Expert Says Warren Buffett's Top Executive Ajit Jain Sold Berkshire Hathaway Stake Because 'The Stock Was Fully Pricing The Business'

Berkshire Hathaway Inc. BRK BRK executives have recently made significant sales of the company’s stock, raising questions about the market’s valuation. The sales, which come amid a historic market cap milestone, could indicate a shift in the company’s outlook.

What Happened: On Monday, it was revealed that Ajit Jain, the insurance chief at Berkshire Hathaway for nearly four decades, sold over half of his Berkshire stake, amounting to $139 million. This marked Jain’s largest stock sale since joining the company in 1986.

These sales, which occurred as Berkshire’s Class A stock closed above $700,000 for the first time and the company reached a $1 trillion market cap, have led some to speculate that Jain may be signaling that Berkshire shares are no longer undervalued.

See Also: How To Earn $500 A Month From Nvidia Stock

According to Steve Check, founder of Check Capital Management, “I think Ajit sold because the stock was fully pricing the business,” reported CNBC.

This view is further supported by Berkshire’s minimal buyback activity, which suggests that even Warren Buffett may share Jain’s perspective on valuations. Earlier this year, the legendary investor also urged caution, noting that his vast empire may only slightly outperform the average American company due to its size and limited impactful investment opportunities. “With our present mix of businesses, Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital,” Buffett stated in his annual letter.

Buffett has also been reducing his stakes in some of his favorite stocks, including Bank of America and Apple. This trend, along with the overall sales of stocks by Berkshire, could indicate a bearish sentiment on the market and valuations.

Why It Matters: These developments also come in the wake of Buffett’s $13 billion bet on Occidental Petroleum turning sour, with shares plummeting 29% since mid-April. This has led to speculation that Buffett might buy more shares, although he is unlikely to take over the company.

Buffett has also been reducing his stake in Bank of America, selling nearly $7 billion worth of shares since mid-July. This has raised questions about his investment strategy, with Bank of America CEO Brian Moynihan stating, “I don’t know what exactly he is doing because frankly we can’t ask.”

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Unstoppable Healthcare Stocks to Buy Right Now for Less Than $200

With $200, one can afford many lottery tickets, one of which could be a winner. However, the odds of winning meaningful money by playing the lottery are minuscule. Investing in the stock market might not make anyone rich overnight the way the lottery could, but even with $200, investors can acquire shares of companies in excellent positions to deliver outsized returns over the long run. Let’s consider two stocks trading well below $200 that have what it takes to do that: Novo Nordisk (NYSE: NVO) and DexCom (NASDAQ: DXCM).

1. Novo Nordisk

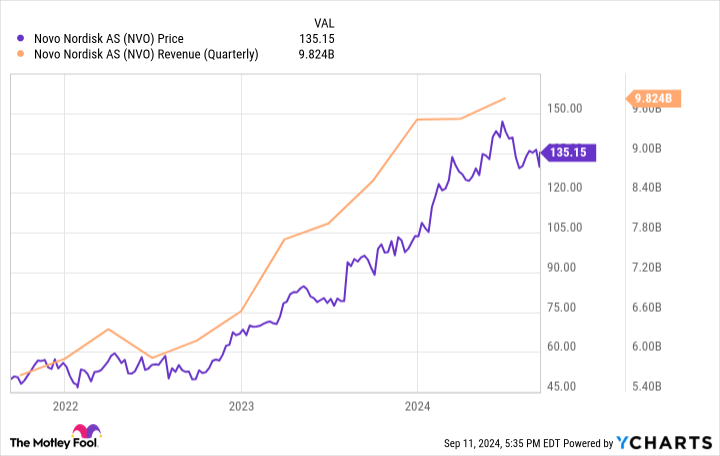

Pharmaceutical companies thrive on innovation. Few have been better at this than Novo Nordisk during the past few years. The drugmaker deserves credit for pioneering GLP-1 medicines for weight loss. Novo Nordisk’s portfolio of approved products, which includes weight loss medicine Wegovy and diabetes therapy Ozempic, is helping it post excellent financial results, leading to above-average returns.

