Analyst Report: Adobe Inc

Analyst Profile

Joseph F. Bonner, CFA

Senior Analyst: Communication Services & Technology

Joe covers the Communication Services sector and selected software technology stocks for Argus. In 2010, he was named #5 Stock Picker for Telecom Services in the Wall Street Journal’s Best on the Street Analyst Survey. In 2008, Joe was named #1 Stock Picker for Media: U.S. by the Financial Times and was second in the Wall Street Journal’s Best on the Street Analyst Survey for Telecommunications: Fixed Line. For more than a decade, Joe worked with Technicolor Inc., where he focused on financial and legal issues. He received his Masters in Business Administration from Fordham University in New York, where he concentrated in Finance. He earned a BA in International Affairs from the George Washington University, and spent three years with the Peace Corps in Talgar, Kazakhstan, developing an English Language resource center and teaching students. Joe is a CFA charterholder.

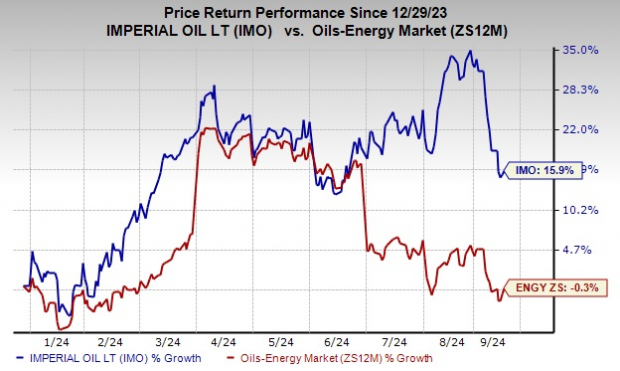

Imperial's Shares Gain 16% YTD: Should You Buy or Wait for Now?

Imperial Oil Limited IMO has experienced 16% growth in its share price year to date (YTD), significantly outperforming the broader oil and energy sector, which has seen a 0.3% decline. This stark disparity raises a key question for investors: Should they invest in the stock now or wait for a more favorable opportunity?

Image Source: Zacks Investment Research

Based in Calgary, Imperial is more than just a Canadian oil company; it’s a major player with a multi-layered portfolio that includes oil and gas production, refining, marketing and chemical manufacturing. As Canada’s largest jet fuel supplier and a leading asphalt producer, the integrated oil and gas company holds a significant position in the market. The company also benefits from the expertise and resources of ExxonMobil XOM, which owns a substantial 69.6% stake.

In simple terms, IMO makes money by finding and extracting oil and gas, refining those into products like gasoline and diesel, and selling them to its customers.

So, what’s fueling Imperial’s rise? Let’s delve into the key drivers behind its impressive YTD performance and explore whether this momentum is likely to continue or not.

Promising Factors

Strong Financial Performance and Cash Flow: IMO has consistently reported strong financial performance, with second-quarter 2024 net income of C$1.1 billion, a significant year-over-year increase from C$675 million. The company also generated C$1.6 billion in cash flow from operations during the quarter, indicating IMO’s ability to generate substantial cash from its core business.

This strong cash generation allows the company to comfortably fund its shareholder returns through dividends and share buybacks while maintaining a solid cash position for growth and operational flexibility. Currently, the company carries a Momentum Score of A.

Production Growth and Operational Efficiency: IMO’s upstream production hit a 30-year high in second-quarter 2024, averaging 404,000 barrels per day (bpd). This was driven by record output at key assets like Kearl, which achieved 255,000 bpd and Cold Lake, which saw production rise to 147,000 bpd.

Image Source: Imperial Oil Limited

The company has been successfully executing turnaround activities ahead of schedule and below cost expectations, reducing downtime and improving operational efficiency. This focus on cost reduction is exemplified by Kearl’s significant reduction in operating costs per barrel, which is a positive long-term driver for profitability. Additionally, the Trans Mountain Pipeline Extension will boost Imperial by adding 590,000 bpd of capacity for oil sands, improving market access and pricing, and supporting growth.

Renewable Energy Investment: In response to global climate concerns and a transition to greener energy, IMO is developing Canada’s largest renewable diesel facility at its Strathcona refinery. After completion, it will produce more than one billion liters of renewable diesel yearly, helping to reduce carbon emissions and positioning the company for growth in the low-carbon energy market.

This strategic investment shows that IMO is not only committed to its traditional fossil fuel business but is also expanding into more sustainable energy solutions. This may improve the company’s long-term resilience and attractiveness to environmentally conscious investors.

Favorable Market Dynamics: The narrowing spread between West Texas Intermediate (“WTI”) and Western Canadian Select (“WCS”) has improved IMO’s price realizations. The WTI/WCS differential has been tightening due to increased pipeline capacity, which benefits Canada’s producers like IMO by improving the profitability of heavy oil exports. This reduced-price volatility and stronger price realizations in the upstream segment have led to a significant improvement in Imperial’s cash flows, positioning the company well for further growth.

Shareholder-Friendly Policies: IMO has a strong track record of returning cash to its shareholders through dividends and share buybacks. In second-quarter 2024, the company declared a dividend of 60 Canadian cents per share and plans to repurchase up to 5% of its outstanding shares by the end of the year. This not only rewards investors but also signals management’s confidence in the company’s future performance.

