|

September 2007 |

(70%) |

(53%) |

|

July 2021 |

(4%) |

145% |

|

Average |

(23%) |

(3%) |

Data source: YCharts.

As shown above, Nvidia has usually performed poorly following stock splits. Its share price has declined by an average of 23% during the first 12 months and was still down by 3% on average after 24 months.

Here’s what that could mean: Nvidia completed its 10-for-1 split after the market closed on June 7. The stock traded at a split-adjusted $121 per share. History says its share price will drop 23% to $93 by June 2025. The stock currently trades at $119 per share, so the implied downside is 22% over the next nine months.

Having said that, past performance is never a guarantee of future results. Moreover, most of the stock splits listed in the chart took place within 12 months of a recession, so Nvidia had little chance of posting positive returns. Going forward, whether Nvidia is a good investment depends on its financial performance and what investors are willing to pay to own shares of the company.

Nvidia is the market leader in artificial intelligence chips

Nvidia dominates the market for data center GPUs, chips used to speed up workloads like AI applications. The company accounted for 98% of data center GPU shipments in 2023, essentially unchanged from the prior year, and those GPUs account for more than 80% of AI chips.

There are two reasons for that dominance. First, Nvidia designs the most powerful GPUs money can buy, and rapid product development keeps its GPUs on the cutting edge in terms of performance. Second, Nvidia complements its chips with a robust ecosystem of software libraries and developer tools called CUDA. The CUDA platform streamlines the building of GPU-accelerated applications.

According to Grand View Research, graphics processor sales are projected to grow at 27% annually through 2030, driven by the proliferation of machine learning and AI. Nvidia’s sales should increase at a similar pace, plus or minus a few percentage points. However, earnings may grow a bit faster due to share repurchases and potential margin expansion driven by pricing power.

Wall Street forecasts adjusted earnings will increase at 35% annually through fiscal 2027 (ends January 2027). That consensus makes the current valuation of 54 times earnings look tolerable. Investors should consider buying a small position in Nvidia stock today, provided they are comfortable with volatility and willing to hold their shares for at least three to five years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Stock Split Update: Down 2% Since June, History Says the AI Stock Will Do This Next was originally published by The Motley Fool

Laura Loomer Faces Republican Wrath Over Racist Posts – Is Donald Trump Defending Her?

Laura Loomer, a known far-right conspiracy theorist, has recently joined Donald Trump on the campaign trail, prompting concerns — even among some Republicans — about her potential influence on him.

Loomer made derogatory remarks about Kamala Harris’ Indian heritage on X, suggesting that if Harris won, the White House would “smell like curry” and “White House speeches will be facilitated via a call center,” reported Politico.

The post has since been deleted for violating X’s policies.

Republicans Against Loomer?

The BBC reported that several high-ranking Republican figures have publicly condemned Loomer and warned Trump against including her in his close circles.

Also Read: Donald Trump’s Media Company Stock Is Down 12% This Week: What’s Going On?

Rep. Marjorie Taylor Greene (R-Ga.) promptly took to X, formerly Twitter, to denounce Loomer for the “racist” post. “This does not represent President Trump. This type of behavior should not be tolerated ever,” Greene posted.

Sen. Thom Tillis (R-N.C.) wrote on X, “Laura Loomer is a crazy conspiracy theorist who regularly utters disgusting garbage intended to divide Republicans. A DNC plant couldn’t do a better job than she is doing to hurt President Trump’s chances of winning re-election.”

In an interview with The Washington Post on Thursday, Sen. Lindsey Graham (R-S.C.) said statements by Loomer are disturbing. “I hope this problem gets resolved, Graham told The Post.

Trump Downplays Loomer’s Controversy?

During a press conference in Rancho Palos Verdes, California, on Friday, Trump stated that he was unaware of Loomer’s controversial comments when questioned about her.

In fact, Trump described Loomer as a “free spirit” with strong opinions on Friday, following criticism from Republicans over her promotion of conspiracy theories and a recent offensive social media post regarding Kamala Harris’s race.

However, later on Friday, Trump conveyed his disagreement with Loomer’s comments in a Truth Social post, clarifying that she is a private citizen and not affiliated with his campaign, noted Politico.

In 2020, Loomer ran for the U.S. House of Representatives in Florida with Trump’s backing but was easily defeated by Rep. Lois Frankel (D-Fla.), BBC noted.

Two years later, she made another attempt to enter Congress by running in primary against Rep. Daniel Webster (R-Fla.) in a different district, but was unsuccessful.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Photo: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Unstoppable Stock That Could Join Nvidia, Microsoft, Apple, Amazon, Alphabet, and Meta in the $1 Trillion Club

The U.S. economy has a history of producing the world’s most valuable companies. United States Steel became the first-ever $1 billion company in 1901, and 117 years later, Apple became the first company in the world to surpass a $1 trillion valuation.