Investors are also excited about the company’s pipeline. Even though Novo Nordisk’s success is attracting plenty of potential competitors — it seems like every drugmaker is now trying to break into the weight loss arena — the Danish pharmaceutical giant still has some of the most promising candidates in development. The most exciting might be CagriSema, a compound combining semaglutide (Wegovy and Ozempic’s active ingredient) and cagrilintide, another GLP-1 medicine. CagriSema seemed more effective than its individual components in a phase 2 study.

CagriSema is currently in phase 3 studies. The research company Evaluate Pharma estimates the therapy could bring in as much as $20.2 billion in annual revenue by 2030. Does that seem too optimistic? At the rate at which Ozempic and Wegovy are growing, the increased popularity of this class of medicines, and the fact that CagriSema could be even more effective, projections of these kinds aren’t surprising. So, plenty of things point to Novo Nordisk’s remaining a dominant force in its core areas of diabetes and obesity care, which should help it to maintain momentum.

Furthermore, the company is developing medicines in several other areas that could help complement and diversify its lineup — more than 90% of its revenue now comes from diabetes or obesity products. This concentration hasn’t been a problem for Novo Nordisk yet, but it could become one if the pool of approved GLP-1 products expands significantly. The company is planning for that eventuality, though, and investors have little to worry about. Novo Nordisk remains a top stock to hold long-term, and its shares are trading at about $137 as of this writing.

2. DexCom

DexCom’s shares dropped by about 40% in July after it released second-quarter results. Some might see that as a bad sign, an understandable reaction. But it’s important to dig deeper. Let’s consider three reasons the medical device specialist remains a top stock. First, DexCom has historically been volatile. The shares have dropped sharply on multiple occasions. However, the company has generally delivered market-beating returns to loyal, long-term shareholders. So, this situation is hardly out of the (historical) ordinary for DexCom.

Second, DexCom’s recent plunge was largely due to issues that won’t affect it long term. For instance, during the company’s rollout of its latest continuous glucose monitoring (CGM) system in the U.S., the G7, patients took advantage of rebates at a rate higher than DexCom expected. The company’s outlook for the third quarter was a bit weak, not on par with what investors expect from richly valued growth stocks: DexCom’s forward price-to-earnings (P/E) ratio of 33 is still high even after the meltdown.

The average forward P/E for the healthcare industry is 19.2. A correction might have been overdue, but the company should eventually rebound if its financial results are strong.

This brings us to the third point: DexCom’s vast worldwide opportunity. DexCom is one of the leaders in CGM technology together with Abbott Laboratories. The latter reported about 6 million users in the world.

Even assuming DexCom has the same installed base (it is likely lower), the 12 million between them doesn’t even come close to the 10% of the half-billion adults with diabetes globally. DexCom will have to develop newer CGM options and enter new territories to increase its addressable market. That’s precisely what it has done historically. After its recent drop, DexCom’s shares are changing hands for about $69. So, $200 can buy two of them with plenty of change to spare.

Should you invest $1,000 in Novo Nordisk right now?

Before you buy stock in Novo Nordisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novo Nordisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends DexCom and Novo Nordisk. The Motley Fool has a disclosure policy.

2 Unstoppable Healthcare Stocks to Buy Right Now for Less Than $200 was originally published by The Motley Fool

Starmer and Biden Meet: Focus on Ukraine Amid Putin Threats

President Biden welcomed British Prime Minister Keir Starmer to the White House on Friday afternoon.

After showing Starmer around the Rose Garden, they proceeded to the Blue Room, reported the BBC.

Also Read: Keir Starmer To Meet Biden at White House Amid Talks on Global Issues And UK-EU Relations

There, at a long rectangular table, the two delegations took their seats, with Biden and Starmer positioned at the heads of the table and each accompanied by seven colleagues.

While Ukraine was the primary focus of the discussions, other significant issues were also addressed, including the Middle East, China, and Iran. Downing Street had previously aimed to present this meeting as a chance for a more in-depth dialogue than what is typically possible in standard international summits.

The UK has been actively advocating for Kyiv’s request to fire Western missiles into Russia, BBC added.

However, Biden remains concerned that such a move could lead to a direct conflict between America, Europe, and Moscow— a possibility that Vladimir Putin has hinted at recently.

While Putin’s previous threats have often amounted to little, there’s a chance this time might be different.

Diplomacy and intelligence efforts are now focused on understanding the psychology of a wartime leader and predicting his potential reactions. The concern is whether Putin might consider a military strike on a NATO member state, which could drag the entire Western alliance into a war with Russia.