IMO Stock: Cautionary Notes

Exposure to Oil Price Volatility: Like most oil and gas companies, IMO’s earnings are highly sensitive to fluctuations in oil prices. While current oil prices are favorable, any downturn in the market could significantly impact the company’s revenues and profitability. For example, if geopolitical tensions ease or there is a global economic slowdown, oil demand could decrease, putting pressure on prices and affecting Imperial’s bottom line. Imperial’s reliance on the oil sector makes it vulnerable to cyclical downturns and commodity price risks, which can lead to lower margins and weaker financial performance in challenging market conditions.

Environmental and Regulatory Risks: IMO operates primarily in Canada, where environmental regulations are stringent. The company is exposed to environmental risks, including wildfires in Western Canada, which have already posed threats to its production sites like Kearl and Cold Lake. Additionally, future carbon pricing or stricter environmental regulations could increase operating costs, affect project viability, or lead to fines and penalties if IMO fails to meet regulatory standards. The company’s large-scale oil sands operations make it a target for environmental concerns, which could also affect investor sentiment.

Weaker Refining Margins: Despite strong upstream performance, IMO’s downstream segment, particularly refining, faced challenges in second-quarter 2024. Refining margins were down due to weaker market conditions and softer crack spreads, particularly in gasoline and diesel. Lower refining margins reduce the company’s overall profitability, particularly in periods of high oil prices when refining costs may not be fully passed on to consumers. The company’s heavy reliance on refined product sales could hurt earnings if these margin pressures persist.

High CapEx Spending Commitments: IMO has significant capital expenditure (“CapEx”) commitments, particularly related to maintaining the company’s upstream assets and advancing its renewable energy projects. While these are long-term investments that could benefit the company, the upfront costs are high, with second-quarter 2024 CapEx reaching C$462 million.

Furthermore, IMO’s management has outlined a capital spending budget of C$1.7 billion for 2024. Any delays or cost overruns in these projects could negatively impact the company’s financials in the short term. Moreover, if oil prices decline, the company could face pressure to scale back or delay its CapEx programs, which may hinder IMO’s growth prospects.

Geopolitical and Market Dependence: While IMO has strong domestic operations, it is heavily concentrated in Canada and highly dependent on local market conditions. Any adverse changes in Canada’s energy policies, such as increased taxes or stricter regulations on oil sands, could negatively impact the company’s operations.

Additionally, Imperial’s exposure to global market dynamics, such as supply chain disruptions, fluctuating demand for oil, or competition from international oil producers, could impact the company’s ability to maintain its competitive position.

IMO Stock: Final Thoughts

Imperial’s impressive stock performance and strategic initiatives paint a promising picture, with the company currently trading 15% away from its 52-week high. The company’s strong financials, operational efficiencies and green energy investments suggest a bright future. However, factors like oil price volatility, regulatory risks and high CapEx warrant careful consideration.

Of the 15 brokers covering IMO stock, four have given Strong Buy recommendations, while 11 have rated it as Hold and there are no Sell recommendations. With a Zacks Rank #3 (Hold), waiting for a more favorable entry point may be prudent before adding the stock to your portfolio.

Key Picks

Investors interested in the energy sector might look at some better-ranked stocks like MPLX LP MPLX, sporting a Zacks Rank #1 (Strong Buy), and Vaalco Energy, Inc. EGY, carrying a Zacks Rank #2 (Buy) at present.

Findlay, OH-based MPLX LP is valued at $44.68 billion. In the past year, its shares have risen 25.7%. MPLX owns and operates midstream energy infrastructure and logistics assets in the United States. It operates under two segments, namely Logistics and Storage, and Gathering and Processing.

Houston, TX-based Vaalco Energy is valued at $579.92 million. The oil and gas exploration and production company currently pays a dividend of 25 cents per share, or 4.47%, on an annual basis. EGY is an independent energy company principally engaged in the acquisition, exploration, development and production of crude oil and natural gas.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Actuate Announces Upcoming Presentation on Initial Data on Elraglusib in Combination with FOLFIRINOX at the AACR Special Conference on Advances in Pancreatic Cancer Research

- Preclinical Study Highlight the Potential of Elraglusib in Overcoming FOLFIRINOX-induced Chemoresistance Through Downregulation of Epithelial to Mesenchymal Transition (EMT)

- Initial Data Demonstrates Early Evidence of Increased Clinical Activity of Combining FOLFIRINOX with Elraglusib and Losartan in Patients with Untreated Metastatic Pancreatic Ductal Adenocarcinoma (PDAC)

- Deep, Durable Responses Observed in 3/6 patients with Extensive Liver Metastases

CHICAGO and FORT WORTH, Texas, Sept. 16, 2024 (GLOBE NEWSWIRE) — Actuate Therapeutics, Inc. ACTU (“Actuate” or the “Company”), a clinical-stage biopharmaceutical company, focused on developing therapies for the treatment of high-impact, difficult-to-treat cancers through the inhibition of glycogen synthase kinase-3 beta (GSK-3β), announced data from the safety cohort of an ongoing Phase 2 trial of FOLFIRINOX in combination with elraglusib and losartan for untreated metastatic pancreatic adenocarcinoma at the American Association for Cancer Research (AACR) Special Conference on Advances in Pancreatic Cancer Research taking place on September 15-18, 2024, in Boston, Massachusetts.

“We are encouraged by the data presentation at this year’s AACR’s Special Conference underscoring elraglusib’s potential in addressing critical challenges in pancreatic cancer treatment,” said Daniel Schmitt, President & Chief Executive Officer of Actuate. “These initial findings provide early clinical evidence that elraglusib may overcome a key chemoresistance mechanism associated with FOLFIRINOX thus enhancing the effectiveness of the combination therapy.”