Apple is now worth over $3 trillion, but since 2018, tech giants Nvidia, Microsoft, Amazon, Meta Platforms, and Alphabet have joined it in the trillion-dollar club. But I think yet another is on track to join them.

Oracle (NYSE: ORCL) was founded in 1977 and has since participated in nearly every technological revolution. Right now, it’s quickly becoming a leader in artificial intelligence (AI) data center infrastructure, which could be the company’s ticket to a $1 trillion valuation.

Based on Oracle’s current market cap of $429 billion, investors who buy its stock today could earn a gain of 133% if it gets there.

A leader in AI infrastructure

Large language models (LLMs) are at the foundation of every AI software application. They are trained by ingesting mountains of data, and from there, the model identifies patterns and learns to make predictions. Typically, the “smartest” AI applications are powered by the LLMs with the most data, and the training process is facilitated by centralized data centers filled with graphics processing units (GPUs).

Nvidia supplies the world’s most powerful GPUs for developing AI models. Simply put, the more GPUs a developer can access, the more data they can feed into an LLM, and the faster it can be processed. The Oracle Cloud Infrastructure (OCI) Supercluster technology allows developers to scale up to more than 32,000 Nvidia GPUs (and soon, over 65,000), which is more than any other data center provider.

Plus, the company’s random direct memory access (RDMA) networking technology moves data from one point to another more quickly than traditional Ethernet networks. Since developers often pay for computing capacity by the minute, OCI is among the fastest and cheapest solutions for training LLMs. That’s why AI leaders like OpenAI, Cohere, and Elon Musk’s xAI are now using Oracle.

Oracle chairman Larry Ellison says the company currently has 85 live data centers, with 77 under construction. However, he estimates the company will eventually have somewhere between 1,000 and 2,000, so it has barely scratched the surface of its opportunity so far.

Automation is one thing that sets Oracle apart from other data center operators. No matter its size, every Oracle data center is identical in terms of functionality, so the company is able to manage them all with software alone — no humans required. Not only is that a big cost savings for the end-user, but it also creates a more secure service by eliminating human error. Plus, automation is the key to scaling up Oracle’s data center locations into the thousands.

Oracle’s data center revenue is surging

Oracle generated $13.3 billion in total revenue during the fiscal 2025 first quarter (ended Aug. 31), a 7% increase from the year-ago period. The OCI segment, specifically, delivered $2.2 billion in revenue, up by a whopping 46%.

As in previous quarters, OCI revenue would have grown even faster during Q1 if the company had more data centers online. It currently has an enormous backlog of customers waiting for more computing capacity.

That is reflected in Oracle’s remaining performance obligations, which came in at a record $99 billion during the quarter, up 52% year over year. That was an acceleration from the 44% growth the company achieved in the final quarter of fiscal 2024. Oracle signed 42 new deals for GPU capacity worth $3 billion during Q1 alone, contributing to the sharp increase in remaining performance obligations (RPOs).

CEO Safra Catz believes 38% of the company’s RPOs (around $37.6 billion) will be converted to revenue over the next 12 months, which should help the company return to double-digit percentage growth at the top line. Additionally, she expects an acceleration in OCI growth compared to the previous fiscal year.

Oracle’s (mathematical) path to the $1 trillion club

Oracle has generated $3.88 in trailing-12-month earnings per share. So, based on its current stock price of $155.89, it trades at a price-to-earnings (P/E) ratio of 40.2. The Nasdaq-100 technology index trades at a P/E ratio of 30.7, so Oracle stock certainly isn’t cheap when measured against its peers.

However, Oracle’s trailing-12-month earnings grew by 15% compared to the prior period, and Wall Street is forecasting accelerated earnings growth of 24% for fiscal 2025 overall. That might explain why investors are now willing to pay a premium for its stock.

Mathematically speaking, if Oracle’s P/E ratio remains constant, the company could achieve a $1 trillion valuation within the next 10 years, even if its earnings growth slows to just 8.8%. But that’s a very conservative estimate considering based on Ellison’s comments, it could grow its data center footprint tenfold over the long term. If that happens, Oracle’s earnings growth is likely to accelerate, not decelerate, in the coming decade.

Remember, the company’s data centers rely on automation, so they offer incredible scalability. In other words, Oracle should experience an expanding gross profit margin as more data centers are built, which will be a huge tailwind for its earnings.