Alternatively, there is worry about whether Ukraine’s allies would tolerate lower-level retaliatory actions, such as cyber attacks or sabotage of undersea communication cables, BBC added.

It was unlikely that this meeting would settle the issue of Western missiles, particularly since further discussions with other parties at the United Nations are anticipated soon.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nebraska Supreme Court Greenlights Competing Abortion Measures For November Ballot

On Friday, the Nebraska Supreme Court decided that dueling initiatives to expand or restrict abortion rights will be included on the November ballot. This decision followed recent hearings in which three separate lawsuits aimed to prevent either or both of the abortion measures from appearing on the ballot, reported The Hill.

Voters in the Cornhusker State will decide on a ballot measure proposing to enshrine the right to abortion up to fetal viability in the state constitution. Conversely, another measure aims to cement the state’s existing 12-week abortion ban into law.

Organizers for both proposals collected over 200,000 signatures each, surpassing the 123,000 valid signatures required to qualify for the ballot, the Hill added. For the first time since the U.S. Supreme Court’s 2022 reversal of Roe v. Wade, Nebraska will feature competing abortion amendments on the same ballot.

Meanwhile, nine other states will also address abortion issues on their ballots this year, including Arizona, Colorado, Florida, Maryland, Missouri, Montana, Nevada, and South Dakota, where measures to protect access are also set to appear.

The latest development follows two initiatives, the Nebraska Medical Cannabis Patient Protection Initiative and the Nebraska Medical Cannabis Regulation Initiative, which have both surpassed the required 87,126 valid signatures to be considered for the November 2024 ballot.

The Nebraska Secretary of State’s office confirmed the 89,000 petitions have valid signatures and that officials are “nearing the end of the verification process by county election offices,” bringing them close to certification.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Also Read:

Image: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan CEO Jamie Dimon Said He'd 'Fire In A Second' Anyone Caught Trading Bitcoin When It Was At $4,000.

Jamie Dimon, the CEO of JPMorgan Chase & Co (NYSE:JPM), is known for his no-holds-barred attacks on Bitcoin (CRYPTO: BTC), despite the banking giant’s investments in exchange-traded funds tied to the leading cryptocurrency.

What happened: Speaking at an investor conference almost exactly seven years ago, Dimon dubbed Bitcoin as “fraud” and “worse than tulip bulbs,” in reference to the Dutch tulip mania in the 17th century.

Don’t Miss:

The remark that gained the most notoriety was when he said he would “fire in a second” any JPMorgan trader caught trading in Bitcoin.

When Dimon made these remarks, one Bitcoin was priced at $4,161.27. Today, the coin’s price has ballooned to $57,926, indicating a massive 1,292% increase.

Why It Matters: Dimon’s criticism of Bitcoin has continued unabated, and he went so far as to ask for a shutdown of the industry during a Congressional testimony in December last year.

However, his stance remarkably softened just a month later when the first-ever Bitcoin ETFs saw the light of day. Dimon said, “I defend your right to do Bitcoin.”

According to the recent filing with the SEC, JPMorgan reported holding $42,000 worth of shares of Grayscale Bitcoin Trust (NYSE:GBTC). It also liquidated its entire portfolio in the iShares Bitcoin Trust ETF (NASDAQ:IBIT) which was acquired in the first quarter.

Price Action: At the time of writing, Bitcoin was exchanging hands at $57,947.66, up 2.50% in the last 24 hours, according to data from Benzinga Pro. Shares of JPMorgan closed 0.78% higher at $207.17 during Thursday’s regular trading session.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article JPMorgan CEO Jamie Dimon Said He’d ‘Fire In A Second’ Anyone Caught Trading Bitcoin When It Was At $4,000. originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This Incredibly Cheap but Fast-Growing Semiconductor Stock Could Outperform Nvidia

There is no denying that Nvidia (NASDAQ: NVDA) has been one of the top semiconductor stocks on the market in 2024, with stunning gains of 118% as of this writing. However, the recent stock price action indicates that investor confidence in this high-flying company is now wavering.

The past two-and-a-half months have been quite volatile for Nvidia investors, with the stock pulling back significantly. Moreover, it was surprising to see that the chip specialist’s latest quarterly report couldn’t turn investors’ sentiment in its favor despite better-than-expected numbers and healthy guidance for the current quarter.