The Phase 2 trial (NCT05077800) is an open-label, multi-arm, non-comparator study of FOLFIRINOX in combination with elraglusib and losartan for the treatment of adult patients with untreated metastatic pancreatic adenocarcinoma. The primary objectives of the trial are to determine the safety, tolerability, and progression-free survival of the combination therapy. The trial will enroll up to 70 treatment-naïve metastatic pancreatic adenocarcinoma patients. Actuate Therapeutics supports this trial by supplying the study drug, elraglusib. The Lustgarten Foundation is providing funding support for this study through a research grant.

“We are excited by the promising safety profile and initial evidence of clinical activity demonstrated by the combination of FOLFIRINOX, elraglusib and losartan in this study,” said Colin Weekes, MD, Ph.D., Director of Medical Oncology Research for Pancreatic Cancer, Massachusetts General Hospital, and the study’s Principal Investigator. “The synergy observed with these drugs suggests that this combination could offer a novel and effective therapeutic strategy for patients with metastatic pancreatic cancer.”

Poster presentation details Abstract: C073

Title: “FOLFIRINOX with Glycogen Synthase Kinase-3 Beta (GSK-3β) Inhibitor Elraglusib and Transforming Growth Factor- β (TGFβ) Inhibitor Losartan in Untreated Metastatic Pancreatic Ductal Adenocarcinoma (PDAC): Interim analysis of safety cohort.”

Presenting Author: Priyadarshini Pathak, MD, Medical Oncologist, Massachusetts General Hospital

Session date: Tuesday, September 17, 6:45-9 p.m. ET

Location: Westin Copley Place

The abstract is available online and the poster will be available on Actuate’s website after the AACR Meeting.

About Actuate Therapeutics, Inc.

Actuate is a clinical-stage biopharmaceutical company focused on developing therapies for the treatment of high-impact, difficult-to-treat cancers. Actuate’s lead investigational drug product, elraglusib (a novel GSK-3β inhibitor), targets molecular pathways in cancer that are involved in promoting tumor growth and resistance to conventional cancer drugs such as chemotherapy including several DDR pathways. Elraglusib is designed to act as a mediator of anti-tumor immunity through the inhibition of NF-kB and regulates multiple immune checkpoints and immune cell function. For additional information, please visit the Company’s website at http://www.actuatetherapeutics.com.

About Massachusetts General Hospital

Massachusetts General Hospital, founded in 1811, is the original and largest teaching hospital of Harvard Medical School. The Mass General Research Institute conducts the largest hospital-based research program in the nation, with annual research operations of more than $1 billion and comprises more than 9,500 researchers working across more than 30 institutes, centers and departments. MGH is a founding member of the Mass General Brigham healthcare system.

Forward-Looking Statements

This press release contains forward-looking statements about us, including our clinical trials and development plans, and our industry. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. All statements, other than statements related to present facts or current conditions or of historical facts, contained in this press release are forward-looking statements. Accordingly, these statements involve estimates, assumptions, substantial risks and uncertainties which could cause actual results to differ materially from those expressed in them, including but not limited to that clinical and preclinical drug development involves a lengthy and expensive process with uncertain timelines and outcomes, results of prior preclinical studies and early clinical trials are not necessarily predictive of future results, and elraglusib may not achieve favorable results in clinical trials or preclinical studies or receive regulatory approval on a timely basis, if at all; that we may not successfully enroll additional patients or establish or advance plans for further development; that elraglusib could be associated with side effects, adverse events or other properties or safety risks, which could delay or preclude regulatory approval, cause us to suspend or discontinue clinical trials or result in other negative consequences; our reliance on third parties to conduct our non-clinical studies and our clinical trials; our reliance on third-party licensors and ability to preserve and protect our intellectual property rights; that we face significant competition from other biotechnology and pharmaceutical companies; and our ability to fund development activities. . In addition, any forward-looking statements are qualified in their entirety by reference to the factors discussed under the heading “Risk Factors” in our final prospectus filed with the SEC on August 13, 2024 pursuant to Rule 424(b)(4) under the Securities Act with respect to our Registration Statement on Form S-1 (File No. 333-279734) and other filings with the SEC. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

Investor Contact

Mike Moyer

Managing Director

LifeSci Advisors, LLC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

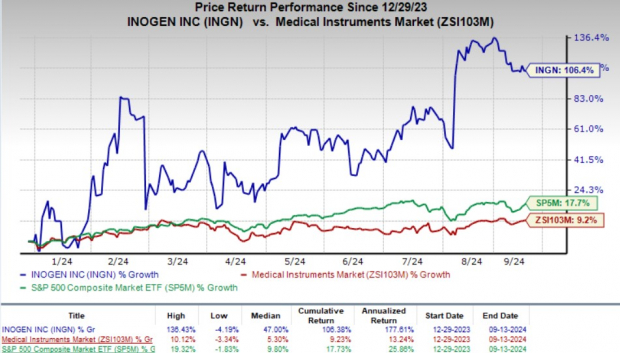

Inogen, Inc. INGN is well-poised for growth in the coming quarters, courtesy of high prospects in the portable oxygen concentrator (POC) space. The optimism, led by solid first-quarter 2024 performance and a strong product portfolio, seems justified. However, issues like stiff competition and forex volatility are major downsides.

The Zacks Rank #2 (Buy) company’s shares have risen 106.4% year to date compared with 9.2% growth of the industry. The S&P 500 has increased 17.7% during the same time frame.

The renowned provider of POCs has a market capitalization of $268.7 million. The company projects 56.6% growth for 2024 and expects to witness continued improvements in its business. Inogen’s P/S ratio of 0.8X makes its valuation attractive compared with the industry’s 3.1X.

