Prediction: This Incredibly Cheap but Fast-Growing Semiconductor Stock Could Outperform Nvidia

There is no denying that Nvidia (NASDAQ: NVDA) has been one of the top semiconductor stocks on the market in 2024, with stunning gains of 118% as of this writing. However, the recent stock price action indicates that investor confidence in this high-flying company is now wavering.

The past two-and-a-half months have been quite volatile for Nvidia investors, with the stock pulling back significantly. Moreover, it was surprising to see that the chip specialist’s latest quarterly report couldn’t turn investors’ sentiment in its favor despite better-than-expected numbers and healthy guidance for the current quarter.

One reason that may be the case is that Nvidia’s stunning surge since the beginning of 2023 has made it very expensive from a valuation perspective. The semiconductor stock has jumped a whopping 639% since the beginning of last year. Though it has justified this red-hot rally with outstanding growth quarter after quarter, it still trades at 27 times sales and 50 times trailing earnings.

Of course, Nvidia can justify its valuation with impressive growth in the coming quarters. However, valuation-led concerns could weigh on the stock. That’s why investors would do well to take a closer look at another semiconductor company that’s not only substantially cheaper than Nvidia but is also witnessing a nice acceleration in growth.

This semiconductor company is growing at a healthy clip

Taiwan Semiconductor Manufacturing (NYSE: TSM), generally known as TSMC, has enjoyed healthy gains of 56% on the stock market this year. Of course, while TSMC’s gains are nowhere near Nvidia’s, there is a good chance that the Taiwan-based foundry giant may upstage its more illustrious peer in the future.

That’s because TSMC’s growth has picked up nicely of late. The company recently reported its August sales figures and delivered a 33% year-over-year increase in revenue. It is also worth noting that TSMC’s revenue in the first eight months of 2024 increased by almost 31% from the same period last year. At this pace, TSMC is well on track to exceed the 26% revenue growth to $87.5 billion analysts are expecting it to deliver in 2024.

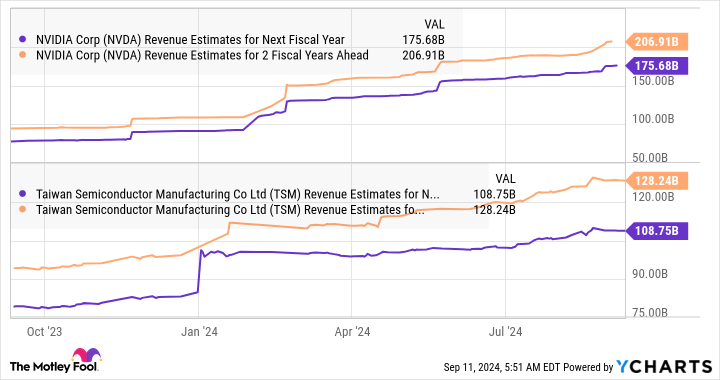

Nvidia, on the other hand, is expected to deliver a 125% increase in revenue in the current fiscal year. But if we look at their revenue estimates a couple of fiscal years ahead, Nvidia and TSMC are expected to clock a similar growth rate of 17%.

The good thing about TSMC is that even if it hits almost $130 billion in revenue after a couple of years, it will still be in a nice position to keep delivering an impressive revenue growth rate. That’s because TSMC now sees a larger addressable market ahead instead of just the foundry business, which it says was worth around $115 billion in 2023.

Under its Foundry 2.0 plan, TSMC is now targeting a much larger market that includes chip packaging, testing, and integrated device manufacturing (IDM). TSMC believes its overall addressable market now stands at $250 billion. TSMC’s 2023 revenue now stood at just over $69 billion, which means it enjoyed a 60% share of the foundry market last year.

Assuming it can corner a similar share of the additional revenue opportunity, its annual revenue has the potential to hit $150 billion in the future (based on the $250 billion market size discussed above). The good part is that TSMC is taking steps to ensure it can capture a bigger share of the end-market opportunity by way of capacity expansion.

For instance, TSMC’s foundry market share increased by 150 basis points year over year in the first quarter of 2024 to 61.7%. The company is expected to increase its capital expenditure (capex) by 12% to 14% in 2025 to $32 billion to $36 billion. Moreover, TSMC’s advanced packaging capacity is estimated to increase by 60% per year through 2026 so that it can manufacture more AI chips.

So, there is a strong possibility of TSMC’s market share improving further in the future, which could allow it to capture a bigger share of the $250 billion addressable market and lead to robust long-term growth.

Why TSMC could outperform Nvidia

Analysts are expecting TSMC’s earnings to increase at an annual pace of 21.5% for the next five years, which is lower than Nvidia’s estimated annual earnings growth of 52% over the same period. Assuming TSMC indeed manages to clock such growth over the next five years, its bottom line could jump to almost $17 per share after five years (using 2024’s estimated earnings of $6.55 per share as the base).

TSMC has a forward earnings multiple of just 20. A similar multiple after five years would translate into a stock price of $340, assuming it indeed hits $17 per share in earnings. That would represent a 114% increase from current levels in five years. But it is worth noting that TSMC’s earnings multiple is much lower than the Nasdaq-100 index’s average of 29. So, if the market decides to reward the stock with a richer valuation, it could deliver even more upside over the next five years.

On the other hand, if Nvidia indeed clocks 52% earnings growth, its bottom line could hit $9.65 per share after five years (using fiscal 2025’s projected earnings of $2.84 per share as the base). Nvidia trades at a relatively expensive 37 times forward earnings when compared to TSMC. That rich valuation is the reason Wall Street has been skeptical about the company’s ability to deliver more upside.

Assuming even Nvidia trades at a discounted 20 times forward earnings after five years, its stock price could hit $193, based on the projected earnings calculated above. That would be a 79% increase from current levels, indicating that TSMC indeed has the potential to deliver stronger gains than Nvidia in the long run.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Prediction: This Incredibly Cheap but Fast-Growing Semiconductor Stock Could Outperform Nvidia was originally published by The Motley Fool

Leave a Reply