One reason that may be the case is that Nvidia’s stunning surge since the beginning of 2023 has made it very expensive from a valuation perspective. The semiconductor stock has jumped a whopping 639% since the beginning of last year. Though it has justified this red-hot rally with outstanding growth quarter after quarter, it still trades at 27 times sales and 50 times trailing earnings.

Of course, Nvidia can justify its valuation with impressive growth in the coming quarters. However, valuation-led concerns could weigh on the stock. That’s why investors would do well to take a closer look at another semiconductor company that’s not only substantially cheaper than Nvidia but is also witnessing a nice acceleration in growth.

This semiconductor company is growing at a healthy clip

Taiwan Semiconductor Manufacturing (NYSE: TSM), generally known as TSMC, has enjoyed healthy gains of 56% on the stock market this year. Of course, while TSMC’s gains are nowhere near Nvidia’s, there is a good chance that the Taiwan-based foundry giant may upstage its more illustrious peer in the future.

That’s because TSMC’s growth has picked up nicely of late. The company recently reported its August sales figures and delivered a 33% year-over-year increase in revenue. It is also worth noting that TSMC’s revenue in the first eight months of 2024 increased by almost 31% from the same period last year. At this pace, TSMC is well on track to exceed the 26% revenue growth to $87.5 billion analysts are expecting it to deliver in 2024.

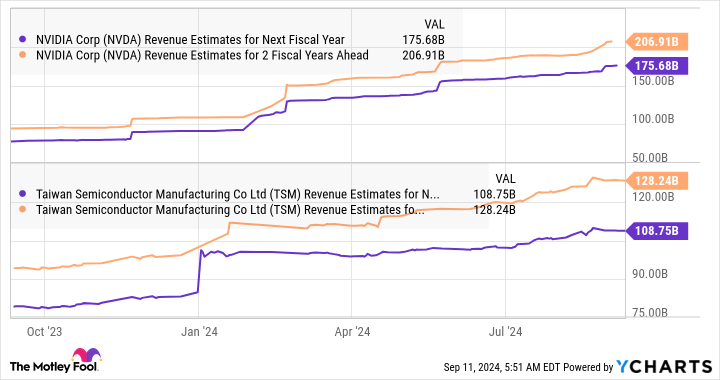

Nvidia, on the other hand, is expected to deliver a 125% increase in revenue in the current fiscal year. But if we look at their revenue estimates a couple of fiscal years ahead, Nvidia and TSMC are expected to clock a similar growth rate of 17%.

The good thing about TSMC is that even if it hits almost $130 billion in revenue after a couple of years, it will still be in a nice position to keep delivering an impressive revenue growth rate. That’s because TSMC now sees a larger addressable market ahead instead of just the foundry business, which it says was worth around $115 billion in 2023.

Under its Foundry 2.0 plan, TSMC is now targeting a much larger market that includes chip packaging, testing, and integrated device manufacturing (IDM). TSMC believes its overall addressable market now stands at $250 billion. TSMC’s 2023 revenue now stood at just over $69 billion, which means it enjoyed a 60% share of the foundry market last year.

Assuming it can corner a similar share of the additional revenue opportunity, its annual revenue has the potential to hit $150 billion in the future (based on the $250 billion market size discussed above). The good part is that TSMC is taking steps to ensure it can capture a bigger share of the end-market opportunity by way of capacity expansion.

For instance, TSMC’s foundry market share increased by 150 basis points year over year in the first quarter of 2024 to 61.7%. The company is expected to increase its capital expenditure (capex) by 12% to 14% in 2025 to $32 billion to $36 billion. Moreover, TSMC’s advanced packaging capacity is estimated to increase by 60% per year through 2026 so that it can manufacture more AI chips.

So, there is a strong possibility of TSMC’s market share improving further in the future, which could allow it to capture a bigger share of the $250 billion addressable market and lead to robust long-term growth.

Why TSMC could outperform Nvidia

Analysts are expecting TSMC’s earnings to increase at an annual pace of 21.5% for the next five years, which is lower than Nvidia’s estimated annual earnings growth of 52% over the same period. Assuming TSMC indeed manages to clock such growth over the next five years, its bottom line could jump to almost $17 per share after five years (using 2024’s estimated earnings of $6.55 per share as the base).