Image Source: Zacks Investment Research

Let us delve deeper.

High Prospects in the POC Space: We are optimistic about the POCs’ superiority over conventional oxygen therapy (known as the delivery model). Inogen primarily develops, manufactures and markets innovative POCs to deliver supplemental long-term oxygen therapy (LTOT) to patients suffering from chronic respiratory conditions.

INGN’s proprietary Inogen One and Inogen Rove systems concentrate the air around the patient to offer a source of supplemental oxygen anytime, anywhere, with a battery that can be plugged into an outlet. Per a report by Data Bridge Market Research, the POCs market was valued at $1.58 billion in 2022 and is anticipated to reach $3.03 billion by 2030 at a CAGR of 8.5%.

Product Portfolio: We are optimistic about Inogen’s expanding product portfolio. The company has received the FDA 510(k) clearance for the Inogen Rove 4, which is set to be launched soon. The Rove 4 will offer patients a new flow setting compared to the earlier versions, a service life of up to eight years and highest oxygen production. It is also the lightest POC in the market.

Inogen launched Rove 6 in the U.S. market in July 2023. The Inogen Rove 6 is the first POC with an expected service life of eight years.

Strong Q2 Results: Inogen’s robust year-over-year uptick in domestic and international business-to-business sales buoys optimism. Solid year-over-year top and bottom-line performances were encouraging. Further, the expansion of the adjusted gross margin bodes well.

On the earnings call, management confirmed that targeting hospitals in addition to individual practitioners through its rental business gave earlier access to patients in their care pathway, increasing the duration over which INGN can receive payments. By expanding its scale, efficiency and throughput in the rental channel, Inogen expects to drive higher profitability over time.

The company is also seeing cost benefits in the form of lower sales and marketing expenses on the back of the recent exit of its third-party relationship in the rental channel. These factors raise optimism about the stock.

Risks

Stiff Competition: The LTOT market has intense industrial competition. Inogen faces competition from several POC producers and distributors as well as suppliers of other LTOT services, such as home delivery of oxygen cylinders or tanks. Given the relatively straightforward regulatory path in the oxygen therapy device manufacturing market, Inogen expects the industry to become increasingly competitive in the future.

Forex Volatility: The foreign market accounts for a sizeable amount of INGN’s income. Management anticipates overseas revenues to continue to be erratic due to the distributor’s size and timing. In the near future, INGN also expects unfavorable foreign exchange rates to hinder revenue growth since the U.S. dollar is increasing relative to the euro and other foreign currencies.

Estimate Trend

Inogen has been witnessing an improving estimate revision trend for 2024. In the past 60 days, the Zacks Consensus Estimate for its loss per share has narrowed 11.4% to $1.95.

The Zacks Consensus Estimate for 2024 revenues is pegged at $327 million, suggesting a 3.6% decline from the year-ago reported number.

Key Picks

Some other top-ranked stocks in the broader medical space are Boston Scientific, AxoGen AXGN and SiBone SIBN, each carrying a Zacks Rank #2 at present.

Boston Scientific’s shares have risen 58.4% in the past year. Estimates for the company’s earnings per share have remained constant at $2.40 for 2024 and $2.71 for 2025 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.2%. In the last reported quarter, it posted an earnings surprise of 6.9%.

Estimates for AxoGen’s 2024 loss per share have remained constant at 1 cent in the past 30 days. Shares of the company have surged 145% in the past year compared with the industry’s growth of 15.5%. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.5%. In the last reported quarter, it delivered an earnings surprise of 200%.

Estimates for SiBone’s 2024 loss per share have remained constant at 89 cents in the past 30 days. Shares of the company have lost 30.4% in the past year against the industry’s 15.5% growth. SIBN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.4%. In the last reported quarter, it delivered an earnings surprise of 15.4%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Just Smoke The Weed': Why This Physician In California Urges Against Cannabis Vaping

Dr. Laurie Vollen, a medical professional from Berkeley, spent decades advocating for cannabis use, but against cannabis vaping.

Vollen’s concerns center on the potential dangers associated with cannabis vape cartridges, particularly the exposure to harmful substances like heavy metals and pesticides.

“You’re just getting an increased exposure to another toxin,” Vollen told SFGATE, reinforcing her long-held skepticism toward vape products.

As a California-based physician, her concerns escalated this year after a pesticide scandal emerged, revealing that several cannabis vapes sold in the legal market tested positive for contaminants.

Dangers In Cannabis Vaping

Cannabis vape cartridges have gained popularity for their convenience, and is becoming a mainstream method for consuming rosin, accounted for nearly $100 million in sales in California last month.

However, this ease of use comes with hidden risks. Studies have shown that components of vape cartridges can leach heavy metals into the vapor, directly exposing users to potentially toxic substances. The cheaper the vape, the more likely it will the metal inside the vape will make direct contact with the vape juice or oil. When the oil vaporizes, so are the metals that compose the vape.

But there are also risks associated with the oil itself. The cannabis oil inside the cartridges results from an extraction process that might concentrate contaminants, including pesticides. Vollen and other experts argue that this makes vaping even riskier than smoking cannabis flower, which typically contains far fewer toxins.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

California’s Struggle To Regulate The Industry

California has implemented stringent pesticide testing for cannabis products, but recent reports suggest regulatory gaps.

Investigators recently tested 42 products for contaminants. As a result, 25 contained pesticide concentrations exceeding state and federal safety standards numerous legal vape products contained banned pesticides, casting doubt on the effectiveness of state oversight.