As a result, I think Oracle has a great opportunity to join its big-tech peers in the $1 trillion club within the next decade.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Unstoppable Stock That Could Join Nvidia, Microsoft, Apple, Amazon, Alphabet, and Meta in the $1 Trillion Club was originally published by The Motley Fool

Dividend Investor Earning $25,000 Annually Shares His Portfolio: Top 6 Stocks and ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

With the elections inching closer and uncertainty around the Federal Reserve’s plans for rate cuts, the market appetite for stable and reliable dividend-paying equities is increasing. Dividend stocks have an attractive history of protecting investors from inflation. According to a report from WisdomTree, from 1975 through 2023, dividends have grown by 5.7% on average per year – more than 2% above the rate of inflation.

But generating a regular monthly income from dividend stocks isn’t easy. That’s why hundreds of beginner investors flock to dividend-focused discussion boards on Reddit, where people share their experiences, secrets and strategies for earning a sustainable income from dividends.

Check It Out:

About five months ago, someone asked /Dividends (now a community with over 580,000 members) how much they earn in yearly dividends. There were many interesting responses. One Redditor said he makes about $25,000 in dividends annually and shared his portfolio. The Redditor said that his total investment was approximately $1 million.

“About one-third of my portfolio is dividend-based,” the Redditor said.

Let’s take a look at the portfolio.

JPMorgan Equity Premium Income ETF

JPMorgan Equity Premium Income ETF (NYSE:JEPI) is one of Reddit’s most popular dividend ETFs. The fund makes money by investing in some of the most notable large-cap U.S. stocks and selling call options. JEPI is ideal for those looking for exposure to defensive stocks. JEPI usually underperforms during bull markets and protects investors against huge losses during bear markets since most of its portfolio consists of large, defensive equities like Trane Technologies PLC (NYSE:TT), Southern Co (NYSE:SO) and Progressive Corp (NYSE:PGR), among many others. Over the past year, the ETF has been up about 6%.

Amplify CWP Enhanced Dividend Income ETF

Amplify CWP Enhanced Dividend Income ETF (NYSE:DIVO) generates monthly income by selling covered calls. Some of the top holdings of the ETF include Visa, UnitedHealth, JPMorgan, Caterpillar, Home Depot and Procter & Gamble. The ETF has over $3.4 billion in assets and has gained much popularity on Reddit. A Redditor performed backtesting to determine the fund’s returns since its inception in 2016. The results showed a $10,000 investment in the ETF in 2016 would have increased to $19,970 vs. $19,614 for SPY with dividends reinvested. Redditors believe the ETF is a good investment for hedging against risks during down markets.

British American Tobacco

British American Tobacco PLC (NYSE:BTI) has a dividend yield of over 9% and a strong history of payout increases. Over the past decade, the company’s dividend has increased by about 5.40%. British American Tobacco PLC (NYSE:BTI) is shifting toward new products amid a decline in smokeable product categories. Analysts believe the company’s Velo nicotine pouches and Vuse vapes present promising growth opportunities to offset declines from the traditional smoking business.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

Philip Morris International

Another tobacco stock in the Redditor’s portfolio claiming to earn about $25,000 in yearly dividends, Philip Morris International Inc. (NYSE:PM) has raised its dividends for 16 straight years. The stock yields about 4.9%. Philip Morris International Inc. (NYSE:PM) second-quarter results posted in July showed revenue and volume growth in the combustible tobacco products segment. Philip Morris is also diversifying its product portfolio with smoke-free products to prepare for the future. Its nicotine pouches brand Zyn and vape brand IQOS are growing.

EPR Properties

Missouri-based entertainment REIT EPR Properties (NYSE:EPR) pays monthly dividends and yields about 7.2%. Raymond James recently upgraded the stock to Strong Buy from Outperform. RBC Capital upgraded the stock earlier this month to Outperform from Sector Perform. Analysts at the firm said EPR Properties (NYSE:EPR) has successfully navigated challenges like the pandemic and Hollywood writers’ strike and is poised to benefit from higher rents and a strong tenant base in the coming months.

BlackRock Science and Technology Trust

BlackRock Science and Technology Trust (NYSE:BST) generates monthly income by investing in science and technology companies and selling covered call options on a portion of its portfolio’s common stocks. It has an over 9% yield. Some of the fund’s top holdings include Nvidia, Broadcom, Meta Platforms, ASML, Microsoft and Apple.

Building Your Own Portfolio? Here’s A Place To Start

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Dividend Investor Earning $25,000 Annually Shares His Portfolio: Top 6 Stocks and ETFs originally appeared on Benzinga.com

2 Cheap Tech Stocks to Buy Right Now

You can define a “cheap stock” in many ways, but there’s nothing quite as classic as a growth stock changing hands at a low valuation ratio. With that in mind, I highly recommend taking a closer look at freelance services platform Fiverr (NYSE: FVRR) and memory-chip giant Micron Technology (NASDAQ: MU) right now. Their stocks look deeply undervalued.