TSMC has a forward earnings multiple of just 20. A similar multiple after five years would translate into a stock price of $340, assuming it indeed hits $17 per share in earnings. That would represent a 114% increase from current levels in five years. But it is worth noting that TSMC’s earnings multiple is much lower than the Nasdaq-100 index’s average of 29. So, if the market decides to reward the stock with a richer valuation, it could deliver even more upside over the next five years.

On the other hand, if Nvidia indeed clocks 52% earnings growth, its bottom line could hit $9.65 per share after five years (using fiscal 2025’s projected earnings of $2.84 per share as the base). Nvidia trades at a relatively expensive 37 times forward earnings when compared to TSMC. That rich valuation is the reason Wall Street has been skeptical about the company’s ability to deliver more upside.

Assuming even Nvidia trades at a discounted 20 times forward earnings after five years, its stock price could hit $193, based on the projected earnings calculated above. That would be a 79% increase from current levels, indicating that TSMC indeed has the potential to deliver stronger gains than Nvidia in the long run.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Prediction: This Incredibly Cheap but Fast-Growing Semiconductor Stock Could Outperform Nvidia was originally published by The Motley Fool

CBD Suppositories Could Be A Game-Changer For Menstrual Relief, Harvard Study Shows

A recent study sheds new light on the use of cannabis for managing menstrual discomfort, specifically through the application of a high-CBD vaginal suppository.

The study, published in NPJ Women’s Health, explores the effects of a commercially available product, Foria, which contains 100 milligrams of cannabidiol (CBD).

See Also: CBD-Infused Tampons Are Real – And Science Says They Are Safe And Effective For Menstrual Pain

This research is significant as it marks the first investigation into a “real-world” high-CBD suppository for menstrual-related symptoms, also known as dysmenorrhea.

CBD’s Impact On Menstrual Symptoms

Conducted by researchers from the McLean Hospital Imaging Center and Harvard Medical School, the study involved 307 participants assigned female at birth.

Of these, 77 received the CBD suppository, while the remaining participants continued their usual treatment. The results were promising: those using the suppository reported notably reduced menstrual pain, improved mood and a decrease in the use of pain medications compared to those using conventional treatments.

“This is the first study to assess the impact of a ‘real-world,’ commercially-available, high-CBD suppository on menstrual-related pain and discomfort,” the report states.

The findings suggest that these suppositories could alleviate a range of menstrual-related symptoms, enhance daily functioning and decrease reliance on analgesics. After one month, 72.9% of the CBD users noted at least moderate improvement, which increased to 81.1% after two months.

Higher CBD Usage Tied To Greater Menstrual Symptom Relief

An intriguing aspect of the study was the observed dose-dependent response. Participants who used the suppositories more frequently reported greater symptom relief. “Increased suppository use was significantly associated with greater reduction of symptoms,” the report indicates.

Despite these encouraging results, the researchers call for further investigation. They advocate for randomized clinical trials to replicate these findings and confirm the efficacy of cannabinoid-based therapies for menstrual pain. “Vaginal suppositories can be an effective route of administration for cannabinoid-based therapies,” they add.

How This CBD Study Stacks Up Against Past Research

This study builds on earlier research published in March, which examined the impact of orally administered CBD on menstrual-related symptoms. That study highlighted CBD’s effectiveness in alleviating symptoms such as irritability and stress, setting a precedent for the current investigation into vaginal administration.

The study, which claimed to be the first to examine cannabidiol’s effects on menstrual-related symptoms (MRS) and irritability, found significant improvements.

“Results revealed reductions…in MRS, irritability, anxiety, global impression of change, stress, and subjective severity scores when comparing baseline to all 3 months of CBD consumption,” the authors wrote, concluding that “CBD may be an effective treatment in alleviating MRS.”

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Incredible Artificial Intelligence (AI) Stocks I'm Planning to Buy If the September Sell-Off Continues

September is historically a bad month for stocks. The ninth month of the year is the only month when the historic average performance of each of the major stock indexes is a negative number.

But if you have a long-term investing mindset, the September sell-off could present a great opportunity. Not only do the winter months bring historically strong returns, but any sell-off in stocks gives investors a chance to buy a stake in great companies at a fairer price.