Thus, cannabis vaping might carry an extra risk even when substances are supposed to be controlled regularly by the state’s authority.

Taking notice about the risks associated to using this products, Dr. Vollen remains advices: “Just smoke the weed. There’s no reason to use vape cartridges if you can use the flower itself.”

Cover: Renz Macorol via Pexels

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Owners At This Prestigious Florida Golf Community May Be At Risk Of Losing Their $30,000 Buy-In – Here's What It Means For Their Investments

Owners at Hunters Run, a golf-course community in South Florida, may soon face a difficult choice – give up the equity they were promised when they bought their homes or brace for a hefty financial hit.

The fate of nearly $49 million in equity is at stake, a sum older residents were expecting to recoup when they eventually sold their homes. Some homeowners could lose as much as $32,000.

Don’t Miss:

The Hunters Run board says it needs the money for crucial capital improvements. Without it, they claim, the only alternative is a special assessment, a nearly $30,000 fee for each household. Faced with that, the board made a controversial decision this year to eliminate the equity refunds.

Unsurprisingly, this hasn’t sat well with many residents. Petitions opposing the move flooded in, forcing a referendum, with the vote set to be counted on September 23. The board’s lawyer has backed the decision, stating that it is within its legal rights to modify the bylaws, allowing them to use equity funds for improvements.

Trending: Miami is expected to take New York’s place as the U.S. Financial Capital. Here’s how you can invest in the city before that happens.

Owners who wish to cash out their equity are racing against the clock. They have until Oct. 1 to sell their units and recover part of their initiation fees. The pressure has led to a sudden surge in sellers, particularly among condo owners.

As a result, prices have plummeted. Currently, 10 two-bedroom condos are listed for less than $5,000, with one unit offering a $10,000 credit to anyone who can close by the deadline. It’s a buyer’s market, but the frenzy to sell by the deadline has been chaotic.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Country clubs in the area typically require an initiation fee, but at Hunters Run, that fee has skyrocketed to $105,000. The fee is no longer refundable when a home is sold, a stark contrast to previous times when up to 80% was refundable.

While it’s not unusual for clubs to increase fees, stripping older owners of their equity is another story. It’s a move near Wycliffe Country Club made years ago, but they did it gradually. Hunters Run’s board acted quickly, stirring emotions.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

“I have mixed feelings,” said Joel Schreiber, a resident who stands to lose $32,000. “My kids don’t need the money. The club needs it for improvements. I love it here, so I’ll support the board. But I get why others want to hold onto their equity.”

More than 100 homeowners felt strongly enough to demand a vote on the matter.

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

In a letter to residents, the board acknowledged the tough decision: “Every member of the board will lose our equity as well. The board saw this as necessary for Hunters Run’s future.” They stressed that the decision was better than imposing steep assessments on everyone.

David Greenblatt, a Realtor in the community, sees the silver lining. “There’s some pain right now, but once we’re past this, Hunters Run will be even better,” he said.

With its lush amenities – three golf courses, tennis courts, pickleball, and more – Hunters Run is home to over 1,600 units. Built in 1979, the community now finds itself at a crossroads, with a decision looming that could impact its future for years to come.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Owners At This Prestigious Florida Golf Community May Be At Risk Of Losing Their $30,000 Buy-In – Here’s What It Means For Their Investments originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On FedEx

Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

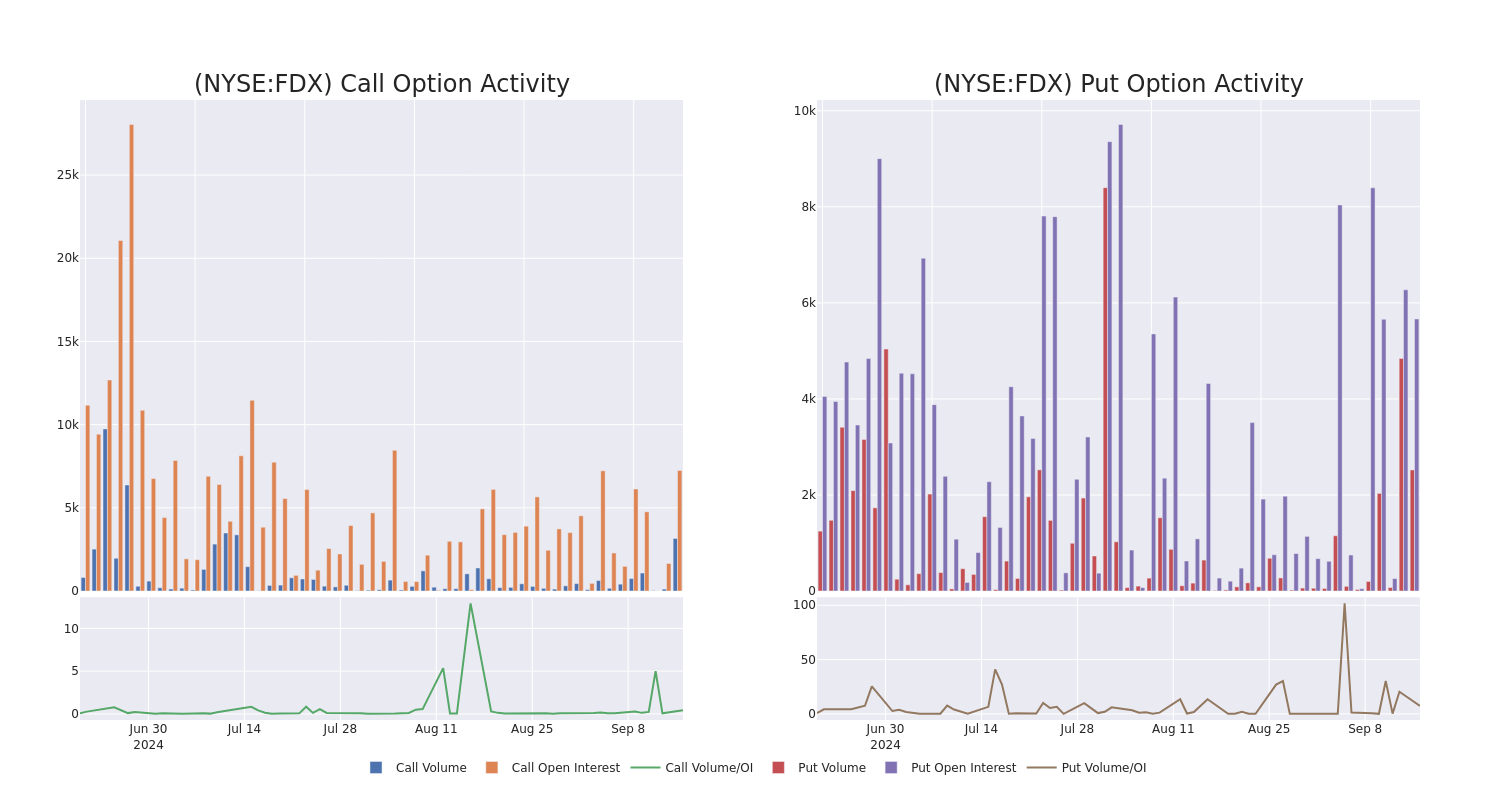

Looking at options history for FedEx FDX we detected 28 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $613,166 and 16, calls, for a total amount of $1,167,212.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $330.0 for FedEx over the last 3 months.

Analyzing Volume & Open Interest

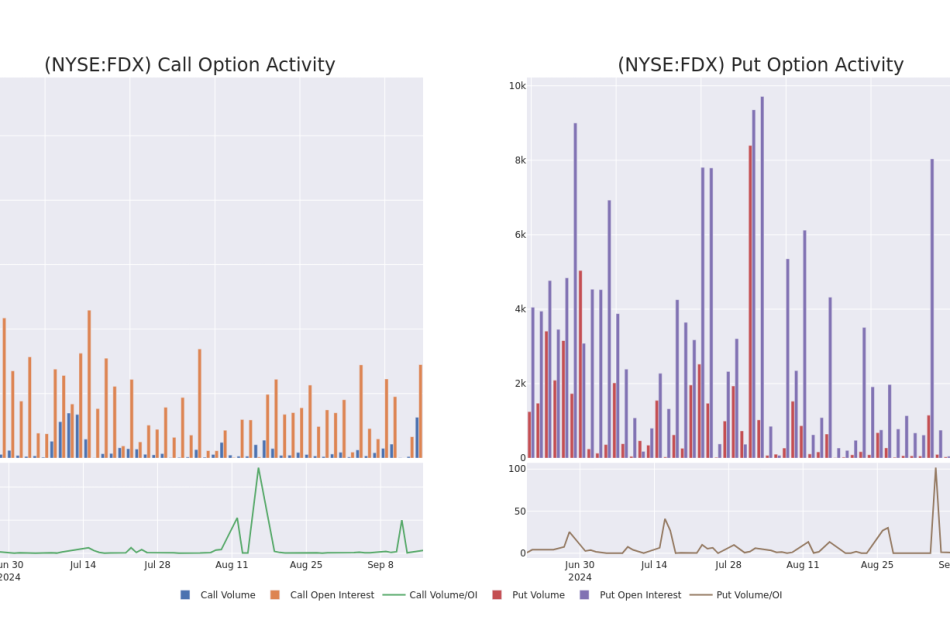

In today’s trading context, the average open interest for options of FedEx stands at 614.86, with a total volume reaching 5,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in FedEx, situated within the strike price corridor from $240.0 to $330.0, throughout the last 30 days.

FedEx Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | CALL | TRADE | BEARISH | 10/18/24 | $6.65 | $6.4 | $6.4 | $310.00 | $163.2K | 725 | 270 |

| FDX | CALL | SWEEP | BEARISH | 10/18/24 | $15.05 | $14.85 | $14.85 | $290.00 | $118.8K | 610 | 85 |

| FDX | CALL | SWEEP | BULLISH | 12/20/24 | $13.4 | $12.2 | $13.27 | $310.00 | $107.0K | 368 | 85 |

| FDX | PUT | SWEEP | BULLISH | 09/20/24 | $10.2 | $10.0 | $10.0 | $290.00 | $100.0K | 3.4K | 125 |

| FDX | CALL | SWEEP | BEARISH | 09/20/24 | $3.95 | $3.8 | $3.8 | $310.00 | $94.3K | 1.5K | 353 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world’s largest express package provider. In its fiscal 2024, which ended May 2024, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting the firm’s presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

After a thorough review of the options trading surrounding FedEx, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of FedEx

- Currently trading with a volume of 567,279, the FDX’s price is up by 2.14%, now at $292.52.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 3 days.

Expert Opinions on FedEx

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $336.3333333333333.

- An analyst from TD Cowen downgraded its action to Buy with a price target of $334.