Micron: A cyclical upswing

The tech sector runs in wide, sweeping cycles. A market-boosting upswing almost always makes middle-market suppliers too optimistic about the long-term bull market for their wares that might be forming. In many cases, they wind up left with overstuffed component inventories when high demand fades out quicker than expected. Then everyone gets caught by surprise by the next boom. Demand surges, and the market realizes that the prior bust’s excess supply has all been sold or rendered obsolete, and in the meantime, none of the hardware providers have built any factories since that last cyclical industry downturn started. Then manufacturers have to play catch-up to boost capacity so that they can meet the fresh wave of reignited demand.

That’s life in the memory chip sector, where Micron plies its trade. Right now, the industry faces soaring product demand because every piece of the artificial intelligence (AI) puzzle requires a ton of high-speed memory chips. As it happens, the aftershocks of the coronavirus crisis and flooding disasters in Taiwan left the largest memory makers woefully unprepared to meet this surge in demand.

But the upswing is happening, and I don’t see how it could be stopped. From smartphones and PC systems to data center servers and technology-packed cars, the devices around us are screaming for more memory chips. So Micron is ramping up its in-house manufacturing capacity with a multibillion-dollar construction push in 2025.

Micron’s chip production and top-line sales are trending up after a heavy crunch in 2022 and 2023. Cash profits and net income are following suit. But it’s unprofitable right now, in terms of earnings per share. As a result, Micron stock might look expensive at first glance due to its negative earnings and nonexistent price-to-earnings (P/E) ratio.

But its bottom line should turn sharply upward over the next couple of years. The stock is trading at just 9 times next year’s estimated earnings and a reasonable 4.5 times sales. Long story short, Micron looks poised to thrive in 2025 and beyond, and the stock deserves a richer forward P/E ratio. It’s a stellar buy at these modest share prices.

Fiverr: Turning a corner on profitability

Many investors wrote Fiverr off as the beneficiary of a short-lived trend a few years ago. Freelancing gigs in digital trades were perfect fits for the excessive amounts of free time people had during the COVID-19 lockdowns. So Fiverr’s stock soared to unsustainable heights amid the social-distancing era, then crashed hard when many of the platform’s users and potential users went back to their workplaces.

The stock has been sliding since early 2021, and is down 92% from its peak. But a funny thing happened on the way to Fiverr’s financial ruin.

The business never stopped growing.

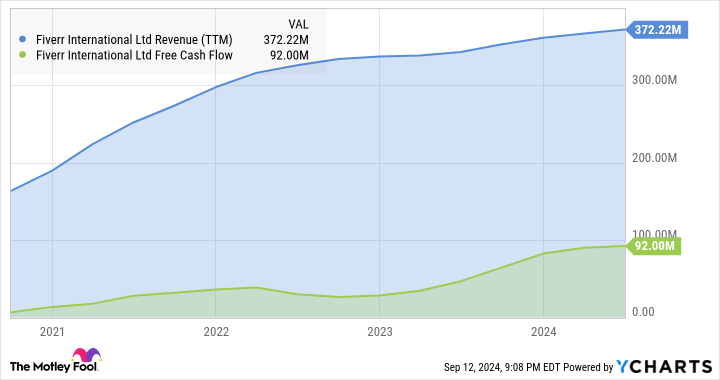

Sure, its after-tax earnings dipped into red-ink territory for a while, and its revenue growth slowed down from the breakneck pace of 2020. But Fiverr kept building its business, step by undaunted step, while pocketing lots of cash profits along the way. Fiverr’s sales have increased by 128% in three years while its free cash flows skyrocketed by 1,400%.

The business is doing just fine, and analysts are starting to catch on. Bottom-line estimates for the next fiscal year are trending upward and Fiverr’s stock price has been struggling to keep up. As a result, the stock trades at just 9.7 times estimated forward earnings and 2.3 times sales today.

This little company has some big ambitions. In the long run, this gig economy leader hopes to disrupt the way people think about careers and work. The company has been around for a decade, but is still in the early days of a potentially epic long-term growth story. I see a tremendous buying opportunity in Fiverr at its currently modest valuation.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Anders Bylund has positions in Fiverr International and Micron Technology. The Motley Fool has positions in and recommends Fiverr International. The Motley Fool has a disclosure policy.

2 Cheap Tech Stocks to Buy Right Now was originally published by The Motley Fool