Some of the biggest opportunities in the market right now are artificial intelligence (AI) stocks. Many AI stocks have rocketed higher in 2024, but the recent pullback in share prices can give investors another chance to get in on the trend before the next leg up. Three stocks in particular have caught my eye as excellent values amid the current sell-off, and all three should see sustained growth from AI spending.

Here are the three stocks I’m planning to buy if the September sell-off continues.

1. Alphabet

Many see the growth of generative AI tools as a major threat to Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) bread and butter, Google Search. The reality, as it stands today, is that AI is a major contributor to Alphabet’s growth in multiple ways, and it’s well-positioned to remain at the forefront of AI for years to come.

At its base level, Alphabet is one of three hyperscale cloud platforms that developers can use to train and deploy generative AI software. Google Cloud has seen substantial growth over the last couple of years, surpassing $10 billion in revenue in the most recent quarter. What’s more, profitability is booming, as operating income nearly tripled year over year.

But AI can also be a major contributor to the core Search business. Google rolled out AI Overviews earlier this year, using generative AI to aggregate information from multiple websites and answer search queries. Management says the feature has increased use and satisfaction. Meanwhile, advertisements above and below AI Overviews continue to convert for businesses.

As one of the leading digital advertisers, Google is also working on ways to incorporate AI into the advertising creation and buying process. Its AI tools help increase the profitability of ad campaigns over revenue-only bidding, and it can help generate thousands of iterations of an ad to optimize images and copy for various target audiences.

Alphabet also owns YouTube, Android, the Google Play app store, and a devices business, and it continues to invest in its Other Bets. Combined, it produces tons of cash to invest in the future of AI while buying back shares and paying a small dividend.

Shares currently trade at just 19 times forward earnings estimates. Meanwhile, analysts expect average annual earnings growth over 20% for the next five years, making its valuation look extremely attractive.

2. Salesforce

Salesforce (NYSE: CRM) is a leading enterprise software company with multiple offerings to help companies get the most from their sales teams and the data they generate. But sales growth has slowed considerably recently, with revenue climbing just 8% last quarter and management’s expectations for 8% to 9% growth for the full year.

That said, management is doing a great job at improving operational efficiency, and it’s using excess cash to buy back shares, leading to strong earnings-per-share growth.

But Salesforce’s investments in AI could be a catalyst to reinvigorate the business. Its users have had access to its Einstein Copilot since early 2024. The AI feature makes it easier for sales teams and service teams to use information and data from their organization to improve productivity and close deals and cases faster.

The next step with AI is Agentforce, which helps a business resolve customer service issues, employer tickets, and sales inquiries by using the organization’s existing data within the Salesforce software suite. CEO Marc Benioff pointed to multiple examples where pilot testers were resolving 90% of cases with AI agents, well above the rate of other AI bots.

Salesforce’s AI advantage stems from the data it has about a business. And while it faces growing competition, it’s unlikely to see much impact on its operations. That’s because the switching costs are extremely high. Not only would a business have to migrate sensitive data to a new platform, it would also have to retrain staff, and it risks switching to an inferior product that isn’t the industry standard.

Salesforce stock currently trades for just 24 times forward earnings. That’s a slight premium to the S&P 500, but the business should see strong earnings-per-share growth as AI sales offer high-margin revenue growth and it buys back more shares.

3. Taiwan Semiconductor Manufacturing

While there are a lot of chip designers that have seen strong results amid the rush to build bigger and better data centers, Taiwan Semiconductor Manufacturing (NYSE: TSM), also known as TSMC, is positioned to see strong results no matter who designs the chips in the next generation of data centers.

TSMC is the world’s leading chip fabricator. In fact, it accounts for the majority of spending on printing silicon chips because of its ability to stay one step ahead of the competition in its technical capabilities. If you want a cutting-edge chip, you need to work with TSMC.

Its scale creates a virtuous cycle. As it generates the bulk of the revenue in the industry, it has more money to reinvest in research and development. As a result, it’s able to come out with the next generation of technology while its competitors are still working on the last generation. That ensures it keeps the business of big tech companies including Nvidia, Apple, and just about everyone else designing leading-edge chips.

TSMC stands to gain long-term as AI matures and more and more companies compete for its limited resources. The biggest tech companies are all investing in their own AI accelerator chips, creating further demand for its advanced processes.