- An analyst from Baird persists with their Outperform rating on FedEx, maintaining a target price of $340.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for FedEx, targeting a price of $335.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Reasons to Buy Supermicro Stock Hand Over Fist — and 1 Reason to Stay Away

What goes up can come down. Just look at Super Micro Computers (NASDAQ: SMCI), commonly referred to as Supermicro.

Shares of the technology solutions company skyrocketed 246% in 2023. This momentum continued into 2024, with Supermicro stock up another 318% by mid-March. Since then, though, everything has been downhill. Supermicro is now down over 60% below its peak.

What should investors do? Here are two reasons to buy Supermicro stock hand over fist — and one reason to stay away.

Reason to buy No. 1: Growth prospects

Supermicro sells the building blocks for technology infrastructure: servers, storage systems, rack solutions, networking devices, and more. To say the demand for the company’s solutions is hot is an understatement. Supermicro announced last month that sales soared 110% year over year in the quarter ended June 30. In a single quarter, the company raked in more money than it did in the entire year in fiscal 2022.

Much of this spectacular growth was driven by artificial intelligence (AI). Organizations in nearly every industry are scrambling to harness the power of AI, especially with the rapidly improving capabilities of generative AI.

Supermicro could be poised for even more growth as data centers deploy its direct liquid cooling (DLC) systems. This technology can offer a lower total cost of ownership than traditional air-cooled systems.

Nvidia‘s growth could largely fuel Supermicro’s growth. Although the shipment of Nvidia’s new Blackwell chips has been pushed back, the delay is only temporary. Nvidia CEO Jensen Huang predicts that Blackwell could become his company’s most successful product ever. If he’s right, Supermicro could be poised for more explosive growth.

Reason to buy No. 2: An attractive valuation

In today’s market environment, it’s not easy to find a tech stock that sports an attractive valuation. However, thanks to the big sell-off in recent months, Supermicro’s valuation indeed looks attractive.

The stock trades at a forward price-to-earnings ratio of only 13.1. That’s much lower than the average forward earnings multiple of 28.2 for the S&P 500 information technology sector. More importantly, Supermicro trades at a discount to its biggest rival, Dell.

Reason to stay away: A dark cloud of controversy

However, there is also a major reason investors might want to not touch Supermicro with a 10-foot pole. The company is under a dark cloud of controversy related to its financial accounting practices.

On Aug. 27, Hindenburg Research published an online report with allegations of “accounting manipulation, sibling self-dealing, and sanctions evasion” by Supermicro. Hindenburg said it conducted a three-month investigation that included interviewing former Supermicro employees. It maintained that this investigation “found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

The day after this scathing online report came out, Supermicro announced that it didn’t expect to file its annual 10-K on time for the fiscal year ended June 30. The company said more time was needed for management to “complete its assessment of the design and operating effectiveness of its internal controls over financial reporting.”

Supermicro CEO Charles Liang released a letter on Sept. 3 to address the controversy. He wrote that the company’s “production capabilities are unaffected” by allegations or the delay in filing its annual report. Liang also stated that management doesn’t “anticipate any material changes in our fourth quarter or fiscal year 2024 financial results.”

What should investors do?

Aggressive investors might decide to buy Supermicro stock hand over fist while it’s beaten down. Such a strategy could pay off handsomely if the company’s growth prospects prove to be as promising as they appear and its internal controls issues are satisfactorily addressed.

However, I think most investors will be better off taking a wait-and-see approach with Supermicro. Sure, Hindenburg Research is a short seller with a financial motivation to drive Supermicro’s shares lower. But Supermicro’s 10-K delay raises questions that would be concerning even if Hindenburg’s report had not been published.

If the controversy fades, investors should still have an opportunity to buy Supermicro at a reasonable valuation. What goes down can go up, but it’s a good idea to make sure it will go up before jumping aboard.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

2 Reasons to Buy Supermicro Stock Hand Over Fist — and 1 Reason to Stay Away was originally published by The Motley Fool

Should JPMorgan BetaBuilders U.S. Small Cap Equity ETF Be on Your Investing Radar?

Looking for broad exposure to the Small Cap Value segment of the US equity market? You should consider the JPMorgan BetaBuilders U.S. Small Cap Equity ETF BBSC, a passively managed exchange traded fund launched on 11/16/2020.

The fund is sponsored by J.P. Morgan. It has amassed assets over $520.35 million, making it one of the average sized ETFs attempting to match the Small Cap Value segment of the US equity market.

Why Small Cap Value

Small cap companies have market capitalization below $2 billion. They usually have higher potential than large and mid cap companies with stocks but higher risk.

While value stocks have lower than average price-to-earnings and price-to-book ratios, they also have lower than average sales and earnings growth rates. Value stocks have outperformed growth stocks in nearly all markets when you consider long-term performance, growth stocks are more likely to outpace value stocks in strong bull markets.

Costs

Since cheaper funds tend to produce better results than more expensive funds, assuming all other factors remain equal, it is important for investors to pay attention to an ETF’s expense ratio.

Annual operating expenses for this ETF are 0.09%, making it one of the least expensive products in the space.

It has a 12-month trailing dividend yield of 1.48%.

Sector Exposure and Top Holdings

Even though ETFs offer diversified exposure which minimizes single stock risk, it is still important to look into a fund’s holdings before investing. Luckily, most ETFs are very transparent products that disclose their holdings on a daily basis.

This ETF has heaviest allocation to the Financials sector–about 19.90% of the portfolio. Healthcare and Industrials round out the top three.

Looking at individual holdings, Jpmorgan Us Govt Mmkt Fun accounts for about 1.50% of total assets, followed by Insmed Inc Common Stock INSM and Carpenter Technology CRS.

The top 10 holdings account for about 5.66% of total assets under management.

Performance and Risk

BBSC seeks to match the performance of the MORNINGSTAR US SML CP TRG MRK EXP EXT ID before fees and expenses. The Morningstar US Small Cap Target Market Exposure Extended Index is a free-float adjusted, market-cap weighted index that targets small cap securities traded in the U.S.

The ETF has gained about 7.42% so far this year and it’s up approximately 20.46% in the last one year (as of 09/16/2024). In the past 52-week period, it has traded between $48.58 and $67.50.

The ETF has a beta of 1.08 and standard deviation of 23.45% for the trailing three-year period. With about 796 holdings, it effectively diversifies company-specific risk.

Alternatives

JPMorgan BetaBuilders U.S. Small Cap Equity ETF holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, BBSC is an excellent option for investors seeking exposure to the Style Box – Small Cap Value segment of the market. There are other additional ETFs in the space that investors could consider as well.

The Avantis U.S. Small Cap Value ETF AVUV and the Vanguard Small-Cap Value ETF VBR track a similar index. While Avantis U.S. Small Cap Value ETF has $12.95 billion in assets, Vanguard Small-Cap Value ETF has $29.58 billion. AVUV has an expense ratio of 0.25% and VBR charges 0.07%.

Bottom-Line

Passively managed ETFs are becoming increasingly popular with institutional as well as retail investors due to their low cost, transparency, flexibility and tax efficiency. They are excellent vehicles for long term investors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500, Nasdaq Futures Mixed As Rate-Cut Hopes Weigh On Techs: Fund Manager Sees Near-Term Corrections As Buying Opportunities

U.S. stocks could start the first trading session of the week on a mixed note, as traders fully bake in the odds of a rate cut by the Federal Reserve this week. Small-caps are outperforming in the premarket, as evidenced by the solid rise in the Russell 2,000 futures. Analysts and market watchers are polarized about the impact the widely anticipated rate cut can have on the market.

Some consolidation around the current levels could not be ruled out before the Fed’s interest-rate announcement, scheduled for Wednesday. While some call for broadening of the market rally, with tech stocks likely to add on to their gains, others draw cues from history, which shows that the market typically collapses after a rate cut. Regional manufacturing activity data could also impact the market direction of the day.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.29% |

| S&P 500 | -0.04% |

| Dow | +0.17% |

| R2K | +0.58% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust (NYSE: SPY edged down 0.02% to $561.77 and the Invesco QQQ ETF (NASDAQ: QQQ) edged down 0.24% to $474.19, according to Benzinga Pro data.

Cues From Last Week:

Wall Street rallied hard in the week ended Sept. 6, reversing from the previous week’s tech-led sell-off. Benign inflation data sealed the fate of the market, as the S&P 500 and the Nasdaq Composite indices rallied in all five sessions of the week, settling at the highest levels since late September. These averages recorded their best weekly gains for the year.

The

| Index | Week’s Performance (+/) |

Value |

| Nasdaq Composite | +5.95% | 17,683.98 |

| S&P 500 Index | +4.02% | 5,626.02 |

| Dow Industrials | +2.60% | 41,393.78 |

| Russell 2000 | +4.36% | 2,129.43 |

Insights From Analysts:

After being down over 4% for the week in the week ended Sept. 6, the S&P 500 settled the next week 4%+ higher. While making note of the remarkable turnaround, Carson Group Chief Market Strategist Ryan Detrick said this bodes well for the future. When such a reversal has taken place in the past, the market was higher 81.8% of the time a year, with a median gain of 18.8%.

The lion’s shade of year-to-date gains may be behind us, he said, adding that “outside of a Black Swan event, there doesn’t appear to be any identifiable material downside risks.”

See also: Best Futures Trading Software

Upcoming Economic Data:

The Federal Open Market Committee meeting will be front and center in the unfolding week, with the odds favoring a 50 basis-point cut over a 25 basis-point cut. The post-meeting policy statement, the Summary of Economic Projections, which also has the dot plot chart, and Chairman Jerome Powell’s press briefing could all be market-moving events.

This apart, traders get to digest the August retail sales report, the industrial production report and two regional manufacturing activity readings for September, and two housing market reports.

On Monday, the New York Federal Reserve is due to release the results of its Empire State manufacturing survey. The business activity index may have worsened from -4.7 in August to -5 in September, suggesting continued contraction.

The Treasury will auction three- and six-month notes at 11:30 a.m. EDT.

Stocks In Focus:

- Trump Media & Technology Group Corp. DJT rose over 3.5% in premarket trading following a second assassination attempt at the company’s owner and presidential candidate Donald Trump.

- Apple, Inc. AAPL moved down over 1.6% on views that preorders for the Pro series have been lower than expected.

- Intel Corporation INTC climbed over 3% on reports that the company has reached a $3.5 billion deal to supply chips to the U.S. military.

Commodities, Bonds And Global Equity Markets:

Crude oil and gold futures rose modestly and the benchmark 10-year Treasury note was little changed at 3.653% ahead of week’s Fed decision. Bitcoin BTC/USD pulled back to the $58.5K mark.

The major markets that were open in Asia ended higher for the day, reacting to Wall Street’s strong finish last Friday, although the New Zealand market pulled back as the nation’s central bank held rates unchanged and hinted at a delay in downward interest-rate adjustment amid sticky inflation. The Chinese, Japanese and South Korean markets remained closed for public holidays.

European stocks were modestly lower in early trading.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.