The stock looks like a bargain with shares trading at less than 20 times analysts’ 2025 earnings expectations. They also expect average earnings growth of over 20% for the next five years, as AI spending powers growing demand and strong margins. That makes the current price extremely attractive, and anything lower an incredible bargain.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Levy has positions in Alphabet, Apple, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Apple, Nvidia, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

3 Incredible Artificial Intelligence (AI) Stocks I’m Planning to Buy If the September Sell-Off Continues was originally published by The Motley Fool

Dan Gilbert Talks Detroit's Revival, Rocket's Success, Personal Tragedy

Rocket Companies Inc RKT co-founder and Chairman Dan Gilbert gave a keynote speech to the Detroit Economic Club (DEC) on Friday focusing on the city’s revitalization.

Bill Emerson, the president of Rocket Companies, introduced Gilbert, highlighting the former’s philanthropic efforts in Detroit. Emerson stated Gilbert and his wife Jennifer put more than $1 billion into the city over the past three or four years.

Gilbert discussed how he began in the real estate industry, getting his real estate license when he was 19. Gilbert spoke about Rock Financial, a company he founded in 1985 and would take public in 1998 and then later sell to Intuit Inc INTU.

Gilbert then bought back his direct-to-consumer business from Intuit in 2002. Once that happened, the company began capturing significant market share from other major mortgage lenders.

Gilbert says Rocket Companies stands out from competitors through its unique culture.

“It’s really a special culture and I think that’s the No. 1 reason,” Gilbert said, speaking of Rocket Companies’ success compared to its peers in the industry.

Gilbert and Rocket Companies found success bringing mortgage services completely online in the 1990s and early 2000s. Gilbert explained that people may have been hesitant to buy things like couches and cars online without seeing them in person, but mortgages are just numbers, so he figured if anything could have success online, it would be that.

Gilbert and DEC Chair Sandy Pierce‘s conversation took a more solemn tone, talking about Gilbert’s late son Nick, who died from neurofibromatosis, commonly referred to as NF, in 2023. Gilbert’s foundation is investing in a medical center in Detroit to help others with NF.

Read Also: Dan Gilbert To Help Fund $400M State-Of-The-Art Detroit Medical Facility: ‘We Decided To Build Something Better’

The medical center, a collaboration with the Henry Ford hospital system, will also house a Shirley Ryan AbilityLab, which focuses on neuro rehabilitation for patients who have suffered strokes and accidents. Gilbert, who had a stroke in 2019, traveled to Chicago for rehabilitation.

Gilbert On Battling Michigan’s Talent Drain: Gilbert discussed bringing Rocket Companies’ headquarters from the suburbs to Detroit, explaining that he saw an opportunity to help rebuild Detroit’s downtown to better recruit young talent from across the country. Gilbert discussed the tendency of Michigan students to leave the state after college for cities such as Chicago and New York City.

“It’s all about talent and talent retention,” Gilbert said. “We survey our young folks almost every month and ask them what they want and need in their city.”

Gilbert highlighted one area downtown that Detroit still needs to improve: public transportation. Gilbert highlighted the QLine, a train that serves a 3.5-mile strip in downtown Detroit, but said that more work needs to be done to expand transportation services in the city.

Dan and Jennifer Gilbert. Benzinga file photo by Dustin Blitchok.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Kroger Co.

Summary

Kroger, based in Cincinnati, operated about 2,700 retail supermarkets and multidepartment stores in 35 states at the end of FY24. We estimate that these stores generated over 90% of the company’s $150 billion in sales in FY24. KR also operated 1,665 supermarket fuel centers, more than 225 Little Clinics, and 33 food processing plants in the U.S. These plants make about 31% of KR’s private-brand units. The company’s name plates include Kroger, Ralphs, Fred Meyer, Food 4 Less, King Scoopers, Smith’s, Fry’s, Dillon’s, City Market and Harris Teeter. Some 15% of the supermarkets are in California, 9% are in Ohio and 8% are in Texas. Wal-Mart and Sam’s Club are primary competitors in most major markets. KR has pharmacies in about 82% of its food stores. The company has 179 million square feet of supermarket space. KR completed the sale of 782 convenience stores in the first quarter of FY19.

Non-Perishables repr

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level